SiC-On-Insulator and Other Substrates Market by Substrate Type (Semi-insulating SiC Substrates, Conductive SiC Substrates), Wafer Size (100mm, 150mm and 200mm), Application (Power Devices, RF Devices) and Region - Global Forecast to 2029

Updated on : September 10, 2025

SiC-On-Insulator and Other Substrates Market Summary

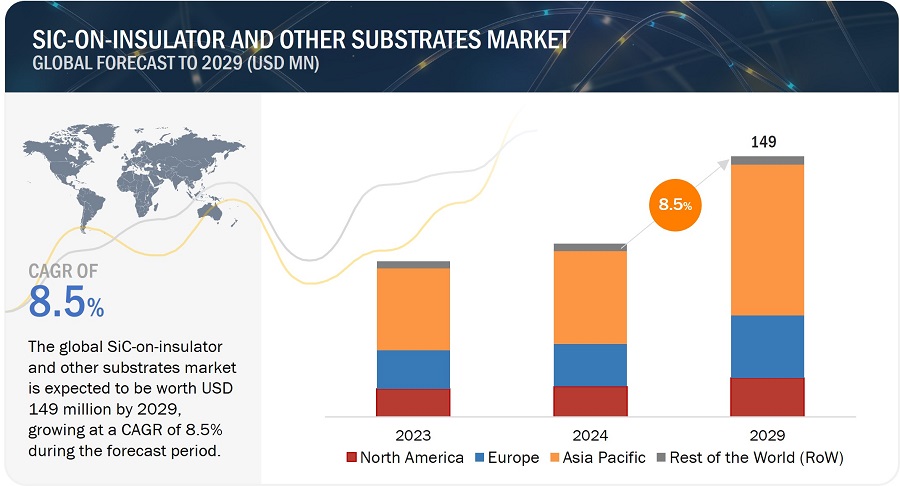

The global SiC-On-Insulator and Other Substrates Market was valued at USD 99 million in 2024 and is projected to grow from USD 109.4 million in 2025 to USD 149 million by 2029, at a CAGR of 8.5% during the forecast period. The market's expansion is primarily driven by the increasing demand for power devices and thermal management solutions. SiC substrates are gaining traction due to their ability to enhance electrical and thermal conductivity, making them essential for various applications, especially in the automotive and telecommunications sectors.

Key Takeaways:

• The global SiC-On-Insulator and Other Substrates Market was valued at USD 99 million in 2024 and is projected to grow from USD 109.4 million in 2025 to USD 149 million by 2029, at a CAGR of 8.5% during the forecast period

• By Application: The power devices segment is anticipated to witness substantial growth due to the increasing use of conductive SiC-on-insulator substrates in electronic devices, which enhances performance efficiency.

• By Technology: Advanced SiC-on-insulator and SiC-based platforms are driving innovation, particularly in photonics, offering potential for large-scale integration in quantum devices and optical systems.

• By End User: The automotive industry is a significant contributor to market growth, driven by the rising adoption of electric vehicles that benefit from SiC substrates' high power densities and fast charging capabilities.

• By Region: ASIA-PACIFIC is expected to grow fastest at a 10.2% CAGR, supported by the region's expanding electronics and automotive sectors.

• Market Dynamics: The mounting demand for sustainable mobility solutions and SiC substrates' role in boosting telecom devices' performance efficiency are key market drivers, despite challenges such as high production costs and complex fabrication processes.

• Opportunities: The photonics industry presents a lucrative opportunity for SiC substrates due to their unique properties, such as low two-photon absorption and optical transparency, which are crucial for advanced photonic applications.

The SiC-On-Insulator and Other Substrates Market is poised for significant growth, driven by technological advancements and increasing applications in power management and sustainable mobility. As industries seek solutions that offer enhanced performance and efficiency, SiC substrates are set to play a pivotal role, particularly in automotive and consumer electronics. Long-term projections indicate robust market expansion, with substantial opportunities in the photonics sector, positioning this market as a key player in the global substrate industry.

The surging demand for power devices and thermal management solutions is a major driver contributing to the market growth of SiC-on-insulator and other substrates. This is attributed towards the growing requirement for electrical and thermal conductivity which can be achieved through the integration of SiC wafers. Additionally, the growing adoption of SiC substrates in electric vehicles is attributed towards the increasing need for high power densities, fast charging, extended driving ranges and reduced overall system-level cost of ownership, thereby contributing towards the market growth of SiC-on-insulator and other substrates globally

SiC-On-Insulator and Other Substrates Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

SiC-On-Insulator and Other Substrates Market Trends:

Driver: Surging demand for power devices and thermal management solutions

The ongoing technological advancements, growing demand for consumer and automotive electronics, surging need for renewable energy expansions and industrial automation drives the demand for power devices and thermal management solutions. The increasing demand for SiC wafers in power devices and thermal management solutions is attributed to the growing requirement for electrical and thermal conductivity, which makes them highly suitable for diverse applications. Therefore, the surging demand for power devices and thermal management solutions is expected to drive the market growth of SiC-on-insulator and other substrates.

Restraint: High costs of SiC Substrates

The high costs associated with SiC substrates hinder the growth of SiC-on-insulator and other substrates market. The costs involved in producing SiC substrates can be a limiting factor for the widespread adoption of SiC-on-insulator technology. The production costs of SiC substrates are influenced by various factors such as prices of raw materials, energy consumption during the production process, and the complex manufacturing methods involved in creating SiC substrates. The initial high costs of SiC substrates can impact the overall cost-effectiveness of SiC-on-insulator solutions which makes them less accessible or economically viable for certain applications, which hinders the market adoption of SiC-on-insulator technology.

Opportunity: The escalating need for SiC-on-substrates based photovoltaic systems

Various SiC polytypes such as 4H-, and 6H- are emerging as attractive photonic materials. Recently, SiC has gained significant attention in the field of photonics due to its unique photonic properties such as low towo-photon absorption and optical transparency, there is a presence of a growing demand for advanced SiC-on-insulator and SiC based platforms to cater to the photonics applications. These advanced platforms have the potential to be used in the manufacturing process of large-scale integration of linear, nonlinear optical systems, quantum devices and integrated quantum photonic circuits. As a result, SiC-on-insulators and other substrates in photonics industry are an emerging market.

Challenge: Process complexities related to SiC-on-insulator and other substrates

Crucial factors such as the fabrication process, material properties, and thermal conductivity in SiC-on-insulators poses challenges in the manufacturing process of SiC-on-insulator devices. Moreover, production of SiC products is expensive which contributes towards the overall expense of manufacturing SiC-on-insulator substrate. Complexities can arise in the fabrication process of manufacturing SiC-on-insulator due to aspects such as ion-cutting, layer transferring, and wafer bonding of crystalline SiC to create an integrated photonic material platform. Moreover, material properties, particularly the requirement for high-quality amorphous silicon carbide deposited at low temperatures for effective hybrid photonic integration, are critical considerations which may impede the market growth of SiC-on-insulator and other substrates.

SiC-On-Insulator and Other Substrates Market Ecosystem

The prominent players in the SiC-on-insulator and other substrates market are Wolfspeed, Inc. (US), SICC Co., Ltd. (China), SOITEC (France), Coherent Corp. (US), GlobalWafers Co., Ltd. (Taiwan). These companies perform organic and inorganic growth strategies to expand themselves globally by providing SiC-on-insulator and other substrates.

SiC-On-Insulator and Other Substrates Market Segmentation

Conductive SiC substrates to register the highest CAGR in the SiC-on-insulator and other substrates market during the forecast period.

The presence of several companies such as Wolfspeed, Inc. (US), Coherent Corp. (US), SOITEC. (France), SICC Co. (China), Ltd., and Xiamen Powerway Advanced Material Co., Ltd. (China) offer conductive SiC substrates that are extensively used in power devices. Additionally, the growing implementation of SiC-on-insulator and other substrates in power electronics is expected to drive the market growth of conductive SiC substrates in the SiC-on-insulator and other substrates market.

Power devices held the largest market size in the SiC-on-insulator and other substrates market during the forecast period.

The unique properties of SiC enable the development of smaller devices that operate at higher voltages, switch faster, and run cooler. Moreover, SiC materials exhibit a significantly higher critical breakdown voltage than Si, which enables the creation of thin drift layers and higher doping concentrations. This results in lower on-resistance for a given die area and voltage rating, contributing to improved efficiency through decreased power loss in power devices. Therefore, power devices are expected to have the largest market size in the SiC-on-insulator and other substrates during the forecast period.

SiC-On-Insulator and Other Substrates Industry Regional Analysis

Asia Pacific held for the largest share of the SiC-on-insulator market in 2023.

Asia Pacific is expected to dominate the SiC-on-insulator and other substrates industry during the forecast period. The presence of established several key players companies such as SICC Co., Ltd. (China), TankeBlue (China) and Ruttonsha International Rectifier (RIR) (India), government-led initiatives for increasing the adoption of electric vehicles are the major factors driving the market growth in Asia Pacific.

SiC-On-Insulator and Other Substrates Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top SiC-On-Insulator and Other Substrates Companies - Key Market Players

The major players in the SiC-on-insulator and other substrates companies include

- Wolfspeed, Inc. (US),

- SICC Co., Ltd. (China),

- SOITEC (France),

- Coherent Corp. (US),

- GlobalWafers Co., Ltd. (Taiwan)

These companies have used both organic and inorganic growth strategies such as product launches, partnerships, agreements, collaborations, contracts, acquisitions, cooperations, and expansions to strengthen their position in the market.

SiC-On-Insulator and Other Substrates Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 99 million in 2024 |

|

Expected Market Size |

USD 149 million by 2029 |

|

Growth Rate |

CAGR of 8.5% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Substrate Type, Application and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

The major players in the SiC-on-insulator and other substrates market are Wolfspeed, Inc. (US), SICC Co., Ltd. (China), SOITEC (France), Coherent Corp. (US), GlobalWafers Co., Ltd. (Taiwan), Ceramicforum Co., Ltd. (Tokyo), Xiamen Powerway Advanced Material Co., Ltd. (China), Homray Material Technology (China), Shanghai Zhongyingrong innovative Material Technology Co., Ltd (China), Precision Micro-optics Inc. (US), Tankeblue Semiconductor Co., Ltd. (China), and Hebei Synlight Crystal Co., Ltd. (China). |

SiC-On-Insulator and Other Substrates Market Highlights

The study segments the SiC-on-insulator and other substrates market based on substrate type, application and region at the regional and global level.

|

Segment |

Subsegment |

|

By Substrate Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in SiC-On-Insulator and Other Substrates Industry

- In May 2023, Wolfspeed, Inc. announced the establishment of a joint European R&D center with ZF Friedrichshafen AG, a global technology company that supplies systems for passenger cars, commercial vehicles, and industrial technology. This joint R&D center will provide SiC power electronics in the Nuremberg Metropolitan region. This joint European R&D center will focus on breakthrough innovations for SiC systems, products, and applications.

- In May 2023, SICC Co., Ltd. announced its agreement with Infineon Technologies AG, a semiconductor manufacturing company, to diversify the SiC material supplier base and have a competitive advantage over SiC sources. In this agreement, the company will supply its high-quality 150 mm wafers and boules to Infineon Technologies AG to manufacture SiC substrates.

- In December 2022, SOITEC and STMicroelectronics, a semiconductor contract manufacturing and design company, announced their cooperation in which STMicroelectronics’ client, Tesla Inc., will use SOITEC’s SiC substrate technology in the form of a bigger 200-mm wafer, which is underdevelopment.

- In October 2023, Coherent Corp. announced that DENSO CORPORATION, an automotive component manufacturing company, and Mitsubishi Electric Corporation, an electronics and electrical equipment manufacturing company, planned to invest about USD 1 billion in its silicon carbide business. Additionally, the company planned to enter a long-term supply agreement with these two companies to address 150 mm and 200 mm substrate and epitaxial wafer demand.

- In June 2020, GlobalWafers announced its collaboration with National Chiao Tung University (NCTU) to establish a compound semiconductor research center including 6″–8″ SiC and GaN technology to support crystal development for high-performance device applications on SiC and GaN materials.

Frequently Asked Questions (FAQs):

What is the current size of the global SiC-on-insulator and other substrates market?

The SiC-on-insulator and other substrates market is estimated to be worth USD 99 million in 2024 and is projected to reach USD 149 million by 2029, at a CAGR of 8.5% during the forecast period. The surging demand for power devices and thermal management solutions and growing adoption of electric vehicles are some of the major factors driving the market growth of SiC-on-insulator and other substrates globally.

Who are the winners in the global SiC-on-insulator and other substrates market?

Companies such as Wolfspeed, Inc. (US), SICC Co., Ltd. (China), SOITEC (France), Coherent Corp. (US), GlobalWafers Co., Ltd. (Taiwan) fall under the winners category.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the SiC-on-insulator and other substrates market during forecast period. The presence of established key players such as SICC Co., Ltd. (China), TankeBlue (China) and Ruttonsha International Rectifier (RIR) (India), government-led initiatives for increasing the adoption of electric vehicles are the major factors driving the market growth in Asia Pacific.

What are the major drivers and opportunities related to the SiC-on-insulator and other substrates market?

The surging demand for power devices and thermal management solutions and the growing adoption of electric vehicles are some of the major drivers and opportunities for the SiC-on-insulator and other substrates market.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, agreements, collaborations, contracts, acquisitions, cooperations, and expansions to strengthen their market position for the SiC-on-insulator and other substrates.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Mounting demand for power and thermal management devices- Increasing use of SiC substrates to boost performance efficiency of telecom devices- Rising preference for sustainable mobility solutionsRESTRAINTS- High production costsOPPORTUNITIES- Demand for SiC substrates in photonics industry- Increasing R&D of SiC-on-insulator substrates for biomedical devicesCHALLENGES- Complex fabrication process and inadequate thermal conductivity

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM/MARKET MAP

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.6 TECHNOLOGY ANALYSISADVANCED SIC-ON-INSULATOR AND SIC-BASED PLATFORMSAMORPHOUS SIC SUBSTRATES

-

5.7 PATENT ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 STANDARDS AND REGULATORY LANDSCAPESTANDARDSREGULATIONS- Asia Pacific- North America- Europe

- 5.10 KEY CONFERENCES AND EVENTS, 2024–2025

- 6.1 INTRODUCTION

- 6.2 SI

- 6.3 SIO2

- 6.4 OTHER MATERIALS

- 7.1 INTRODUCTION

- 7.2 100 MM

- 7.3 150 MM

- 7.4 200 MM

- 8.1 INTRODUCTION

-

8.2 SEMI-INSULATING SIC SUBSTRATESGROWING ADOPTION OF HIGH-PURITY SEMI-INSULATING SIC SUBSTRATES IN RF DEVICES TO DRIVE MARKET

-

8.3 CONDUCTIVE SIC SUBSTRATESINCREASING DEVELOPMENT OF SIC POWER ELECTRONICS TO FUEL SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 POWER DEVICESUSE OF CONDUCTIVE SIC-ON-INSULATOR SUBSTRATES IN ELECTRONIC DEVICES TO FOSTER SEGMENTAL GROWTH

-

9.3 RF DEVICESWIDE BANDGAP AND LOW LEAKAGE CURRENT TO AUGMENT DEMAND

- 9.4 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUSCANADAMEXICO

-

10.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEGERMANYUKFRANCEREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINAJAPANINDIASOUTH KOREAREST OF ASIA PACIFIC

-

10.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- GCC- Rest of Middle East & AfricaSOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023ORGANIC/INORGANIC GROWTH STRATEGIES- Product portfolio expansion- Geographic footprint expansion- Manufacturing footprint expansion

- 11.3 MARKET SHARE ANALYSIS, 2023

-

11.4 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.5 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSWOLFSPEED, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSICC CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOITEC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOHERENT CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGLOBALWAFERS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewXIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewCERAMICFORUM CO., LTD.- Business overview- Products/Solutions/Services offeredHOMRAY MATERIAL TECHNOLOGY- Business overview- Products/Solutions/Services offered- Recent developmentsSHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD- Business overview- Products/Solutions/Services offeredPRECISION MICRO-OPTICS INC.- Business overview- Products/Solutions/Services offeredSICRYSTAL GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsSYNLIGHT- Business overview- Products/Solutions/Services offeredTANKEBLUE CO,. LTD.- Business overview- Products/Solutions/Services offered- Recent developments

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET GROWTH ASSUMPTIONS

- TABLE 2 MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 MARKET: RISK ASSESSMENT

- TABLE 4 COMPANIES AND THEIR ROLES IN SIC-ON-INSULATOR AND OTHER SUBSTRATES ECOSYSTEM

- TABLE 5 MARKET: PATENTS FILED BETWEEN JANUARY AND DECEMBER, 2023

- TABLE 6 MARKET: TOP 20 PATENT OWNERS,2013–2023

- TABLE 7 KEY PATENTS RELATED TO SIC-ON-INSULATOR AND OTHER SUBSTRATES

- TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 10 MARKET, BY SUBSTRATE TYPE,2020–2023 (USD MILLION)

- TABLE 11 MARKET, BY SUBSTRATE TYPE,2024–2029 (USD MILLION)

- TABLE 12 MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 13 MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 14 MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 15 MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 16 MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2023

- TABLE 17 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: DEGREE OF COMPETITION

- TABLE 18 COMPANY OVERALL FOOTPRINT (12 KEY COMPANIES)

- TABLE 19 COMPANY SUBSTRATE TYPE FOOTPRINT (12 KEY COMPANIES)

- TABLE 20 COMPANY APPLICATION FOOTPRINT (12 KEY COMPANIES)

- TABLE 21 COMPANY REGION FOOTPRINT (12 KEY COMPANIES)

- TABLE 22 MARKET: PRODUCT LAUNCHES,2019–2023

- TABLE 23 MARKET: DEALS, 2020–2023

- TABLE 24 MARKET: OTHERS, 2021–2023

- TABLE 25 WOLFSPEED, INC.: COMPANY OVERVIEW

- TABLE 26 WOLFSPEED, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 27 WOLFSPEED, INC.: DEALS

- TABLE 28 WOLFSPEED, INC.: OTHERS

- TABLE 29 SICC CO., LTD.: COMPANY OVERVIEW

- TABLE 30 SICC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 31 SICC CO., LTD.: DEALS

- TABLE 32 SICC CO., LTD.: OTHERS

- TABLE 33 SOITEC: COMPANY OVERVIEW

- TABLE 34 SOITEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 35 SOITEC: PRODUCT LAUNCHES

- TABLE 36 SOITEC: DEALS

- TABLE 37 SOITEC: OTHERS

- TABLE 38 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 39 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 40 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 41 COHERENT CORP.: DEALS

- TABLE 42 COHERENT CORP.: OTHERS

- TABLE 43 GLOBALWAFERS: COMPANY OVERVIEW

- TABLE 44 GLOBALWAFERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 45 GLOBALWAFERS: DEALS

- TABLE 46 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 47 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 48 XIAMEN POWERWAY ADVANCED MATERIAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 49 CERAMICFORUM CO., LTD.: COMPANY OVERVIEW

- TABLE 50 CERAMICFORUM CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 51 HOMRAY MATERIAL TECHNOLOGY: COMPANY OVERVIEW

- TABLE 52 HOMRAY MATERIAL TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 53 HOMRAY MATERIAL TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 54 SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 55 SHANGHAI ZHONGYINGRONG INNOVATIVE MATERIAL TECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 56 PRECISION MICRO-OPTICS INC.: COMPANY OVERVIEW

- TABLE 57 PRECISION MICRO-OPTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 58 SICRYSTAL GMBH: COMPANY OVERVIEW

- TABLE 59 SICRYSTAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 60 SICRYSTAL GMBH: DEALS

- TABLE 61 SYNLIGHT: COMPANY OVERVIEW

- TABLE 62 SYNLIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 63 TANKEBLUE CO,. LTD.: COMPANY OVERVIEW

- TABLE 64 TANKEBLUE CO,. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 65 TANKEBLUE CO,. LTD.: DEALS

- FIGURE 1 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS(APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS(APPROACH 2)

- FIGURE 7 MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET SIZE, 2020–2029

- FIGURE 9 CONDUCTIVE SIC SUBSTRATES TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 POWER DEVICES APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2023

- FIGURE 12 BURGEONING DEMAND FOR ELECTRIC VEHICLES TO FOSTER MARKET GROWTH

- FIGURE 13 POWER DEVICES APPLICATION TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2029

- FIGURE 14 CONDUCTIVE SIC SUBSTRATES TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 15 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 SALES OF ELECTRIC VEHICLES IN US, 2019–2021

- FIGURE 17 MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 MARKET: RESTRAINTSAND THEIR IMPACT

- FIGURE 19 MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 SIC-ON-INSULATOR AND OTHER SUBSTRATES ECOSYSTEM

- FIGURE 23 SIC-ON-INSULATOR AND OTHER SUBSTRATES MARKET: NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 24 MARKET: TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 25 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 MARKET: IMPACT OF PORTER’S FIVE FORCES

- FIGURE 27 CONDUCTIVE SIC SUBSTRATES TO ACCOUNT FOR LARGER MARKET SHAREIN 2029

- FIGURE 28 POWER DEVICES APPLICATION TO EXHIBIT HIGHEST CAGR DURINGFORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 30 MARKET: ORGANIC AND INORGANIC STRATEGIES ADOPTED BY PLAYERS, 2019–2023

- FIGURE 31 MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 32 WOLFSPEED, INC.: COMPANY SNAPSHOT

- FIGURE 33 SOITEC: COMPANY SNAPSHOT

- FIGURE 34 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 35 GLOBALWAFERS: COMPANY SNAPSHOT

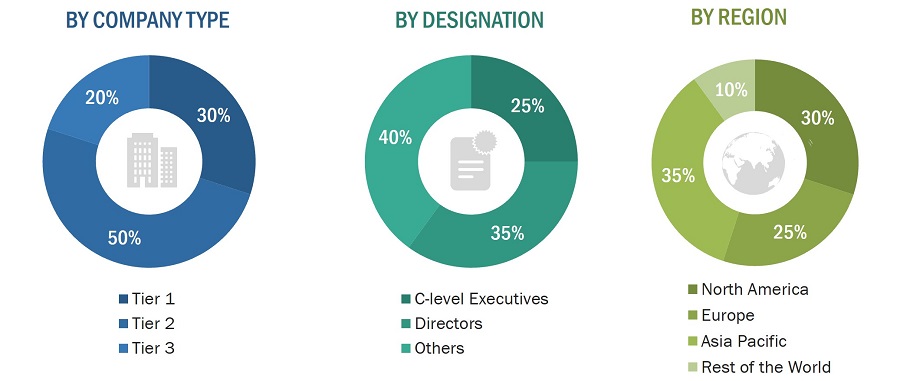

The research study involved four major activities in estimating the size of the SiC-on-insulator and other substrates market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the SiC-on-insulator and other substrates market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the SiC-on-insulator and other substrates market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying different stakeholders in the SiC-on-insulator and other substrates market that influence the entire market, along with participants across the value chain.

- Analyzing major manufacturers of SiC-on-insulator and other substrates and studying their product portfolios

- Analyzing trends related to the adoption of SiC-on-insulator and other substrates.

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, collaborations, acquisitions, agreements, contracts, cooperations and partnerships as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of SiC-on-insulator and other substrates.

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall SiC-on-insulator and other substrates market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

SiC-on-insulator refers to a semiconductor technology where a layer of SiC is grown or deposited on an insulating substrate, typically made of materials like Si, SiO2 and others that include glass, sapphire and quartz. This structure is designed to combine the unique properties of SiC, such as high thermal conductivity and wide bandgap, with the benefits of an insulating or a conductive layer. These layers can help reduce parasitic capacitance, enhance device isolation, increase electrical conductivity and improve overall performance, making them suitable for various electronic and semiconductor applications, including power devices, RF devices and others that include laser diodes, LEDs, amplifiers and transistors.

Stakeholders

- Raw material suppliers

- Design tool and fabrication equipment vendors

- SiC Wafer manufacturers

- Wafer equipment manufacturers

- Integrated device manufacturers (IDMs)

- Pure-play foundry vendors

- Non-pure-play (IDM) foundry vendors

- Electronic design automation (EDA) vendors

- Fabrication players

- Semiconductor intellectual property vendors

- Original devices manufacturers (ODMs) (discrete and chip manufacturers)

- Original equipment manufacturers (OEMs) (electronic equipment manufacturers)

- Assembly, testing, and packaging vendors

- Distributors and Resellers

- End Users

The main objectives of this study are as follows:

- To define, analyze and forecast the SiC-on-insulator and other substrates market size, by substrate type, application, and region, in terms of value.

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the SiC-on-insulator and other substrates market

- To study the complete supply chain and related industry segments for the SiC-on-insulator and other substrates market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the supply chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; Porter’s five forces model; trade analysis; patent analysis; key conferences & events, 2024–2025; and regulations related to the SiC-on-insulator and other substrates market.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders.

- To analyze competitive developments such as product launches, partnerships, agreements, collaborations, contracts, acquisitions, cooperations and expansions and research and development (R&D) activities carried out by players in the SiC-on-insulator and other substrates market.

Customizations Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in SiC-On-Insulator and Other Substrates Market