Small Marine Engines Market by Model (Gasoline, Diesel, Electric), Placement (Outboard, Inboard), Application (Recreational Boats, Support Vessels, Coastal Boats, Fishing Boats), Displacement (Up to 2 L, 2-4 L, 4-6 L) and Region - Global Forecast to 2027

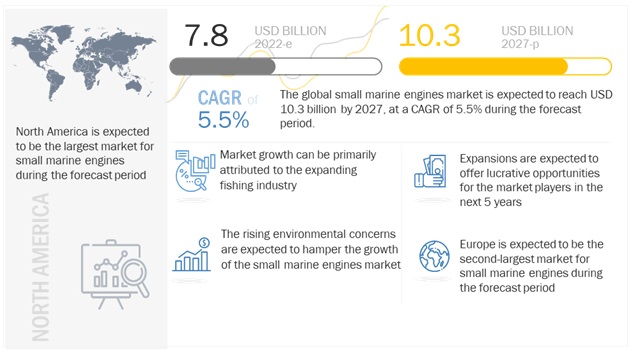

The small marine engines market size was valued at USD 7.8 billion in 2022 to reach USD 10.3 billion by 2027, at a CAGR of 5.5% during the forecast period. The small marine engines market growth is dependent significantly on the development of the boat manufacturing industry, as commissioning of boats would result in an increase in the number of orders for small marine engines for those boats/vessels. Retrofitting of existing vessels with newer engines as emission regulations become more stringent may also lead to an increase in the number of orders for small marine engines.

To know about the assumptions considered for the study, Request for Free Sample Report

Small Marine Engines Market Dynamics

Driver: Growth of fishing industry

Small vessels accounted for the largest share of motorized vessels in all continents. In absolute terms, most of these small, motorized vessels were in Asia, followed by the Americas, particularly Latin American and the Caribbean, and Africa. Reducing fuel costs and saving energy have been key drivers for technological developments in semi-industrial fishing operations, vessels, and gear. There have also been major developments in terms of increasing fishing efficiency, reducing the environmental impact of fishing, improving handling, and enhancing product quality, in addition to improving safety at sea and the working conditions of fishers on board vessels. These developments, together with a general increase in prices of aquatic products, successful fisheries management in some areas, and improved fleet capacity management in Europe and North America, all contributed to the positive financial and economic performance of the main global fishing fleets in recent years, before the COVID-19 pandemic. The fishing industry, in turn, is likely to witness significant growth in the coming years, which will drive the manufacturing of fishing boats on a large scale which will further fuel the demand for small marine engines.

Restraints : Lack of marine infrastructure in developing economies

As the maritime and shipping industries continue to grow, the infrastructure no longer accommodates current vessel traffic and port operations. As global trade by sea increases, infrastructure must be changed by expansion and construction. Smaller economies usually lack liner shipping connectivity, have a lower quality of port infrastructure, and inadequate trade facilitation measures. These shortcomings hamper the growth of maritime trade in such countries and regions. Such factors hinder the growth of the international maritime trade posing a challenge to the small marine engines market.

Opportunities: Increase in installation of offshore energy facilities

Marine Renewable Energy (MRE) includes both offshore wind energy and ocean energy. MRE represents an important source of green energy and can make a significant contribution to the EU’s 2050 energy strategy. During the last decade, the wind energy sector saw a strong increase in offshore wind technologies due to higher capacity factors achievable, availability of much larger sites and a remarkable cost reduction, supported by important technological advances, such as in wind turbine reliability. Also, offshore could build on some lessons learned in the onshore wind sector and competitive tendering. Offshore wind is expected to play a significant role in reaching Europe’s carbon-neutrality targets. The European Commission Offshore Renewable Energy Strategy stated that the boating industry becomes a useful resource for commuting to such places. This proves to be a driving factor for the small marine engines market.

Challenges: High lead times

One of the major problems that the small marine engines market would be facing is the increase in lead times. Lead time is the latency between the initiation and final execution of a product or process. Small marine engine manufacturing companies are focusing on faster deliveries and shorter lead times. This comes up as one of the major challenges and can be improved based upon the new innovations and enhanced productivity. The marine leisure market had record levels in 2021 driven by stay at-home trends in the wake of the COVID-19 pandemic as well as high economic activity. In combination with the strained supply chains, this led to longer lead times. In the marine commercial market, postponed projects in sub segments like passenger vessels for tourism were restarted.

To know about the assumptions considered for the study, download the pdf brochure

The outboard segment by placement is expected to occupy the largest share from 2022 to 2027

Based on the placement, the outboard segment is estimated to be the largest market from 2022 to 2027. An outboard engine, which is also known as an outboard motor, is a unit containing the engine, gearbox, and propeller. This part is mounted to the back of the boat and usually hangs outside the hull. An outboard engine is basically used to power and steer the boat. Smaller boats allows the engine to be steered manually, while larger vessels are equipped with steering wheels. The engine propeller and gear case are underwater during use, which gives the boat the ability to plane quickly and be very swift while turning and mooring. This is expected to grow with the same pace in the upcoming years, hence driving the market for outboard engines.

Recreational boats by application is projected to emerge as the largest segment for small marine engines market

Based on the application, recreational boats is projected to hold the highest market share during the forecast period. Consumer interest and demand for boating and fishing continue to increase as more people opted for boating as an accessible outdoor activity, especially as other leisure activities, sports and travel continue to be impacted by COVID-19. The spurt in boating and fishing activities would increase the demand for yachts, cruiser boats, sailboats, cataraman, and fishing boats. These boats use small marine engines and hence their demand will also be increased. Hence, the small marine engines market is expected to be majorly driven by the recreational boats and the fishing boats.

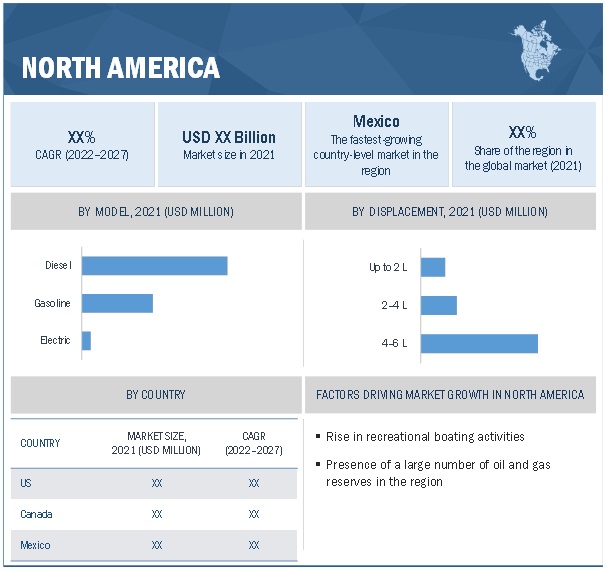

North America and Europe are expected to account for the largest market size during the forecast period.

North America region is expected to dominate the small marine engines market during the forecast period. Increasing investments in the defence sector and restructuring efforts undertaken by ship manufacturing companies are additional factors driving the growth of the small marine engines market. The growth of the recreational boating industry in Europe is one of the most significant factors contributing to the increasing demand for small marine engines in this region. Europe has a strong recreational sector both in supply and demand with countries such as France, the Netherlands, and the UK, world-renowned for their boat building capabilities contributing to the increasing demand for small marine engines in this region.

Key Players

Yamaha Motor Co., Ltd. (Japan), Yanmar Co. Ltd. (Japan), Brunswick Corporation (US), Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Volvo Penta (Sweden), Caterpillar (US), Cummins (US), Deutz AG (Germany), Kirloskar Oil Engines (India), Greaves Cotton Limited (India)

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Model, By Displacement, By Placement, and By Application |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Yamaha Motor Co., Ltd. (Japan), Yanmar Co. Ltd. (Japan), Brunswick Corporation (US), Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Caterpillar (US), Cummins Inc. (US), Volvo Penta (Sweden), Deutz AG (Germany), Greaves Cotton Limited (India), Weichai Power Co., Ltd. (China), John Deere (US), Kohler Co. (US), Tohatsu Corporation (Japan), Kirloskar Oil Engines (India), OXE Marine AB (Sweden), Hyundai SeasAll (South Korea), Mitsubishi Heavy Industries- VST Diesel Engines (India), Doosan Infracore (South Korea), FPT Industrial (Italy) |

This research report categorizes the small marine engines market based on model, displacement, placement, application, and region.

Based on model:

- Gasoline

- Diesel

- Electric

Based on displacement:

- Up to 2 L

- 2-4 L

- 4-6 L

Based on placement:

-

Outboard

- Gasoline

- Diesel

- Electric

-

Inboard

- Gasoline

- Diesel

- Electric

-

Others

- Gasoline

- Diesel

- Electric

Based on placement:

-

Recreational Boats

- Yatchs

- Cruiser Boats

- Others

-

Support Vessels

- Fire Boats

- Rescue Boats

- Others

-

Coastal Boats

- Patrol Boats

- Others

- Fishing Boats

- Others

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In June 2021, Suzuki Marine USA, LLC, the outboard motor distributor of Suzuki Motor Corporation in the US, agreed to supply outboard motors for a new private boat brand by Camping World, a major outdoor retailer with 160 locations in the US.

- In February 2020, Yanmar partnered with Smartgyro, a gyro stabilization technology company. The partnership helped Yanmar enter the growing gyro stabilizer market and enhance boating enjoyment, comfort, and safety with technologically advanced marine systems.

- In January 2020, Yanmar and Nauti-Craft signed an agreement with the purpose of commercializing Yanmar’s boats by utilizing Nauti-Craft’s patented marine suspension technology.

Frequently Asked Questions (FAQ):

What is the current size of the small marine engines market?

The current market size of global small marine engines market is estimated to be USD 7.8 billion in 2022.

What is the major drivers for small marine engines market?

Water-based activities such as boating, yachting, nautical sports will increase the demand for such vessels and crafts, hence driving the market. Engines used in relation to such activities are referred to as small marine engines and is expected to gain a significant market in the coming years. Coastal tourism have been a major driver for the small marine engines market. The demand for small marine engines in the defense sector is also projected to increase because of the ongoing territorial conflicts among countries. The rise in the number of boats, crafts, and vessels needed for defense and patrolling will contribute to the growth of propulsion systems and small marine engines.

Which is the largest-growing region during the forecasted period in small marine engines market?

North America is expected to account for the largest market size during the forecast period. The countries covered in the region are US, Canada, and Mexico. The major end-users for small marine engines in the region include recreational boats. The increase in outboard engine sales reinforces that Canadians embraced boating in record numbers in 2020 as a safe and fun outdoor activity during the COVID-19 pandemic. There has been a significant demand for small marine engines from the boating industry of Canada and this is expected to lead a surge in demand for these engines in the upcoming years as well, as the recreational activities and consumer inclination towards health awareness are likely to gain more importance in the next few years.

Which is the fastest-growing segment, by type during the forecast period in small marine engines market?

The outboard engines, by placement, is expected to be the fastest growing segment in the small marine engines market. On the basis of placement, the small marine engines market is segmented into outboard, inboard, and others. All these segments have three type of model i.e. gasoline, diesel, and electric. Out of them, the gasoline is expected to grow with the highest CAGR. Gasoline outboard engines are the preferred method of propulsion on vessels, such as passenger boats and ferries, with minimal passenger capacity. Sterndrive gasoline engine is perfect for both leisure cruising and thrilling watersports. As the gasoline based engines require less costs to purchase and repower, they are expected to grow at a significant pace during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 SMALL MARINE ENGINES MARKET, BY MODEL

1.3.2 MARKET, BY DISPLACEMENT

1.3.3 MARKET, BY PLACEMENT

1.3.4 MARKET, BY APPLICATION

1.3.5 MARKET, BY REGION

1.4 STUDY SCOPE

1.4.1 SMALL MARINE ENGINES MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 SMALL MARINE ENGINES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

2.2.2.2 Key data from primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR SMALL MARINE ENGINES

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF SMALL MARINE ENGINES

FIGURE 8 SMALL MARINE ENGINES MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 1 SMALL MARINE ENGINES MARKET SNAPSHOT

FIGURE 9 NORTH AMERICA DOMINATED MARKET IN 2021

FIGURE 10 DIESEL TO ACCOUNT FOR LARGEST MARKET SHARE FROM 2022 TO 2027

FIGURE 11 4–6 L SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 12 OUTBOARD SEGMENT TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 13 RECREATIONAL BOATS TO DOMINATE MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMALL MARINE ENGINES MARKET

FIGURE 14 RISE IN RECREATIONAL BOATING ACTIVITIES EXPECTED TO DRIVE MARKET BETWEEN 2022 AND 2027

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY MODEL AND COUNTRY, 2021

FIGURE 16 DIESEL AND US HELD LARGEST SHARES OF NORTH AMERICA MARKET IN 2021

4.4 MARKET, BY MODEL

FIGURE 17 DIESEL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.5 MARKET, BY DISPLACEMENT

FIGURE 18 4–6 L TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.6 MARKET, BY PLACEMENT

FIGURE 19 OUTBOARD TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.7 OUTBOARD MARKET, BY MODEL

FIGURE 20 DIESEL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.8 INBOARD MARKET, BY MODEL

FIGURE 21 DIESEL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.9 OTHERS MARKET, BY MODEL

FIGURE 22 DIESEL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.10 MARKET, BY APPLICATION

FIGURE 23 RECREATIONAL BOATS SEGMENT TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 SMALL MARINE ENGINES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surge in demand for outdoor recreation and personal mobility

5.2.1.2 Growth of fishing industry

FIGURE 25 DISTRIBUTION OF WORLD’S FISHING VESSELS, BY CONTINENT, 2020

5.2.1.3 Emphasis on coastal security and defense

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations for decarbonization

FIGURE 26 IMO GLOBAL SULFUR CAP

FIGURE 27 GLOBAL ENERGY-RELATED CO2 EMISSIONS, 2010 TO 2021

5.2.2.2 Lack of marine infrastructure in developing economies

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in installation of offshore energy facilities

TABLE 2 POLICIES TARGETING AT LEAST 10 GW OF OFFSHORE WIND BY 2030

FIGURE 28 INSTALLED RENEWABLE ENERGY CAPACITY, 2016–2021

5.2.3.2 Growing investments in electrification projects for marine applications

5.2.4 CHALLENGES

5.2.4.1 High lead times

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR SMALL MARINE ENGINE PROVIDERS

FIGURE 29 REVENUE SHIFT FOR SMALL MARINE ENGINES PROVIDERS

5.4 MARKET MAP

FIGURE 30 MARKET MAP: MARKET

TABLE 3 MARKET: ECOSYSTEM

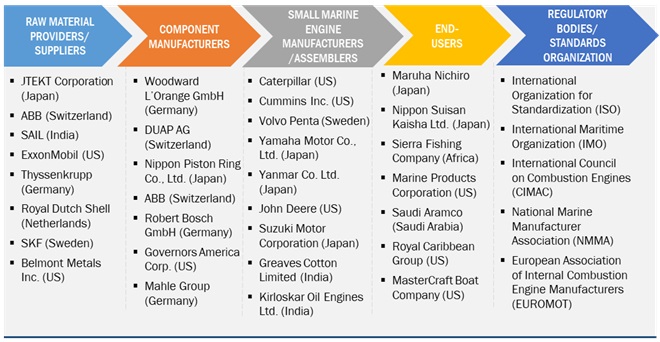

5.5 VALUE CHAIN ANALYSIS

FIGURE 31 MARKET: VALUE CHAIN ANALYSIS

5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.5.2 COMPONENT MANUFACTURERS

5.5.3 MARINE ENGINE MANUFACTURERS/ASSEMBLERS

5.5.4 DISTRIBUTORS (BUYERS)/END-USERS

5.5.5 POST-SALES SERVICE PROVIDERS

5.6 TECHNOLOGY ANALYSIS

5.6.1 IOT-CONNECTED SMALL MARINE ENGINES

5.6.2 DUAL-FUEL AND HYBRID SMALL MARINE ENGINES

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICES OF SMALL MARINE ENGINES, BY DISPLACEMENT

TABLE 4 AVERAGE SELLING PRICES OF SMALL MARINE ENGINES, 2021

TABLE 5 AVERAGE SELLING PRICES OF SMALL MARINE ENGINES, BY DISPLACEMENT, OF KEY PLAYERS (2021)

FIGURE 32 AVERAGE SELLING PRICES OF OFFERINGS OF KEY PLAYERS, BY DISPLACEMENT

5.8 KEY CONFERENCES & EVENTS, 2022–2023

TABLE 6 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 TARIFFS RELATED TO SMALL MARINE ENGINES

TABLE 7 IMPORT TARIFFS FOR HS CODE 840810 MARINE PROPULSION ENGINES IN 2019

TABLE 8 IMPORT TARIFFS FOR HS CODE 840729 MARINE PROPULSION SPARK-IGNITION ENGINES IN 2019

5.10 TRADE ANALYSIS

5.10.1 TRADE ANALYSIS FOR HS 840810 MARINE PROPULSION ENGINES, DIESEL

5.10.1.1 Export scenario

TABLE 9 EXPORT SCENARIO FOR HS CODE 840810, BY COUNTRY, 2019–2021 (USD)

5.10.1.2 Import scenario

TABLE 10 IMPORT SCENARIO FOR HS CODE 842129, BY COUNTRY, 2019–2021 (USD)

5.10.2 TRADE ANALYSIS FOR HS 840729 MARINE PROPULSION SPARK-IGNITION ENGINES

5.10.2.1 Export scenario

TABLE 11 EXPORT SCENARIO FOR HS CODE 840729, BY COUNTRY, 2019–2021 (USD)

5.10.2.2 Import scenario

TABLE 12 IMPORT SCENARIO FOR HS CODE 840729, BY COUNTRY, 2019–2021 (USD)

5.10.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.4 CODES AND REGULATIONS RELATED TO SMALL MARINE ENGINES

TABLE 17 SMALL MARINE ENGINES: CODES AND REGULATIONS

5.11 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 18 SMALL MARINE ENGINES: INNOVATIONS AND PATENT REGISTRATIONS, MARCH 2018–JANUARY 2022

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 19 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 20 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

5.14 BUYING CRITERIA

FIGURE 35 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 21 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.15 CASE STUDY ANALYSIS

5.15.1 YANMAR LAUNCHES MARINE ENGINES FOR APPLICATION IN FISHING BOATS

5.15.1.1 Problem statement: March 2020

5.15.1.2 Solution

5.15.2 YANMAR PROVIDES MARINE DIESEL ENGINES FOR RELIABLE AND SMOOTH OPERATIONS

5.15.2.1 Problem statement: September 2021

5.15.2.2 Solution

6 SMALL MARINE ENGINES MARKET, BY MODEL (Page No. - 104)

6.1 INTRODUCTION

FIGURE 36 MARKET, BY MODEL, 2021

TABLE 22 MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 23 MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

6.2 DIESEL

6.2.1 OFFERS ADVANTAGE OF HIGH TOLERANCE

TABLE 24 DIESEL: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 DIESEL: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

6.3 GASOLINE

6.3.1 REQUIRES LOW COSTS TO PURCHASE AND REPOWER

TABLE 26 GASOLINE: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 GASOLINE: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

6.4 ELECTRIC

6.4.1 OFFERS REDUCED ENVIRONMENTAL RISKS AND NOISE

TABLE 28 ELECTRIC: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 29 ELECTRIC: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

7 SMALL MARINE ENGINES MARKET, BY DISPLACEMENT (Page No. - 110)

7.1 INTRODUCTION

FIGURE 37 MARKET, BY DISPLACEMENT, 2021

TABLE 30 MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 31 MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

7.2 UP TO 2 L

7.2.1 USED IN SPORTS FISHING BOATS

TABLE 32 UP TO 2 L: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 UP TO 2 L: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

7.3 2–4 L

7.3.1 USED FOR VESSELS SAILING ON INLAND WATERS

TABLE 34 2–4 L: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 2–4 L: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

7.4 4–6 L

7.4.1 PROVIDES BENEFITS OF FUEL EFFICIENCY AND LOW MAINTENANCE COST

TABLE 36 4–6 L: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 4–6 L: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

8 SMALL MARINE ENGINES MARKET, BY PLACEMENT (Page No. - 115)

8.1 INTRODUCTION

FIGURE 38 MARKET, BY PLACEMENT, 2021

TABLE 38 MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 39 MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

8.2 OUTBOARD

8.2.1 ARE EASY TO USE AND REQUIRE LOW MAINTENANCE

FIGURE 39 OUTBOARD MARKET, BY MODEL, 2021

TABLE 40 OUTBOARD: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 OUTBOARD: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 42 OUTBOARD: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 43 OUTBOARD: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 44 OUTBOARD: GASOLINE TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 45 OUTBOARD: GASOLINE TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 46 OUTBOARD: DIESEL TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 OUTBOARD: DIESEL TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 48 OUTBOARD: ELECTRIC TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 49 OUTBOARD: ELECTRIC TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

8.3 INBOARD

8.3.1 DESIGNED FOR VESSELS REQUIRING HIGH HORSEPOWER AND TORQUE

FIGURE 40 INBOARD MARKET, BY MODEL, 2021

TABLE 50 INBOARD: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 INBOARD: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 52 INBOARD: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 53 INBOARD: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 54 INBOARD: GASOLINE TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 INBOARD: GASOLINE TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 56 INBOARD: DIESEL TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 57 INBOARD: DIESEL TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 58 INBOARD: ELECTRIC TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 59 INBOARD: ELECTRIC TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS) 8.4 OTHERS

FIGURE 41 OTHERS MARKET, BY MODEL, 2021

TABLE 60 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 OTHERS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 62 OTHERS: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 63 OTHERS: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 64 OTHERS: GASOLINE-TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 65 OTHERS: GASOLINE-TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 66 OTHERS: DIESEL-TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 67 OTHERS: DIESEL-TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 68 OTHERS: ELECTRIC-TYPE MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 69 OTHERS: ELECTRIC-TYPE MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9 SMALL MARINE ENGINES MARKET, BY APPLICATION (Page No. - 130)

9.1 INTRODUCTION

FIGURE 42 MARKET, BY APPLICATION, 2021

TABLE 70 MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 71 MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

9.2 RECREATIONAL BOATS

TABLE 72 RECREATIONAL BOATS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 73 RECREATIONAL BOATS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.2.1 YACHTS

9.2.1.1 Majorly driven by inboard small marine engines

9.2.2 CRUISER BOATS

9.2.2.1 Require less maintenance

9.2.3 OTHERS

9.3 SUPPORT VESSELS

TABLE 74 SUPPORT VESSELS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 75 SUPPORT VESSELS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.3.1 FIRE BOATS

9.3.1.1 Mainly operated by diesel-based small marine engines

9.3.2 RESCUE BOATS

9.3.2.1 Employ petrol-driven outboard small marine engines

9.3.3 OTHERS

9.4 COASTAL BOATS

TABLE 76 COASTAL BOATS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 77 COASTAL BOATS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.4.1 PATROL BOATS

9.4.1.1 Used to perform rescue operations and ensure coastal security

9.4.2 OTHERS

9.5 FISHING BOATS

9.5.1 SPURT IN GLOBAL FISH PRODUCTION TO DRIVE MARKET

TABLE 78 FISHING BOATS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 79 FISHING BOATS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9.6 OTHERS

TABLE 80 OTHER APPLICATIONS: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 81 OTHER APPLICATIONS: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

10 SMALL MARINE ENGINES MARKET, BY REGION (Page No. - 140)

10.1 INTRODUCTION

FIGURE 43 SMALL MARINE ENGINES MARKET SHARE, BY REGION, 2021 (%)

FIGURE 44 MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 82 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 83 MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

10.2 NORTH AMERICA

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

10.2.1 BY MODEL

TABLE 84 NORTH AMERICA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.2.2 BY DISPLACEMENT

TABLE 86 NORTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.2.3 BY PLACEMENT

TABLE 88 NORTH AMERICA: MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

TABLE 90 NORTH AMERICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 92 NORTH AMERICA: INBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: INBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 94 NORTH AMERICA: OTHERS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: OTHERS MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.2.4 BY APPLICATION

TABLE 96 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

10.2.5 BY COUNTRY

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (THOUSAND UNITS)

10.2.6 US

10.2.6.1 Surge in recreation activities

TABLE 100 US: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 101 US: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.2.7 CANADA

10.2.7.1 Spurt in boating activities

TABLE 102 CANADA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 103 CANADA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.2.8 MEXICO

10.2.8.1 Large-scale exploration of oil and gas

TABLE 104 MEXICO: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 105 MEXICO: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3 EUROPE

FIGURE 46 EUROPE: MARKET SNAPSHOT

10.3.1 BY MODEL

TABLE 106 EUROPE: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.3.2 BY DISPLACEMENT

TABLE 108 EUROPE: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3.3 BY PLACEMENT

TABLE 110 EUROPE: MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

TABLE 112 EUROPE: OUTBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 113 EUROPE: OUTBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 114 EUROPE: INBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 115 EUROPE: INBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 116 EUROPE: OTHERS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 117 EUROPE: OTHERS MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.3.4 BY APPLICATION

TABLE 118 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

10.3.5 BY COUNTRY

TABLE 120 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2020–2027 (THOUSAND UNITS)

10.3.5.1 Germany

10.3.5.1.1 Increase in fish imports

TABLE 122 GERMANY: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 123 GERMANY: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3.5.2 Italy

10.3.5.2.1 Surge in boatbuilding activities

TABLE 124 ITALY: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 125 ITALY: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3.5.3 UK

10.3.5.3.1 Increase in trade activities

TABLE 126 UK: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 127 UK: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3.5.4 France

10.3.5.4.1 Digitalization of major seaports

TABLE 128 FRANCE: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.3.5.5 Rest of Europe

TABLE 130 REST OF EUROPE: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 131 REST OF EUROPE: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4 ASIA PACIFIC

10.4.1 BY MODEL

TABLE 132 ASIA PACIFIC: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.4.2 BY DISPLACEMENT

TABLE 134 ASIA PACIFIC: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4.3 BY PLACEMENT

TABLE 136 ASIA PACIFIC: MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

TABLE 138 ASIA PACIFIC: OUTBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: OUTBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 140 ASIA PACIFIC: INBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 141 ASIA PACIFIC: INBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 142 ASIA PACIFIC: OTHERS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: OTHERS MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.4.4 BY APPLICATION

TABLE 144 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

10.4.5 BY COUNTRY

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (THOUSAND UNITS)

10.4.5.1 China

10.4.5.1.1 Standards and regulations to reduce emissions

TABLE 148 CHINA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 149 CHINA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4.5.2 India

10.4.5.2.1 Huge investments in fishing industry

TABLE 150 INDIA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 151 INDIA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4.5.3 Japan

10.4.5.3.1 Growing adoption of private pleasure boats

TABLE 152 JAPAN: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 153 JAPAN: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4.5.4 Australia

10.4.5.4.1 Increase in recreational fishing activities

TABLE 154 AUSTRALIA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 155 AUSTRALIA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.4.6 REST OF ASIA PACIFIC

TABLE 156 REST OF ASIA PACIFIC: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 157 REST OF ASIA PACIFIC: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY MODEL

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.5.2 BY DISPLACEMENT

TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.5.3 BY PLACEMENT

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

TABLE 164 MIDDLE EAST & AFRICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 166 MIDDLE EAST & AFRICA: INBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: INBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 168 MIDDLE EAST & AFRICA: OTHERS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: OTHERS MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.5.4 BY APPLICATION

TABLE 170 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

10.5.5 BY COUNTRY

TABLE 172 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (THOUSAND UNITS)

10.5.5.1 UAE

10.5.5.1.1 Increase in yacht manufacturing

TABLE 174 UAE: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 175 UAE: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.5.5.2 Saudi Arabia

10.5.5.2.1 Demand from tourism and defense sectors

TABLE 176 SAUDI ARABIA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 177 SAUDI ARABIA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.5.5.3 South Africa

10.5.5.3.1 Government support and funds for development of fisheries sector

TABLE 178 SOUTH AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 179 SOUTH AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.5.5.4 Rest of Middle East & Africa

TABLE 180 REST OF MIDDLE EAST & AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 181 REST OF MIDDLE EAST & AFRICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.6 SOUTH AMERICA

10.6.1 BY MODEL

TABLE 182 SOUTH AMERICA: MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.6.2 BY DISPLACEMENT

TABLE 184 SOUTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.6.3 BY PLACEMENT

TABLE 186 SOUTH AMERICA: MARKET, BY PLACEMENT, 2020–2027 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET, BY PLACEMENT, 2020–2027 (THOUSAND UNITS)

TABLE 188 SOUTH AMERICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 189 SOUTH AMERICA: OUTBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 190 SOUTH AMERICA: INBOARD MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 191 SOUTH AMERICA: INBOARD MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

TABLE 192 SOUTH AMERICA: OTHERS MARKET, BY MODEL, 2020–2027 (USD MILLION)

TABLE 193 SOUTH AMERICA: OTHERS MARKET, BY MODEL, 2020–2027 (THOUSAND UNITS)

10.6.4 BY APPLICATION

TABLE 194 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 195 SOUTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (THOUSAND UNITS)

10.6.5 BY COUNTRY

TABLE 196 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 197 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (THOUSAND UNITS)

10.6.5.1 Brazil

10.6.5.1.1 Unprecedented growth in average production of boats

TABLE 198 BRAZIL: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 199 BRAZIL: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.6.5.2 Argentina

10.6.5.2.1 Demand for offshore patrol vessels from navy

TABLE 200 ARGENTINA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 201 ARGENTINA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

10.6.5.3 Rest of South America

TABLE 202 REST OF SOUTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (USD MILLION)

TABLE 203 REST OF SOUTH AMERICA: MARKET, BY DISPLACEMENT, 2020–2027 (THOUSAND UNITS)

11 COMPETITIVE LANDSCAPE (Page No. - 191)

11.1 SMALL MARINE ENGINES MARKET OVERVIEW

TABLE 204 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, DECEMBER 2020– FEBRUARY 2022

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

TABLE 205 MARKET: DEGREE OF COMPETITION

FIGURE 47 MARKET SHARE ANALYSIS, 2021

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 48 TOP PLAYERS IN MARKET FROM 2017 TO 2021

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE PLAYERS

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 49 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2021

11.5 START-UP/SME EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 50 MARKET: START-UP/SME EVALUATION QUADRANT

11.6 COMPETITIVE BENCHMARKING

TABLE 206 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 207 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

11.7 MARKET: COMPANY FOOTPRINT

TABLE 208 BY TYPE: COMPANY FOOTPRINT

TABLE 209 BY ENGINE DISPLACEMENT: COMPANY FOOTPRINT

TABLE 210 BY ENGINE PLACEMENT: COMPANY FOOTPRINT

TABLE 211 BY APPLICATION: COMPANY FOOTPRINT

TABLE 212 BY REGION: COMPANY FOOTPRINT

TABLE 213 COMPANY FOOTPRINT

11.8 COMPETITIVE SCENARIOS AND TRENDS

TABLE 214 MARKET: PRODUCT LAUNCHES, JANUARY 2019– FEBRUARY 2022

TABLE 215 MARKET: DEALS, JANUARY 2020–FEBRUARY 2022

TABLE 216 MARKET: OTHERS, DECEMBER 2020–MARCH 2022

12 COMPANY PROFILES (Page No. - 211)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 YAMAHA MOTOR CO., LTD.

TABLE 217 YAMAHA MOTOR CO., LTD.: COMPANY OVERVIEW

FIGURE 51 YAMAHA MOTOR CO., LTD.: COMPANY SNAPSHOT (2021)

TABLE 218 YAMAHA MOTOR CO., LTD.: PRODUCTS OFFERED

TABLE 219 YAMAHA MOTOR CO., LTD.: DEALS

12.1.2 YANMAR CO. LTD.

TABLE 220 YANMAR CO. LTD.: COMPANY OVERVIEW

FIGURE 52 YANMAR CO. LTD.: COMPANY SNAPSHOT (2021)

TABLE 221 YANMAR CO. LTD.: PRODUCTS OFFERED

TABLE 222 YANMAR CO. LTD.: PRODUCT LAUNCHES

TABLE 223 YANMAR CO. LTD.: DEALS

12.1.3 BRUNSWICK CORPORATION

TABLE 224 BRUNSWICK CORPORATION: COMPANY OVERVIEW

FIGURE 53 BRUNSWICK CORPORATION: COMPANY SNAPSHOT (2021)

TABLE 225 BRUNSWICK CORPORATION: PRODUCTS OFFERED

TABLE 226 BRUNSWICK CORPORATION: PRODUCT LAUNCHES

TABLE 227 BRUNSWICK CORPORATION: OTHERS

12.1.4 SUZUKI MOTOR CORPORATION

TABLE 228 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

FIGURE 54 SUZUKI MOTOR CORPORATION: COMPANY SNAPSHOT (2021)

TABLE 229 SUZUKI MOTOR CORPORATION: PRODUCTS OFFERED

TABLE 230 SUZUKI MOTOR CORPORATION: PRODUCT LAUNCHES

TABLE 231 SUZUKI MOTOR CORPORATION: DEALS

12.1.5 HONDA MOTOR CO., LTD.

TABLE 232 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

FIGURE 55 HONDA MOTOR CO., LTD.: COMPANY SNAPSHOT (2021)

TABLE 233 HONDA MOTOR CO., LTD.: PRODUCTS OFFERED

12.1.6 CATERPILLAR

TABLE 234 CATERPILLAR: COMPANY OVERVIEW

FIGURE 56 CATERPILLAR: COMPANY SNAPSHOT (2021)

TABLE 235 CATERPILLAR: PRODUCTS OFFERED

TABLE 236 CATERPILLAR: PRODUCT LAUNCHES

TABLE 237 CATERPILLAR: DEALS

TABLE 238 CATERPILLAR: OTHERS

12.1.7 CUMMINS INC.

TABLE 239 CUMMINS INC.: COMPANY OVERVIEW

FIGURE 57 CUMMINS INC.: COMPANY SNAPSHOT (2021)

TABLE 240 CUMMINS INC.: PRODUCTS OFFERED

TABLE 241 CUMMINS INC.: PRODUCT LAUNCHES

TABLE 242 CUMMINS INC.: DEALS

12.1.8 VOLVO PENTA

TABLE 243 VOLVO PENTA: COMPANY OVERVIEW

FIGURE 58 VOLVO PENTA: COMPANY SNAPSHOT (2021)

TABLE 244 VOLVO PENTA: PRODUCTS OFFERED

TABLE 245 VOLVO PENTA: PRODUCT LAUNCHES

TABLE 246 VOLVO PENTA: DEALS

TABLE 247 VOLVO PENTA: OTHERS

12.1.9 DEUTZ AG

TABLE 248 DEUTZ AG: COMPANY OVERVIEW

FIGURE 59 DEUTZ AG: COMPANY SNAPSHOT (2021)

TABLE 249 DEUTZ AG: PRODUCTS OFFERED

TABLE 250 DEUTZ AG: OTHERS

12.1.10 GREAVES COTTON LIMITED

TABLE 251 GREAVES COTTON LIMITED: COMPANY OVERVIEW

FIGURE 60 GREAVES COTTON LIMITED: COMPANY SNAPSHOT (2021)

TABLE 252 GREAVES COTTON LIMITED: PRODUCTS OFFERED

12.1.11 WEICHAI POWER CO., LTD.

TABLE 253 WEICHAI POWER CO., LTD.: COMPANY OVERVIEW

FIGURE 61 WEICHAI POWER CO., LTD.: COMPANY SNAPSHOT (2021)

TABLE 254 WEICHAI POWER CO. LTD.: PRODUCTS OFFERED

12.1.12 JOHN DEERE

TABLE 255 JOHN DEERE: COMPANY OVERVIEW

FIGURE 62 JOHN DEERE: COMPANY SNAPSHOT (2021)

TABLE 256 JOHN DEERE: PRODUCTS OFFERED

TABLE 257 JOHN DEERE: DEALS

12.1.13 KOHLER CO.

TABLE 258 KOHLER CO.: COMPANY OVERVIEW

TABLE 259 KOHLER CO.: PRODUCTS OFFERED

TABLE 260 KOHLER CO.: DEALS

12.1.14 TOHATSU CORPORATION

TABLE 261 TOHATSU CORPORATION: COMPANY OVERVIEW

TABLE 262 TOHATSU CORPORATION: PRODUCTS OFFERED

TABLE 263 TOHATSU CORPORATION: PRODUCT LAUNCHES

12.1.15 KIRLOSKAR OIL ENGINES

TABLE 264 KIRLOSKAR OIL ENGINES: COMPANY OVERVIEW

FIGURE 63 KIRLOSKAR OIL ENGINES: COMPANY SNAPSHOT (2020)

TABLE 265 KIRLOSKAR OIL ENGINES: PRODUCTS OFFERED

TABLE 266 KIRLOSKAR OIL ENGINES: DEALS

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 OXE MARINE AB

12.2.2 HYUNDAI SEASALL

12.2.3 MITSUBISHI HEAVY INDUSTRIES-VST DIESEL ENGINES

12.2.4 DOOSAN INFRACORE

12.2.5 FPT INDUSTRIAL

13 APPENDIX (Page No. - 262)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

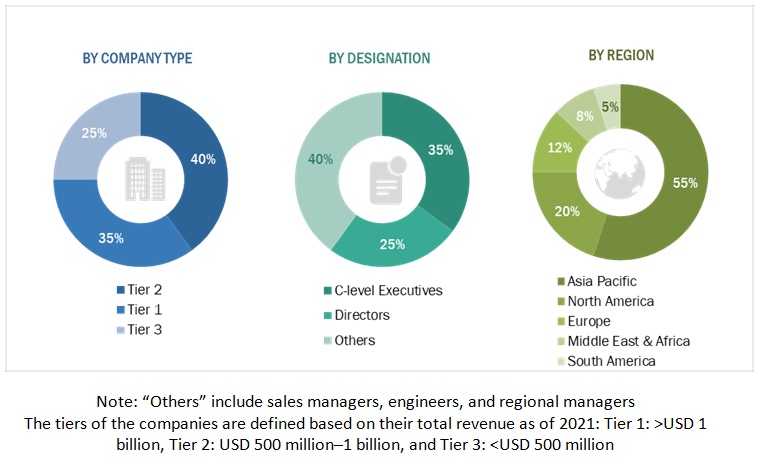

This study involved major activities in estimating the current size of the small marine engines market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global small marine engines market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The small marine engines market comprises several stakeholders, such as raw material providers/suppliers, component manufacturers, small marine engines manufacturers/assemblers, distributors, end-users in the supply chain. The demand-side of this market is characterized by the end-users . Moreover, the demand is also fueled by the growing demand of recreational and fishing sectors. The supply side is characterized by rising demand for contracts from the boatbuilding sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the small marine engines market.

- In this approach, the small marine engines production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of small marine engines.

- Several primary interviews have been conducted with key opinion leaders related to small marine engines system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Small Marine Engines Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the small marine engines market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the small marine engines market by model, displacement, placement, and application in terms of value

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, South America along with their key countries, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the market

- This report covers the small marine engines market size in terms of value

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Small Marine Engines Market