Smart Badge Market by Communication (Contact and ContactLess), Type (With Displays and Without Displays), Application (Government & Healthcare, Corporate, and Retail & Hospitality) and Region (NA, EU, APAC, ROW) - Global Forecast to 2025

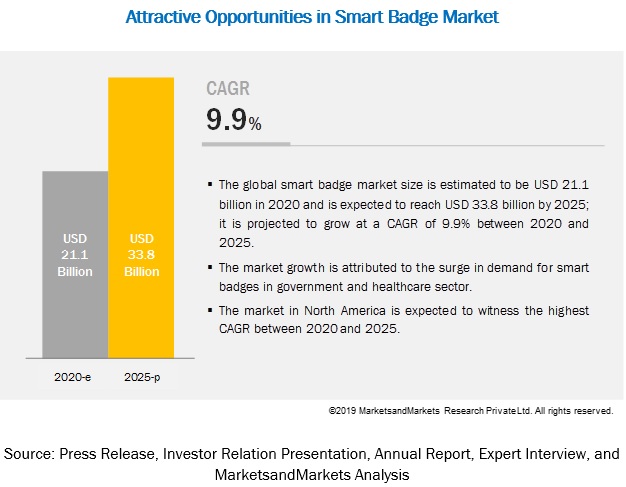

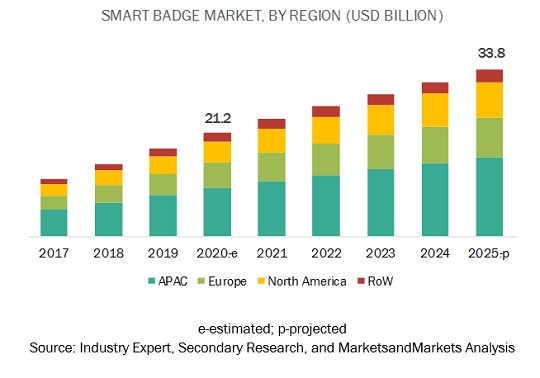

[146 Pages Report] The Smart badge market size is estimated to grow from USD 21.1 billion in 2020 to USD 33.8 billion by 2025, at a CAGR of 9.9% between 2020 and 2025. The most significant factor driving the growth of this market is the increasing demand for smart badges from the government and healthcare sector.

Government interventions in smart badge technology.

Smart badge market are adopted increasingly as the credential of choice for securely controlling physical access of the users. These badges are used to authenticate the identity of a person, and physically admit the cardholder to a facility. Smart badges are frequently used by government agencies to comply with government regulations, such as the Defense Federal Acquisition Regulation System (DFARS) and the International Traffic in Arms Regulations (ITAR).

Government ID badges and cards conform to high-security standards to protect against frauds, forgeries, and alterations. For instance, the United States Environmental Protection Agency (EPA) (US) issues Personal Identity Verification (PIV) badges to all federal employees and certain non-federal personnel. Use of these market is required under Homeland Security Presidential Directive-12 of the Government of the US.

The contactless segment is anticipated to register high CAGR during the forecast period.

Based on communication, the contactless segment of the smart badge market is projected to grow at a higher CAGR than the contact segment during the forecast period. In 2019, the contactless segment accounted for the largest share of market. The growth of this segment can be attributed to the increased demand for contactless smart badges as they enable quick transactions. These badges eliminate the requirement of waiting for terminals to communicate. They allow fast, easy, and secured access to physical and logical areas.

North America is anticipated to register high CAGR during the forecast year.

The market in North America is expected to witness rapid growth during the forecast period owing to the increasing adoption of smart cards in healthcare and event and entertainment verticals. Moreover, Asia Pacific (APAC) to hold a major share of the smart badge market during the forecast period.

Key Market Players

Some of the leading players in the smart badge market are Thales Group (Gemalto) (France), ASSA ABLOY AB (HID Global Corporation) (Sweden), Giesecke+Devrient GmbH (Germany), Brady Worldwide, Inc. (US), IDEMIA (France), Evolis (France), Identiv Inc. (US), BEAM (US), AIOI-SYSTEMS CO., LTD. (DISPLAY IT CARD) (Japan), Watchdata (Singapore), and Identita (Canada). The other players operating in the market include Blendology (UK), Squarofumi (China), KONA I Co. Ltd. (South Korea), Proxfinity Inc. (US), Klik (Canada), Global Net Solutions (GNS) (US), CardLogix Corporation (US), MpicoSys Solutions B.V. (Netherlands), AbeeWay (France), and HierStar Ltd. (China).

Thales Group (Gemalto) designs and manufactures advanced electrical equipment for the transportation, aerospace, defense, and security sectors. Gemalto (UK) is a subsidiary of Thales Group that develops digital solutions for private and government customer bases and manages the activities related to digital identity and security. The company has a unique portfolio of technology that offers secure world digital transformation for payments, border control, IoT, etc. It operates in a range of verticals, such as financial services, government, and transportation. The investments of Gemalto in product developments have substantially increased over the past years. This has helped the company enhance its product portfolio by launching innovative solutions in the smart badge market.

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year considered |

2020 |

|

Forecast period |

20202025 |

|

Forecast units (For the market in terms of Value) |

USD Billion |

|

Segments covered |

Communication, Type, Application, and Geography |

|

Regions covered |

North America, Europe, APAC and RoW |

|

Companies covered |

Thales Group (Gemalto) (France), ASSA ABLOY AB (HID Global Corporation) (Sweden), Giesecke+Devrient GmbH (Germany), Brady Worldwide, Inc. (US), IDEMIA (France), Evolis (France), Identiv Inc. (US), BEAM (US), AIOI-SYSTEMS CO., LTD. (DISPLAY IT CARD) (Japan), Watchdata (Singapore), and Identita (Canada) are some of the leading players in this market. The other players operating in market include Blendology (UK), Squarofumi (China), KONA I Co., Ltd. (South Korea), Proxfinity Inc. (US), Klik (Canada), Global Net Solutions (GNS) (US), CardLogix Corporation (US), MpicoSys Solutions B.V. (Netherlands), AbeeWay (France), and Hierstar Corp (China). |

Smart badge market segmentation

By Communication

- Contact Badges

- Contactless Badges

By Type

- Smart Badges with Display

- Smart Badges without Display

By Application

- Government and Healthcare

- Corporate

- Event and Entertainment

- Retail and Hospitality

- Others

By Geography

- North America

- Europe

- APAC

- RoW

Key questions addressed by the report:

- What are the opportunities for smart badge manufacturers?

- How much growth is expected from types of smart badges in the smart badge market?

- Who are the major current and potential competitors in the market, and what are their growth strategies?

- What are the major applications of the smart badge market?

- What are the major technologies used in the market, their impact, and growth trends in respective communication protocols?

<

Frequently Asked Questions (FAQ):

Which are the major applications of smart badges? How huge is the opportunity for their growth in the next five years?

The major applications of smart badges include government & healthcare, corporate, evernts and entertainment, and hospitality & retail and it is expected that increased use of smart badges with and without displays in these applications and multiffunctionality and flexbility of smart badges will lead to USD 33.8 billion opportunity till 2025.

Which are the major companies in the smart badge market? What are their major strategies to strengthen their market presence?

The major companies in smart badge market includes Thales Group (Gemalto) (France), ASSA ABLOY AB (HID Global Corporation) (Sweden), Giesecke+Devrient GmbH (Germany), Brady Worldwide, Inc. (US), IDEMIA (France), Evolis (France), Identiv Inc. (US), BEAM (US), AIOI-SYSTEMS CO., LTD. (DISPLAY IT CARD) (Japan), Watchdata (Singapore), and Identita (Canada). The major strategies adopted by these players are product launches and expansion strategy.

What are the drivers and opportunities for the smart badge market?

Factors such as growing demand for wearable access control devices for security management, benefits such as multifunctionality and flexibility offered by smart badges, and increased adoption of smart badges with contactless interfaces are fueling the growth of the smart badge market. Moreover, high costs involved in deploying and acquiring smart badgesis expected to affect market growth.

Which end users are expected to drive the growth of the market in the next 5 years?

The market for the government & healthcare, and events and entertainment is expected to grow at the significant CAGR during the forecast period. Smart badge market are adopted increasingly as the credential of choice for securely controlling physical access of the users. These badges are used to authenticate the identity of a person, and physically admit the cardholder to a facility. Smart badges are frequently used by government agencies to comply with government regulations, such as the Defense Federal Acquisition Regulation System (DFARS) and the International Traffic in Arms Regulations (ITAR).

Which product type/communication type is expected to grow at a rapid pace? And why?

Based on communication, the contactless segment of the smart badge market is projected to grow at a higher CAGR than the contact segment during the forecast period. In 2019, the contactless segment accounted for the larger share of market. The growth of this segment can be attributed to the increased demand for contactless smart badges as they enable quick transactions. These badges eliminate the requirement of waiting for terminals to communicate. They allow fast, easy, and secured access to physical and logical areas.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for obtaining market size using bottom-up analysis

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for obtaining market size using top-down analysis

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES FOR GROWTH OF SMART BADGE MARKET

4.2 MARKET, BY TYPE

4.3 MARKET, BY COMMUNICATION

4.4 MARKET, BY VERTICAL

4.5 MARKET, BY REGION

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Benefits such as multifunctionality and flexibility

5.2.1.2 Growing demand for wearable access control devices for security management

5.2.1.3 Increased adoption of smart badges with contactless interfaces

5.2.2 RESTRAINTS

5.2.2.1 High costs involved in deploying and acquiring smart badges

5.2.2.2 Proliferation of digital ID

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements in smart badges

5.2.3.2 Latent opportunities for smart badges in populated countries, particularly China and India

5.2.3.3 Blockchain enables new modes for security

5.2.4 CHALLENGES

5.2.4.1 Lack of standardization and consumer awareness

5.2.4.2 Concerns regarding security and data theft

6 INDUSTRY TRENDS (Page No. - 46)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON SMART BADGE MARKET

6.3 VALUE CHAIN ANALYSIS

6.3.1 RESEARCH AND DEVELOPMENT

6.3.2 COMPONENTS SUPPLIERS

6.3.3 ASSEMBLY AND PRODUCT INTEGRATION

6.3.4 DISTRIBUTION

6.3.5 END USERS

6.4 BENEFITS OF INTEGRATED IN-BADGE DISPLAYS

6.5 USE CASES OR MARKETS FOR MARKET

6.6 GOVERNMENT INTERVENTIONS IN SMART BADGE TECHNOLOGY

7 MARKET, BY COMMUNICATION (Page No. - 53)

7.1 INTRODUCTION

7.2 CONTACT BADGES

7.2.1 INCREASED ADOPTION OF CONTACT SMART BADGES IN GOVERNMENT, HEALTHCARE, RETAIL, AND CORPORATE VERTICALS

7.3 CONTACTLESS BADGES

7.3.1 CONTACTLESS SMART BADGES TO WITNESS SIGNIFICANT ADOPTION IN NORTH AMERICA AND APAC IN COMING YEARS

8 SMART BADGE MARKET, BY TYPE (Page No. - 58)

8.1 INTRODUCTION

8.2 SMART BADGES WITHOUT DISPLAYS

8.2.1 LOW COST OF MARKET WITHOUT DISPLAYS LEADING TO THEIR INCREASED GLOBAL ADOPTION

8.3 MARKET WITH DISPLAYS

8.3.1 SMART BADGES WITH DISPLAYS TO GAIN TRACTION IN EVENT AND ENTERTAINMENT VERTICAL INITIALLY

9 MARKET, BY VERTICAL (Page No. - 63)

9.1 INTRODUCTION

9.2 GOVERNMENT AND HEALTHCARE

9.2.1 ONGOING DIGITIZATION OF GOVERNMENT AND HEALTHCARE SECTORS TO FUEL GLOBAL DEMAND FOR SMART BADGES FROM 2020 TO 2025

9.3 CORPORATE

9.3.1 INCREASING USE OF MARKET FOR MULTIPLE APPLICATIONS IN CORPORATE SECTOR TO FUEL GROWTH OF MARKET FROM 2020 TO 2025

9.4 EVENT AND ENTERTAINMENT

9.4.1 RISING ADOPTION OF MARKET IN EVENT AND ENTERTAINMENT VERTICAL FOR IMPROVED DECISION-MAKING AND STREAMLINED REGISTRATION PROCESS

9.5 RETAIL AND HOSPITALITY

9.5.1 SURGING DEMAND FOR SMART BADGES FROM RETAIL AND HOSPITALITY VERTICAL FOR MARKETING APPLICATIONS TO FUEL GROWTH OF MARKET FROM 2020 TO 2025

9.6 OTHERS

10 GEOGRAPHIC ANALYSIS (Page No. - 72)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 Surge in the ID theft complaints in US to contribute to growth of market in country

10.2.2 CANADA

10.2.2.1 Increased technological awareness in Canada about applications and benefits offered by smart badges to fuel growth of market in country

10.2.3 MEXICO

10.2.3.1 Efforts being made by Mexico government to secure identification credentials of citizens to lead to growth of market in country

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Initiatives undertaken by Government of Germany to facilitate integration of eID with businesses and government services to contribute to growth of market in country

10.3.2 UK

10.3.2.1 Rise in demand for smart and improved security access controls to lead to growth of market in UK

10.3.3 FRANCE

10.3.3.1 Presence of leading manufacturers of smart badges in France to fuel growth of market in country

10.3.4 REST OF EUROPE

10.4 APAC

10.4.1 CHINA

10.4.1.1 Establishment of smart cities and quick adoption rate of new and advanced technologies in China to contribute to growth of market in country

10.4.2 INDIA

10.4.2.1 Rise in adoption of smart badges to take place in next 2 to 3 years in India

10.4.3 JAPAN

10.4.3.1 Increase in use of smart badges in transportation sector to fuel the growth of market in Japan

10.4.4 SOUTH KOREA

10.4.4.1 Surge in use of smart badges for identification applications to meet critical security requirements of users to contribute to growth of market in South Korea

10.4.5 REST OF APAC

10.5 ROW

10.5.1 MIDDLE EAST AND AFRICA

10.5.1.1 Rise in adoption of smart badges for identification applications to contribute to growth of market in Middle East and Africa

10.5.2 SOUTH AMERICA

10.5.2.1 Surge in demand for smart badges from government and healthcare verticals to lead to growth of market in South America

11 COMPETITIVE LANDSCAPE (Page No. - 102)

11.1 OVERVIEW

11.2 SMART BADGE MARKET RANKING ANALYSIS FOR 2019

11.3 COMPETITIVE SITUATIONS AND TRENDS

11.3.1 PRODUCT DEVELOPMENTS, PRODUCT LAUNCHES, AND EXPANSIONS

11.3.2 PARTNERSHIPS AND CONTRACTS

11.3.3 ACQUISITIONS

12 COMPANY PROFILES (Page No. - 110)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2.1 THALES GROUP (GEMALTO)

12.2.2 ASSA ABLOY AB (HID GLOBAL CORPORATION)

12.2.3 GIESECKE+DEVRIENT GMBH

12.2.4 IDEMIA

12.2.5 BRADY WORLDWIDE, INC.

12.2.6 EVOLIS

12.2.7 IDENTIV, INC.

12.2.8 BEAM

12.2.9 AIOI-SYSTEMS CO., LTD. (DISPLAY IT CARD)

12.2.10 WATCHDATA TECHNOLOGIES

12.2.11 IDENTITA

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12.3 OTHER IMPORTANT PLAYERS

12.3.1 BLENDOLOGY

12.3.2 SQUAROFUMI

12.3.3 KONA I

12.3.4 PROXFINITY

12.3.5 KLIK

12.3.6 GLOBAL NET SOLUTIONS (GNS)

12.3.7 CARDLOGIX CORPORATION

12.3.8 MPICOSYS SOLUTIONS B.V.

12.3.9 ABEEWAY

12.3.10 HIERSTAR CORP

13 APPENDIX (Page No. - 140)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (70 Tables)

TABLE 1 COMPARISON OF MULTIFUNCTIONAL SMART CARDS WITH CONVENTIONAL CARDS

TABLE 2 COMPARISON OF TECHNOLOGY FEATURES OF SMART CARDS AND CONVENTIONAL CARDS IN HEALTHCARE APPLICATION

TABLE 3 BENEFITS OF INTEGRATED IN-BADGE DISPLAYS

TABLE 4 ROUND TABLE PIZZA GROUP

TABLE 5 NHH SYMPOSIUM

TABLE 6 MIT INITIATIVE ON THE DIGITAL ECONOMY

TABLE 7 PCMA EUROPEAN INFLUENCERS SUMMIT

TABLE 8 UPM

TABLE 9 STANDARDS FORMULATED BY GOVERNMENT AND ORGANIZATIONS

TABLE 10 MARKET, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 11 CONTACT MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 12 CONTACTLESS MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 13 MARKET, BY TYPE, 20172025 (USD MILLION)

TABLE 14 SMART BADGES WITHOUT DISPLAYS MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 15 SMART BADGES WITH DISPLAYS MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 16 APPLICATION LIFECYCLE OF SMART BADGES

TABLE 17 MARKET, BY VERTICAL, 20172025 (USD MILLION)

TABLE 18 MARKET FOR GOVERNMENT AND HEALTHCARE, BY REGION, 20172025 (USD MILLION)

TABLE 19 MARKET FOR CORPORATE, BY REGION, 20172025 (USD MILLION)

TABLE 20 MARKET FOR EVENT AND ENTERTAINMENT, BY REGION, 20172025 (USD MILLION)

TABLE 21 MARKET FOR RETAIL AND HOSPITALITY, BY REGION, 20172025 (USD MILLION)

TABLE 22 MARKET FOR OTHER VERTICALS, BY REGION, 20172025 (USD MILLION)

TABLE 23 MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 24 MARKET IN NORTH AMERICA, BY COUNTRY, 20172025 (USD MILLION)

TABLE 25 MARKET IN NORTH AMERICA, BY TYPE, 20172025 (USD MILLION)

TABLE 26 MARKET IN NORTH AMERICA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 27 MARKET IN NORTH AMERICA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 28 MARKET IN US, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 29 MARKET IN US, BY VERTICAL, 20172025 (USD MILLION)

TABLE 30 MARKET IN CANADA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 31 MARKET IN CANADA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 32 MARKET IN MEXICO, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 33 MARKET IN MEXICO, BY APPLICATION, 20172025 (USD MILLION)

TABLE 34 MARKET IN EUROPE, BY COUNTRY, 20172025 (USD MILLION)

TABLE 35 MARKET IN EUROPE, BY TYPE, 20172025 (USD MILLION)

TABLE 36 MARKET IN EUROPE, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 37 MARKET IN EUROPE, BY VERTICAL, 20172025 (USD MILLION)

TABLE 38 MARKET IN GERMANY, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 39 MARKET IN GERMANY, BY VERTICAL, 20172025 (USD MILLION)

TABLE 40 MARKET IN UK, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 41 SMART BADGE MARKET IN UK, BY VERTICAL, 20172025 (USD MILLION)

TABLE 42 MARKET IN FRANCE, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 43 MARKET IN FRANCE, BY VERTICAL, 20172025 (USD MILLION)

TABLE 44 MARKET IN REST OF EUROPE, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 45 MARKET IN REST OF EUROPE, BY VERTICAL, 20172025 (USD MILLION)

TABLE 46 MARKET IN APAC, BY COUNTRY, 20172025 (USD MILLION)

TABLE 47 MARKET IN APAC, BY TYPE, 20172025 (USD MILLION)

TABLE 48 MARKET IN APAC, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 49 MARKET IN APAC, BY VERTICAL, 20172025 (USD MILLION)

TABLE 50 MARKET IN CHINA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 51 MARKET IN CHINA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 52 MARKET IN INDIA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 53 MARKET IN INDIA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 54 MARKET IN JAPAN, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 55 MARKET IN JAPAN, BY VERTICAL, 20172025 (USD MILLION)

TABLE 56 MARKET IN SOUTH KOREA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 57 MARKET IN SOUTH KOREA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 58 MARKET IN REST OF APAC, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 59 MARKET IN REST OF APAC, BY VERTICAL, 20172025 (USD MILLION

TABLE 60 MARKET IN ROW, BY REGION, 20172025 (USD MILLION)

TABLE 61 MARKET IN ROW, BY TYPE, 20172025 (USD MILLION)

TABLE 62 MARKET IN ROW, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 63 MARKET IN ROW, BY VERTICAL, 20172025 (USD MILLION)

TABLE 64 MARKET IN MIDDLE EAST AND AFRICA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 65 MARKET IN MIDDLE EAST AND AFRICA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 66 MARKET IN SOUTH AMERICA, BY COMMUNICATION, 20172025 (USD MILLION)

TABLE 67 MARKET IN SOUTH AMERICA, BY VERTICAL, 20172025 (USD MILLION)

TABLE 68 PRODUCT DEVELOPMENTS, PRODUCT LAUNCHES, AND EXPANSIONS, 20172020

TABLE 69 PARTNERSHIPS AND CONTRACTS, 20172019

TABLE 70 ACQUISITIONS, 20172019

LIST OF FIGURES (88 Figures)

FIGURE 1 SMART BADGE MARKET SEGMENTATION

FIGURE 2 MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 MARKET: RESEARCH DESIGN

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SOLUTIONS/PRODUCTS/SERVICES OFFERED IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): ADOPTION LEVEL OF SMART BADGES BY DIFFERENT END USERS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 DATA TRIANGULATION

FIGURE 9 MARKET, 20172025 (USD MILLION)

FIGURE 10 MARKET, 20172025 (MILLION UNITS)

FIGURE 11 MARKET WITHOUT DISPLAYS SEGMENT TO DOMINATE MARKET FROM 2020 TO 2025

FIGURE 12 CONTACTLESS SEGMENT TO HOLD LARGE SIZE OF MARKET IN 2025

FIGURE 13 EVENT AND ENTERTAINMENT SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 14 MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 15 MARKET EXPECTED TO WITNESS SIGNIFICANT GROWTH FROM 2020 TO 2025

FIGURE 16 SMART BADGES WITHOUT DISPLAYS SEGMENT TO DOMINATE MARKET FROM 2020 TO 2025

FIGURE 17 CONTACTLESS SEGMENT OF MARKET TO GROW AT HIGH RATE FROM 2020 TO 2025

FIGURE 18 GOVERNMENT AND HEALTHCARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

FIGURE 19 MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 20 MARKET : DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 21 GLOBAL SHIPMENT OF SECURE ELEMENTS

FIGURE 22 IMPACT ANALYSIS FOR DRIVERS

FIGURE 23 DIGITAL ID EKYC AROUND THE WORLD

FIGURE 24 IMPACT ANALYSIS FOR RESTRAINTS

FIGURE 25 IMPACT ANALYSIS FOR OPPORTUNITIES

FIGURE 26 IMPACT ANALYSIS FOR CHALLENGES

FIGURE 27 MARKET: VALUE CHAIN ANALYSIS

FIGURE 28 IMPACT ANALYSIS OF SMART BADGES WITH DISPLAYS (2020 & 2025)

FIGURE 29 APPLICATIONS OF SMART BADGES WITH REQUIRED STORAGE AND ARITHMETIC PROCESSING CAPACITIES

FIGURE 30 MARKET, BY COMMUNICATION

FIGURE 31 CONTACTLESS SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 32 SMART BADGE MARKET, BY TYPE

FIGURE 33 SMART BADGES WITHOUT DISPLAYS SEGMENT TO HOLD LARGE SIZE OF MARKET FROM 2020 TO 2025

FIGURE 34 MARKET, BY VERTICAL

FIGURE 35 GOVERNMENT AND HEALTHCARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

FIGURE 36 MARKET, BY GEOGRAPHY

FIGURE 37 MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 38 APAC TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 40 US TO ACCOUNT FOR LARGEST SIZE OF MARKET IN NORTH AMERICA FROM 2020 TO 2025

FIGURE 41 IDENTITY THEFTS AND FRAUDS IN US FROM 2015 TO 2018

FIGURE 42 EUROPE: MARKET SNAPSHOT

FIGURE 43 GERMANY TO ACCOUNT FOR LARGEST SIZE OF MARKET IN EUROPE FROM 2020 TO 2025

FIGURE 44 APAC: SMART BADGE MARKET SNAPSHOT

FIGURE 45 CHINA TO ACCOUNT FOR LARGEST SIZE OF MARKET IN APAC FROM 2020 TO 2025

FIGURE 46 MIDDLE EAST AND AFRICA TO HOLD LARGE SIZE OF MARKET FROM 2020 TO 2025

FIGURE 47 KEY STRATEGIES ADOPTED BY LEADING PLAYERS IN MARKET FROM JANUARY 2017 TO FEBRUARY 2020

FIGURE 48 MARKET RANKING OF TOP 3 PLAYERS IN MARKET, 2019

FIGURE 49 THALES GROUP: COMPANY SNAPSHOT

FIGURE 50 ASSA ABLOY: COMPANY SNAPSHOT

FIGURE 51 GIESECKE+DEVRIENT GMBH: COMPANY SNAPSHOT

FIGURE 52 BRADY WORLDWIDE, INC.: COMPANY SNAPSHOT

FIGURE 53 EVOLIS: COMPANY SNAPSHOT

FIGURE 54 IDENTIV: COMPANY SNAPSHOT

FIGURE 55 GLOBAL SHIPMENT OF SECURE ELEMENTS

FIGURE 56 IMPACT ANALYSIS FOR DRIVERS

FIGURE 57 DIGITAL ID EKYC AROUND THE WORLD

FIGURE 58 IMPACT ANALYSIS FOR RESTRAINTS

FIGURE 59 IMPACT ANALYSIS FOR OPPORTUNITIES

FIGURE 60 IMPACT ANALYSIS FOR CHALLENGES

FIGURE 61 SMART BADGE MARKET: VALUE CHAIN ANALYSIS

FIGURE 62 IMPACT ANALYSIS OF SMART BADGES WITH DISPLAYS (2020 & 2025)

FIGURE 63 APPLICATIONS OF SMART BADGES WITH REQUIRED STORAGE AND ARITHMETIC PROCESSING CAPACITIES

FIGURE 64 MARKET, BY COMMUNICATION

FIGURE 65 CONTACTLESS SEGMENT OF MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 66 MARKET, BY TYPE

FIGURE 67 MARKET WITHOUT DISPLAYS SEGMENT TO HOLD LARGE SIZE OF MARKET FROM 2020 TO 2025

FIGURE 68 MARKET, BY VERTICAL

FIGURE 69 GOVERNMENT AND HEALTHCARE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2025

FIGURE 70 MARKET, BY GEOGRAPHY

FIGURE 71 MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 72 APAC TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

FIGURE 73 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 74 US TO ACCOUNT FOR LARGEST SIZE OF MARKET IN NORTH AMERICA FROM 2020 TO 2025

FIGURE 75 IDENTITY THEFTS AND FRAUDS IN US FROM 2015 TO 2018

FIGURE 76 EUROPE: MARKET SNAPSHOT

FIGURE 77 GERMANY TO ACCOUNT FOR LARGEST SIZE OF MARKET IN EUROPE FROM 2020 TO 2025

FIGURE 78 APAC: MARKET SNAPSHOT

FIGURE 79 CHINA TO ACCOUNT FOR LARGEST SIZE OF MARKET IN APAC FROM 2020 TO 2025

FIGURE 80 MIDDLE EAST AND AFRICA TO HOLD LARGE SIZE OF MARKET FROM 2020 TO 2025

FIGURE 81 KEY STRATEGIES ADOPTED BY LEADING PLAYERS IN MARKET FROM JANUARY 2017 TO FEBRUARY 2020

FIGURE 82 MARKET RANKING OF TOP 3 PLAYERS IN MARKET, 2019

FIGURE 83 THALES GROUP: COMPANY SNAPSHOT

FIGURE 84 ASSA ABLOY: COMPANY SNAPSHOT

FIGURE 85 GIESECKE+DEVRIENT GMBH: COMPANY SNAPSHOT

FIGURE 86 BRADY WORLDWIDE, INC.: COMPANY SNAPSHOT

FIGURE 87 EVOLIS: COMPANY SNAPSHOT

FIGURE 88 IDENTIV: COMPANY SNAPSHOT

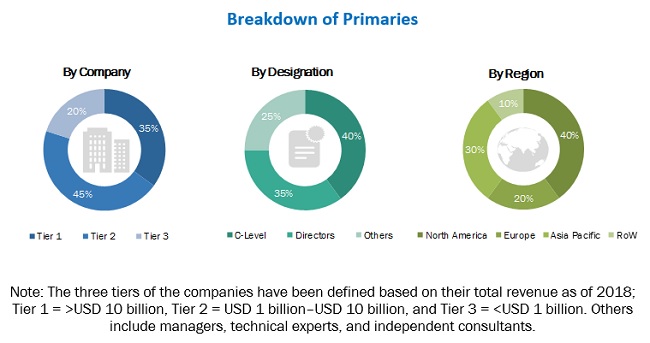

The study involved four major activities for estimating the size of the global smart badge market. Exhaustive secondary research was done to collect information on the market, including its peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, press releases, investor presentations, and financial statements); trade, business, and professional associations; white papers, smart badge solution-based marketing-related journals, certified publications, and articles from recognized authors; gold and silver standard websites; directories; and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through primary research. The secondary data has been collected and analyzed to arrive at the global smart badge market size, which has also been validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants from various key companies and organizations operating in the smart badge market.

Primary research has also been conducted to identify segmentation types and key players, as well as to analyze the competitive landscape, key market dynamics (drivers, restraints, opportunities, and challenges), and major growth strategies adopted by market players. During market engineering, both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to estimate and forecast the market, including the overall smart badge market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed during the complete market engineering process to list the key information/insights throughout the report. Primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the overall market and other dependent submarkets listed in this report. Extensive qualitative and quantitative analyses have been performed during market engineering to list key information/insights.

Major players in the smart badge market have been identified through secondary research, and their market ranking has been determined through primary and secondary research. This involved studying the annual and financial reports of top market players and interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insightsboth quantitative and qualitative.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall smart badge market size through the process explained above, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives

- To define, describe, forecast, and analyze the smart badge market by smart badges Type, communication, application, and geography

- To forecast the market for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the smart badge market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the smart badge market

- To strategically profile the key players and comprehensively analyze their market position in terms of their market ranking and core competencies and to analyze the competitive landscape across the ecosystem

Available Customization

With the given market data, MarketsandMarkets offers customizations according to a companys specific needs. The following customization options are available for the smart badge market report.

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Smart Badge Market