Silane Coupling Agents Market by Type (Epoxy, Vinyl, Amino, Acryloxy, Methacryloxy), Application (Rubber & Plastics, Adhesives & Sealants, Paints & Coatings), End-Use Industry, and Region - Global Forecast to 2026

Silane Coupling Agents Market

The global silane coupling agents market was valued at USD 1.2 billion in 2021 and is projected to reach USD 1.6 billion by 2026, growing at a cagr 5.5% from 2021 to 2026. The driving factors for the market is increasing penetration of silane coupling agents in the automotive & transportation, building & construction industry, energy & chemical segment, and electrical & electronics industry in the emerging economies, such as India, China, and the Middle-East, Thailand, Indonesia, Brazil, and Argentina.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Silane Coupling Agents Market

The global silane coupling agents market includes major Tier I and II suppliers like Dow (US), Wacker Chemie AG (Germany), Evonik Industries AG (Germany), Momentive (US), and Shin-Etsu Chemical Co. Ltd. (Japan), These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

The global silane coupling agents market is expected to witness a decrease in its growth rate in 2020-2021, as the automotive, energy & chemical and building & construction is badly hit by the covid-19 pandemic. The pandemic has affected both material, labor, and key cost components of construction projects. The pandemic has led to production stoppage in several silane coupling agent-producing countries that are under lockdown. APAC and Europe are the leading producers of silane coupling agent for various end-use industries. All these factors have led to disruption in the supply chain of the silane coupling agent market as operations have slowed down in many manufacturing units.

Silane Coupling Agents Market Dynamics

Driver: Increased demand for silane coupling agents in paints & coatings

The Silane coupling agents are used in paints and coatings to enhance adhesion. Silanes help enhance UV and thermal stability, surface strength, chemical resistance, and ability to protect against corrosion. They are majorly used for adhesion promotion as well as enhancing corrosion resistance and scratch resistance. Siloxane-alkyd, siloxane-epoxy, and siloxane-acrylic chemistries are used to achieve low viscosity, low VOC, high solids, metal adhesion, cement and quartz-like surfaces, low combustibility, high heat and UV tolerance in automotive, architectural, and marine antifouling coatings. Silanes are also used as the feedstock for a thin-coating industrial sol-gel process. Paints & coatings find a wide range of applications in major end-use industries such as automotive, construction, and aerospace. In the building and construction industry, paints and coatings are used to enhance the esthetic appeal of the structure. The growth of the building and construction industry, with the rising residential and non-residential construction, across the globe has fueled the demand for paints and coatings. For instance, according to the US Census Bureau, the overall construction spending in the US stood at USD 1,524.2 billion as of April 2021, a 9.8% increase compared to April 2020. Furthermore, the increasing construction and infrastructure activities in developed and developing economies in Asia Pacific, such as India, China, Thailand, and Malaysia, due to rapid urbanization and industrialization is projected to propel the demand for silane coupling agents.

Restraint: Decreasing demand from plastic packaging

The demand for environmentally friendly materials such as paper and jute is increasing in the packaging industry. This is decreasing the demand for plastics in the packaging industry. Consumers prefer paper and glass over plastics. Paper packaging that replaces plastic is most often a multi-layered material that includes metallic foil in addition to the paper. Plastic packaging is extremely wasteful and impacts earth’s ecosystems. Due to poor product design and lack of political infrastructure, the majority of plastic waste is sent to landfills or disposed of into the environment. 9.2 billion tons of plastic have been produced, of which only 9% has been recycled properly. Many major corporations, including American food giants like Coca-Cola, Walmart, Starbucks, and McDonald’s, and major European companies like Danone, Nestlé, and Pernod Ricard, have pledged to reduce the amount of single-use plastics in their products in response to consumer preferences and new legislation. Silane coupling agents are used in the plastic packaging, and the ban on such packaging material will affect the market growth.

Opportunity: Emerging applications in pharmaceutical & healthcare industries

Emerging applications in the pharmaceutical and healthcare industries are expected to create new opportunities for silane coupling agent manufacturers. Silane coupling agents are widely used in dental fields. One of the most important aspects in the field of dentistry is adhesion. Adhesion can be enhanced through different mechanisms, most commonly by chemical and mechanical modifications of dental material surfaces. Chemical adhesion utilizes primers or bonding agents containing coupling agents. Universal primers which are (mainly organophosphate-based monomers) and silane coupling agents are the most effective and most widely used for unifying dissimilar materials. Other than improving adhesion, silanes have many other applications in dentistry. They have been found also to enhance the mechanical properties of materials either by adhesion or by becoming a constituent of dental materials itself. Modern-day dental resin composites are composed of resin matrix, free radical initiator, inhibitor, filler particles (lithium aluminosilicate, silica, or boron silicate), and silane coupling agents. Silane coupling agent is used to ensure durable bonding between the filler particles and the resin matrix. Development of new silane coupling agents, their optimization, and surface treatment methods are in progress to address the long-term resin bond durability. This development in turn will increase the consumption of silane coupling agents in the future. Development of next-generation antibiotics will also increase the need for silane coupling agents by pharmaceutical manufacturers.

Challenges: high cost of production

Manufacturers are working on developing solutions to minimize the cost of production by implementing new technologies and minimizing the cost of raw materials. Currently, the switching cost for silanes is very high, which deters its use in many end-use industries. For example, in tire production, the application of silica silane technology was approximately 65% more costly than carbon black. Hence, the green tire produced using silica silane technology contributes approximately 28 to 30% of the total tire industry. German multinational chemical company WACKER AG announced to raise the prices for all its silicones product range, including silanes, amidst fuming raw material rates and supply shortage. The upward revision in the price was between 10 and 20 percent for all its shipments across the globe scheduled from April 2021 onwards. The company also stated strengthening cost for packaging materials and pandemic-related constraints as the additional factors supporting the uptrend. Although Dow Corning and Evonik Industries, the leading market players, are making continuous efforts to minimize the prices of coupling agents, they are still unable to overcome the challenge.

Silane Coupling Agents Market Ecosystem

The Silane coupling agents market is projected to register a CAGR of 5.5% during the forecast period, in terms of value.

The global Silane coupling agents market is estimated to be USD 1,221.2 million in 2021 and is projected to reach USD 1,593.8 million by 2026, at a CAGR of 5.5% from 2021 to 2026. The growth is due to the growing demand from rubber & plastics, paints & coatings and other applications throughout the world. The rising demand from the automotive and building & construction sectors in developing countries such as China and India are driving the market. North America and Europe have introduced stringent regulations for tire labeling and fuel efficiency which act as drivers for the silane coupling agents in production of green tires. Also, the new trend of low VOC paints & coatings is now changing the focus of industry toward powder coatings.

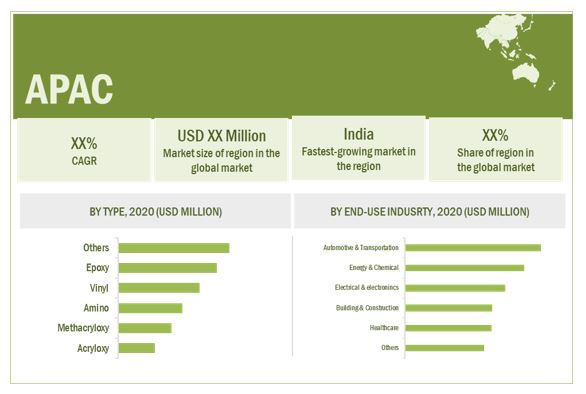

APAC is the largest market for Silane coupling agents .

APAC accounted for the largest share of the Silane coupling agents market in 2020. The market in the region is growing because of increased foreign investments because of cheap labor and availability of raw materials. The APAC silane coupling agents market has been growing rapidly over the past few years with the rising income level of the middle-class population and increasing government investments, especially in the automotive & transportation and building & construction sectors.

Silane Coupling Agents Market Players

Silane coupling agents is a diversified and competitive market with a large number of global players and few regional and local players. Dow (US), Wacker Chemie AG (Germany), Evonik Industries (Germany), Momentive (US), Shin-Etsu Chemical Co. Ltd. (Japan), are some of the key players in the market.

Silane Coupling Agents Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.2 billion |

|

Revenue Forecast in 2026 |

USD 1.6 billion |

|

CAGR |

5.5% |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) and Volume (Million Units) |

|

Segments Covered |

Type, Application, End-Use Industry and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, and South America |

|

Companies Covered |

Some of the leading players operating in the silane coupling agents market include Dow (US), Wacker Chemie AG (Germany), Evonik Industries AG (Germany), Momentive (US), and Shin-Etsu Chemical Co. Ltd. (Japan) |

This research report categorizes the silane coupling agents market based on type, application, end- use industry, and region.

Silane Coupling Agents Market, By Type

- Epoxy

- Amino

- Vinyl

- Acryloxy

- Methacryloxy

- Others

Silane Coupling Agents Market, By Application

- Paints & Coatings

- Adhesives & sealants

- Rubber & Plastics

- Others

Silane Coupling Agents Market, By End-Use Industry

- Energy & Chemical

- Automotive & Transportation

- Building & Construction

- Electrical & Electronics

- Healthcare

- Others

Silane Coupling Agents Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In January 2021, Momentive acquired the silicone business of KCC corporation in South Korea and UK. The company also acquired sales operation in China. It aims to strengthen the company’s position in the Asia Pacific region – including Korea, a country with strong and growing demand for silicones and specialty materials.

- In September 2020, Evonik Industries AG did an expansion of production capacity for integrated silica and silane products in Antwerp, Belgium. It aims to expand its geographical presence and increase production capacity.

- In December 2018, Elkem ASA opened a new research & development Center at Saint-Fons site. It will support the growth strategy of developing value-added silicones specialties.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Russia

- France

- Spain

- Rest of Europe

What is the COVID-19 impact on the silane coupling agents market?

Industry experts believe that COVID-19 would have a significant impact on silane coupling agents market. There seems to be decrease in the demand for silane coupling agents from automotive & transportation and building & construction end-use industries, during COVID-19. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Updated on : June 30, 2023

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 SILANE COUPLING AGENTS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

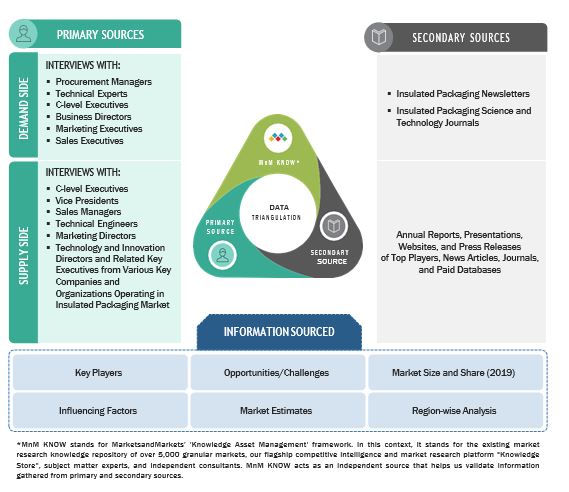

2.1 RESEARCH DATA

FIGURE 1 SILANE COUPLING AGENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION APPROACH

2.2.1 ESTIMATION OF SILANE COUPLING AGENTS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY SIDE ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION: DEMAND SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM–UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP–DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 4 SILANE COUPLING AGENTS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.5.1 LIMITATIONS

2.5.2 GROWTH RATE ASSUMPTIONS

2.5.3 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 5 OTHER SILANE COUPLING AGENTS LED THE MARKET IN 2020

FIGURE 6 RUBBER & PLASTIC APPLICATION LED THE SILANE COUPLING AGENTS MARKET IN 2020

FIGURE 7 AUTOMOTIVE & TRANSPORTATION IS THE LEADING END–USE INDUSTRY OF SILANE COUPLING AGENTS

FIGURE 8 APAC WAS THE LARGEST MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN SILANE COUPLING AGENTS MARKET

FIGURE 9 GROWING UE OF SILANE COUPLING AGENTS IN RUBBER & PLASTICS APPLICATION TO DRIVE THE MARKET

4.2 SILANE COUPLING AGENTS MARKET, BY REGION

FIGURE 10 APAC TO BE THE LARGEST MARKET BETWEEN 2021 AND 2026

4.3 APAC: SILANE COUPLING AGENTS MARKET, BY COUNTRY AND END–USE INDUSTRY

FIGURE 11 CHINA AND AUTOMOTIVE & TRANSPORTATION SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.4 SILANE COUPLING AGENTS MARKET: BY MAJOR COUNTRIES

FIGURE 12 INDIA TO BE THE FASTEST–GROWING MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 COVID–19 ECONOMIC ASSESSMENT

FIGURE 13 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.3 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE SILANE COUPLING AGENTS MARKET

5.3.1 DRIVERS

5.3.1.1 Increased demand for silane coupling agents in paints & coatings

5.3.1.2 Increasing demand from developing countries

5.3.1.3 Growing initiatives on fuel efficiency and regulation compliance

5.3.1.4 Rising demand for water–based coating formulation

5.3.2 RESTRAINTS

5.3.2.1 Decreasing demand for plastic packaging

5.3.3 OPPORTUNITIES

5.3.3.1 Emerging applications in pharmaceutical & healthcare industries

5.3.4 CHALLENGES

5.3.4.1 High cost of production

6 INDUSTRY TRENDS (Page No. - 55)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

TABLE 1 SILANE COUPLING AGENTS MARKET: PORTER’S FIVE FORCE ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 THREAT OF NEW ENTRANTS

6.1.3 THREAT OF SUBSTITUTES

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 VALUE CHAIN ANALYSIS

FIGURE 16 PRODUCTION PROCESS CONTRIBUTES THE MOST VALUE TO OVERALL PRICE OF SILANE COUPLING AGENTS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 17 SUPPLY CHAIN OF SILANE COUPLING AGENTS INDUSTRY

6.4 PROMINENT COMPANIES

6.5 SMALL & MEDIUM ENTERPRISES

TABLE 2 SILANE COUPLING AGENTS MARKET: VALUE CHAIN

6.5.1 IMPACT OF COVID–19 ON SUPPLY CHAIN

6.5.2 IMPACT OF COVID–19 ON END–USE INDUSTRIES OF SILANE COUPLING AGENT

6.5.3 DISRUPTION IN END–USE INDUSTRIES OF SILANE COUPLING AGENT MARKET

6.5.4 COVID–19 IMPACT ON CHEMICAL INDUSTRY

6.5.5 COVID–19 IMPACT ON ENERGY INDUSTRY

6.6 YC & YCC SHIFT

6.6.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR SILANE COUPLING AGENT MANUFACTURERS

FIGURE 18 REVENUE SHIFT FOR SILANE COUPLING AGENTS MANUFACTURERS

6.7 TRADE ANALYSIS

TABLE 3 SILICON TRADE DATA 2020 (USD MILLION)

6.8 ECOSYSTEM

6.9 PRICING ANALYSIS

FIGURE 19 AVERAGE SELLING PRICE (2020–2026)

6.10 TECHNOLOGY ANALYSIS

6.11 CASE STUDY ANALYSIS

6.11.1 GELEST, INC. LAUNCHED ITS NEW SIVATE™ E610 ENHANCED AMINE FUNCTIONAL SILANE

6.11.1.1 Objective

6.11.1.2 Solution statement

6.12 REGULATORY ANALYSIS

6.12.1 EPA STANDARDS

6.12.2 OTHER STANDARDS

6.13 PATENT ANALYSIS

6.13.1 INTRODUCTION

6.13.2 METHODOLOGY

6.13.3 DOCUMENT TYPE

FIGURE 20 NUMBER OF PATENTS REGISTERED IN LAST 11 YEARS

6.13.4 PATENT PUBLICATION TRENDS

FIGURE 21 NUMBER OF PATENTS YEAR–WISE IN LAST 10 YEARS

6.13.5 INSIGHTS

6.13.6 JURISDICTION ANALYSIS

FIGURE 22 JAPAN ACCOUNTED FOR MOST NUMBER OF PATENTS

6.13.7 TOP COMPANIES/APPLICANTS

FIGURE 23 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 4 LIST OF PATENTS BY SUMITOMO RUBBER INDUSTRIES

TABLE 5 LIST OF PATENTS BY BRIDGESTONE CORPORATION

TABLE 6 LIST OF PATENTS BY SHIN–ETSU CHEMICAL CO., LTD.

TABLE 7 LIST OF PATENTS BY LINTEC CORP.

TABLE 8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 IMPACT OF COVID–19 ON SILANE COUPLING AGENTS MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 73)

7.1 SCENARIO ANALYSIS

7.2 RANGE SCENARIOS OF SILANE COUPLING AGENTS MARKET

7.2.1 OPTIMISTIC SCENARIO

7.2.2 PESSIMISTIC SCENARIO

7.2.3 REALISTIC SCENARIO

8 SILANE COUPLING AGENTS MARKET, BY TYPE (Page No. - 75)

8.1 INTRODUCTION

FIGURE 24 OTHER SEGMENT TO LEAD THE SILANE COUPLING AGENTS MARKET DURING THE FORECAST PERIOD

TABLE 9 SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 10 SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

8.2 EPOXY

8.2.1 INCREASING DEMAND FROM PAINTS & COATINGS APPLICATIONS TO BOOST THE MARKET

TABLE 11 EPOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 12 EPOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.3 AMINO

8.3.1 DEMAND FROM FIBERGLASS APPLICATIONS TO DRIVE THE MARKET

TABLE 13 AMINO SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 14 AMINO: SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.4 VINYL

8.4.1 HIGH DEMAND FROM ELECTRICAL WIRES AND CABLES TO PROPEL THE MARKET

TABLE 15 VINYL SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 16 VINYL SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.5 ACRYLOXY

8.5.1 ELECTRICAL, CHEMICAL, AND AUTOMOTIVE END–USE INDUSTRIES TO DRIVE THE MARKET

TABLE 17 ACRYLOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 ACRYLOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.6 METHACRYLOXY

8.6.1 HIGH DEMAND FROM GLASS REINFORCED FIBERS & COMPOSITES TO GOVERN THE MARKET GROWTH

TABLE 19 METHACRYLOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 METHACRYLOXY SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.7 OTHERS

TABLE 21 OTHER SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 OTHER SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9 SILANE COUPLING AGENTS MARKET, BY APPLICATION (Page No. - 84)

9.1 INTRODUCTION

FIGURE 25 RUBBER & PLASTICS TO LEAD THE SILANE COUPLING AGENTS MARKET DURING THE FORECAST PERIOD

TABLE 23 SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 24 SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

9.2 PAINTS & COATINGS

9.2.1 RISING DEMAND FOR GREEN COATINGS IN RESIDENTIAL & COMMERCIAL PROJECTS TO BOOST THE MARKET

TABLE 25 SILANE COUPLING AGENTS MARKET SIZE FOR PAINTS & COATINGS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 SILANE COUPLING AGENTS MARKET SIZE FOR PAINTS & COATINGS APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.3 ADHESIVES & SEALANTS

9.3.1 EXCELLENT ADHESION PROPERTY OF SILANE COUPLING AGENTS TO DRIVE THE DEMAND IN THIS SEGMENT

TABLE 27 SILANE COUPLING AGENTS MARKET SIZE FOR ADHESIVES & SEALANTS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 SILANE COUPLING AGENTS MARKET SIZE FOR ADHESIVES & SEALANTS APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.4 RUBBER & PLASTICS

9.4.1 INCREASING FOCUS OF AUTOMOBILE MANUFACTURERS ON HIGH–PERFORMANCE MATERIAL TO BOOST THE MARKET

TABLE 29 SILANE COUPLING AGENTS MARKET SIZE FOR RUBBER & PLASTICS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 SILANE COUPLING AGENTS MARKET SIZE FOR RUBBER & PLASTICS APPLICATION, BY REGION, 2019–2026 (KILOTON)

9.5 OTHERS

TABLE 31 SILANE COUPLING AGENTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 SILANE COUPLING AGENTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

10 SILANE COUPLING AGENTS MARKET, BY END USE INDUSTRY (Page No. - 91)

10.1 INTRODUCTION

FIGURE 26 AUTOMOTIVE & TRANSPORTATION SEGMENT TO LEAD THE SILANE COUPLING AGENTS MARKET

TABLE 33 SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026(USD MILLION)

TABLE 34 SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

10.2 ENERGY & CHEMICAL

10.2.1 INCREASING USE OF SILANE COUPLING AGENTS IN HYBRID MATERIALS DRIVING THE MARKET

TABLE 35 SILANE COUPLING AGENTS MARKET SIZE IN ENERGY & CHEMICAL END–USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 SILANE COUPLING AGENTS MARKET SIZE IN ENERGY & CHEMICAL END–USE INDUSTRY, BY REGION, 2019–2026 (KILOTON)

10.3 AUTOMOTIVE & TRANSPORTATION

10.3.1 RISING DEMAND FOR SUSTAINABLE & FUEL–EFFICIENT GREEN TIRES RESPONSIBLE FOR MARKET GROWTH IN THIS SEGMENT

TABLE 37 SILANE COUPLING AGENTS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END–USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 SILANE COUPLING AGENTS MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION END–USE INDUSTRY, BY REGION, 2019–2026 (KILOTON)

10.4 BUILDING & CONSTRUCTION

10.4.1 USE OF PAINTS & COATINGS, ADHESIVES, AND SEALANTS IN THE BUILDING & CONSTRUCTION INDUSTRY TO DRIVE THE SILICONE MARKET

TABLE 39 SILANE COUPLING AGENTS MARKET SIZE IN BUILDING & CONSTRUCTION END–USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 SILANE COUPLING AGENTS MARKET SIZE IN BUILDING & CONSTRUCTION END–USE INDUSTRY, BY REGION, 2019–2026 (KILOTON)

10.5 ELECTRICAL & ELECTRONICS

10.5.1 EMERGING TREND OF MINIATURIZATION IN THE ELECTRONICS INDUSTRY TO BOOST THE DEMAND

TABLE 41 SILANE COUPLING AGENTS MARKET SIZE IN ELECTRICAL & ELECTRONICS END–USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 SILANE COUPLING AGENTS MARKET SIZE IN ELECTRICAL & ELECTRONICS END–USE INDUSTRY, BY REGION, 2019–2026 (KILOTON)

10.6 HEALTHCARE

10.6.1 GROWING USE OF SILANE COUPLING AGENTS IN DENTAL INDUSTRY TO BOOST THE MARKET

TABLE 43 SILANE COUPLING AGENTS MARKET SIZE FOR HEALTHCARE END–USE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 SILANE COUPLING AGENTS MARKET SIZE FOR HEALTHCARE END–USE INDUSTRY, BY REGION, 2019–2026 (KILOTON)

10.7 OTHERS

TABLE 45 SILANE COUPLING AGENTS MARKET SIZE IN OTHER END–USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 SILANE COUPLING AGENTS MARKET SIZE IN OTHER END–USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

11 SILANE COUPLING AGENTS MARKET, BY REGION (Page No. - 100)

11.1 INTRODUCTION

FIGURE 27 APAC TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 47 SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 SILANE COUPLING AGENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

11.2 APAC

FIGURE 28 APAC: SILANE COUPLING AGENTS MARKET SNAPSHOT

TABLE 49 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 51 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 53 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 54 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 55 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 APAC: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.2.1 CHINA

11.2.1.1 Largest tire producing industry to boost the market during the forecast period

TABLE 57 CHINA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 CHINA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 59 CHINA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 60 CHINA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY 2019–2026 (KILOTON)

11.2.2 JAPAN

11.2.2.1 Country to witness moderate growth during the forecast period

TABLE 61 JAPAN: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 JAPAN: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 63 JAPAN: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 64 JAPAN: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.2.3 INDIA

11.2.3.1 Growing construction industry and rapid industrialization driving the market

TABLE 65 INDIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE 2019–2026 (USD MILLION)

TABLE 66 INDIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 67 INDIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 68 INDIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.2.4 SOUTH KOREA

11.2.4.1 Growing automotive & construction industry to support market growth

TABLE 69 SOUTH KOREA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 SOUTH KOREA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 71 SOUTH KOREA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 72 SOUTH KOREA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.2.5 AUSTRALIA & NEW ZEALAND

11.2.5.1 Strong spending in building & construction activities likely to drive the market

TABLE 73 AUSTRALIA & NEW ZEALAND: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 AUSTRALIA & NEW ZEALAND: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 75 AUSTRALIA & NEW ZEALAND: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 AUSTRALIA & NEW ZEALAND: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.2.6 REST OF APAC

TABLE 77 REST OF APAC: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 REST OF APAC: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 79 REST OF APAC: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 80 REST OF APAC: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SNAPSHOT

TABLE 81 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 83 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 85 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 87 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.3.1 US

11.3.1.1 Established tire manufacturing industry to drive the market

TABLE 89 US: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 US: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 91 US: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 92 US: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.3.2 CANADA

11.3.2.1 Automotive and construction industries in the country to drive the market

TABLE 93 CANADA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 CANADA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 95 CANADA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 96 CANADA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTONS)

11.3.3 MEXICO

11.3.3.1 Private investment in infrastructure & energy sector to drive the market

TABLE 97 MEXICO: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 MEXICO: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 99 MEXICO: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 MEXICO: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTONS)

11.4 EUROPE

FIGURE 30 EUROPE: SILANE COUPLING AGENTS MARKET SNAPSHOT

TABLE 101 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 103 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 105 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 106 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 107 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 108 EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.1 GERMANY

11.4.1.1 Stringent environment regulations to drive the market

TABLE 109 GERMANY: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 GERMANY: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 111 GERMANY: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 112 GERMANY: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.2 FRANCE

11.4.2.1 Increasing tire production to support market growth

TABLE 113 FRANCE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 FRANCE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 115 FRANCE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 116 FRANCE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.3 UK

11.4.3.1 There is an increasing demand for silane coupling agents in the building & construction industry

TABLE 117 UK: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 UK: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 119 UK SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 120 UK: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.4 ITALY

11.4.4.1 Rapid urbanization & infrastructural development to drive the demand

TABLE 121 ITALY: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 ITALY: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 123 ITALY: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 124 ITALY: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.5 SPAIN

11.4.5.1 Growth of automobile and construction sectors to boost the market

TABLE 125 SPAIN: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 SPAIN: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 127 SPAIN: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 128 SPAIN: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.6 RUSSIA

11.4.6.1 Growth of renewable energy sector to drive the market

TABLE 129 RUSSIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 RUSSIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 131 RUSSIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 RUSSIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.4.7 REST OF EUROPE

TABLE 133 REST OF EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 REST OF EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 135 REST OF EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 136 REST OF EUROPE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.5 MIDDLE EAST & AFRICA

TABLE 137 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 139 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 141 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 143 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.5.1 SAUDI ARABIA

11.5.1.1 Mega housing projects in the country to drive the market

TABLE 145 SAUDI ARABIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 SAUDI ARABIA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 147 SAUDI ARABIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 148 SAUDI ARABIA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.5.2 UAE

11.5.2.1 Growing demand for fuel–efficient & lightweight vehicles to drive the market

TABLE 149 UAE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 UAE: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 151 UAE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 152 UAE: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.5.3 SOUTH AFRICA

11.5.3.1 Booming building & construction industry to drive the market

TABLE 153 SOUTH AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 SOUTH AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 155 SOUTH AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 156 SOUTH AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 157 REST OF MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 REST OF MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 159 REST OF MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST & AFRICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.6 SOUTH AMERICA

TABLE 161 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 163 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 165 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 166 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 167 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 168 SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.6.1 BRAZIL

11.6.1.1 The government’s efforts for the country’s fiscal sustainability to be helpful for the market growth

TABLE 169 BRAZIL: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 BRAZIL: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 171 BRAZIL: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 172 BRAZIL: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.6.2 ARGENTINA

11.6.2.1 Rising investment in infrastructural development to drive the market

TABLE 173 ARGENTINA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 ARGENTINA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 175 ARGENTINA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 176 ARGENTINA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

11.6.3 REST OF SOUTH AMERICA

TABLE 177 REST OF SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 179 REST OF SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 180 REST OF SOUTH AMERICA: SILANE COUPLING AGENTS MARKET SIZE, BY END–USE INDUSTRY, 2019–2026 (KILOTON)

12 COMPETITIVE LANDSCAPE (Page No. - 166)

12.1 OVERVIEW

12.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

FIGURE 31 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY, 2016–2021

12.3 MARKET RANKING

FIGURE 32 MARKET RANKING OF KEY PLAYERS, 2020

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 REVENUE ANALYSIS FOR KEY COMPANIES IN SILANE COUPLING AGENT MARKET

12.5 MARKET SHARE ANALYSIS

TABLE 181 SILANE COUPLING AGENTS MARKET: MARKET SHARES OF KEY PLAYERS

FIGURE 34 SHARE OF LEADING COMPANIES IN SILANE COUPLING AGENTS MARKET

12.6 COMPANY EVALUATION QUADRANT

FIGURE 35 SILANE COUPLING AGENTS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.6.1 STAR

12.6.2 PERVASIVE

12.6.3 EMERGING LEADER

12.6.4 PARTICIPANT

12.7 COMPETITIVE BENCHMARKING

12.7.1 STRENGTH OF PRODUCT PORTFOLIO

12.7.2 BUSINESS STRATEGY EXCELLENCE

TABLE 182 COMPANY APPLICATION FOOTPRINT

TABLE 183 COMPANY PRODUCT FOOTPRINT

TABLE 184 COMPANY REGION FOOTPRINT

TABLE 185 COMPANY END–USE INDUSTRY FOOTPRINT

12.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM–SIZED ENTERPRISES)

12.8.1 PROGRESSIVE COMPANIES

12.8.2 RESPONSIVE COMPANIES

12.8.3 STARTING BLOCKS

12.8.4 DYNAMIC COMPANIES

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM–SIZED ENTERPRISES), 2020

12.9 COMPETITIVE SCENARIO AND TRENDS

12.9.1 PRODUCT LAUNCHES

TABLE 186 SILANE COUPLING AGENTS MARKET: PRODUCT LAUNCHES, JULY 2016–JANUARY 2021

12.9.1.1 Deals

TABLE 187 SILANE COUPLING AGENTS MARKET: DEALS, JULY 2016–JANUARY 2021

12.9.1.2 Others

TABLE 188 SILANE COUPLING AGENTS MARKET: OTHERS, JULY 2016–JANUARY 2021

13 COMPANY PROFILES (Page No. - 181)

13.1 KEY COMPANIES

(Business Overview, Products and solutions, MnM view, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats, right to win)*

13.1.1 THE DOW CHEMICAL COMPANY

TABLE 189 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 37 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

TABLE 190 THE DOW CHEMICAL COMPANY: PRODUCT AND SOLUTIONS

13.1.2 SHIN–ETSU CHEMICAL CO., LTD.

TABLE 191 SHIN–ETSU CHEMICAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 38 SHIN–ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

TABLE 192 SHIN–ETSU CHEMICAL CO., LTD.: PRODUCT AND SOLUTIONS

TABLE 193 SHIN–ETSU CHEMICAL CO., LTD.: DEALS

13.1.3 MOMENTIVE

TABLE 194 MOMENTIVE: BUSINESS OVERVIEW

TABLE 195 MOMENTIVE: PRODUCT AND SOLUTIONS

TABLE 196 MOMENTIVE: DEALS

13.1.4 EVONIK INDUSTRIES AG

TABLE 197 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

FIGURE 39 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 198 EVONIK INDUSTRIES AG: PRODUCT AND SOLUTIONS

TABLE 199 EVONIK INDUSTRIES AG: DEALS

13.1.5 WACKER CHEMIE AG

TABLE 200 WACKER CHEMIE AG: BUSINESS OVERVIEW

FIGURE 40 WACKER CHEMIE AG: COMPANY SNAPSHOT

TABLE 201 WACKER CHEMIE AG: PRODUCT AND SOLUTIONS

TABLE 202 WACKER CHEMIE AG: DEALS

13.1.6 WD SILICONE CO., LTD.

TABLE 203 WD SILICONE CO., LTD.: BUSINESS OVERVIEW

TABLE 204 WD SILICONE CO., LTD.: PRODUCT AND SOLUTIONS

13.1.7 GELEST INC.

TABLE 205 GELEST INC.: BUSINESS OVERVIEW

TABLE 206 GELEST INC.: PRODUCT AND SOLUTIONS

TABLE 207 GELEST INC.: PRODUCT LAUNCHES

TABLE 208 GELEST INC.: DEALS

13.1.8 3M

TABLE 209 3M: BUSINESS OVERVIEW

FIGURE 41 3M: COMPANY SNAPSHOT

TABLE 210 3M: PRODUCT AND SOLUTIONS

13.1.9 NANJING UNION SILICON CHEMICAL CO., LTD.

TABLE 211 NANJING UNION SILICON CHEMICAL CO., LTD.: BUSINESS OVERVIEW

TABLE 212 NANJING UNION SILICON CHEMICAL CO., LTD.: PRODUCT AND SOLUTIONS

13.1.10 STRUKTOL COMPANY OF AMERICA, LLC

TABLE 213 STRUKTOL COMPANY OF AMERICA, LLC: BUSINESS OVERVIEW

TABLE 214 STRUKTOL COMPANY OF AMERICA, LLC: PRODUCT AND SOLUTIONS

13.2 OTHER PLAYERS

13.2.1 SILAR

TABLE 215 SILAR: COMPANY OVERVIEW

13.2.2 RAYTON CHEMICALS CO., LTD.

TABLE 216 RAYTON CHEMICALS CO., LTD.: COMPANY OVERVIEW

13.2.3 POWER CHEMICAL CORPORATION

TABLE 217 POWER CHEMICAL CORPORATION: COMPANY OVERVIEW

13.2.4 QINGDAO HENGDA ZHONGCHENG TECHNOLOGY CO., LTD.

TABLE 218 QINGDAO HENGDA ZHONGCHENG TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

13.2.5 ADVANCED POLYMER, INC.

TABLE 219 ADVANCED POLYMER, INC.: COMPANY OVERVIEW

13.2.6 HEXPOL RUBBER COMPOUNDING

TABLE 220 HEXPOL RUBBER COMPOUNDING: COMPANY OVERVIEW

13.2.7 NANJING SHUGUANG CHEMICAL GROUP CO., LTD.

TABLE 221 NANJING SHUGUANG CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

13.2.8 JINGZHOU JIANGHAN FINE CHEMICAL CO. LTD.

TABLE 222 JINGZHOU JIANGHAN FINE CHEMICAL CO. LTD.: COMPANY OVERVIEW

13.2.9 NITROCHEMIE ASCHAU GMBH

TABLE 223 NITROCHEMIE ASCHAU GMBH: COMPANY OVERVIEW

13.2.10 SUPREME SILICONES

TABLE 224 SUPREME SILICONES: COMPANY OVERVIEW

13.2.11 KETTLITZ–CHEMIE GMBH & CO. KG

TABLE 225 KETTLITZ–CHEMIE GMBH & CO. KG: COMPANY OVERVIEW

13.2.12 TANGSHAN SUNFAR NEW MATERIALS CO., LTD.

TABLE 226 TANGSHAN SUNFAR NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

13.2.13 ANHUI FEIDIAN ADVANCED MATERIALS CO., LTD.

TABLE 227 ANHUI FEIDIAN ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

13.2.14 SRI IMPEX PVT. LTD.

TABLE 228 SRI IMPEX PVT. LTD.: COMPANY OVERVIEW

13.2.15 TCI EUROPE N.V.

TABLE 229 TCI EUROPE N.V.: COMPANY OVERVIEW

*Details on Business Overview, Products and solutions, MnM view, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats, right to win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 226)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the silane coupling agents Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

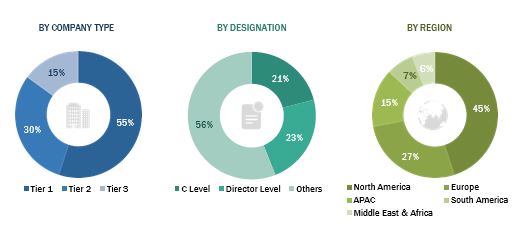

The silane coupling agents market comprises several stakeholders, such as raw material suppliers, end- product manufacturers, and regulatory organizations in the supply chain. Developments in thesilane coupling agents market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

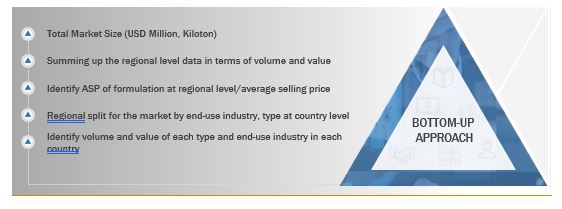

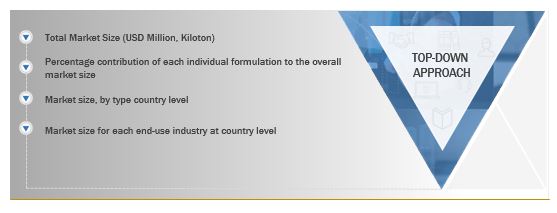

Both top-down and bottom-up approaches were used to estimate and validate the total size of the silane coupling agents market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research. The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes. All percentage shares, splits, and breakdowns were determined using secondary sources andverified through primary sources.

Silane Coupling Agents: Bottom-Up Approach

Silane Coupling Agents: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To completethe overall market engineering process and arrive at the exact statistics of each market segmentand subsegment, the data triangulation, and market breakdown procedures were employed,wherever applicable. The data was triangulated by studying various factors and trends from boththe demand and supply sides in the silane coupling agents market.

Report Objectives

- To define, describe, and forecast the silane coupling agents market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on type, applications and end-use industry.

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as new product launch, expansion, mergers & acquisitions, and partnership & collaboration in the silane coupling agents market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Silane Coupling Agents Market