Rubber Bonded Abrasives Market by Application (Heavy Industries, Transportation Components, Electrical & Electronic Equipment, Medical Equipment), and Region - Global Forecast to 2026

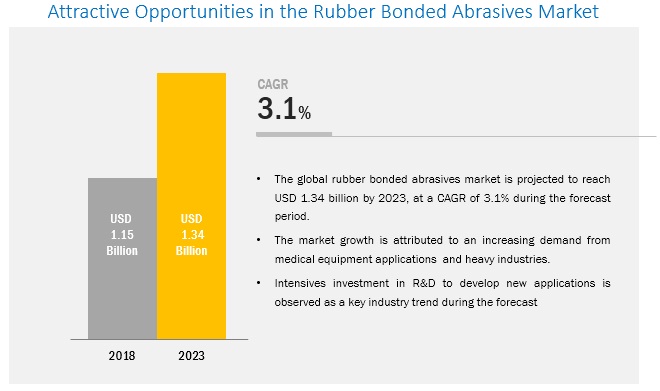

[130 Pages Report] The overall rubber bonded abrasive market is expected to grow from USD 1.09 million in 2016 to USD 1.47 million by 2026, at a CAGR of 3.1% from 2016 to 2021. Rubber bonded abrasives are bonded by specific types of rubber, which allows a soft treatment of the piece. The bonding makes the grain only touch the piece very lightly, paving way to a fine removal without hampering the actual metal. In addition, they are extremely flexible. These properties of rubber bonded abrasives lead to their demand from end-use industries which in turn, help in the growth of the market. The rubber bonded abrasive market is expanding with the emergence of new applications and technologies. Rubber bonded abrasive is being used in many applications such as heavy industries, transportation components, electrical & electronic equipment, and medical equipment. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2026.

Market Dynamics

Drivers

- Rising demand from the precious metal industry

- Flexibility in operations with rubber bonded abrasives

Restraints

- Pollution causing manufacturers to shift base

- Machine parameter constraints

Opportunities

- Increasing demand from high speed applications

Challenges

- Substitution from superior bonded abrasives

Use of rubber bonded abrasive in heavy industries drives the global rubber bonded abrasive market

Rubber bonded abrasive is used in heavy industries application for specific needs that range from initial processing of metal to manufacturing of finished products. Rubber bonded abrasives are used in foundries where fixed points are utilized, and for general precision in cutting and grinding of the extremely minute details of tools as they are very flexible. In addition, the steel industry has widespread application of rubber bonded abrasives, mainly for the purpose of removing scale or defects from the surface of slabs. Therefore, the growing heavy industries application drives the growth of rubber bonded abrasive market.

The following are the major objectives of the study.

- To define, describe, and forecast the rubber bonded abrasives market on the basis of application, and region

- To analyze and forecast market size, in terms of value and volume, of the rubber bonded abrasives industry

- To analyze the detailed market segmentation and forecast the market size, in terms of value and volume, and on the basis of applications for major regions such as North America, Europe, Asia-Pacific, Middle East & Africa, and South America and the key countries within these regions

- To identify the driving and restraining factors and analyze the opportunities and challenges in the rubber bonded abrasives market

- To analyze and forecast the market size, in terms of value and volume, for rubber bonded abrasives with respect to key applications such as heavy industries, transportation components, electrical & electronic equipment, and medical equipment

- To analyze competitive developments such as expansions, new product launches, supply contracts, and mergers & acquisitions in the global rubber bonded abrasives market

- To strategically profile the leading players in the industry

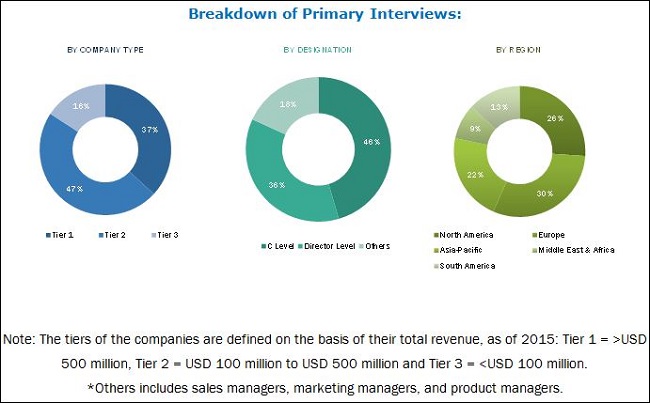

During this research study, major players operating in the rubber bonded abrasive market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The rubber bonded abrasive market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the rubber bonded abrasive market are 3M (US), Tyrolit Group (Austria), PFERD (Germany), Y. IKEMURA & Co. LTD. (Japan), Abrasivos Manhattan (Spain), Pacer Industries (US), Buffalo Abrasives (U.S.), Schwarzhaupt GmbH & co. Kg (Germany), Saint Gobain (France), Cratex manufacturing Company (UK), Marrose Abrasives (UK), Atto Abrasives (Ireland), Lowton Abrasive (UK), Buehler (UK), and Artifex Dr Lohmann Gmbh & Co KG (Germany).

Major Market Developments

- In July 2016, Atto Abrasive launched the new Atto Alpha Superfinishing range. Which includes bonded mounted points, quick change disks, and polishing wheels. Its application include surface preparation, deburring, and polishing.

- In July 2016, Atto Abrasive launched new range of Axiom range of polishing wheels for the saw blade industry. It is available in both rubber and cork bond also it is available in a number of grit types and grit sizes. It is used for polishing of saw blades.

- In June 2016, Saint Gobain abrasive launched new line of centerless grinding wheels, these newly developed wheels reduce cycle time up to 50 percent improves stock removal up to 30 percent & increases wheel life.

Target Audience

- Raw material suppliers

- Rubber bonded abrasives manufacturers and distributors

- Companies in end-use applications such as heavy industries, transportation components, electrical & electronic equipment, medical equipment and other applications

- Government & industry associations

- Regulatory bodies

Report Scope

By Application:

- Heavy industries

- Transportation components

- Electrical & electronic equipment

- Medical equipment

- Other applications (aerospace, household, printing)

By Region

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Critical questions which the report answers

- What are new application areas which the rubber bonded abrasive manufacturing companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the clients specific requirements. The available customization options are as follows:

Geographic Analysis

- Rubber bonded abrasive market analysis for additional countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The rubber bonded abrasive market is expected to grow from USD 1.09 billion in 2016 to USD 1.47 billion by 2026, at a CAGR of 3.1%. The use of rubber bonded abrasives in floor polishing, fabrication, off-hand tool grinding, and precision grinding applications is the key factors driving the growth of this market.

A mixture of abrasive grains, fillers, and bonding materials are called bonded abrasives. Rubber bonded abrasives are bonded by specific types of rubber, which allows a soft treatment of the piece. The bonding makes the grain only touch the piece very lightly, paving the way to a fine removal.

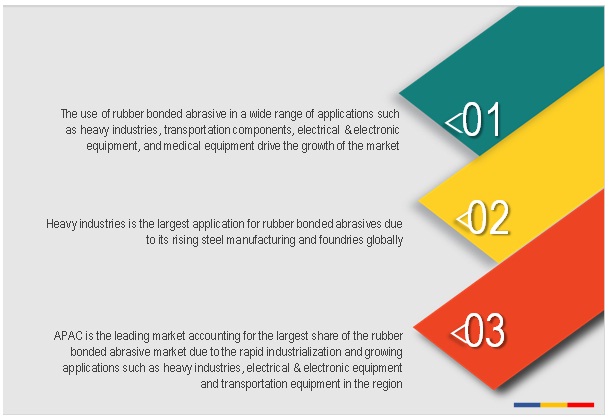

Rubber bonded abrasive market has been segmented into five applications. These applications are heavy industries, transportation components, electrical & electronic equipment, medical equipment, and other applications. Among all the applications, heavy industries are the largest application for rubber bonded abrasive as these abrasives are better to use and have flexibility during operations when compared to other bonded abrasives. Moreover, rising steel manufacturing and foundries globally will drive the market for rubber bonded abrasives.

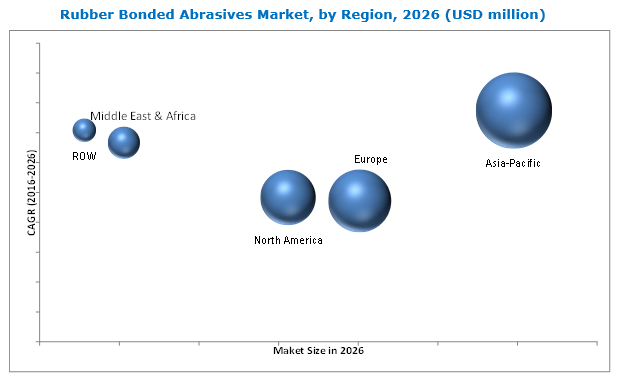

The rubber bonded abrasive market in APAC is expected to grow at the highest CAGR during the forecast period. Rapid industrialization and growing applications such as heavy industries, electrical & electronic equipment, and transportation equipment have led to the increase in the demand for rubber bonded abrasives in this region. Majority of the key players in the industry are focusing on the emerging markets in APAC and increasing their footprint by setting up manufacturing facilities, distribution centers, and R&D centers in this region. As a result, APAC holds a significant share of the overall rubber bonded abrasive market.

Rubber bonded abrasive applications in heavy industries, transportation components, electrical & electronic equipment, and medical equipment drive the growth of rubber bonded abrasive market

Heavy industries

Heavy industries are one of those applications where rubber bonded abrasives are extensively used for specific needs that range from initial processing of metal to manufacturing of finished products. Rubber bonded abrasives are used in foundries, steel industry and for general precision in cutting and grinding of the extremely minute details of tools as they are very flexible.

Transportation components

Rubber bonded abrasives are used in the manufacturing of transportation components such as auto ancillaries, bearing & gears, and auto OEMs. They are used throughout the processing of bearings, disc grinding, and centerless grinding, mainly for bearing rind and roller. The auto ancillaries require high precision while manufacturing these components. Therefore, the high precision grinding wheels used in the manufacturing of these components comprises of rubber bonded abrasives. This helps auto ancillary manufacturers to improve productivity as well as product quality.

Electrical & electronic equipment

Rubber bonded abrasives play an important role in electrical & electronic equipment application. They are used in the manufacturing of semiconductors; electronic applications, such as CMP pad dressing, back grinding, wafer slicing, IC die cutting; and other electronics manufacturing operations.

Medical equipment

In medical equipment application, rubber bonded abrasives are used in the manufacturing of several intrinsic medical equipment for end-user industries, such as dental, eyeglass or ophthalmic production. They are also used in deburring and polishing of medical tweezers, medical scissors, as well as surface polishing of artificial joints for hip and knee replacement surgeries.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for rubber bonded abrasives?

Pollution caused during the manufacturing and machine parameter constraints are the major factors restraining the growth of the market. The pollution that is the outcome of production of rubber bonded abrasives has resulted in the implementation of several government regulations to protect the environment. Countries such as Germany or the U.S. where the environment protection is paramount, have stringent environment regulations imposed on the production of rubber bonded abrasives or such materials. Moreover, the rubber bonded abrasives are heavy compared to the other types of bonded abrasives. Therefore, their application is restricted to only a few machines which lead to machine parameter constraints.

Key players in the market include 3M (US), Tyrolit Group (Austria), PFERD (Germany), Y. IKEMURA & Co. LTD. (Japan), Abrasivos Manhattan (Spain), Pacer Industries (US), Buffalo Abrasives (U.S.), Schwarzhaupt GmbH & Co. Kg (Germany), Saint Gobain (France), Cratex manufacturing Company (UK), Marrose Abrasives (UK), Atto Abrasives (Ireland), Lowton Abrasive (UK), Buehler (UK), and Artifex Dr. Lohmann Gmbh & Co KG (Germany). These players are increasingly undertaking expansions, mergers & acquisitions, and new product developments to expand their product portfolio and market share.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segments Covered

1.3.2 Market Size Estimation Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunity for Rubber Bonded Abrasives

4.2 Rubber Bonded Abrasives Market Share, By Type and Region

4.3 Fastest Growing Rubber Bonded Abrasives Markets

4.4 Heavy Industries to Remain the Largest Market By 2021

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Demand From the Precious Metal Industry

5.3.1.2 Flexibility in Operations With Rubber Bonded Abrasives

5.3.2 Restraints

5.3.2.1 Pollution Causing Manufacturers to Shift Base

5.3.2.2 Machine Parameter Constraints

5.3.3 Opportunities

5.3.3.1 Increasing Demand From High Speed Applications

5.3.4 Challenge

5.3.4.1 Substitution From Superior Bonded Abrasives

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Rubber Bonded Abrasives Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Heavy Industries

7.3 Transportation Components

7.4 Electrical & Electronic Equipment

7.5 Medical Equipment

7.6 Other Applications

8 Rubber Bonded Abrasives Market, By Region (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 France

8.3.3 Italy

8.3.4 Russia

8.3.5 U.K.

8.3.6 Rest of the Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 India

8.4.3 Japan

8.4.4 South Korea

8.4.5 Indonesia

8.4.6 Taiwan

8.4.7 Australia & New Zealand

8.4.8 Rest of the Asia-Pacific

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.2 UAE

8.5.3 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of the South America

9 Company Profiles (Page No. - 103)

9.1 3M Company

9.1.1 Business Overview

9.1.2 Products & Services

9.1.3 Recent Developments

9.1.4 SWOT Analysis

9.1.5 MnM View

9.2 Tyrolit Group

9.2.1 Business Overview

9.2.2 Products & Services

9.2.3 Recent Development

9.3 Pferd Inc.

9.3.1 Business Overview

9.3.2 Products & Services

9.3.3 Recent Development

9.4 Y. Ikemura & Co. Ltd.

9.4.1 Business Overview

9.4.2 Products & Services

9.5 Abrasivos Manhattan SA

9.5.1 Business Overview

9.5.2 Products & Services

9.6 Pacer Industries, Inc.

9.6.1 Business Overview

9.6.2 Products & Services

9.7 Buffalo Abrasives, Inc.

9.7.1 Business Overview

9.7.2 Products & Services

9.8 Schwarzhaupt GmbH & Co. Kg

9.8.1 Business Overview

9.8.2 Products & Services

9.9 Saint Gobain.

9.9.1 Business Overview

9.9.2 Products & Services

9.9.3 Recent Developments

9.9.4 SWOT Analysis

9.9.5 MnM View

9.10 Cratex Manufacturing Co.

9.10.1 Business Overview

9.10.2 Products & Services

9.11 Marrose Abrasives.

9.11.1 Business Overview

9.11.2 Products & Services

9.11.3 Recent Developments

9.12 Atto Abrasives Ltd.

9.12.1 Business Overview

9.12.2 Products & Services

9.12.3 Recent Developments

9.13 Lowton Abrasive Ltd.

9.13.1 Business Overview

9.13.2 Products & Services

9.14 Buehler.

9.14.1 Business Overview

9.14.2 Products & Services

9.14.3 Recent Developments

9.15 Artifex DR Lohmann GmbH & Co Kg.

9.15.1 Business Overview

9.15.2 Products & Services

10 Appendix (Page No. - 124)

10.1 Key Expert Insights

10.2 Discussion Guide

10.3 Introducing RT: Real Time Market Intelligence

10.4 Available Customizations

10.5 Related Reports

List of Tables (80 Tables)

Table 1 Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kilotons)

Table 2 Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 3 Rubber Bonded Abrasives Market Size in Heavy Industries, By Region, 20142026 (Kilotons)

Table 4 Rubber Bonded Abrasives Market Size in Heavy Industries, By Region, 20142026 (USD Million)

Table 5 Rubber Bonded Abrasives Market Size in Transportation Components, By Region, 20142026 (Kilotons)

Table 6 Rubber Bonded Abrasives Market Size in Transportation Components, By Region, 20142026 (USD Million)

Table 7 Rubber Bonded Abrasives Market Size in Electrical & Electronic Equipment, By Region, 20142026 (Kilotons)

Table 8 Rubber Bonded Abrasives Market Size in Electrical & Electronics, By Region, 20142026 (USD Million)

Table 9 Rubber Bonded Abrasives Market Size in Medical Equipment, By Region, 20142026 (Kilotons)

Table 10 Rubber Bonded Abrasives Market Size in Medical Equipment, By Region, 20142026 (USD Million)

Table 11 Rubber Bonded Abrasives Market Size in Other Applicattions, By Region, 20142026 (Kilotons)

Table 12 Rubber Bonded Abrasives Market Size in Other Applicattions, By Region, 20142026 (USD Million)

Table 13 Global Rubber Bonded Abrasives Market Size, By Region, 20142026 (Kilotons)

Table 14 Global Rubber Bonded Abrasives Market Size, By Region, 20142026 (USD Million)

Table 15 North America By Market Size, By Country, 20142026 (Kilotons)

Table 16 North America By Market Size, By Country, 20142026 (USD Million)

Table 17 North America By Market Size, By Application, 20142026 (Kiloton)

Table 18 North America By Market Size, By Application, 20142026 (USD Million)

Table 19 U.S. Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 20 U.S. Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 21 Canada Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 22 Canada By Market Size, By Application, 20142026 (USD Million)

Table 23 Mexico By Market Size, By Application, 20142026 (Kiloton)

Table 24 Mexico By Market Size, By Application, 20142026 (USD Million)

Table 25 Europe By Market Size, By Country, 20142026 (Kilotons)

Table 26 Europe By Market Size, By Country, 20142026 (USD Million)

Table 27 Europe By Market Size, By Application, 20142026 (Kiloton)

Table 28 Europe By Market Size, By Application, 20142026 (USD Million)

Table 29 Germany Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 30 Germany Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 31 France Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 32 France Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 33 Italy Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 34 Italy Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 35 Russia Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 36 Russia Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 37 U.K. Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 38 U.K. Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 39 Rest of the Europe Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 40 Rest of the Europe Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 41 Asia-Pacific By Market Size, By Country, 20142026 (Kilotons)

Table 42 Asia-Pacific By Market Size, By Country, 20142026 (USD Million)

Table 43 Asia-Pacific By Market Size, By Application, 20142026 (Kiloton)

Table 44 Asia-Pacific By Market Size, By Application, 20142026 (USD Million)

Table 45 China Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 46 China Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 47 India By Market Size, By Application, 20142026 (Kiloton)

Table 48 India By Market Size, By Application, 20142026 (USD Million)

Table 49 Japan By Market Size, By Application, 20142026 (Kiloton)

Table 50 Japan By Market Size, By Application, 20142026 (USD Million)

Table 51 South Korea Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 52 South Korea Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 53 Indonesia Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 54 Indonesia Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 55 Taiwan Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 56 Taiwan Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 57 Australia & New Zealand Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 58 Australia & New Zealand Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 59 Rest of Asia-Pacific By Market Size, By Application, 20142026 (Kiloton)

Table 60 Rest of Asia-Pacific By Market Size, By Application, 20142026 (USD Million)

Table 61 Middle East & Africa By Market Size, By Country, 20142026 (Kilotons)

Table 62 Middle East & Africa By Market Size, By Country, 20142026 (USD Million)

Table 63 Middle East & Africa By Market Size, By Application, 20142026 (Kiloton)

Table 64 Middle East & Africa By Market Size, By Application, 20142026 (USD Million)

Table 65 Saudi Arabia By Market Size, By Application, 20142026 (Kiloton)

Table 66 Saudi Arabia By Market Size, By Application, 20142026 (USD Million)

Table 67 UAE By Market Size, By Application, 20142026 (Kiloton)

Table 68 UAE By Market Size, By Application, 20142026 (USD Million)

Table 69 Rest of Middle East & Africa Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 70 Rest of Middle East & Africa Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 71 South America By Market Size, By Country, 20142026 (Kilotons)

Table 72 South America By Market Size, By Country, 20142026 (USD Million)

Table 73 South America By Market Size, By Application, 20142026 (Kiloton)

Table 74 South America By Market Size, By Application, 20142026 (USD Million)

Table 75 Brazil By Market Size, By Application, 20142026 (Kiloton)

Table 76 Brazil Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 77 Argentina Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 78 Argentina Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

Table 79 Rest of South the America Rubber Bonded Abrasives Market Size, By Application, 20142026 (Kiloton)

Table 80 Rest of South the America Rubber Bonded Abrasives Market Size, By Application, 20142026 (USD Million)

List of Figures (43 Figures)

Figure 1 Global Rubber Bonded Abrasives Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation: Rubber Bonded Abrasives Market

Figure 5 Heavy Industries is Projected to Lead the Rubber Bonded Abrasives Market During the Forecast Period (Kilotons)

Figure 6 Asia-Pacific to Lead the Rubber Bonded Abrasives Market Between 2016 and 2021

Figure 7 Global Market Scenario 2014-2026

Figure 8 Top Ten Markets for Rubber Bonded Abrasives- 2015

Figure 9 Rubber Bonded Abrasives Market Size, 2016 vs 2021 (USD Billion)

Figure 10 China is Leading the Market in Asia-Pacific and Heavy Industries is the Leading Application (2016)

Figure 11 India, China, and Russia are the Fastest Growing Markets for Rubber Bonded Abrasives Globally Between 2016-2021 (Kiloton)

Figure 12 Rubber Bonded Abrasives Market, By Type, 2016-2021 (Kiloton)

Figure 13 Rubber Bonded Abrasives Market Segmentation, By Application

Figure 14 Rubber Bonded Abrasives Market Segmentation, By Region

Figure 15 Rubber Bonded Abrasives- Rising Demand From Precious Metal Industry

Figure 16 Value Chain Analysis: Rubber Bonded Abrasives

Figure 17 Porters Five Forces Analysis

Figure 18 Rubber Bonded Abrasives Market Share, By Application, 2015 (Kiloton)

Figure 19 Asia-Pacific to Lead Rubber Bonded Abrasives Market in Heavy Industries (2016-2021)

Figure 20 Asia-Pacific Projected to Register the Fastest Growth in Transportation Components (2016-2021)

Figure 21 South America to Be the Fastest-Growing Region for Rubber Bonded Abrasives in Electrical & Electronic Equipment (2016-2021)

Figure 22 Asia-Pacific is Projected to Register the Fastest Growth for in Medical Equipment (2016-2021)

Figure 23 Asia-Pacific is the Fastest Growing Region for Rubber Bonded Abrasives in Other Applications (2016-2021)

Figure 24 Rubber Bonded Abrasives Market Share, By Type, 2015 (Kilotons)

Figure 25 Rubber Bonded Abrasives Market Share, By Country, 2015 (Kilotons)

Figure 26 Rubber Bonded Abrasives Market Share, By Country, 2015 (Kilotons)

Figure 27 The 3M Company: Company Snapshot

Figure 28 The 3M Company: SWOT Analysis

Figure 29 The Tyrolit Group: Company Snapshot

Figure 30 Pferd Inc : Company Snapshot

Figure 31 Y.Ikemura & Co. Ltd.: Company Snapshot

Figure 32 Abrasivos Manhattan SA : Company Snapshot

Figure 33 Pacer Industries Inc.: Company Snapshot

Figure 34 Buffalo Abrasives, Inc.: Company Snapshot

Figure 35 Schwarzhaupt GmbH & Co. Kg : Business Overview

Figure 36 Saint Gobain Business Overview

Figure 37 Saint Gobain: SWOT Analysis

Figure 38 Cratex Manufacturing Co: Business Overview

Figure 39 Marrose Abrasives: Business Overview

Figure 40 Atto Abrasives Ltd.: Business Overview

Figure 41 Lowton Abrasive Ltd. : Business Overview

Figure 42 Buehler : Business Overview

Figure 43 Artifex DR Lohmann GmbH & Co Kg: Business Overview

Growth opportunities and latent adjacency in Rubber Bonded Abrasives Market