Sensor Testing Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Oscilloscope, Multimeter, Spectrum Analyzer, Signal Generator), Software, Sensor Type (Analog, Digital Sensors), Application (Automotive, Consumer Electronics, Aerospace, Healthcare, Industrial) - Global Growth Driver and Industry Forecast to 2028

Updated on : October 22, 2024

Sensor Testing Market Size & Growth

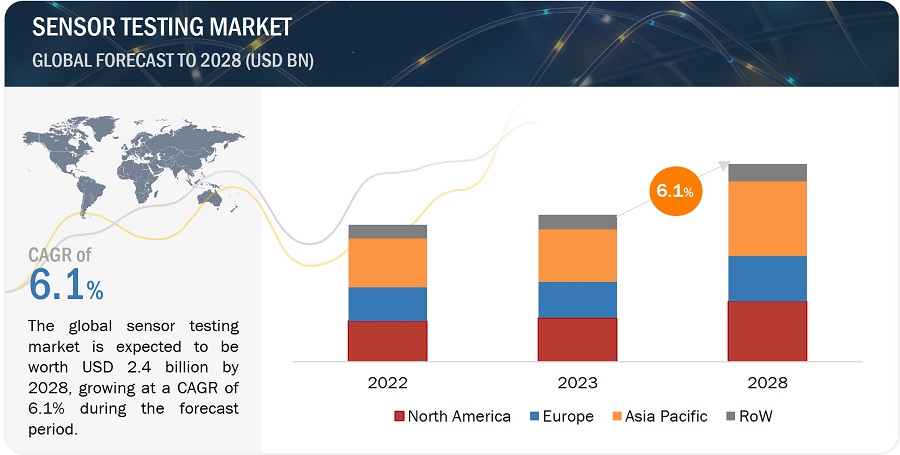

Global sensor testing market size is estimated to be worth USD 1.8 billion in 2023 and is projected to reach USD 2.4 billion by 2028, growing at a CAGR of 6.1% during the forecast period from 2023 to 2028.

The growing demand for sensor testing in hybrid and autonomous vehicles and the rising adoption of IoT is contributing to this market growth. The market is likely to witness increased demand for specialized testing methodologies, customized solutions, and the integration of AI and analytics, ultimately driving innovation and global market reach while addressing the evolving complexities of modern sensor applications.

Sensor Testing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Sensor Testing Market Overview

The Sensor Testing Market is poised for significant growth driven by the escalating demand for sensors in various industries, including automotive, consumer electronics, aerospace, healthcare, and industrial applications. The growing demand for sensors in hybrid and autonomous vehicles and the rising adoption of IoT are major factors contributing to this market growth. Additionally, the need for quality control and the increasing complexity of sensor applications are driving the demand for comprehensive sensor testing services and solutions. The market is expected to witness increased demand for specialized testing methodologies, customized solutions, and the integration of AI and analytics, ultimately driving innovation and global market reach while addressing the evolving complexities of modern sensor applications.

Sensor Testing Market Trends and Dynamics

Driver: Surging demand for sensors in hybrid and autonomous vehicles

The demand for sensor testing in the automotive industry has increased significantly due to the growing complexity of automotive systems and the increasing adoption of advanced driver-assistance systems (ADAS) that rely heavily on sensor technology. Sensor testing is critical in the automotive industry to ensure that sensors are functioning accurately and providing correct data. Automotive sensors are used to monitor various aspects of vehicle performance, such as speed, acceleration, temperature, pressure, and proximity, among others. Therefore, the accurate and reliable operation of these sensors is crucial to the safe and efficient operation of the vehicle. In addition, the automotive industry is constantly evolving, with new technologies and innovations emerging regularly. This requires continuous sensor testing to ensure that sensors are compatible with new systems and technologies and that they function correctly under various conditions and environments.

Restraint: High cost of sensor testing equipment

While using a sensor tester, there are several costs that may be incurred as part of the testing process includes, including equipment costs, labor costs, material costs, maintenance and calibration cost, and downtime costs. These equipment are expensive for a variety of reasons as the research and development expenses for equipment designing, cost of production, maintenance, and servicing. The complexity of the sensors themselves is one of the factors contributing to their high cost. Testing can be a time-consuming process that needs qualified workers to complete depending on the complexity of the sensor and the testing processes involved. This may lead to higher labor expenses or a delay in the release of products. There are numerous types of sensors, each having its own unique characteristics and specification for performance. It takes a lot of research and development work, which can be expensive, to create testing apparatus that can precisely and consistently test all these distinct types of sensors.

Opportunity: Growing demand for sensors in emerging markets such as automotive and consumer electronics

In many industries, such as automotive and consumer electronics, there is a strong focus on industrialization and modernization, which is driving the adoption of advanced technologies such as sensors. Sensors play a critical role in enabling automation and digitization by collecting and transmitting data that can be used to optimize processes, improve efficiency, and reduce costs. As product design and development become more complex, the need for highly accurate, sophisticated sensors for test and measurement applications will increase. Moreover, manufacturers are increasing their production of sensors to meet this demand. This increased production leads to a greater need for testing to ensure that the sensors are functioning properly and meeting the required specifications. With growing technology and demand for new sensor applications, manufacturers are increasingly investing in quality control measures to ensure that their products meet the required standards and are reliable. The increasing demand for sensor testing in emerging markets such as China and India is being driven by a range of factors, including technological advancements, the need for quality control, and government regulations. This trend is expected to continue as these regions continue to invest in innovation and new technologies. This has led to an increased demand for sensors, which creates an opportunity for sensor testing companies to expand their services to these regions.

Challenge: Lack of common standardization

There are various types of sensors, such as temperature, moisture, gas, proximity, motion, light, sound, humidity, and chemical, among others. These sensors need to undergo testing to verify their performance and functionality and to ensure they deliver reliable and accurate sensing data. However, without common standards for sensor testing, different testing labs use several test methods for evaluating sensors, such as visual inspection, functional testing, calibration testing, and environmental and performance testing. Therefore, it can be difficult to compare the effectiveness of various sensors because of variations in testing results with diverse methods used. Moreover, many devices and systems, such as home automation systems, automotive systems, medical devices, and industrial control systems, depend on sensors, so reliable and precise performance is essential.

Sensor Testing Market Ecosystem

Sensor Testing Market: Key Trends

TE Connectivity Ltd. (Switzerland), National Instruments Corp. (US), Keysight Technologies, Inc. (US), Fluke Corporation (US), and Rohde & Schwarz GmbH & Co. KG (Germany) are the top players in the sensor testing market. These sensor testing companies boast sensor trends with a comprehensive product portfolio and solid geographic footprint.

Sensor Testing Market Segmentation

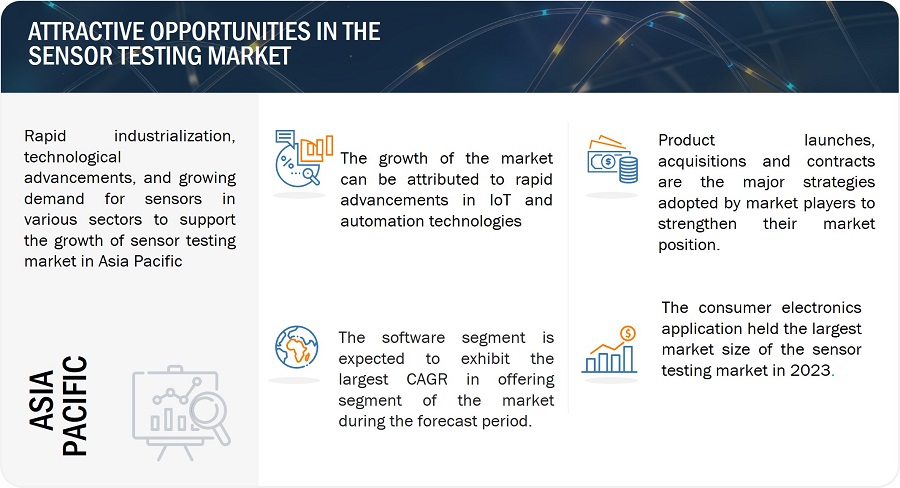

Software to grow at the highest CAGR in the offering segment of the sensor testing market during 2023-2028.

Software facilitates efficient, accurate, and systematic evaluation of sensor performance. It provides a structured framework for designing and executing complex testing scenarios, enabling the simulation of diverse real-world conditions that might be impractical or hazardous to replicate physically. Software-driven sensor testing allows for precise control over test parameters, data collection, and analysis, ensuring consistency and repeatability in results. Through automated routines and advanced algorithms, the software accelerates testing processes, reduces human error, and enables rapid iteration and optimization. Additionally, software platforms offer intuitive data visualization tools and statistical analysis capabilities that aid in deciphering sensor behavior, identifying anomalies, and making informed decisions, ultimately leading to enhanced sensor reliability and effectiveness across various industries and applications.

Industrial application to grow at the highest CAGR of the sensor testing market during the forecast period.

In industrial applications, the emphasis of sensor testing lies in performance verification. This entails assessing crucial aspects such as the sensor's response time, linearity, repeatability, sensitivity, and robustness. Through performance testing, the sensor's adherence to specified requirements is confirmed, along with its ability to withstand the demanding operational conditions typically encountered in industrial environments. In industrial applications, sensor testing encompasses environmental testing as well. This involves subjecting sensors to extreme temperatures, humidity, vibrations, and other environmental factors. By conducting environmental testing, the sensors' capacity to endure these conditions while preserving their performance and durability is ensured. This process aids in identifying any potential issues that may arise in real-world industrial settings, facilitating necessary design improvements or modifications.

Sensor Testing Industry Regional Analysis

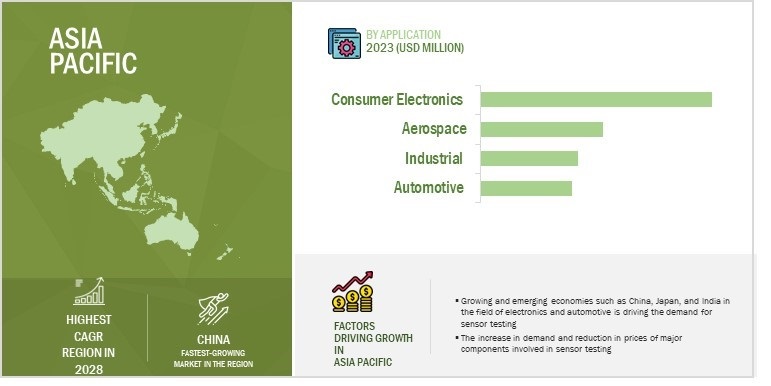

Asia Pacific is expected to grow at the highest CAGR in the sensor testing industry during the forecast period.

Asia Pacific region offers a promising landscape for sensor testing services due to its rapid industrialization, technological advancements, and growing demand for sensors in various sectors. The need for quality assurance, compliance with regulations, and reliable sensor performance drives the demand for comprehensive and accurate sensor testing solutions in this region. Moreover, favorable regulatory policies for the approval of new electronics technologies and the saturation of the market in developed countries are further intensifying the interest of foreign players in expanding their presence in the Asia Pacific.

Sensor Testing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Sensor Testing Companies - Market Key Players

The major sensor testing companies include

- TE Connectivity Ltd. (Switzerland),

- National Instruments Corp. (US),

- Keysight Technologies, Inc. (US),

- Fluke Corporation (US),

- and Rohde & Schwarz GmbH & Co. KG (Germany).

These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships, to strengthen their position in the sensor testing market.

Sensor Testing Market Applications

The Sensor Testing Market encompasses a wide range of applications across various industries. Real-world applications include medical diagnostics, environmental monitoring, smart homes, and industrial automation. In industrial settings, sensor testing is crucial for ensuring the performance and reliability of sensors used in control processes, monitoring systems, and automated systems.

The market is also driven by the growing demand for sensors in emerging markets such as automotive and consumer electronics, where sensors play a critical role in enabling automation and digitization. Additionally, the increasing adoption of IoT and the need for quality control in various sectors are driving the demand for sensor testing services and solutions.

The market is expected to witness increased demand for specialized testing methodologies, customized solutions, and the integration of AI and analytics, ultimately driving innovation and global market reach while addressing the evolving complexities of modern sensor applications.

Sensor Testing Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.8 Billion in 2023 |

|

Projected Market Size |

USD 2.4 Billion by 2028 |

|

Growth Rate |

CAGR of 6.1% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/Billion) |

|

Segments Covered |

Offering, Sensor Type, and Application |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

TE Connectivity Ltd. (Switzerland), National Instruments Corp. (US), Keysight Technologies, Inc. (US), Fluke Corporation (US), and Rohde & Schwarz GmbH & Co. KG (Germany). A total of 25 players are covered. |

Sensor Testing Market Highlights

In this report, the overall sensor testing market has been segmented based on offering, sensor type, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Sensor Type |

|

|

By Application |

|

|

By Region |

|

Recent Developments in Sensor Testing Industry

- In April 2023, Keysight Technologies, Inc. unveiled a new real-time spectrum analysis (RTSA) solution that can support a maximum RTSA bandwidth of 2 GHz and is compatible with the Keysight N9042B UXA Signal Analyzer. This software-based RTSA solution can effectively monitor satellite signals and interference, enabling satellite network operators to ensure optimal service quality (QoS) for their users.

- In February 2023, TE Connectivity and Preddio collaborated to develop innovative solutions that integrate TE's digital sensors with Preddio's wireless technology, edge gateway, cloud software, and analytics. These integrated solutions offer operators unprecedented visibility into the condition of their equipment.

- In September 2022, Rohde & Schwarz GmbH & Co. KG expanded their product line of signal and spectrum analyzers by introducing the R&S FSV3050 and R&S FSVA3050 variants. These new models offer an extended frequency range of up to 50 GHz. The R&S FSV is designed to simplify the setup of complex measurements with its user-friendly interface and high measurement speed.

Frequently Asked Questions (FAQs)

What is the current size of the global sensor testing market?

The sensor testing market is estimated to be worth USD 1.8 billion in 2023 and is projected to reach USD 2.4 billion by 2028, at a CAGR of 6.1% during the forecast period. The Increased demand for sensors in emerging markets such as automotive and consumer electronics are major factors driving the growth of the global sensor testing market.

Who are the global sensor testing market winners?

Companies such as TE Connectivity Ltd. (Switzerland), National Instruments Corp. (US), Keysight Technologies, Inc. (US), Fluke Corporation (US), and Rohde & Schwarz GmbH & Co. KG (Germany) fall under the winners’ category.

Which region is expected to hold the highest share of the sensor testing market?

Asia Pacific will dominate the sensor testing market in 2028. Countries in the Asia Pacific are showing growth from nascent sectors such as consumer electronics, industrial and automotive sectors. Moreover, rapidly growing economies, technological advancements, and burgeoning industries. With key players, research initiatives, and innovation centers spread across countries like China, Japan, and South Korea, the region is positioned to lead in sensor testing developments, catering to a wide array of applications from industrial automation to consumer electronics.

What are the major drivers and opportunities related to the sensor testing market share?

Surging demand for sensors in hybrid and autonomous vehicles and growing demand for sensors in emerging markets such as automotive and consumer electronics are some of the major drivers and opportunities for the sensor testing market.

What are the major strategies adopted by sensor testing companies?

The agitator companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the sensor testing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Surging use of sensors in hybrid and autonomous vehicles- Rising adoption of IoT and automation technologiesRESTRAINTS- High cost of sensor testing equipment- Rapidly evolving sensor technologiesOPPORTUNITIES- Emerging sensor applications in automotive and consumer electronics sectors- Rising adoption of predictive maintenance techniques by manufacturing firmsCHALLENGES- Lack of common testing standards- Difficulties in calibrating sensors under varied environmental conditions

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TRENDPRICING ANALYSIS OF SENSOR TESTING EQUIPMENT OFFERED BY KEY PLAYERS

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISNON-DESTRUCTIVE TESTINGPREDICTIVE ANALYTICSARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGIOT

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS

- 6.1 INTRODUCTION

-

6.2 VISUAL INSPECTIONPHYSICAL INSPECTIONCONNECTION AND ASSEMBLY VERIFICATIONLABELING AND PACKAGING

-

6.3 FUNCTIONAL TESTINGRESPONSE TIME TESTINGSENSITIVITY TESTINGSIGNAL CONDITIONING TESTING

-

6.4 CALIBRATION TESTINGCOMPARISON CALIBRATIONSOFTWARE-BASED CALIBRATIONCALIBRATION SOFTWARE AND DATA MANAGEMENT

-

6.5 ENVIRONMENTAL TESTINGTEMPERATURE TESTINGHUMIDITY TESTINGVIBRATION TESTINGEMI/EMC TESTING

-

6.6 PERFORMANCE TESTINGACCURACY TESTINGSENSITIVITY TESTINGLINEARITY TESTINGDYNAMIC RANGE TESTINGDRIFT TESTING

-

6.7 OTHER TESTING TECHNIQUESCOMPARISON TESTINGLIFE TESTINGDURABILITY TESTINGSTABILITY TESTING

- 7.1 INTRODUCTION

-

7.2 HARDWAREMULTIMETERS- Rising use of multimeters to measure electrical parameters in sensors to drive segmental growthOSCILLOSCOPES- Growing adoption of oscilloscopes to visualize and analyze electrical signals to fuel segmental growthSPECTRUM ANALYZERS- Increasing use of spectrum analyzers to analyze electromagnetic interference affecting sensor performance to drive marketSIGNAL GENERATORS- Surging demand for signal generators to test overall functionality of sensors to accelerate market growthOTHER HARDWARE OFFERINGS

-

7.3 SOFTWARERISING NEED FOR EFFICIENT EVALUATION AND CHARACTERIZATION OF SENSOR PERFORMANCE TO BOOST SOFTWARE DEMAND

- 8.1 INTRODUCTION

-

8.2 ANALOGINCREASING USE OF ANALOG SENSORS TO CALIBRATE SENSOR PERFORMANCE ON ACCURACY, NOISE LEVELS, AND RESPONSE TIME TO DRIVE MARKETACCELEROMETERSSOUND SENSORSPRESSURE SENSORSTEMPERATURE SENSORSLIGHT SENSORSHUMIDITY SENSORS

-

8.3 DIGITALGROWING IMPLEMENTATION OF DIGITAL SENSORS TO CONVERT PHYSICAL QUANTITIES INTO DIGITAL SIGNALS TO FUEL SEGMENTAL GROWTHLEVEL SENSORSMAGNETIC SENSORSPROXIMITY SENSORSMOTION SENSORSOPTICAL ENCODERS

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVERISING DEMAND FOR SENSOR TESTING FROM SELF-DRIVING AND HYBRID CAR MANUFACTURERS TO SUPPORT MARKET GROWTH

-

9.3 CONSUMER ELECTRONICSGROWING ATTENTION OF CONSUMER ELECTRONICS COMPANIES ON INCREASING CREDIBILITY AND MARKET COMPETITIVENESS TO BOOST DEMAND FOR SENSOR TESTING EQUIPMENT

-

9.4 AEROSPACEINCREASING FOCUS ON OPTIMIZING PERFORMANCE, SAFETY, AND EFFICIENCY OF AEROSPACE SYSTEMS TO FOSTER ADOPTION OF SENSOR TESTING SERVICES

-

9.5 HEALTHCARESURGING NEED FOR ACCURATE AND PRECISE MEDICAL DEVICES TO INCREASE DEMAND FOR SENSOR TESTING EQUIPMENT

-

9.6 INDUSTRIALGROWING USE OF INDUSTRY 4.0 AND IIOT TECHNOLOGIES BY INDUSTRIAL PLAYERS TO ELEVATE DEMAND FOR SENSOR TESTING

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing adoption of electric vehicles and smart grid systems to fuel market growthCANADA- Rising focus on improving environmental sustainability to boost demand for sensor testing equipmentMEXICO- Growing manufacturing sector to create opportunities for sensor testing service providers

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Booming automotive industry to drive marketUK- Rising investments and innovations in sensor technologies to support market growthFRANCE- Thriving aerospace & defense sector to contribute to market growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Smart city initiatives by government to boost adoption of sensor testing equipmentJAPAN- Increasing FDIs in robotics and automation technologies to create opportunities for market playersSOUTH KOREA- Rising investments in cutting-edge manufacturing technologies to contribute to market growthREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)ROW: RECESSION IMPACTSOUTH AMERICA- Heavy reliance of aerospace, energy, and healthcare sectors on advanced technologies to boost demand for sensor testingMIDDLE EAST & AFRICA- Growing manufacturing sector to support market growth

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 SENSOR TESTING MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSTE CONNECTIVITY LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNATIONAL INSTRUMENTS CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKEYSIGHT TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFLUKE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROHDE & SCHWARZ GMBH & CO. KG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTERADYNE INC.- Business overview- Products/Solutions/Services offered- Recent developmentsOMEGA ENGINEERING, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsADVANTEST CORPORATION- Business overview- Product/Solutions/Services offered- Recent developmentsPEPPERL+FUCHS SE- Business overview- Products/Solutions/Services offered- Recent developmentsANRITSU CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSTÜV RHEINLAND AGVX INSTRUMENTS GMBHELEMENT MATERIALS TECHNOLOGYITM INTEGRATED TEST + MEASUREMENTUL LLCUNI-TREND TECHNOLOGY (CHINA) CO., LTD.RIGOL TECHNOLOGIES, CO. LTD.AECO SRLU-THERM INTERNATIONAL (H.K.) LIMITEDBOSCH SENSORTEC GMBHHORIBA, LTD.B&K PRECISION CORPORATIONMEASX GMBH & CO. KGTEKTRONIX, INC.H&B SENSORS LTD.

- 13.1 TEST AND MEASUREMENT EQUIPMENT MARKET

- 13.2 INTRODUCTION

-

13.3 AUTOMOTIVE & TRANSPORTATIONINTEGRATION OF ADVANCED ELECTRONIC SYSTEMS IN VEHICLES TO BOOST DEMAND FOR TEST AND MEASUREMENT EQUIPMENT

-

13.4 AEROSPACE & DEFENSESAFETY AND RELIABILITY CONCERNS IN AIR TRAFFIC CONTROL SYSTEMS TO INCREASE ADOPTION OF TEST AND MEASUREMENT EQUIPMENT

-

13.5 IT & TELECOMMUNICATIONSGROWING USE OF WIRELESS TECHNOLOGIES TO FUEL REQUIREMENT FOR TEST AND MEASUREMENT EQUIPMENT

-

13.6 EDUCATION & GOVERNMENTHIGH DEMAND FOR GENERAL-PURPOSE TEST EQUIPMENT FROM EDUCATION & GOVERNMENT VERTICAL TO SUPPORT MARKET GROWTH

-

13.7 ELECTRONICS & SEMICONDUCTORRISING USE OF ADVANCED TECHNOLOGIES IN CONSUMER ELECTRONICS TO ACCELERATE NEED FOR TEST AND MEASUREMENT EQUIPMENT

-

13.8 INDUSTRIALINCREASING FOCUS ON MACHINE HEALTH MONITORING AND PREVENTIVE MAINTENANCE TO CONTRIBUTE TO MARKET GROWTH

-

13.9 HEALTHCARESURGING NEED FOR EFFECTIVE AND PRECISE MEDICAL DEVICES TO INCREASE DEMAND FOR TEST AND MEASUREMENT EQUIPMENT

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 ROLE OF PARTICIPANTS IN SENSOR TESTING ECOSYSTEM

- TABLE 2 ASP OF SENSOR TESTING EQUIPMENT, 2022 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF OSCILLOSCOPES, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF TOP 3 PRODUCTS PROVIDED BY TOP 3 PLAYERS (USD)

- TABLE 5 SENSOR TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 SAMSUNG FOUNDRY ADOPTS KEYSIGHT TECHNOLOGIES’ NOISE ANALYZER TO MEASURE LOW-FREQUENCY NOISE OF SEMICONDUCTOR DEVICES

- TABLE 9 ON SEMICONDUCTOR CORPORATION RELEASES ATE SOLUTION TO REDUCE IMAGE SENSOR TESTING TIME

- TABLE 10 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 11 LIST OF PATENTS RELATED TO MARKET

- TABLE 12 MARKET: CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 STANDARDS FOR SENSOR TESTING

- TABLE 18 SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 19 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 20 HARDWARE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 21 HARDWARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 HARDWARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 HARDWARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 HARDWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 HARDWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 SOFTWARE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 SOFTWARE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 SOFTWARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SENSOR TESTING MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 31 MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 32 ANALOG: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 ANALOG: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 DIGITAL: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 DIGITAL: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 SENSOR TESTING MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 AUTOMOTIVE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 39 AUTOMOTIVE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 40 AUTOMOTIVE: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 41 AUTOMOTIVE: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 42 AUTOMOTIVE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 AUTOMOTIVE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 CONSUMER ELECTRONICS: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 45 CONSUMER ELECTRONICS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 46 CONSUMER ELECTRONICS: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 AEROSPACE: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 51 AEROSPACE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 52 AEROSPACE: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 53 AEROSPACE: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 54 AEROSPACE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 AEROSPACE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 HEALTHCARE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 57 HEALTHCARE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 58 HEALTHCARE: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 59 HEALTHCARE: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 60 HEALTHCARE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 HEALTHCARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 INDUSTRIAL: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 63 INDUSTRIAL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 64 INDUSTRIAL: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 65 INDUSTRIAL: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 66 INDUSTRIAL: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 INDUSTRIAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 69 OTHER APPLICATIONS: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 70 OTHER APPLICATIONS: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 SENSOR TESTING MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 ROW: SENSOR TESTING MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 101 ROW: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 ROW: MARKET, BY SENSOR TYPE, 2019–2022 (USD MILLION)

- TABLE 103 ROW: MARKET, BY SENSOR TYPE, 2023–2028 (USD MILLION)

- TABLE 104 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 107 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 OVERVIEW OF STRATEGIES FOLLOWED BY PLAYERS IN MARKET

- TABLE 109 SENSOR TESTING MARKET SHARE ANALYSIS, 2022

- TABLE 110 OVERALL COMPANY FOOTPRINT

- TABLE 111 OFFERING: COMPANY FOOTPRINT

- TABLE 112 APPLICATION: COMPANY FOOTPRINT

- TABLE 113 REGION: COMPANY FOOTPRINT

- TABLE 114 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 115 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 116 MARKET: PRODUCT LAUNCHES, 2021−2023

- TABLE 117 MARKET: DEALS, 2021−2023

- TABLE 118 SENSOR TESTING MARKET: OTHERS, 2021−2023

- TABLE 119 TE CONNECTIVITY LTD.: COMPANY OVERVIEW

- TABLE 120 TE CONNECTIVITY LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 121 TE CONNECTIVITY LTD.: DEALS

- TABLE 122 NATIONAL INSTRUMENTS CORP.: COMPANY OVERVIEW

- TABLE 123 NATIONAL INSTRUMENTS CORP.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 124 NATIONAL INSTRUMENTS CORP.: PRODUCT LAUNCHES

- TABLE 125 NATIONAL INSTRUMENTS CORP.: DEALS

- TABLE 126 KEYSIGHT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 127 KEYSIGHT TECHNOLOGIES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 128 KEYSIGHT TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 129 KEYSIGHT TECHNOLOGIES, INC.: DEALS

- TABLE 130 KEYSIGHT TECHNOLOGIES, INC.: OTHERS

- TABLE 131 FLUKE CORPORATION: COMPANY OVERVIEW

- TABLE 132 FLUKE CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 133 FLUKE CORPORATION: PRODUCT LAUNCHES

- TABLE 134 ROHDE & SCHWARZ GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 135 ROHDE & SCHWARZ GMBH & CO. KG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 136 ROHDE & SCHWARZ GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 137 ROHDE & SCHWARZ GMBH & CO. KG: DEALS

- TABLE 138 TERADYNE INC.: COMPANY OVERVIEW

- TABLE 139 TERADYNE INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 140 TERADYNE INC.: DEALS

- TABLE 141 OMEGA ENGINEERING, INC.: COMPANY OVERVIEW

- TABLE 142 OMEGA ENGINEERING, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 143 OMEGA ENGINEERING, INC.: PRODUCT LAUNCHES

- TABLE 144 OMEGA ENGINEERING, INC.: DEALS

- TABLE 145 ADVANTEST CORPORATION: COMPANY OVERVIEW

- TABLE 146 ADVANTEST CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 147 ADVANTEST CORPORATION: PRODUCT LAUNCHES

- TABLE 148 ADVANTEST CORPORATION: DEALS

- TABLE 149 PEPPERL+FUCHS SE: COMPANY OVERVIEW

- TABLE 150 PEPPERL+FUCHS SE: PRODUCTS OFFERED

- TABLE 151 PEPPERL+FUCHS SE: PRODUCT LAUNCHES

- TABLE 152 PEPPERL+FUCHS SE: DEALS

- TABLE 153 ANRITSU CORPORATION: COMPANY OVERVIEW

- TABLE 154 ANRITSU CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 155 ANRITSU CORPORATION: PRODUCT LAUNCHES

- TABLE 156 ANRITSU CORPORATION: DEALS

- TABLE 157 TÜV RHEINLAND AG: COMPANY OVERVIEW

- TABLE 158 VX INSTRUMENTS GMBH: COMPANY OVERVIEW

- TABLE 159 ELEMENT MATERIALS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 160 ITM INTEGRATED TEST + MEASUREMENT: COMPANY OVERVIEW

- TABLE 161 UL LLC: COMPANY OVERVIEW

- TABLE 162 UNI-TREND TECHNOLOGY (CHINA) CO., LTD.: COMPANY OVERVIEW

- TABLE 163 RIGOL TECHNOLOGIES, CO. LTD.: COMPANY OVERVIEW

- TABLE 164 AECO SRL: COMPANY OVERVIEW

- TABLE 165 U-THERM INTERNATIONAL (H.K.) LIMITED: COMPANY OVERVIEW

- TABLE 166 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 167 HORIBA, LTD.: COMPANY OVERVIEW

- TABLE 168 B&K PRECISION CORPORATION: COMPANY OVERVIEW

- TABLE 169 MEASX GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 170 TEKTRONIX, INC.: COMPANY OVERVIEW

- TABLE 171 H&B SENSORS LTD.: COMPANY OVERVIEW

- TABLE 172 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 173 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 174 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 175 AUTOMOTIVE & TRANSPORTATION: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 176 AUTOMOTIVE & TRANSPORTATION: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 177 AUTOMOTIVE & TRANSPORTATION: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 AUTOMOTIVE & TRANSPORTATION: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 179 AUTOMOTIVE & TRANSPORTATION: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 180 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 181 AEROSPACE & DEFENSE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 AEROSPACE & DEFENSE: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 183 AEROSPACE & DEFENSE: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 184 AEROSPACE & DEFENSE: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 185 AEROSPACE & DEFENSE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 186 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 187 IT & TELECOMMUNICATIONS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 IT & TELECOMMUNICATIONS: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 189 IT & TELECOMMUNICATIONS: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 190 IT & TELECOMMUNICATIONS: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 191 IT & TELECOMMUNICATIONS: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 192 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 193 EDUCATION & GOVERNMENT: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 EDUCATION & GOVERNMENT: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 195 EDUCATION & GOVERNMENT: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 196 EDUCATION & GOVERNMENT: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 197 EDUCATION & GOVERNMENT: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 198 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 199 ELECTRONICS & SEMICONDUCTOR: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 200 ELECTRONICS & SEMICONDUCTOR: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 201 ELECTRONICS & SEMICONDUCTOR: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 202 ELECTRONICS & SEMICONDUCTOR: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 203 ELECTRONICS & SEMICONDUCTOR: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 204 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 205 INDUSTRIAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 206 INDUSTRIAL: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 207 INDUSTRIAL: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 208 INDUSTRIAL: MARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 209 INDUSTRIAL: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 210 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 211 HEALTHCARE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 212 HEALTHCARE: MARKET, BY PRODUCT TYPE, 2019–2022 (USD MILLION)

- TABLE 213 HEALTHCARE: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 214 HEALTHCARE: ARKET, BY SERVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 215 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 SENSOR TESTING MARKET SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY-SIDE): REVENUE FROM HARDWARE/SOFTWARE PRODUCTS IN MARKET

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SENSOR TESTING MARKET SIZE, 2019−2028 (USD MILLION)

- FIGURE 8 HARDWARE OFFERINGS ACCOUNTED FOR LARGER MARKET SHARE THAN SOFTWARE OFFERINGS IN 2022

- FIGURE 9 ANALOG SEGMENT TO DOMINATE MARKET, BY SENSOR TYPE, FROM 2023 TO 2028

- FIGURE 10 CONSUMER ELECTRONICS SEGMENT CAPTURED LARGEST SHARE OF MARKET, BY APPLICATION, IN 2022

- FIGURE 11 ASIA PACIFIC HELD LARGEST MARKET SHARE IN 2022

- FIGURE 12 EMERGING SENSOR APPLICATIONS IN AUTOMOTIVE AND CONSUMER ELECTRONICS SECTORS TO OFFER LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 ANALOG SENSORS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 CONSUMER ELECTRONICS APPLICATIONS TO HOLD LARGEST SHARE OF MARKET IN 2023

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 16 SENSOR TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 SENOR TESTING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN SENSOR TESTING ECOSYSTEM

- FIGURE 23 AVERAGE SELLING PRICE OF SENSOR TESTING EQUIPMENT, 2019−2028

- FIGURE 24 AVERAGE SELLING PRICE OF SENSOR TESTING EQUIPMENT PROVIDED BY KEY PLAYERS

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN SENSOR TESTING ECOSYSTEM

- FIGURE 26 SENSOR TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 29 IMPORT DATA FOR KEY COUNTRIES, 2017−2021 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR KEY COUNTRIES, 2017−2021 (USD MILLION)

- FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- FIGURE 33 MARKET, BY OFFERING

- FIGURE 34 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 35 OSCILLOSCOPES TO HOLD LARGEST SHARE OF MARKET FOR HARDWARE OFFERINGS IN 2023

- FIGURE 36 MARKET, BY SENSOR TYPE

- FIGURE 37 ANALOG TO ACCOUNT FOR LARGER MARKET SHARE THAN DIGITAL IN 2028

- FIGURE 38 SENSOR TESTING MARKET, BY APPLICATION

- FIGURE 39 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY APPLICATION, IN 2028

- FIGURE 40 NORTH AMERICA TO CAPTURE LARGEST MARKET SHARE FOR AEROSPACE APPLICATIONS IN 2028

- FIGURE 41 CHINA TO REGISTER HIGHEST CAGR IN MARKET FROM 2023 TO 2028

- FIGURE 42 NORTH AMERICA: SNAPSHOT OF MARKET

- FIGURE 43 EUROPE: SNAPSHOT OF MARKET

- FIGURE 44 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

- FIGURE 46 SENSOR TESTING MARKET: SHARE OF KEY PLAYERS

- FIGURE 47 MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 48 MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 49 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

- FIGURE 50 NATIONAL INSTRUMENTS CORP.: COMPANY SNAPSHOT

- FIGURE 51 KEYSIGHT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 52 FORTIVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 TERADYNE INC.: COMPANY SNAPSHOT

- FIGURE 54 ADVANTEST CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 ANRITSU CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 INDUSTRIAL VERTICAL TO HOLD LARGEST SHARE OF TEST AND MEASUREMENT EQUIPMENT MARKET IN 2028

The study involves four major activities that estimate the size of the sensor testing market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the sensor testing market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

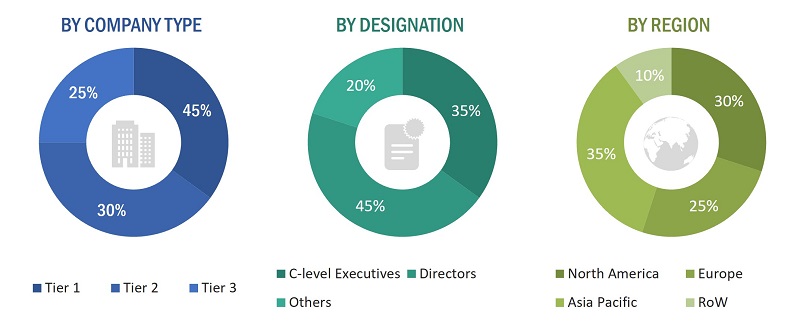

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from sensor testing providers, such as TE Connectivity Ltd. (Switzerland), National Instruments Corp. (US), Keysight Technologies, Inc. (US), Fluke Corporation (US), and Rohde & Schwarz GmbH & Co. KG (Germany); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Market Size Estimation Methodology-Bottom-up approach and Top-down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Sensor testing is the process of evaluating the performance and functionality of sensors used in a wide range of applications. It involves verifying the accuracy, precision, sensitivity, and response time of sensors to ensure they operate correctly and reliably within their specified parameters. This testing includes calibration, assessing the sensor's accuracy and precision, evaluating its sensitivity and response time, and considering the impact of environmental conditions. By conducting comprehensive sensor testing, industries can ensure that sensors provide accurate and reliable data, enabling effective decision-making and enhancing the performance of automated systems, control processes, and monitoring systems.

Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Raw material suppliers and distributors

- Retail service providers

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Wafer Vendors

- Original Equipment Manufacturers (OEMs)

- Original Design Manufacturers (ODMs) And OEM Technology Solution Providers

- Networking Solutions Providers

- Distributors and Retailers

- Research Organizations

- Technology Standards Organizations, Forums, Alliances, and Associations

- Technology Investors

- Software Providers

- Value-added Resellers (Vars)

The main objectives of this study are as follows:

- To define, describe, and forecast the sensor testing market in terms of value by offering, sensor type, application, and region

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To provide a detailed overview of the sensor testing value chain, along with industry trends, technology trends, use cases, security standards, and Porter’s five forces

- To analyze opportunities for stakeholders by identifying high-growth segments of the sensor testing market

- To analyze the probable impact of the recession on the market in the future

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the battery energy storage system market

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Sensor Testing Market