Sectionalizer Market by Phase Type (Three Phase and Single Phase), Control Type (Resettable Electronic and Programmable Resettable), Voltage Rating (Up to 15 kV, 16-27 kV, and 28-38 kV), and Region - Global Forecast to 2027

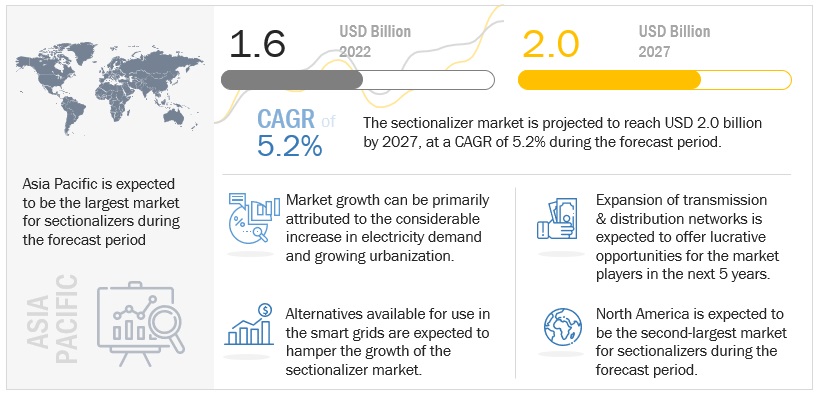

[179 Pages Report] The global sectionalizer market is expected to reach USD 2.0 billion by 2027 from an estimated USD 1.6 billion in 2022, at a CAGR of 5.2% during the forecast period. To minimize the outages and to build a reliable and efficient distribution network, the sectionalizer are used in conjunction with the reclosers. Therefore, the increase in the recloser market is expected to drive the market for sectionalizers as well.

To know about the assumptions considered for the study, Request for Free Sample Report

Sectionalizer Market Dynamics

Driver: Growing renewable power generation and increasing investments in renewable energy

Distribution automation technology comprises equipment such as reclosers, sectionalizer, switches, and feeder protection & control systems among others. In a distribution network, sectionalizer are used in combination with reclosers to protect circuit from fault currents. These are critical components and play a dominant role in the automation systems. Global utilities suffers annual economic losses due to power interruptions. Distribution automation is one such advanced automation technology that improves power reliability, delivering cost efficient operation of distribution network. This technology helps electric utilities in improving operational efficiency, power quality, and safety, making it a fundamental requirement for all utilities.

Restraints: Availability of Substitute for use in Smart Grid

Pulse reclosers are introduced in the market to eliminate the flaws of a sectionalizer. The pulse technology is helpful in determining whether a fault is located without requirement of a breaker or recloser to reclose into the full fault. It is more like a three phase recloser than a sectionalizer because it can interrupt fault current and provide more accurate time current curves, which makes device coordination much easier and more flexible. On networks that use both pulse reclosers and sectionalizers, the pulse reclosers should have at least one hard recloser configured in order for sectionalizer to count correctly because sectionalizers cant count an upstream pulse recloser.

Opportunities: Implementation of performance based incentive schemes & guaranteed service programs

Many government bodies have added a reliability component to performance based revenue regulations. These regulations have a financial incentive structure that may be one sided, that is, distributors may face a penalty for not meeting their standards, or two sided where distributors can also receive a bonus for exceeding them. Such incentive schemes, above and beyond tracking of performance against standards, provide regulators with a direct control to improve reliability standards. Mostly, the guarantees relate to outage restoration times and the provision of information about outages including expected time of service restoration. These schemes would drive the usage of distribution equipment such as sectionalizers by distribution operators.

Challenges: Upgrade of existing substation and feeder line protection

Planned power generation capacities are likely to stress the existing power grid unless expanded and upgraded. The replacement of the aging infrastructure and capacity additions require expanded, new, and upgraded T&D infrastructures. Most existing power infrastructures in developed countries are already old and need to be upgraded. Sectionalizer is a major component in substations and feeder automation to interrupt the fault current and provide reliable power to end-users. Therefore, to maximize power quality and minimize power loss, aging power systems either need to be replaced or modernized, which is the major challenge of the sectionalizer market as it is capital intensive.

To know about the assumptions considered for the study, download the pdf brochure

Resettable Electronic segment, by control type, to emerge as the largest segment of the sectionalizer market from 2022 to 2027

The sectionalizer market has been segmented, based on control type, into resettable electronic and programmable resettable. The growth of resettable electronic sectionalizers can be attributed to the increased demand for the protection of single-phase lateral lines. The global trend of increasing investments in transmission & distribution infrastructure and distribution automation is expected to aid the growth further.

Up to 15 kV segment, by voltage rating, to grow at the highest CAGR from 2022 to 2027

The sectionalizer market has been segmented, based on voltage rating, into three segments, namely, up to 15 kV, 1627 kV, and 2838 kV. The up to 15 kV segment is expected to grow with the highest CAGR during the forecast period. The up to 15 kV sectionalizers are primarily used in residential applications and rural distribution lines. Increasing urbanization, rising investments in smart grid projects, and growing commercial, residential, and industrial sectors are likely to drive the market for up to 15 kV sectionalizers.

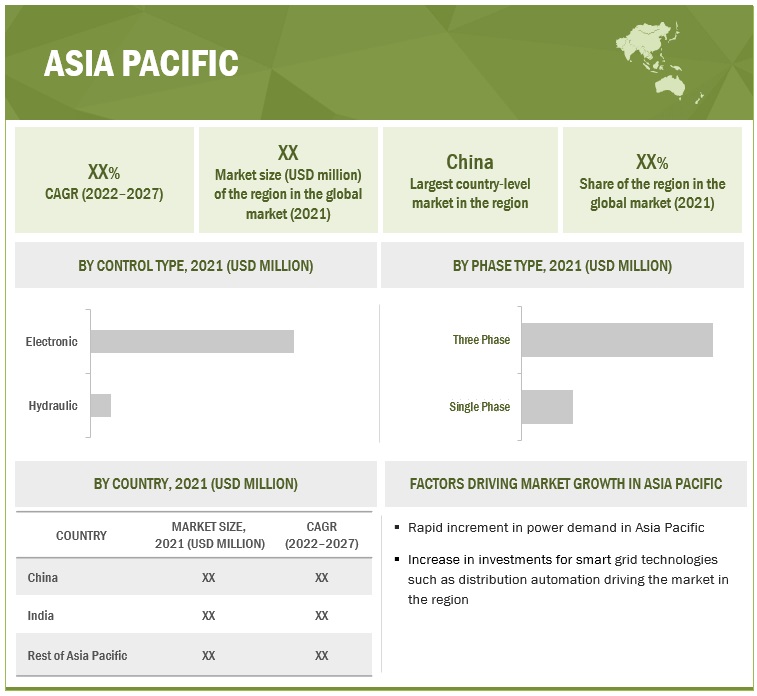

Asia Pacific to account for largest market size during the forecast period

The manufacturing industry in Asia Pacific is expected to thrive due to lower capital and labor costs. The demand for power generation is also witnessing an upward trend with the growing population in China and India. According to the Energy Information Administration (EIA), the Chinas installed power generation capacity is expected to double and reach 2,265 GW by 2040, which is driven by a combination of renewable energy sources, nuclear and coal. The government in China is largely investing in transmission and distribution (T&D) projects to meet the increasing electricity demand. Also, China is investing in smart grid projects, thereby driving the market for sectionalizers in the country. Also, rising investments in upgrading smart grid infrastructure and distribution automation projects will increase demand for sectionalizers in Asia Pacific.

Key Players

ABB (Switzerland), Hubbell (US), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), Brush Group (England), G&W Electric (US), Entec Electric & Electronic (South Korea), Tavrida Electric (Estonia), and Elektrolites (India).

Scope of the Report

|

Report Metrics |

Details |

| Market Size available for years | 20202027 |

| Base year considered | 2021 |

| 2021 | 20222027 |

| Forecast units | Value (USD Million) |

| Segments covered | By Phase Type, By Control Type, By Voltage rating |

| Geographies covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

| Companies covered | ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Hubbell (US), Eaton Corporation (Ireland), Tavrida Electric (Estonia), G&W Electric (US), Entec Electric & Electronic (South Korea), Elektrolites (India), Bevins Co. (US), Celsa S.A. (Colombia), HEAG (China), Hughes Power System (Sweden), Zhiyuan Power Technology Co., Ltd. (China), Ghorit Electricals (China) |

This research report categorizes the sectionalizer market based on by Phase Type, Control Type, Voltage Rating, and Region.

Based on Phase Type, the sectionalizer market has been segmented as follows:

- Three

- Single

Based on Control Type, the sectionalizer market has been segmented as follows:

- Resettable Electronic

- Programmable Resettable

Based on Voltage Rating, the sectionalizer market has been segmented as follows:

- Up to 15 kV

- 16-27 kV

- 28-38 kV

Based on region, the sectionalizer market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In October 2021, Eaton and Enel X partnered to expand clean energy infrastructure and strengthen energy resilience in Puerto Rico with a second microgrid. With the help of these projects, Eaton will be able to use more renewable energy sources to power its manufacturing processes and improve its operations' energy resilience.

- In August 2020, Schneider Electric completed a transaction to combine its low voltage and industrial automation business in India with Larsen & Toubros electrical & automation business.

- In January 2020, Siemens Ltd. (India) acquired New Delhi-based C&S Electric Limited. This acquisition is expected to strengthen Siemens position as a key supplier of low-voltage power distribution and electrical installation technology in one of the worlds fastest-growing economies.

Frequently Asked Questions (FAQ):

What is the current size of the global sectionalizer market?

The global sectionalizer market is estimated to be USD 1.6 billion in 2022.

What are the major drivers for the sectionalizer market?

The sectionalizer market is expected to witness significant growth during the forecast period because of the growth in renewable power generation, expanding transmission and distribution networks, and the increasing distribution automation solutions for power quality and reliability.

Which is the largest-growing region during the forecast period in the sectionalizer market?

Asia Pacific is expected to account for the largest market size during the forecast period. It is also expected to grow with the highest CAGR from 2022 to 2027. According to the United Nations Economic and Social Commission for Asia and the Pacific data, despite of increasing population in the region, the number of people lacking electrical connections dropped substantially. This is all because of the electrification, which was being carried out rapidly in this region, especially in remote parts.

Which is the fastest-growing segment in the sectionalizer market during the forecast period?

The programmable resettable, by control type, is the fastest-growing segment in the sectionalizer market. The programmable resettable sectionalizer has built-in intelligence and discriminate between temporary and permanent faults on distribution systems. They are installed at the beginning of a lateral, and virtually eliminates unnecessary outages. The functions and design of this type of sectionalizer improves the system coordination. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.5 Assumptions

2.6 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities

4.2 Asia-Pacific: Potential Market to Invest During the Forecast Period

4.3 The Americas Dominated the Sectionalizer Market in 2014

4.4 The Three-Phase Sectionalizer Segment is Expected to Dominate the Market During the Forecast Period

4.5 Increase in Demand for Electronic Sectionalizers

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Sectionalizer: Market Segmentation

5.2.1 By Phase Type

5.2.2 By Control Type

5.2.3 By Voltage Rating

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Investments in Distribution Automation for Power Quality & Reliability

5.3.1.2 Reduction in Service Outages & Increase in Power Reliability

5.3.1.3 Increasing Energy Consumption Worldwide

5.3.2 Restraints

5.3.2.1 Availability of Substitute for Use in Smart Grid

5.3.2.2 Requirement of Additional Upstream Breaker Or Recloser to Interrupt Fault Current

5.3.2.3 Cost-Effectiveness in Rural Areas

5.3.3 Opportunities

5.3.3.1 Increasing Investments in Smart Grid Vision

5.3.3.2 Implementation of Performance-Based Incentives Schemes & Guaranteed Service Programs

5.3.4 Challenges

5.3.4.1 Upgrade of Existing Substation & Feeder Line Protection

5.4 Value Chain Analysis

5.5 Supply Chain Analysis

5.6 Porters Five Forces Analysis

5.6.1 Threat of Substitutes

5.6.2 Threat of New Entrants

5.6.3 Bargaining Power of Buyers

5.6.4 Bargaining Power of Suppliers

5.6.5 Intensity of Rivalry

6 Sectionalizer Market, By Phase Type (Page No. - 55)

6.1 Three-Phase Sectionalizer

6.2 Single-Phase Sectionalizer

7 Sectionalizer Market, By Control Type (Page No. - 60)

7.1 Resettable Electronic Sectionalizer

7.2 Programmable Resettable Sectionalizer

8 Sectionalizer Market, By Voltage Rating (Page No. - 65)

8.1 0-15 Kv Sectionalizer

8.2 15-27 Kv Sectionalizer

8.3 Above 27 Kv Sectionalizer

9 Sectionalizer Market, By Region (Page No. - 72)

9.1 Introduction

9.2 North America

9.2.1 North America, By Control Type

9.2.2 North America, By Voltage Rating

9.2.3 North America, By Phase Type

9.2.4 North America, By Country

9.2.4.1 U.S.

9.2.4.2 Canada

9.2.4.3 Rest of North America

9.3 Asia-Pacific

9.3.1 Asia-Pacific, By Control Type

9.3.2 Asia-Pacific, By Voltage Rating

9.3.3 Asia-Pacific, By Phase Type

9.3.4 Asia-Pacific, By Country

9.3.4.1 China

9.3.4.2 India

9.3.4.3 Japan

9.3.4.4 Australia

9.3.4.5 Rest of Asia-Pacific

9.4 Europe

9.4.1 Europe, By Control Type

9.4.2 Europe, By Voltage Rating

9.4.3 Europe, By Phase Type

9.4.4 Europe, By Country

9.4.4.1 Russia

9.4.4.2 U.K.

9.4.4.3 Italy

9.4.4.4 France

9.4.4.5 Rest of Europe

9.5 South America

9.5.1 South America, By Control Type

9.5.2 South America, By Voltage Rating

9.5.3 South America, By Phase Type

9.5.4 South America, By Country

9.5.4.1 Brazil

9.5.4.2 Argentina

9.5.4.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Middle East, By Control Type

9.6.2 Middle East & Africa, By Voltage Rating

9.6.3 Middle East & Africa, By Phase Type

9.6.4 Middle East & Africa, By Country

9.6.4.1 Saudi Arabia

9.6.4.2 South Africa

9.6.4.3 UAE

9.6.4.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 116)

10.1 Overview

10.2 Market Share Analysis, By Key Players

10.3 Competitive Situation & Trends

10.3.1 New Product Launches

10.3.2 Contracts & Agreements

10.3.3 Mergers & Acquisitions

10.3.4 Expansions

10.3.5 Other Developments

11 Company Profiles (Page No. - 129)

11.1 ABB Ltd.

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments, 2011-2015

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Eaton Corporation

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments, 2012-2014

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Schneider Electric

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments, 2012-2014

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Hubbell Incorporated

11.4.1 Business Overview

11.4.2 Products & Services Offered

11.4.3 Recent Developments, 2013-2015

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Tavrida Electric

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments, 2012-2015

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 Entec Electric & Electronics Co. Ltd.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments,

11.7 Elektrolites

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments, 2014-2015

11.8 Bevins

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments, 2014-2015

11.9 Celsa

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.10 Heag

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.11 Zhiyuan Power Technology Co., Ltd.

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.12 Inael

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Recent Developments, 2015

11.13 S&C Electric Company

11.13.1 Business Overview

11.13.2 Products Offered

11.13.3 Recent Developments, 2014- 2015

11.14 G&W Electric

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Recent Developments, 2011-2012

12 Appendix (Page No. - 174)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (66 Tables)

Table 1 Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 2 Three-Phase Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 3 Single-Phase Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 4 Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 5 Resettable Electronic Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 6 Programmable Resettable Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 7 Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 8 0-15 Kv Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 9 15-27 Kv Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 10 Above 27 Kv Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 11 Sectionalizer Market Size, By Region, 20132020 (USD Million)

Table 12 North America: Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 13 North America: Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 14 North America: Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 15 North America: Three-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 16 North America: Single-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 17 North America Sectionalizer Market Size, By Country, 2013-2020, (USD Million)

Table 18 U.S. Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 19 Canada: Sectionalizer Market Size, By Phase Type,2013-2020 (USD Million)

Table 20 Rest of North America: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 21 Asia-Pacific: Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 22 Asia-Pacific: Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 23 Asia-Pacific: Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 24 Asia-Pacific: Three-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 25 Asia-Pacific: Single-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 26 Asia-Pacific Sectionalizer Market Size, By Country, 2013-2020, (USD Million)

Table 27 China: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 28 India: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 29 Japan: Sectionalizer Market Size, By Phase Type,2013-2020 (USD Million)

Table 30 Australia: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 31 Rest of Asia-Pacific: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 32 Europe: Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 33 Europe: Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 34 Europe: Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 35 Europe: Three-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 36 Europe: Single-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 37 Europe Sectionalizer Market Size, By Country, (USD Million)

Table 38 Russia: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 39 U.K. Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 40 Italy: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 41 France: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 42 Rest of Europe: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 43 South America: Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 44 South America: Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 45 South America: Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 46 South America: Three-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 47 South America: Single-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 48 South America Sectionalizer Market Size, By Country, 2013-2020, (USD Million)

Table 49 Brazil: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 50 Argentina: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 51 Rest of South America: Sectionalizer Market Size, By Phase Type , 2013-2020 (USD Million)

Table 52 Middle East & Africa: Sectionalizer Market Size, By Control Type, 20132020 (USD Million)

Table 53 Middle East & Africa: Sectionalizer Market Size, By Voltage Rating, 20132020 (USD Million)

Table 54 Middle East & Africa: Sectionalizer Market Size, By Phase Type, 20132020 (USD Million)

Table 55 Middle East& Africa: Three-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 56 Middle East & Africa: Single-Phase Sectionalizer Market Size, By Country, 20132020 (USD Million)

Table 57 Middle East & Africa Sectionalizer Market Size, By Country, 2013-2020, (USD Million)

Table 58 Saudi Arabia: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 59 South Africa: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 60 UAE: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 61 Rest of Middle East & Africa: Sectionalizer Market Size, By Phase Type, 2013-2020 (USD Million)

Table 62 New Product Launches, 2011-2015*

Table 63 Contracts & Agreements, 2012-2014

Table 64 Merger & Acquisition, 2012-2014

Table 65 Expansions, 2011-2015*

Table 66 Other Developments, 2014-2015*

List of Figures (55 Figures)

Figure 1 Markets Covered: Sectionalizer Market

Figure 2 Sectionalizer Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Assumptions of the Research Study

Figure 6 Limitations of the Research Study

Figure 7 Sectionalizer Market: Regional Snapshot (2015 vs 2020)

Figure 8 North America Dominated the Sectionalizer Market in 2014

Figure 9 0-15 Kv Sectionalizer Market, By Region, 2020 (USD Million)

Figure 10 Sectionalizer Market Size, By Phase Type, 2015 & 2020 (USD Million)

Figure 11 Sectionalizer Market Size, By Control Type, 2014-2020 (USD Million)

Figure 12 Investment in Distribution Automation Systems Will Drive the Market for Sectionalizer in Future

Figure 13 Asia-Pacific is Expected to Hold About 32% of the Total Market Share in 2020

Figure 14 The North American Sectionalizer Market Accounted for About 35% Share in 2014

Figure 15 Three-Phase Electronic Sectionalizer Segment is Estimated to Account for More Than 70% of the Market Share in 2015

Figure 16 Demand for Programmable Electronic Sectionalizer Would Be on A Rise During the Forecast Period

Figure 17 Life Cycle Analysis: By Region in Upcoming Years

Figure 18 Three-Phase Sectionalizer: Commonly Used Sectionalizer All Over the World

Figure 19 Three-Phase Sectionalizer: Potential Markets to Invest

Figure 20 Resettable Electronic Sectionalizer Segment is Expected to Dominate the Sectionalzier Market During the Forecast Period

Figure 21 Sectionalizer With Voltage Rating of 0-15 Kv is Expected to Dominate the Market During the Forecast Period

Figure 22 Asia-Pacific Market is Expected to Grow at A CAGR of 5.59% During the Forecast Period

Figure 23 0-15 Kv Sectionalizer : Potential Market Size, 2015-2020 (USD Million)

Figure 24 Asia-Pacific & North America are Potential Markets to Demand Sectionalizer During the Forecast Period

Figure 25 Potential Markets to Invest During the Forecast Period

Figure 26 North America: Sectionalizer Market Snapshot

Figure 27 Canada is Expected to Grow at A CAGR of 4.25% During the Forecast Period

Figure 28 Asia-Pacific: Sectionalizer Market Snapshot

Figure 29 China is Expected to Dominate the Market During the Forecast Period

Figure 30 Europe: Sectionalizer Market Snapshot

Figure 31 Middle East & Africa: Sectionalizer Market Snapshot

Figure 32 Companies Adopted New Product Development as the Key Growth Strategy in the Past Four Years

Figure 33 Sectionalizer Market Share Analysis, By Key Players, 2014

Figure 34 Market Evaluation Framework: Share of Key Growth Strategies, By Development, 2011 2015

Figure 35 Battle for Market Share: New Product/Technology Launch is the Key Strategy

Figure 36 Regional Revenue Mix of the Top 4 Market Players

Figure 37 ABB Ltd.: Company Snapshot

Figure 38 ABB Ltd.: SWOT Analysis

Figure 39 Eaton Corporation: Company Snapshot

Figure 40 Eaton Corporation: SWOT Analysis

Figure 41 Schneider Electric : Company Snapshot

Figure 42 Schneider Electric : SWOT Analysis

Figure 43 Hubbell Incorporated: Company Snapshot

Figure 44 Hubbell Inc.: SWOT Analysis

Figure 45 Entec Electric & Electronic Co. Ltd.: Company Snapshot

Figure 46 Elektrolites: Company Overview

Figure 47 Bevins: Company Overview

Figure 48 Celsa: Company Snapshot

Figure 49 Heag: Company Snapshot

Figure 50 Zhiyuan Power Technology Co., Ltd.: Company Snapshot

Figure 51 Inael: Company Snapshot

Figure 52 Tavrida Electric: Company Snapshot

Figure 53 Tavrida Electric.: SWOT Analysis

Figure 54 S&C Electric Company: Company Snapshot

Figure 55 G&W Electric: Company Snapshot

This study involved major activities in estimating the current size of the sectionalizer market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved using extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global sectionalizer market. The other secondary sources comprised press releases and investor presentations of companies, whitepapers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

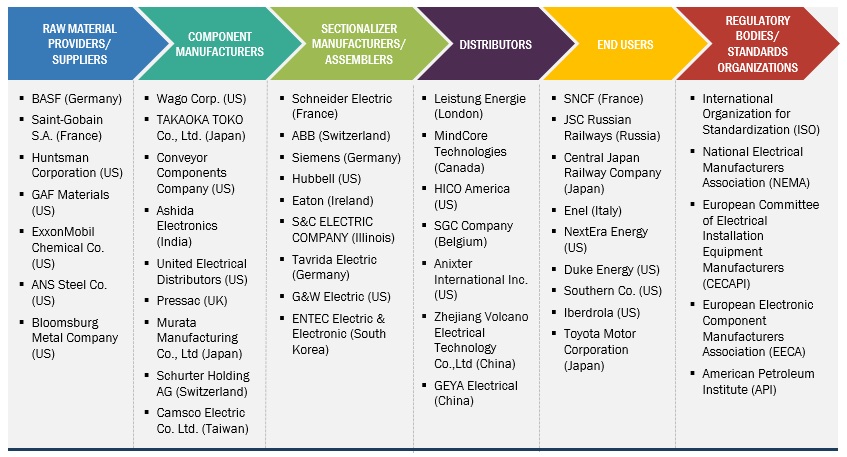

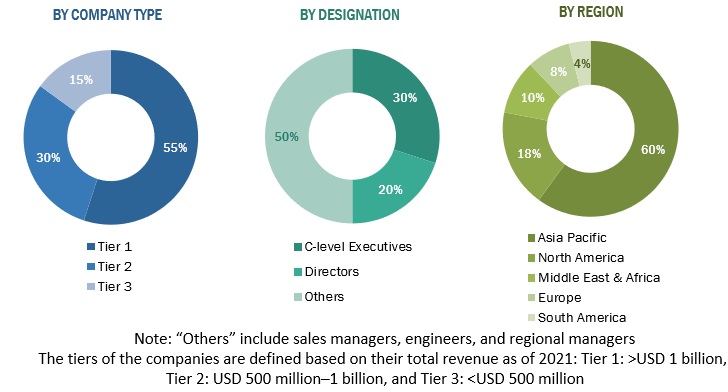

The sectionalizer market comprises stakeholders, such as raw material suppliers, component manufacturers, product manufacturers/assemblers, distributors, end-users, and regulatory bodies/standard organizations in the supply chain. Industrial end-users characterize the demand side of this market. Moreover, the demand is also fueled by the growing transmission and distribution utility demand. The supply side is characterized by rising demand for contracts from the industrial sector and mergers and acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the sectionalizer market size.

- In this approach, the sectionalizer production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of sectionalizers.

- Several primary interviews have been conducted with key opinion leaders related to sectionalizer system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

Global Sectionalizer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying numerous factors and trends from both the demand and supply sides in the sectionalizer market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the sectionalizer market by Phase Type, Control Type, Voltage Rating, and Region.

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East and Africa, along with their key countries

- To provide comprehensive information about drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the sectionalizer market

- This report covers the sectionalizer market size in terms of value and volume

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for a report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Sectionalizer Market