Seed Processing Market by Type (Seed Treatment, Seed Coating Material), Crop Type (Cereals & Grains, Oilseeds & Pulses, Vegetables, Flowers & Ornamentals), Equipment (Cleaners, Gravity-separators, Graders, De-stoners), & Region – Global Forecast to 2025

Seed Processing Market

The global seed processing market is projected to grow at a CAGR of 10.6% during the forecast period

Drivers and Restraints:

The market for seed processing continues to evolve on the basis of drivers and restraints. Some of the factors which promotes the growth of the market include the increase in global trade for processed seeds, prominence of low-cost seed treatment solutions, and increased adoption of commercial seeds owing to high rates of seed replacement. Some of the major drivers and restraints impacting the market have been listed below.

Key drivers for seed processing include:

- Increase in global trade for processed seeds

- Low-cost seed treatment solutions to encourage demand across regions

- Increase in seed replacement rate to drive the adoption of commercialized seeds

Restraints impeding the market include:

- Stringent government regulations to impact the growth of the market

Seed processing is used in almost all the crop segments. Cereals & grains are the staple diet across regions such as Asia, Africa, Latin America, and the Carribean regions. The growing awareness among the farmers about the benefits of processed seeds such as enhanced seed germination, protection from pathogens are few of the factors contributing to its adoption in the agricultural sector.

Leading crop application segments for seed processing

- Fruits and vegetables

- Cereals & grains

- Oilseeds and Pulses

- Flowers & ornamentals

Seed treatment is the largest segment within the seed treatment market during the forecast period. This is owing to the high rates of seed replacement in the Asia Pacific region during the cropping season. Seed treatment products usually include insecticides, bactericides, and fungicides. These products provide enhanced crop protection at a relatively low-cost as compared to spraying which makes it one of the preferred treatment.

The major types of seed processing include:

- Seed treatment

- Seed coating material

Top 10 players in seed processing market include:

- Bayer AG

- BASF SE

- Syngenta

- Nufarm

- Lanxess

- Clariant

- Incotec

- Sensient Technologies

- Cimbria

- Alvan Blanch Development Company

Top 10 Start-ups in seed processing market include:

- Petkus Technologie GmbH

- Lewis Carter Manufacturing

- Westrup A/S

- Hefty Seed Company

- Chromatech

- Centor Group

- Precision Laboratories

- Germains Seed Technologies

- Eastman Chemical Company

- Tozer Seeds

Use case for seed processing market:

Headline

Helped a leading player in the seed processing market identify a USD 80 million revenue potential by tapping into the seed processing market in the Asia Pacific region.

Client’s Problem statement

Our client, a major player in the seed processing market was looking at expanding its presence in the Asia Pacific market through market entry in Australia. They also wanted an insight into the demand patterns of the farmers in the region.

MnM Approach

MNM identified the major players across regions and the trends prevailing in each of the markets to improve, as well as understand the changing revenue mix of our client’s clients in end-use applications, particularly for cereals & grains and oilseeds & pulses. MNM also interviewed industry stakeholders to gain perspectives on regions that witness significant demand for seed processing in the Australian market. A detailed analysis on the cropping patterns and the corresponding demand for seed processing was also undertaken. These steps helped MNM to offer insights on the existing products in the market and identify gaps in the current product line for various crops. The client was able to make appropriate investment decision to diversify its product line in the Australian market.

Revenue Impact (RI)

Our work has helped the client to tap into a USD 9.1 billion market, with projected revenues of USD 80 million in three years from our recommendations.

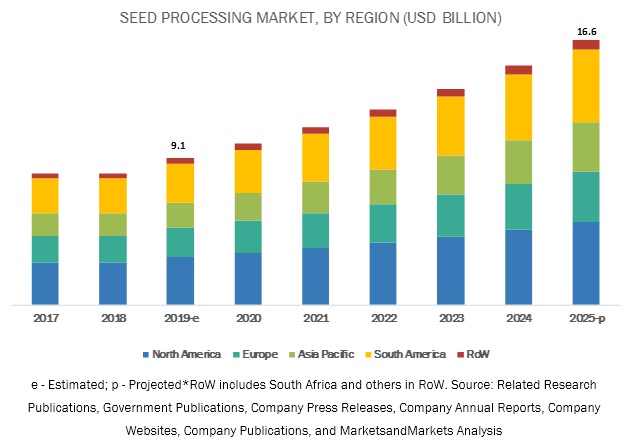

[188 Pages Report] The seed processing market is estimated at USD 9.1 billion in 2019 and is projected to reach USD 16.6 billion by 2025, recording a CAGR of 10.6% during the forecast period. This is driven by the increased trade of processed seeds at the global level, growing awareness among farmers in emerging countries of the Asia Pacific region pertaining to the advantages of seed treatment, and the rise in investment from governments and companies.

By type, the seed treatment segment is projected to dominate the market during the forecast period.

Based on type, the seed treatment segment is estimated to account for the largest share in the seed processing market in 2019. In Asia Pacific, particularly in countries such as India, farmers are replacing seeds saved from previous crops with advanced seeds developed by seed companies. The rise in demand for hybrid seeds due to factors such as increasing middle-class population, rise in disposable income, and the growth in the food processing sector is projected to drive the market in the developing countries across regions. Seed treatment products usually include insecticides, bactericides, and fungicides. It provides enhanced crop cultivation at a relatively low cost as compared to spraying, which makes it one of the preferred treatments for seeds. Thus, seed treatment manufacturers are projected to witness significant growth in developing countries.

By crop type, the cereals & grains segment is projected to dominate the market for seed processing during the forecast period.

Based on crop type, the cereals & grains segment is estimated to account for the largest share in the market in 2019. Cereals & grains constitute the staple food products in many countries. It includes wheat, rice, corn, sorghum, oats, and barley. Of these cereals & grains, rice is consumed as a staple food for consumers in many developing countries. It is majorly consumed in Asia, Africa, Latin America, and the Caribbean. Corn is consumed on a larger scale in the US, with the country being the largest producer of corn at the global level. Thus, increasing awareness of the benefits of seed processing, such as enhanced seed germination and protection from pathogens, is a key factor that is projected to drive the growth of the cereals & grains segment in the market.

Increase in global trade for processed seeds to drive the market growth

According to the International Seed Federation (ISF), in 2015, nearly 3.9 million tonnes of seeds were traded globally, valued at USD 10.0 billion. The growing international trade due to the trade agreements between various regions and countries has created growth opportunities for manufacturers in different industries, including seeds. The increase in demand for high yield and premium quality seeds across regions has also led to an increase in the trade of processed seeds. Manufacturers are focusing on processing and developing high-quality seeds and serve customers across regions. For instance, developing countries, such as China and Brazil, are price-sensitive, as they are less aware of the quality of seeds. However, farmers in developed and mature markets, such as the US, Germany, and other European countries, mainly focus on the quality of seeds while making purchase decisions, which has led to an increase in demand for processed seeds. Thus, the increase in the import and export of seeds in developed and developing countries is projected to drive the demand for processed seeds. According to the FAO, in 2017, the US witnessed a significant increase in the import and export of seeds. European countries, such as the Netherlands, Germany, and France, have also witnessed a considerable rise in the seed import and export. Thus, increasing commercial seed trade is projected to play a key role in the seed processing market.

Key Market Players

The key players in global market include Bayer (Germany), BASF (Germany), Corteva (US), Syngenta (Switzerland), Nufarm (Australia), Lanxess (Germany), Clariant (Switzerland), Incotec (Netherlands), Sensient Technologies (US), Cimbria (Denmark), Alvan Blanch Development Company Ltd. (UK), PETKUS Technologie GmbH (Germany), Lewis M. Carter Manufacturing, LLC (US), WESTRUP A/S (Denmark), Seed Dynamics (US), Germains Seed Technology (US), Chromatech (US), Centor Group (Australia), and Precision Laboratories (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Type, Crop Type, and Equipment |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of World (RoW) |

|

Companies covered |

Bayer (Germany), BASF (Germany), Corteva (US), Syngenta (Switzerland), Nufarm (Australia), Lanxess (Germany), Clariant (Switzerland), Incotec (Netherlands), Sensient Technologies (US), Cimbria (Denmark), Alvan Blanch Development Company Ltd. (UK), PETKUS Technologie GmbH (Germany), Lewis M. Carter Manufacturing, LLC (US), WESTRUP A/S (Denmark), Seed Dynamics (US), Germains Seed Technology (US), Chromatech (US), Centor Group (Australia), and Precision Laboratories (US). |

This research report categorizes the market for seed processing based on type, crop type, equipment, and region.

Based on type, the market for seed processing has been segmented as follows:

- Seed treatment

- Seed coating material

Based on the crop type, the market for seed processing has been segmented as follows:

- Cereals & grains

- Oilseeds & pulses

- Vegetables

- Flowers & ornamentals

- Other crop types (sugar beet, turf & ornamentals, and forages)

Based on equipment, the seed processing market has been segmented as follows:

- Cleaners

- Gravity separators

- Seed treatment

- Dryers

- Graders

- De-stoners

- Other equipment (color sorter and dust equipment machines)

Based on the region, market for seed processing has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW) (South Africa and others in RoW)

Key questions addressed by the report

- What are the new application areas that the seed processing companies are exploring?

- Which are the key players in the market, and how intense is the competition?

- What kind of competitors and stakeholders, such as seed processing companies, would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&A’s in the seed processing market projected to create a disrupting environment in the coming years?

- What will be the level of impact on the revenues of stakeholders, of the benefits of seed processing to different stakeholders??from rising revenue, environmental regulatory compliance, to sustainable profits for the suppliers?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

1.7 Inclusions & Exclusions

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations of the Study

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 38)

4.1 Overview of the Market

4.2 Seed Coating Materials Market, By Subtype

4.3 Seed Treatment Market, By Subtype

4.4 North America: Seed Processing Market, By Country and Key Crop Type

4.5 Seed Processing Market, By Crop Type and Region

4.6 Seed Processing Market: Major Regional Submarkets

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Global Trade for Processed Seeds to Drive the Market Growth

5.2.1.2 Low-Cost Seed Treatment Solutions to Encourage Demand Across Regions

5.2.1.3 Increase in the Seed Replacement Rate to Drive the Adoption of Commercialized Seeds

5.2.2 Restraints

5.2.2.1 Introduction of Government Regulations to Impact Market Growth

5.2.3 Opportunities

5.2.3.1 Innovative Product Combination to Widen Growth Prospects

5.2.3.2 Europe: A Key Revenue Generator

5.2.4 Challenges

5.2.4.1 The Imposition of Regulations on Gm Crops to Inhibit the Market Growth

6 Market for Seed Processing, By Type (Page No. - 50)

6.1 Introduction

6.2 Seed Treatment

6.2.1 Chemical Seed Treatment

6.2.1.1 Root Rot Can Be Controlled By the Use of Systemic Fungicides and Biological Seed Treatment Methods

6.2.2 Non-Chemical Seed Treatment

6.2.2.1 Physical Seed Treatment

6.2.2.1.1 It Provides Effective Control Against Seed Contamination During Seed Storage

6.2.2.2 Biological Seed Treatment

6.2.2.2.1 Microbial Seed Treatment

6.2.2.2.1.1 Microbial Seed Treatment Protects Crops By Increasing the Heat Tolerance Capacity, Drought Tolerance Capability, as Well as Resistance to Insects, Weeds, Pests, and Plant Diseases

6.2.2.2.2 Botanical Seed Treatment

6.2.2.2.2.1 Adoption of Affordable and Effective Methods to Optimize the Early Growth and Yield Potential Across Regions

6.3 Seed Coating Material

6.3.1 Polymers

6.3.1.1 The Multiple Benefits of Polymers Have Contributed to the Market Growth

6.3.2 Colorants

6.3.2.1 Colorants Help in Enhancing the Appearance of Seeds

6.3.3 Pellets

6.3.3.1 Pellets Help in Increasing the Weight of Seeds, Which Benefits Crops That Need Uniform Planting

6.3.4 Minerals/Pumice

6.3.4.1 Porosity Helps in the Germination and Protection of Seeds

7 Market for Seed Processing, By Crop Type (Page No. - 64)

7.1 Introduction

7.2 Cereals & Grains

7.2.1 Increasing Consumption of Cereals & Grains in the Food and Feed Industries has Encouraged Growers to Adopt Seed Processing Techniques

7.3 Oilseeds & Pulses

7.3.1 Increasing Use in Feed and Production of Biodiesel & Other Renewable Chemicals to Drive Their Demand

7.4 Vegetables

7.4.1 Increasing Demand for Vegetable Crops has Encouraged Growers to Use Seed Processing Techniques for Safe and Improved Crop Yields

7.5 Flowers & Ornamentals

7.5.1 Seed Coating and Seed Treatment Methods Smoothen the Seed Surface and Improve the Germination Rate

7.6 Other Crop Types

8 Market for Seed Processing, By Equipment (Page No. - 72)

8.1 Introduction

8.2 Cleaners

8.2.1 Presence of Key Players to Increase the Sales of Cleaners in Europe

8.3 Gravity Separators

8.3.1 The US Stands as A Lucrative Market Owing to the Country Being Among the Top Producers of Crops Such as Corn and Wheat, Where Gravity Separators are Widely Used

8.4 Dryers

8.4.1 Rise in Demand for Processed Seeds Expected to Increase Demand for Dryers in the Asia Pacific Region

8.5 Graders

8.5.1 Rising Population in Developing Countries Expected to Increase Demand for Food Products And, in Turn, Processed Seeds

8.6 De-Stoners

8.6.1 Demand for High Quality Seeds From the Developed Countries Expected to Increase Demand for De-Stoners in the Years to Come

8.7 Seed Treatment

8.7.1 Rise in Awareness Among the Farmers in Developing Countries Expected to Increase Demand for Seed Treatment

8.8 Other Equipment

8.8.1 Manufacturers Coming Up With Innovative Products, Especially for Color Sorter, Expected to Increase Demand for Other Equipment at A Global Level

9 Market for Seed Processing, By Region (Page No. - 81)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The Use of Neonicotinoids and Advanced Equipment in Seed Processing to Drive the Market Growth in the Country

9.2.2 Canada

9.2.2.1 Insecticides Were Major Seed Protection Solutions Used By Canadian Farmers

9.2.3 Mexico

9.2.3.1 Increase in the Export Demand for High-Quality Crops to Drive the Market

9.3 Europe

9.3.1 France

9.3.1.1 The Country’s Leading Position in the Trade of Field Crop Seeds Makes It A Key Revenue Generator for Seed Processing Companies

9.3.2 Germany

9.3.2.1 The Country Witnesses the Presence of Key Players Operating in the Seed Processing Market

9.3.3 Italy

9.3.3.1 Favorable Environment Conditions Attract Seed Growers, Making It A Lucrative Market for Seed Treatment and Seed Processing Equipment Companies to Penetrate

9.3.4 Spain

9.3.4.1 The Country Ranks Among the Leading Seed Producers in Europe

9.3.5 Russia

9.3.5.1 Increase in the Domestic Production of Seeds to Create Lucrative Opportunities for Seed Processing Companies

9.3.6 Netherlands

9.3.6.1 Vegetable Seed Growers are Projected to Create Growth Opportunities for Seed Processing Companies

9.3.7 Rest of Europe

9.3.7.1 Ukraine is Projected to Be A Key Revenue Generator in the Seed Processing Market

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Government Subsidies Have Led to an Increase in the Domestic Production of Various Crops

9.4.2 Japan

9.4.2.1 Government and Institutes are Working Actively in Increasing the Seed Production Through the Adoption of Seed Processing Practices

9.4.3 India

9.4.3.1 Rise in the Adoption of Bt Cotton Hybrids, Single Cross Corn Hybrids, and Hybrid Vegetables to Increase the Seed Replacement Rate in Crops, Which is Projected to Drive the Market Growth

9.4.4 Australia

9.4.4.1 Government Policies Regarding Value Addition in Seeds and Crops to Offer Growth Opportunities to Manufacturers to Invest in the Country

9.4.5 Thailand

9.4.5.1 The Large Gap Between the Demand and Supply of Seeds to Offer High-Growth Potential for Seed Processing Manufacturers

9.4.6 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.1.1 Farmers are Adopting Sustainable and Organic Farming Practices in This Country

9.5.2 Argentina

9.5.2.1 The Increased Requirement for High-Quality Seeds Due to Different Soil-Climate Combinations has Led to High Growth

9.5.3 Chile

9.5.3.1 Chile Was the Fifth-Largest Producer of Genetically Modified Seeds in the World

9.5.4 Rest of South America

9.6 Rest of the World

9.6.1 South Africa

9.6.1.1 New Products and Technologies to Help Farmers Meet the Growing Demand for Food Products and Reduce the Use of Crop Protection Products

9.6.2 Others in Row

10 Competitive Landscape (Page No. - 129)

10.1 Overview

10.2 Competitive Leadership Mapping (Overall Market)

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Ranking of Key Players, 2018

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Expansions

10.4.3 Acquisitions

10.4.4 Collaborations

11 Company Profiles (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 BASF

11.2 Bayer

11.3 Corteva

11.4 Syngenta

11.5 Nufarm

11.6 Lanxess

11.7 Clariant

11.8 Incotec

11.9 Sensient Technologies

11.10 Cimbria

11.11 Alvan Blanch Development Company Limited

11.12 PETKUS Technologie Gmbh

11.13 Lewis M. Carter Manufacturing, Llc

11.14 WESTRUP A/S

11.15 Akyurek Technology

11.16 Seed Dynamics

11.17 Germains Seed Technology

11.18 Chromatech

11.19 Centor Group

11.20 Precision Laboratories

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 180)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (105 Tables)

Table 1 USD Exchange Rate, 2014–2018

Table 2 Global Import and Export of Seeds, 2016–2017 (USD Million)

Table 3 Seed Processing Market Size, By Type, 2017–2025 (USD Million)

Table 4 Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 5 Chemical Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 6 Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 7 Non-Chemical Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 8 Physical Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 9 Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 10 Biological Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 11 Microbial Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 12 Botanical Seed Treatment Market Size, By Region, 2017–2025 (USD Million)

Table 13 Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 14 Polymer Seed Coating Materials Market Size, By Subtype, 2017–2025 (USD Million)

Table 15 Polymer Seed Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 16 Polymer Gel Seed Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 17 Superabsorbent Polymer Gel Seed Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 18 Seed Colorant Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 19 Seed Pellet Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 20 Seed Minerals/Pumice Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 21 Other Seed Coating Materials Market Size, By Region, 2017–2025 (USD Million)

Table 22 Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 23 Market Size for Seed Processing for Cereals & Grains, By Region, 2017–2025 (USD Million)

Table 24 Market Size for Seed Processing for Oilseeds & Pulses, By Region, 2017–2025 (USD Million)

Table 25 Market Size for Seed Processing for Vegetables, By Region, 2017–2025 (USD Million)

Table 26 Market Size for Seed Processing for Flowers & Ornamentals, By Region, 2017–2025 (USD Million)

Table 27 Market Size for Seed Processing for Other Crop Types, By Region, 2017–2025 (USD Million)

Table 28 Seed Processing Market Size, By Equipment, 2017–2025 (USD Million)

Table 29 Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 30 Cleaners: Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 31 Gravity Separators: Market Size For Seed Processing, By Region, 2017–2025 (USD Million)

Table 32 Dryers: Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 33 Graders: Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 34 De-Stoners: Market Size For Seed Processing, By Region, 2017–2025 (USD Million)

Table 35 Seed Treatment: Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 36 Other Equipment: Seed Processing Market Size, By Region, 2017–2025 (USD Million)

Table 37 Market Size for Seed Processing, By Region, 2017–2025 (USD Million)

Table 38 Seed Processing Equipment Market Size, By Region, 2017–2025 (USD Million)

Table 39 North America: Market Size for Seed Processing, By Country, 2017–2025 (USD Million)

Table 40 North America: Market Size For Seed Processing, By Type, 2017–2025 (USD Million)

Table 41 North America: Seed Treatment Market Size, By Subtype,2017–2025 (USD Million)

Table 42 North America: Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 43 North America: Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 44 North America: Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 45 North America: Seed Coating Material Market Size, By Polymer Type, 2017–2025 (USD Million)

Table 46 North America: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 47 North America Seed Processing Equipment Market Size, By Type, 2017–2025 (USD Million)

Table 48 US: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 49 Canada: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 50 Mexico: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 51 Europe: Seed Processing Market Size, By Country, 2017–2025 (USD Million)

Table 52 Europe: Market Size For Seed Processing, By Type, 2017–2025 (USD Million)

Table 53 Europe: Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 54 Europe: Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 55 Europe: Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 56 Europe: Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 57 Europe: Seed Coating Materials Market Size, By Polymer Type, 2017–2025 (USD Million)

Table 58 Europe: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 59 Europe Seed Processing Equipment Market Size, By Type, 2017–2025 (USD Million)

Table 60 France: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 61 Germany: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 62 Italy: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 63 Spain: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 64 Russia: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 65 Netherlands: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 66 Rest of Europe: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 67 Asia Pacific: Seed Processing Market Size, By Country, 2017–2025 (USD Million)

Table 68 Asia Pacific: Market Size For Seed Processing, By Type, 2017–2025 (USD Million)

Table 69 Asia Pacific: Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 70 Asia Pacific: Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 71 Asia Pacific: Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 72 Asia Pacific: Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 73 Asia Pacific: Seed Coating Material Market Size, By Polymer Type, 2017–2025 (USD Million)

Table 74 Asia Pacific: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 75 Asia Pacific Seed Processing Equipment Market Size, By Type, 2017–2025 (USD Million)

Table 76 China: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 77 Japan: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 78 India: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 79 Australia: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 80 Thailand: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 81 Rest of Asia Pacific: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 82 South America: Seed Processing Market Size, By Country, 2017–2025 (USD Million)

Table 83 South America: Market Size For Seed Processing, By Type, 2017–2025 (USD Million)

Table 84 South America: Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 85 South America: Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 86 South America: Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 87 South America: Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 88 South America: Seed Coating Material Market Size, By Polymer Type, 2017–2025 (USD Million)

Table 89 South America: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 90 South America Seed Processing Equipment Market Size, By Type, 2017–2025 (USD Million)

Table 91 Brazil: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 92 Argentina: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 93 Chile: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 94 Rest of South America: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 95 Row: Seed Processing Market Size, By Country, 2017–2025 (USD Million)

Table 96 Row: Market Size For Seed Processing, By Type, 2017–2025 (USD Million)

Table 97 Row: Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 98 Row: Non-Chemical Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 99 Row: Biological Seed Treatment Market Size, By Subtype, 2017–2025 (USD Million)

Table 100 Row: Seed Coating Material Market Size, By Subtype, 2017–2025 (USD Million)

Table 101 Row: Seed Coating Material Market Size, By Polymer Type, 2017–2025 (USD Million)

Table 102 Row: Seed Processing Market Size, By Crop Type, 2017–2025 (USD Million)

Table 103 Row Seed Processing Equipment Market Size, By Type, 2017–2025 (USD Million)

Table 104 South Africa: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

Table 105 Others in Row: Market Size For Seed Processing, By Crop Type, 2017–2025 (USD Million)

List of Figures (48 Figures)

Figure 1 Market Segmentation

Figure 2 Seed Treatment Market Segmentation

Figure 3 Seed Coating Material Market Segmentation

Figure 4 Regional Segmentation

Figure 5 Research Design

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Cereals & Grains Projected to Be the Fastest-Growing Segment in the Market, on the Basis of Crop Type, During the Forecast Period

Figure 10 Seed Coating Material Market Size, By Subtype, 2019 vs. 2025 (USD Million)

Figure 11 Seed Processing Market Size, By Type, 2019 vs. 2025 (USD Million)

Figure 12 Market Share (Value), By Region, 2018

Figure 13 Increasing Need for High-Quality Seeds to Drive the Growth of the Market

Figure 14 Polymers Were the Most Preferred Subtype for Seed Coating in 2018

Figure 15 Chemicals Were the Most Preferred Subtype for Seed Treatment, 2019 vs. 2025

Figure 16 North America: the Us Was One of the Major Consumers Across the Globe in 2018

Figure 17 The North American Market Accounted for the Largest Share for the Cereals & Grains and Oilseeds & Pulses Segments in 2018

Figure 18 Asian Countries are Projected to Witness Fast Growth During the Forecast Period

Figure 19 Key Seed Producing Countries in the Global Market, 2015

Figure 20 Market for Seed Processing: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Europe: Top Five Seed Producing Countries, 2013–2016 (‘000 Hectare)

Figure 22 Seed Processing Market Size, By Type, 2019 vs. 2025 (USD Million)

Figure 23 Market Size for Seed Processing, By Crop Type, 2019 vs. 2025 (USD Million)

Figure 24 Market Size for Seed Processing, By Equipment, 2019 vs. 2025 (USD Million)

Figure 25 US, Brazil, and Argentina Accounted for Large Shares in the Market in 2018

Figure 26 North America: Regional Snapshot

Figure 27 Europe Seed Market, 2019

Figure 28 Seed Imports and Exports of Japan, 2017

Figure 29 South America: Share of Global Trade in Food and Agriculture

Figure 30 South America: Agricultural Imports and Exports, 2012–2014 (USD Billion)

Figure 31 South America: Regional Snapshot

Figure 32 Market for Seed Processing: Competitive Leadership Mapping, 2018

Figure 33 Key Developments of the Leading Players in the Market, 2014–2019

Figure 34 Bayer Led the Seed Processing Market in 2018

Figure 35 BASF: Company Snapshot

Figure 36 BASF: SWOT Analysis

Figure 37 Bayer: Company Snapshot

Figure 38 Bayer: SWOT Analysis

Figure 39 Corteva: Company Snapshot

Figure 40 Corteva: SWOT Analysis

Figure 41 Syngenta: Company Snapshot

Figure 42 Syngenta: SWOT Analysis

Figure 43 Nufarm: Company Snapshot

Figure 44 Nufarm: SWOT Analysis

Figure 45 Lanxess: Company Snapshot

Figure 46 Clariant: Company Snapshot

Figure 47 Incotec: Company Snapshot

Figure 48 Sensient Technologies: Company Snapshot

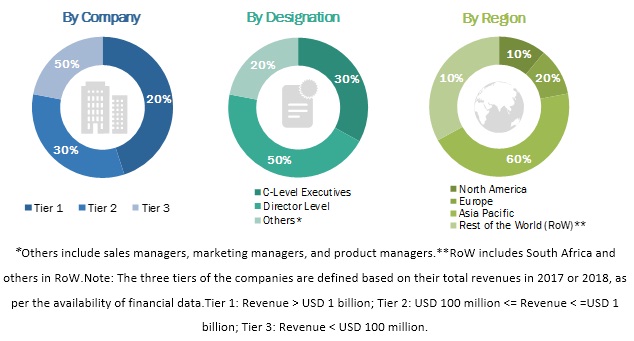

The study involves four major activities to estimate the current market size for seed processing. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The seed processing market comprises several stakeholders, such as manufacturers of seed treatment products, manufacturers of seed processing equipment, and suppliers of raw materials. The demand-side of this market is characterized by the rising demand from various end-use industries such as oilseeds & pulses, cereals & grains, vegetables, flowers & ornamentals. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of the primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the seed processing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes, as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for the seed processing market

- To understand the structure of the seed processing market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total seed processing market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific seed processing market, by country

- Further breakdown of other Rest of Europe seed processing market, by country

- Further breakdown of other Rest of the World seed processing market, by region

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Seed Processing Market