Shell & Tube Heat Exchanger Market by Material (Steel, Nickel & Nickel Alloys, Titanium, Tantalum), Application (Chemicals, Petrochemicals, HVAC & Refrigeration, Food & Beverages, Power Generation, Pulp & Paper), and Region - Global Forecast to 2027

Updated on : August 28, 2025

Shell & Tube Heat Exchanger Market

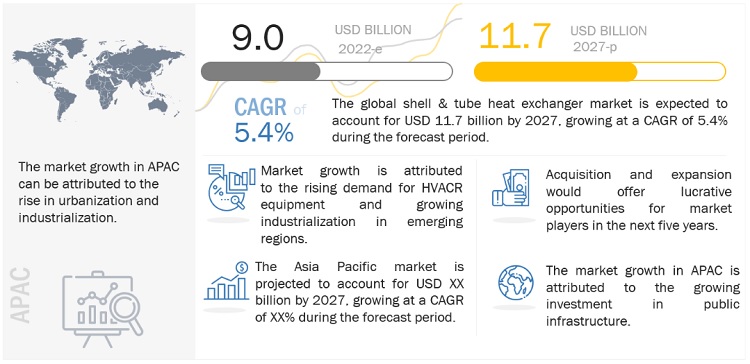

The global shell & tube heat exchanger market was valued at USD 9.0 billion in 2022 and is projected to reach USD 11.7 billion by 2027, growing at 5.4% cagr from 2022 to 2027. Increasing demand for shell & tube heat exchanger from emerging markets and rising demand for HVACR equipment are driving the market.

Attractive Opportunities in the Shell & Tube Heat Exchanger Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Shell & Tube Heat Exchanger Market Dynamics

Driver: Growing industrialization in emerging regions

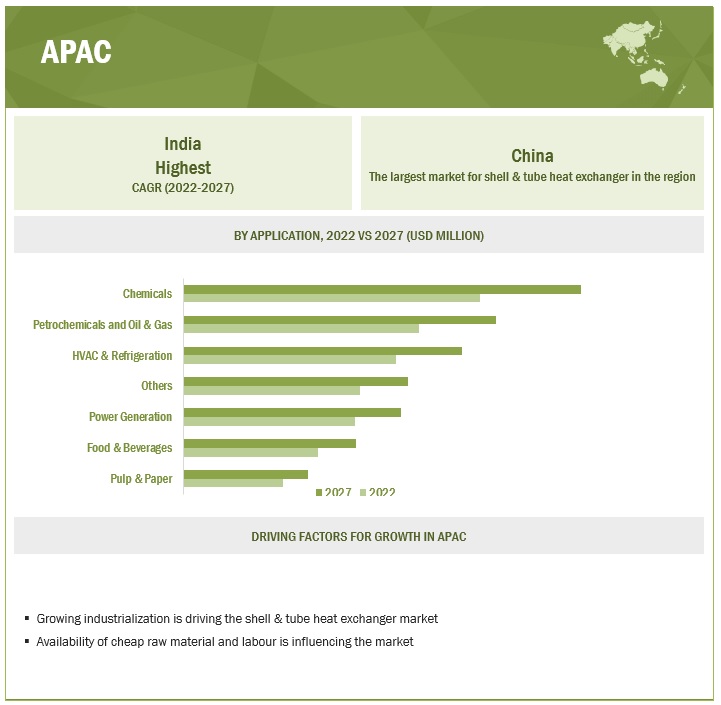

The shell & tube heat exchangers demand from the developing economies of Asia Pacific including China and India is increasing, owing to rapid industrialization, raw material prices, and low-cost labor. The increasing investments in manufacturing, commercial, and industrial projects in the region have contributed to the overall expansion of the heat exchangers market. The shell & tube heat exchangers market in Asia Pacific is expected grow at a high growth rate, due to increasing demand from the chemical, HVAC, petrochemical, food & beverage, and oil & gas industries. According to the International Energy Agency (IEA), Asia Pacific accounts for more than 50% of the global petrochemical production. Further, many major manufacturers are expanding their manufacturing plants across Asia Pacific to capitalize on the opportunity in the emerging economies of the region. According to the India Brand Equity Foundation, the demand for chemicals in India is expected to expand by 9% per annum and the chemical industry is projected to contribute USD 300 billion to the country’s GDP by 2025.

According to BP statistical review of World Energy 2022, China’s nuclear power generation was 407.7 TW-hour in 2021, and natural gas production increased by 8.1% to 209.2 billion cubic meters, which will have a significant impact on the shell & tube heat exchangers market in China, as power and oil & gas industries widely utilize shell & tube heat exchangers. The food & beverage industry in Asia Pacific is also expected to grow at a high growth rate owing to the rising urbanization, growing population, and rising disposable income of the middle-class population. The growth in these end use industries will drive the shell & tube heat exchangers market.

Restraint: Volatility in raw material prices

The fluctuation in raw material prices of copper, aluminium, steel, and other metals used for the manufacturing of shell & tube heat exchangers have contributed to the overall increase in the manufacturing cost and time. Many manufactures struggle in estimating the exact manufacturing cost of equipment owing to the uncertainty in the raw material prices. The pricing of these metals is dependent on various factors such as economic conditions, exchange rates, supply conditions, mining policies, processing of the raw materials, and others. Moreover, volatility in prices may increase the customer cost of operating business, resulting in delay or cancelation of large capital projects, which affects the profitability of the manufacturers.

Due to high cost and restricted availability of quality raw materials such as ferrous and nonferrous materials, manufactures shift to cheaper materials that affect the performance and efficiency of the equipment. Such actions reduce the longevity of shell & tube heat exchangers and increase maintenance cost. The price fluctuations or increase in tariffs and shortage of materials create an adverse effect on manufacturers as they may not be able to provide competitive pricing. Manufacturers are also engaged in long-term supplier contracts that may increase their exposure to pricing fluctuations. However, to manage the risk associated with pricing fluctuation, companies closely monitor the pricing trends to slightly overcome the risk related to pricing.

Opportunity: Growing aftermarket for shell & tube heat exchangers

A heat exchanger is a critical component in any process industry and its performance and longevity has direct impact not only on the capital cost, but also on operating costs. Breakdown maintenance is always costly; thus, regular maintenance of shell & tube heat exchangers is crucial, which can be relatively lower compared to rotating equipment such as pumps and compressors. Heat exchanger maintenance is important to ensure continuous production and system uptime for avoiding its sudden failure. The cost of prevention is normally lower than emergency repairs.

The process fluids and utility fluids in shell & tube heat exchangers generate scale and deposits due to high dissolved solid content and suspended colloidal solids that adhere to the heat transfer surface. These scale and deposits impact the heat exchange rate and leads to corrosion, erosion, scaling, or fouling in the heat exchangers. Well-planned maintenance of shell & tube heat exchangers helps companies in saving energy and reducing operational costs by up to 30%. Maintenance helps avoid pressure drops on the system, requiring less load on the pumps and other components. This helps in lowering energy consumption while increasing the heat transfer rate and operational efficiency. Regular maintenance of shell & tube heat exchangers has several other benefits, such as improved performance and efficiency, energy conservation, environment protection, and cost reductions. However, maintenance of plate type heat exchangers is much easier as compared to shell & tube. The shell & tube heat exchangers create a huge aftermarket for shell & tube heat exchangers manufactures, wherein, they can sell spare parts, such as gaskets, seals, tubes, and other components and take service contracts for cleaning and maintenance of shell & tube heat exchangers.

Challenge: High capital cost

The shell & tube heat exchangers market is very capital intensive to enter and operate. Heavy investments are required in setting up sophisticated manufacturing processes. Manufacturers are required to invest huge capital in R&D to develop innovative and consumer-centric products. Consumers have specific requirements depending upon their application area. Manufacturers must address these requirements with minimal operating and production costs. Furthermore, shell & tube heat exchangers manufacturers are required to produce products as per the needs of the end consumers, which further increases the capital required. In the manufacturing of heat exchangers, the grade of materials, heat transfer rate, refrigerant charge, and other factors such as volume and durability are crucial parameters for manufacturers. Established manufacturers invest significant amount of their revenue in R&D activities. However, local manufacturers offer products at lower costs, which creates credibility issues for the bigger players and increases market competition.

The heat exchangers industry being capital-intensive in nature, many small players are discouraged from entering the business. The initial investment cost for setting up HVAC systems including shell & tube heat exchangers in end applications is very high for small players. Moreover, the existing players are more dominant in the market, which makes it difficult for the new entrants to establish high-cost manufacturing units and market their products. Thus, the high capital cost for setting up new plants affects the growth of the shell & tube heat exchanger market. Shell & tube heat exchanger:

Shell & Tube Heat Exchanger Market Ecosystem

|

COMPANY |

ROLE IN ECOSYSTEM |

|

Baosteel Group |

Raw Material |

|

Rio Tinto Group |

Raw Material |

|

BHP |

Raw Material |

|

Alfa Laval |

Product Manufacturing |

|

Koch Heat Transfer Company |

Product Manufacturing |

|

Xylem Inc. |

Product Manufacturing |

|

Benns Industrial Solutions |

Distribution |

|

Valutech Inc. |

Distribution |

Source: Company Websites and MarketsandMarkets Analysis

In terms of value, the petrochemicals and oil & gas segment is projected to account for the second largest share of the shell & tube heat exchanger market, by application, during the forecast period.

The petrochemicals and oil & gas segment accounted for a share of 17.7% in terms of value, of the overall shell & tube heat exchanger market in 2021. Typical applications for shell & tube heat exchangers in the oil & gas industry include crude oil dehydration/stabilization, gas cooling and condensing, gas sweetening, gas dehydration, regasification, gas sweetening, and utility cooling. According to the International Energy Agency, by 2026, global oil consumption is projected to reach 104.1 million barrels per day which is expected to drive the demand for heat exchangers in the oil & gas industry. Furthermore, with increasing global population, the demand for energy as well as the products manufactured from oil and gas is projected to increase.

Steel raw material segment is projected to account for one of the fastest growth of the shell & tube heat exchanger market, by material, during the forecast period

Based on material, the steel dominated the market. Shell & tube heat exchangers are made of variety of steel grades. Super duplex steel has excellent weld-ability characteristics, and strong machinability capabilities. It provides excellent resistance to corrosion by oxidation. Super duplex steel contains 25% chromium, 7% nickel and 4% molybdenum. The higher percentage of these metals gives enhanced resistance to corrosions. It is more expensive than duplex steel due to their high percentage of nickel.

APAC is expected to be the fastest-growing market during the forecast period.

Based on region, Asia Pacific is a key market to produce shell & tube heat exchanger and is projected to grow at a CAGR of 7.6% in terms of value during the forecasted period. The availability of low-cost raw materials and labour, coupled with growing industrialization, makes the region an attractive investment destination for shell & tube heat exchanger manufacturers. The rising population, urbanization, and industrialization are some of the factors that will drive the shell & tube heat exchanger market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Shell & Tube Heat Exchanger Market Players

Major players operating in the global shell & tube heat exchanger market include Alfa Laval AB (Sweden), HRS Heat Exchangers (UK), Kelvion (Germany), Xylem (US), API Heat Transfer (US), Koch Heat Transfer (US), Thermex (UK), Manning and Lewis (US), Thermofin (Canada), and Mersen (France)

Shell & Tube Heat Exchanger Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion), Units |

|

Segments |

Material, Application, and Region |

|

Regions |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies |

Alfa Laval AB (Sweden), HRS Heat Exchangers (UK), Kelvion (Germany), Xylem (US), API Heat Transfer (US), Koch Heat Transfer (US), Thermex (UK), Manning and Lewis (US), Thermofin (Canada), and Mersen (France). |

This research report categorizes the shell & tube heat exchanger market based on type, application, and region.

Shell & Tube Heat Exchanger Market based on Material:

- Steel

- Nickel & Nickel Alloys

- Titanium

- Tantalum

- Others

Shell & Tube Heat Exchanger Market based on Application:

- Chemicals

- Petrochemicals and Oil & Gas

- HVAC & Refrigeration

- Food & Beverages

- Power Generation

- Pulp & Paper

- Others

Shell & Tube Heat Exchanger Market based on Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In Sep 2018, Kelvion combined its double tube safety technology with its compact fin system to produce the new ComFin Safety heat exchanger. The benefits are optimized energy efficiency, small footprint, and efficient performance due to enlarged surface through fins. The product can be used in various industries such as power, marine and heavy industry.

- In Oct 2021, Kelvion is expanding its, The Port of Catoosa site, to meet the growing demand in the North American market. The company investment of USD 6 million will increase manufacturing and create jobs.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the shell & tube heat exchanger market?

The growth of this market can be attributed to growing requirement in APAC and growing industrialization.

Which are the key applications driving the shell & tube heat exchanger market?

Applications such as chemicals, petrochemical and oil & gas, HVAC & refrigeration, food & beverages, power generation, and pulp & paper are driving the demand for shell & tube heat exchanger market.

Who are the major manufacturers?

Major manufacturers include Alfa Laval AB (Sweden), HRS Heat Exchangers (UK), Kelvion (Germany), Xylem (US), API Heat Transfer (US), Koch Heat Transfer (US), Thermex (UK), Manning and Lewis (US), Thermofin (Canada), and Mersen (France), among others.

What is the biggest restraint for shell & tube heat exchanger?

The biggest restraint can be volatility in raw materials prices.

How is COVID-19 affecting the overall shell & tube heat exchanger market?

The shell & tube heat exchanger market saw a disruption in supply chain for supply of raw materials.

What will be the growth prospects of the shell & tube heat exchanger market?

Growing industrialization in emerging regions and rising demand for HVAC equipment are driving the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the shell & tube heat exchanger market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, BP statistics, and World Bank, to identify and collect information useful for the technical, market-oriented, and commercial study of the shell & tube heat exchanger market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, and certified publications.

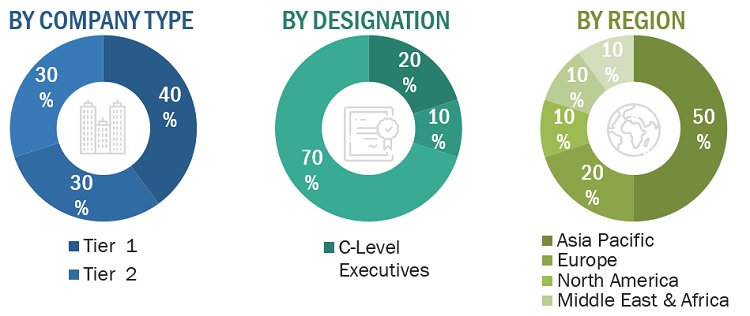

Primary Research

The shell & tube heat exchanger market comprises several stakeholders, such as raw material suppliers, manufacturers, distributors, buyers, and regulatory organizations. The demand side of this market is characterized by component manufacturers. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = > USD 1 billion, Tier 2 = USD 500 million– USD 1 billion, and Tier 3 = < USD 500 million.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of the various submarkets for shell & tube heat exchanger for each region. The research methodology used to estimate the market size included the following steps:

- Global heat exchanger market was identified, and the share for shell & tube heat exchanger was determined through primary and secondary research.

- The global market was then segmented into five major regions and validated through industry experts.

- All percentage shares, splits, and breakdowns based on material, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above— shell & tube heat exchanger market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying several factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the shell & tube heat exchanger market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To estimate and forecast the market size based on material, application, and region

- To forecast the size of the market in the major regions, namely, Europe, North America, Asia Pacific (APAC), Middle East & Africa, and South America along with their key countries

- To strategically analyse micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyse opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To identify the impact of the COVID-19 pandemic on the market

- To track and analyse recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the shell & tube heat exchanger market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the shell & tube heat exchanger market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Shell & Tube Heat Exchanger Market