Shipbuilding Anti-Vibration Market by Material, Product Type (Mounts, Bearing Pads, Bellows, Washers), Function Type (Engine Vibration, HVAC Vibration, Gernerators & Pumps), Application and Region - Global Forecast to 2027

Shipbuilding Anti-Vibration Market Analysis

The global shipbuilding anti-vibration market was valued at USD 958 million in 2022 and is projected to reach USD 1,253 million by 2027, growing at a cagr 5.5% from 2022 to 2027. This growth rate is attributed to the high demand for ships that offer high comfort, which is a key factor fueling the demand for shipbuilding anti-vibration systems. The major challenge for the manufacturers in this industry is price sensitivity, as it relies on raw material costs. The price competitiveness of Asian manufacturers is another big challenge affecting the other major market players.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Shipbuilding Anti-Vibration Market

COVID-19 had negative impact on the global economy and the shipping sector with the disruptions in supply chains that impacted the demand. The pandemic lead to the decline in maritime transportation and other marine activities that resulted in disintegration of shipbuilding anti-vibration industry. International trade, tourism and supply chain were influenced at an unmatched scale. After the third quarter of 2021, the impact started demolishing and the volumes started to recover for both containerized trade and dry bulk commodities. Though pandemic created a big disruption to the economy and the sector but has also created new opportunities for the sector with a good trend in e-commerce trade.

As the restrictions are removed, the shipbuilding industry is gaining traction with the help of government initiatives. For instance UK government has planned to invest USD 29 billion on leisure, tourism and hospitality sector to mitigate the losses of pandemic. These measures will inturn impact the shipbuilding anti-vibration market positively.

Shipbuilding Anti-Vibration: Market Dynamics

Driver: Increasing consumer spending coupled with growing preference for luxurious lifestyles to boost market growth

The global market for shipbuilding anti-vibration products is expected to expand at a significant rate during the forecast period, owing to the integration of numerous anti-vibration components in shipbuilding. The high demand for ships that offer high comfort is a key factor fueling the demand for anti-vibration systems for shipbuilding. The growing tourism industry, coupled with the increasing preference for luxurious lifestyles, is expected to drive the passenger ships market growth, which, in turn, accelerates the shipbuilding anti-vibration market.

Consumers’ inclination toward sailing holiday activities is on the rise and represents a significant portion of the Blue Economy growth in Europe and across the world. In comparison to touring a region by car, cruise ship, or island-hopping via ferry, sailing boats are a low-impact and more sustainable mode of exploring coastal areas. Yacht ownership has declined, due to the global pandemic , but demand for such holiday products remained steady, therefore shifting the yachters' profiles toward younger and less experienced consumers who prefer to charter boats, rather than own one, thereby driving the market for yachts. Also, boat chartering offers more flexibility to explore different regions on a year-to-year basis, which further boosts the market growth of shipbuilding anti-vibration systems.

Restrain: High maintenance costs and replacement rate required for anti-vibration products

One of the major challenges faced by the global anti-vibration mount industry is the significant cost of maintenance. The anti-vibration mounts are subjected to high temperature and pressure, and thus, require proper maintenance in a timely manner. Some of the specific mounts are expensive, for instance, for large heat exchangers, thereby restraining the growth of the market. Shipbuilding anti-vibration systems like mounts need to be replaced after ten years. Similar to many other aspects of boat maintenance, the life span of these products depends on variables, such as the frequency of boat uses, operating conditions, ,etc.

Stringent industry regulations, high product costs, and component reliability problems are expected to inhibit market growth over the years. Manufacturers are forced to upgrade their products due to the stringent regulations and policies imposed by the defense and maritime authorities, globally. This, in effect, hampers the market growth.

Opportunity: Rise of e-commerce and online trade

There is shift in the way consumers are purchasing the goods after the impact of the COVID-19 pandemic. Rapid increase in digitalization has led to the rise in e-commerce purchasing.Online purchasing became the new style of shopping and fulfilling the requirements, which lead to the increase in online trade activities. The unplanned increase in online trade is resulted in logistical bottlenecks and supply chain uncertainties such as shortages of shipping containers, and various other equipment used in trade.

The e-commerce shopping/purchasing is providing exciting opportunities to maritime trade such as shipping, warehousing, and distribution facilities. Maritime transport at global scale is quite feasible and cheaper compared to air, road, and rail transport. The quick adoption of digitization in marine industry, will definitely lead to a rise in the shipbuilding anti-vibration market.

Challenge: Structural factors increasing maritime transport costs

Structural factors like port infrastructure, imbalances in trade, and shipping connectivity are expected to impact shipping and port prices. Developing countries with poor marine infrastructure, are expected to experience the high maritime transport cost as compared to other developed countries. These developing countries may require support to reduce transition costs that would result from decarbonization in maritime transport. Hence, improving structural factors, such as infrastructure of port, trade-facilitating environment, and better shipping connectivity, will eventually reduce maritime transport costs.

Liner shipping connectivity, poor port infrastructure, and inadequate trade facilitation in small countries such as Romania, hamper the growth of maritime trade in such countries. Upgradation of these shortcomings will result in better shipping service, shorter waiting times for large vessels, and lower transport costs. The bilateral trade imbalances impacts the costs and overall trade in these countries. Such structural factors impact the rise in international maritime trade and pose a challenge for shipbuilding anti-vibration market growth.

Shipbuilding Anti-Vibration Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Natural rubber sub-segment is the fastest-growing market amongst elastomer material segment in the shipbuilding anti-vibration market during forecast period

The natural rubber sub-segment of elastomer segment is the fastest-gowing sub-segment in elastomer, in terms of value during 2022-2027. The growth is attributes to its excellent properties such as good tensile strength; resistant to cutting, tearing, wear, fatigue, and abrasion. Anti-vibration mounts are produced with natural rubber, as it has one of the highest levels of resilience that results in vibration reduction.

Bearing Pads followed by Bellows are the fastest-growing product type in terms of value, during forecast period

Bearing pads segment is the fastest-growing product type in the shipbuilding anti-vibration market during 2022-2027. The growth is attributed to its capability of witstanding heavy loads. Bellows is the second-fastest-growing market segment in shipbuilding anti-vibration market during 2022-2027. The growth is attributed to its use in a wide range of applications, including gas turbine exhausts, power units, generator sets, marine propulsion systems, OEM engines, and auxiliary systems in shipbuilding.

HVAC Vibration function type segment accounts for a significant share in shipbuilding anti-vibration market in terms of value during forecast period

HVAC Vibration holds a significant market share in shipbuilding anti-vibration market. The growth of this segment is attributed to increase in number of shipbuilding in emerging economies such as India and China. Also, it’s ability to control the complete onboard climate of a ship increases its usage in various applications such as cruise ships, tugs, yachts, bulk containers etc.

Fishing Boats and Bulk Carriers account for the largest market share in shipbuilding anti-vibration market, in terms of value in 2021

Fishing boats is largest market in 2021 and fastest-growing segment during 2022-2027, in terms of value. The growth of fishing segment is attributed the increasing fishing activities including import and export in countries such as China, Japan, US etc. Bulk Carriers account for second-largest market in shipbuilding anti-vibration market, in terms of value in 2021. . The growth is attributed to the increase in global international trade. The rise in the volume of minor bulk shipments is mainly driven by dry bulk cargo comprising bagged cement, fertilizers, chemicals, minerals, metals, and steel products.

APAC is projected to grow the fastest in the shipbuilding anti-vibration market during the forecast period.

APAC is the fastest-growing market for shipbuilding anti-vibration market from 2022-2027. This growth can be largely attributed to its rapid economic development and the growth of the manufacturing and energy sectors. The growth is also attributed to increase in activities such as shipbuilding, and investment in marine infrastructuere by government.

Key Market Players

The shipbuilding anti-vibration market is dominated by few globally established players such as Trelleborg(Sweden), Parker LORD (US), Hutchinson Paulstra (France), GMT Rubber-Metal-Technic Ltd. (UK), Continental (Germany). The shipbuilding anti-vibration market report analyzes the key growth strategies, such as investment & expansion, and mergers & acquisitions adopted by the leading market players between 2016 and 2021.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Thousand Units) and Value (USD Million) |

|

Segments |

Application, Function Type, Product Type, Material, and Region |

|

Regions |

North America, Asia Pacific, Europe, and Rest of the World (RoW) |

|

Companies |

Trelleborg (Sweden), Parker LORD (US), Hutchinson Paulstra (France), GMT Rubber-Metal-Technic Ltd. (UK), and Continental (Germany), AMC Mecanocaucho (Spain), Getzner Werkstoffe GmbH (Austria), Vibracoustics Ltd. (UK), Angst + Pfister (Switzerland), and Bridgestone Industrial (Japan) |

This research report categorizes the shipbuilding anti-vibration market based on application, product type, function type, material, and region.

By Product Type

- Mounts

- Bearing Pads

- Bellows

- Washers

- Others

By Function Type

- Engine Vibration

- HVAC Vibration

- Generators & Pumps

- Others

By Material

- Elastomer

- Plastic

- Others

By Application

- Tugs

- Yachts

- Fishing Boats

- Motorboats

- Sailboats

- Cruise Ships

- Container Ships

- Oil Tankers

- Bulk Carriers

By Region

- North America

- Asia Pacific

- Europe

- Rest of the World

The shipbuilding anti-vibration market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In November 2021, The Parker LORD has named Ashton Seals as its partner for the distribution of industrial vibration isolation products in the UK. The agreement aims to increase logistics presence of Parker Lord in the UK.

- In June 2020, Lita Ocean received a contract for six patrol boats from Maritime and Port Authority of Singapore. Getzner Werkestoffe GmbH supplied Sylomer Bearings to Lita Ocean for protecting the sensitive electronic components in the wheelhouse.

- In March 2019, Continental acquired ‘Anti-Vibration System’ business of Cooper Standard. The acquisition aims to increase anti-vibration product portfolio and geographical reach of Continental.

- In April 2017, Trelleborg signed an agreement in principle with Freudenberg to sell its shares in TrelleborgVibracoustic to Freudenberg.

- March 2016, Trelleborg acquired Loggers Rubbertechniek B.V. (Netherlands) that provides specially engineered anti-vibration solutions for marine applications. The company designs and develops solutions that minimize noise and dampen vibrations and shocks, mainly for onboard ship systems. The acquisition aims to strengthen Trelleborg’s antivibration operation within marine applications in Europe.

FAQs:

What is the current size of the global shipbuilding anti-vibration market?

The global shipbuilding anti-vibration market size is projected to reach USD 1253.3 million by 2027 from USD 958.5 million in 2022, at a CAGR of 5.5% during the forecast period.

Are there any regulations for shipbuilding anti-vibration?

Several countries in Europe have introduced regulations for this market. For e.g., The Merchant Shipping And Fishing Vessel (Control Of Vibration At Work) Regulation 2007 set daily exposure limit values and action values for both hand-arm and whole-body vibration. ILO (INTERNATIONAL LABOUR ORGANIZATION) Code Of Practice On Safety And Health In Shipbuilding And Ship Repair provides practical guidance for the use of all those, both in the public and private sectors, who have obligations, responsibilities, duties and rights regarding safety and health in shipbuilding and ship repair.

Who are the winners in the global shipbuilding anti-vibration market?

Companies such as Trelleborg(Sweden), Parker LORD (US), Hutchinson Paulstra (France), GMT Rubber-Metal-Technic Ltd. (UK), Continental (Germany), AMC Mecanocaucho (Spain), Getzner Werkestoffe GmbH (Austria), Vibracoustics Ltd. (UK), Angst+Pfiser (Switzerland), and Bridgestone Industrial (Japan) come under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on shipbuilding anti-vibration manufacturers?

The pandemic resulted in a considerable decline in maritime transportation and related activities, which led to a downfall of the shipbuilding anti-vibration industry and its manufacturers. It interfered with international trade, creating inefficiencies, delays, and supply chain disruptions on an unprecedented scale. However, the situation has started to improve as the economies have now started to stabilized and trade activities have normalized.

What are some of the drivers in the market?

Growth in international freight transport and rise in commercial trade activities are few drivers in the market.

What are some technological advancements in the market?

Increase in adoption of machine learning and IoT for vibration analysis are few technological advancements .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 SHIPBUILDING ANTI-VIBRATION MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 SHIPBUILDING ANTI-VIBRATION MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 SHIPBUILDING ANTI-VIBRATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 SHIPBUILDING ANTI-VIBRATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 SHIPBUILDING ANTI-VIBRATION MARKET: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1

FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 2

2.3 FORECAST NUMBER CALCULATION

2.4 DATA TRIANGULATION

FIGURE 6 SHIPBUILDING ANTI-VIBRATION MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 LIMITATIONS & RISKS ASSOCIATED WITH SHIPBUILDING ANTI-VIBRATION MARKET

2.7 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 7 MOUNTS PRODUCT TYPE ACCOUNTED FOR LARGEST SHARE IN SHIPBUILDING ANTI-VIBRATION MARKET IN 2021

FIGURE 8 ELASTOMER MATERIAL TYPE ACCOUNTED FOR LARGEST SHARE IN SHIPBUILDING ANTI-VIBRATION MARKET IN 2021

FIGURE 9 CONTAINER SHIPS APPLICATION SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC LED SHIPBUILDING ANTI-VIBRATION MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN SHIPBUILDING ANTI-VIBRATION MARKET

FIGURE 11 HIGH GROWTH OPPORTUNITIES IN CRUISE SHIPS AND TUGS APPLICATIONS

4.2 SHIPBUILDING ANTI-VIBRATION MARKET, BY PRODUCT TYPE

FIGURE 12 BEARING PADS PRODUCT TYPE TO LEAD SHIPBUILDING ANTI-VIBRATION MARKET DURING FORECAST PERIOD

4.3 SHIPBUILDING ANTI-VIBRATION MARKET, BY MATERIAL

FIGURE 13 ELASTOMER MATERIAL TO LEAD SHIPBUILDING ANTI-VIBRATION MARKET

4.4 SHIPBUILDING ANTI-VIBRATION MARKET, BY FUNCTION TYPE

FIGURE 14 ENGINE VIBRATION FUNCTION TYPE TO LEAD SHIPBUILDING ANTI-VIBRATION MARKET

4.5 SHIPBUILDING ANTI-VIBRATION MARKET, BY APPLICATION

FIGURE 15 FISHING BOATS APPLICATION TO LEAD SHIPBUILDING ANTI-VIBRATION MARKET

4.6 SHIPBUILDING ANTI-VIBRATION MARKET: MAJOR COUNTRIES

FIGURE 16 INDIA TO REGISTER AN IMPRESSIVE CAGR DURING FORECAST PERIOD

4.7 ASIA PACIFIC SHIPBUILDING ANTI-VIBRATION MARKET, BY APPLICATION AND COUNTRY

FIGURE 17 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SHIPBUILDING ANTI-VIBRATION MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in international marine freight transport

5.2.1.2 Growing applications of anti-vibration systems to drive the market growth

5.2.1.3 Rise in commercial trade activities to boost the shipbuilding anti-vibration market growth

5.2.1.4 Increasing consumer spending coupled with growing preference for luxurious lifestyles to boost market growth

5.2.2 RESTRAINTS

5.2.2.1 High maintenance costs and replacement rate required for anti-vibration products

5.2.3 OPPORTUNITIES

5.2.3.1 Rise of e-commerce and online trade

5.2.4 CHALLENGES

5.2.4.1 Structural factors increasing maritime transport costs

5.2.4.2 Volatility in raw material prices

FIGURE 19 CRUDE OIL PRICES FROM 2014 TO 2020

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 20 SHIPBUILDING ANTI-VIBRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 SHIPBUILDING ANTI-VIBRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF BUYERS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 RAW MATERIAL ANALYSIS

5.4.1 NATURAL RUBBER

5.4.2 SYNTHETIC RUBBER

5.4.3 EPE (EXPANDED POLYETHYLENE FOAM)

5.4.4 PU FOAM (POLYURETHANE FOAM)

5.4.5 FIBER

5.5 ECOSYSTEM MAPPING

TABLE 3 SHIPBUILDING ANTI-VIBRATION MARKET: ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 DEPLOYMENT OF INTERNET OF THINGS (IOT) TO ENHANCE SHIP PERFORMANCE BY DYNAMIC VIBRATION MONITORING

5.7 CASE STUDY ANALYSIS

5.7.1 BEARING OF WHEELHOUSE ON PATROL BOATS

5.7.2 BEARING OF SHIP’S HULL ON M.Y. EXCELLENCE SUPERYACHTS

5.8 VALUE CHAIN OF SHIPBUILDING ANTI-VIBRATION

FIGURE 21 OVERVIEW OF SHIPBUILDING ANTI-VIBRATION MARKET VALUE CHAIN

5.8.1 RAW MATERIAL

5.8.2 COMPOUNDER

5.8.3 SHIPBUILDING ANTI-VIBRATION MANUFACTURER

5.8.4 MANUFACTURING CONTRACTORS

5.8.5 OEM’S

5.9 IMPACT OF COVID-19 ON SHIPBUILDING ANTI-VIBRATION MARKET

5.9.1 COVID-19

5.9.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 22 COVID-19’S PACE OF GLOBAL PROPAGATION IS UNPRECEDENTED

5.9.3 IMPACT ON END-USE INDUSTRY

5.10 PATENT ANALYSIS

5.10.1 INTRODUCTION

5.10.2 METHODOLOGY

5.10.3 DOCUMENT TYPE

TABLE 4 TOTAL NUMBER OF PATENTS

FIGURE 23 TOTAL NUMBER OF PATENTS

5.10.4 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 24 NUMBER OF PATENTS YEAR-WISE, FROM 2011 TO 2021

5.10.5 INSIGHTS

5.10.6 LEGAL STATUS OF PATENTS

FIGURE 25 PATENT ANALYSIS, BY LEGAL STATUS

5.10.7 JURISDICTION ANALYSIS

FIGURE 26 TOP JURISDICTION – BY DOCUMENT

5.10.8 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

5.10.8.1 List of Patents by Hudong Zhonghua Shipbuilding Group Co Ltd

TABLE 5 PATENTS BY HUDONG ZHONGHUA SHIPBUILDING GROUP CO LTD

5.10.8.2 List of Patents by Hyundai Heavy Industries Co., Ltd

TABLE 6 PATENTS BY HYUN DAI HEAVY IND CO LTD.

5.10.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 7 TOP 10 PATENT OWNERS

5.11 AVERAGE PRICING ANALYSIS

FIGURE 28 AVERAGE PRICE BASED ON GEOGRAPHY

TABLE 8 AVERAGE PRICES OF SHIPBUILDING ANTI-VIBRATION, BY PRODUCT TYPE (USD/UNIT)

5.12 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.12.1 TRENDS AND FORECAST OF GDP

TABLE 9 TRENDS AND FORECAST OF PER CAPITA GDP (USD)

5.12.2 SHIPBUILDING INDUSTRY

TABLE 10 COMPENSATED GROSS TON SYSTEM (CGT CALCULATION)

TABLE 11 SHIP BUILT BY ECONOMY OF BUILDING (GROSS TONNAGE)

5.12.3 KEY FREIGHT TRANSPORT STATISTICS

TABLE 12 INLAND WATERWAYS FREIGHT TRANSPORT (TONNE-KILOMETER, MILLION)

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.14 TRADE ANALYSIS

5.14.1 IMPORT-EXPORT SCENARIO OF SHIPBUILDING ANTI-VIBRATION MARKET

TABLE 13 EPDM IMPORTS, BY COUNTRY (2016-2019) (TONS)

TABLE 14 EPDM EXPORTS, BY COUNTRY (2016-2019) (TONS)

5.15 TARIFF POLICIES/REGULATIONS/GUIDELINES/STANDARDS

5.15.1 THE MERCHANT SHIPPING AND FISHING VESSEL (CONTROL OF VIBRATION AT WORK) REGULATION 2007

5.15.2 ISO 6954:2000

5.15.3 ISO 20283-5

5.15.4 ISO 20154:2017

5.15.5 ISO 6954:1984

5.15.6 ILO (INTERNATIONAL LABOUR ORGANIZATION) CODE OF PRACTICE ON SAFETY AND HEALTH IN SHIPBUILDING AND SHIP REPAIR

5.16 KEY FACTORS AFFECTING BUYING DECISION

5.16.1 QUALITY

5.16.2 SERVICE

FIGURE 29 SUPPLIER SELECTION CRITERION

6 SHIPBUILDING ANTI-VIBRATION MARKET, BY MATERIAL (Page No. - 74)

6.1 INTRODUCTION

FIGURE 30 ELASTOMER TO BE DOMINANT MATERIAL IN SHIPBUILDING ANTI-VIBRATION MARKET

TABLE 15 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY MATERIAL, 2020–2027 (THOUSAND UNIT)

TABLE 16 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY MATERIAL, 2020–2027 (USD MILLION)

6.2 ELASTOMER

6.2.1 NATURAL RUBBER

6.2.1.1 Huge demand from mounts to drive market

6.2.2 SYNTHETIC RUBBER

6.2.2.1 Better thermal stability and resistance to oils and chemicals driving demand for synthetic rubber in various shipbuilding anti-vibration products

6.3 PLASTIC

6.3.1 LIGHTWEIGHT AND SHOCK-ABSORBING CAPABILITY TO DRIVE DEMAND FOR PLASTICS IN SHIPBUILDING ANTI-VIBRATION MOUNTS AND DAMPERS

6.4 OTHERS

7 SHIPBUILDING ANTI-VIBRATION MARKET, BY PRODUCT TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 31 MOUNTS TO BE LARGEST PRODUCT TYPE IN OVERALL SHIPBUILDING ANTI-VIBRATION MARKET

TABLE 17 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (THOUSAND UNITS)

TABLE 18 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

7.2 MOUNTS

7.2.1 GROWING APPLICATION OF MOUNTS IN VARIOUS FUNCTIONS OF SHIPS TO DRIVE MARKET GROWTH

7.3 BEARING PADS

7.3.1 HUGE DEMAND FROM SHIPBUILDING MAINTENANCE SERVICE PROVIDERS TO BOOST MARKET

7.4 BELLOWS AND WASHERS

7.4.1 BELLOWS AND WASHERS TO ACCOUNT FOR 16% OF SHIPBUILDING ANTI-VIBRATION MARKET, IN TERMS OF VALUE

7.5 OTHERS

7.5.1 OTHERS SEGMENT TO ACCOUNT FOR 3% OF SHIPBUILDING ANTI-VIBRATION MARKET

8 SHIPBUILDING ANTI-VIBRATION MARKET, BY FUNCTION TYPE (Page No. - 82)

8.1 INTRODUCTION

FIGURE 32 ENGINE VIBRATION TO BE LARGEST FUNCTION TYPE IN SHIPBUILDING ANTI-VIBRATION MARKET

TABLE 19 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY FUNCTION TYPE, 2020–2027 (THOUSAND UNIT)

TABLE 20 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY FUNCTION TYPE, 2020–2027 (USD MILLION)

8.2 ENGINE VIBRATION

8.2.1 SHIPBUILDING ANTI-VIBRATION MOUNTS USED TO OVERCOME ENGINE VIBRATION

8.3 HVAC VIBRATION

8.3.1 INCREASING DEMAND FOR HVAC SYSTEMS IN SHIPS TO DRIVE MARKET

8.4 GENERATORS & PUMPS

8.4.1 INCREASING DEMAND FOR POWER SUPPLY AND GENERATION TO BOOST MARKET

8.5 OTHERS

9 SHIPBUILDING ANTI-VIBRATION MARKET, BY APPLICATION (Page No. - 85)

9.1 INTRODUCTION

FIGURE 33 FISHING BOATS APPLICATION TO ACCOUNT FOR LARGEST SHARE IN SHIPBUILDING ANTI-VIBRATION MARKET

TABLE 21 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 22 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 FISHING BOATS

9.2.1 FISHING BOATS TO CREATE LUCRATIVE GROWTH OPPORTUNITIES IN THE SHIPBUILDING ANTI-VIBRATION MARKET

9.3 BULK CARRIERS

9.3.1 RISE IN VOLUME OF MINOR BULK SHIPMENTS TO DRIVE MARKET

9.4 CRUISE SHIPS

9.4.1 GROWTH OF TOURISM & HOSPITALITY SECTOR TO BOOST THIS SEGMENT

9.5 TUGS

9.5.1 INCREASE IN RESCUE AND DEFENSE ACTIVITIES TO SPUR MARKET GROWTH

9.6 YACHTS

9.6.1 GROWING INCLINATION TOWARD RECREATIONAL AND LEISURE ACTIVITIES TO PROPEL THIS MARKET SEGMENT

9.7 SAILBOATS

9.7.1 INCREASING LEISURE ACTIVITIES TO FUEL MARKET GROWTH

9.8 MOTORBOATS

9.8.1 INCREASING RECREATIONAL ACTIVITIES TO SUPPORT MARKET GROWTH

9.9 CONTAINER SHIPS

9.9.1 SURGE IN DEMAND FOR CARGO TRANSPORTATION TO DRIVE MARKET

9.10 OIL TANKERS

9.10.1 GROWTH IN INTERNATIONAL CONTAINERIZED TRADE TO PROPEL MARKET

10 SHIPBUILDING ANTI-VIBRATION MARKET, BY REGION (Page No. - 90)

10.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN SHIPBUILDING ANTI-VIBRATION MARKET, IN TERMS OF VALUE, IN 2022

TABLE 23 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY REGION, 2020–2027 (THOUSAND UNIT)

TABLE 24 SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SNAPSHOT

TABLE 25 ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 26 ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 27 ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (THOUSAND UNIT)

TABLE 28 ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Growing investment in domestic and international maritime trade activities to propel market growth

TABLE 29 CHINA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 30 CHINA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.2 SOUTH KOREA

10.2.2.1 Growing shipbuilding industry drive demand for anti-vibration products

TABLE 31 SOUTH KOREA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 32 SOUTH KOREA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.3 JAPAN

10.2.3.1 Financial aid by government bodies to drive market

TABLE 33 JAPAN: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 34 JAPAN: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.4 INDIA

10.2.4.1 Economic growth, favorable government policies and incentives framework, and long coastline to drive market

TABLE 35 INDIA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 36 INDIA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.5 SOUTHEAST ASIA

10.2.5.1 Geographical structure and increasing trade activities to boost market growth

TABLE 37 SOUTHEAST ASIA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 38 SOUTHEAST ASIA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 39 REST OF ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 40 REST OF ASIA PACIFIC: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

TABLE 41 NORTH AMERICA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 42 NORTH AMERICA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (THOUSAND UNIT)

TABLE 44 NORTH AMERICA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.1 US

10.3.1.1 Increasing international and domestic maritime trade to fuel market growth

TABLE 45 US: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 46 US: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increasing demand for merchant ships to transport commodities drives market

TABLE 47 CANADA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 48 CANADA: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Rapid industrialization and increasing trade activities to propel market

TABLE 49 MEXICO: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 50 MEXICO: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4 EUROPE

FIGURE 36 EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SNAPSHOT

TABLE 51 EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (THOUSAND UNIT)

TABLE 52 EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 54 EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Presence of a large number of shipping companies to drive market

TABLE 55 GERMANY: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 56 GERMANY: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 Second-largest maritime zone in the world

TABLE 57 FRANCE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 58 FRANCE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.3 ITALY

10.4.3.1 Leading country for manufacturing fishing boats and cruise ships and largest ferry fleet in Europe

TABLE 59 ITALY: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 60 ITALY: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 Repair shipyards attract new cruise, passenger, ferry, and gas shipping clients

TABLE 61 SPAIN: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 62 SPAIN: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.5 UK

10.4.5.1 Investment and support of government to support market growth

TABLE 63 UK: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 64 UK: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.6 GREECE

10.4.6.1 Continuous investment in new shipbuilding from Greek shipowners to boost demand for anti-vibration products

TABLE 65 GREECE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 66 GREECE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.4.7 REST OF EUROPE

TABLE 67 REST OF EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 68 REST OF EUROPE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.5 REST OF WORLD (ROW)

TABLE 69 ROW: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (THOUSAND UNIT)

TABLE 70 ROW: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 ROW: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 72 ROW: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.1 UAE

10.5.1.1 Oil & gas exports to drive market in the country

TABLE 73 UAE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 74 UAE: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.2 BRAZIL

10.5.2.1 Rapidly expanding economy to drive demand for shipbuilding anti-vibration

TABLE 75 BRAZIL: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 76 BRAZIL: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

10.5.3 OTHER COUNTRIES

TABLE 77 OTHER COUNTRIES: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (THOUSAND UNIT)

TABLE 78 OTHER COUNTRIES: SHIPBUILDING ANTI-VIBRATION MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 126)

11.1 INTRODUCTION

11.1.1 SHIPBUILDING ANTI-VIBRATION MARKET, KEY DEVELOPMENTS

TABLE 79 COMPANIES HAVE ADOPTED MERGER & ACQUISITION AS THEIR MAJOR DEVELOPMENT STRATEGY

11.2 MARKET RANKING ANALYSIS

11.2.1 RANKING OF KEY MARKET PLAYERS

FIGURE 37 RANKING OF TOP FIVE PLAYERS IN SHIPBUILDING ANTI-VIBRATION MARKET, 2021

11.3 MARKET SHARE ANALYSIS

11.3.1 MARKET SHARE OF KEY PLAYERS, 2021

FIGURE 38 SHIPBUILDING ANTI-VIBRATION MARKET SHARE, BY COMPANY, 2021

TABLE 80 SHIPBUILDING ANTI-VIBRATION MARKET: DEGREE OF COMPETITION

11.3.1.1 Trelleborg

11.3.1.2 Parker LORD

11.3.1.3 Hutchinson Paulstra

11.3.1.4 Continental

11.3.1.5 GMT Rubber-Metal-Technic Ltd.

11.4 REVENUE ANALYSIS OF TOP PLAYERS

TABLE 81 SHIPBUILDING ANTI-VIBRATION MARKET: REVENUE ANALYSIS (USD)

11.5 MARKET EVALUATION MATRIX

TABLE 82 MARKET EVALUATION MATRIX

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

FIGURE 39 SHIPBUILDING ANTI-VIBRATION MARKET: COMPANY EVALUATION MATRIX, 2021

11.6.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SHIPBUILDING ANTI-VIBRATION MARKET

11.6.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SHIPBUILDING ANTI-VIBRATION MARKET

11.7 COMPETITIVE EVALUATION QUADRANT {SMALL AND MEDIUM-SIZED ENTERPRISES (SMES}

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

FIGURE 42 SHIPBUILDING ANTI-VIBRATION MARKET (SMES): COMPANY EVALUATION MATRIX FOR SMES, 2021

11.7.4 STRENGTH OF PRODUCT PORTFOLIO (SMES)

FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SHIPBUILDING ANTI-VIBRATION MARKET (SMES)

11.7.5 BUSINESS STRATEGY EXCELLENCE (SMES)

FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SHIPBUILDING ANTI-VIBRATION MARKET (SMES)

11.8 COMPETITIVE BENCHMARKING

TABLE 83 SHIPBUILDING ANTI-VIBRATION MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.9 COMPANY FOOTPRINT

11.10 COMPANY TYPE FOOTPRINT

11.11 COMPANY MATERIAL FOOTPRINT

11.12 COMPANY REGIONAL FOOTPRINT

12 COMPANY PROFILES (Page No. - 144)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 TRELLEBORG

TABLE 84 TRELLEBORG: COMPANY OVERVIEW

FIGURE 45 TRELLEBORG: COMPANY SNAPSHOT

TABLE 85 TRELLEBORG: PRODUCT LAUNCHES

TABLE 86 TRELLEBORG: DEALS

12.1.2 HUTCHINSON PAULSTRA

TABLE 87 HUTCHINSON PAULSTRA: COMPANY OVERVIEW

12.1.3 GMT RUBBER - METAL – TECHNIC LTD

TABLE 88 GMT RUBBER – METAL – TECHNIC LTD: COMPANY OVERVIEW

12.1.4 PARKER LORD

TABLE 89 PARKER LORD: COMPANY OVERVIEW

TABLE 90 PARKER LORD: DEALS

12.1.5 CONTINENTAL

TABLE 91 CONTINENTAL: COMPANY OVERVIEW

FIGURE 46 CONTINENTAL: COMPANY SNAPSHOT

TABLE 92 CONTINENTAL: DEALS

12.1.6 AMC MECANOCAUCHO

TABLE 93 AMC MECANOCAUCHO: COMPANY OVERVIEW

12.1.7 GETZNER WERKSTOFFE GMBH

TABLE 94 GETZNER WERKSTOFFE GMBH: COMPANY OVERVIEW

TABLE 95 GETZNER WERKSTOFFE GMBH: DEALS

12.1.8 VIBRACOUSTICS LTD.

TABLE 96 VIBRACOUSTICS LTD.: COMPANY OVERVIEW

12.1.9 ANGST + PFISTER

TABLE 97 ANSGT + PFISTER: COMPANY OVERVIEW

12.1.10 BRIDGESTONE INDUSTRIAL

TABLE 98 BRIDGESTONE INDUSTRIAL: COMPANY OVERVIEW

12.1.11 POLYMER TECHNOLOGIES INC

TABLE 99 POLYMER TECHNOLOGIES INC: COMPANY OVERVIEW

12.1.12 PATRINI GIACOMO

TABLE 100 PATRINI GIACOMO.: COMPANY OVERVIEW

12.2 OTHER PLAYERS

12.2.1 MACHINE HOUSE (INDIA) PVT. LTD.

TABLE 101 MACHINE HOUSE (INDIA) PVT. LTD.: COMPANY OVERVIEW

12.2.2 ROSTA AG

TABLE 102 ROSTA AG: COMPANY OVERVIEW

12.2.3 RUBBER DESIGN B.V.

TABLE 103 RUBBER DESIGN B.V.: COMPANY OVERVIEW

12.2.4 AV INDUSTRIAL PRODUCTS LTD

TABLE 104 AV INDUSTRIAL PRODUCTS LTD: COMPANY OVERVIEW

12.2.5 VULKAN

TABLE 105 VULKAN: COMPANY OVERVIEW

12.2.6 TREBI

TABLE 106 TREBI: COMPANY OVERVIEW

12.2.7 VIBRASYSTEMS INC.

TABLE 107 VIBRASYSTEMS INC.: COMPANY OVERVIEW

12.2.8 MACKAY CONSOLIDATED INDUSTRIES

TABLE 108 MACKAY CONSOLIDATED INDUSTRIES: COMPANY OVERVIEW

12.2.9 VIBROSTOP SRL

TABLE 109 VIBROSTOP SRL: COMPANY OVERVIEW

12.2.10 STAMPAGGIO GOMMA

TABLE 110 STAMPAGGIO GOMMA: COMPANY OVERVIEW

12.2.11 HIDAMP INDUSTRIAL MOUNTINGS (P) LTD

TABLE 111 HIDAMP INDUSTRIAL MOUNTINGS (P) LTD: COMPANY OVERVIEW

12.2.12 NORD-LOCK GROUP

TABLE 112 NORD-LOCK GROUP: COMPANY OVERVIEW

12.2.13 SKF

TABLE 113 SKF: COMPANY OVERVIEW

12.2.14 DAB ANTIVIBRANTI

TABLE 114 DAB ANTIVIBRANTI: COMPANY OVERVIEW

12.2.15 BOGE RUBBER & PLASTICS

TABLE 115 BOGE RUBBER & PLASTICS: COMPANY OVERVIEW

12.2.16 PT KEMENENGAN

TABLE 116 PT KEMENENGAN: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Product launches, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 177)

13.1 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.2 AVAILABLE CUSTOMIZATIONS

13.3 RELATED REPORTS

13.4 AUTHOR DETAILS

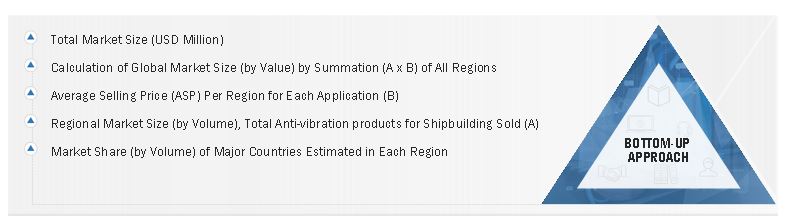

The study involved four major activities in estimating the current market size for shipbuilding anti-vibration. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, extensive use of secondary sources, directories, and databases, such as Bloomberg, World Bank, Statista, Organization for Economic Co-operation and Development (OECD) sources, Trademap, Zauba, other government & private websites, associations related to the shipbuilding anti-vibration industry. The study also involves analyzing regulations and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial shipbuilding anti-vibration market study.

Primary Research

The shipbuilding anti-vibration market comprises several stakeholders such as raw material suppliers, manufacturers, compounders and end-users, and regulatory organizations in the supply chain. Primary sources include experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess growth prospects.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

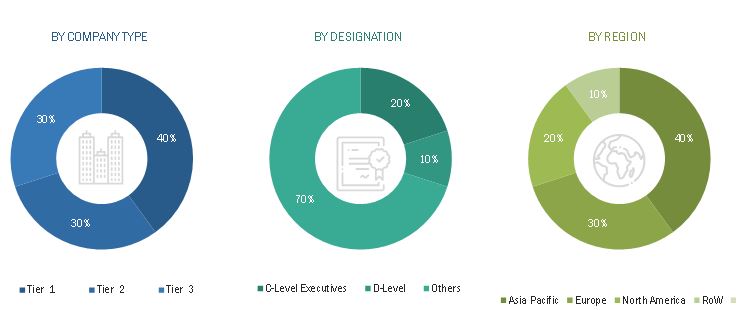

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the shipbuilding anti-vibration market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, product types, function type, material, and applications in the industry and markets were identified through extensive secondary research.

- The industry’s value chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of shipbuilding anti-vibration and their applications.

Report Objectives:

- To analyze and forecast the shipbuilding anti-vibration market size, in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by product type, function type, material, and application

- To forecast the size of the market with respect to four regions, namely, Asia Pacific, Europe, North America, and Rest of the World, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as new product launch, mergers & acquisitions, and agreement & collaborations, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Notes: 1. Micro markets are defined as sub segments of the shipbuilding ati-vibration market included in the report.

2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the shipbuilding anti-vibration market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Shipbuilding Anti-Vibration Market