RSV Diagnostics Market by Product (Kits and Assays, Instruments), Method (Rapid Antigen Detection Test (Immunofluorescence Assay, ELISA), Molecular Diagnostic), End User (Hospitals & Clinics, Clinical Laboratories, Homecare) & Region

The global RSV diagnostics market is expected to grow at a CAGR of 10.1%. Respiratory syncytial virus (RSV) diagnostics market growth is primarily driven by the rising burden of RSV infections, growing demand for PoC molecular diagnostic tests for the diagnosis of RSV infections, and increasing approval of RSV diagnostic kits and assays.

RSV Diagnostics Market Dynamics

Drivers

- Increasing Burden of RSV Infections

- Growing Demand for Point-Of-Care Molecular Diagnostic Tests for the Diagnosis of RSV Infections

- Increasing Adoption of Molecular Diagnostics Over Immunoassays

- Increasing Approval of RSV Diagnostic Kits and Assays

Restraint

- Low Detection Limits of Immunoassays

Opportunities

- Technological Advancements in Diagnostic Methods

Threats

- Development of RSV Vaccines

The objectives of this study are as follows:

- To define, describe, and forecast the global RSV diagnostics market by product, methods, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities and threats)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, APAC, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product launches, agreements, expansions, acquisitions, and other developments in the global RSV diagnostics market

Research Methodology

Top-down and bottom-up approaches were used to estimate and validate the size of the global RSV diagnostics industry and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation—by products and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained.

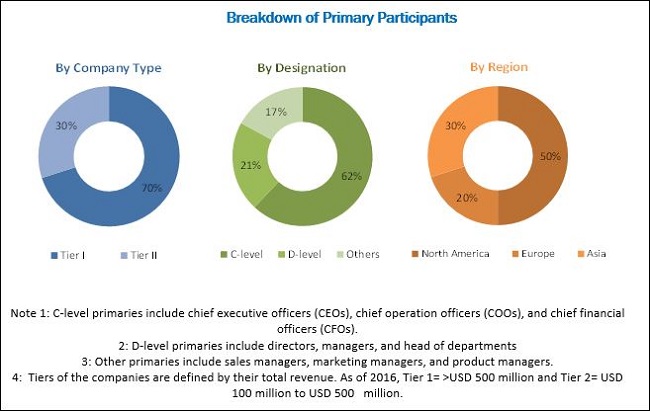

Various secondary sources referred to for this research study include publications from government sources such as the white papers; articles from recognized authors; gold standard and silver standard websites, directories, and databases; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations have been used to identify and collect information useful for this extensive commercial study of the RSV diagnostics market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the RSV diagnostics market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major players in the RSV diagnostics market are bioMérieux (France), Abbott (US), Roche (Switzerland), BD (US), Thermo Fisher (US), Luminex (US), Danaher (US), Biocartis (Belgium), and Hologic (US).

Target Audience for this Report:

- Manufacturers and vendors of respiratory syncytial virus diagnostic

- Research associations related to infectious diseases

- Various research and consulting firms

- Distributors of respiratory syncytial virus diagnostic products

- Contract manufacturers of respiratory syncytial virus diagnostic products

- Healthcare institutions

- Research institutes

Value Addition for the Buyer:

This report provides insights into the global RSV diagnostics market. It provides valuable information on the products, methods, and regions in the RSV diagnostics market. The geographic analysis for these segments is also presented in this report. Leading players in the market are profiled to study their device offerings and understand strategies undertaken by them to be competitive in this market.

The above-mentioned information would help the buyer understand market dynamics. In addition, the forecasts provided in the report will enable firms to understand the trends in this market and better position themselves to capitalize on the growth opportunities.

Major Market Developments

- In 2014, bioMérieux acquired BioFire Diagnostics (US).

- In 2015, bioMérieux commercialized its FilmArray multiplex PCR system.

- In 2016, Abbott received the US FDA and CLIA waivers for its Alere i RSV Rapid Molecular Test and Alere Reader Lateral Flow Assay Analyzer.

- In 2017, Abbott acquired Alere Medical (US). Also in 2016, the company opened its diagnostics manufacturing facility in Manesar, Haryana, India.

Critical questions the report answers

- How the market developments of key players impact the overall industry?

- What are the restraining factors for this market?

A wide array of tests are available for RSV diagnosis, including molecular diagnostic tests, viral culture tests, rapid tests, serology tests, and rapid immunoassays. Players are focusing on combining these technologies and rapid immunoassays to develop the best approach to diagnose RSV infections. For instance, Becton Dickinson (US) has developed the Veritor System, which is a combination of rapid Immunoassay diagnosis with fully automated point-of-care instruments that offer high accuracy and sensitivity. Similarly, Quidel (US) has developed the Solana Assay, which includes molecular as well as traditional and next-generation immunoassays.

As compared to immunoassays, the demand for molecular testing of RSV infections is increasing in hospitals and reference laboratories. Moreover, a number of CLIA waivers and US FDA clearances are supporting the adoption of molecular diagnostic tests in physician offices and urgent care clinics. Since RSV infections have a higher prevalence among infants and young children, the adoption of molecular diagnostics is increasing as compared to immunoassays in this patient group. Rapid immunoassays are preferred whenever a quick estimation of the infection is required in inpatient and outpatient settings as well as for community surveillance; however, for the confirmation of the infection, molecular diagnostic tests are deployed to better evaluate the entire course of infection.

Scope of the Report:

This report categorizes the RSV diagnostics market into the following segments:

By Product

- Kits and Assays

- Instruments

- Other Products

- RSV Diagnostics Market, By Methods

- Molecular Diagnostics

-

Rapid Antigen Detection Tests

- Enzyme-Linked Immunosorbent Assays

- Immunofluorescence Assays

-

Other Rapid Antigen Detection Tests

- Chromatographic Immunoassays

- Optical Immunoassays

- Other Methods

By End User

- Hospitals and Clinics

- Clinical Laboratories

- Home Care

By Region

- North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market.

The RSV diagnostics market is expected to grow at a CAGR of 10.1%. Market growth is primarily driven by the rising burden of RSV infections, growing demand for PoC molecular diagnostic tests for the diagnosis of RSV infections, and increasing approval of RSV diagnostic kits and assays.

This market is segmented based on products, method, end user, and region. The global RSV diagnostics market is segmented based on product, method, end user, and region. By product, the global market is segmented into kits and assays, instruments, and other products. The kits and assays segment is estimated to account for the largest share of the global market in 2017. Factors driving the growth of this segment include the growing patient base of RSV disease and increasing demand for kits and assays for RSV diagnosis.

The RSV diagnostics market by method is segmented into rapid antigen detection tests, molecular diagnostics, and other methods. The molecular diagnostics segment is estimated to account for the largest share of the global market in 2017. Growing demand for molecular diagnostic tests for the diagnosis of RSV infections, and increasing approval of RSV diagnostic kits and assays are the major factors driving the growth of this segment.

The RSV diagnostics market by end user is segmented into hospitals and clinics, clinical laboratories and home care. The hospitals and clinics segment is estimated to account for the largest share of the global market. Increasing burden of RSV disease among children, increasing demand for RSV diagnosis in hospitals and clinics and increasing adoption of PoC molecular diagnostic devices in hospitals and clinics for RSV diagnosis are the major factors driving the growth of this segment.

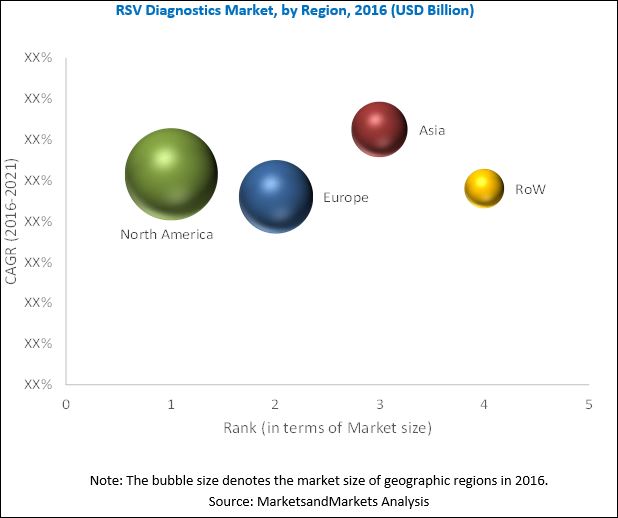

The global RSV diagnostics market is dominated by North America, followed by Europe. North America will continue to dominate the global market in the forecast period. However, Asia Pacific is expected to witness the highest CAGR. Factors such as the increasing burden of infectious disease such as RSV and focus of major players in emerging Asia Pacific countries are driving the growth of the RSV diagnostics market in this region. While development of a RSV vaccine in the forecast period is expected to be a major challenge for the global market.

Technological Advancements in Diagnostic Methods Will Boost the Growth of this Market

New technologies such as filament-based antibody detection assays, thin layer-based amperometric enzyme immunoassay (EIA), and multiplex virus testing are in the final stage of development. Furthermore, nucleic acid amplification techniques and loop-mediated isothermal amplification will soon be aligned with PoC devices. This will allow testing to be performed using a one-step kit, which will require only the addition of a patient sample. Also, the nanoparticle technology, which has the potential to bring about a four-fold improvement in viral detection as compared to RT-PCR (the current gold standard), is under development.

Similarly, plasmonic detection techniques such as localized surface plasmon resonance (LSPR) spectroscopy (which uses metallic nanomaterials by exploiting physicochemical peculiarities) are under development with PoC detection devices. This is considered as a major development as methods such as LSPR spectroscopy offer rapid diagnostics and superior sensitivity & affordability as compared to techniques such as surface-enhanced Raman spectroscopy (SERS) and PCR coupled with electrospray ionization Mass Spectrometry (PCR-ESI-MS), which are not cost-effective, cumbersome to perform, and are more limited to research purposes. In the next few years, all the above-mentioned technologies are expected to be included in commercialized diagnostic methods. This is considered as a potential growth area for players operating in the global RSV diagnostics market.

Key players in the RSV diagnostics market are RSV diagnostics market bioMérieux (France), Abbott (US), Roche (Switzerland), BD (US), Thermo Fisher (US), Luminex (US), Danaher (US), Biocartis (Belgium), and Hologic (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews, By Company Type, Designation, and Region

2.1.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 24)

4.1 Attractive Opportunities in the RSV Diagnostics Market

4.2 Geographic Analysis: Global Market, By Product & Region (2017)

4.3 Global Market, By End Users, 2017–2022

4.4 Geographical Snapshot of the RSV Diagnostics Market

5 Market Overview (Page No. - 27)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Burden of RSV Infections

5.2.1.2 Growing Demand for Point-Of-Care Molecular Diagnostic Tests for the Diagnosis of RSV Infections

5.2.1.2.1 Increasing Adoption of Molecular Diagnostics Over Immunoassays

5.2.1.3 Increasing Approval of RSV Diagnostic Kits and Assays

5.2.2 Restraints

5.2.2.1 Low Detection Limits of Immunoassays

5.2.3 Opportunities

5.2.3.1 Technological Advancements in Diagnostic Methods

5.2.4 Threats

5.2.4.1 Development of RSV Vaccines

6 RSV Diagnostics Market, By Product (Page No. - 32)

6.1 Introduction

6.2 Kits and Assays

6.3 Instruments

6.4 Other Products

7 RSV Diagnostics Market, By Method (Page No. - 39)

7.1 Introduction

7.2 Molecular Diagnostics

7.3 Rapid Antigen Detection Tests

7.3.1 Enzyme-Linked Immunosorbent Assays

7.3.2 Immunofluorescence Assays

7.3.3 Other Rapid Antigen Detection Tests

7.3.3.1 Chromatographic Immunoassays

7.3.3.2 Optical Immunoassays

7.4 Other Methods

8 RSV Diagnostics Market, By End User (Page No. - 53)

8.1 Introduction

8.2 Hospitals and Clinics

8.3 Clinical Laboratories

8.4 Home Care

9 RSV Diagnostics Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of Europe

9.4 APAC

9.5 RoW

10 Competitive Landscape (Page No. - 81)

10.1 Introduction

10.2 Market Overview

10.3 Market Share Analysis, 2016

10.4 Competitive Scenario

10.4.1 Product Launches and Approvals

10.4.2 Acquisitions

10.4.3 Agreements and Collaborations

10.4.4 Expansions

11 Company Profiles (Page No. - 85)

Business Overview, Products Offered, Recent Developments, MnM View

11.1 Biomérieux

11.2 Becton, Dickinson and Company (BD)

11.3 Abbott

11.4 Roche

11.5 Danaher

11.6 Thermo Fisher

11.7 Biocartis

11.8 Luminex

11.9 Hologic

11.10 Fast Track Diagnostics

*Details Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 104)

12.1 Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (86 Tables)

Table 1 Current Status of RSV Vaccines

Table 2 RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 3 Global Respiratory Syncytial Virus Diagnostic Market for Kits and Assays, By Region, 2015–2022 (USD Million)

Table 4 North America: Respiratory Syncytial Virus Diagnostic Market for Kits and Assays, By Country, 2015–2022 (USD Million)

Table 5 Europe: Respiratory Syncytial Virus Diagnostic Market for Kits and Assays, By Country, 2015–2022 (USD Million)

Table 6 Global Respiratory Syncytial Virus Diagnostic Market for Instruments, By Region, 2015–2022 (USD Million)

Table 7 North America: RSV Diagnostics Market for Instruments, By Country, 2015–2022 (USD Million)

Table 8 Europe: RSV Diagnostics Market for Instruments, By Country, 2015–2022 (USD Million)

Table 9 Global Respiratory Syncytial Virus Diagnostic Market for Other Products, By Region, 2015–2022 (USD Million)

Table 10 North America: Market for Other Products, By Country, 2015–2022 (USD Million)

Table 11 Europe: Respiratory Syncytial Virus Diagnostic Market for Other Products, By Country, 2015–2022 (USD Million)

Table 12 Global Respiratory Syncytial Virus Diagnostic Market, By Method, 2015–2022 (USD Million)

Table 13 Molecular Diagnostics Market, By Region, 2015–2022 (USD Million)

Table 14 North America: Molecular Diagnostics Market, By Country, 2015–2022 (USD Million)

Table 15 Europe: Molecular Diagnostic Market, By Country, 2015–2022 (USD Million)

Table 16 Rapid Antigen Detection Tests Market, By Type, 2015–2022 (USD Million)

Table 17 Rapid Antigen Detection Tests Market, By Region, 2015–2022 (USD Million)

Table 18 North America: Rapid Antigen Detection Tests Market, By Country, 2015–2022 (USD Million)

Table 19 Europe: Rapid Antigen Detection Tests Market, By Country, 2015–2022 (USD Million)

Table 20 Rapid Antigen Detection Tests Market for Enzyme-Linked Immunosorbent Assays, By Region, 2015–2022 (USD Million)

Table 21 North America: Rapid Antigen Detection Tests Market for Enzyme-Linked Immunosorbent Assays, By Country, 2015–2022 (USD Million)

Table 22 Europe: Rapid Antigen Detection Tests Market for Enzyme-Linked Immunosorbent Assays, By Country, 2015–2022 (USD Million)

Table 23 Rapid Antigen Detection Tests Market for Immunofluorescence Assays, By Region, 2015–2022 (USD Million)

Table 24 North America: Rapid Antigen Detection Tests Market for Immunofluorescence Assays, By Country, 2015–2022 (USD Million)

Table 25 Europe: Rapid Antigen Detection Tests Market for Immunofluorescence Assays, By Country, 2015–2022 (USD Million)

Table 26 Other Rapid Antigen Detection Tests Market, By Type, 2015–2022 (USD Million)

Table 27 Other Rapid Antigen Detection Tests Market, By Region, 2015–2022 (USD Million)

Table 28 North America: Other Rapid Antigen Detection Tests Market, By Country, 2015–2022 (USD Million)

Table 29 Europe: Other Rapid Antigen Detection Tests Market, By Country, 2015–2022 (USD Million)

Table 30 Rapid Antigen Detection Tests Market for Chromatographic Immunoassays, By Region, 2015–2022 (USD Million)

Table 31 North America: Rapid Antigen Detection Tests Market for Chromatographic Immunoassays, By Country, 2015–2022 (USD Million)

Table 32 Europe: Rapid Antigen Detection Tests Market for Chromatographic Immunoassays, By Country, 2015–2022 (USD Million)

Table 33 Rapid Antigen Detection Tests Market for Optical Immunoassays, By Region, 2015–2022 (USD Million)

Table 34 North America: Rapid Antigen Detection Tests Market for Optical Immunoassays, By Country, 2015–2022 (USD Million)

Table 35 Europe: Rapid Antigen Detection Tests Market for Optical Immunoassays, By Country, 2015–2022 (USD Million)

Table 36 Other Methods Market for RSV Diagnostics, By Region, 2015–2022 (USD Million)

Table 37 North America: Other Methods Market for RSV Diagnostics, By Country, 2015–2022 (USD Million)

Table 38 Europe: Other Methods Market for RSV Diagnostics, By Country/Region, 2015–2022 (USD Million)

Table 39 RSV Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 40 RSV Diagnosis Market for Hospitals and Clinics, By Region, 2015–2022 (USD Million)

Table 41 North America: RSV Diagnosis Market for Hospitals and Clinics, By Country, 2015–2022 (USD Million)

Table 42 Europe: RSV Diagnosis Market for Hospitals and Clinics, By Region, 2015–2022 (USD Million)

Table 43 RSV Diagnosis Market for Clinical Laboratories, By Region, 2015–2022 (USD Million)

Table 44 North America: RSV Diagnosis Market for Clinical Laboratories, By Country, 2015–2022 (USD Million)

Table 45 Europe: RSV Diagnosis Market for Clinical Laboratories, By Region, 2015–2022 (USD Million)

Table 46 RSV Diagnosis Market for Home Care, By Region, 2015–2022 (USD Million)

Table 47 North America: RSV Diagnostics Market for Home Care, By Country, 2015–2022 (USD Million)

Table 48 Europe: RSV Diagnostics Market for Home Care, By Region, 2015–2022 (USD Million)

Table 49 Global Market, By Region, 2015–2022 (USD Million)

Table 50 North America: RSV Diagnostics Market, By Country, 2015–2022 (USD Million)

Table 51 North America: Respiratory Syncytial Virus Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 52 North America: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 53 North America: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 54 US: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 55 US: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 56 US: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 57 Canada: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 58 Canada: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 59 Canada: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 60 Europe: RSV Diagnostics Market, By Country, 2015–2022 (USD Million)

Table 61 Europe: Respiratory Syncytial Virus Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 62 Europe: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 63 Europe: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 64 Germany: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 65 Germany: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 66 Germany: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 67 UK: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 68 UK: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 69 UK: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 70 France: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 71 France: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 72 France: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 73 RoE: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 74 RoE: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 75 RoE: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 76 APAC: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 77 APAC: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 78 APAC: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 79 RoW: RSV Diagnostics Market, By Product, 2015–2022 (USD Million)

Table 80 RoW: Respiratory Syncytial Virus Diagnostics Market, By Method, 2015-2022 (USD Million)

Table 81 RoW: Respiratory Syncytial Virus Diagnostics Market, By End User, 2015–2022 (USD Million)

Table 82 Share of Companies in the RSV Diagnostics Market (2016)

Table 83 Product Approvals and Launches, 2014–2018

Table 84 Acquisitions, 2014–2018

Table 85 Agreements and Collaborations, 2014–2018

Table 86 Expansions, 2014–2018

List of Figures (31 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 RSV Diagnostics Market, By Product, 2017 vs 2022 (USD Billion)

Figure 6 Global Respiratory Syncytial Virus Diagnostics Market, By Method, 2017 vs 2022 (USD Billion)

Figure 7 Global Respiratory Syncytial Virus Diagnostics Market, By End User, 2017 vs 2022 (USD Billion)

Figure 8 RSV Diagnostics Market, By Region, 2017 vs 2022 (USD Billion)

Figure 9 Increasing Incidences of RSV Infection and Increasing Adoption of Molecular Diagnostics are Driving the Growth of the RSV Diagnostics Market

Figure 10 Molecular Diagnostics is Estimated to Command the Largest Market Share in 2017

Figure 11 Hospitals and Clinics to Grow at the Highest Rate During the Forecast Period

Figure 12 APAC to Register the Highest CAGR Between 2017 & 2022

Figure 13 RSV Diagnostics Market: Drivers, Restraints, Opportunities, and Threats

Figure 14 Kits and Assays Segment Will Continue to Dominate the Global Market in 2022

Figure 15 Molecular Diagnostics Segment Will Continue to Dominate the RSV Diagnostics Market in 2022

Figure 16 Hospitals and Clinics Segment Will Continue to Dominate the Global Market in 2022

Figure 17 APAC to Register the Highest Growth in the RSV Diagnostics Market During the Forecast Period

Figure 18 North America: RSV Diagnostics Market Snapshot

Figure 19 Europe: Market Snapshot

Figure 20 APAC: RSV Diagnostics Market Snapshot

Figure 21 RoW: Market Snapshot

Figure 22 Product Launches, the Most Adopted Growth Strategy From 2014 to 2018

Figure 23 Biomérieux: Company Snapshot (2016)

Figure 24 Becton, Dickinson and Company: Company Snapshot (2016)

Figure 25 Abbott: Company Snapshot

Figure 26 Roche: Company Snapshot (2016)

Figure 27 Danaher: Company Snapshot

Figure 28 Thermo Fisher Scientific: Company Snapshot

Figure 29 Biocartis: Company Snapshot (2016)

Figure 30 Luminex: Company Snapshot (2016)

Figure 31 Hologic: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RSV Diagnostics Market