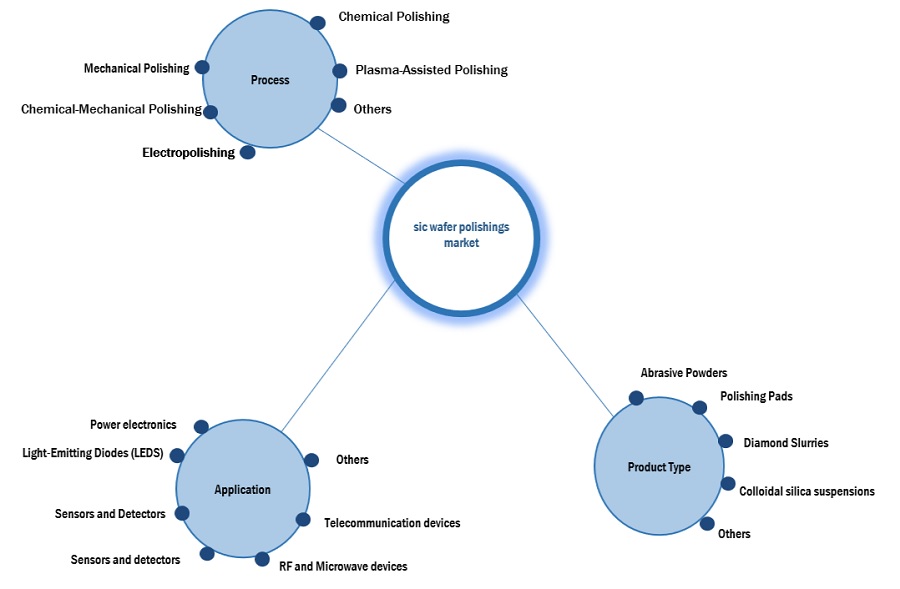

SiC Wafer Polishing Market by Product Type (Abrasive Powders, Polishing Pads, Diamond Slurries, Colloidal Silica Suspensions), application, Process, & Region (North America, Europe, APAC, South America, MEA) - Global Forecast 2028

Updated on : July 17, 2025

SiC Wafer Polishing Market

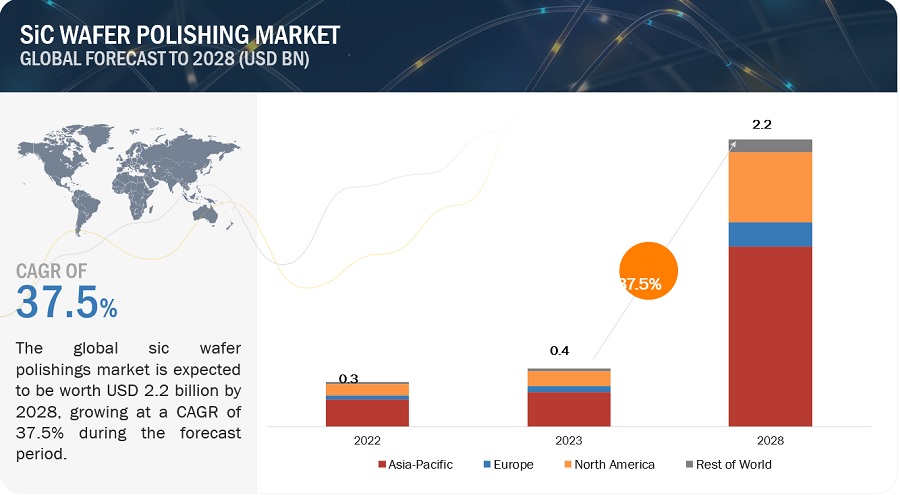

The SiC wafer polishing market was valued at USD 0.4 billion in 2023 and is projected to reach USD 2.2 billion by 2028, growing at 37.5% cagr from 2023 to 2028. Power electronics is one of the major applications of the Sic wafer polishing market and offers market growth opportunities. The polishing product sic wafer polishing centrifuge by product type segment is experiencing high growth rates in emerging regions such as Asia Pacific.

Attractive Opportunities in the SiC Wafer Polishing Market

To know about the assumptions considered for the study, Request for Free Sample Report

SiC Wafer Polishing Market Dynamics

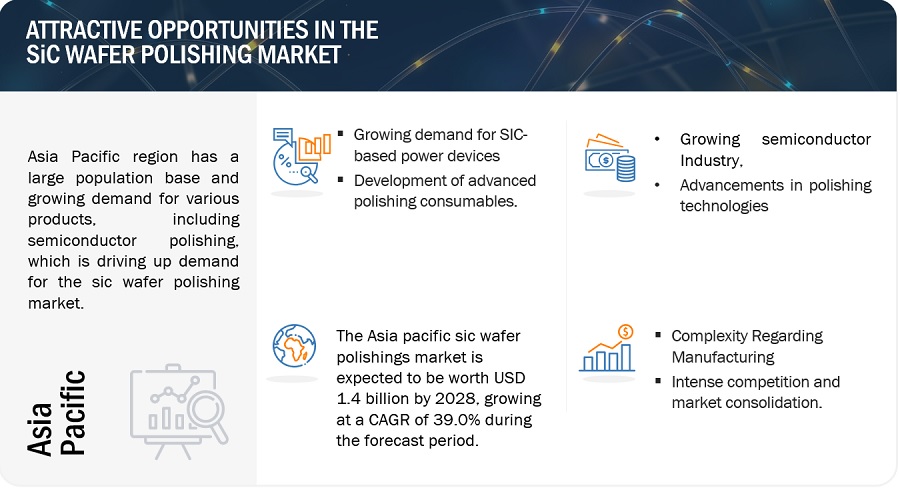

Driver: Development of advanced polishing consumable

The advancement of advanced polishing consumables has a significant impact on the growth of the SiC wafer polishing market. Polishing consumables are items used in the wafer polishing process, including abrasive slurries, pads, and chemicals. The developments in these consumables have given various benefits to the SiC wafer polishing market, driving its growth and efficiency. One of the primary advantages of modern polishing consumables is their capacity to produce better levels of precision and uniformity in the wafer polishing process. As SiC wafers become thinner and more complicated in design, the demand for precise and consistent polishing grows. Advanced consumables are meant to enable greater control over material removal rates, surface roughness, and planarization, resulting in higher overall wafer quality. This is extremely critical for SiC wafers, as their unique properties require meticulous polishing to maintain their desired characteristics. Furthermore, modern polishing consumables improve productivity and cost-effectiveness in the SiC wafer polishing process. They are designed to improve polishing efficiency, reduce polishing time, and reduce material waste.

Restraint: Long cycle polishing times

The long polishing cycle time in the SiC wafer polishing industry might have a substantial impact on market growth and even hinder it. SiC wafers are widely utilized in a variety of industries, including power electronics, automotive, telecommunications, and aerospace, due to their exceptional qualities, such as high-temperature resistance, high power density, and low power loss. However, the polishing process used in the manufacture of SiC wafers is a critical and time-consuming phase. The increased polishing cycle time has a direct impact on the production capacity and throughput of SiC wafers. Because the polishing process takes longer, it affects overall manufacturing efficiency and slows the rate at which finished wafers may be produced. This can result in supply shortages and delays in meeting client requests, especially in industries with high demand. The SiC wafer polishing market is experiencing slow growth due to a variety of factors, including extended polishing cycle times. For starters, manufacturers' ability to scale up their operations and meet the increasing demand for SiC wafers is hampered by restricted production capacity.

Opportunities: Advancement in polishing technology

Polishing technology advancements create a substantial opportunity for the SiC wafer polishing market. As the demand for SiC wafers grows, more efficient, precise, and cost-effective polishing processes are required. The advancement of modern polishing technology allows for better process control, higher surface quality, and higher productivity. The opportunity resides in the SiC wafer polishing market's capacity to embrace these improvements and provide cutting-edge solutions. The market can meet the changing needs of SiC wafer manufacturers and end-users by adopting and refining novel polishing techniques. Surface flaws, homogeneity, and dimensional control can all be addressed by advanced polishing processes, assuring the manufacturing of high-quality polished SiC wafers. Polishing technology improvements include improved chemical mechanical planarization (CMP) techniques, innovative slurries, and optimized polishing pads. These methods contribute to higher material removal rates, lower surface roughness, and improved planarity. Polishing service providers and equipment manufacturers may address the demand for high-performance SiC wafers across multiple industries by incorporating these developments into their offerings.

Challenges: Intense competition and market consolidation

The SiC wafer polishing market faces major challenges due to intense rivalry and market consolidation. As demand for SiC wafers grows, the industry becomes more competitive, with multiple firms fighting for market share. This rivalry increases pricing pressures and diminishes profit margins, affecting the profitability and sustainability of SiC wafer polishing firms. Consolidation in the market adds to the difficulties. Mergers, acquisitions, and strategic alliances can result in a highly concentrated market dominated by a few companies. This consolidation has the potential to create entry hurdles for new players, reducing market diversity and innovation. Smaller enterprises may struggle to get market access and compete against well-established companies with existing client relationships and economies of scale. Intense rivalry and market consolidation pose various challenges to the expansion of the SiC wafer polishing market. To begin with, smaller players may find it difficult to compete successfully in terms of pricing and resources, limiting their potential to gain market share. This can hinder innovation and limit the market's diversity of products and services.

SIC WAFER POLISHING MARKET ECOSYSTEM

Manufacturers of sic wafer polishing who are well-known in the industry and have a secure financial situation. These businesses have a long history in the industry, a wide range of products, and effective international sales and marketing networks. Prominent companies in this market include Kemet International (UK), Entegris (US), Iljin Diamond (US), Fujimi Corporation (Japan), Saint-Gobain (US), JSR Corporation (Japan), Engis Corporation (US), Ferro Corporation (US), 3M (US), SKC (South Korea), DuPont Incorporated (US), Fujifilm Holding America Corporation (US).

The polishing pad segment, by product type, is expected to be the largest market during the forecast period.

Based on the product type, With the polishing pad type of the market, Sic wafer polishing centrifuge manufacturers can target a larger customer base across different industries. Due to their material-specific design, precision and uniformity capabilities, efficient material removal characteristics, compatibility with chemical slurry, continuous innovation, and increasing demand driven by the expanding applications of SiC wafers, polishing pads dominate the SiC wafer polishing market. These features combine to make polishing pads the preferred method for achieving the required surface smoothness and flatness for high-performance SiC semiconductor devices.

Based on process, the chemical mechanical polishing segment accounts for the largest share of the overall market.

Based on application, The chemical polishing segment accounts for the largest share of the globally; because of its effectiveness in eliminating faults and contaminants from SiC wafers, CMP is a popular method for producing reliable and high-quality devices. As a result of these benefits, CMP has the fastest-growing market share in the SiC wafer polishing market and has emerged as the go-to technology for semiconductor manufacturers seeking optimal wafer surface quality and productivity.

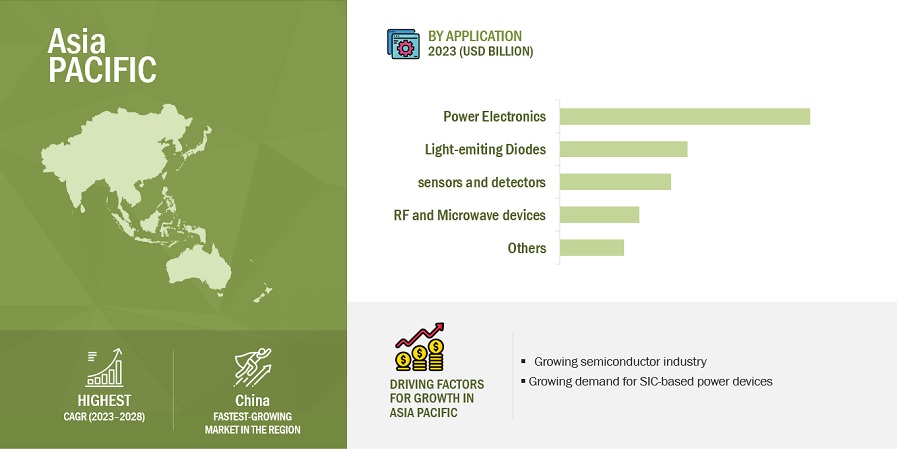

Asia Pacific is expected to account for the largest share of the global market during the forecast period.

Based on the region the Asia Pacific region is home to a large consumer electronics market, with a growing population and rising disposable incomes driving the demand for smartphones, tablets, and other electronic devices. SiC-based power devices are increasingly being incorporated into these consumer electronics for enhanced efficiency and longer battery life, further propelling the need for polished SiC wafers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The SiC wafer polishing market is dominated by a few major players that have a wide regional presence. The key players in the Sic wafer polishing market include Kemet International (UK), Entegris (US), Iljin Diamond (US), Fujimi Corporation (Japan), Saint-Gobain (US), JSR Corporation (Japan), Engis Corporation (US), Ferro Corporation (US), 3M (US), SKC (South Korea), DuPont Incorporated (US), Fujifilm Holding America Corporation (US). In the last few years, the companies have adopted growth strategies such as acquisitions, new product launches, partnerships, contracts, and agreements to capture a larger share of the Sic wafer polishing market.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Product type, process, application, and region. |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kemet International (UK), Entegris (US), Iljin Diamond (US), Fujimi Corporation (Japan), Saint-Gobain(US), JSR Corporation (Japan), Engis Corporation (US), Ferro Corporation (US), 3M (US), SKC (South Korea), DuPont Incorporated (US), Fujifilm Holding America Corporation (US). |

This report categorizes the global Sic wafer polishing market based on product type, process, application, and region.

Based on By Process Type, the Sic wafer polishing market has been segmented as follows:

- Mechanical polishing

- Chemical-mechanical polishing (CMP)

- Electropolishing

- Chemical polishing

- Plasma-assisted polishing

- Others

Based on By Product type, the Sic wafer polishing market has been segmented as follows:

- Abrasive powders

- Polishing pads

- Diamond slurries

- Colloidal silica suspensions

- Others

Based on Application, the Sic wafer polishing market has been segmented as follows:

- Power Electronics

- Light-emitting diodes (LEDs)

- Sensors and detectors

- Rf and microwave devices

- Others

Based on the Region, the Sic wafer polishing market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- December 2019 Entegris Completes Acquisition of CABOT MICROELECTRONICS; the acquisition is helping Cabot Microelectronics become more critical to its semiconductor industry customers and touch more parts of its production processes.

- In November 2021, SKC will borrow 1.5 trillion won from Korea Development Bank (KDB) to expand its secondary battery and eco-friendly materials business.

- July 2021 Fujifilm Announces $350 Million Investment in its U.S. Electronic Materials Business; the planned U.S. investment will support the development and manufacture of Fujifilm’s broad range of semiconductor materials and chemicals, particularly Chemical Mechanical Polishing (CMP) slurry and Photolithography-related high purity materials.

- In July 2023, SKC decided to acquire ISC, a semiconductor test solution provider.

Frequently Asked Questions (FAQ):

What is the current size of the SiC wafer polishing market?

The current market size of the global SiC wafer polishing market is 0.4 billion in 2023.

What are the major drivers for the Sic wafer polishing market?

Adoption of SiC wafers in radio frequency (RF) devices, Development of advanced polishing consumables.

Which is the fastest-growing region during the forecasted period in the Sic wafer polishing market?

Asia Pacific is expected to be the fastest-growing region for the global Sic wafer polishing market between 2023–2028. also has a well-established regulatory framework that supports innovation and the adoption of new technologies in the semiconductor and electronics industries.

Which is the fastest-growing segment, by type, during the forecasted period in the SiC wafer polishing market?

By product type, the polishing pads segment is anticipated to be the fastest growing in the SiC wafer polishing market.

Which is the fastest growing segment by design type method during the forecasted period in the Sic wafer polishing market?

By application type, the power electronics segment is anticipated to be the fastest growing in the SiC wafer polishing market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing consumption of consumer electronics- Growing demand for SiC-based power devices- Development of advanced polishing consumable- Adoption of SiC wafers in radio frequency (RF) devicesRESTRAINTS- Surface defects and contamination- Long polishing cycle times- Limited supplier baseOPPORTUNITIES- Growing investments in SiC R&D- Emergence of new applications- Advancements in polishing technologiesCHALLENGES- Complexity regarding manufacturing- Intense competition and market consolidation

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 RECESSION IMPACT

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USER

-

6.3 VOLUME DATAGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.4 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSTARIFFS

-

6.5 PRICING ANALYSISPOLISHING PADS AVERAGE SELLING PRICE TREND, BY PRODUCTPOLISHING PADS AVERAGE SELLING PRICE TREND, BY REGIONDIAMOND SLURRIES AVERAGE SELLING PRICE TREND, BY REGION

-

6.6 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.7 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document typeINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISANALYSIS OF TOP APPLICANTS

-

6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFTS & NEW REVENUE POCKETS FOR SIC WAFER POLISHING MARKET

-

6.9 ECOSYSTEM/MARKETMAP

-

6.10 TECHNOLOGY ANALYSISCHEMICAL MECHANICAL PLANARIZATION (CMP) TECHNOLOGYFIXED ABRASIVE POLISHING (FAP)

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.12 KEY CONFERENCES & EVENTS IN 2023–2025

- 7.1 INTRODUCTION

-

7.2 ABRASIVE POWDERCOMPATIBILITY WITH DIFFERENT POLISHING SYSTEMS AND EQUIPMENT TO DRIVE MARKET

-

7.3 POLISHING PADSHIGHLY VERSATILE NATURE TO INCREASE USAGE

-

7.4 DIAMOND SLURRIESINCREASING DEMAND FOR HIGH-PERFORMANCE SIC-BASED DEVICES TO DRIVE MARKETROUGH LAPPINGPRIMARY LAPPINGSECONDARY LAPPING

-

7.5 COLLOIDAL SILICA SUSPENSIONSCOST-EFFECTIVENESS IN SIC WAFER POLISHING PROCESSES TO DRIVE MARKET

-

7.6 OTHERSABRASIVE SLURRIES

- 8.1 INTRODUCTION

-

8.2 MECHANICAL POLISHINGVERSATILE PROCESS FOR POLISHING COMPLEX SIC WAFERS TO DRIVE MARKET

-

8.3 CHEMICAL-MECHANICAL POLISHING (CMP)HIGH DEMAND FOR POLISHING SEMICONDUCTOR DEVICES TO DRIVE MARKET

-

8.4 ELECTROPOLISHINGCUTTING-EDGE ELECTROPOLISHING ADVANCES TO INCREASE DEMAND

-

8.5 CHEMICAL POLISHINGRISING DEMAND FOR HIGH-THROUGHPUT SIC POLISHING TO DRIVE MARKET

-

8.6 PLASMA-ASSISTED POLISHINGHIGHLY EFFICIENT AND EFFECTIVE PROCESS TO DRIVE MARKET

-

8.7 OTHERSREACTIVE ION ETCHING (RIE)

- 9.1 INTRODUCTION

-

9.2 POWER ELECTRONICSADVANCED POLISHING TECHNIQUES TO DRIVE MARKET

-

9.3 LIGHT-EMITTING DIODES (LEDS)STABLE ILLUMINATION AND INCREASING PRODUCTIVITY TO DRIVE MARKET

-

9.4 SENSORS AND DETECTORSSIC POLISHING EMPOWERING GROWTH WITH ADVANCED SENSORS AND DETECTORS TO DRIVE MARKET

-

9.5 RF AND MICROWAVE DEVICESELECTRICAL AND THERMAL PERFORMANCE TO DRIVE MARKET

-

9.6 OTHERSSEMICONDUCTOR DEVICES

- 10.1 INTRODUCTION

-

10.2 EUROPERECESSION IMPACTGERMANY- Increasing availability of SiC wafers to drive marketITALY- Government initiatives promoting adoption of renewable energy to drive marketFRANCE- Growing demand for high-performance electronic devices to drive marketSWEDEN- Growing importance of cybersecurity for semiconductors to increase marketREST OF EUROPE

-

10.3 ASIA PACIFICRECESSION IMPACTCHINA- Increasing demand for SiC wafers in power electronics applications to drive marketJAPAN- Growing importance as semiconductors market to drive growthSOUTH KOREA- Development of new polishing technologies to drive marketTAIWAN- Efforts to reduce carbon emissions to drive marketREST OF ASIA PACIFIC

-

10.4 NORTH AMERICARECESSION IMPACTUS- Rising adoption of SiC-based power devices in renewable energy to hamper marketCANADA- Growing research activities to drive marketMEXICO- Growing telecommunication industry to increase demand

-

10.5 REST OF WORLD (ROW)BRAZIL- Favorable government policies to drive marketSOUTH AFRICA- Expanding SiC wafer manufacturing base to drive demandREST OF ROW

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 MARKET SHARE AND REVENUE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Kemet International Limited- Entegris- Fujimi Incorporated- Ferro Corporation- Iljin DiamondREVENUE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.5 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.6 COMPETITIVE SCENARIOS AND TRENDSDEALSOTHERS

-

12.1 KEY PLAYERSENTEGRIS- Business overview- Products/Services/Solutions offered- Recent development- MnM viewSAINT-GOBAIN- Business overview- Products/Services/Solutions offered- MnM viewKEMET INTERNATIONAL LIMITED- Business overview- Products/Services/Solutions offered- MnM viewILJIN DIAMOND CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewDUPONT INCORPORATED- Business overview- Products/Services/Solutions offered- MnM viewFUJIBO HOLDINGS, INC.- Business overview- Products/Services/Solutions offered- MnM viewFUJIFILM HOLDINGS AMERICA CORPORATION- Business overview- Products/Services/Solutions offered- Recent development- MnM viewENGIS CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewSKC- Business overview- Products/Services/Solutions offered- Recent development- MnM viewFERRO CORPORATION- Business overview- Products/Services/Solutions offered- MnM view3M- Business overview- Products/Services/Solutions offeredJSR CORPORATION- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSPUREONLAPMASTER WOLTERSLOGITECH LTD.ADVANCED ABRASIVES CORPORATIONALLIED HIGH TECH PRODUCTSACE NANOCHEM CO., LTD.SHANGHAI XINANNA ELECTRONIC TECHNOLOGY CO., LTDAGC INC.FUJIMI INCORPORATEDLAM PLAN SASNITTA DUPONT INCORPORATED

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SIC WAFER POLISHING MARKET: SNAPSHOT

- TABLE 2 SIC WAFER POLISHING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2019–2027 (USD MILLION)

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MFN TARIFFS FOR SEMICONDUCTOR MANUFACTURING EQUIPMENT, BY COUNTRY, 2023

- TABLE 8 POLISHING PADS AVERAGE SELLING PRICE, BY PRODUCT, 2023–2028 (USD/SQUARE INCH)

- TABLE 9 POLISHING PADS AVERAGE SELLING PRICE, BY REGION, 2023–2028 (USD/SQUARE INCH)

- TABLE 10 DIAMOND SLURRIES AVERAGE SELLING PRICE, BY REGION, 2023–2028 (USD/L)

- TABLE 11 GRANTED PATENTS ACCOUNTED FOR 35% OF TOTAL PATENTS IN LAST 10 YEARS

- TABLE 12 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2019–2027

- TABLE 13 ADVANTAGES OF CHEMICAL MECHANICAL PLANARIZATION (CMP) TECHNOLOGY

- TABLE 14 ADVANTAGES OF FIXED ABRASIVE POLISHING (FAP) TECHNOLOGY

- TABLE 15 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP 4 APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- TABLE 17 SIC WAFER POLISHING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2025

- TABLE 18 SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 19 SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 20 SIC WAFER POLISHING PADS MARKET, BY LAPPING PROCESS, 2020–2022 (USD MILLION)

- TABLE 21 SIC WAFER POLISHING PADS MARKET, BY LAPPING PROCESS, 2023–2028 (USD MILLION)

- TABLE 22 SIC WAFER POLISHING PADS MARKET IN ROUGH LAPPING, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 23 SIC WAFER POLISHING PADS MARKET IN ROUGH LAPPING, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 24 SIC WAFER POLISHING PADS MARKET IN PRIMARY LAPPING, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 25 SIC WAFER POLISHING PADS MARKET IN PRIMARY LAPPING, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 26 SIC WAFER POLISHING PADS MARKET IN SECONDARY LAPPING, BY MATERIAL, 2020–2022 (USD MILLION)

- TABLE 27 SIC WAFER POLISHING PADS MARKET IN SECONDARY LAPPING, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 28 SIC WAFER POLISHING DIAMOND SLURRIES MARKET, BY LAPPING PROCESS, 2020–2022 (USD MILLION)

- TABLE 29 SIC WAFER POLISHING DIAMOND SLURRIES MARKET, BY LAPPING PROCESS, 2023–2028 (USD MILLION)

- TABLE 30 SIC WAFER POLISHING DIAMOND SLURRIES MARKET, BY PARTICLE SIZE, 2020–2022 (USD MILLION)

- TABLE 31 SIC WAFER POLISHING DIAMOND SLURRIES MARKET, BY PARTICLE SIZE, 2023–2028 (USD MILLION)

- TABLE 32 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN ROUGH LAPPING, BY PARTICLE SIZE, 2020–2022 (USD MILLION)

- TABLE 33 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN ROUGH LAPPING, BY PARTICLE SIZE, 2023–2028 (USD MILLION)

- TABLE 34 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN PRIMARY LAPPING, BY PARTICLE SIZE, 2020–2022 (USD MILLION)

- TABLE 35 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN PRIMARY LAPPING, BY PARTICLE SIZE, 2023–2028 (USD MILLION)

- TABLE 36 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN SECONDARY LAPPING, BY PARTICLE SIZE, 2020–2022 (USD MILLION)

- TABLE 37 SIC WAFER POLISHING DIAMOND SLURRIES MARKET IN SECONDARY LAPPING, BY PARTICLE SIZE, 2023–2028 (USD MILLION)

- TABLE 38 SIC WAFER POLISHING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 39 SIC WAFER POLISHING MARKET SIZE, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 40 SIC WAFER POLISHING MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 41 SIC WAFER POLISHING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 SIC WAFER POLISHING MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 43 SIC WAFER POLISHING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 45 SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 46 SIC WAFER POLISHING MARKET, BY PROCESS, 2020–2022 (USD MILLION)

- TABLE 47 SIC WAFER POLISHING MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 48 SIC WAFER POLISHING MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 49 SIC WAFER POLISHING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 EUROPE: SIC WAFER POLISHING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 51 EUROPE: SIC WAFER POLISHING MARKET SHARE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 53 EUROPE: SIC WAFER POLISHING, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 54 GERMANY: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 55 GERMANY: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 56 ITALY: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 57 ITALY: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 58 FRANCE: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 59 FRANCE: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 60 SWEDEN: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 61 SWEDEN: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 62 REST OF EUROPE: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 63 REST OF EUROPE: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: SIC WAFER POLISHING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SIC WAFER POLISHING MARKET SHARE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 67 ASIA PACIFIC: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 68 CHINA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 69 CHINA: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 70 JAPAN: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 71 JAPAN: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT 2023–2028 (USD MILLION)

- TABLE 72 SOUTH KOREA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 73 SOUTH KOREA: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 74 TAIWAN: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 75 TAIWAN: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: SIC WAFER POLISHING MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: SIC WAFER POLISHING MARKET SHARE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 82 US: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 83 US: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 85 CANADA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 86 MEXICO: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 87 MEXICO: SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 88 REST OF WORLD: SIC WAFER POLISHING MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 89 REST OF WORLD: SIC WAFER POLISHING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 REST OF WORLD: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 91 REST OF WORLD: SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 92 BRAZIL: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 93 BRAZIL: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 94 SOUTH AFRICA: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 95 SOUTH AFRICA: SIC WAFER POLISHING MARKET SHARE, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 96 REST OF ROW: SIC WAFER POLISHING MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

- TABLE 97 REST OF ROW: SIC WAFER POLISHING MARKET, BY PRODUCT, 2023–2028 (USD MILLION)

- TABLE 98 OVERVIEW OF STRATEGIES ADOPTED BY KEY SIC WAFER POLISHING MARKET

- TABLE 99 SIC WAFER POLISHINGS: DEGREE OF COMPETITION

- TABLE 100 SIC WAFER POLISHING MARKET, REVENUE ANALYSIS FOR DIAMOND SLURRY, BY COMPANY, 2023–2028 (USD MILLION)

- TABLE 101 SIC WAFER POLISHING MARKET, REVENUE ANALYSIS FOR ABRASIVE POWDERS, BY COMPANY, 2023–2028 (USD MILLION)

- TABLE 102 SIC WAFER POLISHING MARKET, REVENUE ANALYSIS FOR POLISHING PADS, BY COMPANY, 2023–2028 (USD MILLION)

- TABLE 103 SIC WAFER POLISHING MARKET: KEY COMPANY PROCESS FOOTPRINT

- TABLE 104 SIC WAFER POLISHING MARKET: KEY COMPANY PRODUCT FOOTPRINT

- TABLE 105 SIC WAFER POLISHING MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 106 SIC WAFER POLISHING MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 107 SIC WAFER POLISHING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 108 SIC WAFER POLISHING MARKET: STARTUPS/SME PLAYERS PROCESS FOOTPRINT

- TABLE 109 SIC WAFER POLISHING MARKET: STARTUPS/SME PLAYERS PRODUCT FOOTPRINT

- TABLE 110 SIC WAFER POLISHING MARKET: STARTUPS/SME PLAYERS APPLICATION FOOTPRINT

- TABLE 111 SIC WAFER POLISHING MARKET: STARTUPS/SME PLAYERS REGION FOOTPRINT

- TABLE 112 SIC WAFER POLISHING MARKET: DEALS (2020–2023)

- TABLE 113 SIC WAFER POLISHING MARKET: OTHERS (2021–2023)

- TABLE 114 ENTEGRIS: COMPANY OVERVIEW

- TABLE 115 ENTEGRIS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 ENTEGRIS: DEALS

- TABLE 117 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 118 SAINT-GOBAIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 119 KEMET INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 120 KEMET INTERNATIONAL LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 ILJIN DIAMOND CO., LTD.: COMPANY OVERVIEW

- TABLE 122 ILJIN DIAMOND CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 123 DUPONT INCORPORATED: COMPANY OVERVIEW

- TABLE 124 DUPONT INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 125 FUJIBO HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 126 FUJIBO HOLDINGS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 127 FUJIFILM HOLDINGS AMERICA CORPORATION: COMPANY OVERVIEW

- TABLE 128 FUJIFILM HOLDINGS AMERICA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 129 FUJIFILM HOLDINGS AMERICA CORPORATION: OTHERS

- TABLE 130 FUJIFILM HOLDINGS AMERICA CORPORATION: DEALS

- TABLE 131 ENGIS CORPORATION: COMPANY OVERVIEW

- TABLE 132 ENGIS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 133 SKC: COMPANY OVERVIEW

- TABLE 134 SKC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 SKC: DEALS

- TABLE 136 SKC: OTHERS

- TABLE 137 FERRO CORPORATION: COMPANY OVERVIEW

- TABLE 138 FERRO CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 3M: COMPANY OVERVIEW

- TABLE 140 3M: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 142 JSR CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 PUREON: COMPANY OVERVIEW

- TABLE 144 LAPMASTER WOLTERS: COMPANY OVERVIEW

- TABLE 145 LOGITECH LTD.: COMPANY OVERVIEW

- TABLE 146 ADVANCED ABRASIVES CORPORATION: COMPANY OVERVIEW

- TABLE 147 ALLIED HIGH TECH PRODUCTS: COMPANY OVERVIEW

- TABLE 148 ACE NANOCHEM CO., LTD.: COMPANY OVERVIEW

- TABLE 149 SHANGHAI XINANNA ELECTRONIC TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 150 AGC INC.: COMPANY OVERVIEW

- TABLE 151 FUJIMI INCORPORATED: COMPANY OVERVIEW

- TABLE 152 LAM PLAN SAS: COMPANY OVERVIEW

- TABLE 153 NITTA DUPONT INCORPORATED: COMPANY OVERVIEW

- FIGURE 1 SIC WAFER POLISHING MARKET: RESEARCH DESIGN

- FIGURE 2 KEY INDUSTRY INSIGHTS

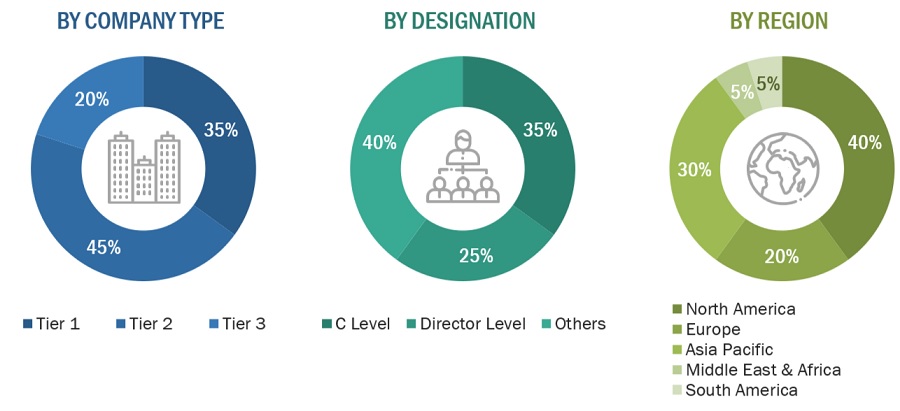

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 DATA TRIANGULATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DEMAND-SIDE ANALYSIS

- FIGURE 8 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR SIC WAFER POLISHING

- FIGURE 9 DIAMOND SLURRIES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 POWER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 CHEMICAL MECHANICAL POLISHING (CMP) PROCESS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD SIC WAFER POLISHING MARKET IN 2023

- FIGURE 13 INCREASING AWARENESS OF SUSTAINABLE TECHNOLOGY DRIVING MARKET DURING FORECAST PERIOD

- FIGURE 14 CHEMICAL AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- FIGURE 15 DIAMOND SLURRIES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 16 POWER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 17 CHEMICAL MECHANICAL POLISHING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 18 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF SIC WAFER POLISHING MARKET IN 2023

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SIC WAFER POLISHING MARKET

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: SIC WAFER POLISHING MARKET

- FIGURE 21 VALUE CHAIN FOR SIC WAFER POLISHING MARKET

- FIGURE 22 EXPORT SCENARIO FOR HS CODE 381800, BY KEY COUNTRY (2019–2022)

- FIGURE 23 IMPORT SCENARIO FOR HS CODE 381800, BY KEY COUNTRY, (2019–2022)

- FIGURE 24 PUBLICATION TRENDS OVER LAST TEN YEARS

- FIGURE 25 LEGAL STATUS OF PATENTS FIELD FOR SIC WAFER POLISHING MARKET

- FIGURE 26 TOP JURISDICTION-BY DOCUMENT

- FIGURE 27 TAIWAN SEMICONDUCTOR MFG CO LTD REGISTERED HIGHEST NUMBER OF PATIENTS BETWEEN 2017 AND 2022

- FIGURE 28 REVENUE SHIFT OF SIC WAFER POLISHING PROVIDERS

- FIGURE 29 SIC WAFER POLISHING MARKET: ECOSYSTEM

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 4 APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR END-USER INDUSTRIES

- FIGURE 32 SIC WAFER POLISHING MARKET, BY PRODUCT, 2022

- FIGURE 33 SIC WAFER POLISHING MARKET, BY PROCESS, 2022

- FIGURE 34 SIC WAFER POLISHING MARKET, BY APPLICATION, 2023

- FIGURE 35 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 36 EUROPE: SIC WAFER POLISHING MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: SIC WAFER POLISHING MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: SIC WAFER POLISHING MARKET SNAPSHOT

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN SIC WAFER POLISHING MARKET, 2022

- FIGURE 40 SIC WAFER POLISHING MARKET IN 2022

- FIGURE 41 SIC WAFER POLISHING MARKET COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- FIGURE 42 SIC WAFER POLISHING MARKET STARTUPS/SMES COMPANY EVALUATION MATRIX, 2022

- FIGURE 43 ENTEGRIS: COMPANY SNAPSHOT

- FIGURE 44 DUPONT: COMPANY SNAPSHOT

- FIGURE 45 FUJIBO HOLDING, INC.: COMPANY SNAPSHOT

- FIGURE 46 SKC: COMPANY SNAPSHOT

- FIGURE 47 3M: COMPANY SNAPSHOT

- FIGURE 48 JSR CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Sic wafer polishing market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Sic wafer polishing market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the Sic wafer polishing market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Sic wafer polishing industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to Sic wafer polishing by product type, process type, applications, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Sic wafer polishing and the future outlook of their business, which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Kemet Internatinal (UK) |

Regional Head |

|

Entegris (US) |

Sales Manager |

|

Fujimi Corporation (Japan) |

Director |

|

Saint-Gobainl (US) |

Marketing Manager |

|

JSR (Japn), |

R&D Manager |

|

|

|

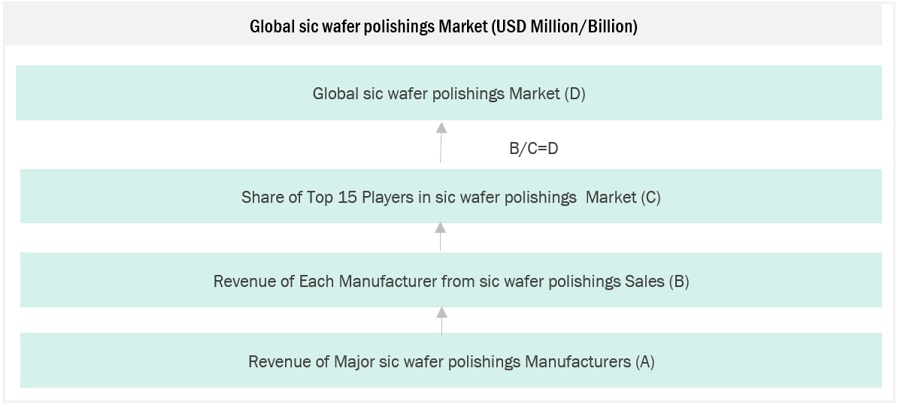

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the Sic wafer polishing market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

SiC Wafer Polishing Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Sic Wafer Polishing Market: Top-Down Approach

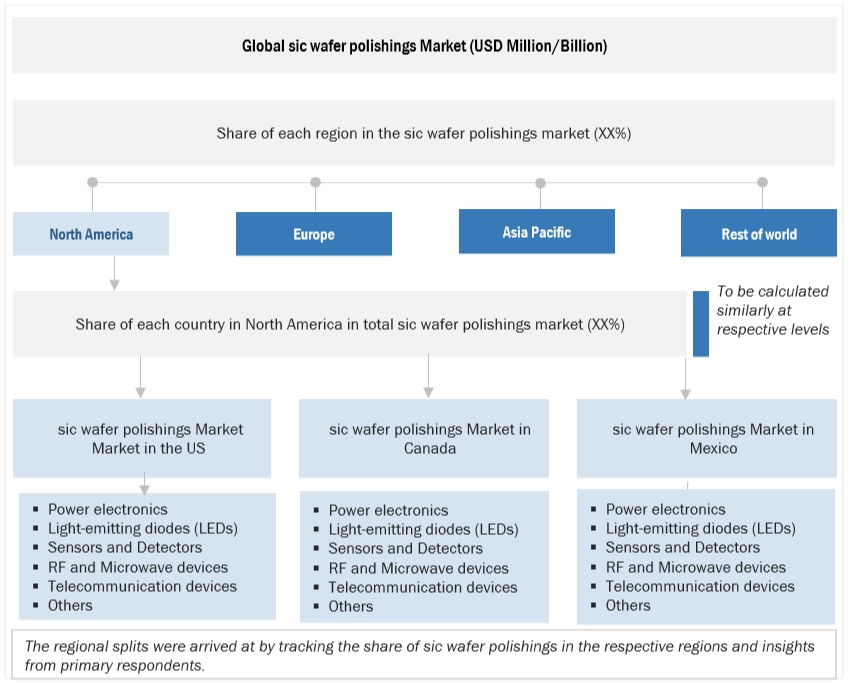

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The SiC wafer polishing market is largely concerned with the production and refining of SiC wafers in order to meet the strict criteria of the semiconductor industry. Wafer polishing is the process of removing surface imperfections, faults, and contaminants from SiC substrates in order to obtain the requisite flatness, smoothness, and thickness uniformity. This procedure is crucial because it has a direct impact on the overall performance and yield of the electrical devices that are manufactured on these wafers because of its strong semiconductor and electronics businesses. It is segmented into product type, process, application, and region.

The SiC wafer market share is rapidly growing as industries shift towards high-efficiency power solutions in electric vehicles and renewable energy. Asia-Pacific leads the SiC wafer market share, driven by the presence of semiconductor giants and robust manufacturing infrastructure. Meanwhile, North America and Europe are emerging as strong contenders due to increasing EV adoption and energy transition initiatives. The global SiC wafer market share is further boosted by advancements in wafer technology and increased production capabilities by key players like Wolfspeed and STMicroelectronics. This growth highlights the critical role of SiC wafers in shaping the future of power electronics.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define and describe the Sic wafer polishing market based on It is segmented into by product type, process, application, in terms of value.

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate the market size in terms of value.

- To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contributions to the overall Sic wafer polishing market.

- To provide post-pandemic estimation for the Sic wafer polishing market and analyze the impact of the pandemic on market growth.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders.

- To forecast the growth of the Sic wafer polishing market with respect to five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries.

- To strategically profile the key players and comprehensively analyze their core competencies2.

- To analyze competitive developments, such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the Sic wafer polishing market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in SiC Wafer Polishing Market