Shrink Plastic Film Market for Beverage Multipacks by Type (Printed, Unprinted), Application (Alcoholic beverages, Water, carbonated soft drinks), Container Type (Can, Bottle, Brick), Multipack Size (3x2, 4x2, 4x3, 6x3) & Region - Global Forecast to 2025

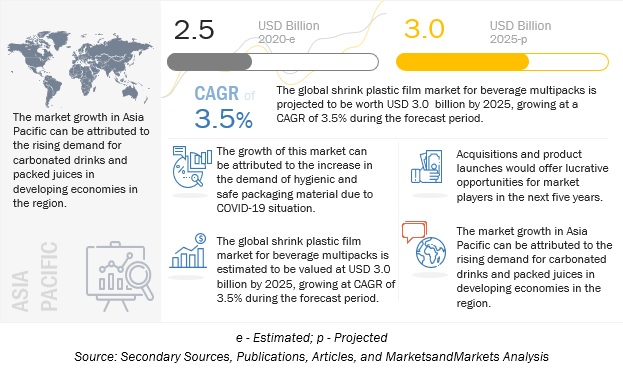

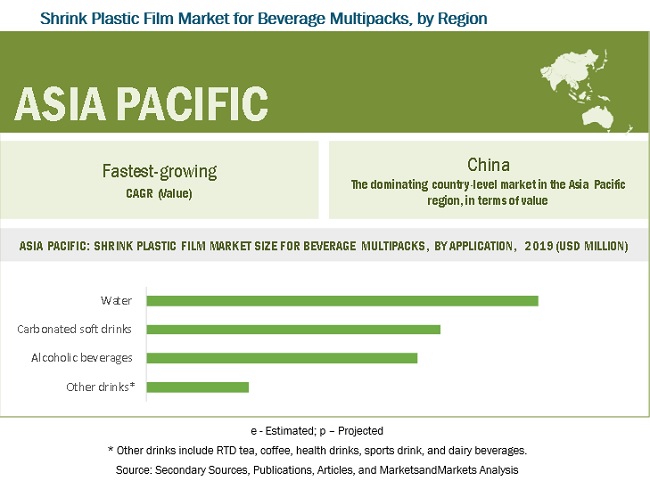

The global shrink plastic film market as per revenue was estimated to be worth $2.5 billion in 2020 and is poised to reach $3.0 billion by 2025, growing at a CAGR of 3.5% from 2020 to 2025. The new research study includes an analysis of industry trends in the market, as well as pricing and patent analyses, conference and webinar materials, key stakeholders, and buying behavior. The growing demand for processed and packaged beverage products among consumers is expected to drive the market. The European segment is poised to dominate the shrink plastic film market due to its high population demanding packaged water, whereas the Asia Pacific region is projected to be the fastest-growing, owing to the larger demand of both packaged drinking water and carbonated beverages, among its millennial population.

To know about the assumptions considered for the study, Request for Free Sample Report

Shrink Plastic Film Market Dynamics

Drivers: Increasing Alcohol Consumption

The most prevalent tendency, worldwide, is an increase in recorded per capita consumption of alcohol. This trend is mainly driven by the rise in alcohol consumption in China and India, which could potentially be linked to active marketing by the alcohol industry and increased income in these countries. This trend has a positive effect on the shrink plastic film market for beverage multipacks as well. Growing demand is creating a marketplace for multipacks.

The significant rise in the global population and increasing disposable income are the major factors influencing the consumption of beer and other alcoholic beverages. Another driving factor is the high commercialization and strengthened distribution channels adopted by alcoholic beverage manufacturers as well as the purchase channels adopted, such as online stores. In addition, the increasing per capita income, accompanied by the increasing disposable income of the youth, has boosted the consumption of alcoholic beverages.

Restraints: Non-availability of raw materials due to COVID-19

Increasing demand for shrink plastic film is fueling the demand for virgin plastics with demand outpacing supply. Supply has been limited due to the stalling of production of plastic producing factories in China, the US, and Germany. Also, the price war between Russia and Saudi Arabia is creating supply chain bottlenecks. China plays a vital role in the US plastic industry supply chain. With factory closures in China, the cargo volume has fallen by 23% in February, significantly impairing the packaging industry in the wake. Supply chain pressure is also being created on packaging inks and coatings, with global unavailability of raw materials and a rapid increase in price.

Opportunities: Increasing Consumption of Packaged Beverages

Changing consumption patterns of consumers with an increase in demand for ready-to-drink beverages is the key opportunity in shrink plastic film market. Consumers prefer the use of packaged beverages as it is healthy, safe, convenient, refreshing, and is easy to carry. They are showing interest in other packaging materials over the traditional glass bottle packaging in cartons. They want a lightweight, easy to carry beverage multipacks for long term use. Moreover, consumers are seeking an environment-friendly packaging solution with increasing awareness. Shrink film packaging provides a packaging solution that has all the required features according to the client's demands. Thus, the consumption of beverages increases the opportunities for the market for beverage multipacks as the customers buy more multipacks of beverages.

Challenges: High Cost of Packaging Testing

According to the European regulation (EC) 1935/2004, packaging companies will have to ensure the use of good quality packaging materials as they directly come in contact with products such as food, drugs, or personal care products that impact consumer health directly. Therefore, the packaging manufacturer must carry out an extensive toxicological analysis test. The costs incurred for the test is very high. The cost for testing of plastics and other material increases with the increase in migration.

Automated instruments provide reliable and faster test results. However, due to the high cost of instruments, the testing cost also increases. End-user industries have become reluctant to conduct tests on the packaging due to the high costs associated with testing, thereby failing to comply with required regulatory standards. The high costs for testing lead to an increase in the cost of shrink plastic film, owing to which it is difficult for manufacturers to sustain in the competitive market. High-end technologies such as HPLC, gas chromatography, atomic absorption spectroscopy, and FTIR, which tests shrink plastic film effectively, are expensive.

By container type, the bottle segment is projected to account for the largest share in the shrink plastic film market for beverage multipacks during the forecast period

PET bottles or glass bottles are packed in shrink wraps due to its ability to provide safety to fragile products. Pallets of glass and polyethylene terephthalate (PET) bottles tend to be heavy and unstable. The shrink wraps are therefore preferred by the manufacturers of beverages to protect the products during transportation and while at the shelf.

Shrink wraps hold the shape very well for the bottles, so the products seem appealing, which is a very important criteria for consumer products. It also helps to detect tempering issues as well. Since the processing and manufacturing of packaged water are on the rise, the demand for secondary packaging for the bottles is also high. Both developing and developed economy markets are having a high demand for packaged water, as it is one of the necessities. Thereby, it is increasing the demand for shrink wraps to secure the bottles.

By application, water is projected to account for the largest share in the shrink plastic film market for beverage multipacks during the forecast period

The increase in the demand for packaged water has driven the market for shrink wraps for water bottles. It is being demanded at various places such as shopping malls, offices, restaurants, and houses. Therefore, the consumption is a major factor for the high demand of shrink wraps for water bottle packaging.

The water bottles are in high demand at both the developed as well as developing economies. The shrink wraps are one of the easier and cost-effective methods of packaging for the water bottles. The bottles are stacked up by the industrial shrink wrap machines which apply heat directly from the assembly line conveyors. Many times, handheld heat applicators called “heat guns” are also used to seal and tighten small stacks, as per requirements. The convenient equipment and less cost are attracting water bottle manufacturers and suppliers to use shrink film for secondary packaging; hence it is dominating the shrink plastic film market.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific is projected to account for the fastest-growing market during the forecast period

Due to the high population in the region and the increase in the purchasing capacity, consumers are looking for various comfort food and on the go options for beverages. The shift in the consumption habits of the population due to an increase in the stress and low availability of time to cook the customer is looking for more packaged options. This has created the demand for packaged juices, drinks, and water as well. The millennial population is increasing the demand for carbonated beverages and alcoholic beverages, which is again a driving factor for the shrink plastic film market for beverage multipacks.

Key Market Players:

Amcor Plc (Switzerland), Coveris Holdings Sa (Austria), Ceisa Semo (France), Clondalkin Group (The Netherlands), RKW Group (Germany), Berry Global Inc (US), Plastotecnica SpA (Italy), Clearpack group (Singapore), Sarkina (US), Baroda Packaging (India), Brentwood Plastic, Inc (US), Aintree Plastics Limited (UK), Elite Plastics Ltd. (UK), Xinjiang Rival Tech Co. Ltd (China), Poly-Pack Verpackungs-GmbH & Co. KG (Germany), Huan Yuan Plastic Film Co. Ltd (China), Jiangyin Bairuijia Plastics Science & Technology Co., Ltd. (China), Allied Propack Pvt. Ltd (India), Don Polymer (Russia), and Sandeep Polymers (India).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD) |

|

Segments covered |

|

|

Regions covered |

|

|

Companies studied |

|

Target Audience:

- Shrink plastic film manufacturing companies and government organizations

- Service providing company officials

- Government and research organizations

- Beverage manufacturing companies

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the shrink plastic film market

- Manufacturing and marketing companies

Report Scope

- This research report categorizes the shrink plastic film market for beverage multipacks based on type, multipack size, application, application packaging, and region.

By Application

- Alcoholic beverages

- Water

- Carbonated Soft drinks

- Other drinks

- Carbonated soft drinks

- Other drinks*

*Other drinks include RTD tea, coffee, health drinks, sports drink, and dairy beverages.

By Type

- Unprinted

- Printed

By Multipack

- 3X2

- 4X2

- 4X3

- 6X3

- Other multipack sizes*

*Other Multipack sizes include 6X2, 5X2, 2X2, and 5X3.

By Application Packaging

- Can

- Bottle

- Brick

By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- South Africa

- Middle East

- Others in Africa

Recent Developments

- February 2020, Coveris Holdings SA(Austria) expands its capacities and further invests in its Kufstein plant. It is planning to expand and upgrade the technical capabilities in Kufstein, Austria, through investment in a 5-layer specialist agri-extrusion line.

- June 2019, Amcor Plc (Switzerland) acquired Bemis Company Inc. (US) to strengthen its hold over the US market.

- July 2019, Coveris Holdings SA (Austria) confirms that it has acquired 100% of the shares of Amberley Adhesive Labels Ltd, a company based in Dorset, UK. The deal was closed on 31st July at an undisclosed amount

Frequently Asked Questions (FAQ):

Where is the iced tea and coffee segment included in the report?

Iced tea and coffee segments are considered under other beverage segment of the applications along with RTD tea.

Does the scope include the food multipacks market?

The scope of this report is confined to the beverages only. We can provide a separate analysis of the food multipacks market for shrink plastic film.

How the market can be quantified at each stage in the supply chain?

We have provided the quantification in terms of value chain analysis and supply chain analysis at regional and global levels.

What are the key multipack sizes for the beverages that are gaining traction in the market?

In this report, detailed quantitative analysis at the regional and country-level is provided for beverage multipack sizes. We have given the market size and forecast for all segments where you can find the insights for the largest and fastest-growing market.

How many companies are covered in the report for the demand side and supply side of the market?

We have provided detailed company profiles of 20 supply-side players which include 10 start-ups and SMEs. In addition to this, we have provided an overall industry matrix for 25 supply-side players and a start-up matrix for 15 supply-side market players. We can provide the demand side analysis as a part of customization.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 SHRINK FILM FOR BEVERAGE MULTIPACKS MARKET SEGMENTATION

1.3.1 OUT OF SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2019

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 SHRINK FILM FOR BEVERAGE MULTIPACKS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data From Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data From Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 INTRODUCTION TO COVID-19

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 6 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 9 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET SNAPSHOT, BY APPLICATION, 2020 VS. 2025

FIGURE 10 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET SIZE, BY CONTAINER TYPE, 2020 VS. 2025 (USD BILLION)

FIGURE 11 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET SIZE, BY MULTIPACK SIZE, 2020 VS. 2025 (USD BILLION)

FIGURE 12 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD BILLION)

FIGURE 13 EUROPE TO GROW AT THE HIGHEST CAGR IN THE SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET, 2020 VS.2025

FIGURE 14 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SHRINK FILM FOR BEVERAGE MULTIPACK MARKET

FIGURE 15 GROWING DEMAND FOR CLEAN SHRINK FILMS DUE TO PACKAGING ADVANTAGES DRIVES THE GROWTH OF THE SHRINK FILM FOR BEVERAGE MULTIPACK MARKET

4.2 SHRINK FILM FOR BEVERAGE MULTIPACK MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 ASIA PACIFIC WAS THE FASTEST-GROWING MARKET FOR SHRINK FILMS IN 2019

4.3 SHRINK FILM FOR BEVERAGE MULTIPACK MARKET, BY APPLICATION

FIGURE 17 WATER SEGMENT OF SHRINK FILM FOR BEVERAGE MULTIPACK PROJECTED TO DOMINATE THE MARKET THROUGH 2025

4.4 SHRINK FILM FOR BEVERAGE MULTIPACK MARKET, BY TYPE

FIGURE 18 UNPRINTED SEGMENT PROJECTED TO DOMINATE DURING THE FORECAST PERIOD

4.5 SHRINK FILM FOR BEVERAGE MULTIPACK MARKET, BY MULTIPACK SIZE

FIGURE 19 4X2 SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD (USD MILLION)

4.6 SHRINK FILM FOR BEVERAGE MULTIPACKS MARKET, BY CONTAINER TYPE

FIGURE 20 BOTTLE SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.7 SHRINK FILM FOR BEVERAGE MULTIPACKS MARKET, BY REGION

FIGURE 21 EUROPEAN REGION PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

TABLE 2 SHRINK FILM PROPERTIES

5.2 MARKET DYNAMICS

FIGURE 22 MARKET DYNAMICS: SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET

5.2.1 DRIVERS

5.2.1.1 Shipping Friendly

5.2.1.2 Increasing Alcohol Consumption

FIGURE 23 SHIFT IN BREWERY MARKET SHARE IN THE US, 2009 VS. 2019 (BY VALUE)

5.2.1.2.1 Rise in disposable income

FIGURE 24 WORLD GDP GROWTH, 2011–2018 (%)

FIGURE 25 US DISPOSABLE PERSONAL INCOME, 2017–2018 (USD BILLION)

5.2.1.3 Strong Sealing Capability

5.2.1.4 Less Wasteful

5.2.1.5 Printability

5.2.1.6 Appealing to Customers

5.2.2 RESTRAINTS

5.2.2.1 Competition for Raw Materials

5.2.2.1.1 Non-availability of raw materials due to COVID-19

5.2.2.2 Continuous Change in Demands of Customer

5.2.2.2.1 Demand for sustainable and recyclable packaging

FIGURE 26 PACKAGING WASTE IN EUROPE: GENERATED VS. RECYCLED VS. RECOVERED, 2014-2017 (MILLION TONNES)

5.2.2.3 Reduced Beverage Production in Q2 of 2020 due to COVID-19 Outbreak

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing Consumption of Packaged Beverages

TABLE 3 LEADING SOFT DRINK BRANDS AND CHANGE IN MARKET SHARES FROM 2012 TO 2017 (BY VOLUME)

5.2.3.2 Emerging Markets

FIGURE 27 ANNUAL GDP GROWTH IN EMERGING ECONOMIES, 2011-2018 (%)

FIGURE 28 INVESTMENT OPPORTUNITIES IN INDIA, 2019

5.2.3.2.1 Growth in demand for carbonated soft drinks in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Stringent Regulations

5.2.4.1.1 High cost of packaging testing

5.2.4.2 Regular Developments and New Product Launches in the Packaging Industry

5.3 BEVERAGE INDUSTRY

TABLE 4 TOP 20 BEVERAGE COMPANIES IN THE WORLD BASED ON REVENUE, 2018

5.3.1 ALCOHOL INDUSTRY

5.3.1.1 Brewing Industry

FIGURE 29 GLOBAL BEER PRODUCTION FOR TOP 10 COUNTRIES, 2017 (KILO LITERS)

5.3.2 SOFT DRINK INDUSTRY

FIGURE 30 SOFT DRINK SALES IN EUROPE, 2011–2016 (MILLION LITERS)

FIGURE 31 TOTAL SOFT DRINK CONSUMPTION, UK, 2018

5.3.2.1 Fortified Beverages: Water-soluble Vitamins

5.3.3 DAIRY INDUSTRY

5.3.3.1 Dairy Fortification: A Major Trend

6 INDUSTRY TRENDS (Page No. - 69)

6.1 INTRODUCTION

6.2 YC-YCC SHIFT

FIGURE 32 SHRINK FILM MARKET: YC-YCC SHIFT

6.3 ECOSYSTEM MAP: F&B LOGISTICS, COLD CHAIN, AND PACKAGING

6.3.1 ECOSYSTEM VIEW

6.3.2 MARKET MAP

6.4 PATENT ANALYSIS

TABLE 5 KEY PATENTS GRANTED WITH RESPECT TO SHRINK FILMS, 2018–2020

6.5 CASE STUDIES

6.5.1 CASE STUDY 1

6.5.1.1 Title

6.5.1.2 Problem Statement

6.5.1.3 MnM Approach

6.5.1.4 Revenue Impact (RI)

6.5.2 CASE STUDY 2

6.5.2.1 Title

6.5.2.2 Problem Statement

6.5.2.3 MnM Approach

6.5.2.4 Revenue Impact (RI)

6.5.3 CASE STUDY 3

6.5.3.1 Title

6.5.3.2 Problem Statement

6.5.3.3 MnM Approach

6.5.3.4 Revenue Impact (RI)

6.6 COVID-19 DRIVERS

6.7 VALUE CHAIN ANALYSIS

FIGURE 33 SHRINK FILM MARKET: VALUE CHAIN ANALYSIS

6.8 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

6.8.1 THREAT OF NEW ENTRANTS

6.8.1.1 High Capex

6.8.1.2 Dominated by Large-scale established players

6.8.2 THREAT OF SUBSTITUTES

6.8.2.1 Government policies and environmental concerns

6.8.3 BARGAINING POWER OF SUPPLIERS

6.8.3.1 Limited availability of raw materials and fluctuating price of raw materials

6.8.4 BARGAINING POWER OF BUYERS

6.8.4.1 Low product differentiation

6.8.4.2 High-volume buyers hold a high degree of bargaining power

6.8.5 INTENSITY OF COMPETITIVE RIVALRY

6.8.5.1 Many big players

6.8.5.2 High exit barrier

6.9 STRATEGIC BENCHMARKING

FIGURE 35 KEY STRATEGIES ADOPTED BY FOOD & BEVERAGE COMPANIES TO SUSTAIN IN COMPETITIVE MARKET, BY REGION, 2018-2020

6.1 AVERAGE SELLING PRICE (ASP) TREND

FIGURE 36 SHRINK FILM FOR BEVERAGE MULTIPACKS: GLOBAL AVERAGE SELLING PRICE (ASP) TREND, 2018-2025

7 SHRINK PLASTIC FILM MARKET, BY TYPE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 37 SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 38 SHRINK PLASTIC FILM MARKET SIZE FOR BEVERAGE MULTIPACKS, BY TYPE, 2020 VS. 2025 (KT)

TABLE 6 SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 7 SHRINK PLASTIC FILM MARKET SIZE FOR BEVERAGE MULTIPACKS, BY TYPE, 2018–2025 (KT)

7.2 COVID-19 IMPACT ON THE MARKET, BY TYPE, 2018-2021 (USD MILLION)

7.2.1 OPTIMISTIC SCENARIO

TABLE 8 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2.2 PESSIMISTIC SCENARIO

TABLE 9 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.3 UNPRINTED

7.3.1 COST-EFFECTIVENESS OF SHRINK FILMS MAKES IT A POPULAR CHOICE AMONG MANUFACTURERS

FIGURE 39 UNPRINTED: SHRINK PLASTIC FILM MARKET SIZE FOR BEVERAGE MULTIPACKS, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 10 UNPRINTED: SHRINK PLASTIC FILMS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 UNPRINTED: MARKET FOR SHRINK PLASTIC FILM SIZE, BY REGION, 2018–2025 (KT)

7.4 PRINTED

7.4.1 BETTER SAFETY FOR FRAGILE PRODUCTS THROUGH SHRINK WRAPS FUELS THE MARKET

TABLE 12 PRINTED: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 PRINTED: MARKET FOR SHRINK PLASTIC FILM SIZE, BY REGION, 2018–2025 (KT)

8 SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET, BY APPLICATION (Page No. - 88)

8.1 INTRODUCTION

FIGURE 40 SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 41 SHRINK PLASTIC FILMS FOR BEVERAGE MULTIPACKS MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (KT)

TABLE 14 SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 15 SHRINK PLASTIC FILM FOR BEVERAGE MULTIPACKS MARKET, BY APPLICATION, 2018–2025 (KT)

8.2 COVID-19 IMPACT ON THE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

8.2.1 OPTIMISTIC SCENARIO

TABLE 16 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.2.2 PESSIMISTIC SCENARIO

TABLE 17 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.3 ALCOHOLIC BEVERAGES

8.3.1 DUE TO CONVENIENT PACKAGING OPTION IN OPEN TRAY FOR ALCOHOLIC BEVERAGES, SHRINK WRAPS ARE GAINING MARKET SHARE

TABLE 18 ALCOHOLIC BEVERAGES: MARKET FOR SHRINK PLASTIC FILM SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 ALCOHOLIC BEVERAGES: SHRINK PLASTIC FILMS MARKET SIZE, BY REGION, 2018–2025 (KT)

8.4 WATER

8.4.1 SAFETY AND TAMPER PROOFING ARE SOME OF THE MAJOR FACTORS FOR WATER MANUFACTURERS TO USE SHRINK WRAPS

TABLE 20 WATER: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 WATER: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (KT)

8.5 CARBONATED SOFT DRINKS

8.5.1 SHRINK WRAPS SERVE AS MAJOR COST-EFFECTIVE MARKETING TOOL FOR SOFT DRINKS MANUFACTURERS

TABLE 22 CARBONATED SOFT DRINKS: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 CARBONATED SOFT DRINKS: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (KT)

8.6 OTHER DRINKS

TABLE 24 OTHER DRINKS: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 OTHER DRINKS: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (KT)

9 SHRINK WRAP MARKET, BY CONTAINER TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 42 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET SIZE, BY CONTAINER TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 26 SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

9.2 COVID-19 IMPACT ON THE MARKET, BY CONTAINER TYPE, 2018-2021 (USD MILLION)

9.2.1 OPTIMISTIC SCENARIO

TABLE 27 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY CONTAINER TYPE, 2018–2021 (USD MILLION)

9.2.2 PESSIMISTIC SCENARIO

TABLE 28 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET SIZE, BY CONTAINER TYPE, 2018–2021 (USD MILLION)

9.3 CANS

9.3.1 COST-EFFECTIVENESS OF SHRINK WRAPS MAKES IT A POPULAR CHOICE AMONG MANUFACTURERS

TABLE 29 CANS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 BOTTLE

9.4.1 BETTER SAFETY OF FRAGILE PRODUCTS THROUGH SHRINK WRAPS DRIVES THE MARKET

FIGURE 43 BOTTLE: SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 30 BOTTLE: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.5 BRICK

9.5.1 SHRINK WRAPS ARE MORE MOISTURE RESISTANT AND COST-EFFECTIVE THAN OTHER PACKAGING OPTIONS

TABLE 31 BRICK: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET, BY MULTIPACK SIZE (Page No. - 103)

10.1 INTRODUCTION

FIGURE 44 SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY MULTIPACK SIZE, 2020 VS. 2025 (USD MILLION)

TABLE 32 SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

10.2 COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET, BY MULTIPACK SIZE, 2018-2021 (USD MILLION)

10.2.1 OPTIMISTIC SCENARIO

TABLE 33 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET SIZE, BY MULTIPACK SIZE, 2018–2021 (USD MILLION)

10.2.2 PESSIMISTIC SCENARIO

TABLE 34 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET SIZE, BY MULTIPACK SIZE, 2018–2021 (USD MILLION)

10.3 3X2

10.3.1 ARRANGEMENT IS MORE POPULAR WITH RETAIL PRODUCTS

TABLE 35 3X2 SIZE: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 4X2

10.4.1 MOSTLY BEER AND SOFT DRINKS MANUFACTURERS USE THIS ARRANGEMENT

FIGURE 45 4X2: SHRINK FILMS MARKET SIZE FOR BEVERAGE MULTIPACKS, BY REGION, 2020 VS. 2025 (USD MILLION)

TABLE 36 4X2 SIZE: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 4X3

10.5.1 MID TO LARGE-SIZED BEVERAGE ARE KEPT IN THIS KIND OF ARRANGEMENT

TABLE 37 4X3 SIZE: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.6 6X3

10.6.1 SMALL-SIZED PACKS ARE KEPT IN THIS ARRANGEMENT

TABLE 38 6X3 SIZE: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.7 OTHER PACK SIZES

TABLE 39 OTHER PACK SIZES: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 SHRINK PLASTIC FILM MARKET, BY REGION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 46 ASIA PACIFIC TO RECORD SIGNIFICANT MARKET GROWTH IN THE MARKET, 2018–2025

TABLE 40 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 SHRINK FILM FOR BEVERAGE MULTIPACKS MARKET SIZE, BY REGION, 2018–2025 (TON)

11.2 COVID-19 IMPACT ON THE SHRINK PLASTIC FILM MARKET

11.2.1 OPTIMISTIC SCENARIO

TABLE 42 OPTIMISTIC SCENARIO: SHRINK PLASTIC FILM MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.2 PESSIMISTIC SCENARIO

TABLE 43 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT (BY VALUE)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

11.3.1 US

11.3.1.1 Increase in the production of beverages to drive the growth of the market

TABLE 52 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 US: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.3.2 CANADA

11.3.2.1 Increase in export of beverages to drive the demand for shrink plastic films in the country

TABLE 54 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.3.3 MEXICO

11.3.3.1 Shrink plastic film is an economical option for packaging among Mexican manufacturers

TABLE 56 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 57 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4 EUROPE

FIGURE 48 EUROPE: SHRINK PLASTIC FILM MARKET SNAPSHOT, 2019 (BY VALUE)

TABLE 58 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 60 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 62 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 64 EUROPE: MARKET SIZE, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Increase in the exports of food & beverage products to drive the demand for shrink plastic films

TABLE 66 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.2 UK

11.4.2.1 Rise in demand for ready-to-drink beverages to drive the demand for shrink plastic films among manufacturers

TABLE 68 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.3 FRANCE

11.4.3.1 Increase in the production of innovative products to drive the demand for beverages, which, in turn, drives the market growth

TABLE 70 FRANCE: SHRINK PLASTIC FILM SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.4 ITALY

11.4.4.1 High production of food & beverages to drive the demand for efficient packages as well in the country

TABLE 72 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.5 SPAIN

11.4.5.1 Macroeconomic factors to drive the growth of the market

TABLE 74 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.6 NETHERLANDS

11.4.6.1 Increase in investment in the food & beverages manufacturing infrastructure to drive the growth of the secondary packaging market

TABLE 76 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 NETHERLANDS: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.7 SCANDINAVIAN COUNTRIES

11.4.7.1 Rise in consumer demand for convenient packaging materials to drive the market growth

TABLE 78 SCANDINAVIAN COUNTRIES: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 SCANDINAVIAN COUNTRIES: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.4.8 REST OF EUROPE

TABLE 80 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.5 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT (BY VALUE)

TABLE 82 ASIA PACIFIC: MARKET SIZE FOR BEVERAGE MULTIPACKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE FOR BEVERAGE MULTIPACKS, BY COUNTRY, 2018–2025 (KT)

TABLE 84 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 86 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 88 ASIA PACIFIC: MARKET SIZE, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

TABLE 89 ASIA PACIFIC: SHRINK PLASTIC FILM MARKET SIZE, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

11.5.1 CHINA

11.5.1.1 High demand for ready-to-drink beverages and change in the lifestyle of consumers to drive the growth of the market

TABLE 90 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 91 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.5.2 INDIA

11.5.2.1 High demand among consumers to drive the market for convenience and secondary packaging solutions

TABLE 92 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 93 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.5.3 JAPAN

11.5.3.1 Increase in consumer awareness about hygienic packaging conditions of beverages to drive the growth of the market

TABLE 94 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.5.4 AUSTRALIA & NEW ZEALAND

11.5.4.1 Manufacturers are focusing on investing in product differentiation through opting for various packaging solutions

TABLE 96 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 97 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.5.5 REST OF ASIA PACIFIC

TABLE 98 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 99 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.6 SOUTH AMERICA

TABLE 100 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 102 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: SHRINK PLASTIC FILM MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 104 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 106 SOUTH AMERICA: MARKET SIZE, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

TABLE 107 SOUTH AMERICA: MARKET SIZE, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Increase in the packaging of alcoholic beverages in bottles and cans to drive the market growth of shrink plastic films

TABLE 108 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 109 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.6.2 ARGENTINA

11.6.2.1 Rise in the export of beverages to create high growth potential for manufacturers in the shrink plastic film market

TABLE 110 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 111 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.6.3 REST OF SOUTH AMERICA

TABLE 112 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 113 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.7 REST OF THE WORLD

TABLE 114 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 115 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 116 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 117 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

TABLE 118 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 ROW: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 120 ROW: MARKET SIZE, BY MULTIPACK SIZE, 2018–2025 (USD MILLION)

TABLE 121 ROW: MARKET SIZE, BY CONTAINER TYPE, 2018–2025 (USD MILLION)

11.7.1 MIDDLE EAST

11.7.1.1 High competition encourages product differentiation through packaging, which drives the growth of the market

TABLE 122 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 123 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.7.2 SOUTH AFRICA

11.7.2.1 Packaging of health drinks to drive the growth of the market for shrink plastic films

TABLE 124 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 125 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

11.7.3 REST OF AFRICA

TABLE 126 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 127 REST OF AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (KT)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 MARKET EVALUATION FRAMEWORK

FIGURE 50 MARKET EVALUATION FRAMEWORK, 2019 VS. 2020

12.2 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 51 AMCOR PLC LED THE SHRINK FILMS FOR BEVERAGE MULTIPACKS MARKET IN 2019

12.3 COVID-19 SPECIFIC COMPANY RESPONSE

12.4 KEY MARKET DEVELOPMENTS

12.4.1 EXPANSIONS & INVESTMENTS

TABLE 128 EXPANSIONS & INVESTMENTS, 2018–2020

12.4.2 MERGERS & ACQUISITIONS

TABLE 129 MERGERS & ACQUISITIONS, 2019

13 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 159)

13.1 OVERVIEW

13.2 COMPANY EVALUATION MATRIX: DEFINITIONS & METHODOLOGY

13.2.1 STARS

13.2.2 EMERGING LEADERS

13.2.3 PERVASIVE PLAYERS

13.2.4 EMERGING COMPANIES

13.3 COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

FIGURE 52 GLOBAL SHRINK PLASTIC FILM MARKET COMPANY EVALUATION MATRIX, 2019 (OVERALL MARKET)

13.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View)*

13.4.1 AMCOR PLC

FIGURE 53 AMCOR PLC: COMPANY SNAPSHOT

FIGURE 54 SWOT ANALYSIS: AMCOR PLC

13.4.2 COVERIS HOLDINGS SA

FIGURE 55 SWOT ANALYSIS: COVERIS HOLDING SA

13.4.3 CEISA SEMO

FIGURE 56 SWOT ANALYSIS: CEISA SEMO

13.4.4 CLONDALKIN GROUP

FIGURE 57 SWOT ANALYSIS: CLONDALKIN GROUP

13.4.5 RKW GROUP

FIGURE 58 SWOT ANALYSIS: RKW GROUP

13.4.6 BERRY GLOBAL INC.

FIGURE 59 BERRY GLOBAL INC: COMPANY SNAPSHOT

13.4.7 PLASTOTECNICA SPA

13.4.8 CLEARPACK GROUP

13.4.9 SARKINA

13.4.10 BARODA PACKAGING

13.4.11 KYUNG WON CHEMICAL CO. LTD.

13.4.12 BENISON & CO. LTD

13.5 COMPETITIVE LEADERSHIP MAPPING (START-UP/SME)

13.5.1 PROGRESSIVE COMPANIES

13.5.2 STARTING BLOCKS

13.5.3 RESPONSIVE COMPANIES

13.5.4 DYNAMIC COMPANIES

FIGURE 60 SHRINK PLASTIC FILMS MARKET COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SME PLAYERS, 2019

13.6 START-UP/SME PROFILES

13.6.1 SANDEEP POLYMER

13.6.2 HUYAN YUAN PLASTIC FILM

13.6.3 AINTREE PLASTICS

13.6.4 ALLIED PROPACK PVT LTD

13.6.5 ELITE PLASTICS

13.6.6 JIANGYIN BAIRUIJIA PLASTICS SCIENCE & TECHNOLOGY CO., LTD

13.6.7 BRENTWOOD PLASTICS, INC

13.6.8 XINJIANG RIVAL TECH CO., LTD

13.6.9 DON-POLYMER

13.6.10 POLY-PACK VERPACKUNGS-GMBH & CO. KG

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 188)

14.1 KEY INDUSTRY INSIGHTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL:

14.4 AVAILABLE CUSTOMIZATION

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

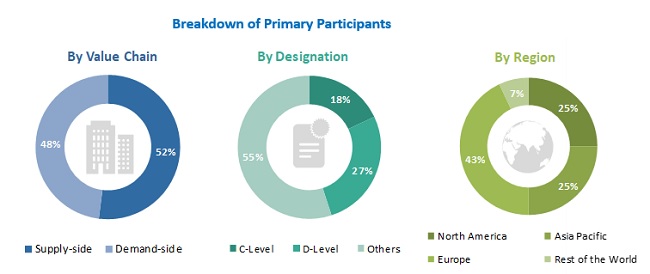

The study involved four major activities in estimating the shrink plastic film market for beverage multipacks size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of enzyme manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the shrink plastic film market for beverage multipacks for beverage multipacks. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the shrink plastic film market for beverage multipacks for beverage multipacks, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the shrink plastic film market for beverage multipacks, in terms of type, origin, application, form, and region

- To describe and forecast the market for beverage multipacks, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the market for beverage multipacks

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market for beverage multipacks

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the shrink plastic film market for beverage multipacks

Available Customizations

Based on the given Market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of the World shrink plastic film market for beverage multipacks into the Middle East, South Africa, and the Rest of Africa (Rest of Africa consists of Nigeria, Kenya, DR Congo, Ethiopia, Tanzania, and Sudan.)

- Further breakdown of the Rest of European shrink plastic film market for beverage multipacks into Poland, Belgium, Switzerland, Ukraine, and other EU & non-EU countries.

- Further breakdown of the Rest of Asia Pacific includes Thailand, Malaysia, Singapore, Bangladesh, Sri Lanka, and other ASEAN countries.

- Further breakdown of the Rest of South America includes Chile, Colombia, Uruguay, Venezuela, and Peru.

Segment Analysis

- Further breakdown of the application segment into major countries

Growth opportunities and latent adjacency in Shrink Plastic Film Market