Second-life Battery Market by Battery Type (Lithium-ion Battery, Lead Acid Battery), Application (Stationary (Power & Energy Storage), Motive), and Region (North America, Europe, Asia Pacific, and Rest of the World) - Global Forecast to 2030

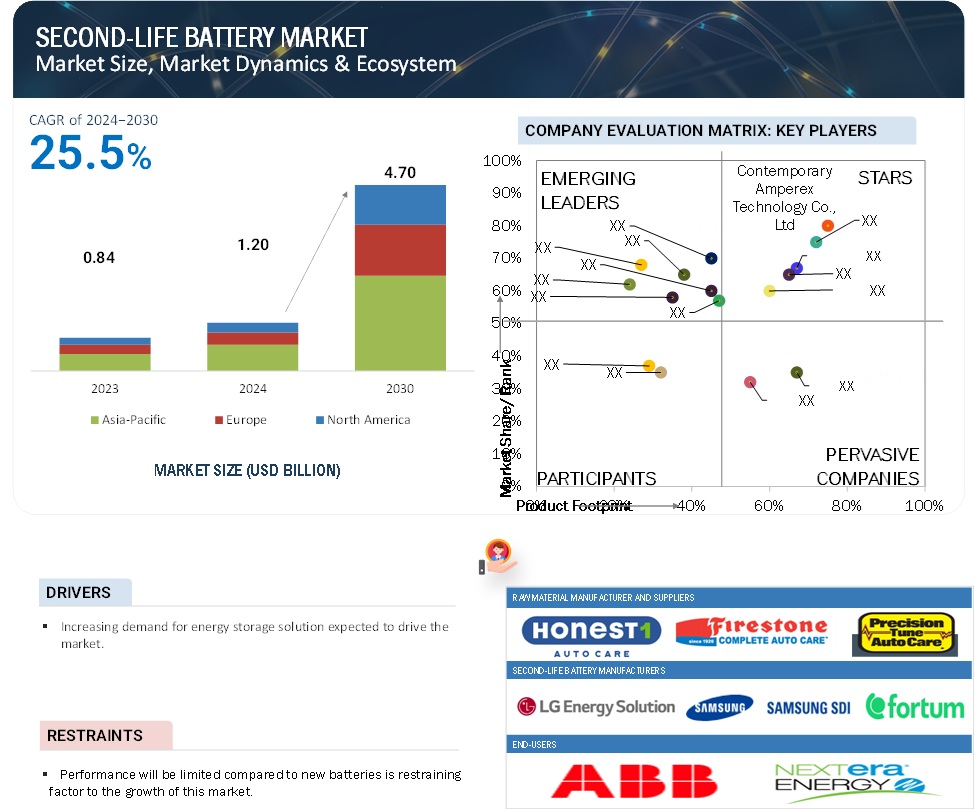

The global second-life battery market is projected to grow from USD 1,200 million in 2024 to USD 4,700 million by 2030, at a CAGR of 25.5% during the forecast period. The growth of the second-life battery market is driven by increasing demand for cost-effective energy storage solutions, the rise of renewable energy integration, and the expanding pool of retired EV batteries with significant remaining capacity. Environmental concerns and the push for sustainability also play a key role, as it reduces waste and the need for resource-intensive raw material extraction.

Attractive Opportunities in the Second-life Battery Market

To know about the assumptions considered for the study, Request for Free Sample Report

Second-life Battery Market Dynamics

Driver: Rising demand for energy storage solutions

Renewable energy, such as wind and solar energy, strongly leads to power storage solutions using second-life batteries, which are second-hand batteries from electric and hybrid vehicles and other applications. Second-life batteries are viable, sustainable, and cost-effective for energy storage. These will help balance the supply-demand to enable better use of renewables on the grid and improve the overall energy security. However, several initiatives have been undertaken worldwide- primarily by governments and organizations- aimed at reducing fossil fuel dependence and greenhouse gas emissions due to such applications of battery storage systems. That would extend the second-life application of batteries, particularly in household and commercial settings. Demand continues to escalate and thus move the market forward, with considerable investments being generated in the second-life battery market industry.

Restraint: Performance will be limited compared to new batteries

The major limitation of the second-life battery market is the limited performance of repurposed batteries when compared to new ones. As batteries are sufficiently aged, they only show reduced capacity and efficiency. They are not favored to withstand high-demand requirements that require batteries for many hours in mission-oriented environments- for instance, electric vehicles- well beyond the usual and necessary range of capabilities. In addition, performance variation between alternate battery makes, and models adds complexity to the situation. While some second-life batteries may still have enough power for secondary applications, others may degrade unevenly, making them unpredictable and less dependable. This may lead to limited market opportunities for second-life batteries, which are expected mainly by the industries and consumers for energy solutions to be consistently long-lasting.

Opportunity: Grid-Scale Energy Storage and V2G Applications

Large-scale battery-based second-life energy systems could significantly improve energy grid reliability and resilience. In that case, they would supplement power from fossil fuel-based generation sources with excess renewable energy stored and released as required and balance the grid during periods when demand is at its lowest. Furthermore, the massive assembly of second-life batteries can enhance grid stability to mitigate the effects of fluctuating renewable energy sources, such as solar and wind.

A potential second use for batteries is in the V2G systems. These enable mobility across the V2G-battery-equipped vehicle while controlling the network to operate as an additional energy storage unit during peak electricity demand when used along with an articulated V2G system, thus feeding power back to grids for additional capacity and reliability. This would create mutual advantages for the grid and owners of EVs. It would also give EV owners an economic incentive to sell "harvested" energy through energy storage capacity to the grid. This application will revolutionize how energy is managed and consumed as the retired batteries multiply with growing EV adoption and open markets, calling for a more sustainable and efficient energy management system.

Challenges: Streamlining the Repurposing Process and Ensuring Long-Term Performance

The key hurdle for second-life battery deployment is an efficient repurposing process. The chemistry, design, and degradation patterns vary so much among various electric vehicle (EV) batteries that refurbishment workflows become challenging to standardize, thus making it much costlier and less scalable to identify, test, and incorporate used batteries into second-life applications. The development of automated diagnostic tools and standardization protocols becomes a remedy to this issue. The third pillar is guaranteeing long-term performance reliability. For most, second-life batteries need more detailed information on degradation trends, so the operation lifecycle cannot be predicted. Further complicating deployment would be performance variability across battery makes and models, particularly for high-stakes applications like grid stabilization.

Second-Life Battery Market: Ecosystem

Based on battery type, the lithium-ion battery is accounted for the fastest growing segment during the forecast period.

Lithium-ion batteries dominate the second-life battery market, as accounted for the fastest growing segment because of their rising demand in electric vehicles, consumer electronics, and energy storage systems. They possess high energy density, longer cycle life, and better performance than other variants. Thus, they are ideal candidates for repurposing in second-life applications such as renewable energy integration and grid stabilization. This further catalyzes the growth due to increased EV production and sustainability. In addition, improvements in battery diagnostics and refurbishment technologies facilitate improving the efficiency of lithium-ion reuse while reducing the cost, further boosting this segment.

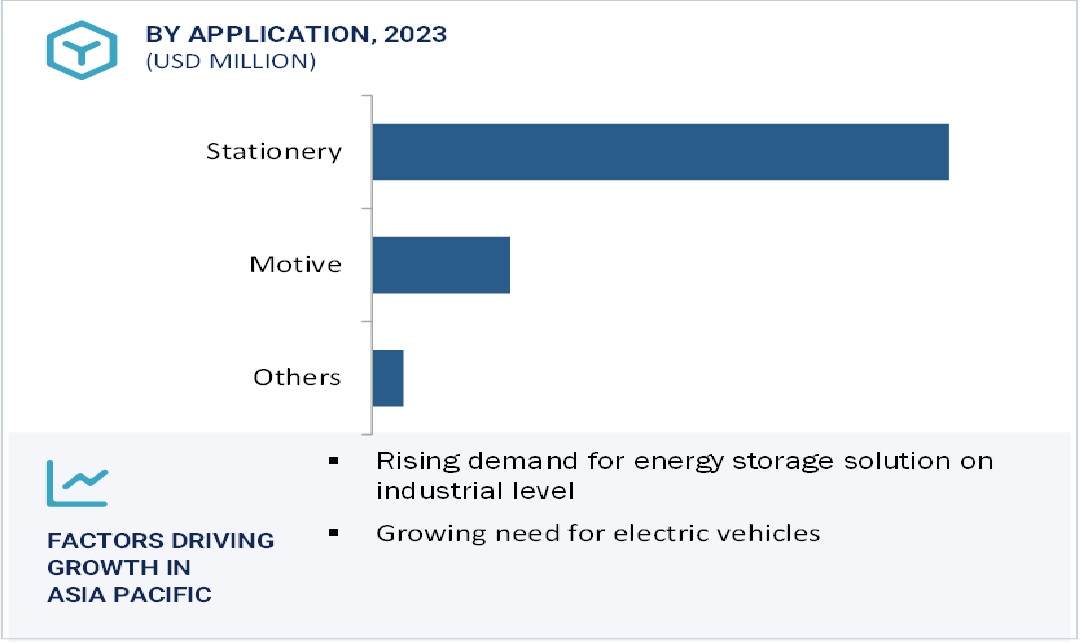

Based on application, the stationary segment is accounted for the fastest growing segment during the forecast period.

The market for second-life batteries is proliferating, with many people adopting electric vehicles (EVs) and demand for sustainable energy storage solutions rising exponentially. In this regard, stationary applications have developed fast into a segment with excellent demand for repurposed stationary deployment of EV batteries. Although no longer taking cars far or fast, these batteries have sufficient capacity and power density for stationary applications, as these second-life uses are very cost-effective and environmentally friendly. Such applications are expected to stabilize the grid into a fossil-free future in which second-life batteries will also play a significant part in creating.

Asia Pacific region is projected to grow at a significant CAGR during the forecast period

Asia Pacific has mainly been coming up as the fastest player in the growing market for second-life batteries. The central driving element for this market is the rapid expansion of the electric vehicle and others industry in countries like China, Japan, South Korea, and India. Furthermore, the massive thrust of this region on renewable energy and sustainable efforts, which, along with growing numbers of available retired EV batteries, pushes the second-life battery undertakings further. Government initiatives, supporting policies, and considerable R&D investments are also beneficial to this region's involvement in the vast second-life battery market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Enel X S.r.l. (Italy), Nissan Motor Co., Ltd. (Japan), Fortum (Finland), LOHUM (India), Volvo Energy (Sweden), Renault Group (France), Mercedes-Benz Group AG (Germany), RWE (Germany), BMW Group (Germany), SAMSUNG SDI (South Korea), AESC Group Ltd. (Japan), CATL (China), Sonnen (Germany), Murata Manufacturing Co., Ltd. (Japan), LG Energy Solutions (South Korea), Northvolt AB (Sweden), Tesla (US), are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Recent Developments in Second-life Battery Market

- In June 2024, Connected Energy collaborates with Nissan Motor Co., Ltd. on project to boost EV battery sustainability. Connected Energy will focus on developing second-life battery solutions, leveraging its existing technology to create large-scale energy storage systems using repurposed EV batteries. These systems address grid power capacity challenges, optimize renewable energy usage in buildings with solar arrays, and enhance energy resilience, significantly reducing the environmental impact of EV batteries before recycling.

- In September 2023, Volvo Energy and Connected Energy signed a Letter of Intent to collaborate on developing second-life battery energy storage systems (BESS). The partnership aims to repurpose batteries from Volvo's electric buses, trucks, and machines after their mobile use, providing environmental and economic benefits while extending the batteries' lifecycle.

- In June 2023, LOHUM will repurpose end-of-first-life MG electric vehicle batteries to create sustainable second-life Battery Energy Storage Systems (BESS) for diverse clean energy applications across India. Using proprietary technology, LOHUM maximizes the remaining useful life of healthy cells, extending their utility before recycling.

- In December 2021, RWE and Audi launched an innovative energy transition project in Herdecke, North Rhine-Westphalia. The project utilizes 60 used lithium-ion batteries from Audi EVs to create an energy storage system. Located at RWE's pumped-storage power plant at Hengsteysee reservoir, the system provides temporary storage for approximately 4.5 megawatt hours of electricity.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What is a second-life battery?

A second-life battery is a battery that is generally discharged under conditions unsuitable for its primary application. It is an electric vehicle battery or similar type whose capacity has declined from its original levels below the threshold for optimal performance. Such a battery can no longer fulfill the rigid conditions of powering a vehicle. However, it still has considerable energy storage capabilities and several potential applications, such as stationary energy supply, renewable energy integration, and grid stabilization. Two tremendous ways by which second-life batteries contribute to sustainability are the extension of the life of battery materials and the reduction of electronic waste.

What are the different battery types from which the second-life battery is made?

Second-life batteries are primarily made from lithium-ion batteries and lead acid batteries.

Which key companies are operating in the global second-life battery market?

Enel X S.r.l. (Italy), Nissan Motor Co., Ltd. (Japan), Fortum (Finland), Renault Group (France), Mercedes-Benz Group AG (Germany), and among others are companies operating in the second-life battery market.

What are the key strategies adopted by the market players?

Companies involved in the second-life battery market have prioritized collaboration, partnership, and others as key strategies for expanding their geographical reach and revenue.

What is the total CAGR expected to record for the second-life battery market during 2024-2030?

The market is expected to record a CAGR of 25.5% from 2024-2030.

Second-life Battery Market

Growth opportunities and latent adjacency in Second-life Battery Market