Sexually Transmitted Diseases Diagnostics Market by Disease Type (CT/NG, Gonorrhea, Syphilis, Genital Herpes, Hepatitis B, HIV/AIDS, HPV), End User (Laboratory, PoC) and Geography - Global Forecast to 2027

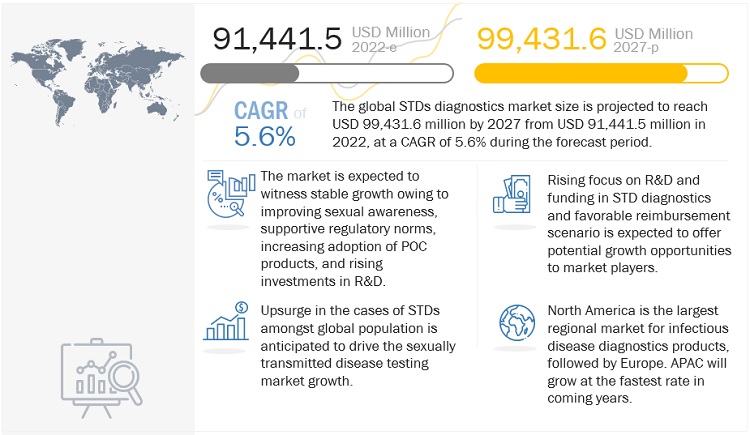

The STDs diagnostics market size is projected to reach $99,431.6 million by 2027 from $91,441.5 million in 2022, at a CAGR of 5.6% during the forecast period. Sexually transmitted diseases diagnostics market is driven by factors such as global prevalence of HIV, CT/NG, and other STDs and the growing awareness for early disease diagnosis, shift in focus from centralized laboratories to decentralized POC testing and rising technological advancements. On the other hand, an unfavorable reimbursement scenario is expected to limit market growth to a certain extent in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Upsurge in the cases of STDs amongst global population is anticipated to drive the sexually transmitted disease testing market growth. Increasing government initiatives to launch new diagnostics kits and tests are anticipated to propel market growth. In 2020, according to the Public Health Agency of Canada (PHAC), cases for syphilis were increased to 9,126 in 2020 compared to 6,281 in 2018. There is lack of awareness regarding safe sexual intercourses and unappropriated sharing of contaminated and unclean personal objects. This had led to increase in STDs and its diagnosis. Increasing government initiatives for spreading the awareness regarding sexual health and testing are predicted to propel market development.

However, reluctance toward sexually transmitted disease testing is anticipated to hinder market development. Fear of testing positive, the stigma of being judged, and privacy concerns are expected to restrict market growth.

“The HIV disease accounted for the largest market share in the STD diagnostics market, type, during the forecast period”

The STDs diagnostics market is segmented into CT/NG, Gonorrhea, Syphilis, Genital herpes, Hepatitis B, HIV/AIDS, HPV and other STDs. In 2021, Chlamydia accounted for a sizable market share. However, HPV infection is expected to increase significantly between 2021 and 2027. In 2019, the CDC received 616,392 reports of gonorrhea, making it the second most common reportable condition in the United States.

“Laboratory testing segment accounted for the largest market share”

Based on type of testing, the STDs diagnostics market is segmented into Laboratory Testing and POC Testing. The Laboratory Testing segment accounted for the largest market share in 2021. Laboratory testing held the largest market share in 2021, while point of care testing is expected to grow at the fastest rate in the years ahead, from 2021 to 2027. This can be attributed to the increasing need for automation and the rising incidence of various STDs.

“APAC region accounted for the highest CAGR”

The global STD Testing market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the Asia-Pacific region is likely to retain a significant market share in 2021 and the future. The Asia-Pacific STD testing market is being propelled by an increase in the number of STI cases, an increase in the youth population, a lack of awareness, and rising government initiatives. North America, on the other hand, will experience significant growth in the coming years due to the presence of key players, the availability of technologically advanced products, and the rising adoption of point of care testing.

Competitive Landscape

Key Market Players to Propel Market Progress Due to Advanced Logistics

Primary players operating in the market utilize expansion and offering strengthening strategies. Due to its strong distribution channels, F. Hoffmann-La Roche Ltd. extended its diagnostic capabilities by its global access program which has raised funds for malaria, AIDS, and tuberculosis, which is anticipated to boost market growth. Increasing strategic initiatives and launches will strengthen their distribution channels in the market.

Key Industry Development:

May 2022- Becton, Dickinson and Company, announced the U.S. launch of its new, fully automated, high-throughput infectious disease molecular diagnostics platform named BD COR MX instrument is a new analytic instrument option for the BD COR System. The test is a single test that detects the three most prevalent non-viral sexually transmitted infections (STIs) — Chlamydia trachomatis (CT), Neisseria gonorrhoeae (GC) and Trichomonas vaginalis (TV). These three STIs can include a range of negative patient outcomes, from pregnancy complications to increased risk of HIV.

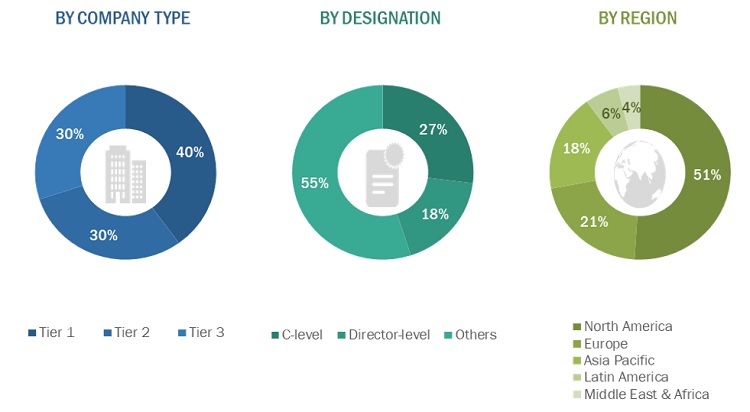

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

Lits of Companies Profiled in the Report:

- Abbott Laboratories (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- bioMérieux SA (France)

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Quidel Corporation(US)

- Hologic, Inc. (US)

- Bio-Rad Laboratories, Inc. (US)

- QIAGEN (Netherlands)

- DiaSorin S.p.A (Italy)

- Grifols S.A. (Spain)

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Device Type, type of testing, disease type, end user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMérieux SA (France), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Quidel Corporation(US), Hologic, Inc. (US), Bio-Rad Laboratories, Inc. (US), QIAGEN (Netherlands), DiaSorin S.p.A (Italy), Grifols S.A. (Spain). |

This report categorizes the infectious disease diagnostics market into the following segments and subsegments:

By Disease Type

- CT/NG

- Gonorrhea

- HIV/AIDS

- Genital Herpes (HSV-1, HSV-2)

- Hepatitis B

- Syphilis

- Mycoplasma Genitalium

- Genital Warts

- Candidal Vaginitis

- Trichomoniasis (Trichomonas Vaginitis)

- Bacterial Vaginosis

- HPV

- Other STDS

By Type of Testing

- Culture/Isolation Of Organisms

- Molecular Test

- Immunology Assay

- Other Types Of Testing

By Device Type

- Laboratory Devices

- Thermal Cyclers – PCR

- Lateral Flow Readers

- Flow Cytometers

- Absorbance Microplate Reader

- Differential Light Scattering Machines

- Point Of Care (Poc) Devices

- Phone Chips (Microfluidics + ICT)

- Portable/Bench Top/Rapid Diagnostic Kits

By End User

- Laboratory

- Commerical/Private Labs

- Public Health Labs

- Point of Care (POC)

By Region

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 GROWTH RATE ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Global prevalence of STDs

5.2.1.2 Rising focus on R&D and funding in STD diagnostics and favorable reimbursement scenario

5.2.1.3 Growing awareness programs for early disease diagnosis in developing countries

5.2.1.4 Rising technological advancements in STD disease diagnostics

5.2.1.5 Shift in focus from centralized laboratories to decentralized POC testing R&D spending

5.2.2 RESTRAINTS

5.2.2.1 Unfavorable scenario due to social stigma related to sexual diseases

5.2.2.2 Huge proportion of patients infected with STDs in remote areas

5.2.3 OPPORTUNITIES

5.2.3.1 Developing and underdeveloped countries offering huge potential for STD diagnosis

5.3 IMPACT OF COVID-19 ON THE STD DIAGNOSTICS MARKET

5.4 PRICING ANALYSIS

5.5 PATENT ANALYSIS

5.6 TRADE ANALYSIS

5.7 VALUE CHAIN ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

5.9 ECOSYSTEM ANALYSIS OF STD DIAGNOSTICS MARKET

5.10 PORTER’S FIVE FORCES ANALYSIS

5.11 PESTLE ANALYSIS

5.12 REGULATORY LANDSCAPE

5.13 TECHNOLOGY ANALYSIS

5.14 DISRUPTIVE TECHNOLOGIES IN STD DIAGNOSTICS MARKET

6 GLOBAL STD DIAGNOSTICS MARKET, BY TYPE (USD MILLION) (VOLUME IN NUMBER OF TESTS)

6.1 INTRODUCTION

6.2 CT/NG

6.3 HIV/AIDS

6.4 GONORRHEA

6.5 GENITAL HERPES (HSV-1, HSV-2)

6.6 HEPATITIS B

6.7 SYPHILIS

6.8 MYCOPLASMA GENITALIUM

6.9 GENITAL WARTS

6.10 CANDIDAL VAGINITIS

6.11 TRICHOMONIASIS (TRICHOMONAS VAGINITIS)

6.12 BACTERIAL VAGINOSIS

6.13 HPV

6.14 OTHER STDS

7 GLOBAL STD DIAGNOSTICS MARKET, BY TYPE OF TESTING (USD MILLIONS)

7.1 INTRODUCTION

7.2 CULTURE

7.3 MOLECULAR TEST

7.4 IMMUNOLOGY ASSAY

7.5 OTHER TYPES OF TESTING

8 GLOBAL STD DIAGNOSTICS MARKET, BY DEVICE TYPE (USD MILLIONS)

8.1 INTRODUCTION

8.2 LABORATORY DEVICES

8.2.1 THERMAL CYCLERS - PCR

8.2.2 LATERAL FLOW READERS

8.2.3 FLOW CYTOMETERS

8.2.4 ABSORBANCE MICROPLATE READER

8.2.5 DIFFERENTIAL LIGHT SCATTERING MACHINES

8.3 POINT OF CARE (POC) DEVICES

8.3.1 PHONE CHIPS (MICROFLUIDICS + ICT)

8.3.2 PORTABLE/BENCH TOP/RAPID DIAGNOSTIC

9 GLOBAL STD DIAGNOSTICS MARKET, BY END USER (USD MILLIONS)

9.1 INTRODUCTION

9.2 LABORATORIES

9.2.1 PRIVATE LABS

9.2.2 PUBLIC HEALTH LABS

9.3 POINT OF CARE

10 GLOBAL STD DIAGNOSTICS MARKET, BY REGION (USD MILLIONS)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 GERMANY

10.3.2 UK

10.3.3 FRANCE

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 INDIA

10.4.4 REST OF ASIA PACIFIC

10.5 LATIN AMERICA

10.5.1 BRAZIL

10.5.2 MEXICO

10.5.3 REST OF LATAM

10.6 MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT

11.6 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES (2020)

11.7 COMPETITIVE BENCHMARKING

11.8 COMPETITIVE SCENARIO

12 COMPANY PROFILES

12.1 KEY PLAYERS

(Business Overview, Products and Services Offered, Recent Developments, MnM View, Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats)*

12.1.1 DIASORIN S.P.A.

12.1.2 MEDMIRA INC.

12.1.3 F. HOFFMAN LA ROCHE LTD.

12.1.4 ABBOTT LABORATORIES

12.1.5 BECTON DICKINSON AND CO.

12.1.6 CEPHEID

12.1.7 QIAGEN

12.1.8 AFFYMETRIX

12.1.9 GENEPROOF

12.1.10 SANSURE

12.1.11 ASTRA BIOTECH GMBH

12.1.12 LIFERIVER

*Details on Business Overview, Products and Services Offered, Recent Developments, MnM View, Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

13 APPENDIX

13.1 INDUSTRY INSIGHTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

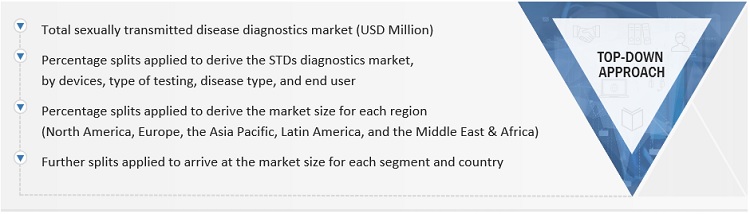

This study involved four major activities in estimating the current size of the Sexually Transmitted Disease Diagnostics Market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the STDs diagnostics market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the STDs diagnostics market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global STDs Diagnostics Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the global Sexually Transmitted Disease Diagnostics Market by device type, type of testing, disease type, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as acquisitions, product launches and approvals, expansions, and other developments in the STDs diagnostics market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

Sexually Transmitted Disease Diagnostics market size and growth rate estimates for countries in the Rest of Europe, the Rest of Asia Pacific, Latin America, and Middle East & Africa

Company profiles

Company profiles of 30 players operating in the Sexually Transmitted Disease Diagnostics Market.

Growth opportunities and latent adjacency in Sexually Transmitted Diseases Diagnostics Market