Service Assurance Market by Component (Platforms and Solutions, and Services), Organization Size (SMEs, Large Enterprises), Deployment Mode (On-premises, Cloud), End Use Industries (Telecommunication, IT, Government, Transportation, Retail, Healthcare, Other End Use Industries) and Region - Global Forecast to 2027

Service Assurance is the policy and process that helps the technology provider to enhance customer satisfaction and improve service quality. The service assurance includes solutions and tools which includes performance management, fault management, quality of service management, quality assurance, service level management, network testing, quality control, traffic management, probe monitoring and more. These solutions enable customers to increase operational efficiency, detect network fault, predictive analysis, and improve helps to enhance customer experience, and automatically increases the profitability of business.

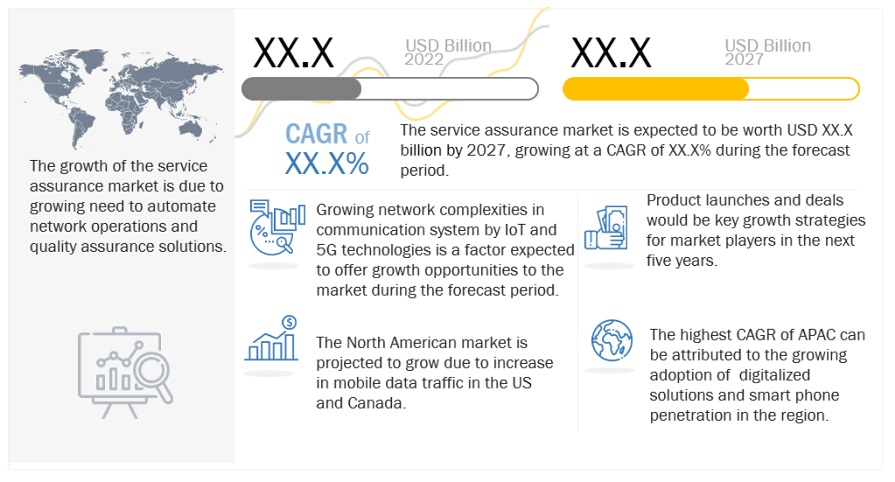

The global service assurance market size is expected to grow from USD XX.X billion in 2022 to USD XX.X billion by 2027, at a CAGR of XX.X%. The need to improve and automate the capabilities to serve customers with best-in-class experience is expected to drive the market growth.

Drivers: Increasing smart device users in telecom sector will drive the market.

Due to increasing trend of digitalization in various verticals demand of smart devices is increasing in a fast pace. According to Mobile Economy Report of Global System for Mobile communications Association (GSMA), the number of mobile subscribers is expected to reach at XX.X billion in 2025. To handle the large amount of data traffic and fulfill the requirement of huge number of users, telecom operators are expected to adopt service assurance solutions. The changing trend of digitalization in the world have forced the companies to invest heavily in service assurance platforms and reorganize their business to increase customer satisfaction and hence increase revenue.

Drivers: Growing need to automate the network operations and resolve network issue.

Communication service providers are adopting service assurance solutions to offer unique service experience to their customers to maintain long term relationship by offering early network fault detection and correction, performance management, quality assurance and control tools. Operators worldwide need new ways of launching, monitoring, managing, and ensuring the quality and performance of their services and networks with an ever-increasing degree of automation. This trend will increase the demand of service assurance market in the forecast period.

Challenges: High cost of deploying service assurance solution can hinder the growth of the market.

Deployment cost of service assurance solution is high and need huge maintenance cost too. Due to this few companies are not adopting this solution and still relying on traditional system. The requirement of heavy investments can affect the demand of service assurance solutions, which in turn, may hamper the growth of market.

Key players in the market

Comarch (Poland), NETSCOUT (US), Broadcom (US), NEC (Japan), Ericsson (Sweden), EXFO (Canada), Anritsu (Japan), Amdocs (UK), Cisco (US), Huawei (China) are few key players in the service assurance market globally.

Recent Developments

- In September 2022, Anritsu and SecuPi entered into partnership with Data Protection and GDPR Data compliance to provide automate service assurance solution in telecommunication provider.

- In September 2021, Anritsu announced the deployment of 5G based standalone service assurance solution with amazon web services in the public cloud.

- In July 2021, NETSCOUT has launched smart edge monitoring solution to provide real-time visibility and insights to ensure the high-quality experience to customers.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 SERVICE ASSURANCE MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 FACTOR ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN THE SERVICE ASSURANCE MARKET

4.2 MARKET, BY COMPONENT

4.3 MARKET, BY ORGANIZATION SIZE

4.4 MARKET, BY DEPLOYMENT MODE

4.5 MARKET, BY END USE INDUSTRIES AND REGION

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 INDUSTRY TRENDS

5.3.1 ECOSYSTEM: SERVICE ASSURANCE MARKET

5.3.2 CASE STUDIES

5.3.2.1 Use Case 1

5.3.2.2 Use Case 2

5.3.2.3 Use case 3

5.3.2.4 Use Case 4

5.3.2.5 Use Case 5

5.3.3 PATENT ANALYSIS

5.3.3.1 Methodology

5.3.3.2 Types of Patents

5.3.3.3 Innovation And Patent Applications

5.3.3.3.1 Top applicants

5.3.4 VALUE CHAIN ANALYSIS

5.3.5 PORTER’S FIVE FORCES ANALYSIS

5.3.5.1 Threat of new entrants

5.3.5.2 Threat of substitutes

5.3.5.3 Bargaining power of suppliers

5.3.5.4 Bargaining power of buyers

5.3.5.5 Intensity of competitive rivalry

5.3.6 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.7 PRICING ANALYSIS

5.3.7.1 Pricing models and indicative price points

5.3.8 TECHNOLOGY ANALYSIS

5.3.8.1 AI/ML

5.3.8.2 IoT

5.3.8.3 5G

5.3.8.4 Big data and Analytics

5.3.8.5 Cloud Computing

5.3.9 KEY CONFERENCES AND EVENTS IN 2022-2023

5.3.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.11 REGULATORY LANDSCAPE

5.3.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

6 SERVICE ASSURANCE MARKET SIZE, BY COMPONENT

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.2 PLATFORMS AND SOLUTIONS

6.3.1 PERFORMANCE MANAGEMENT

6.3.2 FAULT AND EVENT MANAGEMENT

6.3.3 QUALITY OF SERVICE MANAGEMENT

6.3.4 NETWORK AND SERVICE TESTING

6.3.5 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.2 MANAGED SERVICES

7 SERVICE ASSURANCE MARKET SIZE, BY ORGANIZATION SIZE

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: MARKET DRIVERS

7.2 SMES

7.3 LARGE ENTERPRISES

8 MARKET SIZE, BY DEPLOYMENT MODE

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: MARKET DRIVERS

8.2 CLOUD

8.3 ON-PREMISES

9 SERVICE ASSURANCE MARKET SIZE, BY END USE INDUSTRIES

9.1 INTRODUCTION

9.1.1 END USE INDUSTRIES: MARKET DRIVERS

9.2 TELECOM

9.3 IT

9.4 GOVERNMENT

9.5 TRANSPORTATION

9.6 RETAIL

9.7 HEALTHCARE

9.8 OTHER END USE INDUSTRIES

10 SERVICE ASSURANCE MARKET SIZE, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: PESTLE ANALYSIS

10.2.2 UNITED STATES

10.2.3 CANADA

10.3 EUROPE

10.3.1 EUROPE: PESTLE ANALYSIS

10.3.2 UNITED KINGDOM

10.3.3 GERMANY

10.3.4 FRANCE

10.3.5 SPAIN

10.3.6 ITALY

10.3.7 NORDICS

10.3.8 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: PESTLE ANALYSIS

10.4.2 CHINA

10.4.3 INDIA

10.4.4 JAPAN

10.4.5 AUSTRALIA AND NEW ZEALAND

10.4.6 SOUTH EAST ASIA

10.4.7 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: PESTLE ANALYSIS

10.5.2 MIDDLE EAST

10.5.2.1 UAE

10.5.2.2 KSA

10.5.2.3 REST OF MIDDLE EAST

10.5.3 AFRICA

10.5.3.1 SOUTH AFRICA

10.5.3.2 EGYPT

10.5.3.3 NIGERIA

10.5.3.4 REST OF AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: PESTLE ANALYSIS

10.6.2 BRAZIL

10.6.3 MEXICO

10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SERVICE ASSURANCE SOLUTION PROVIDERS

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

11.4 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

11.5 KEY COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.6 COMPETITIVE BENCHMARKING

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

11.8 COMPETITIVE SCENARIO AND TRENDS

11.8.1 PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHERS

12 COMPANY PROFILES

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 NETSCOUT

12.2.1.1 Business and Financial overview

12.2.1.2 Recent developments

12.2.1.3 MNM VIEW

12.2.1.3.1 Key strengths/right to win

12.2.1.3.2 Strategic choices made

12.2.1.3.3 Weaknesses and competitive threats

12.2.2 NEC

12.2.2.1 Business and Financial Overview

12.2.2.2 Recent developments

12.2.2.3 MNM VIEW

12.2.2.3.1 Key strengths/right to win

12.2.2.3.2 Strategic choices made

12.2.2.3.3 Weaknesses and competitive threats

12.2.3 ERICSSON

12.2.3.1 Business and Financial Overview

12.2.3.2 Recent developments

12.2.3.3 MNM VIEW

12.2.3.3.1 Key strengths/right to win

12.2.3.3.2 Strategic choices made

12.2.3.3.3 Weaknesses and competitive threats

12.2.4 AMDOCS

12.2.4.1 Business and Financial Overview

12.2.4.2 Recent Developments

12.2.4.3 MNM VIEW

12.2.4.3.1 Key strengths/right to win

12.2.4.3.2 Strategic choices made

12.2.4.3.3 Weaknesses and competitive threats

12.2.5 NOKIA

12.2.5.1 Business and Financial Overview

12.2.5.2 Recent Developments

12.2.5.3 MnM View

12.2.5.3.1 Key strengths/right to win

12.2.5.3.2 Strategic choices made

12.2.5.3.3 Weaknesses and competitive threats

12.2.6 HPE

12.2.6.1 Business and Financial Overview

12.2.6.2 Recent developments

12.2.7 BROADCOM

12.2.7.1 Business and Financial Overview

12.2.7.2 Recent developments

12.2.8 ACCENTURE

12.2.8.1 Business and Financial Overview

12.2.8.2 Recent developments

12.2.9 COMARCH

12.2.9.1 Business and Financial Overview

12.2.9.2 Recent developments

12.2.10 HUAWEI

12.2.10.1 Business and Financial Overview

12.2.10.2 Recent developments

12.2.10 CISCO

12.2.12 IBM

12.2.13 COMMSCOPE

12.2.14 EXFO

12.2.15 COMVIVA

12.2.16 VIAVI

12.2.17 TEOCO

12.2.18 ANRITSU

12.2.19 SPIRENT

12.2.20 RAKUTEN

12.2.21 JUNIPER NETWORKS

12.2.22 SPLUNK

12.2.23 INFOSYS

12.2.24 WIPRO

12.3 STARTUPS/ SMES

12.3.1 MAGNOOS

12.3.2 ZENOSS

12.3.3 MYCOM OSI

12.3.4 INFOVISTA

12.3.5 CENTINA

12.3.6 RADCOM

(The list of players is subject to further modification over the course of research)

Growth opportunities and latent adjacency in Service Assurance Market