Satellite Navigation (GNSS) System Market by Constellation (Global Navigation Satellite (GPS, Galileo, Glonass, BDS) Regional Navigation Satellite (NAVIC, QZSS, BEIDOU), and Augmented Satellite), Orbit (MEO, GEO, Others), Solution, and Region- Global Forecast to 2028

Satellite Navigation (GNSS) System Market Summary

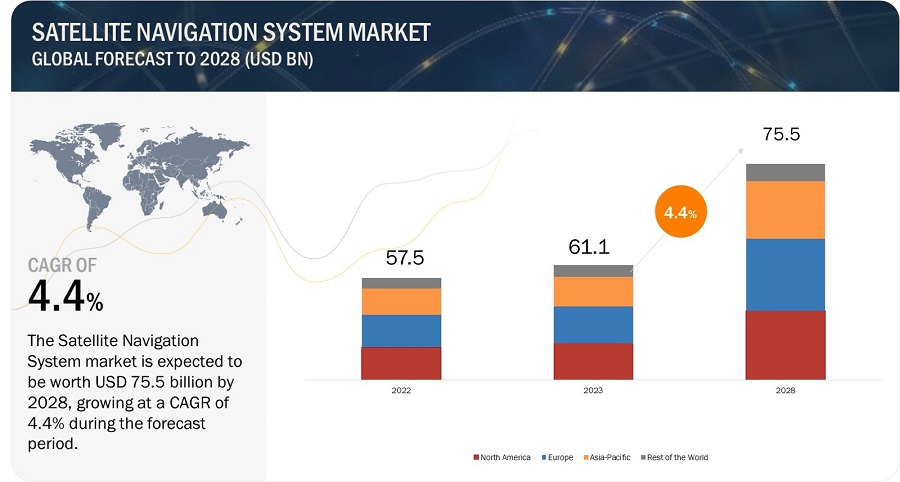

[240 Pages Report] The Satellite Navigation (GNSS) System market is projected to grow from USD 61.1 billion in 2023 to USD 75.5 billion by 2028, at a CAGR of 4.4 %. The rigorous development of Satellite Navigation System equipment and the increased scope of satellite navigation across homeland security, defense, marine, and search & rescue, among other sectors, are primarily responsible for the rapid growth of the Satellite Navigation System market. The space industry is shifting toward a future with a large constellation of satellites that creates an efficient satcom network for offering all types of satellite services globally. Government support and growing investments are propelling the launch of satellites into space, further boosting the growth of the Satellite Navigation System market. Increased adoption of big data, artificial intelligence (AI), the Industrial Internet of Things (IIoT), the Internet of Things (IoT), and data analytics in Satellite Navigation Systems are democratizing space and making new space applications a reality. These Satellite Navigation Systems help provide a stable space-based navigation platform for IoT devices. They are now being developed in large volumes for mega-constellations for navigation, communication, and IoT. Furthermore, the deployment of a Satellite Navigation System for providing services to multiple users is the latest trend in the market. The Global Navigation Satellite Constellation provides navigation services across the globe. The users can avail of the satcom services by owning the particular frequency band from the system owned by the service providers.

Satellite Navigation System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Satellite Navigation System Market Dynamics

Driver: Technological advancements in navigation satellite and ground stations

The development of navigation satellites and satellite ground stations has benefited greatly from technological advancements, which have improved their functionality and performance in the field of satellite navigation systems. These developments have led to increased precision in locating, navigation, and timing data, as well as increased accuracy, dependability, and functionality. Technological developments have resulted in the deployment of next-generation satellite constellations with increased features and capabilities in the field of navigation satellites. For instance, the number of Global Navigation Satellite Systems (GNSS) that have been developed and put into use has increased the alternatives for satellite navigation. With more satellites in orbit, systems like GPS, Galileo, GLONASS, and BeiDou offer better coverage, signal availability, and redundancy. This makes it possible for users to simultaneously receive signals from several satellites, improving location accuracy and dependability.

Additionally, contemporary navigation satellites use more potent signal modulation algorithms and higher power levels, enabling improved signal reception even in difficult situations with obstacles or interference. Similar improvements have been made in satellite ground stations, which are essential for supporting navigation satellite systems. The command and control of the satellite constellation, as well as the reception and processing of satellite signals, are carried out by ground stations. New ground station hardware and software have been developed as a result of technological breakthroughs. For better signal capture, tracking, and data extraction, this also contains sophisticated receivers with enhanced signal processing capabilities. Additionally, to provide continuous monitoring and management of the satellite constellation, ground station networks have been developed to cover a wider geographic region. These developments have also aided in the adoption of sophisticated signal correction methods that increase the precision of satellite navigation systems, such as differential and precise point positioning (PPP).

Restraints: Regulatory challenges related to frequency allocation and spectrum management for satellite navigation signals

The market for satellite navigation systems must take into account regulatory issues with frequency distribution and spectrum management. These issues come from the necessity for effective and interference-free transmission of satellite navigation signals and the constrained availability of the radio frequency spectrum. The practice of allocating particular frequency bands to various services and applications, such as satellite navigation systems, is known as frequency allocation. Coordination and control of spectrum utilization are required for satellite navigation systems to operate optimally and without interference.

The selection of appropriate frequency bands for satellite navigation communications is one of the major regulatory difficulties. Competition for available frequencies grows as spectrum demand rises across a range of sectors and applications. The successful operation and interoperability of satellite navigation systems with other wireless services depend on the allocation of sufficient frequency bands to them. To handle possible conflicts and guarantee efficient spectrum allocation, this calls for collaboration between regulatory agencies, satellite navigation system suppliers, and other stakeholders.

Spectrum protection and interference provide yet another regulatory difficulty. Both deliberate and inadvertent forms of interference can affect satellite navigation signals. Intentional jamming or spoofing, which interferes with or spoofs satellite navigation signals, can result in intentional interference. Due to the functioning of other wireless systems or devices in surrounding frequency bands, accidental interference may happen. Implementing rules, technological standards, and monitoring systems to find and reduce interference concerns is essential to effective spectrum management. To design and implement spectrum protection measures, regulatory agencies, suppliers of satellite navigation systems, and pertinent sectors must work together.

Opportunities: Exploration of new business models and revenue streams through value-added services and customized solution

Businesses in the satellite navigation system market have made it a strategic priority to investigate new business models and income streams through value-added services and customized solutions. By utilizing extra services and customized solutions, this strategy seeks to go above and beyond the conventional delivery of satellite location and navigation data. Companies may stand out in the market, increase their client base, and generate more income by providing value-added services and tailored solutions. A variety of services are categorized as value-added services because they improve the fundamental capabilities of satellite navigation systems. Real-time traffic updates, weather reports, places of interest, and location-based advertising are a few examples of these services. Companies may give consumers improved navigational experiences and more complete solutions that go beyond basic location data by including such services in their products. Customized solutions entail adjusting the capabilities of satellite navigation systems to match particular client needs and business objectives. For industries like agriculture, construction, or logistics, which may need customized features and data processing algorithms, organizations might provide specialized navigation systems. These personalized solutions offer focused solutions that address particular client pain areas and difficulties, increasing customer happiness and maybe opening up new business prospects.

Challenges: Challenges associated with rapid change/deployment of new technologies in satellites.

Technology degradation is the process by which a piece of technology ages and becomes no longer relevant or competitive in a certain market. Technological obsolescence may be quite difficult for satellite navigation system operators in the satellite sector since it forces them to constantly invest in new tools and technology to stay competitive and relevant. Rapid technological development is a hallmark of the satellite industry, which is fuelled by a variety of causes, including rising demand for high-speed connectivity, developing satellite data applications, and changing consumer needs. In order to stay competitive, ground station operators must keep up with these developments by putting money into new technologies and improving their current infrastructure.

The transition from geostationary satellites to low Earth orbit (LEO) and medium Earth orbit (MEO) satellite constellations is an illustration of technical degradation in the satellite business. Although geostationary satellites have long served as the foundation of the satellite industry, LEO and MEO constellations provide a number of benefits over them, including lower latency, higher bandwidth, and more flexibility. As a result, many satellite operators are refocusing on these more recent technologies, which can provide difficulties for satellite navigation system operators that have substantially invested in the infrastructure of geostationary satellites.

Operators of satellite navigation systems must deal with the quickening pace of technical development in other fields, such as data processing and storage, in addition to changes in satellite technology. New applications and use cases for satellite data are being driven by advances in cloud computing and artificial intelligence, but ground station operators must continually invest in new hardware and software to stay competitive. In conclusion, satellite navigation system operators in the satellite sector have substantial hurdles as a result of technology obsolescence, but there are a number of approaches they can take to overcome these obstacles.

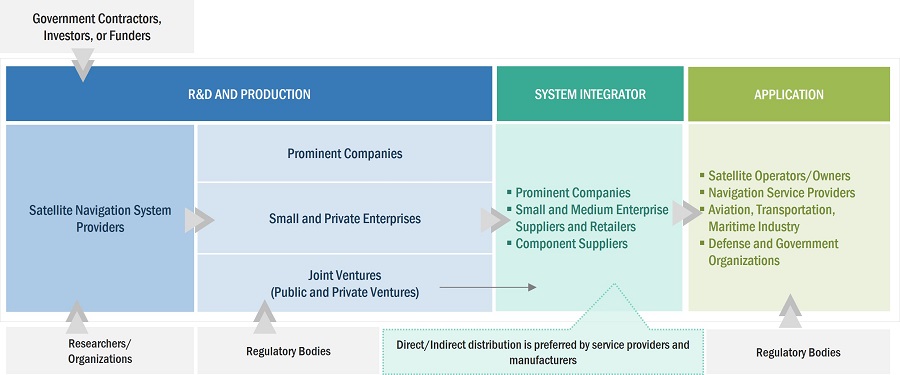

Satellite Navigation System Market Ecosystem

Companies that design and manufacture navigation satellites & ground stations and service providers, including private firms and space agencies, are key stakeholders in the satellite navigation system market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include Raytheon Technologies (US), Northrop Grumman Corporation (US), QualComm Technologies, Inc (US), Lockheed Martin Corporation (US), and L3Harris Technologies (US).

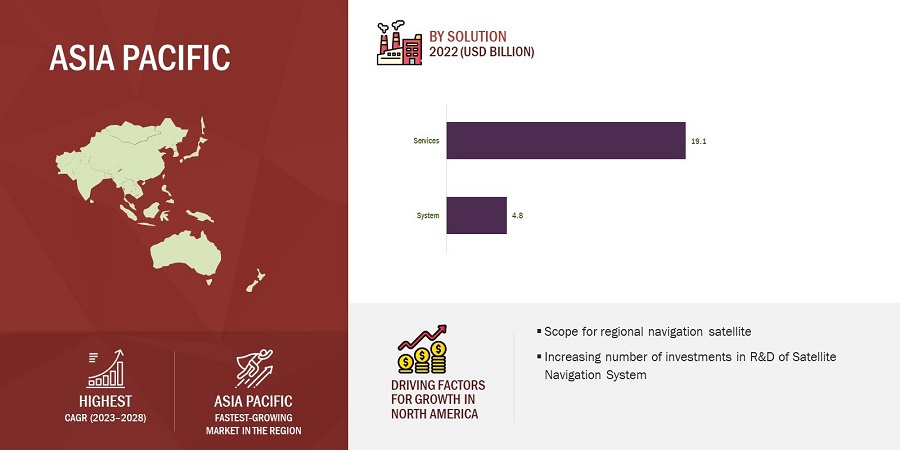

Based on the Solution, the Services segment is estimated to account for the largest market share of the Satellite Navigation System market.

Based on the Solution, the Services segment is estimated to account for the largest market share. Services are a promising development in the space industry and are expected to grow in popularity as more organizations look to leverage the benefits of satellite navigation without investing in their own ground station infrastructure.

Based on Constellation, the Global Navigation Satellite Constellation is anticipated to dominate the market.

Based on the constellation, the Global Navigation Satellite Constellation holds the largest market share. The primary objective of a Global Navigation Satellite Constellation revolves around delivering highly accurate positioning data to end users. This is accomplished through the utilization of sophisticated satellite-based positioning systems like GPS or GNSS. These systems employ the transmission of precise timing signals from satellites, which are subsequently acquired and processed by ground receivers.

The MEO segment of the Satellite Navigation System market by orbit is projected to dominate the market.

The Medium Earth Orbit (MEO) Segment holds the major market share of the Satellite Navigation System market by orbit segment. The MEO (Medium Earth Orbit) sector has undergone significant proliferation, primarily attributed to the expansionary strides of global navigation satellite systems (GNSS). These systems endeavor to deliver amplified positioning, navigation, and timing services, marked by precision, dependability, and worldwide scope.

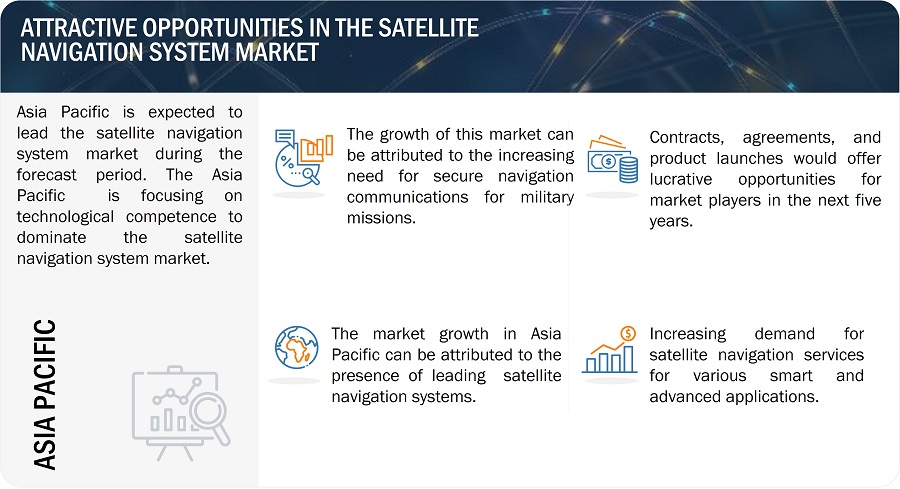

The Asia Pacific market is projected to witness the highest growth rate for the Satellite Navigation System market.

Asia Pacific is expected to hold the highest growth rate in the Satellite Navigation System market during the forecast period. The Asia Pacific holds the highest market share. China is the largest market for the Satellite Navigation Systems market in Asia Pacific. The growth of the Satellite Navigation System market in Asia Pacific can be attributed to the increased demand for Satellite Navigation System deployments. The Satellite Navigation System market in Asia Pacific was predicted to develop and evolve in future years, owing to advancements in satellite technology and rising demand for satellite-based applications and services.

Satellite Navigation System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key GNSS Market Players

The Satellite Navigation System companies is dominated by a few globally established players such as Raytheon Technologies (US), Northrop Grumman Corporation (US), QualComm Technologies, Inc (US), Lockheed Martin Corporation (US), and L3Harris Technologies (US) some of the leading players operating in the Satellite Navigation System market; they are the key manufacturers that secured Satellite Navigation System contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and military & space users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Solution, By Constellation, By Orbit |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), QualComm Technologies, Inc (US), Lockheed Martin Corporation (US), and L3Harris Technologies Inc. (US) and among others. |

Satellite Navigation System Market Highlights

The study categorizes the Satellite Navigation System market based on Solution, Constellation, Orbit, and Region.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Constellation |

|

|

By Orbit |

|

|

By Region |

|

Recent Developments

- In March 2023, Lockheed Martin Corporation:- Lockheed Martin Corporation developed Horizon and Compass on an integrated and scalable modular architecture that is tailored to particular customer requirements. They offer mission-critical capabilities for small, medium, and large constellations, including orbit management, autonomous operations, and formation flying.

- In November 2022, Northrop Grumman Corporation: - The North Grumman Corporation demonstrated its newly developed prototype Tactical Intelligence Targeting Access Node (TITAN). It is an all-domain ground station that will provide rapid satellite images and data to command centers across the borders.

- In September 2022, Furuno Electric Co. Ltd: Furuno Electric Co. Ltd built GNSS receivers for time synchronization, which are widely used in critical infrastructure such as mobile base stations and RAN equipment, commercial and defense radio communications, broadcasting, financial trading, smart power grids, and others, where high robustness, reliability, and security are required

Frequently Asked Questions (FAQ):

Which are the major companies in the Satellite Navigation System market? What are their major strategies to strengthen their market presence?

Some of the key players in the Satellite Navigation System market are Raytheon Technologies (US), Northrop Grumman Corporation (US), QualComm Technologies, Inc (US), Lockheed Martin Corporation (US), and L3Harris Technologies (US), among others, are the key manufacturers that secured Satellite Navigation System system contracts in the last few years.

What are the drivers and opportunities for the Satellite Navigation System market?

he market for Satellite Navigation System equipment has grown substantially across the globe, especially in Asia Pacific. With new capabilities, including faster data rates, better positioning, and increased dependability, satellite technology is growing vigorously quickly. Due to this increased demand, there is an increased need for navigation systems with the necessary capabilities. Several advancements in navigation technology have been made recently, and the creation of cutting-edge antenna technologies such as phased-array antennas. Because of these developments, navigation systems can now navigate with perfect positioning and support more advanced sophisticated applications. Various end-users, basically commercial industries such as defense and security, are utilizing software-defined satellites for their product mapping, earth exploration, and navigation.

Which region is expected to grow at the highest rate in the next five years?

The market in the Asia Pacific region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for Satellite Navigation Systems in the region. Several Asia Pacific countries and organizations are also actively investing in the deployment of Satellite Navigation Systems around the region.

What is the CAGR of the Satellite Navigation Market?

The CAGR of the Satellite Navigation Market is 4.4%

Which function of Satellite Navigation System is expected to significantly lead in the coming years?

The services segment of the Satellite Navigation System market is projected to witness the highest CAGR. There have been continuous services of Satellite Navigation Systems for different purposes such as communications and navigation and Increased deployment of miniature satellites for various navigation for various end-user. The market will be driven by the widespread usage of Satellite Navigation Systems to improve navigation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need for precise positioning and navigation data in various industries- Technological advancements in navigation satellites and ground stations- Rapid development of space technologiesRESTRAINTS- Lack of unified regulations and government policiesOPPORTUNITIES- Integrating artificial intelligence, machine learning, and computer vision to enhance accuracy and reliability- Exploring new business models and revenue streams through value-added services and customized solution- Increasing government investments in space agenciesCHALLENGES- Regulatory guidelines related to frequency allocation and spectrum management- High initial costs for deploying satellite navigation infrastructure and developing compatible receivers- Criticality of electronic information security and risks of hacking- Challenges associated with rapid change or deployment of new satellite technologies

-

5.3 RECESSION IMPACT ANALYSISVALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR SATELLITE GROUND STATION EQUIPMENT MANUFACTURERS

-

5.5 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESRESEARCH ORGANIZATIONS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.9 TRADE ANALYSIS

-

5.10 PATENT ANALYSIS

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSKEY BUYING CRITERIA

- 5.12 1.15 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Anti-jamming and anti-spoofing technologies- Cloud-based services and connectivitySUPPORTING TECHNOLOGIES- AI in satellite ground stations

-

5.14 USE CASE ANALYSISUSE CASE 1: TOMTOM NAVIGATION SERVICEUSE CASE 2: SATELLITE GROUND STATION FOR IOT

- 5.15 OPERATIONAL DATA

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSSUPERGPSADVANCED GROUND STATIONSINTEGRATION WITH UNMANNED AERIAL VEHICLES (UAVS)CLOUD-BASED SERVICES

-

6.4 IMPACT OF MEGATRENDSSATELLITE INTERNET OF THINGSRELEVANT MANUFACTURING

- 7.1 INTRODUCTION

-

7.2 GLOBAL NAVIGATION SATELLITE CONSTELLATIONHIGHLY ACCURATE POSITIONING DATA TO DRIVE MARKETGLOBAL POSITIONING SYSTEM (GPS)- Technological advancements to drive marketGALILEO- Implementing open-service authentication to drive marketGLOBAL NAVIGATION SATELLITE SYSTEM (GLONASS)- Deployment of novel satellite models with atomic clocks, signal modulation, and higher-power transmissions to drive marketBEIDOU NAVIGATION SATELLITE SYSTEM (BDS)- Easy deployment and enhanced connectivity to drive market

-

7.3 REGIONAL NAVIGATION SATELLITE CONSTELLATIONREGIONAL COVERAGE FOR POSITIONING, NAVIGATION, AND TIMING SERVICES TO DRIVE MARKETNAVIGATION WITH INDIAN CONSTELLATION (NAVIC)- Initiatives of integration with GPS, Galileo, and GLONASS to drive marketQUASI-ZENITH SATELLITE SYSTEM (QZSS)- Development of application-specific services to drive marketBEIDOU-2- Upgradation to second-generation system to drive market

-

7.4 AUGMENTED SATELLITE CONSTELLATIONINTEGRATION OF SUPPLEMENTARY SATELLITES, GROUND-BASED INFRASTRUCTURE, AND OTHER TECHNOLOGICAL COMPONENTS TO ENHANCE PERFORMANCEWIDE AREA AUGMENTATION SYSTEM (WAAS)- Extended service to aviation industry to drive marketEUROPEAN GEOSTATIONARY NAVIGATION OVERLAY SERVICE (EGNOS)- Continuous development for efficiency to drive marketMULTI-FUNCTIONAL SATELLITE AUGMENTATION SYSTEM (MSAS)- Data transmission and utilization of satellite bandwidth to drive marketGPS AIDED GEO AUGMENTED NAVIGATION (GAGAN)- Superior precision and dependability to drive market

- 8.1 INTRODUCTION

-

8.2 PLATFORMDEPLOYMENT OF ADVANCED PLATFORMS TO DRIVE MARKETNAVIGATION SATELLITE- Increasing demand for navigation services to drive marketGROUND STATION EQUIPMENT- Increased demand for ground station equipment to drive market- Antenna Systems- RF systems- Data Processing units- Telemetry, tracking, and command (TT&C)

-

8.3 SERVICESUSE OF SATELLITE NAVIGATION SERVICES IN AUTOMOTIVE INDUSTRY TO DRIVE MARKETAUTOMOTIVE- Increasing use in traffic management and vehicle tracking to drive marketRAIL- Railroad management and planning of rail transports to drive marketMARINE- Accurate positioning, navigation, and timing information for ship tracking & collision prevention to drive growthAVIATION- Precise positioning, navigation, timing data, and other emergency services to drive growthSURVEYING- Increasing adoption of navigation services in land survey equipment to drive marketWEATHER PREDICTION AND BROADCAST- Increased accuracy of weather prediction and broadcast services to drive growthOTHER SERVICES

- 9.1 INTRODUCTION

-

9.2 MEDIUM EARTH ORBIT (MEO)AMPLIFIED POSITIONING, NAVIGATION, AND TIMING SERVICES TO DRIVE MARKET

-

9.3 GEOSTATIONARY EARTH ORBIT (GEO)ADVANCEMENTS IN APPLICATIONS AND GEOPOLITICAL ISSUES TO DRIVE MARKET

- 9.4 OTHER ORBITS (IGSO, HEO)

- 10.1 INTRODUCTION

- 10.2 REGIONAL RECESSION IMPACT ANALYSIS

-

10.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Increased government investments in space initiatives to drive marketCANADA- High domestic demand for satellite-based services to drive market

-

10.4 EUROPEPESTLE ANALYSIS: EUROPEUK- Innovations in satellite navigation system technologies to drive marketFRANCE- Demand for location-based services to drive marketGERMANY- Increasing demand for accurate positioning solutions to drive marketITALY- Increasing investments in defense sector to drive marketRUSSIA- Increasing government investments in self-developed space technologies to drive marketREST OF EUROPE

-

10.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Advancements in self-made satellite systems to drive marketINDIA- Increasing government investments to drive marketJAPAN- Rising technological advancements in satellite systems to drive marketSOUTH KOREA- Government initiatives for developing satellite systems to drive marketAUSTRALIA- Recent growth in satellite navigation systems to drive marketREST OF ASIA PACIFIC- Development of national infrastructure to support GNSS systems to drive market

-

10.6 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTSAUDI ARABIA- High investments in advanced satellite systems to drive marketISRAEL- Initiatives to launch independent satellite systemTURKEY- Development of own regional navigation satellite system to drive marketREST OF MIDDLE EAST

-

10.7 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDAFRICA- Planning and development of AfriSat and satellite-based augmented systems to drive marketLATIN AMERICA- Development of satellite systems to drive market

- 11.1 OVERVIEW

-

11.2 GNSS MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022NORTHROP GRUMMAN CORPORATIONRAYTHEON TECHNOLOGIES CORPORATIONQUALCOMM TECHNOLOGIES, INC.LOCKHEED MARTIN CORPORATIONL3HARRIS TECHNOLOGIES, INC.

- 11.3 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSNORTHROP GRUMMAN CORPORATION- Business overview- Products offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developments- MnM viewQUALCOMM TECHNOLOGIES, INC.- Business overview- Products offered- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products offered- Recent developments- MnM viewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products offered- Recent developments- MnM viewCOBHAM LIMITED- Business overview- Products offeredTOPCON CORPORATION- Business overview- Products offered- Recent developmentsHEMISPHERE GNSS, INC.- Business overview- Products offered- Recent developmentsFURUNO ELECTRIC CO., LTD.- Business overview- Products offered- Recent developmentsTEXAS INSTRUMENTS INCORPORATED- Business overview- Products offeredHEXAGON AB- Business overview- Products offered- Recent developmentsAIRBUS- Business overview- Products offeredTHALES- Business overview- Products offered- Recent developmentsSURREY SATELLITE TECHNOLOGY LTD.- Business overview- Products offeredHONEYWELL INTERNATIONAL INC.- Business overview- Products offeredTELEDYNE TECHNOLOGIES INC.- Business overview- Products offered- Recent developmentsSAFRAN SA- Business overview- Products offered- Recent developmentsTRIMBLE INC.- Business overview- Products offeredTOMTOM INTERNATIONAL BV.- Business overview- Products offeredBROADCOM INC.- Business overview- Products offered

-

12.3 OTHER PLAYERSSTONEX SRLSWIFT NAVIGATIONU-BLOXSEPTENTRIOCOMNAV TECHNOLOGY LTD.

-

13.1 DISCUSSION GUIDEINTRODUCTION

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 SATELLITE NAVIGATION SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 LIST OF KEY SECONDARY SOURCES

- TABLE 4 LIST OF KEY PRIMARY SOURCES

- TABLE 5 GNSS MARKET, BY PLATFORM

- TABLE 6 SATELLITE NAVIGATION SYSTEM MARKET, BY SERVICES

- TABLE 7 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- TABLE 8 SATELLITE NAVIGATION SYSTEM MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 GNSS SYSTEM MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 10 SUBSCRIPTION RATES OF SATELLITE NAVIGATION SERVICES, 2022

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 16 SATELLITE NAVIGATION SYSTEM MARKET: COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 17 GNSS MARKET: COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 18 MAJOR PATENTS FOR SATELLITE NAVIGATION SYSTEM MARKET

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING SATELLITE NAVIGATION SYSTEMS, BY END USER (%)

- TABLE 20 KEY BUYING CRITERIA FOR SATELLITE NAVIGATION SYSTEMS, BY CONSTELLATION

- TABLE 21 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 22 NUMBER OF NAVIGATION SATELLITES LAUNCHED (2019–2028)

- TABLE 23 NUMBER OF SATELLITE NAVIGATION SERVICE SUBSCRIBERS (2019–2028)

- TABLE 24 SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 25 SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 26 GNSS SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 27 SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 28 SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 29 SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 30 GNSS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 33 SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 34 RECESSION IMPACT ANALYSIS, BY REGION

- TABLE 35 SATELLITE NAVIGATION SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 GNSS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: GNSS SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: GNSS MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: GNSS SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 US: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 50 US: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 51 US: GNSS SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 52 US: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 53 CANADA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 54 CANADA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 55 CANADA: GNSS SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 56 CANADA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 57 EUROPE:-SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 58 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 59 EUROPE: GNSS MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 60 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 61 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 62 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 63 EUROPE: GNSS MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 EUROPE: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 66 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: GNSS SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 UK: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 70 UK: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 71 UK: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 72 UK: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 73 FRANCE: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 74 FRANCE: GNSS SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 75 FRANCE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 76 FRANCE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 77 GERMANY: GNSS MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 78 GERMANY: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 79 GERMANY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 80 GERMANY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 81 ITALY: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 82 ITALY: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 83 ITALY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 84 ITALY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 85 RUSSIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 86 RUSSIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 87 RUSSIA: GNSS MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 88 RUSSIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 92 REST OF EUROPE: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 106 CHINA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 107 CHINA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 108 CHINA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 109 INDIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 110 INDIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 111 INDIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 112 INDIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 113 JAPAN: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 114 JAPAN: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 115 JAPAN: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 116 JAPAN: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 117 SOUTH KOREA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 118 SOUTH KOREA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 120 SOUTH KOREA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 121 AUSTRALIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 122 AUSTRALIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 123 AUSTRALIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 124 AUSTRALIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 129 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 135 MIDDLE EAST: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 136 MIDDLE EAST: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 138 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 139 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 SAUDI ARABIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 142 SAUDI ARABIA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 143 SAUDI ARABIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 144 SAUDI ARABIA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 145 ISRAEL: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 146 ISRAEL: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 147 ISRAEL: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 148 ISRAEL: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 149 TURKEY: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 150 TURKEY: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 151 TURKEY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 152 TURKEY: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 157 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 158 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 159 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 160 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 161 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 162 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 163 REST OF THE WORLD: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 164 REST OF THE WORLD: SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 165 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 166 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 167 REST OF THE WORLD:- SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 168 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 169 AFRICA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 170 AFRICA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 171 AFRICA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 172 AFRICA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2019–2022 (USD MILLION)

- TABLE 174 LATIN AMERICA SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2019–2022 (USD MILLION)

- TABLE 176 LATIN AMERICA: SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028 (USD MILLION)

- TABLE 177 SATELLITE NAVIGATION SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 178 KEY DEVELOPMENTS BY LEADING PLAYERS IN SATELLITE NAVIGATION SYSTEM MARKET, 2019–2022

- TABLE 179 COMPANY SOLUTION FOOTPRINT

- TABLE 180 COMPANY REGIONAL FOOTPRINT

- TABLE 181 SATELLITE NAVIGATION SYSTEM MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 182 SATELLITE NAVIGATION SYSTEM MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 183 SATELLITE NAVIGATION SYSTEM MARKET: DEALS, 2019–2023

- TABLE 184 SATELLITE NAVIGATION SYSTEM MARKET: OTHER DEVELOPMENTS, 2019–2023

- TABLE 185 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 186 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 187 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 188 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 189 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 190 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 191 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 192 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 193 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 194 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 195 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 196 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 197 COBHAM LIMITED: COMPANY OVERVIEW

- TABLE 198 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 199 TOPCON CORPORATION: DEALS

- TABLE 200 HEMISPHERE GNSS, INC.: COMPANY OVERVIEW

- TABLE 201 HEMISPHERE GNSS, INC..: PRODUCT LAUNCHES

- TABLE 202 HEMISPHERE GNSS, INC.: DEALS

- TABLE 203 FURUNO ELECTRIC CO, LTD.: COMPANY OVERVIEW

- TABLE 204 FURUNO ELECTRIC CO, LTD.: PRODUCT LAUNCHES

- TABLE 205 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 206 HEXAGON AB: COMPANY OVERVIEW

- TABLE 207 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 208 AIRBUS: COMPANY OVERVIEW

- TABLE 209 THALES: COMPANY OVERVIEW

- TABLE 210 THALES: DEALS

- TABLE 211 SURREY SATELLITE TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 212 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 213 TELEDYNE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 214 TELEDYNE TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 215 TELEDYNE TECHNOLOGIES INC.: DEALS

- TABLE 216 SAFRAN SA: COMPANY OVERVIEW

- TABLE 217 SAFRAN SA: DEALS

- TABLE 218 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 219 TOMTOM INTERNATIONAL BV.: COMPANY OVERVIEW

- TABLE 220 BROADCOM INC.: COMPANY OVERVIEW

- TABLE 221 STONEX SRL: COMPANY OVERVIEW

- TABLE 222 SWIFT NAVIGATION: COMPANY OVERVIEW

- TABLE 223 U-BLOX: COMPANY OVERVIEW

- TABLE 224 SEPTENTRIO: COMPANY OVERVIEW

- TABLE 225 COMNAV TECHNOLOGY LTD.: COMPANY OVERVIEW

- FIGURE 1 SATELLITE NAVIGATION SYSTEM MARKET: RESEARCH METHODOLOGY MODEL

- FIGURE 2 SATELLITE NAVIGATION SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028

- FIGURE 8 SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028

- FIGURE 9 SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028

- FIGURE 10 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 INCREASING USE OF SATELLITE NAVIGATION SYSTEMS IN NAVIGATION APPLICATIONS TO DRIVE MARKET

- FIGURE 12 GLOBAL NAVIGATION SATELLITE CONSTELLATION SEGMENT TO DRIVE MARKET

- FIGURE 13 MEDIUM EARTH ORBIT SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 INDIAN SATELLITE NAVIGATION SYSTEM MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SATELLITE NAVIGATION SYSTEM MARKET

- FIGURE 16 RECESSION IMPACT ANALYSIS ON SATELLITE NAVIGATION SYSTEM MARKET

- FIGURE 17 SATELLITE NAVIGATION SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 REVENUE SHIFT IN SATELLITE NAVIGATION SYSTEM MARKET

- FIGURE 19 SATELLITE NAVIGATION SYSTEM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 SATELLITE NAVIGATION SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 21 MAJOR PATENTS FOR SATELLITE GROUND STATIONS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING SATELLITE NAVIGATION SYSTEMS, BY END USER

- FIGURE 23 KEY BUYING CRITERIA FOR SATELLITE NAVIGATION SYSTEMS, BY CONSTELLATION

- FIGURE 24 SATELLITE NAVIGATION SYSTEM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 SATELLITE NAVIGATION SYSTEM MARKET, BY CONSTELLATION, 2023–2028

- FIGURE 26 SATELLITE NAVIGATION SYSTEM MARKET, BY SOLUTION, 2023–2028

- FIGURE 27 SATELLITE NAVIGATION SYSTEM MARKET, BY PLATFORM, 2023–2028

- FIGURE 28 SATELLITE NAVIGATION SERVICES MARKET, BY INDUSTRY, 2023–2028

- FIGURE 29 SATELLITE NAVIGATION SYSTEM MARKET, BY ORBIT, 2023–2028

- FIGURE 30 SATELLITE NAVIGATION SYSTEM MARKET, BY REGION, 2023–2028

- FIGURE 31 NORTH AMERICA: SATELLITE NAVIGATION SYSTEM MARKET SNAPSHOT

- FIGURE 32 EUROPE: SATELLITE NAVIGATION SYSTEM MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: SATELLITE NAVIGATION SYSTEM MARKET SNAPSHOT

- FIGURE 34 MIDDLE EAST: SATELLITE NAVIGATION SYSTEM MARKET SNAPSHOT

- FIGURE 35 REST OF THE WORLD: SATELLITE NAVIGATION SYSTEM MARKET SNAPSHOT

- FIGURE 36 SATELLITE NAVIGATION SYSTEM MARKET SHARE ANALYSIS, 2022

- FIGURE 37 MARKET RANKING OF LEADING PLAYERS IN SATELLITE NAVIGATION SYSTEM MARKET, 2022

- FIGURE 38 REVENUE ANALYSIS OF LEADING PLAYERS IN SATELLITE NAVIGATION SYSTEM MARKET, 2019–2022

- FIGURE 39 SATELLITE NAVIGATION SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 SATELLITE NAVIGATION SYSTEM MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 42 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 QUALCOMM TECHNOLOGIES, INC..: COMPANY SNAPSHOT

- FIGURE 45 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 47 COBHAM LIMITED: COMPANY SNAPSHOT

- FIGURE 48 TOPCON CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 FURUNO ELECTRIC CO, LTD.: COMPANY SNAPSHOT

- FIGURE 50 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 51 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 52 AIRBUS: COMPANY SNAPSHOT

- FIGURE 59 BROADCOM INC.: COMPANY SNAPSHOT

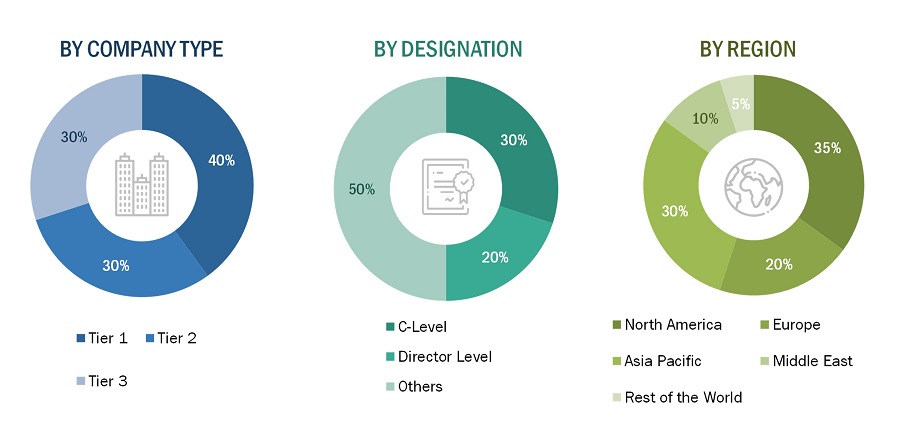

The study involved four major activities in estimating the current size of the Satellite Navigation System market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Satellite Navigation System market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the European Space Agency (ESA), the National Aeronautics and Space Administration (NASA), the United Nations Conference on Trade and Development (UNCTAD), the Satellite Industry Association (SIA), corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Satellite Navigation System market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Satellite Navigation System vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using Satellite Navigation Systems, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Satellite Navigation System and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

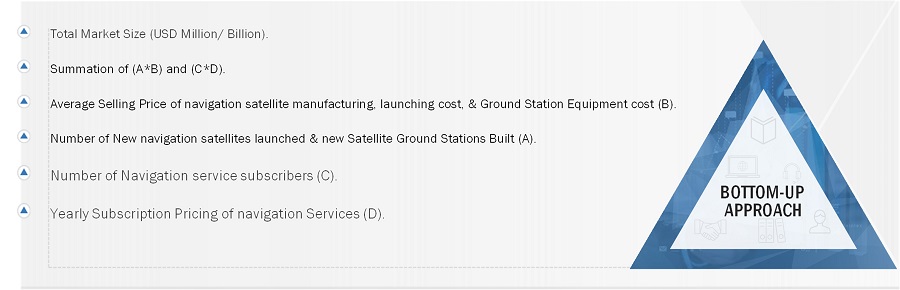

Market Size Estimation

The research methodology used to estimate the size of the Satellite Navigation System market includes the following details.

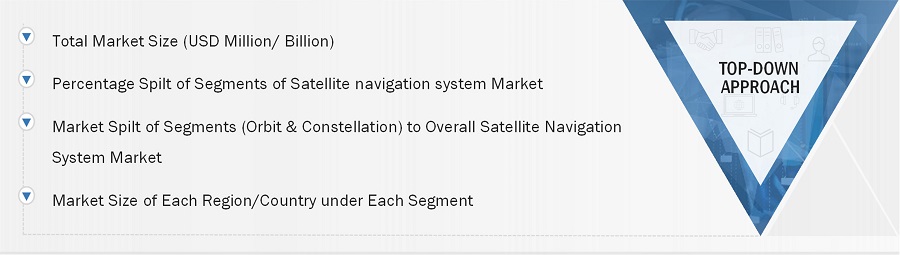

- The top-down and bottom-up approaches were used to estimate and validate the size of the Satellite Navigation System market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Global Satellite Navigation System market size: Bottom-Up Approach

- The Satellite Navigation System market, by constellation and solution, was used for estimating and projecting the global market size from 2023 to 2028.

- The market size was calculated by adding the solution subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are outlined below:

- Satellite Navigation System market = (Volume * Average Selling Price of Satellite navigation system) + (Number of Satellite Navigation System Users * Yearly Subscription Price of Satellite navigation Systems)

Global Satellite Navigation System Market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing satellite navigation systems are included in the report.

- Companies’ total revenue was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees using sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to satellite navigation systems were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), each segment’s share of satellite navigation systems was estimated.

Data Triangulation

After arriving at the overall size of the Satellite Navigation System market from the market size estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the Satellite Navigation System market based on solution, constellation, orbit, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the Satellite Navigation System market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies.

Market Definition

A satellite navigation system is a complex and advanced infrastructure that enables highly accurate global positioning, navigation, and timing services. It incorporates an array of orbiting satellites, ground-based control stations, and user receivers. The satellites emit signals encoded with relevant information, which the user receivers capture and analyze to determine their precise geographical coordinates, velocity, and time data.

These systems rely on intricate triangulation techniques and time-of-flight measurements to provide users with dependable and precise positioning information. Satellite navigation systems employ sophisticated algorithms and signal processing methodologies to counteract errors originating from factors such as atmospheric disruptions, signal propagation delays, and receiver biases. The impact of satellite navigation systems is transformative across diverse sectors such as transportation, logistics, surveying, emergency management, and scientific exploration. They enable accurate navigation, optimize route planning, strengthen safety and security measures, and coordinate time-sensitive operations. With their expansive coverage and continuous advancements, satellite navigation systems have emerged as fundamental constituents of modern technological infrastructure, enabling global connectivity and empowering a wide range of vital services.

Market Stakeholders

- Satellite Navigation System Component Manufacturers

- Satellite Navigation System Manufacturers

- Satellite Navigation System Service Providers

- Government and Civil Organizations

- Satellite Navigation System Operators

- Meteorological Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Satellite Navigation System market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Satellite Navigation System market

Growth opportunities and latent adjacency in Satellite Navigation (GNSS) System Market