Self-Compacting Concrete Market by Type (Powder, Viscosity, Combination), Application (Drilled Shafts, Columns, Metal Decking, Concrete Frames), End User (Oil & Gas Construction, Infrastructure, Building & Construction), Region - Global Forecast to 2026

[172 Pages Report] The overall self-compacting concrete market is expected to grow from USD 8.74 billion in 2016 to USD 11.67 billion by 2023, at a CAGR of 6.0% from 2016 to 2021. Self-compacting concretes are used in the construction industry to ensure durable concrete structures, independent of the requirement of skilled workers. These concretes can compact into every corner of a formwork, purely by means of their own weight and without need for vibrating compaction. The base year considered for the study is 2017, and the forecast has been provided for the period between 2018 and 2023.

Market Dynamics

Drivers

- Non-requirement of vibration processes in laying self-compacting concrete

- Significant reduction in maintenance, repairing, and overhauling overall costs of self-compacting concrete

- Low noise involved in construction activities using self-compacting concrete

Restraints

- High cost of raw material

Opportunities

- Growing popularity of low-fines self-compacting concrete (smart dynamic concrete)

- Gradually recovering construction and housing sectors in the European region post-recession

Challenges

- Limited usage of self-compacting concrete in emerging economies

- Eco-SCC an alternative to self-compacting concrete

Significant reduction in overall costs of self-compacting concrete drives the global self-compacting concrete market

The concept of self-compacting concrete (SCC), as a building material, has gained a global acceptance in the recent years. Manufacturing of self-compacting concrete is more economical than conventional concretes. The self-compacting property of self-compacting concrete eliminates requirement of vibrations, thereby resulting in requirement of limited manpower for placing it. In some cases, the labor requirement can be half the number of labors required for using conventional concrete. The use of self-compacting concrete results in elimination of energy consumption, which is otherwise used in carrying out vibration processes. Additionally, formworks are no longer subject to stresses caused by vibration processes, thereby reducing both, initial as well as maintenance costs of formworks.

The use of self-compacting concrete results in reduced maintenance, repairing, and overhauling costs of self-compacting concrete, as it ensures labor savings, accelerates project schedules, reduces noise, addresses environmental concerns, and ensures reduced equipment wearing & tearing. It can be placed over any distance or constraint without vibration or mechanical consolidations.

Labor and time increase costs for concrete producers and contractors. Self-compacting concrete can be placed quickly and easily with no vibration to give a smooth surface finish. Hence, the cost beneficial factors offered by self-compacting concrete drives the growth of the self-compacting concrete market across the globe.

The following are the major objectives of the study.

- To define, describe, and forecast the market on the basis of raw material, type of design mix, application, end user, and region

- To analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the self-compacting concrete market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To forecast the market size in terms of value with respect to main regions, namely, Asia-Pacific, North America, Europe, Middle East & Africa, and South America, along with their respective countries

- To profile the key players in the market and comprehensively analyze their core competencies

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product launches, and research & development (R&D) activities in the market

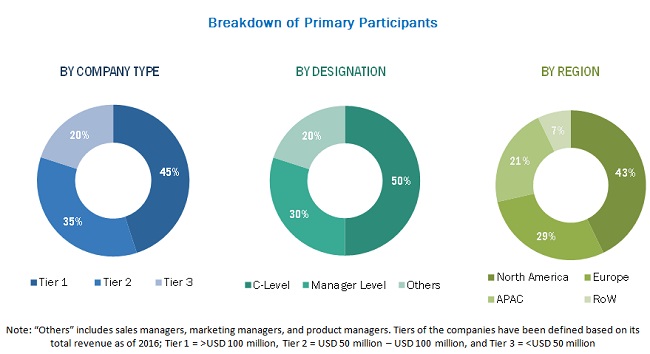

During this research study, major players operating in the self-compacting concrete market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The self-compacting concrete market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the market are CEMEX S.A.B. de C.V., ACC Limited, Sika Group, BASF SE, LafargeHolcim Limited, and HeidelbergCement AG.

Target Audience:

- Government and Research Organizations

- National Precast Concrete Association

- Raw Material Suppliers and Distributors

- Self-Compacting Concrete Manufacturers/Traders

- Infrastructure Companies

- End-Use Industries

Report Scope:

By Raw Material:

- Cement

- Admixtures

- Fibers

- Aggregates

- Additions

- Others

By Type of Design Mix:

- Powder Type SCC

- Viscosity Agent Type SCC

- Combination Type SCC

By Application:

- Drilled Shafts

- Columns

- Metal Decking

- Concrete Frames

By End-User:

- Infrastructure

- Oil & Gas Construction

- Building & Construction

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Further breakdown of a region with respect to a particular country

- Detailed analysis and profiling of additional market players (up to five).

The overall self-compacting concrete market is expected to grow from USD 8.74 billion in 2016 to USD 11.67 billion by 2022 at a CAGR of 6.0%. Non-requirement of vibration processes in laying self-compacting concrete, significant reduction in maintenance, repairing, and overhauling overall costs of self-compacting concrete, and low noise involved in construction activities using self-compacting concrete are the key factors driving the growth of the market.

Self-compacting concrete (SCC), also known as self-consolidating concrete, is a non-segregating concrete that can flow under its own weight, spread into places, fill formworks, and encapsulate reinforcements without any mechanical consolidation. In present times, self-compacting concretes have proved to be a boon for the construction industry in comparison to normal concrete, owing to rapidly changing construction techniques that involve use of modern machineries and wide range of chemicals and additives, among others.

The self-compacting concrete market has been segmented, on the basis of application, into metal decking, drilled shafts, columns, and concrete frames. The metal decking segment is expected to grow at the highest CAGR between 2018 and 2023. The concrete frame segment is the largest application segment in 2016 of the global market.

On the basis of type, the market is segmented into powder type SCC, viscosity type SCC, and combination type SCC. The combination type SCC is expected to grow at the highest CAGR between 2018 and 2023. The powder type SCC segment is the largest type segment in 2016 of the global self-compacting concrete market.

On the basis of end-user, the market is segmented into infrastructure, oil & gas, and building & construction. The infrastructure end-user segment is expected to grow at the highest CAGR between 2018 and 2023. It is the largest type segment in 2016 of the global self-compacting concrete market.

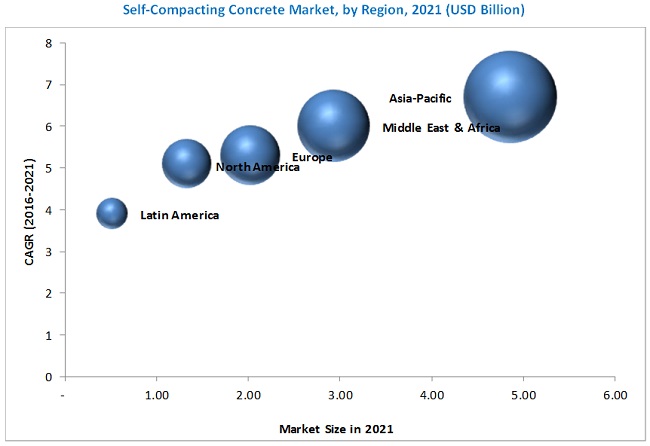

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The Asia-Pacific region construction market is expected to remain the largest market due to the rapid growth in per capita incomes, along with the increasing urbanization in the region. The Asia-Pacific region is one of the fastest-developing markets mainly due to the population growth and gradual rise in construction activities.

The use of self-compacting concrete by end-users like infrastructure, oil & gas, and building & construction drive the growth of self-compacting concrete market

Infrastructure

Infrastructure refers to structures, systems, and facilities serving the economy of a business, industry, country, city, town, or area, including services and facilities necessary for its economy to function. Accelerated infrastructure spending will drive economic growth, According to World Economic Forum, “Every dollar spent on Infrastructure Development generates an economic revenue of 5% to 25%.”

Oil & Gas Construction

Self-compacting concrete is used in drilled shafts for oil & gas construction. Various processes in refineries involve columns for distillation segments and other stages to separate oil, water, and solids from each other. As such, several drilled shafts in the oil & gas industry are constructed using self-compacting concrete as a part of its field trial with concrete mix.

Building & Construction

Building designs for contemporary architectural buildings set new requirements regarding construction methods of reinforced concrete buildings. Meeting those criteria led to the development of concrete with specifically defined properties. Self-compacting concrete (SCC), a material that flows, is placed into formwork and is compacted under the influence of self-weight only without vibration and additional processing emerged. Self-compacting with its numerous advantage such as reduction in overall cost, and excellent finishing leads to improvement of economic building conditions.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the future trends for self-compacting concrete?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

High cost of self-compacting concrete is a major factor restraining the growth of the market. High costs of the raw materials used in the manufacturing of self-compacting concrete continue to hinder its use across different segments of the construction industry. However, the productivity economics of self-compacting concrete take-over in achieving favorable performance benefits and work out to be economical in the pre-cast industry.

Key players in the market CEMEX S.A.B. de C.V. (Mexico), LafargeHolcim Limited (Switzerland), Tarmac (U.S.), Sika Group (Switzerland), BASF SE (Germany), and ACC Limited (India).

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered in the Report

1.4 Currency & Pricing

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews: By Company, Designation, and Region

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities for the Self-Compacting Concrete Market Between 2016 and 2021

4.2 Market, By Region

4.3 Market, By Type of Design Mix

4.4 Self-Compacting Concrete Market, By Application

4.5 Self-Compacting Concrete Market, By End User

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Drivers

5.2.1.1 Non-Requirement of Vibration Processes in Laying Self-Compacting Concrete

5.2.1.2 Low Noise Involved in Construction Activities Using Self-Compacting Concrete

5.2.1.3 Significant Reduction in Overall Costs of Self-Compacting Concrete

5.2.2 Restraints

5.2.2.1 High Costs of Raw Materials

5.2.3 Opportunities

5.2.3.1 Growing Popularity of Low-Fines Self-Compacting Concrete (Smart Dynamic Concrete)

5.2.3.2 Gradually Recovering Construction and Housing Sectors in the European Region Post-Recession

5.2.4 Challenges

5.2.4.1 Limited Usage of Self-Compacting Concrete in Emerging Economies

5.2.4.2 Eco-SCC an Alternative to Self-Compacting Concrete

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Revenue Pocket Matrix

6.2.1 Revenue Pocket Matrix for the Self-Compacting Concrete Market, End User, 2015

6.2.2 Revenue Pocket Matrix for the Self-Compacting Concrete, By Type of Design Mix, 2015

6.3 Regulations/Standards for Self-Compacting Concrete

6.4 Economic Indicators

6.4.1 Trends & Forecast of the Construction Industry and GDP

6.4.2 Trends of Residential & Non-Residential Construction Industries in North America

6.4.3 U.K. & Germany to Spend the Largest Amount for Growth of the Construction Industry in Europe

6.4.4 China & India to Spend the Largest Amount on the Construction Industry in Asia-Pacific

6.4.5 Saudi Arabia to Spend the Largest Amount on the Construction Industry in the Middle East & Africa

6.4.6 Brazil to Spend the Largest Amount for Construction Industry in Latin America

6.5 Industry Outlook

6.5.1 Oil & Gas Construction

6.5.2 Building & Construction

6.6 Infrastructure

6.7 Value Chain Analysis

6.8 Product Research & Development

6.8.1 Established Companies

6.8.2 Local Manufacturers

6.8.3 Distributors

6.8.4 End Users

6.9 Cost Structure of Self-Compacting Concrete

6.10 Porter’s Five Forces Analysis

6.10.1 Bargaining Power of Suppliers

6.10.2 Bargaining Power of Buyers

6.10.3 Threat of New Entrants

6.10.4 Threat of Substitutes

6.10.5 Intensity of Competitive Rivalry

7 Self-Compacting Concrete Market, By Raw Material (Page No. - 61)

7.1 Introduction

7.2 Cement

7.3 Admixtures

7.3.1 Fly Ash

7.3.2 Superplasticizer

7.3.3 Acrylic Copolymers (AC)

7.3.4 Polycarboxylate Ethers (PCE)

7.4 Fibers

7.5 Aggregates

7.5.1 Sand

7.6 Additions

7.6.1 Stone Powder

7.6.2 Others

7.6.2.1 Silica Fumes

7.6.2.2 Ground (Granulated) Blast Furnace Slag

7.6.2.3 Ground Glass Filler

7.6.2.4 Pigments

8 Self-Compacting Concrete Market, By Type of Design Mix (Page No. - 68)

8.1 Introduction

8.2 Powder Type Self-Compacting Concrete

8.3 Viscosity Agent Type Self-Compacting Concrete

8.4 Combination Type Self-Compacting Concrete

9 Self-Compacting Concrete Market, By Application (Page No. - 75)

9.1 Introduction

9.2 Columns

9.2.1 Drilled Shaft

9.2.2 Metal Decking

9.3 Concrete Frame

10 Self-Compacting Concrete Market, By End User (Page No. - 84)

10.1 Introduction

10.2 Infrastructure

10.3 Building & Construction

10.4 Oil & Gas Construction

11 Self-Compacting Concrete Market, By Region (Page No. - 90)

11.1 Introduction

11.2 Asia-Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 Thailand

11.2.5 Malaysia

11.2.6 Singapore

11.2.7 Australia

11.2.8 Rest of Asia-Pacific

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 U.K.

11.3.4 The Netherlands

11.3.5 Italy

11.3.6 Sweden

11.3.7 Turkey

11.3.8 Rest of Europe

11.4 North America

11.4.1 U.S.

11.4.2 Canada

11.4.3 Mexico

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 Qatar

11.5.3 South Africa

11.5.4 UAE

11.5.5 Rest of Middle East & Africa

11.6 South America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Rest of South America

12 Competitive Landscape (Page No. - 142)

12.1 Overview

12.2 Market Share of Key Players

12.3 Competitive Situation and Trends

12.3.1 Acquisitions

12.3.2 Expansions

12.3.3 New Product Launches

12.3.4 Divestments

13 Company Profiles (Page No. - 147)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 Cemex S.A.B De C.V.

13.2 ACC Limited

13.3 Sika Group

13.4 Lafargeholcim Ltd.

13.5 BASF SE

13.6 Tarmac

13.7 Kilsaran

13.8 Heidelbergcement AG

13.9 Unibeton Ready Mix

13.10 Other Companies

13.10.1 Ultratech Cement Limited

13.10.2 Breedon Group PLC

13.10.3 Firth Concrete

13.10.4 Buzzi Unicem S.P.A.

*Details Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 166)

14.1 Discussion Guide

14.2 Available Customizations

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Related Reports

14.5 Author Details

List of Tables (113 Tables)

Table 1 Self-Compacting Concrete Market Snapshot

Table 2 Market : By Raw Material

Table 3 Self-Compacting Concrete Market, By Type of Design Mix

Table 4 Market, By Application

Table 5 Market, By End User

Table 6 Materials Used and Their Economical Alternatives for Self-Compacting Concrete

Table 7 North America: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 8 North America: GDP, By Country, 2014–2021 (USD Billion)

Table 9 Europe: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 10 Europe: GDP, By Country, 2014–2021 (USD Billion)

Table 11 Asia-Pacific: Contribution to Construction Industry , By Country, 2014–2021 (USD Billion)

Table 12 Asia-Pacific: GDP, By Country, 2014–2021 (USD Billion)

Table 13 Middle East & Africa: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 14 Middle East & Africa: GDP, By Country, 2014–2021 (USD Billion)

Table 15 South America: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 16 Latin America: GDP, By Country, 2014–2021 (USD Billion)

Table 17 Self-Compacting Concrete – Cost Structure

Table 18 Comparison of Design Mix and Suggested Typical Range From European Federation of National Associations Representing for Concrete (Efnarc)

Table 19 Specifications and Guidelines of Raw Materials Used in SCC By European Federation of National Associations Representing for Concrete (Efnarc)

Table 20 Physical and Chemical Properties of Cement Used in SCC

Table 21 Key Properties of Acrylic Copolymers

Table 22 Self-Compacting Concrete Market, By Type of Design Mix, 2014–2026 (USD Million)

Table 23 Powder Type: Market, By Region, 2014–2026 (USD Million)

Table 24 Viscosity Type: Market, By Region, 2014–2026 (USD Million)

Table 25 Combination Type Self-Compacting Concrete Market, By Region, 2014–2026 (USD Million)

Table 26 Market, By Application, 2014–2026 (USD Million)

Table 27 Self-Compacting Concrete Market in Columns Application, By Region, 2014–2026 (USD Million)

Table 28 Market in Drilled Shafts Application, By Region, 2014–2026 (USD Million)

Table 29 Market in Metal Decking Application, By Region, 2014–2021 (USD Million)

Table 30 Self-Compacting Concrete Market in Concrete Frame Application, By Region, 2014–2021 (USD Million)

Table 31 Market, By End User, 2014–2026 (USD Million)

Table 32 Self-Compacting Concrete Market for Infrastructure, By Region, 2014 – 2026 (USD Million)

Table 33 Self-Compacting Concrete Market for Building & Construction, By Region, 2014 – 2026 (USD Million)

Table 34 Market for Oil & Gas Construction, By Region, 2014 – 2026 (USD Million)

Table 35 Self-Compacting Concrete Market, By Region, 2014–2026 (USD Million)

Table 36 Asia-Pacific Market, By Country, 2014–2026 (USD Million)

Table 37 Asia-Pacific Market, By Application, 2014–2026 (USD Million)

Table 38 Asia-Pacific Market, By End User Industry, 2014–2026 (USD Million)

Table 39 Asia-Pacific Market, By Type of Design Mix, 2014–2026 (USD Million)

Table 40 China Market, By Application, 2014–2026 (USD Million)

Table 41 China Market, By End User Industry, 2014–2026 (USD Million)

Table 42 India Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 43 India Market, By End User Industry, 2014–2026 (USD Million)

Table 44 Japan Market, By Application, 2014–2026 (USD Million)

Table 45 Japan Market, By End User Industry, 2014–2026 (USD Million)

Table 46 Thailand Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 47 Thailand Market, By End User Industry, 2014–2026 (USD Million)

Table 48 Malaysia Market, By Application, 2014–2026 (USD Million)

Table 49 Malaysia Market, By End User Industry, 2014–2026 (USD Million)

Table 50 Singapore Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 51 Singapore Market, By End User Industry, 2014–2026 (USD Million)

Table 52 Australia Market, By Application, 2014–2026 (USD Million)

Table 53 Australia Market, By End User Industry, 2014–2026 (USD Million)

Table 54 Rest of Asia-Pacific Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 55 Rest of Asia-Pacific Market, By End User Industry, 2014–2026 (USD Million)

Table 56 Europe Market, By Country, 2014–2026 (USD Million)

Table 57 Europe Market, By Application, 2014–2026 (USD Million)

Table 58 Europe Market, By End User Industry, 2014–2026 (USD Million)

Table 59 Europe Market, By Type of Design Mix, 2014–2026 (USD Million)

Table 60 Germany Market, By Application, 2014–2026 (USD Million)

Table 61 Germany Market, By End User Industry, 2014–2026 (USD Million)

Table 62 France Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 63 France Market, By End User Industry, 2014–2026 (USD Million)

Table 64 U.K. Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 65 U.K. Market, By End User Industry, 2014–2026 (USD Million)

Table 66 The Netherlands Market, By Application, 2014–2026 (USD Million)

Table 67 The Netherlands Market , By End User Industry, 2014–2026 (USD Million)

Table 68 Italy Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 69 Italy Market, By End User Industry, 2014–2026 (USD Million)

Table 70 Sweden Market, By Application, 2014–2026 (USD Million)

Table 71 Sweden Market, By End User Industry, 2014–2026 (USD Million)

Table 72 Turkey Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 73 Turkey Market, By End User Industry, 2014–2026 (USD Million)

Table 74 Rest of Europe Market, By Application, 2014–2026 (USD Million)

Table 75 Rest of Europe Market, By End User Industry, 2014–2026 (USD Million)

Table 76 North America Self-Compacting Concrete Market, By Country, 2014–2026 (USD Million)

Table 77 North America Market, By Application, 2014–2026 (USD Million)

Table 78 North America Market , By End User Industry, 2014–2026 (USD Million)

Table 79 North America Market, By Type of Design Mix, 2014–2026 (USD Million)

Table 80 U.S. Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 81 U.S. Market, By End User Industry, 2014–2026 (USD Million)

Table 82 Canada Market, By Application, 2014–2026 (USD Million)

Table 83 Canada Market, By End User Industry, 2014–2026 (USD Million)

Table 84 Mexico Market, By Application, 2014–2026 (USD Million)

Table 85 Mexico Market, By End User Industry, 2014–2026 (USD Million)

Table 86 Middle East & Africa Self-Compacting Concrete Market, By Country, 2014–2026 (USD Million)

Table 87 Middle East & Africa Market, By Application, 2014–2026 (USD Million)

Table 88 Middle East & Africa Market, By End User Industry, 2014–2026 (USD Million)

Table 89 Middle East & Africa Market, By Type of Design-Mix, 2014–2026 (USD Million)

Table 90 Saudi Arabia Market, By Application, 2014–2026 (USD Million)

Table 91 Saudi Arabia Market, By End User Industry, 2014–2026 (USD Million)

Table 92 Qatar Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 93 Qatar Market, By End User Industry, 2014–2026 (USD Million)

Table 94 South Africa Market, By Application, 2014–2026 (USD Million)

Table 95 South Africa Market, By End User Industry, 2014–2026 (USD Million)

Table 96 UAE Market, By Application, 2014–2026 (USD Million)

Table 97 UAE Market, By End User Industry, 2014–2026 (USD Million)

Table 98 Rest of Middle East & Africa Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 99 Rest of Middle East & Africa Market, By End User Industry, 2014–2026 (USD Million)

Table 100 South America Market, By Country, 2014–2026 (USD Million)

Table 101 South America Market, By Application, 2014–2026 (USD Million)

Table 102 South America Market, By End User Industry, 2014–2026 (USD Million)

Table 103 South America Market, By Type of Design-Mix, 2014–2026 (USD Million)

Table 104 Brazil Self-Compacting Concrete Market, By Application, 2014–2026 (USD Million)

Table 105 Brazil Market, By End User Industry, 2014–2026 (USD Million)

Table 106 Argentina Market, By Application, 2014–2026 (USD Million)

Table 107 Argentina Market, By End User Industry, 2014–2026 (USD Million)

Table 108 Rest of South America Market, By Application, 2014–2026 (USD Million)

Table 109 Rest of South America Market, By End User Industry, 2014–2026 (USD Million)

Table 110 Acquisitions, 2011–2016

Table 111 Expansions, 2011–2016

Table 112 New Product Launches, 2010–2016

Table 113 Divestments, 2016

List of Figures (48 Figures)

Figure 1 Self Compacting Concrete Market: Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Self-Compacting Concrete Market: Data Triangulation

Figure 6 The Powder Type Self-Compacting Concrete Segment Would Lead the Self-Compacting Concrete Market in 2016

Figure 7 The Concrete Frames Application Segment Would Lead the Market in 2016

Figure 8 The Infrastructure End User Segment Would Lead the Market in 2016

Figure 9 The Asia-Pacific Region Would Lead the Market in 2016

Figure 10 Self-Compacting Concrete Market to Witness A Steady Growth Between 2016 and 2021

Figure 11 The Markets in the Asia-Pacific and Middle East & Africa Regions are Projected to Grow at Significant Rates During the Forecast Period

Figure 12 The Powder Type Self-Compacting Concrete Accounted for the Largest Share of the Market Across All Regions in 2015

Figure 13 The Concrete Frames Application Segment is Projected to Lead the Self-Compacting Concrete Market Between 2016 and 2021

Figure 14 The Infrastructure End User Segment is Projected to Be the Largest Segment of the Self-Compacting Concrete Market During the Forecast Period

Figure 15 Market, By Region

Figure 16 Drivers, Restraints, Opportunities, and Challenges in the Market

Figure 17 Cement Prices in the U.S., 2012-2015 (In U.S. Dollars Per Metric Ton)

Figure 18 Market: Value Chain

Figure 19 Organized vs Non-Organized Market

Figure 20 Self-Compacting Concrete – Cost Structure

Figure 21 Porter’s Five Forces Analysis

Figure 22 Powder Type SCC Estimated to Lead the SCC Market in 2016

Figure 23 Asia-Pacific Expected to Lead the Powder Type SCC Segment in 2016

Figure 24 Asia-Pacific Expected to Dominate the Viscosity Type Segment of the SCC Market in 2016

Figure 25 Asia-Pacific Region Expected to Lead the Combined Type Segment of the SCC Market in 2016

Figure 26 Self-Compacting Concrete Market, By Application, 2016 vs 2021

Figure 27 Market in Columns Application, By Region, 2016 & 2021

Figure 28 Market in Drilled Shafts Application, By Region, 2016 & 2021

Figure 29 Self-Compacting Concrete Market in Metal Decking Application, By Region, 2016 & 2021

Figure 30 Market in Concrete Frame Application, By Region, 2016 & 2021

Figure 31 Based on End User, the Infrastructure Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Self-Compacting Concrete Market for Infrastructure End User, By Region, 2016 & 2021

Figure 33 Market for Building & Construction, By Region, 2016 & 2021

Figure 34 Self-Compacting Concrete Market for Oil & Gas Construction, By Region, 2016 & 2021

Figure 35 Regional Snapshot (2016-2021): India Emerging as A New Hot Spot

Figure 36 Asia-Pacific Market Snapshot

Figure 37 Europe Market Snapshot

Figure 38 North America Self-Compacting Concrete Market Snapshot

Figure 39 Middle East & Africa Self-Compacting Concrete Market Snapshot

Figure 40 South America Market Snapshot

Figure 41 Companies Adopted New Product Launch as the Key Growth Strategy Between 2010 and 2016

Figure 42 Cemex S.A.B. De C.V., is the Leading Player in the SCC Market in 2015

Figure 43 Cemex S.A.B De C.V.: Company Snapshot

Figure 44 ACC Limited: Company Snapshot

Figure 45 Sika Group: Company Snapshot

Figure 46 Lafargeholcim Ltd: Company Snapshot

Figure 47 BASF SE: Company Snapshot

Figure 48 Heidelbergcement AG: Company Snapshot

Growth opportunities and latent adjacency in Self-Compacting Concrete Market