Rubber Coated Fabric Market by Type (Extrusion, Roller, Dip, Spray), Application (Protective Suits & Gloves, Boats & Gangway Bellows, Conveyor Belts), End-use (Protective Clothing, Transportation & Watercraft), and Region - Global Forecast to 2028

Updated on : April 05, 2024

Rubber Coated Fabric Market

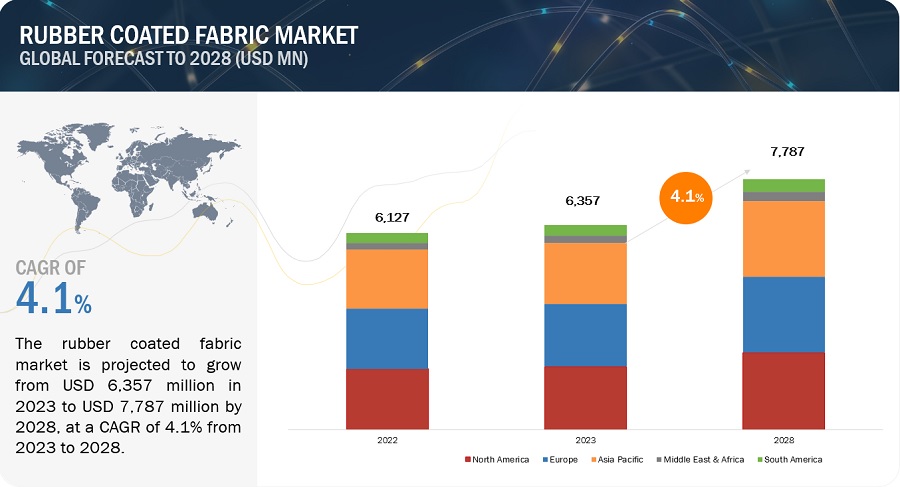

The global rubber coated fabric market size was valued at USD 6,357 million in 2023 and is projected to reach USD 7,787 million by 2028, growing at 4.1% cagr from 2023 to 2028. Rubber coated fabrics are composed of a variety of materials, including natural rubber, SBR, neoprene, Hypalon, nitrile, butyl, EPDM, and silicone. Rubber coated fabrics are frequently employed in various sectors and applications where a combination of fabric features and rubber characteristics is desired.

Attractive Opportunities in the Rubber Coated Fabric Market

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

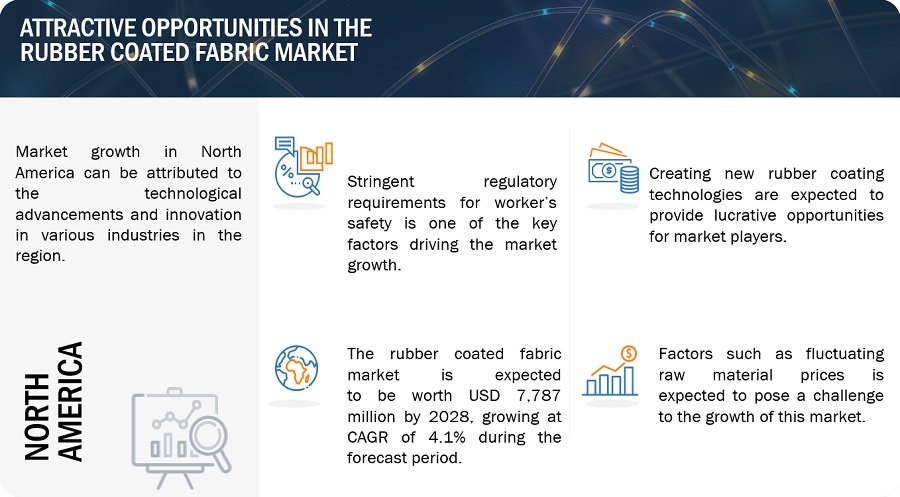

Driver: Stringent regulatory requirements for worker’s safety

Stringent regulatory requirements for worker's safety are driving the growth of the protective clothing segment, which in turn is driving the demand for rubber coated fabrics. In many industries, workers are exposed to hazardous materials, chemicals, and extreme conditions, which can pose a significant risk to their health and safety. Protective clothing made from rubber coated fabrics can help mitigate these risks by providing a barrier between the worker and the hazardous environment.

Restraint: Availability of substitute

The availability of substitutes can restrain the growth of the market. There are a large number of substitute products available for rubber coated fabrics. Some of the major substitutes are leather, uncoated fabrics, and plastic products. Also, rubber coatings, for instance, can be replaced by synthetic materials such as PVC (polyvinyl chloride) and polyurethane coatings. These alternatives can be preferred to rubber coated fabric, which can limit market expansion, depending on the particular needs of an application.

Opportunity: Technological advancement

The market for rubber coated fabrics offers opportunities for new product development and technological advancement. Manufacturers can concentrate on creating new rubber coating technologies, expanding the functionality of already-existing coatings, and improving the general characteristics of cloth that has been rubber coated. This may entail improvements in toughness, adaptability, lightweight design, flame resistance, and other specialized qualities that address the demands of a given sector.

Challenge: Fluctuating raw material prices

Rubber coated fabrics rely on rubber as a key raw material, and the prices of rubber can be subjected to volatility. Fluctuations in rubber prices can affect the overall production costs and profitability of rubber coated fabric manufacturers. Manufacturers can encounter difficulties as a result of price fluctuations in the two main raw materials for rubber coated fabric: fabric and rubber. Production costs and profitability may be impacted by sudden price hikes or supply shortages. It can be difficult for businesses in the rubber coated cloth sector to control these price swings and maintain a steady supply chain.

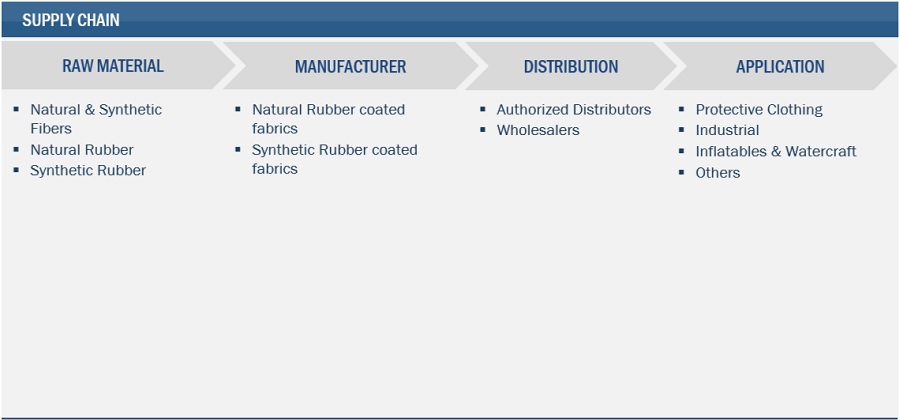

Rubber Coated Fabric Market: Value Chain

Prominent companies in this market include well-established, financially stable rubber coated fabric manufacturers. These companies have been operating in the market for several years and possess a strong product portfolio and strong global sales and marketing networks. Prominent companies in this market include Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France).

Based on type, the synthetic segment is estimated to have the largest market share in 2023.

Buildings, bridges, and roads are all examples of infrastructure development projects that need the use of durable materials that can survive adverse weather conditions. In waterproofing products, protective covers, and roofing membranes, synthetic rubber coated fabric is used. The demand for synthetic rubber coated fabric is influenced by the expanding infrastructure building activities.

Based on application, the transmission & conveyor belts was the second largest segment in 2022, by value.

Rubber coated fabric has good traction and grip qualities, making it suitable for conveyor and gearbox belts. Assuring effective power transfer and preventing slippage, the rubber coating increases friction between the belt and the pulleys or rollers. The necessity for dependable traction and improved belt performance drives the demand for rubber coated cloth in transmission & conveyor belts.

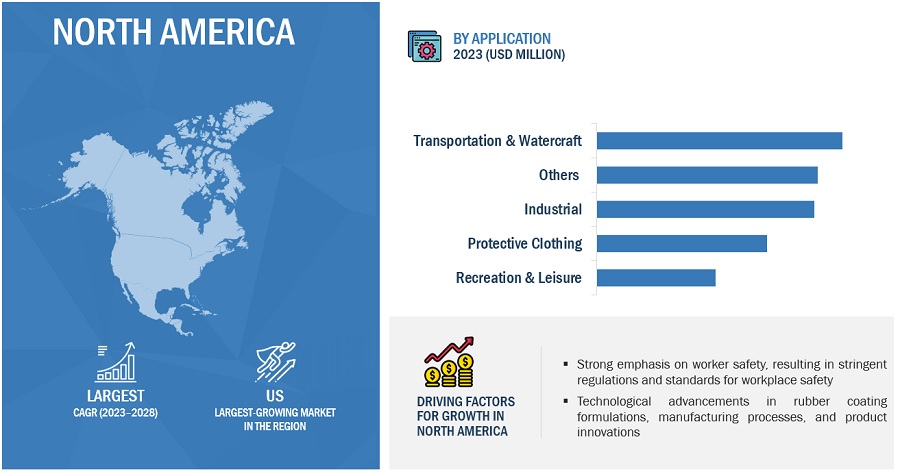

Based on end-use, the transportation & watercraft segment is estimated to account for the largest share during the forecast period, by value.

Rubber coated fabric has flexibility and design adaptability, making it suitable for use in a variety of transportation & watercraft applications. It can be customized and optimized for performance by being made to fit particular forms, sizes, and configurations. The capacity to fulfil specific design specifications and offer solutions for various transportation & watercraft demand drives demand for rubber coated fabric.

Based on region, North America is projected to account for the largest market share in 2023, by value.

North America is known for its technological advancements and innovation in various industries. Rubber coated fabric manufacturers in the region invest in research and development to enhance the performance characteristics of their products. Technological advancements in rubber coating formulations, manufacturing processes, and product innovations contribute to the growth of the rubber coated fabric market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France), are among the major players leading the market through their geographical presence, enhanced production capacities, and efficient distribution channels.

Scope of the Report:

|

Report Metric |

Details |

|

Market Size Available for Years |

2018 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million), Volume (Kiloton) |

|

Segments Covered |

Type, Application, End-use, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France), and others |

This research report categorizes the rubber coated fabric market based on type, application, end-use, and region.

Based on type, the rubber coated fabric market has been segmented as follows:

- Natural

- Synthetic

Based on application, the rubber coated fabric market has been segmented as follows:

- Protective Suits & Gloves

- Boats & Gangway Bellows

- Transmission and Conveyor Belts

- Outdoor Gear & Rainwear

- Gaskets & Diaphragms

- Others

Based on end-use, the rubber coated fabric market has been segmented as follows:

- Protective Clothing

- Industrial

- Transportation & Watercraft

- Recreation & Leisure

- Others

Based on the region, the rubber coated fabric market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- Saudi Arabia

- UAE

- Turkey

- Rest of Middle East & Africa

-

South America

-

- Brazil

- Argentina

- Rest of South America

-

Recent Developments

- In November 2022, Trelleborg Engineered Coated Fabrics focuses on innovation in healthcare & medical textiles. One of its recent product launches was the Dartex Zoned Coatings fabric. The fabric allows different combinations of stretch properties across its surface without changing the textile. For example, patients could benefit from a breathable center area for skin contact purposes, while clinicians could benefit from a tougher edge for durability.

- In December 2020, in response to the COVID-19 pandemic, Saint-Gobain developed the ONESuit ProTech, a protective suit designed to help first responders and medical professionals stay safe while treating patients with highly contagious diseases.

- In May 2020, Continental AG innovated timing belts which are used in wind turbines in place of gearboxes. The company has equipped the wind turbines made by Chinese manufacturer Xinjiang Goldwind Science and Technology with drive belts. Continental engineers used an optimal combination of two tried-and-tested timing belt technologies to develop these belts.

Frequently Asked Questions (FAQ):

What is the current size of the rubber coated fabric market?

The rubber coated fabric market is projected to grow from USD 6,357 million in 2023 to USD 7,787 million by 2028, at a CAGR of 4.1% from 2023 to 2028.

Which region is expected to hold the largest market share in the rubber coated fabric market?

The rubber coated fabric market in North America is estimated to hold the largest market share.

Which is the major application of rubber coated fabric?

The boats & gangway bellows segment is the major application of rubber coated fabric.

Who are the major players operating in the rubber coated fabric market?

The major players operating in the market include Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France).

What is the total CAGR expected to record for the rubber coated fabric market during 2023-2028?

The market is expected to record a CAGR of 4.1% from 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Increasing safety measures in transportation application- Stringent regulatory requirements for worker safetyRESTRAINTS- Release of pollutants during manufacturing process- Availability of low-cost substitutesOPPORTUNITIES- Potential for new applications due to technological advancements- Growing demand across industriesCHALLENGES- Fluctuating raw material prices- Stringent industry standards and regulations

-

5.2 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.3 CASE STUDYPROBLEM STATEMENT

-

5.4 TRADE ANALYSISIMPORT–EXPORT SCENARIO

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE, BY APPLICATIONAVERAGE SELLING PRICE, BY REGION

-

5.6 ECOSYSTEM

-

5.7 VALUE CHAIN ANALYSISRAW MATERIAL ACQUISITIONPROCESSING AND COATINGMANUFACTURINGDISTRIBUTION TO END USERS

-

5.8 TECHNOLOGY ANALYSISGROWING INFLUENCE OF NANOCOATING TECHNOLOGYWEARABLE TECHNOLOGY INTEGRATION

-

5.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS RELATED TO RUBBER COATED FABRIC MARKET

- 5.10 KEY CONFERENCES AND EVENTS, 2023

-

5.11 PATENT ANALYSISINSIGHTS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 EXTRUSION COATINGPROVIDES UNIFORMITY AND DURABILITY

-

6.3 ROLLER COATINGOFFERS MULTIPLE SURFACE FINISHES

-

6.4 DIP COATINGSIMPLE AND COST-EFFECTIVE METHOD

-

6.5 SPRAY COATINGRESULTS IN LOWER MATERIAL WASTAGE

- 7.1 INTRODUCTION

-

7.2 SYNTHETIC RUBBEROFFERS VERSATILITY AND DURABILITY

-

7.3 NATURAL RUBBERPROVIDES EXCELLENT WATER RESISTANCE AND FLEXIBILITY

- 8.1 INTRODUCTION

-

8.2 PROTECTIVE SUITS & GLOVESENSURES WORKER SAFETY IN HAZARDOUS ENVIRONMENTS

-

8.3 BOATS & GANGWAY BELLOWSPROVIDES DURABILITY AND FLEXIBILITY

-

8.4 TRANSMISSION & CONVEYOR BELTSPROTECTS AGAINST CONSTANT WEAR AND TEAR

-

8.5 OUTDOOR GEAR & RAINWEAROFFERS RELIABLE PROTECTION AGAINST RAIN AND MOISTURE

-

8.6 GASKETS & DIAPHRAGMSHELPS MAINTAIN INTEGRITY OF INDUSTRIAL SYSTEMS

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 PROTECTIVE CLOTHINGPROVIDES RELIABLE PROTECTION IN HAZARDOUS ENVIRONMENTS

-

9.3 INDUSTRIALSUITED FOR DIVERSE INDUSTRIAL APPLICATIONS

-

9.4 TRANSPORTATION & WATERCRAFTIMPROVES SAFETY AND EXTENDS LIFE OF VESSELS

-

9.5 RECREATION & LEISUREOFFERS PROTECTION FOR OUTDOOR ACTIVITIES

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFIC- China- India- Japan- South KoreaREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICA- US- Canada- Mexico

-

10.4 EUROPERECESSION IMPACT ON EUROPE- Germany- Italy- UK- France- SpainREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICA- Turkey- Saudi Arabia- UAEREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICA- Brazil- ArgentinaREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Continental AG- Trelleborg AB- Saint-Gobain S.A.- Colmant Coated Fabrics- Fabric CoteREVENUE ANALYSIS OF TOP FIVE PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSCONTINENTAL AG- Business overview- Products offered- Recent developments- MnM viewTRELLEBORG AB- Business overview- Products offered- Recent developments- MnM viewSAINT-GOBAIN S.A.- Business overview- Products offered- Recent developments- MnM viewCOLMANT COATED FABRICS- Business overview- Products offered- Recent developments- MnM viewFABRI COTE- Business overview- Products offered- Recent developments- MnM viewTHE RUBBER COMPANY- Business overview- Products offered- Recent developmentsWHITE CROSS RUBBER PRODUCTS LIMITED- Business overview- Products offered- Recent developmentsCAODETEX S.A.- Business overview- Products offered- Recent developmentsAUBURN MANUFACTURING, INC.- Business overview- Products offered- Recent developmentsFOTHERGILL GROUP- Business overview- Products offered- Recent developmentsARVILLE TEXTILES LIMITED- Business overview- Products offered- Recent developmentsZENITH RUBBER- Business overview- Products offered- Recent developmentsBOBET COMPANY- Business overview- Products offered

-

12.2 OTHER KEY MARKET PLAYERSUNIRUB TECHNO INDIA PRIVATE LIMITEDKURWA RUBBER & VALVESRAVASCO TRANSMISSION AND PACKING PRIVATE LIMITEDAMERICAN FABRIC FILTERPOLYMERTECHNIK ORTRAND GMBHNEETA BELLOWSKANHA VANIJYA PVT LTD.

- 13.1 INTRODUCTION

-

13.2 LIMITATIONSRUBBER COATED FABRIC INTERCONNECTED MARKETSCOATED FABRICS MARKET- Market Definition- Market Overview- Coated Fabrics Market, By Application

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 RUBBER COATED FABRIC MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 RUBBER COATED FABRIC MARKET SNAPSHOT: 2023 VS. 2028

- TABLE 3 US: PPE PROVISIONS AND STANDARDS

- TABLE 4 RUBBER COATED FABRIC MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 RUBBER TEXTILE FABRIC IMPORT TRADE DATA

- TABLE 6 RUBBER TEXTILE FABRIC EXPORT TRADE DATA

- TABLE 7 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE OF RUBBER COATED FABRIC, BY REGION, 2021–2028 (USD/KG)

- TABLE 9 RUBBER COATED FABRIC MARKET: ECOSYSTEM

- TABLE 10 RUBBER COATED FABRIC MARKET: CONFERENCES AND EVENTS, 2023

- TABLE 11 PATENTS: BANDO CHEMICAL INDUSTRIES, LTD.

- TABLE 12 PATENTS: CONTITECH USA INC.

- TABLE 13 TOP PATENT OWNERS DURING LAST 10 YEARS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 16 RUBBER COATED FABRIC MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 17 RUBBER COATED FABRIC MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 RUBBER COATED FABRIC MARKET, BY TYPE, 2019–2022 (KILOTONS)

- TABLE 19 RUBBER COATED FABRIC MARKET, BY TYPE, 2023–2028 (KILOTONS)

- TABLE 20 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 21 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2019–2022 (KILOTONS)

- TABLE 23 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 24 RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 25 RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 26 RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 27 RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 28 RUBBER COATED FABRIC MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 RUBBER COATED FABRIC MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 RUBBER COATED FABRIC MARKET, BY REGION, 2019–2022 (KILOTONS)

- TABLE 31 RUBBER COATED FABRIC MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 32 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 35 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 36 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 39 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 40 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 41 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 42 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 43 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 44 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 45 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 46 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 47 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 48 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 49 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 50 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 51 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 52 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 53 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 54 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 55 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 56 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 59 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 60 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 63 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 64 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 67 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 68 US: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 69 US: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 70 US: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 71 US: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 72 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 73 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 74 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 75 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 76 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 77 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 78 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 79 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 80 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 81 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 83 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 84 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 87 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 88 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 89 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 90 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 91 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 92 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 93 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 94 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 95 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 96 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 97 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 98 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 99 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 100 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 101 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 102 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 103 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 104 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 105 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 106 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 107 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 108 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 111 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 112 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 115 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 116 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 119 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 120 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 121 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 122 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 123 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 124 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 126 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 127 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 128 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 129 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 130 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 131 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 136 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 139 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 140 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 141 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019–2022 (KILOTONS)

- TABLE 143 SOUTH AMERICA: RUBBER COATED FABRICS MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 144 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 145 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 146 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 147 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 148 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 149 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 150 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 151 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 152 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019–2022 (KILOTONS)

- TABLE 155 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023–2028 (KILOTONS)

- TABLE 156 RUBBER COATED FABRIC MARKET: DEGREE OF COMPETITION

- TABLE 157 RUBBER COATED FABRIC MARKET: TYPE FOOTPRINT

- TABLE 158 RUBBER COATED FABRIC MARKET: END USE FOOTPRINT

- TABLE 159 RUBBER COATED FABRIC MARKET: COMPANY REGION FOOTPRINT

- TABLE 160 RUBBER COATED FABRIC MARKET: KEY STARTUPS/SMES

- TABLE 161 RUBBER COATED FABRIC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 162 RUBBER COATED FABRIC MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 163 RUBBER COATED FABRIC MARKET: DEALS, 2019–2023

- TABLE 164 RUBBER COATED FABRIC MARKET: EXPANSIONS AND INVESTMENTS, 2019–2023

- TABLE 165 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 166 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 167 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 168 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 169 TRELLEBORG AB: PRODUCTS OFFERED

- TABLE 170 TRELLEBORG AB: DEALS

- TABLE 171 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 172 SAINT-GOBAIN S.A.: PRODUCTS OFFERED

- TABLE 173 SAINT-GOBAIN S.A.: PRODUCT LAUNCHES

- TABLE 174 COLMANT COATED FABRICS: COMPANY OVERVIEW

- TABLE 175 COLMANT COATED FABRICS: PRODUCTS OFFERED

- TABLE 176 FABRI COTE: COMPANY OVERVIEW

- TABLE 177 FABRI COTE: PRODUCTS OFFERED

- TABLE 178 FABRI COTE: DEALS

- TABLE 179 THE RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 180 THE RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 181 WHITE CROSS RUBBER PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 182 WHITE CROSS RUBBER PRODUCTS LIMITED: PRODUCTS OFFERED

- TABLE 183 CAODETEX S.A.: COMPANY OVERVIEW

- TABLE 184 CAODETEX S.A.: PRODUCTS OFFERED

- TABLE 185 AUBURN MANUFACTURING, INC.: COMPANY OVERVIEW

- TABLE 186 AUBURN MANUFACTURING, INC.: PRODUCTS OFFERED

- TABLE 187 FOTHERGILL GROUP: COMPANY OVERVIEW

- TABLE 188 FOTHERGILL GROUP: PRODUCTS OFFERED

- TABLE 189 ARVILLE TEXTILES LIMITED: COMPANY OVERVIEW

- TABLE 190 ARVILLE TEXTILES LIMITED: PRODUCTS OFFERED

- TABLE 191 ARVILLE TEXTILES LIMITED: DEALS

- TABLE 192 ARVILLE TEXTILES LIMITED: OTHERS

- TABLE 193 ZENITH RUBBER: COMPANY OVERVIEW

- TABLE 194 ZENITH RUBBER: PRODUCTS OFFERED

- TABLE 195 BOBET COMPANY: COMPANY OVERVIEW

- TABLE 196 BOBET COMPANY: PRODUCTS OFFERED

- TABLE 197 UNIRUB TECHNO INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 198 KURWA RUBBER & VALVES: COMPANY OVERVIEW

- TABLE 199 RAVASCO TRANSMISSION AND PACKING PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 200 AMERICAN FABRIC FILTER: COMPANY OVERVIEW

- TABLE 201 POLYMERTECHNIK ORTRAND GMBH: COMPANY OVERVIEW

- TABLE 202 NEETA BELLOWS: COMPANY OVERVIEW

- TABLE 203 KANHA VANIJYA PVT LTD.: COMPANY OVERVIEW

- TABLE 204 COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 205 COATED FABRICS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 206 COATED FABRICS MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 207 COATED FABRICS MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- FIGURE 1 RUBBER COATED FABRIC MARKET SEGMENTATION

- FIGURE 2 RUBBER COATED FABRIC MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR RUBBER COATED FABRICS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 RUBBER COATED FABRIC MARKET: DATA TRIANGULATION

- FIGURE 7 SYNTHETIC RUBBER SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 PROTECTIVE SUITS & GLOVES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 9 TRANSPORTATION & WATERCRAFT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 INCREASING DEMAND FROM VARIOUS END-USE APPLICATIONS TO DRIVE MARKET

- FIGURE 12 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR, BY VOLUME, FROM 2023 TO 2028

- FIGURE 13 SYNTHETIC RUBBER SEGMENT HELD LARGER MARKET SHARE, BY VOLUME, IN 2022

- FIGURE 14 PROTECTIVE SUITS & GLOVES SEGMENT TO HOLD LARGEST MARKET SHARE BETWEEN 2023-2028

- FIGURE 15 PROTECTIVE CLOTHING SEGMENT TO REGISTER HIGHEST CAGR, BY VOLUME, DURING FORECAST PERIOD

- FIGURE 16 MARKET DYNAMICS

- FIGURE 17 RUBBER PRICE FROM JUNE 2018 – DECEMBER 2023

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF RUBBER COATED FABRIC MARKET

- FIGURE 19 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS

- FIGURE 20 AVERAGE SELLING PRICE OF RUBBER COATED FABRIC, BY REGION, 2021–2028

- FIGURE 21 ECOSYSTEM MAP OF RUBBER COATED FABRIC MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS OF RUBBER COATED FABRIC MARKET

- FIGURE 23 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 24 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 25 LEGAL STATUS OF PATENTS

- FIGURE 26 TOP JURISDICTIONS, BY DOCUMENT

- FIGURE 27 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 30 SYNTHETIC RUBBER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 31 PROTECTIVE SUITS & GLOVES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 32 TRANSPORTATION & WATERCRAFT SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: RUBBER COATED FABRIC MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: RUBBER COATED FABRIC MARKET SNAPSHOT

- FIGURE 36 EUROPE: RUBBER COATED FABRIC MARKET SNAPSHOT

- FIGURE 37 RANKING OF KEY PLAYERS IN RUBBER COATED FABRIC MARKET, 2022

- FIGURE 38 RUBBER COATED FABRIC MARKET SHARE ANALYSIS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 40 RUBBER COATED FABRIC MARKET: COMPANY FOOTPRINT

- FIGURE 41 COMPANY EVALUATION QUADRANT: RUBBER COATED FABRIC MARKET (TIER 1 COMPANIES)

- FIGURE 42 STARTUP/SME EVALUATION QUADRANT: RUBBER COATED FABRIC MARKET

- FIGURE 43 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 44 TRELLEBORG AB: COMPANY SNAPSHOT

- FIGURE 45 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

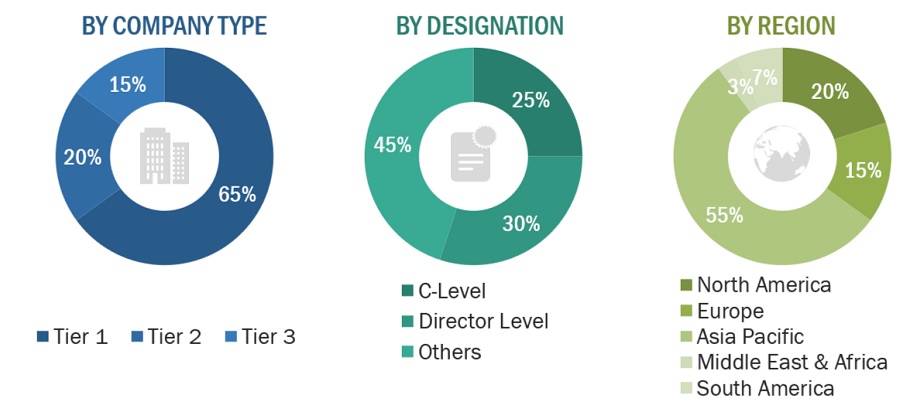

The study involved four major activities in estimating the current market size of rubber coated fabric. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of rubber coated fabric through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The rubber coated fabric market comprises several stakeholders, such as raw material suppliers, rubber coated fabric manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the rubber coated fabric market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the rubber coated fabric market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the rubber coated fabric market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Rubber Coated Fabric Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Rubber Coated Fabric Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the rubber coated fabric sources.

Market Definition

According to The Rubber Company, rubber coated textiles, also referred to as technical coated textiles or rubber proofed fabrics, grant rubber properties to a variety of fabrics and materials. Depending on how the fabric will be used, different rubber compounds are carefully coated on one or both sides of the fabric substrate using bonding agents. Coated fabrics are flexible composite materials. The rubber and the fabric form a solid bond after the coating has dried and hardened. The finished product is substantially stronger than uncoated fabrics, has good stability, and can be washed. Rubber coated fabrics have close textured mature and hence demonstrate low permeation and diffusion. They can be temperature, weather, and oil resistant as well as electrically conductive.

Key Stakeholders

- Manufacturers of rubber coated fabrics

- Manufacturers in end-use industries

- Traders, distributors, and suppliers of rubber coated fabrics

- Regional manufacturers and chemical associations

- Contract manufacturing organizations (CMOs)

- Market research and consulting firms

- NGOs, governments, investment banks, venture capitalists, and private equity firms

- Environmental support agencies

Report Objectives:

- To analyze and forecast the market size of rubber coated fabrics in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global rubber coated fabric market on the basis of type, application, end-use, and region.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To strategically analyze the micro markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective key countries.

- To track and analyze competitive developments, such as product launch, agreement, acquisition, and investments, in the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the rubber coated fabric market

- Profiling of additional market players (up to 8)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Rubber Coated Fabric Market