Ruminant Feed Additives Market by Type (Phosphates, Amino Acids, Vitamins, Acidifiers, Carotenoids, Enzymes, Flavors & Sweeteners, Mycotoxin Detoxifiers, Minerals, and Antioxidants), Ruminant, Form, Source, and Region - Global Forecast to 2029

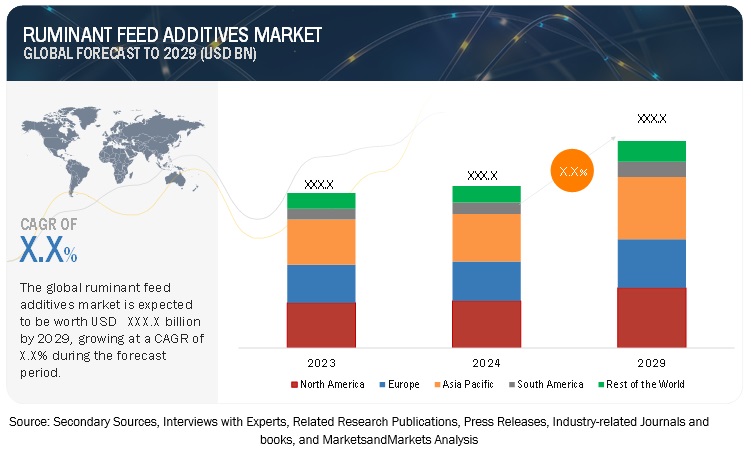

According to MarketsandMarkets, the global ruminant feed additives market size is estimated to be valued at USD XXX.X billion in 2024 and is projected to reach USD XXX.X billion by 2029, recording a CAGR of X.X%.

The ruminant feed additives market rise is mainly caused by the combination of several factors: higher global demand for meat and dairy products, state support for sustainable livestock practices, and an increased focus on animal health and productivity. The USDA data reveal that per capita meat consumption in the United States reached 225 pounds by 2022. Thus, waste generation per livestock was lowered to the minimum possible. This means a greater demand for the use of sustainable feed additives that are environmentally friendly and reduce methane emissions on the part of the EU by 2030, as supported by Eurostat. On the other hand, the statistics from FAO clearly point to the steady increase in the cattle population all over the world to more than 1.5 billion in 2022, particularly in developing countries. Government interventions like India's National Livestock Mission, which is concerned with sustainable livestock feeding practices, are of great importance. These supportive schemes not only assist in securing the lives of the farmers but also contribute to sustainable practices that support healthy livestock production.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

RUMINANT FEED ADDITIVES MARKET DYNAMICS

Drivers: Increase in demand and consumption of livestock-based products

An increase in demand and consumption of livestock-based products such as dairy & dairy-based products and meats is expected to drive the usage of feed additives in feed for the growth and development of farm animals. According to FAO data, it has been stated that global meat production is projected to be 16% higher by 2025. Furthermore, owing to the increasing awareness about the role and dynamics of food nutrients, especially protein, on overall physical and mental growth and development, there is a growing trend toward animal-sourced protein. This drives the usage of feed additives in feed as it increases its nutritional quality.

Restraints: Stringent regulatory framework

Rules and regulations concerning feed additives are becoming increasingly stringent. In 2006, in the European Union and in 2009 in the US, a ban on the use of antibiotics as growth promoters (feed additives) in animals was imposed. However, many countries, including Brazil and China, which export meat products to Europe and the US, do not have such regulations against antibiotics usage in feed additives. Such disparities in regulations have adverse effects on the global meat trade, especially between developed and developing economies, in the form of standard issues such as meat quality, animal welfare, and environmental protection. Producers of feed additives are required to follow strict regulations related to regional and national health and safety for product approvals in developed nations; this ultimately affects the cost of the final products.

Some of the EU provisions include the following:

- Regulation 1831/2003 on additives for use in animal nutrition

- Directive 2002/32 on undesirable substances in feed

- Directive 2008/38 establishing a list of intended uses of animal feedstuffs for particular nutritional purposes

- Regulation 767/2009 on the placing on the market and the use of feed

Such regulatory initiatives are posing challenges for existing feed additive products and increasing the cost of new feed additive developments. Moreover, feed additive manufacturers have to submit patent and approval applications to launch new products in different countries. Huge losses are incurred due to delays in receiving approvals from regulatory agencies. The establishment of a universal governing body for the feed additives sector will help smoothen business operations worldwide.

Opportunities: Advancements in feed technology

The animal feed industry is undergoing a transformative shift driven by emerging technologies, sustainability imperatives, and evolving consumer demands. This presents a significant market opportunity for companies that can leverage digital disruption to optimize feed production and delivery. As highlighted at AgriVision 2023, factors such as precision feeding, functional feeds, and the use of novel ingredients are becoming increasingly vital. The integration of IoT, AI, and blockchain technologies offers the potential to enhance traceability, improve animal performance, and reduce environmental impact.

According to a research paper published in July 2024 titled "Nano-Mineral Technology in Ruminant Feeding: Progress and Prospects," the application of nanotechnology in ruminant feed represents a significant advancement in feed technology. The study highlights the use of nano-sized minerals, such as zinc, selenium, copper, and cobalt, which have shown promising results in improving ruminant health and production. Nano-minerals exhibit higher bioavailability, promoting growth, enhancing immunity, improving fertility, and modifying rumen fermentation. Additionally, they reduce environmental pollution by minimizing the excretion of unused minerals, making them effective at lower concentrations compared to traditional inorganic minerals. These findings underscore the potential of nano-minerals in advancing ruminant nutrition and sustainable livestock management.

Challenges: Quality control of genetic feed additive products manufactured by Asian countries

In Asia Pacific, livestock plays a crucial role in overall agricultural development and has been growing at an unprecedented rate in the last few decades. According to the World Health Organization (WHO), in 2022, Asia ranked first in livestock production; furthermore, the per capita consumption of livestock products in Asia is projected to grow from 94.6 pounds in 1999 to 154.4 pounds by 2030. The Asian livestock industry has witnessed several changes in terms of population growth, resource availability, environmental destruction, and the rise in demand for animal products.

China is a major feed producer and consumer in the East Asian region, experiencing rapid livestock production expansion. It is also one of the significant feed exporters to North America and Europe. The lack of an integrated quality control system in feed analysis is one of the main issues faced by Asian feed manufacturers. Feed additive product testing and the data originating from many laboratories in Asian countries are not considered reliable because quality control systems and good laboratory practices are not integrated into their feed analysis. A manual to address these issues has been produced by FAO (FAO 2011). Science managers and feed industries must ensure that quality control systems and good laboratory practices are routinely used by feed analysis laboratories.

The Ruminant feed additives market ecosystem

Amino Acid holds a significant share in the ruminant feed additives market

Amino acids help to enhance the reproductive performance, growth, and overall health of ruminants. Unlike other nutrients, specific amino acids such as L-arginine, L-lysine, L-methionine, and L-glutamine are essential for the development and survival of ruminant embryos and neonates. Although many amino acids are catabolized by ruminal microbes to synthesize microbial proteins, recent research by NIH in 2021 “Amino Acid Nutrition and Reproductive Performance in Ruminants,” has highlighted the importance of amino acids such as L-citrulline and L-glutamate, which are not degraded by ruminal microbes. Supplementation with these amino acids has been shown to improve embryonic survival, fetal growth, and neonatal health, particularly in gestating and lactating ruminants.

Given these benefits, amino acids are increasingly recognized as vital components in feed formulations, particularly for improving reproductive efficiency. This growing recognition drives their demand within the ruminant feed additives market.

By Ruminant type, Beef holds a substantial share in the ruminant feed additives market

Advancements in feed technology are also used as an effective tool for enhancing feed solutions for fostering cattle growth and health due to an increase in global beef consumption, which is expected to surpass 60 million metric tons by 2022. Feed additives improve feed efficiency & digestibility and prevent diseases, ultimately optimizing beef production. That is added to more significant attention to practices for sustainability since the additives align with new environmental regulations and consumer needs for methane reduction and feed efficiency improvement.

The key drivers of this market are considered to be regions such as North and South America, which present many significant beef-producing countries. Investments done by key players such as Cargill, among others, in new facilities represent an indication of growth potential for this sector. Moreover, there is constant research and development of new additives to improve productivity without negating stringent health standards. All these factors only reserve beef a ruminant stronghold in the feed additives market since this sector has gained critically relevant importance for the fulfillment of global protein requirements and sustainability goals.

Dry forms of ruminant feed additives hold a significant share in the market

The dry form segment of ruminant feed additives includes mash, pellet, and crumble forms. The dry form has higher demand among livestock producers, as they are easy to mix with feed and are easy to store and handle. The mash form is more economical as compared to pellet feed, in which the cost increases by 10%. The pellet form is a modification of the mash form, which includes mechanically pressing the mash into hard, dry pellets, resulting in decreased feed wastage and increased nutrient digestibility. Crumble is made from whole pellets, which are cracked or rolled into a smaller size.

Most of the players in the market provide the dry form of products considering the demand from end users. Amino acids, flavors & sweeteners, minerals, probiotics, phosphates, carotenoids, acidifiers, mycotoxin detoxifiers, antioxidants, and vitamins are a few types of feed additives that are mostly preferred in the dry form. Pellet feed and crumble feed forms are mainly preferred in the animal feed industry due to benefits such as better digestibility, palatability, and better performance of livestock in terms of feed conversion ratio.

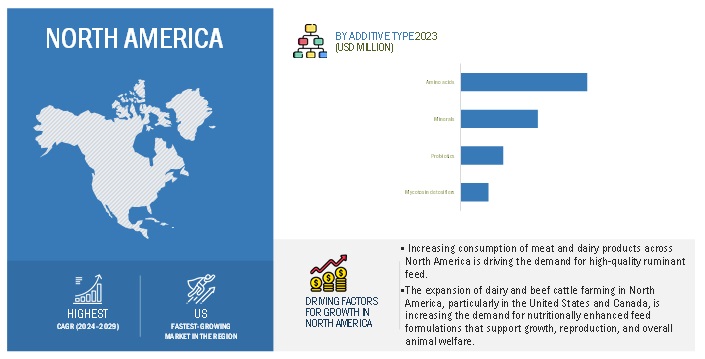

North America holds a substantial share in the ruminant feed additives market

North America holds a significant share of the ruminant feed additives market due to advanced agricultural infrastructure, high levels of beef and dairy production, and a focus on animal health and productivity. Beef production in the US amounted to approximately 27 million metric tons, while milk production was around 101 billion liters in 2023, resulting in huge demand for feed additives. It secures the safety and effectiveness of the feed additives through strong regulatory framing set by the likes of the FDA and CFIA and assures innovative practices within industry organizations such as AFIA and the CFIA. Additionally, sustainability, with additive-provided solutions for reducing methane emissions and promoting feed efficiency, is part of the environmental goals for the future. In addition, enormous investments in R&D and industry support solidify the leading position in the regional market. This only serves to underline that there is a real commitment to improving livestock productivity and health.

North America: Ruminant feed additives market SNAPSHOT

Key Market Players

Key players in this market include Cargill, Incorporated (US), ADM (US), Alltech, Inc. (US), Novozymes A/S (Denmark), DSM (Switzerland), Ajinomoto (Japan), Tegasa (Spain), Kemin Industries (US), Evonik (Germany), International Flavors & Fragrances (IFF) (US).

Recent Developments

- In July 2024, Alltech partnered with Tobermore Concrete, CEMCOR, and Road Safety Contracts in the Mid-Ulster Biorefinery and Circular Economy Cluster. This collaboration, supported by the Centre for Advanced Sustainable Energy at Queen’s University Belfast, will focus on constructing a 10-megawatt biomethane facility in Northern Ireland. Alltech will leverage its fermentation expertise to optimize biogas production and promote renewable energy from agricultural waste.

- In January 2024 Novozymes A/S and Chr. Hansen, both leading players in the ruminant feed additives market, have merged to form a prominent global biosolutions partner. This merger, announced on December 12, 2022, combines their strengths in biosolutions and enhances their market position, enabling them to offer expanded and innovative solutions in the ruminant feed additives sector.

- In January 2023, Cargill expanded its partnership with BASF to introduce advanced enzyme solutions in the US Ruminant feed additives market. This collaboration integrates BASF’s expertise in enzyme R&D with Cargill’s extensive market reach to enhance feed efficiency and sustainability for US animal protein producers. The expanded agreement builds on their successful international projects, aiming to address productivity and cost challenges while promoting animal wellbeing through innovative feed solutions.

Frequently Asked Questions (FAQ):

What are the key forms considered in the study for the ruminant feed additives market, and which segments within Europe’s Ruminant feed additives livestock are projected to experience promising growth?

The study focuses on two major forms: Dry and Liquid. Within Europe’s Ruminant feed additives forms, the subsegment dry emerges as the dominant category, showcasing promising growth potential in the projected market trends.

Is there customizable information available specific to the North American ruminant feed additives market, and if so, what details are provided?

Yes, Certainly, customization options are available for the North American ruminant feed additives market across different segments, encompassing market size, dynamics, forecasts, competitive landscape, and company profiles. Exclusive insights will be offered for the specified North American countries below:

- US

- Canada

- Mexico

What are the key trends driving the growth of the global ruminant feed additives market?

Key drivers include rising global demand for beef and dairy products, advancements in feed technology, the need for improved feed efficiency, and a focus on sustainable livestock practices. Increasing investments in research and development and regulatory support for safe and effective additives also contribute to market growth.

How does the demand for beef influence the ruminant feed additives market?

The high global consumption of beef drives demand for effective feed additives to improve growth rates, feed conversion ratios, and overall cattle health. With beef production reaching significant levels, especially in major markets like North America and South America, there is a continuous need for advanced feed solutions.

How is the market for ruminant feed additives expected to evolve in the next five years?

The market is expected to grow at a CAGR of 5%, driven by increasing livestock production, technological advancements, and rising awareness of animal nutrition. The focus on sustainability and efficiency will also shape future market trends.

What are the main challenges faced by the ruminant feed additives market?

Ahallenges include regulatory hurdles, the high cost of advanced additives, concerns about environmental impact, and market saturation. Additionally, ensuring consistent quality and efficacy while managing supply chain issues can impact market dynamics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Ruminant Feed Additives Market