Seed Ingredients Market - Global Forecast to 2029

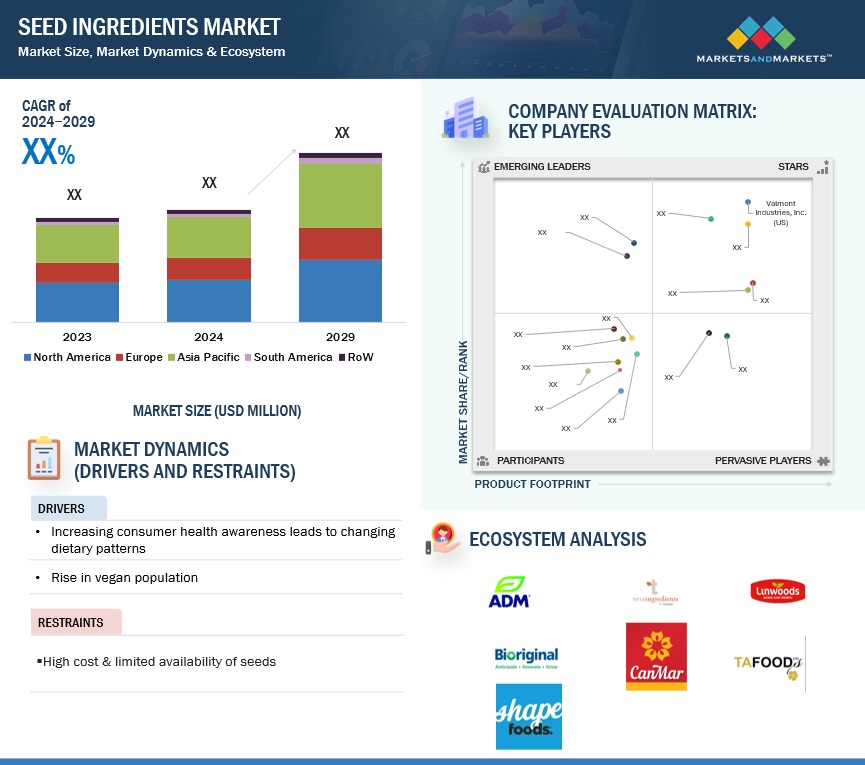

The global seed ingredients market is projected to expand from USD XX million in 2024 to reach USD XX million by 2029, at a CAGR of XX% during the forecast period. The wellness industry is prospering with individuals seeking foods that provide enhanced health benefits beyond basic nutrition. This shift in consumer behavior is propelling the demand for seed ingredients in the market. The rising incidence of chronic diseases leads consumers to incorporate seed ingredients into their diets. According to the U.S. Department of Health & Human Services, in 2024 42% of Americans are dealing with multiple chronic conditions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Increasing consumer health awareness leads to changing dietary patterns

In recent years, consumers have transformed into active participants in the food system, by equipping themselves with information on healthy lifestyles. This has resulted in the shift towards ingredients that provide increased health benefits. A huge percentage of the millennial population in Western countries has been shifting their food habits to the consumption of plant-based foods as an ideal food solution. In recent years, the adoption of organic plant-based food products among consumers has been higher due to its functional benefits for a healthy digestive system and prevention of obesity and chronic diseases. This trend is augmenting the increasing preference foods rich in omega-3 fatty acids and antioxidants. Flaxseed is one of the rich sources of omega-3 fatty acids, alpha-linolenic acid (ALA) acids which is required for the upkeep of joints and bone, along with cognitive health. Increasing consumer health awareness and rising disposable income are factors that have encouraged people to opt for high-quality products. Consumers are increasingly seeking to incorporate seed ingredients into their daily lifestyles. This has led food & beverage manufacturers to consider reformulation of the ingredient lists of their products or innovating food & beverages in response to the changing consumer perception and demand. .

Restraints: High costs & limited availability of seeds

The increased prices of raw or unprocessed seeds have led to an increase in production costs for manufacturers, thereby, further leading to the increase in retail prices. During times of economic uncertainty and recession, consumers have become highly conscious of their spending choices. Given a choice between staple food options such as grains or legumes and relatively expensive seeds, budget-conscious consumers are likely to prioritize costs over health benefits. In addition, many consumers, particularly those in developing regions, struggle to afford these expenses, leading to slower adoption rates of seed ingredients. According to the Good Food Institute (GFI), the average plant-based food including seed ingredients has increased by 8% in 2023 and 18% as compared to 2021 in the US. This inflation for plant-based foods is posing a salient challenge and has led to a decrease in their retail sales in 2023.

Flaxseeds, chia seeds, pumpkin seeds, and sunflower seeds among others are often categorized as superfoods. They are available in the mainstream grocery stores in urban areas. However, in rural areas, they have very limited availability in grocery stores. This coupled with the increased prices is limiting the growth of the seed ingredients market.

Opportunities: Increasing applications in the beauty and wellness industry

Seed ingredients like chia seeds offer a myriad of benefits for the detoxification of skin and enhancing overall skin health, due to their unique properties and rich nutrient profile. It can aid in protecting the skin from oxidative damage, decrease inflammation, enhance hydration, and strengthen the skin barrier. With the increasing social media campaigns, there is an increase in awareness of the benefits of seed ingredients among consumers across the world. This has led many skincare product manufacturers to be involved in research and development and launch products that contain seed ingredients like Chia seeds. For instance, in May 2023, Amway India launched skincare ranges under the brand Artistry Skin Nutrition for youthful skin. The balancing and hydrating range contains chia seeds to protect the skin and maintain the natural skin barrier.

Ongoing research studies on the incorporation of flaxseed oil in skin care products are further proliferating the growth of the market. A research article published in PubMed Central in 2023, highlighted that the supplementation of flaxseed oil can aid in improving skin condition. Flax oil can decrease dull-looking skin and soften the appearance of fine lines and wrinkles. It also aids in keeping the skin hydrated and soft.

Challenges: Concerns regarding taste and texture offered by seed ingredients

Consumers always look for high quality and consistency, in terms of taste and texture, of the products they consume. In recent years, with growing awareness regarding health & wellness and the environment, consumers are demanding more nutritious, clean-label, and sustainable products. Although seed ingredients offer various benefits, the major challenge associated with adopting plant-based products including seed ingredients is the taste and texture of the product. According to the marketing director of a leading plant-based protein-producing company, unsatisfactory taste and mouthfeel in finished products is a common issue that formulators face using plant-based ingredients. Chia seeds and flax seeds tend to develop a gel-like texture. This does not seem to appeal to consumers who generally have crunchier or firmer textures. Seeds like sunflower seeds have a distinctive nutty flavor that many consumers enjoy. However, for consumers who tend to prefer milder tastes, these flavors can be off-putting. In addition, flax seeds have a slightly bitter taste when consumed in whole, this can further their incorporation into consumers' diets. The lack of awareness and experience in integrating these seeds with consumers' diet flavors can result in decreasing the favorability of accepting them and limit the growth of the market.

SEED INGREDIENTS MARKET ECOSYSTEM

Prominent companies in this market include well-established, financially stable manufacturers of seed ingredients. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ADM (US), Terra Ingredients by AgMotion (US), Linwoods Health Foods (UK), Bioriginal Food & Science Corp (Canada), CanMar Foods Ltd. (Canada), Waltanna Farms (Australia), TA Foods Ltd. (Canada), Shape Foods Inc., Prairie Premium Products Inc. (Canada), NOW (US), SESAJAL (Mexico) and Nutiva Inc. (US) among others.

Based on type, the chia seed segment is estimated to dominate the market during the studied period.

The increasing popularity of superfoods over the years due to the hectic busy lifestyles of consumers has resulted the consumers prefer ready-to-eat packaged food products. However, this has further resulted in obesity and other illnesses. In response to this, there is a heightened demand for superfoods and organic ingredients in the food industry. Chia seeds are high in omega-3 fatty acids, protein, and fiber. They can be used in the form of crushed oil, deflated flour, whole seeds, or extracted protein. The versatility of applications of chia seeds in various culinary dishes and growing consumer preference for whole and unprocessed foods are driving the growth of chia seeds. Consumers are increasingly willing to incorporate chia seeds into their diets by adding them to salads, smoothies, yogurts, and baked goods. Over the years, food manufacturers, have applied for different use cases of Chia under the novel food regulation in Europe. The continuous innovation in the potential applications areas of Chia seeds is propelling the market growth. The ease of use and grinding of the seeds to incorporate them into baked goods with the growing demand for baked goods is also contributing to the increasing popularity of chia seeds.

Based on application, the food and beverages segment is the largest segment during the studied period.

The food applications of seed ingredients have shown significant growth over recent years due to their increased adoption of plant-based food products. The change in consumer preferences driven by the increase in awareness toward meat sourcing practices, and its ecological impact, have led consumers to opt for no-meat products. The resulting vegan trend has led to a surge in the presence of manufacturers in the sector. Seed ingredients are used across bread, muffins, cookies, and crackers, and their use is associated with several health benefits in baked goods, such as increasing antioxidants and reducing blood pressure and cholesterol. Plant-based bakery products are being expanded across vegan food service outlets and retail formats, which continue to gain widespread acceptance among consumer groups.

Chia seeds are increasingly being used in the beverages such as smoothies and Drinks. The growing trend of healthy snacking pumpkin seeds and sunflower seeds is dominating their applications in the snacking sector. They are used in the preparation of granola bars, and mixes, and as nut butter alternatives. The growing demand for clean-label foods highlighting the transparency and minimal ingredients further strengthens the demand for these seeds.

The Asia Pacific region is anticipated to experience rapid growth between 2024 and 2029.

The Asia Pacific accounts for the fastest-growing market during the forecast period owing to rising awareness and increased health risks, such as cardiovascular diseases in the region, which have led an increased number of consumers to shift toward seed ingredients in recent years. According to reports published in the Journal of the American Heart Association (JAHA), the cardiovascular death rate of 272 per 100,000 population is higher in India than the global average of 235 per 100,000 population. Apart from health issues, increasing disposable income and rapid urbanization also play a significant role in influencing consumer preferences toward seed ingredients in this region, which is a significant contributor to the growth of the seed ingredients market in the Asia Pacific region. Furthermore, the adaptation of seeds into local cuisines influenced by Western diets is also leading to the growth of the market in the region.

According to a recent report by the European Parliament report, 28.7% of the Japanese population are aged 65 years or older, which is projected to represent one-third of the population by 2036. As meat consumption gradually declines with age, it increases dependence on plant-based foods, presenting good business opportunities for seed ingredient food products.

Key Market Players

- ADM (US)

- Terra Ingredients by AgMotion (US)

- Linwoods Health Foods (UK)

- Bioriginal Food & Science Corp (Canada)

- CanMar Foods Ltd. (Canada)

- Waltanna Farms (Australia)

- TA Foods Ltd. (Canada)

- Shape Foods Inc.

- Prairie Premium Products Inc. (Canada)

- NOW (US)

- SESAJAL (Mexico)

- Nutiva Inc.(US)

- NAVITAS ORGANICS (US)

- Chia Bia (UK)

- The Chia Co.(Australia)

- Vega Produce (US)

- Naturkost Übelhör (Germany)

- LIFEFOOD INTERNATIONAL (UK)

- European Natural Food Co. (UK)

- Tierra Farm (US)

- Amayu (India)

- Living Nutz. (US)

- Shiloh Farms (US)

- GO RAW (US)

- SunRidge Farms (US)

These market players are focusing on increasing their presence through agreements and partnerships. These companies have a strong presence in North America, Europe, Asia Pacific, South America, and RoW. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In February 2024, Bioriginal Food & Science Corp (Canada) acquired POS Biosciences Corp. (POS) of Saskatoon, from Canopy Growth Corp. (Canada). This strategic move will allow the company to become POS's largest vendor and customer acquiring access to processing facilities for oils and proteins for value-added seed products. This allows the company to expand its operations to eight manufacturing facilities across the globe.

- In March 2023, Nutiva Inc. (Canada) an organic foods company announced to complete shutdown its production plant and warehouse in Richmond, Canada. The company has taken this move to shift to an outsourced manufacturing model.

- In May 2022, Waltanna Farms (Australia) a part of TUI foods received USD 2.5 million in the modern manufacturing drive initiative to build a new automated food production facility with a 6,500 square-meter manufacturing plant. This enables the company to build Australia’s first oat-flax syrup production facility and specialized dehydration technology for nutraceutical and innovative food ingredients.

- In April 2022, Linwood Health Foods (UK), launched Multiboost Milled Hemp Range in a new packaging design that places special importance on the hemp ingredient. The new packaging design captures the nutritional benefits of hemp seeds, featuring three nutritious organic blends. This strategic move aims to capture and increase the market visibility of hemp seed products.

- In Shape Foods Inc. (Canada) has expanded its product offerings by adding hemp seeds, and sunflower seeds to their product lines. This allows the company to increase its market presence and gain a strong foothold in the market.

Frequently Asked Questions (FAQ):

What is the current size of the seed ingredients market?

The seed ingredients market is estimated at USD XX million in 2024 and is projected to reach USD XX million by 2029, at a CAGR of xx%.

What are the key market players, and how intense is the competition?

Key players in the chilled dough market include General Mills, Inc. (US), Nestlé S.A. (Switzerland), Pillsbury Company, LLC (US), Dawn Foods (US), Aryzta AG (Switzerland), and Rich Products Corporation (US). The market is highly competitive, with companies investing in product innovations, expanding product portfolios, and adopting aggressive pricing strategies. R&D efforts to develop dough with extended shelf life and versatile applications also contribute to competition intensity. Companies are focusing on expanding their e-commerce presence and forming partnerships to reach a broader consumer base.

Which region is estimated to account for the largest share of the seed ingredients market in 2024?

The North American market is estimated to dominate the seed ingredients market in 2024. The region is a key supplier and processor of plant-based foods while also maintaining a strong base of product manufacturers and consumers for seed ingredients. The region is also influenced by the global trend of veganism and has a high awareness of the benefits of seed ingredients, which presents significant business opportunities for seed ingredients during the forecast period.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to illustrate the company's potential better.

What are the factors driving the seed ingredients market?

Increasing health consciousness among consumers, Rising vegan populations, a continuous rise in demand for food and beverage products with organic ingredients, and increasing sales of plant-based food are increasing the demand for seed ingredients.

Growth opportunities and latent adjacency in Seed Ingredients Market