Rotary Uninterruptible Power Supply (UPS) Market by Power Rating (up to 1000 kVA, 1001-2000 kVA, 2001-2500 kVA, and Above 2500 kVA), Type (Diesel, Hybrid), Application, and Region(APAC, North America, Europe, MEA, South America ) - Global Forecast to 2026

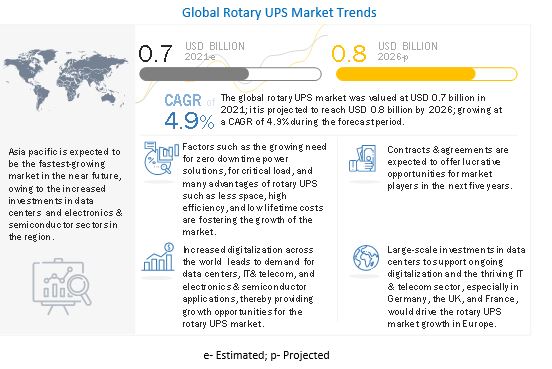

[169 Pages Report] The global rotary uninterruptible power supply (UPS) market is projected to reach USD 0.8 billion by 2026 from an estimated USD 0.7 billion in 2021, at a CAGR of 4.9% during the forecast period. The growing need for zero downtime power supply solutions for critical power applications is the major driver of the rotary or rotary UPS market. The advantages of rotary UPS such as high efficiency, fewer space requirements, and low lifetime costs are expected to further drive the demand. Increasing data center investments are expected to be the single biggest contributing factor to the growth of rotary UPS market during forecast period.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global Rotary UPS Market

The most significant near-term impacts on rotary UPS that are already contracted or under manufacturing process may be felt through supply chains. Industry executives are anticipating delivery and construction slowdowns, either because of the closure of industries to reduce the spread of coronavirus or because the workers start getting sick. Many components/parts for manufacturing rotary UPS come from Europe, China, Asia Pacific, and the US. Manufacturing disruptions in China and the US could contribute to a significant short-term decline in the rotary UPS market.

Moreover, due to the COVID-19 outbreak, the value of the local currencies of many countries have depreciated. There is a misalignment of supply and demand, which leads to financial losses to the metal manufactures, also the key components used in manufacturing rotary UPS are typically procured in US dollars, which could result in increased component costs.

Rotary UPS Market Dynamics

Driver: Growing need for zero downtime power supply solutions for critical applications

Before the onset of COVID-19, there was a strong global momentum in demand for manufactured products, which had strengthened the manufacturing sector. According to NAM, world trade has more than doubled from USD 4.8 trillion in 2000 to USD 12.2 trillion in 2017. However, all demand and sales estimates are being revised to factor in the disruption due to COVID-19. Many countries such as China and New Zealand have resumed their manufacturing operations. The ramp-up of production and the rise in manufacturing demand in the medium to long term will, in turn, generate demand for continuous and reliable power supply, as the loss of consistent power supply would result in plant downtime and hence, heavy losses. In case of power failure or loss of primary power supply, there must be an assured and reliable power supply. When primary power goes down, UPS ensures continuity and reliability so that ongoing work can be saved and hardware can be protected. This need for zero downtime power supply solutions is expected to drive the demand for rotary UPS.

Restraints: Declining battery costs and Improved battery energy density

Rotary UPS is an alternative to the battery-based static UPS system. One of the major disadvantages of static UPS at present is the cost and space requirements of the batteries used in them. The three main types of batteries used in UPS are valve-regulated lead-acid (VRLA) batteries, vented lead-acid (VLA) batteries, and maintenance lithium-ion batteries. To support large power-rated UPS, a large number of batteries are connected in parallel. These battery banks require a large number of batteries and due to their short lifetime, they need to be replaced every five years. These factors add to the total lifetime cost of the static UPS. In the recent years due to ongoing research and development in battery technologies for utility-scale energy storage, electric vehicles, and unmanned aerial vehicles, the cost of batteries is rapidly declining. At the same time, the battery energy density is increasing. Battery energy density is the ratio of the energy that can be stored to the total weight of the battery. With high energy density, the batteries become compact and take less physical space.

Opportunities: Growing digitalization fueled by recent Covid-19 crisis

Due to the ongoing COVID-19 pandemic, the entire global economy has witnessed a major shift in trends. Several companies across the world have opted for remote work due to social distancing and isolation requirements. Video conferencing has replaced the need for physical travel. Students, white-collar workers, and knowledge workers are increasingly relying on the new digital workplace infrastructure. The sudden surge in the use of this digital infrastructure has created the need for large-scale investments, especially in the IT & telecommunications and datacenter sectors. Despite the slowdown of the economy and the decline in global investment flow, the investments in the above-mentioned sectors are expected to present opportunities for rotary UPS market growth. With the growing investments in data centers, IT infrastructure, and telecommunication projects, rotary UPS manufacturers can take advantage of these opportunities.

Challenges: Rotary UPS supply chain disruptions due to COVID-19

The COVID-19 pandemic has posed business continuity challenges among various verticals, including construction and real estate, IT, healthcare, and manufacturing, owing to global lockdowns. Rotary UPS is a combination of many key components, a few of which are manufactured or procured separately. Due to this, any disruption in the supply chain can lead to long lead times and thereby loss of revenues. It has impacted supply chains such as import and export control as per regional government policy and future influence on the industries. It is negatively impacting the UPS market growth.

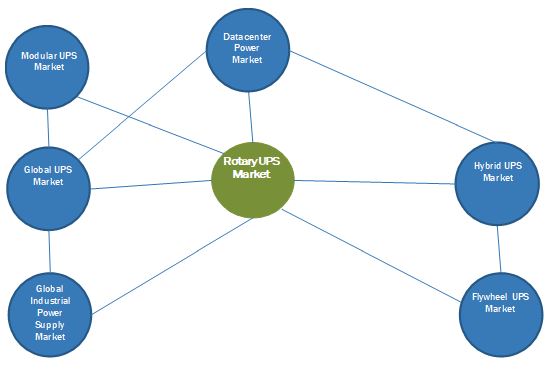

Market Interconnection

The diesel segment by type is expected to be the largest market during the forecast period

The rotary uninterruptible power supply (UPS) market, by type, is segmented into diesel, hybrid and others which include flywheel UP. The diesel segment is projected to hold the largest market share by 2026. Diesel-type rotary UPS are the oldest and most popular type of rotary UPS and offer several advantages including the elimination of the need for an additional backup power generator. These advantages are expected to drive the market.

The above 2500 kVA rotary UPS segment is expected to be the largest contributor to the rotary UPS market, by power rating, during the forecast period

The rotary uninterruptible power supply (UPS) market is segmented, by power rating, into Up to 1000 kVA, 1001–2000 kVA, 2001–2500 kVA, and Above 2500 kVA. The Above 2500 kVA segment is projected to hold the largest market share by 2026. Rotary UPS is cost-effective and beneficial at high power ratings. The increasing demand for rotary UPS of large power rating for large data center applications is expected to be the major driver for market growth in this segment.

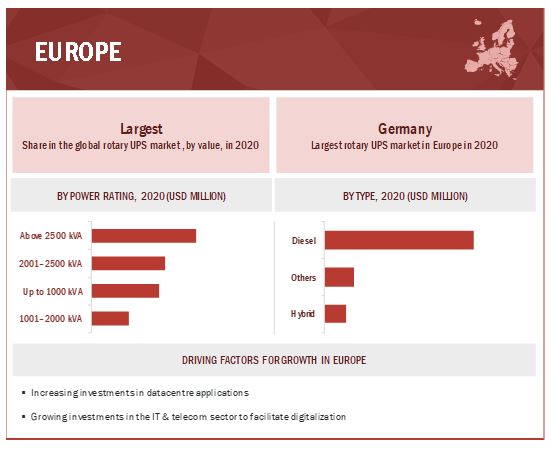

Europe is expected to be the fastest growing market during the forecast period

In this report, the rotary uninterruptible power supply (UPS) market has been analyzed with respect to five regions, namely, Asia Pacific, North America, Europe, Middle East & Africa, and South America. Europe is estimated to be the largest market during forecast period from 2021 to 2026. Germany, the UK, and France are among the top four destinations for data center investments in Europe. The growing investments in data centers are expected to be the major driver for the growth of the rotary UPS market. Thriving IT & telecom and pharmaceuticals sectors in Germany, and aerospace and pharmaceuticals sectors in France present the second biggest opportunity for the growth of rotary UPS in Europe.

Key Market Players

The key players profiled in this report are Piller Power System (Germany), Hitec Holdings (Netherlands), Rolls Royce Holdings (UK), Hitzinger (Austria), and IEM Power System (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Power Rating, Application and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, South America |

|

Companies covered |

Piller Power System (Germany), Hitec Holdings (Netherlands), Rolls Royce Holdings (UK), Hitzinger (Austria), IEM Power System (US), Power Systems & Control (US), ABB (Switzerland), Vycon (US), Thycon (Australia), Powerthru (US) and Ausonia (Italy) |

This research report categorizes the rotary uninterruptible power supply (UPS) market by type, power rating, application, and region.

The rotary UPS market, by type, has been segmented as follows:

- Diesel

- Hybrid

- Others

The rotary UPS market, by power rating, has been segmented as follows:

- Up to 1000 kVA

- 1001–2000 kVA

- 2001–2500 kVA

- Above 2500 kVA

The rotary UPS market, by application, has been segmented as follows:

- Aerospace & Defense

- Electronics & Semiconductors

- Manufacturing Industry

- IT & Telecommunications

- Data centers

- Healthcare & Pharmaceuticals

- Others

The rotary UPS market, by region, has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In March 2021, Piller France deployed a 3.2 MW kinetic energy storage-backed UPS installation in Algeria's Packaging Manufacturing company Maghreb Emballage. The company installed two new 60MJ flywheels at the factory near Oran.

- In September 2020, Hitec has secured an order to deliver the complete turnkey installation of high-voltage PowerPro 3600 units at an advanced pharmaceutical facility in the Netherlands

- In July 2020, Rolls Royce Holdings acquired Kinolt Sa, formerly known as Euro-Diesel, thus expanding the Rolls-Royce holdings product offerings to include rotary UPS. Kinolt was one of the largest specialist manufacturers of rotary UPS based out of Belgium. With this acquisition, Rolls-Royce expects to strengthen its critical power product offerings.

- In March 2019, the Dorflinger Group acquired the Linz-based Hitzinger company. With the change in ownership, the Dorflinger Group will take over the running of Hitzinger.

Frequently Asked Questions (FAQ):

What is the current size of the rotary UPS market?

The current market size of global rotary UPS market is estimated to be 0.7 billion in 2021.

What are the major drivers for rotary UPS market?

The growing need for zero downtime power supply solutions for critical power applications is the major driver of the rotary or rotary UPS market. The advantages of rotary UPS such as high efficiency, fewer space requirements, and low lifetime costs are expected to further drive the demand. Increasing digitalization due to the recent COVID-19 pandemic and large-scale investments in hyperscale data centers are expected to present new market opportunities for rotary UPS.

Which is the fastest growing region during the forecasted period in rotary UPS market?

Asia Pacific is the fastest growing region during the forecasted period in rotary UPS market.

Which is the largest segment, by power rating during the forecasted period in rotary UPS market?

The Above 2500 kVA segment is projected to hold the largest market share during the forecast period. Rotary UPS is cost-effective and beneficial at high power ratings.

Which is the largest segment, by application during the forecasted period in rotary UPS market?

The data center segment is projected to hold the largest market share during forecast period. Investments in large hyperscale data centers have increased significantly to meet the increasing data demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 ROTARY UPS MARKET: INCLUSIONS AND EXCLUSIONS

TABLE 1 ROTARY UPS MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

TABLE 2 ROTARY UPS MARKET, BY POWER RATING: INCLUSIONS AND EXCLUSIONS

TABLE 3 ROTARY UPS MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKETS COVERED

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 1 ROTARY UPS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.2.2.3 Rotary UPS market: Players/companies connected

2.3 SCOPE

2.4 IMPACT OF COVID-19 ON INDUSTRIES

2.5 MARKET SIZE ESTIMATION

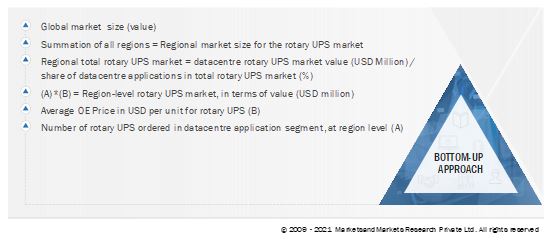

2.5.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.3 DEMAND-SIDE ANALYSIS

FIGURE 5 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR ROTARY UPS

2.5.3.1 Calculation for regional market size

2.5.3.2 Assumptions for demand-side analysis

2.5.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED WHILE ASSESSING SUPPLY OF ROTARY UPS

FIGURE 7 ROTARY UPS MARKET: SUPPLY-SIDE ANALYSIS

2.5.4.1 Calculations for supply-side analysis

2.5.4.2 Assumptions while calculating supply-side market size

2.5.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 34)

TABLE 4 ROTARY UPS MARKET SNAPSHOT

FIGURE 8 DIESEL SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF ROTARY UPS MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 9 ABOVE 2500 KVA SEGMENT, BY POWER RATING, TO DOMINATE ROTARY UPS MARKET BY 2026

FIGURE 10 DATA CENTER TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF ROTARY UPS MARKET, BY APPLICATION, THROUGHOUT FORECAST PERIOD

FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ROTARY UPS MARKET DURING 2021–2026

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN ROTARY UPS MARKET

FIGURE 12 INCREASING INVESTMENTS IN DATA CENTERS AND THRIVING IT & TELECOMMUNICATIONS SECTOR EXPECTED TO DRIVE ROTARY UPS MARKET GROWTH DURING 2021–2026

4.2 ROTARY UPS MARKET, BY REGION

FIGURE 13 ROTARY UPS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ROTARY UPS MARKET, BY TYPE

FIGURE 14 DIESEL SEGMENT HELD LARGEST SHARE OF ROTARY UPS MARKET IN 2020

4.4 ROTARY UPS MARKET, BY POWER RATING

FIGURE 15 ABOVE 2500 KVA SEGMENT HELD LARGEST SHARE OF ROTARY UPS MARKET IN 2020

4.5 ROTARY UPS MARKET, BY APPLICATION

FIGURE 16 DATA CENTER HELD LARGEST SHARE OF ROTARY UPS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 17 COVID-19 GLOBAL PROPAGATION

FIGURE 18 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 GLOBAL ROAD TO RECOVERY FROM COVID-19

FIGURE 19 GLOBAL RECOVERY ROAD FROM COVID-19 FROM 2020 TO 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 21 ROTARY UPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

FIGURE 22 GLOBAL ELECTRICITY DEMAND, BY SECTOR, 2018–2040 (THOUSAND TWH)

5.5.1.2 High efficiency, fewer space requirements, and low lifetime costs of rotary UPS

5.5.2 RESTRAINTS

5.5.2.1 Declining battery costs and improved battery energy density

FIGURE 23 LI-ION BATTERY VOLUME WEIGHTED AVERAGE PRICE, 2013–2030 (2020 REAL USD/KWH)

5.5.2.2 Increasing restrictions on use of diesel and fossil fuels in rotary UPS

5.5.3 OPPORTUNITIES

5.5.3.1 Growing digitalization fueled by recent COVID-19 crisis

5.5.3.2 Rising investments in hyperscale data centers by colocation and cloud service providers

5.5.4 CHALLENGES

5.5.4.1 Rotary UPS supply chain disruptions due to COVID-19

5.6 YC-SHIFT

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS

FIGURE 24 REVENUE SHIFT FOR ROTARY UPS

5.7 MARKET MAP

FIGURE 25 MARKET MAP FOR ROTARY UPS

5.8 AVERAGE SELLING PRICE TREND

FIGURE 26 AVERAGE SELLING PRICE OF DIESEL ROTARY UPS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 27 ROTARY UPS SUPPLY CHAIN ANALYSIS

5.9.1 RAW MATERIAL SUPPLIERS

5.9.2 MANUFACTURERS

5.9.3 SYSTEM INTEGRATORS AND DISTRIBUTORS

5.9.4 END USERS

TABLE 5 ROTARY UPS MARKET: SUPPLY CHAIN

5.10 TECHNOLOGY ANALYSIS

FIGURE 28 DIESEL ROTARY UPS LINE DIAGRAM

5.11 ROTARY UPS MARKET: TARIFFS AND REGULATIONS

5.12 CASE STUDY ANALYSIS

5.12.1 USE OF ROTARY UPS BY TOULOUSE-BLAGNAC AIRPORT IN FRANCE FOR CRITICAL POWER SOLUTIONS, FEBRUARY 2021

5.12.1.1 Problem statement

5.12.1.2 Solution

5.12.2 USE OF ROTARY UPS FOR BBC’S NEW HEADQUARTERS IN WALES FOR CRITICAL LOADS, OCTOBER 2020

5.12.2.1 Problem statement

5.12.2.2 Solution

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 ROTARY UPS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF SUBSTITUTES

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF NEW ENTRANTS

5.13.5 DEGREE OF COMPETITION

5.14 ALTERNATIVE FUELS FOR DATA CENTER GENERATORS

5.15 UPS CUSTOMER LIST BY INDUSTRY

5.16 COMPANY REGIONAL SALES DATA

6 ROTARY UPS MARKET, BY TYPE (Page No. - 61)

6.1 INTRODUCTION

FIGURE 30 DIESEL TYPE ACCOUNTED FOR LARGEST SHARE OF ROTARY UPS MARKET, IN TERMS OF VALUE, IN 2020

TABLE 7 ROTARY UPS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 8 ROTARY UPS MARKET, BY TYPE, 2019–2026 (UNITS)

6.2 DIESEL

6.2.1 OLDEST AND MOST POPULAR TYPE OF ROTARY UPS

TABLE 9 DIESEL: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 HYBRID

6.3.1 OFFERS BEST OF BOTH AS IT HAS COMBINATION OF STATIC AND ROTARY UPS COMPONENTS

TABLE 10 HYBRID: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 OTHERS

TABLE 11 OTHERS; ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 ROTARY UPS MARKET, BY POWER RATING (Page No. - 66)

7.1 INTRODUCTION

FIGURE 31 ABOVE 2500 KVA SEGMENT ACCOUNTED FOR LARGEST SHARE OF ROTARY UPS MARKET, IN TERMS OF VALUE, IN 2020

TABLE 12 ROTARY UPS MARKET, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 13 ROTARY UPS MARKET, BY POWER RATING, 2019–2026 (UNITS)

7.2 UP TO 1000 KVA

7.2.1 INCREASED DEMAND FOR RELIABLE BACKUP SOLUTIONS IN MANUFACTURING AND SMALL-SCALE APPLICATIONS TO FUEL DEMAND FOR ROTARY UPS

TABLE 14 UP TO 1000 KVA ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 1001–2000 KVA

7.3.1 DEMAND FROM EUROPE AND ASIA PACIFIC TO DRIVE MARKET FOR ROTARY UPS IN THIS SEGMENT

TABLE 15 1001 –2000 KVA ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 2001–2500 KVA

7.4.1 ADVANTAGES SUCH AS MODULARITY AND SPACE ARE MAJOR DRIVERS FOR MARKET GROWTH

TABLE 16 2001 –2500 KVA ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.5 ABOVE 2500 KVA

7.5.1 INCREASING DEMAND FOR ROTARY UPS IN DATA CENTER APPLICATIONS TO DRIVE MARKET IN THIS SEGMENT

TABLE 17 ABOVE 2500 KVA ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8 ROTARY UPS MARKET, BY APPLICATION (Page No. - 72)

8.1 INTRODUCTION

FIGURE 32 DATA CENTER ACCOUNTED FOR LARGEST SHARE OF ROTARY UPS MARKET, IN TERMS OF VALUE, IN 2020

TABLE 18 ROTARY UPS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 19 ROTARY UPS MARKET, BY APPLICATION, 2019–2026 (UNITS)

8.2 AEROSPACE & DEFENSE

8.2.1 RUGGEDNESS AND ROTARY UPS’ ABILITY TO OPERATE IN DIVERSE ENVIRONMENTAL CONDITIONS MAKE IT ATTRACTIVE SOLUTION

TABLE 20 AEROSPACE & DEFENSE: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 ELECTRONICS & SEMICONDUCTORS

8.3.1 GROWING DEMAND FOR CONSUMER ELECTRONICS IS DRIVING INVESTMENTS IN ELECTRONICS & SEMICONDUCTOR SECTOR

TABLE 21 ELECTRONICS & SEMICONDUCTORS: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 MANUFACTURING INDUSTRIES

8.4.1 NEED FOR CONTINUOUS RELIABLE POWER TO AVOID PRODUCTION LOSS IS SINGLE BIGGEST DRIVER FOR ROTARY UPS MARKET

TABLE 22 MANUFACTURING INDUSTRIES: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.5 IT & TELECOMMUNICATIONS

8.5.1 INVESTMENTS IN 5G AND INCREASED DIGITALIZATION ARE EXPECTED TO BE MAJOR DRIVERS FOR ROTARY UPS MARKET IN THIS SEGMENT

TABLE 23 IT & TELECOMMUNICATIONS: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.6 DATA CENTER

8.6.1 INCREASING INVESTMENTS IN LARGE HYPERSCALE DATA CENTERS DRIVE ROTARY UPS MARKET FOR THIS SEGMENT

TABLE 24 DATACENTER: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.7 HEALTHCARE & PHARMACEUTICALS

8.7.1 ONGOING INVESTMENTS IN HEALTHCARE INFRASTRUCTURE AND PHARMACEUTICAL MANUFACTURING ARE EXPECTED TO BOOST MARKET GROWTH

TABLE 25 HEALTHCARE & PHARMACEUTICALS: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHERS

TABLE 26 OTHERS: ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

9 ROTARY UPS MARKET, GEOGRAPHIC ANALYSIS (Page No. - 82)

9.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 ROTARY UPS MARKET SHARE (VALUE), BY REGION, 2020

TABLE 27 ROTARY UPS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 ROTARY UPS MARKET, BY REGION, 2019–2026 (UNITS)

9.2 EUROPE

FIGURE 35 SNAPSHOT: ROTARY UPS MARKET IN EUROPE

TABLE 29 ROTARY UPS MARKET IN EUROPE, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 30 ROTARY UPS MARKET IN EUROPE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 31 ROTARY UPS MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 ROTARY UPS MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.1 UK

9.2.1.1 Growing datacenter investments to drive market growth

TABLE 33 ROTARY UPS MARKET IN UK, BY TYPE, 2019–2026 (USD MILLION)

TABLE 34 ROTARY UPS MARKET IN UK, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.2 GERMANY

9.2.2.1 Rising datacenter investments and thriving IT & telecom sector as well as pharmaceutical sectors to boost market growth

TABLE 35 ROTARY UPS MARKET IN GERMANY, BY TYPE, 2019–2026 (USD MILLION)

TABLE 36 ROTARY UPS MARKET IN GERMANY, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3 RUSSIA

9.2.3.1 Growing investments in data centers to accelerate market growth

TABLE 37 ROTARY UPS MARKET IN RUSSIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 ROTARY UPS MARKET IN RUSSIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4 FRANCE

9.2.4.1 Demand for rotary UPS in data center, aerospace, and pharmaceutical applications to drive market

TABLE 39 ROTARY UPS MARKET IN FRANCE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 40 ROTARY UPS MARKET IN FRANCE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.5 REST OF EUROPE

TABLE 41 ROTARY UPS MARKET IN REST OF EUROPE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 42 ROTARY UPS MARKET IN REST OF EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 36 SNAPSHOT: ROTARY UPS MARKET IN ASIA PACIFIC

TABLE 43 ROTARY UPS MARKET IN ASIA PACIFIC, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 44 ROTARY UPS MARKET IN ASIA PACIFIC, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 ROTARY UPS MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 46 ROTARY UPS MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.1 CHINA

9.3.1.1 Planned investments in data centers and thriving electronics & semiconductors sector to support market growth

TABLE 47 ROTARY UPS MARKET IN CHINA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 ROTARY UPS MARKET IN CHINA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.2 AUSTRALIA

9.3.2.1 Data center investments to drive rotary UPS market

TABLE 49 ROTARY UPS MARKET IN AUSTRALIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 50 ROTARY UPS MARKET IN AUSTRALIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 JAPAN

9.3.3.1 Japan’s manufacturing sector along with data center demand to boost adoption of rotary UPS

TABLE 51 ROTARY UPS MARKET IN JAPAN, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 ROTARY UPS MARKET IN JAPAN, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4 INDIA

9.3.4.1 Increasing investments in data centers to surge demand for rotary UPS

TABLE 53 ROTARY UPS MARKET IN INDIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 54 ROTARY UPS MARKET IN INDIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.5 SOUTH KOREA

9.3.5.1 Thriving electronics & semiconductors sector to drive market

TABLE 55 ROTARY UPS MARKET IN SOUTH KOREA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 ROTARY UPS MARKET IN SOUTH KOREA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.6 MALAYSIA

9.3.6.1 Thriving electronics & semiconductor sector to boost market growth

TABLE 57 ROTARY UPS MARKET IN MALAYSIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 ROTARY UPS MARKET IN MALAYSIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.7 SINGAPORE

9.3.7.1 Rotary UPS for electronics & semiconductor and datacenter applications to drive market

TABLE 59 ROTARY UPS MARKET IN SINGAPORE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 ROTARY UPS MARKET IN SINGAPORE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.8 REST OF ASIA PACIFIC

TABLE 61 ROTARY UPS MARKET IN REST OF ASIA PACIFIC, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 ROTARY UPS MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

9.4 NORTH AMERICA

TABLE 63 ROTARY UPS MARKET IN NORTH AMERICA, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 64 ROTARY UPS MARKET IN NORTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 ROTARY UPS MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 66 ROTARY UPS MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.1 US

9.4.1.1 Increased military spending and sustained investments in data centers to accelerate demand for rotary UPS

TABLE 67 ROTARY UPS MARKET IN US, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 ROTARY UPS MARKET IN US, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.2 CANADA

9.4.2.1 Government as well as private investments in IT & telecom infrastructure along with data centers to drive market

TABLE 69 ROTARY UPS MARKET IN CANADA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 ROTARY UPS MARKET IN CANADA, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Planned large-scale investments in IT & telecom as well as data centers to boost market growth

TABLE 71 ROTARY UPS MARKET IN MEXICO, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 ROTARY UPS MARKET IN MEXICO, BY APPLICATION, 2019–2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 73 ROTARY UPS MARKET IN MIDDLE EAST & AFRICA, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 74 ROTARY UPS MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 ROTARY UPS MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 MIDDLE EAST & AFRICA: ROTARY UPS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Large-scale investments in manufacturing sector and data centers to drive market for rotary UPS

TABLE 77 ROTARY UPS MARKET IN SAUDI ARABIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 ROTARY UPS MARKET IN SAUDI ARABIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.2 UAE

9.5.2.1 Planned investments in IT & telecom to boost market growth

TABLE 79 ROTARY UPS MARKET THE UAE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 ROTARY UPS MARKET IN THE UAE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3 SOUTH AFRICA

9.5.3.1 Rotary UPS find applications in data centers and manufacturing industries

TABLE 81 ROTARY UPS MARKET IN SOUTH AFRICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 ROTARY UPS MARKET IN SOUTH AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4 NIGERIA

9.5.4.1 Rotary UPS finds application in data centers and manufacturing industries

TABLE 83 ROTARY UPS MARKET IN NIGERIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 ROTARY UPS MARKET IN NIGERIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.5 ALGERIA

9.5.5.1 Investments in country’s manufacturing industries are expected to propel market growth

TABLE 85 ROTARY UPS MARKET IN ALGERIA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 ROTARY UPS MARKET IN ALGERIA, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 87 ROTARY UPS MARKET IN REST OF MIDDLE EAST & AFRICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 ROTARY UPS MARKET IN REST OF MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 89 ROTARY UPS MARKET IN SOUTH AMERICA, BY POWER RATING, 2019–2026 (USD MILLION)

TABLE 90 ROTARY UPS MARKET IN SOUTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 ROTARY UPS MARKET IN SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 92 ROTARY UPS MARKET IN SOUTH AMERICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Increased investments in data centers to drive market

TABLE 93 ROTARY UPS MARKET IN BRAZIL, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 ROTARY UPS MARKET IN BRAZIL, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Large-scale power outages and increased naval budget to accelerate market growth

TABLE 95 ROTARY UPS MARKET IN ARGENTINA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 ROTARY UPS MARKET IN ARGENTINA, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 97 ROTARY UPS MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 ROTARY UPS MARKET IN REST OF SOUTH AMERICA, BY APPLICATION, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 126)

10.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN ROTARY UPS MARKET DURING 2018–2020

10.2 MARKET SHARE ANALYSIS

TABLE 99 ROTARY UPS MARKET: DEGREE OF COMPETITION

FIGURE 38 LEADING PLAYERS IN ROTARY UPS MARKET

10.3 MARKET EVALUATION FRAMEWORK

TABLE 100 MARKET EVALUATION FRAMEWORK

10.4 COMPETITIVE SCENARIO

TABLE 101 ROTARY UPS MARKET: PRODUCT LAUNCHES, JANUARY 2018–FEBRUARY 2021

TABLE 102 ROTARY UPS MARKET: DEALS, JANUARY 2018–FEBRUARY 2021

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 39 COMPETITIVE LEADERSHIP MAPPING: ROTARY UPS MARKET, 2020

10.5.5 PRODUCT FOOTPRINT

TABLE 103 COMPANY PRODUCT FOOTPRINT

TABLE 104 COMPANY APPLICATION FOOTPRINT

TABLE 105 COMPANY PRODUCT RATING FOOTPRINT

TABLE 106 COMPANY REGION FOOTPRINT

11 COMPANY PROFILES (Page No. - 139)

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

11.1 KEY PLAYERS

11.1.1 PILLER POWER SYSTEMS

TABLE 107 PILLER POWER SYSTEMS: BUSINESS OVERVIEW

FIGURE 40 PILLER POWER SYSTEMS: COMPANY SNAPSHOT

TABLE 108 PILLER POWER SYSTEMS: PRODUCTS OFFERED

11.1.2 HITEC HOLDING

TABLE 109 HITEC HOLDING: BUSINESS OVERVIEW

TABLE 110 HITEC HOLDING: PRODUCTS OFFERED

11.1.3 ROLLS-ROYCE HOLDINGS

TABLE 111 ROLLS-ROYCE HOLDINGS: BUSINESS OVERVIEW

FIGURE 41 ROLLS-ROYCE HOLDINGS: COMPANY SNAPSHOT

TABLE 112 ROLLS-ROYCE HOLDINGS: PRODUCTS OFFERED

11.1.4 HITZINGER

TABLE 113 HITZINGER: BUSINESS OVERVIEW

TABLE 114 HITZINGER: PRODUCTS OFFERED

11.1.5 IEM POWER SYSTEMS

TABLE 115 IEM POWER SYSTEMS: BUSINESS OVERVIEW

TABLE 116 IEM POWER SYSTEMS: PRODUCTS OFFERED

11.1.6 POWER SYSTEMS & CONTROL

TABLE 117 POWER SYSTEMS & CONTROL: BUSINESS OVERVIEW

TABLE 118 POWER SYSTEMS & CONTROL: PRODUCTS OFFERED

11.1.7 ABB

TABLE 119 ABB: BUSINESS OVERVIEW

FIGURE 42 ABB: COMPANY SNAPSHOT

TABLE 120 ABB: PRODUCTS OFFERED

11.1.8 VYCON

TABLE 121 VYCON: BUSINESS OVERVIEW

TABLE 122 VYCON: PRODUCTS OFFERED

11.1.9 THYCON

TABLE 123 THYCON: BUSINESS OVERVIEW

TABLE 124 THYCON: PRODUCTS OFFERED

11.1.10 POWERTHRU

TABLE 125 POWERTHRU: BUSINESS OVERVIEW

TABLE 126 POWERTHRU: PRODUCTS OFFERED

11.1.11 AUSONIA

TABLE 127 AUSONIA: BUSINESS OVERVIEW

TABLE 128 AUSONIA: PRODUCTS OFFERED

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 162)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the rotary uninterruptible power supply (UPS) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global rotary uninterruptible power supply (UPS) market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

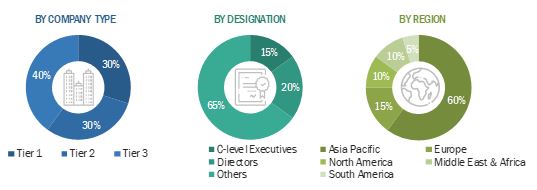

The rotary uninterruptible power supply (UPS) market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. This market's demand-side is characterized by its end-users, such as aerospace & defense, electronics & semiconductors, manufacturing industry, IT & telecommunications, data center, healthcare & pharmaceuticals among others. The supply-side is characterized by rotary UPS manufacturers and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global rotary uninterruptible power supply (UPS) market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The industry and market's key players have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Rotary UPS Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define and describe the global rotary uninterruptible power supply (UPS) market by type, power rating, application, and region.

- To provide detailed information about the major factors influencing the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze the global rotary uninterruptible power supply (UPS) market with respect to individual growth trends, future expansions, and each segment's contribution to the market.

- The impact of the COVID-19 pandemic on the rotary uninterruptible power supply (UPS) market has been analyzed to estimate the market size.

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders.

- To forecast the growth of the global rotary uninterruptible power supply (UPS) market with respect to the main regions (Asia Pacific, North America, Europe, Middle East & Africa, and South America).

- To profile and rank key players and comprehensively analyze their market share.

- To analyze competitive developments such as contracts & agreements, product launches, and mergers & acquisitions in the rotary uninterruptible power supply (UPS) market.

Rotary UPS & Its impact on Rotary Uninterruptible Power Supply (UPS) Market

A Rotary UPS (Uninterruptible Power Supply (UPS) system is one that uses a rotary device, such as a flywheel, to provide backup power in the event of a power outage. Rotary UPS systems are extremely reliable and have several advantages over other types of UPS systems, including lower maintenance, a longer lifespan, and higher efficiency. The market for these types of UPS systems, including rotary and other types of UPS technologies, is referred to as the Rotary Uninterruptible Power Supply (UPS) market. The market for rotary UPS systems is a subset of the larger UPS market, and it is being driven by factors such as rising demand for uninterrupted power supply, rising cloud computing adoption, and increased use of data centres.

In other words, Rotary UPS is a technology that is used in specific types of UPS systems, and the market for Rotary UPS systems is a subset of the larger UPS market. The growing demand for reliable power supply solutions for critical applications such as data centres, medical facilities, and other industries that require uninterrupted power supply is driving the growth of the Rotary UPS market.

Rotary UPS can have a significant impact on the Rotary Uninterruptible Power Supply (UPS) Market in several ways. Here are a few examples:

- Improved Efficiency: Rotary UPS systems are highly efficient and have low operating costs compared to other types of UPS systems.

- Reduced Maintenance Costs: Rotary UPS systems have a longer lifespan than other types of UPS systems and require less maintenance, leading to reduced maintenance costs over time.

- Increased Reliability: Rotary UPS systems are highly reliable and can provide uninterrupted power for longer durations compared to other types of UPS systems.

- Growing Demand: As the demand for uninterrupted power supply continues to grow across various industries, the market for Rotary UPS systems is expected to expand rapidly.

The top players in the Rotary UPS market are Schneider Electric SE, Mitsubishi Electric Corporation, Toshiba Corporation, Hitec Power Protection BV, ABB Ltd, General Electric Company, Socomec Group SA, Falcon Electric, Inc., Active Power, Inc., Power Innovations International, Inc.

Some of the key industries that are going to get impacted because of the growth of Rotary UPS are,

1. Data Centres: The demand for Rotary UPS systems is growing in the data center industry, where uninterrupted power supply is critical for maintaining data security and reducing the risk of downtime.

2. Healthcare: The adoption of Rotary UPS systems can help reduce the risk of power outages and improve patient care.

3. Manufacturing: The use of Rotary UPS systems in manufacturing can help reduce downtime, improve productivity, and lower maintenance costs.

4. Telecommunications: Rotary UPS systems can help reduce the risk of downtime and improve the reliability of telecommunications networks.

Speak to our Analyst today to know more about Rotary UPS Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rotary Uninterruptible Power Supply (UPS) Market