Role-based Access Control Market by Component (Solutions and Services (Implementation & Integration, Training & Consulting, Support & Maintenance), Model Type, Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2027

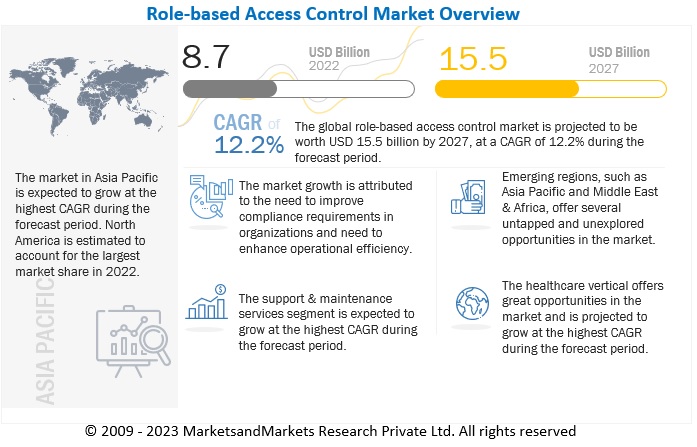

The Role-Based Access Control Market size was estimated at USD 8.7 billion in 2022 and is projected to reach USD 15.5 billion by 2027 at a CAGR of 12.2%. The need to enhance operational efficiency and requirement of simplified workflows in order to eliminate bottlenecks is expected to drive the growth of the global role-based access control market.

To know about the assumptions considered for the study, Request for Free Sample Report

Role-based Access Control Market Dynamics

Driver: Need to improve compliance requirements in the organizations

Organizations are subject to federal, state, and local regulations. With an RBAC system in place, companies can easily meet statutory and regulatory requirements for privacy and confidentiality, as IT departments and executives have control over how data is accessed and used. This is especially significant for health care and financial institutions, which manage lots of sensitive data, such as PHI and PCI data. RBAC offers a mechanism for managing and controlling access to information based on the roles and responsibilities of an employee in the organization. Adminitrators can keep track of the employees who are accessing the system at what time, the modifications mase and what permissions are granted. Organizations can rectify the issues at any point in time which helps in meeting the regulatory requirements such as HIPPA, SOX, SOC2, and ISO 27001. These all regulatory requirements depend on the network visibility to justify that data sensitive requirements have been handled based on the privacy, security, and confidentiality requirements.

Restraint: Rise in number of roles resulting in increased strain on RBAC systems

In small companies, creating and maintaining roles can be more labor-intensive than assigning permissions individually. Therefore, the RBAC model is only used when a certain number of roles and employees has been reached. However, in large organizations, role-based access control results in creating many roles which creates a strain on the system. If a company has ten departments and ten roles, this will already result in 100 different groups. Further, the changing hierarchical structure within the organizations can affect the access management process with the changing nature of roles. This is likely to impact the adoption of role-based access control solutions during the forecast period.

Opportunity: Advent of blockchain technology in role-based access control

Blockchain technology is best known for its use in developing cryptocurrencies, such as Bitcoin security Since it can be used to provide a secure ledger, blockchain seems to be the traceability and validation solution of the future. The intrinsically secure nature of blockchain technology provides an efficient solution for granting access control. This can be done by only allowing certain people to access specific areas. Blockchain identity management systems can be used to eradicate current identity issues such as inaccessibility, data insecurity, and fraudulent identities. As per US Consumer Data Breach Report 2019, In 2018, more than 2.8 billion consumer data records were exposed in 342 breaches – at an estimated total cost of more than USD 654 billion. Such security breaches are projected to boost the adoption of the role-based access control market.

Challenge: Poor identity management and role creation process

Role creation and management require proper processes, policies, and systems in place to manage identities. Immature IDM/IGA systems may result in poor data quality which can also impact the implementation of RBAC, as it may lack control over how administrators manage user access. Identity governance and administration solutions provide automation capabilities to create and manage user accounts, roles, and access rights for individual users within organizations. In order to implement an RBAC model efficiently in organizations, administrators are allowed to change group memberships and entitlements directly in Active Directory. Hence, without a proper access control framework in place, RBAC will create challenges for admins and end users.

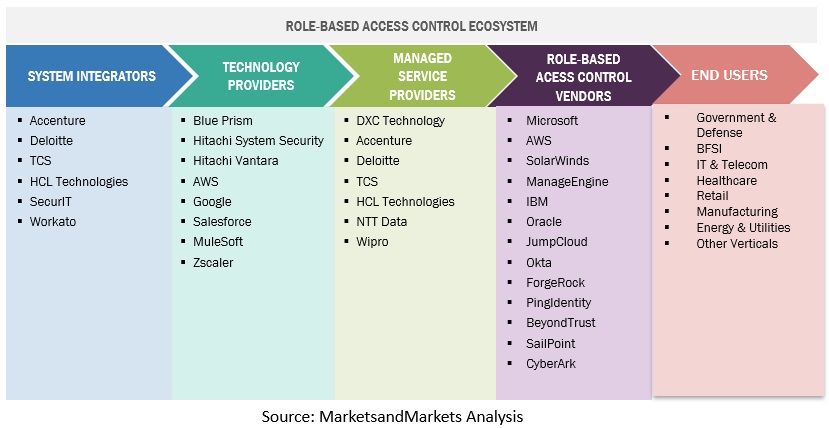

Role-based Access Control Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on services, support & mainteanance segment to grow at a higher CAGR during the forecast period

Support and maintenance services play a crucial role in the role-based access control market. These services include assistance provided during installations and maintenance activities at large. These services can also be offered from remote locations, although the physical presence of security professionals may be required in some cases. Support and maintenance service providers help enterprises in providing installation, maintenance, and other support activities, such as data migration and replication.

Based on verticals, healthcare vertical to grow at the highest CAGR during the forecast period

The outbreak of COVID-19 in 2020 has changed the technological landscape in the healthcare sector. Whether facilitated through insider threat, external hacking, or employee negligence, factors, such as Malware and ransomware, DDoS attacks, personal data breaches, and phishing pose a serious risk for healthcare organizations. Like all other industry verticals, the healthcare sector had to adapt to the digital and mobile era. There has been an increase in the use of electronic personal health data (ePHI) as well as rapid advances in technology. Mobile endpoints and self-service web portals have brought convenience to patients. When the organization factor in inpatient data moving to cloud-based storage and the increase in IoT-enabled devices creates a complex and connected network. Furthermore, healthcare organizations can face severe penalties for failing to comply with security regulations such as HIPAA, HITECH, and GDPR. Controlling privileged access is a key component of the expected security measures. Privileged access management and access control systems offer the most effective way to comply with regulations and protect healthcare organizations from mass data breaches.

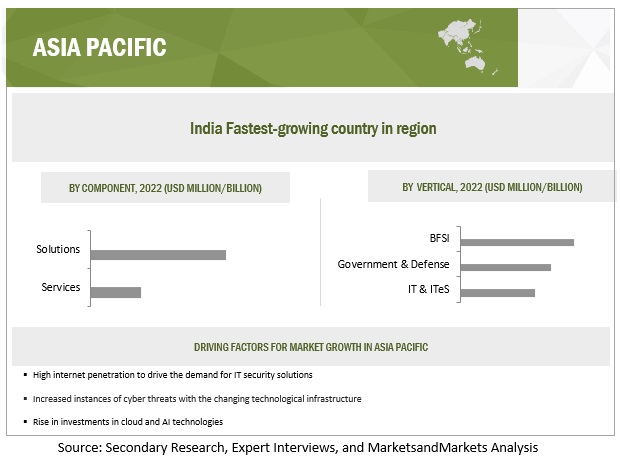

Asia Pacific to grow at highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the role-based access control market. The region comprises emerging economies, such as India, Japan, China, and Australia. These countries are home to various SMEs. With the rise in cyber security risks, increased use of online services, citizen and workforce demands, and government initiatives, the modernization of digital identity to provide exceptional digital experiences is an urgent priority for governments and agencies across the region. The increase in digitalization activities such as online banking, and UPI payments in is transforming financial services sector across Asia Pacific and the globe. At the same time, this is paving the way for cyberthreats, ransomware, and third-party risks. Thus, the financial services sector in Asia Pacific region must rethink its cybersecurity framwework to cope up with the changing technological landscape, business opportunities, and associated risks. he most cited cause of cyber incidents across Asia Pacific is malware, which includes ransomware, spyware, and virus. In addition, the COVID-19 pandemic has resulted in an increase in online fraud and identity theft. According to a report by ADVANCE.AI, during the pandemic, online fraud and higher debt risk were two top critical risks that businesses faced in emerging markets, including Indonesia, Philippines, Thailand, Vietnam, and Singapore in Southeast Asia. These factors are expected to boost the adoption of role-based access control solutions.

Key Market Players

The role-based access control market is dominated by companies such as are Microsoft (US), AWS (US), SolarWinds (US), IBM (US), ManageEngine (US), Oracle (US), JumpCloud (US), Okta (US), ForgeRock (US) and Ping Identity (US), BeyondTrust (US), SailPoint(US), CyberArk (US), Broadcom (US), SecureAuth(US), Varonis (US), Edgile (US), Imprivata (US), and Bravura Security (Canada). These vendors have a large customer base and a strong geographic presence with distribution channels globally to drive business revenue and growth.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Market value in 2027 |

USD 15.7 Million |

|

Market value in 2022 |

USD 8.7 Million |

|

Market Growth Rate |

12.2% CAGR |

|

Segments covered |

Component, Model Type, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), AWS (US), SolarWinds (US), IBM (US), ManageEngine (US), Oracle (US), JumpCloud (US), Okta (US), ForgeRock (US) and Ping Identity (US), BeyondTrust (US), SailPoint(US), CyberArk (US), Broadcom (US), SecureAuth(US), Varonis (US), Edgile (US), Imprivata (US), Bravura Security (Canada), Frontegg (US), Ekran System (US), Tenfold (Austria), Delinea (US), Automox (US), HostBooks (US), EmpowerID (US), FusionAuth (US), StronDM (US), and One Identity (US). |

Role-based Access Control Market Highlights

This research report categorizes the Role-based Access Control Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

Based on Component: |

|

|

Based on Model Type: |

|

|

Based on Organization Size: |

|

|

Based on Verticals: |

|

|

Based on Region: |

|

Recent Developments

- In December 2022, AWS announced eight new capabilities to its SageMaker Role Manager which help administrators to control access and define permissions for improved machine learning governance and make it easier to document and review model information throughout the machine learning lifecycle.

- In December 2022, IBM announced the acquisition of Octo, a US-based IT modernization and digital transformation services provider to support the US federal government, including defense, health, and civilian agencies.

- In June 2022, Microsoft launched Microsoft Entra which encompasses all of Microsoft’s identity and access capabilities. Microsoft Entra includes Azure AD as well as two new product categories, Microsoft Entra Permissions Management and Microsoft Entra Verified ID to offer secure access to customers in the connected world.

- In July 2020, SolarWinds announced a collaboration with Microsoft that will integrate Microsoft 365 capabilities with SolarWinds N-central and RMM. This will deliver monitoring of devices managed by Microsoft Intune from within the SolarWinds dashboard, enabling a single device view, extensive management features, and impactful reporting.

Frequently Asked Questions (FAQ):

What is the projected market value of the role-based access control market?

The role-based access control market size is expected to grow from USD 8.7 billion in 2022 to USD 15.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 12.2% during the forecast period.

Which region has the highest market share in the role-based access control market?

The North America region has a higher market share in the role-based access control market.

Which component is expected to witness high adoption in the coming years?

Services segment will witness the highest adoption rate in the coming five years.

Which are the major vendors in the role-based access control market?

Microsoft (US), AWS (US), SolarWinds (US), IBM (US), and ManageEngine (US) are major vendors in the role-based access control market.

What are some of the drivers in the role-based access control market?

A surge in data breaches and changing organizational structure .

The advent of blockchain, zero trust, AI in role-based access control offerings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need to improve compliance requirements in organizations- Need to enhance operational efficiency- Requirement of simplified workflows in order to eliminate bottlenecksRESTRAINTS- Rise in number of roles resulting in increased strain on RBAC systemsOPPORTUNITIES- Advent of blockchain technology in role-based access control- Increased adoption of role-based access control systems for cloud securityCHALLENGES- Poor identity management and role creation processes- Accurate security risk analysis

-

5.3 CASE STUDY ANALYSISCASE STUDY 1: AD360 HELPED ERSTE BANK STREAMLINE ITS USER PROVISIONING AND ACTIVE DIRECTORY MANAGEMENTCASE STUDY 2: JUMPCLOUD HELPED CHASE INTERNATIONAL NAVIGATE REMOTE WORK TRANSITION AND ACHIEVE REGULATORY COMPLIANCECASE STUDY 3: AGU DEPLOYED FORGEROCK IDENTITY CLOUD TO HOST ONLINE EVENTS AND MODERNIZE ITS WEBSITECASE STUDY 4: PING IDENTITY HELPED GCU PROVIDE THEIR EMPLOYEES WITH SEAMLESS AND SECURE USER EXPERIENCECASE STUDY 5: UNIVERSITY OF NORTH CAROLINA UTILIZED BEYONDTRUST ROLE-BASED ACCESS CONTROL SYSTEM TO OFFER REMOTE SECURITY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISBLOCKCHAINARTIFICIAL INTELLIGENCEZERO TRUST

- 5.7 PRICING ANALYSIS

-

5.8 PATENT ANALYSIS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY CONFERENCES AND EVENTS IN 2023

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- Payment Card Industry Data Security Standard (PCI DSS)- Health Insurance Portability and Accountability Act (HIPPA)- Federal Information Security Management Act (FISMA)- Sarbanes-Oxley Act (SOX)- Service Organization Control 2 (SOC 2)

-

5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONCOMPONENT: ROLE-BASED ACCESS CONTROL MARKET DRIVERS

-

6.2 SOLUTIONSNEED TO PROVIDE SYSTEM ACCESS TO USERS BASED ON AUTHENTICATION HIERARCHY TO DRIVE GROWTH

-

6.3 SERVICESLACK OF TECHNICAL EXPERTISE AND SKILLED WORKFORCE TO DRIVE GROWTH- Implementation & Integration Services- Support & Maintenance Services- Training & Consulting Services

-

7.1 INTRODUCTIONMODEL TYPE: ROLE-BASED ACCESS CONTROL MARKET DRIVERS

- 7.2 CORE RBAC

- 7.3 HIERARCHICAL RBAC

- 7.4 CONSTRAINED RBAC

-

8.1 INTRODUCTIONORGANIZATION SIZE: ROLE-BASED ACCESS CONTROL MARKET DRIVERS

-

8.2 LARGE ENTERPRISESGROWING NEED TO IMPLEMENT STANDARDIZED POLICIES FOR REGULATORY COMPLIANCE AMONG LARGE ENTERPRISES

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISESRISING SECURITY ISSUES SUPPORT ADOPTION IN SMALL AND MEDIUM-SIZED ENTERPRISES

-

9.1 INTRODUCTIONVERTICAL: ROLE-BASED ACCESS CONTROL MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, & INSURANCEINCREASED CONCERNS REGARDING DATA BREACHES AND RANSOMWARE AND ATTACKS IN FINANCIAL SECTOR TO SPUR GROWTH

-

9.3 IT & ITESRISE IN NEED TO PROVIDE SECURE INFORMATION TO FUEL GROWTH

-

9.4 HEALTHCAREUSE OF ROLE-BASED ACCESS CONTROL SYSTEMS TO EFFECTIVELY SECURE SENSITIVE INFORMATION AND ENSURE DATA PRIVACY

-

9.5 GOVERNMENT & DEFENSENEED TO ELIMINATE VULNERABILITIES IN EXTENDED GOVERNMENT SUPPLY CHAINS TO PROPEL GROWTH

-

9.6 TELECOMMUNICATIONSRISE IN NEED FOR CYBERSECURITY SOLUTIONS TO PROTECT INTERCONNECTED INFRASTRUCTURE TO DRIVE MARKET GROWTH

-

9.7 RETAIL & ECOMMERCEREQUIREMENT OF ACCESS CONTROL SYSTEMS TO ENSURE SAFETY OF CUSTOMER DATA

-

9.8 EDUCATIONINCREASED NEED FOR DATA SECURITY AND COMPLIANCE TO DRIVE GROWTH

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: ROLE-BASED ACCESS CONTROL MARKET DRIVERSUS- Well-developed security policies to drive market growthCANADA- Technological advancements to fuel adoption

-

10.3 EUROPEEUROPE: ROLE-BASED ACCESS CONTROL MARKET DRIVERSUK- Growing adoption of cloud to drive demandGERMANY- Need for data security to enhance user experienceFRANCE- Huge investments in cloud computing and digital identity projects to drive demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: ROLE-BASED ACCESS CONTROL MARKET DRIVERSCHINA- Increased budget for cybersecurity solutions across verticals to drive market growthJAPAN- Rise in investments in new technologies to propel market growthAUSTRALIA- Growth in online business impacting IT security landscapeINDIA- Increased incidences of cybercrimes and identity threats to propel market growthREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ROLE-BASED ACCESS CONTROL MARKET DRIVERSMIDDLE EAST- Changing technological landscape to spur demandAFRICA- Inclination toward development of advanced security solutions to drive market growth

-

10.6 LATIN AMERICALATIN AMERICA: ROLE-BASED ACCESS CONTROL MARKET DRIVERSBRAZIL- Increased risks of cybercrimes and rise in use of digital payment methods to boost market growthMEXICO- Rise in internet penetration to drive demandREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 MARKET EVALUATION FRAMEWORK

- 11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.4 REVENUE ANALYSIS

- 11.5 MARKET SHARE ANALYSIS

-

11.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.7 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.8 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOLARWINDS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMANAGEENGINE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developmentsJUMPCLOUD- Business overview- Products/Solutions/Services offered- Recent developmentsOKTA- Business overview- Products/Solutions/Services offered- Recent developmentsFORGEROCK- Business overview- Products/Solutions/Services offered- Recent developmentsPING IDENTITY- Business overview- Products/Solutions/Services offered- Recent developmentsBEYONDTRUSTSAILPOINTCYBERARKBROADCOMSECUREAUTHVARONISEDGILEIMPRIVATABRAVURA SECURITY

-

12.3 SMES/STARTUPSFRONTEGGEKRAN SYSTEMTENFOLDDELINEAAUTOMOXHOSTBOOKSEMPOWERIDFUSIONAUTHSTRONGDMONE IDENTITY

-

13.1 INTRODUCTIONRELATED MARKETS

- 13.2 PRIVILEGED IDENTITY MANAGEMENT MARKET

- 13.3 IDENTITY AND ACCESS MANAGEMENT MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 JUMPCLOUD: PRICING ANALYSIS OF VENDORS IN ROLE-BASED ACCESS CONTROL MARKET

- TABLE 4 FRONTEGG: PRICING ANALYSIS OF VENDORS IN MARKET

- TABLE 5 PING IDENTITY: PRICING ANALYSIS OF VENDORS IN MARKET

- TABLE 6 TOP TEN PATENT APPLICANTS (US)

- TABLE 7 MARKET: PATENTS

- TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 ROLE-BASED ACCESS CONTROL MARKET: KEY CONFERENCES AND EVENTS IN 2023

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 15 KEY BUYING CRITERIA FOR END USERS

- TABLE 16 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 17 ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 18 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 19 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 20 MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 21 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 22 IMPLEMENTATION & INTEGRATION SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 23 IMPLEMENTATION & INTEGRATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 24 SUPPORT & MAINTENANCE SERVICES: ROLE-BASED ACCESS CONTROL MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 25 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 TRAINING & CONSULTING SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 27 TRAINING & CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 29 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 31 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 33 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 34 ROLE-BASED ACCESS CONTROL MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 35 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 36 BFSI: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 37 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 38 IT & ITES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 39 IT & ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 40 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 41 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 42 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 43 GOVERNMENT & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 44 TELECOMMUNICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 45 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 46 RETAIL & ECOMMERCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 47 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 EDUCATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 49 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 50 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 51 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 53 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 54 NORTH AMERICA: PESTLE ANALYSIS

- TABLE 55 NORTH AMERICA: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 65 US: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 66 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 67 US: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 68 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 69 CANADA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 70 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 71 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 72 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 73 EUROPE: PESTLE ANALYSIS

- TABLE 74 EUROPE: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 77 EUROPE: MARKET, SERVICES, 2022–2027 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 84 UK: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 85 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 86 UK: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 87 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 88 GERMANY: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 89 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 90 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 91 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 92 FRANCE: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 93 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 94 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 95 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 96 REST OF EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 97 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 99 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PESTLE ANALYSIS

- TABLE 101 ASIA PACIFIC: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 111 CHINA: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 112 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 113 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 114 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 115 JAPAN: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 116 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 117 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 118 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 119 AUSTRALIA: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 120 AUSTRALIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 121 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 122 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 123 INDIA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 124 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 125 INDIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

- TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ROLE-BASED ACCESS CONTROL MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 142 MIDDLE EAST: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 143 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 144 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 145 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 146 AFRICA: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 147 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 148 AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 149 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 150 LATIN AMERICA: PESTLE ANALYSIS

- TABLE 151 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 152 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 153 LATIN AMERICA: MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 155 LATIN AMERICA: ROLE-BASED ACCESS CONTROL MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 156 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 158 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 160 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 161 BRAZIL: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 162 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 163 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 164 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 165 MEXICO: ROLE-BASED ACCESS CONTROL MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 166 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 167 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 168 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 172 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 173 OVERVIEW OF STRATEGIES ADOPTED BY KEY ROLE-BASED ACCESS CONTROL VENDORS

- TABLE 174 MARKET: DEGREE OF COMPETITION

- TABLE 175 COMPANY EVALUATION QUADRANT: CRITERIA

- TABLE 176 GLOBAL COMPANY FOOTPRINT

- TABLE 177 ROLE-BASED ACCESS CONTROL MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 STARTUPS/SMES FOOTPRINT

- TABLE 179 PRODUCT LAUNCHES & ENHANCEMENTS, 2020–2022

- TABLE 180 DEALS, 2020–2022

- TABLE 181 MICROSOFT: BUSINESS OVERVIEW

- TABLE 182 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 184 MICROSOFT: DEALS

- TABLE 185 AWS: BUSINESS OVERVIEW

- TABLE 186 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 188 SOLARWINDS: BUSINESS OVERVIEW

- TABLE 189 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 SOLARWINDS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 SOLARWINDS: DEALS

- TABLE 192 IBM: BUSINESS OVERVIEW

- TABLE 193 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 IBM: DEALS

- TABLE 196 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 197 MANAGEENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 MANAGEENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 199 ORACLE: BUSINESS OVERVIEW

- TABLE 200 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 202 ORACLE: DEALS

- TABLE 203 JUMPCLOUD: BUSINESS OVERVIEW

- TABLE 204 JUMPCLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 JUMPCLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 JUMPCLOUD: DEALS

- TABLE 207 OKTA: BUSINESS OVERVIEW

- TABLE 208 OKTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 OKTA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 OKTA: DEALS

- TABLE 211 FORGEROCK: BUSINESS OVERVIEW

- TABLE 212 FORGEROCK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 FORGEROCK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 FORGEROCK: DEALS

- TABLE 215 PING IDENTITY: BUSINESS OVERVIEW

- TABLE 216 PING IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 PING IDENTITY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 PING IDENTITY: DEALS

- TABLE 219 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2014–2021 (USD MILLION)

- TABLE 220 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY INSTALLATION TYPE, 2014–2021 (USD MILLION)

- TABLE 221 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2014–2021 (USD MILLION)

- TABLE 222 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2014–2021 (USD MILLION)

- TABLE 223 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2021 (USD MILLION)

- TABLE 224 PRIVILEGED IDENTITY MANAGEMENT MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

- TABLE 225 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 226 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 227 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 228 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 229 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 230 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 231 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 232 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 233 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

- TABLE 234 IDENTITY AND ACCESS MANAGEMENT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 ROLE-BASED ACCESS CONTROL MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE AND SERVICES FROM ROLE-BASED ACCESS CONTROL VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF ROLE-BASED ACCESS CONTROL VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): CAGR PROJECTIONS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY ROLE-BASED ACCESS CONTROL VENDORS FROM EACH COMPONENT

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT APPLICATIONS

- FIGURE 9 FASTEST-GROWING SEGMENTS IN MARKET, 2022–2027

- FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 11 IMPLEMENTATION & INTEGRATION SERVICES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 12 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 13 TOP VERTICALS IN MARKET

- FIGURE 14 ROLE-BASED ACCESS CONTROL MARKET: REGIONAL SNAPSHOT

- FIGURE 15 NEED TO ENHANCE OPERATIONAL EFFICIENCY TO BOOST MARKET

- FIGURE 16 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 IMPLEMENTATION & INTEGRATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 IT & TELECOM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 21 MARKET DYNAMICS: MARKET

- FIGURE 22 MARKET: SUPPLY CHAIN

- FIGURE 23 MARKET: ECOSYSTEM

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 25 TOP FIVE PATENT OWNERS (GLOBAL)

- FIGURE 26 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 ROLE-BASED ACCESS CONTROL MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR END USERS

- FIGURE 30 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 HISTORICAL FOUR-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018–2021 (USD MILLION)

- FIGURE 38 MARKET: MARKET SHARE ANALYSIS, 2022

- FIGURE 39 ROLE-BASED ACCESS CONTROL MARKET, KEY COMPANY EVALUATION QUADRANT, 2022

- FIGURE 40 RANKING OF KEY PLAYERS IN MARKET, 2021

- FIGURE 41 STARTUPS/SMES EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 42 MARKET (GLOBAL) STARTUPS/SMES COMPANY EVALUATION QUADRANT, 2022

- FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 44 AWS: COMPANY SNAPSHOT

- FIGURE 45 SOLARWINDS: COMPANY SNAPSHOT

- FIGURE 46 IBM: COMPANY SNAPSHOT

- FIGURE 47 ORACLE: COMPANY SNAPSHOT

- FIGURE 48 OKTA: COMPANY SNAPSHOT

- FIGURE 49 FORGEROCK: COMPANY SNAPSHOT

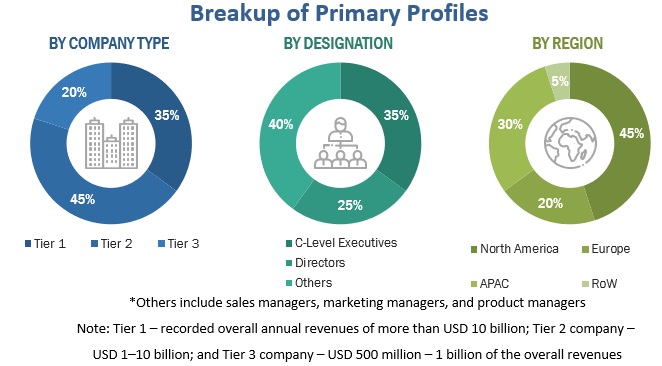

The study involved four major activities in estimating the current market size of the role-based access control market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the role-based access control market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the role-based access control market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were utilized to estimate and validate the total role-based access control market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through paid and unpaid secondary resources.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides, in the role-based access control market.

Report Objectives

- To define, describe, and forecast the global Role-Based Access Control (RBAC) market based on component (solutions and services), model type, organization size, vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the role-based access control market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall role-based access control market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the role-based access control market

- To profile the key players in the role-based access control market and comprehensively analyze their core competencies in each subsegment.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs and on best effort basis for profiling additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Role-based Access Control Market