Rail Infrastructure Market by Infrastructure (Rail Network, New Track Investment and Maintenance Investment), by Type (Locomotive, Rapid Transit Vehicle and Railcar) and Region (Europe, Asia-Pacific, North America and RoW) - Global Forecast 2020

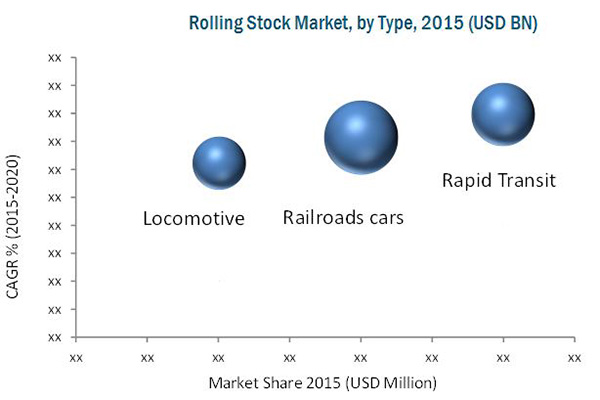

[101 Pages Report] The global rail infrastructure market is projected to grow at a CAGR of 3.59% from 2015 to 2020. The rolling stock market is estimated to be USD 45.73 Billion in 2015 and projected to reach USD 54.55 Billion by 2020. In this study, 2014 has been considered as the base year and 2015 to 2020 as the forecast years for estimating the size of the rolling stock market. The study segments the global rail infrastructure market based on type, infrastructure investments on rolling stock, infrastructure maintenance investments and investments on development of new rail tracks.

The market has been classified by type; Locomotive, Rapid Transit, and Railroad Cars. Locomotives are traditionally used to haul freight and passenger wagons for long distance main line transport. However, vehicles such as metros, light rail vehicles, and subways are being used for intra-city as well as intercity transportation. In the diesel and electric locomotive market, the Asia-Pacific is estimated to lead the market, in terms of value, in 2015. The North America region is estimated to be the second-largest market for diesel and electric locomotives, following the increasing urbanization and need of rapid transportation

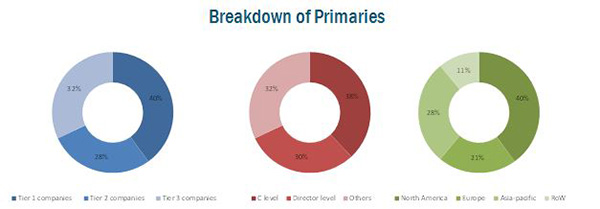

The research methodology used in the report involves various secondary sources including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the trends of investments in rolling stock market. The bottom-up approach has been used to estimate and validate the size of the global market. The market size, by volume, is derived by identifying the country-wise production volumes and analyzing the demand trends. The market size, by value, is derived by multiplying the average selling price of the rolling stock market by the number of units. Figure below shows the break-up of profile of industry experts, who participated in primary discussions

To know about the assumptions considered for the study, download the pdf brochure

The global rail infrastructure market ecosystem consists of manufacturers including CSR Corp. (China) Bombardier Transportation (Canada), and Alstom (France), Research Institutes such as the Railway Technical Research Institute of India, CNR Sifang Rolling Stock Research Institute China, and Qingdao Sifang Rolling Stock Research Institute Co., Ltd, and JSC Railway Research Institute (VNIIZHT) among others.

Target Audience

- Manufacturers of rolling stock & rolling stock components

- Raw material suppliers

- Transport authorities

- Government, Legal and regulatory authorities

- Fleet operators

- Architects, Construction & Mining Companies

- Financial Institutions

- Electricity boards

- Fuel Supplier

- Railway Infrastructure and track maintenance bodies

- Railway Engineered Products And Services

Scope of the Report

- Rail infrastructureanalysis

- Analysis of rail track network and investment on new rail track , by region

- Investments scenario for refurbishment of rolling stock

- Rolling stock technological overview

-

Rolling stock market, by product (railroad, rapid transit, locomotive)

- Railroad (passenger coaches, freight wagons)

- Rapid transit(diesel multiple unit ,light rail/tram, electric multiple unit )

- Locomotive(diesel locomotive, electric locomotive)

Available Customizations

MarketsandMarkets also offers the following customizations for this market:

- EMU, By type

- Import export data

- Detailed analysis and profiling of additional market players (up to 3).

Please click here to get the similar type of report Rolling Stock Market by Type (Locomotives, Rapid Transit Vehicles, Wagons), Locomotive Technology (Conventional Locomotive, Turbocharged and MAGLEVs), Application (Passenger Coach and Freight wagons), & by Region - Trend and Forecast to 2021

The global rail infrastructure market size is estimated to be at USD 45.73 Billion in 2015, which is projected to grow to USD 54.55 Billion by 2020, at a CAGR of 3.59%. Rail transportation offers an ideal, safe comfortable and environment friendly mobility solution for urban and interurban transportation systems. Increasing urbanization in emerging nations has strained the existing road, rail, and air infrastructure. This has also resulted in the development of infrastructure for connectivity of metros to the suburbs. Population growth in these regions is further driving the demand for rolling stock and supporting infrastructure such as maintenance and services. Urbanization is estimated to drive the demand for intra-city mobility solutions.

The report also segments the global rail infrastructure market by type (Railroad cars, Rapid transit and Locomotives). Locomotives are traditionally used to haul freight and passenger wagons for long distance main line transport. However, vehicles such as metros, light rail vehicles, and subways are being used for intra-city as well as intercity transportation. The growth in this market is attributed to factors such as increasing population on a global level, coupled with urbanization, increasing need for cleaner and faster modes of transportation, and economic growth is driving this market. However, reliance on government projects, insufficient infrastructure, and competition of faster modes of travel such as airways can hinder the growth of the rolling stock market

Asia-Pacific is the largest market for rolling stock, followed by North America and Europe. Growth in this market is fuelled by the increase in urbanization, high growth rate of urban population, and railway privatization in countries like China and Japan

The global rail infrastructure market report gives a detailed study regarding railway track networks by region as well as investment on development of new railway track network by country. The Asia-Pacific has the highest potential in terms of infrastructure investment for new rail track development. This growth is propelled by rise in need of transportation in urban regions and increasing production of automobiles, which has resulted in traffic congestion. This in turn has boosted the rolling stock market

The global rail infrastructure market report also gives detailed analysis on the investment scenario in the rolling stock infrastructure market across globe. This report also analyses the investment on maintenance cost of the rolling stock infrastructure.

The global rail infrastructure market is highly capital-intensive and require a high degree of support from the government. There is a growing demand for public transport in metropolitan regions. Government bodies are expected to invest heavily in developing support infrastructure and improving existing infrastructure to accommodate this demand.

However, if the capital requirement for a particular project is too high, it could discourage investments and act as a restraint. The return on investment (ROI) period is also long and may hinder the growth of capital-intensive projects or technologies.

The CSR Corporation has a strong presence and manufacturing capabilities in its domestic market, which will help it in product development and revenue generation owing to infrastructure development in China. The merger with CNR Corp. will further enhance these capabilities. It will also ensure that domestic competition will not act as a hindrance to overseas supply orders. The company is attempting to expand in overseas markets which are witnessing an increase in investments for infrastructural development.

Bombardier Transportation has a wide product portfolio that is able to meet both, intercity and intracity transportation needs. This helps the company to supply application-specific transit solutions for cities based on existing infrastructure. The rising demand for passenger rail in emerging nations and additional services in developed nations will also present new opportunities for the Germany-based company. The company has secured supply contracts for its products which will help to maintain a balanced revenue stream; however, the changing economic scenario in Europe may affect future orders, as the majority of the company’s revenue is derived from this region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency and Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Increase in Urban Sprawl Drive the Rail Network

2.4.2.2 High-Speed Rail Links in Major Countries

2.4.2.3 Increasing Trade With Neighboring Countries Boosts Cross Border Rail Networks

2.4.3 Supply Side Analysis

2.4.3.1 Technological Advancements

2.4.3.2 Globalization to Lead International Cooperation in Manufacturing

2.5 Market Size Estimation

2.6 Market Size Estimation

3 Technological Overview (Page No. - 24)

3.1 Introduction

3.1.1 Magnetic Levitation Trains (Maglev)

3.1.1.1 Advantages of Maglev System Trains

3.1.1.2 Comparison of HSR(High Speed Railway) and Maglev Systems

3.1.1.3 Ecological Impact of Maglev.

3.1.1.4 Types of Maglev

3.1.1.4.1 Electromagnetic Suspension (EMS)

3.1.1.4.2 Electrodynamic Suspension (EDS)

3.1.1.4.3 Inductrack

3.2 Safety Related Technology

3.2.1 Navigation

3.2.2 Collusion Avoidance System

3.2.3 Fire Protection

3.2.4 Conventional Locomotives

3.2.5 Turbocharged Locomotives

4 Infrastructure Analysis (Page No. - 29)

4.1 Analysis of Global Rail Track Network

4.1.1 Rail Network, By Region

4.1.2 Investments on New Rail Track, By Region

4.2 R0lling Stock Infrastructure Investments, By Region

4.3 R0lling Stock Infrastructure Maintenance, By Region

4.4 R0lling Stock Refurbishment

4.4.1 Refurbishment Programmes, By Region

5 Rolling Stock Market, By Type (Page No. - 39)

5.1 Introduction

5.2 Locomotive Market, By Motive Power

5.2.1 Diesel Locomotive

5.2.2 Electric Locomotive

5.3 Rapid Transit Market, By Type

5.3.1 Diesel Multiple Unit (DMU)

5.3.2 Electric Multiple Unit (EMU)

5.3.3 Light Rail/Tram

5.3.4 Metro/Subway

5.4 Railroad Cars Market, By Type

5.4.1 Passenger Coach

5.4.2 Freight Wagon

6 Competitive Landscape (Page No. - 55)

6.1 Overview

6.2 Company Ranking: Rolling Stocks and Infrastructure Market

6.3 Battle for Market Share: Supply Contracts Were the Key Strategy

6.4 Supply Contracts and Agreements

6.5 New Product Launches

6.6 Joint Venture/Acquisition/ Partnership

6.7 Expansion

7 Company Profiles (Page No. - 67)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

7.1 Introduction

7.2 CSR Corporation Limited

7.3 Bombardier Transportation AG

7.4 Alstom SA

7.5 General Electric Company

7.6 Siemens AG

7.7 Kawasaki Heavy Industries, Ltd.

7.8 Hyundai Rotem Company

7.9 Stadler Rail AG

7.10 SCG Solutions

7.11 CJSC Transmashholding

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

8 Appendix (Page No. - 98)

8.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

List of Tables (44 Tables)

Table 1 Comparison of Maglev and HSR Technologies(250-Mph Maglev and 200-Mph High-Speed Rail)

Table 2 Asia-Pacific Railway Track Network (Kilometres) 2012 -2020

Table 3 North American Railway Track Network (Kilometres) 2012 -2020

Table 4 Europe Railway Track Network (Kilometres) 2012 -2020

Table 5 RoW Railway Track Network (Kilometres) 2012 -2020

Table 6 Asia-Pacific New Rail Track Network Investments (USD Millions) 2012 -2020

Table 7 North American New Rail Track Network Investments (USD Millions) 2012 -2020

Table 8 Europe New Rail Track Network Investments (USD Millions) 2012 -2020

Table 9 RoW New Rail Track Network Investments (USD Millions) 2012 -2020

Table 10 APAC Rolling Stock Investments (USD Billions) 2008 -2015

Table 11 North America Rolling Stock Investments (USD Billions) 2008 -2015

Table 12 Europe Rolling Stock Investments (USD Billions) 2008 -2015

Table 13 RoW Rolling Stocks Investments (USD Billions) 2008 -2015

Table 14 APAC Rolling Stocks Investments Maintenance (USD Billions) 2008 -2013

Table 15 North America Rolling Stocks Investments Maintenance (USD Billions) 2008 -2013

Table 16 Europe Rolling Stocks Investments Maintenance (USD Billions) 2008 -2013

Table 17 Rolling Stock Market, By Type, 2013-2020 (Units)

Table 18 Rolling Stock Market, By Type, 2013-2020 (USD Million)

Table 19 Locomotive Market Size, By Type, 2013-2020 (Units)

Table 20 Locomotive Market Size, By Type, 2013-2020 ( USD Million)

Table 21 Diesel Locomotive Market Size, By Region, 2013-2020 (Units)

Table 22 Diesel Locomotive Market Size, By Region, 2013-2020 (USD Million)

Table 23 Electric Locomotive Market Size, By Region, 2013-2020 (Units)

Table 24 Electric Locomotive Market Size, By Region, 2013-2020 (USD Million)

Table 25 Rapid Transit Market Size, By Type, 2013-2020 (Units)

Table 26 Rapid Transit Market Size, By Type, 2013-2020 (USD Million)

Table 27 DMU Market Size, By Region, 2013-2020 (Units)

Table 28 DMU Market Size, By Region, 2013-2020 (USD Million)

Table 29 EMU Market Size, By Region, 2013-2020 (Units)

Table 30 EMU Market Size, By Type, 2013-2020 (USD Million)

Table 31 Light Rail Vehicle Market Size, By Region, 2013-2020 (Units)

Table 32 Light Rail Market Size, By Region, 2013-2020 (USD Million)

Table 33 Metro Market Size, By Region, 2013-2020 (Units)

Table 34 Metro Market Size, By Region, 2013-2020 (USD Million)

Table 35 Railroad Cars Market Size, By Region, 2013-2020 (Units)

Table 36 Railroad Cars Market Size, By Region, 2013-2020 (USD Million)

Table 37 Passenger Coach Market Size, By Region, 2013-2020 (Units)

Table 38 Passenger Coach Market Size, By Region, 2013-2020 (USD Million)

Table 39 Freight Wagon Market Size, By Region, 2013-2020 (Units)

Table 40 Freight Wagon Market Size, By Region, 2013-2020 (USD Million)

Table 41 Supply Contracts and Agreement, 2012–2015

Table 42 New Product Launches 2012–2014

Table 43 Joint Venture/Acquisition/ Partnership 2012–2014

Table 44 Expansion, 2014

List of Figures (30 Figures)

Figure 1 Rolling Stock & Rolling Stock Infrastructure Market: Markets Covered

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Rail Network and Passenger Carried in Major Countries

Figure 5 High-Speed Rail Links in Major Countries, 2014

Figure 6 Rail Freight in Major Countries in 2012 & 2014

Figure 7 Data Triangulation

Figure 8 Market Size Estimation Methodology: Bottom-Up Approach

Figure 9 Assumptions

Figure 10 Urbanization is Projected to Drive the Market for Rapid Transit Vehicles

Figure 11 Electric Locomotive Market Estimated to Witness A Higher Growth Than Diesel Locomotives, 2015 & 2020

Figure 12 EMU Market Size Projected to Hold the Maximum Market Share Owing to Increasing Suburban Transit 2015 & 2020

Figure 13 Europe Estimated to Hold the Largest Market Share Owing to Domestic as Well as Overseas Demand 2015 & 2020

Figure 14 Companies Adopted Expansion as the Key Growth Strategy From 2011 to 2015

Figure 15 Rolling Stocks and Infrastructure Market Share, By Key Player Ranking, 2014

Figure 16 Market Evaluation: Expansions Fuelled Growth From 2012 to 2015

Figure 17 Region-Wise Revenue Mix of Five Major Players 2015

Figure 18 CSR Corporation Limited: Company Snapshot

Figure 19 CSR Corporation: SWOT Analysis

Figure 20 Bombardier Transportation: Company Snapshot

Figure 21 Bombardier Transportation: SWOT Analysis

Figure 22 Alstom SA: Company Snapshot

Figure 23 Alstom SA: SWOT Analysis

Figure 24 General Electric Company: Company Snapshot

Figure 25 General Electric Company : SWOT Analysis

Figure 26 Siemens AG: Company Snapshot

Figure 27 Kawasaki Heavy Industries, Ltd.: Company Snapshot

Figure 28 Hyundai Rotem Company: Company Snapshot

Figure 29 Marketsandmarkets Knowledge Store Snapshot

Figure 30 Marketsandmarkets Knowledge Store: Automotive and Transportation Industry Snapshot

Growth opportunities and latent adjacency in Rail Infrastructure Market