Slide Stainer Market by Product (Reagent (Stains, Probes, ABS), Equipment (Automated, Manual)), Technology (H&E, IHC, ISH, Cytology), Application (Disease Diagnosis (Cancer) Research), End User (Hospitals, Diagnostic Labs) - Global Forecast to 2027

Slide Stainer Market Overview and Growth Projections

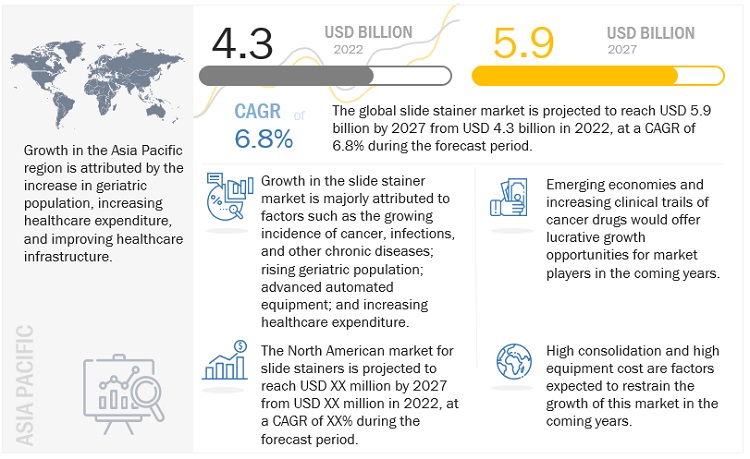

Slide stainer market growth forecasted to transform from $4.3 billion in 2022 to $5.9 billion by 2027, driven by a CAGR of 6.8%. The growth in this market is driven by the increasing diagnosis of cancer, infectious, and other chronic diseases, expanding patient base and improving healthcare infrastructure.

Attractive Opportunities in the Slide Stainer Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Slide Stainer Market Dynamics

Drivers:

- Growth in prevalence of cancer

- Recommendations for cancer screening

- Increase in healthcare expenditure

- Rise in geriatric population with subsequent growth in chronic and infectious diseases

- Increase in private diagnostics centers globally

- Greater automation in laboratories

- Higher usage of AI in histopathology

The increased prevalence of cancer, chronic, and infectious diseases and the high volume of slide staining places a great demand for slide stainer products. The vast geriatric population base, increasing numbers of cancer screening, and increasing cancer drug trials. The fast, efficient, and high throughput features of the automated and semi-automated slide staining systems have been efficient in meeting the demand for the high volume of slide staining, especially amid the COVID-19 pandemic and increasing cancer cases.

Opportunity:

- High-growth opportunities in emerging markets

- Increase in the number of clinical trials pertaining to cancer drugs

Emerging economies such as India and China hold massive potential in the slide stainer market with their improving healthcare infrastructure and investments, increasing population, and increasing burden of cancer, infections and chronic diseases.

Challenges:

- Dearth of knowledgeable and skilled technicians

- Product recalls

- Availability of refurbished equipment

The slide stainer market faces certain challenging elements that hinder its growth. The dearth of skilled professionals for slide staining work, recalls of several slide stainers, and the availability of affordable refurbished slide stainers staggers the growth of the market.

The reagent & kits segment to grow at the highest CAGR in the slide stainer market during the forecast period of 2022 to 2027

By product, the slide stainer market is fragmented into reagents & kits, equipment, and consumables & accessories. The reagents & kits dominate the market with their massive consumption for diagnosing and researching high prevalence diseases such as cancer, infections, and chronic diseases.

Disease diagnosis to dominate the slide stainer market among applications in 2022

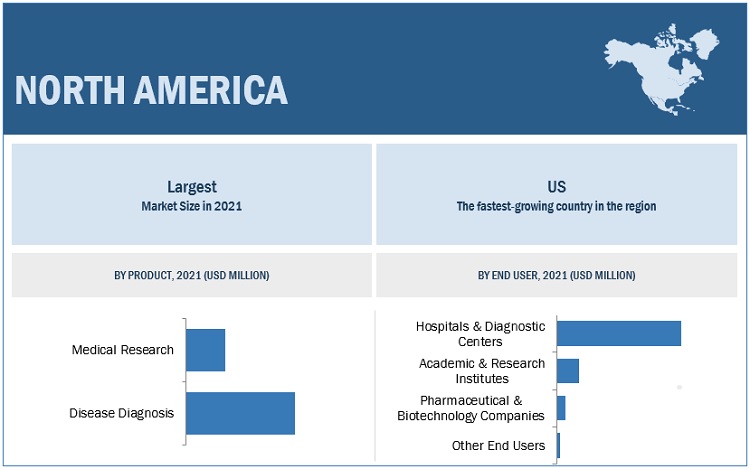

By application, the slide stainer market is further fragmented into disease diagnosis and medical research. The massive burden of cancer and its high volume of diagnoses has promoted the share of the segment. Also, the increasing cases of infectious diseases have pushed the market growth with the increasing pathological and tissue diagnosis.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest regional market for the slide stainer in 2021

The slide stainer market has been analysed for North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2021, North America ruled the market, followed by Europe. The dominating share of North America is driven by the massive pool of geriatric population, advanced healthcare infrastructure, high prevalence of chronic diseases and infections, and the strong presence of leading industry players.

Key Players:

Some of the major players operating in the slide stainer market are F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), PHC Holdings Corporation (Japan), Thermo Fisher Scientific, Inc. (US), Merck KGAA (Germany), Agilent Technologies, Inc. (US), Abcam Plc. (UK), Becton, Dickinson and Company (US), Siemens Healthineers AG (Germany), Biocare Medical, LLC (US), Hardy Diagnostics (US), General Data Company (US), ELITechGroup (France), Biogenex (US), Histo-Line Laboratories (Italy), SLEE medical GmbH (Germany), Amos scientific Pty Ltd. (Australia), MEDITE Medical GMBH (Germany), Cellpath Ltd (UK), Diapath S.P.A. (Italy), Bio SB, Inc. (US), Rockland Immunochemicals, Inc. (US), Cell Signaling Technology, Inc. (US), Diagnostic BioSystems, Inc. (US), and Dakewe Biotech Co., Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Application, Technology, End User, and Region |

|

Regions covered |

North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and the RoE), APAC (China, Japan, India, and the RoAPAC), Latin America, and the Middle East & Africa. |

|

Companies covered |

F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), PHC Holdings Corporation (Japan), Thermo Fisher Scientific, Inc. (US), Merck KGAA (Germany), Agilent Technologies, Inc. (US), Abcam Plc. (UK), Becton, Dickinson and Company (US), Siemens Healthineers AG (Germany), Biocare Medical, LLC (US), Hardy Diagnostics (US), General Data Company (US), ELITechGroup (France), Biogenex (US), Histo-Line Laboratories (Italy), SLEE medical GmbH (Germany), Amos scientific Pty Ltd. (Australia), MEDITE Medical GMBH (Germany), Cellpath Ltd (UK), Diapath S.P.A. (Italy), Bio SB, Inc. (US), Rockland Immunochemicals, Inc. (US), Cell Signaling Technology, Inc. (US), Diagnostic BioSystems, Inc. (US), and Dakewe Biotech Co., Ltd. (China). |

This research report categorizes the slide stainer market into the following segments and subsegments:

By Product

-

Reagents

- Stains

- Diluents & Buffers

- Blocking Sera & Reagents

- Mounting Media, Fixative Reagents, and Embedding Media

- Probes

- Antibodies

-

Equipment

- Automated & Semi-automated Slide Stainer

- Manual Staining Set

- Consumables & Accessories

By Technology

- Hematoxylin and Eosin

- Immunohistochemistry

- Cytology

- Microbiology

- Special Stains

- In-situ Hybridization

- Hematology

By Application

-

Disease Diagnosis

- Breast Cancer

- Gastric Cancer

- Lymphoma

- Prostate Cancer

- Non-small Lung Cancer

- Other Diseases

- Medical Research

By End User

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Recent Developments

- In March 2022, Leica Biosystems, the brand of Danaher, launched its new advanced staining solution, the BOND-PRIME staining platform, which offers speed, quality, and diagnostic productivity.

- In August 2021, Abcam acquired BioVision, Inc., a wholly owned subsidiary of Boai NKY Medical Holdings Ltd. The acquisition would strengthen the portfolio of biopharma, diagnostic and life sciences products.

- In July 2021, Danaher Corporation (US) acquired privately held Aldevron, LLC (Fargo, US). The acquisition would strengthen Danaher’s portfolio of high-quality plasmid DNA, mRNA, and proteins, serving biotechnology and pharmaceutical customers across research, clinical and commercial applications.

- In March 2021, Roche announced the launch of the DISCOVERY Green HRP kit for cancer research.

- In June 2019, PHC Holdings Corporation acquired the Anatomical Pathology business of Thermo Fisher Scientific Inc. The acquisition would strengthen the anatomic pathology portfolio of the company.

Frequently Asked Questions (FAQ):

Who are the key players in the slide stainer market?

The prominent players operating in this market include F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), and PHC Holdings Corporation (Japan).

Which type segment accounted for the largest share in 2021?

The reagents & kits segment accounted for the largest share in the market owing to its massive demand for the slide staining purpose in the research and diagnosis of various cancer, infections, and other medical conditions.

Which region is lucrative for the slide stainer market?

Asia Pacific offers tremendous growth opportunities for the market players, attributed mainly to the rising healthcare infrastructure, increasing geriatric population, rising medical expenditure, and increasing prevalence of chronic diseases.

What is the value of the global slide stainer market?

The global slide stainer market is valued at USD 4.3 billion in 2022 and is projected to reach USD 5.9 billion in 2027 at a CAGR of 6.8% from 2022 to 2027

What are the drivers of the global slide stainer market?

The growth of the market is driven by the rising prevalence of cancer, recommendations for cancer screening, increasing healthcare expenditure, rising geriatric population with subsequent growth in chronic and infectious diseases, growing private diagnostics centers globally, increasing automation in laboratories, and increasing usage of AI in histopathology. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: F. HOFFMANN-LA ROCHE AG

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 10 SLIDE STAINER MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

FIGURE 11 SLIDE STAINER MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD BILLION)

FIGURE 12 SLIDE STAINER MARKET, BY APPLICATION, 2022 VS. 2027 (USD BILLION)

FIGURE 13 SLIDE STAINER MARKET, BY END USER, 2022 VS. 2027 (USD BILLION)

FIGURE 14 GEOGRAPHIC SNAPSHOT: SLIDE STAINER MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 SLIDE STAINER MARKET OVERVIEW

FIGURE 15 RISING PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC SLIDE STAINER MARKET: BY APPLICATION AND COUNTRY (2021)

FIGURE 16 DISEASE DIAGNOSTICS SEGMENT DOMINATED ASIA PACIFIC SLIDE STAINER MARKET, BY APPLICATION, IN 2021

4.3 GEOGRAPHIC MIX: SLIDE STAINER MARKET

FIGURE 17 NORTH AMERICA TO DOMINATE SLIDE STAINER MARKET DURING FORECAST PERIOD

4.4 SLIDE STAINER MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SLIDE STAINER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of cancer

TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

TABLE 3 PROJECTED INCREASE IN GLOBAL NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

5.2.1.2 Recommendations for cancer screening

5.2.1.3 Increasing healthcare expenditure

FIGURE 20 HEALTH EXPENDITURE PER CAPITA, 2010–2019

FIGURE 21 HEALTH EXPENDITURE (% OF GDP), 2010–2019

5.2.1.4 Rising geriatric population and subsequent growth in chronic and infectious disease prevalence

FIGURE 22 ESTIMATED INCREASE IN CANCER INCIDENCE (MILLION), 2020 VS. 2030

FIGURE 23 ESTIMATED CANCER DEATHS (MILLION), 2020 VS. 2030

5.2.1.5 Growing number of private diagnostic centers globally

5.2.1.6 Increasing automation in laboratories

5.2.1.7 Increasing use of AI in histopathology

5.2.2 RESTRAINTS

5.2.2.1 High equipment cost

5.2.3 OPPORTUNITIES

5.2.3.1 High-growth opportunities in emerging markets

FIGURE 24 GROWTH IN HEALTHCARE EXPENDITURE PER CAPITA IN BRICS COUNTRIES, 2012–2019

5.2.3.2 Increasing number of clinical trials pertaining to cancer drugs

5.2.4 CHALLENGES

5.2.4.1 Dearth of knowledgeable and skilled technicians

TABLE 4 NUMBER OF PATHOLOGISTS PER 100,000 POPULATION, BY COUNTRY, 2018

5.2.4.2 Product recalls

TABLE 5 INDICATIVE LIST OF PRODUCT RECALLS FOR SLIDE STAINING EQUIPMENT (2019–2022)

5.2.4.3 Availability of refurbished equipment

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 26 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

5.5 TECHNOLOGY ANALYSIS

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 INTENSITY OF COMPETITIVE RIVALRY

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 THREAT OF SUBSTITUTES

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS (%)

5.7.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.8 REGULATORY LANDSCAPE

TABLE 8 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING SLIDE STAINING MARKET

5.9 PATENT ANALYSIS

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 9 LIST OF CONFERENCES AND EVENTS

5.11 PRICING ANALYSIS

TABLE 10 PRICE RANGE FOR SLIDE STAINERS

5.12 TRADE ANALYSIS

TABLE 11 IMPORT DATA FOR HS CODE 847989, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 12 EXPORT DATA FOR HS CODE 847989, BY COUNTRY, 2017–2021 (USD MILLION)

5.13 ECOSYSTEM ANALYSIS

TABLE 13 ROLE IN ECOSYSTEM

FIGURE 29 KEY PLAYERS OPERATING IN SLIDE STAINER MARKET

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

6 SLIDE STAINER MARKET, BY PRODUCT (Page No. - 75)

6.1 INTRODUCTION

TABLE 14 SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

6.2 REAGENTS AND KITS

TABLE 15 SLIDE STAINER MARKET FOR REAGENTS AND KITS, BY TYPE, 2020–2027 (USD MILLION)

6.2.1 STAINS

6.2.1.1 Staining is extensively used in diagnosis and research of carcinoma tissue samples

TABLE 16 SLIDE STAINER MARKET FOR STAINS, BY REGION, 2020–2027 (USD MILLION)

6.2.2 BLOCKING SERA AND REAGENTS

6.2.2.1 Blocking sera and reagents prevent nonspecific binding and reduce background noise

TABLE 17 SLIDE STAINER MARKET FOR BLOCKING SERA AND REAGENTS, BY REGION, 2020–2027 (USD MILLION)

6.2.3 DILUENTS AND BUFFERS

6.2.3.1 Diluents and buffers are used for IHC workflow optimization

TABLE 18 SLIDE STAINER MARKET FOR DILUENTS AND BUFFERS, BY REGION, 2020–2027 (USD MILLION)

6.2.4 MOUNTING MEDIA, FIXATIVE REAGENTS, AND EMBEDDING MEDIA

6.2.4.1 Fixative reagents are used to immobilize antigens and retain cellular and subcellular structures

TABLE 19 SLIDE STAINER MARKET FOR MOUNTING MEDIA, FIXATIVE REAGENTS, AND EMBEDDING MEDIA, BY REGION, 2020–2027 (USD MILLION)

6.2.5 PROBES

6.2.5.1 Probes are widely used in ISH

TABLE 20 SLIDE STAINER MARKET FOR PROBES, BY REGION, 2020–2027 (USD MILLION)

6.2.6 ANTIBODIES

6.2.6.1 Increasing prevalence of infectious diseases and cancer to drive segment growth

TABLE 21 SLIDE STAINER MARKET FOR ANTIBODIES, BY REGION, 2020–2027 (USD MILLION)

6.3 EQUIPMENT

TABLE 22 SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 AUTOMATED AND SEMI-AUTOMATED SLIDE STAINERS

6.3.1.1 High-throughput efficacy and accuracy of staining biological samples driving segment growth

TABLE 23 KEY BRANDS OF AUTOMATED SLIDE STAINERS

TABLE 24 AUTOMATED AND SEMI-AUTOMATED SLIDE STAINERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.2 MANUAL SLIDE STAINING SETS

6.3.2.1 Low cost of manual staining sets to drive segment growth

TABLE 25 KEY BRANDS OF MANUAL SLIDE STAINING SETS

TABLE 26 MANUAL SLIDE STAINERS MARKET, BY REGION, 2020–2027 (USD MILLION)

6.4 CONSUMABLES AND ACCESSORIES

TABLE 27 SLIDE STAINER MARKET FOR CONSUMABLES AND ACCESSORIES, BY REGION, 2020–2027 (USD MILLION)

7 SLIDE STAINER MARKET, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

TABLE 28 SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 DISEASE DIAGNOSTICS

TABLE 29 SLIDE STAINER MARKET FOR DISEASE DIAGNOSTICS, BY DISEASE TYPE, 2020–2027 (USD MILLION)

7.2.1 BREAST CANCER

7.2.1.1 High prevalence of breast cancer to drive segment growth

TABLE 30 BREAST CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 31 SLIDE STAINER MARKET FOR BREAST CANCER, BY REGION, 2020–2027 (USD MILLION)

7.2.2 GASTRIC CANCER

7.2.2.1 Growing prevalence of and increasing research on gastric cancer to drive segment growth

TABLE 32 COLORECTAL CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 33 SLIDE STRAINER MARKET FOR GASTRIC CANCER, BY REGION, 2020–2027 (USD MILLION)

7.2.3 LYMPHOMA

7.2.3.1 IHC and biopsy are preferable tests to diagnose lymphoma

TABLE 34 HODGKIN’S LYMPHOMA INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 35 NON-HODGKIN’S LYMPHOMA INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 36 SLIDE STAINER MARKET FOR LYMPHOMA, BY REGION, 2020–2027 (USD MILLION)

7.2.4 PROSTATE CANCER

7.2.4.1 IHC tests are used to identify prostate cancer

TABLE 37 PROSTATE CANCER INCIDENCE, BY REGION, 2018 VS. 2025

TABLE 38 SLIDE STAINER MARKET FOR PROSTATE CANCER, BY REGION, 2020–2027 (USD MILLION)

7.2.5 NON-SMALL CELL LUNG CANCER

7.2.5.1 IHC helps analyze adenocarcinoma and squamous carcinoma of lungs through staining of antibodies

TABLE 39 NON-SMALL CELL LUNG CANCER INCIDENCE, BY REGION, 2020 VS. 2040

TABLE 40 SLIDE STAINER MARKET FOR NON-SMALL CELL LUNG CANCER, BY REGION, 2020–2027 (USD MILLION)

7.2.6 OTHER DISEASES

TABLE 41 SLIDE STAINER MARKET FOR OTHER DISEASES, BY REGION, 2020–2027 (USD MILLION)

7.3 MEDICAL RESEARCH

7.3.1 WIDE USE OF TISSUE BIOPSY AND SLIDE STAINING IN DRUG DEVELOPMENT TO DRIVE SEGMENT GROWTH

TABLE 42 SLIDE STAINER MARKET FOR MEDICAL RESEARCH, BY REGION, 2020–2027 (USD MILLION)

8 SLIDE STAINER MARKET, BY TECHNOLOGY (Page No. - 95)

8.1 INTRODUCTION

TABLE 43 SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

8.2 HEMATOXYLIN & EOSIN (H&E)

8.2.1 WIDE USE OF H&E FOR STAINING VARIOUS BIOLOGICAL SAMPLES DRIVING SEGMENT GROWTH

TABLE 44 HEMATOXYLIN & EOSIN SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 IMMUNOHISTOCHEMISTRY (IHC)

8.3.1 AUTOMATION OF IHC TECHNIQUES DRIVING SEGMENT GROWTH

TABLE 45 IMMUNOHISTOCHEMISTRY SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.4 IN SITU HYBRIDIZATION (ISH)

8.4.1 EMERGING ISH STAINING TECHNIQUES SUCH AS FISH AND CISH DRIVING SEGMENT GROWTH

TABLE 46 IN SITU HYBRIDIZATION SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.5 CYTOLOGY

8.5.1 WIDE USE OF CYTOLOGY FOR CANCER STUDIES DRIVING SEGMENT GROWTH

TABLE 47 CYTOLOGY SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.6 MICROBIOLOGY

8.6.1 INCREASING PREVALENCE OF INFECTIOUS DISEASES DRIVING SEGMENT GROWTH

TABLE 48 GLOBALLY REPORTED CASES OF INFECTIOUS DISEASES

TABLE 49 MICROBIOLOGY SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.7 HEMATOLOGY

8.7.1 INCREASING PREVALENCE OF HEMATOLOGY DISORDERS DRIVING SEGMENT GROWTH

TABLE 50 HEMATOLOGY SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

8.8 SPECIAL STAINING

8.8.1 SPECIAL STAINING IS USED WHERE ROUTINE H&E TECHNIQUES CANNOT PROVIDE NEEDED INFORMATION

TABLE 51 SPECIAL SLIDE STAINERS OFFERED BY SOME PLAYERS

TABLE 52 SPECIAL SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

9 SLIDE STAINER MARKET, BY END USER (Page No. - 105)

9.1 INTRODUCTION

TABLE 53 SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS AND DIAGNOSTIC LABORATORIES

9.2.1 NUMBER OF HOSPITALS AND DIAGNOSTIC LABORATORIES INCREASING IN SEVERAL COUNTRIES

TABLE 54 SLIDE STAINER MARKET FOR HOSPITALS AND DIAGNOSTIC LABORATORIES, BY REGION, 2020–2027 (USD MILLION)

9.3 ACADEMIC AND RESEARCH INSTITUTES

9.3.1 INCREASING INVESTMENTS FOR RESEARCH ON DISEASE DIAGNOSIS DRIVING SEGMENT GROWTH

TABLE 55 SLIDE STAINER MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

9.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

9.4.1 INCREASING RESEARCH ON DRUG DISCOVERY TO DRIVE SEGMENT GROWTH

TABLE 56 SLIDE STAINER MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION)

9.5 OTHER END USERS

TABLE 57 ONCOLOGY CONTRACT RESEARCH ORGANIZATIONS

TABLE 58 SLIDE STAINER MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 SLIDE STAINER MARKET, BY REGION (Page No. - 111)

10.1 INTRODUCTION

TABLE 59 SLIDE STAINER MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: CANCER INCIDENCE AND MORTALITY, 2012–2035

FIGURE 31 NORTH AMERICA: SLIDE STAINER MARKET SNAPSHOT

TABLE 60 NORTH AMERICA: SLIDE STAINER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: SLIDE STAINER REAGENTS AND KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: SLIDE STAINER MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate global slide stainer market

TABLE 68 US: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 69 US: KEY MACROINDICATORS

TABLE 70 US: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 71 US: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 US: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 73 US: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing prevalence of cancer to drive market growth

TABLE 74 CANADA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 75 CANADA: KEY MACROINDICATORS

TABLE 76 CANADA: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 77 CANADA: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 78 CANADA: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 79 CANADA: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

FIGURE 32 EUROPE: CANCER INCIDENCE AND MORTALITY, 2012–2035

TABLE 80 EUROPE: SLIDE STAINER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: SLIDE STAINER REAGENTS AND KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 EUROPE: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 85 EUROPE: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: SLIDE STAINER MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 87 EUROPE: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing cancer screening initiatives to drive market growth

TABLE 88 GERMANY: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 89 GERMANY: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 90 GERMANY: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 GERMANY: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 92 GERMANY: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Government funding for cancer diagnosis and prevention to support market growth

TABLE 93 FRANCE: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 94 FRANCE: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Government initiatives to drive market growth

TABLE 98 UK: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 99 UK: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 UK: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 101 UK: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 High incidence of cancer to support market growth

TABLE 102 ITALY: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 103 ITALY: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 104 ITALY: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 105 ITALY: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 106 ITALY: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 High incidence of chronic diseases to drive market growth

TABLE 107 SPAIN: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 108 SPAIN: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 109 SPAIN: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 SPAIN: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 111 SPAIN: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 112 LUNG CANCER INCIDENCE IN KEY REST OF EUROPE COUNTRIES, 2020 VS. 2040

TABLE 113 LIVER CANCER INCIDENCE IN KEY REST OF EUROPE COUNTRIES, 2020 VS. 2040

TABLE 114 ROE: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 115 ROE: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 ROE: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 117 ROE: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: CANCER INCIDENCE AND MORTALITY, 2012–2035

FIGURE 34 ASIA PACIFIC: SLIDE STAINER MARKET SNAPSHOT

TABLE 118 APAC: SLIDE STAINER MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 119 APAC: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 120 APAC: SLIDE STAINER REAGENTS AND KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 APAC: SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 APAC: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 123 APAC: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 124 APAC: SLIDE STAINER MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 125 APAC: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Advanced healthcare infrastructure to support market growth

TABLE 126 JAPAN: CANCER INCIDENCE, BY TYPE OF CANCER, 2020 VS. 2040

TABLE 127 JAPAN: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 128 JAPAN: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 129 JAPAN: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 130 JAPAN: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increasing healthcare expenditure and funding to drive market growth

TABLE 131 CHINA: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 132 CHINA: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 133 CHINA: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 134 CHINA: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Expanding healthcare sector to drive market growth

TABLE 135 INDIA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 136 INDIA: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 137 INDIA: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 138 INDIA: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 139 INDIA: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 140 INCIDENCE OF CANCER IN REST OF ASIA PACIFIC

TABLE 141 ROAPAC: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 142 ROAPAC: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 143 ROAPAC: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 144 ROAPAC: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INCREASING NUMBER OF CANCER SCREENING PROGRAMS TO SUPPORT MARKET GROWTH

TABLE 145 LUNG CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 146 LIVER CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 147 BREAST CANCER INCIDENCE IN KEY LATIN AMERICAN COUNTRIES, 2018 VS. 2025

TABLE 148 LATAM: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 149 LATAM: SLIDE STAINER REAGENTS AND KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 LATAM: SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 151 LATAM: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 152 LATAM: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 153 LATAM: SLIDE STAINER MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 154 LATAM: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST AND AFRICA

10.6.1 INCREASING INCIDENCE OF CANCER IN AFRICA TO SUPPORT MARKET GROWTH

TABLE 155 AFRICA: CANCER INCIDENCE, BY TYPE OF CANCER, 2018 VS. 2025

TABLE 156 MEA: SLIDE STAINER MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 157 MEA: SLIDE STAINER REAGENTS AND KITS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 MEA: SLIDE STAINER EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 MEA: SLIDE STAINER MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 160 MEA: SLIDE STAINER MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 161 MEA: SLIDE STAINER MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 162 MEA: SLIDE STAINER MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 159)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 163 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SLIDE STAINER MARKET

11.3 REVENUE SHARE ANALYSIS

FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN SLIDE STAINER MARKET

11.4 MARKET SHARE ANALYSIS

TABLE 164 SLIDE STAINER MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION MATRIX

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 36 SLIDE STAINER MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS

11.6 COMPANY EVALUATION MATRIX FOR SMES/START-UPS

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 DYNAMIC COMPANIES

FIGURE 37 SLIDE STAINER MARKET: COMPANY EVALUATION MATRIX FOR SMES/ START-UPS

11.7 COMPANY FOOTPRINT ANALYSIS

11.7.1 REGIONAL FOOTPRINT OF COMPANIES

11.7.2 PRODUCT FOOTPRINT OF COMPANIES

11.7.3 OVERALL FOOTPRINT OF COMPANIES

11.8 COMPETITIVE BENCHMARKING

TABLE 165 SLIDE STAINER MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.9 COMPETITIVE SCENARIO

11.9.1 PRODUCT LAUNCHES/APPROVALS

TABLE 166 KEY PRODUCT LAUNCHES

11.9.2 DEALS

TABLE 167 KEY DEALS

11.9.3 OTHER DEVELOPMENTS

TABLE 168 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES (Page No. - 173)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 F. HOFFMANN-LA ROCHE LTD.

TABLE 169 F. HOFFMAN-LA ROCHE LTD.: BUSINESS OVERVIEW

FIGURE 38 F. HOFFMAN-LA ROCHE LTD.: COMPANY SNAPSHOT (2021)

12.1.2 DANAHER

TABLE 170 DANAHER: BUSINESS OVERVIEW

FIGURE 39 DANAHER: COMPANY SNAPSHOT (2021)

12.1.3 PHC HOLDINGS CORPORATION

TABLE 171 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 40 PHC HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.4 MERCK KGAA

TABLE 172 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 41 MERCK KGAA: COMPANY SNAPSHOT (2021)

12.1.5 AGILENT TECHNOLOGIES, INC.

TABLE 173 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 42 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

12.1.6 ABCAM PLC.

TABLE 174 ABCAM PLC.: BUSINESS OVERVIEW

FIGURE 43 ABCAM PLC.: COMPANY SNAPSHOT (2021)

12.1.7 BECTON, DICKINSON AND COMPANY

TABLE 175 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 44 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

12.1.8 SIEMENS HEALTHINEERS AG

TABLE 176 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

FIGURE 45 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2021)

12.1.9 SAKURA FINETEK JAPAN CO., LTD.

TABLE 177 SAKURA FINETEK JAPAN CO., LTD.: BUSINESS OVERVIEW

12.1.10 BIOCARE MEDICAL, LLC

TABLE 178 BIOCARE MEDICAL, LLC.: BUSINESS OVERVIEW

12.1.11 HARDY DIAGNOSTICS

TABLE 179 HARDY DIAGNOSTICS: BUSINESS OVERVIEW

12.1.12 GENERAL DATA COMPANY, INC.

TABLE 180 GENERAL DATA COMPANY, INC.: BUSINESS OVERVIEW

12.1.13 ELITECHGROUP

TABLE 181 ELITECHGROUP: BUSINESS OVERVIEW

12.1.14 BIOGENEX

TABLE 182 BIOGENEX.: BUSINESS OVERVIEW

12.1.15 HISTO-LINE LABORATORIES

TABLE 183 HISTO-LINE LABORATORIES: BUSINESS OVERVIEW

12.1.16 SLEE MEDICAL GMBH

TABLE 184 SLEE MEDICAL GMBH: BUSINESS OVERVIEW

12.1.17 AMOS SCIENTIFIC PTY LTD.

TABLE 185 AMOS SCIENTIFIC PTY LTD.: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 MEDITE MEDICAL GMBH

TABLE 186 MEDITE MEDICAL GMBH: COMPANY OVERVIEW

12.2.2 CELLPATH LTD.

TABLE 187 CELLPATH LTD.: COMPANY OVERVIEW

12.2.3 DIAPATH S.P.A.

TABLE 188 DIAPATH S.P.A.: COMPANY OVERVIEW

12.2.4 BIO SB, INC.

TABLE 189 BIO SB, INC.: COMPANY OVERVIEW

12.2.5 ROCKLAND IMMUNOCHEMICALS, INC.

TABLE 190 ROCKLAND IMMUNOCHEMICALS, INC.: COMPANY OVERVIEW

12.2.6 CELL SIGNALING TECHNOLOGY, INC.

TABLE 191 CELL SIGNALING TECHNOLOGY, INC.: COMPANY OVERVIEW

12.2.7 DIAGNOSTIC BIOSYSTEMS, INC.

TABLE 192 DIAGNOSTIC BIOSYSTEMS, INC.: COMPANY OVERVIEW

12.2.8 DAKEWE BIOTECHNOLOGY CO., LTD.

TABLE 193 DAKEWE BIOTECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.2.9 THERMO FISHER SCIENTIFIC, INC.

TABLE 194 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

13 APPENDIX (Page No. - 219)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major stages in estimating the current size of the slide stainer market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Then, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments. Finally, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

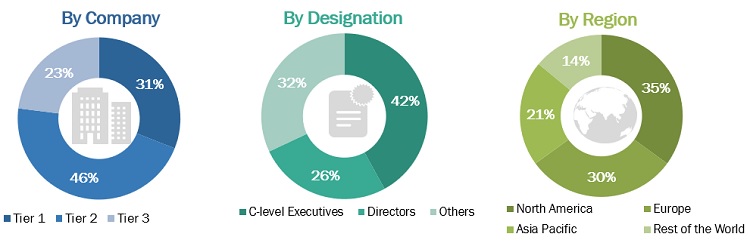

Several stakeholders, such as slide stainer manufacturers, vendors, and distributors; researchers; and doctors from hospitals, clinics/physician offices, and other end users, were consulted for this report. The demand side of this market is characterized by the significant use of slide stainer products due to the increasing prevalence of chronic and infectious diseases across the globe. The supply side is characterized by technological advancements and a shift towards advanced devices. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

Breakdown of Primary Participants

*Others include sales, marketing, and product managers.

Note: The tiers of companies are defined based on their total revenues, as of 2021; Tier 1= Revenue > USD 500 million, Tier 2 = USD 100 million to USD 500 million, and Tier 3 = Revenue < 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the slide stainer market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the slide stainer market.

Report Objectives

- To define, describe, segment, and forecast the slide stainer market by product, application, technology, end user, and region

- To forecast the market size with respect to the main regional segments—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as collaborations, regulatory approvals, partnerships, acquisitions, and product launches in the slide stainer market

Customizations Options

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Over 26 companies profiled

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Slide Stainer Market