Robotics as a Service Market Size, Share & Industry Trends Analysis Report by Type (Personal, Professional), Application (Handling, Processing, Dispensing, Welding & Soldering), Vertical (Logistics, Manufacturing, Automotive, Retail, Food & Beverage) and Region - Global Forecast to 2028

Updated on : Oct 04, 2024

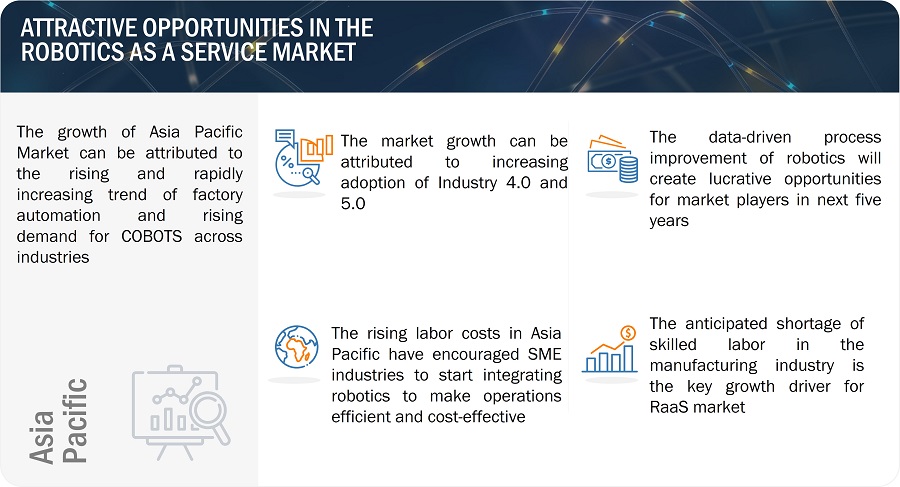

Factors such as rising demand for COBOTS; anticipated labour shortage in manufacturing industries; growing adoption of robotics-as-a-service market growth. The emergence of Industry 5.0 and data-driven process improvement are a few of the market opportunities that lie ahead for market players. However, challenges such as interoperability & integration issues, and safety concerns related to industrial robotic systems still need to addressed in the market.

Robotics as a Service Market Size & Share

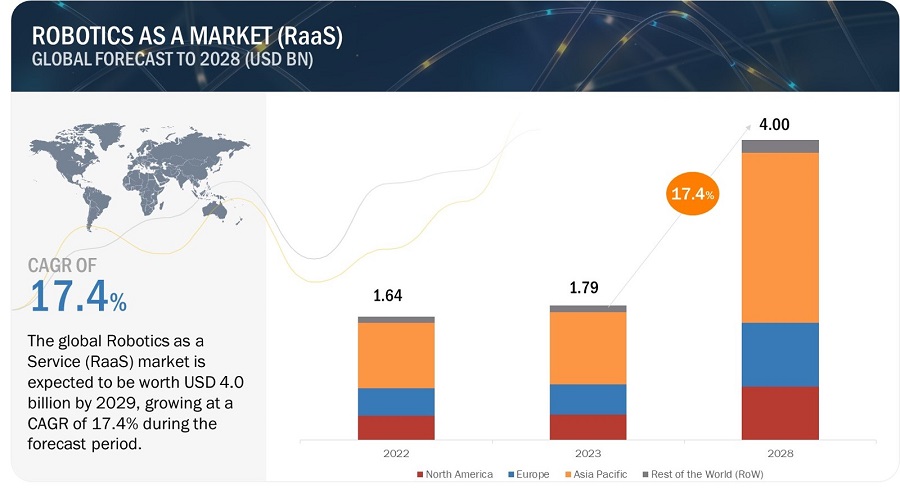

The global robotics-as-a-service market Size is expected to be valued at USD 1.8 billion in 2023 and is projected to reach USD 4.0 billion by 2028; growing at a CAGR of 17.4% during the forecast period.

Robotics as a service (RaaS) is a business model in which robotics companies offer the use of their robot devices via a subscription-based contract. The benefits of the RaaS model over the traditional robotic program, such as higher flexibility, scalability, and lower cost of entry, are the key factors driving the robotics as a service industry.

Robot as a Service Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Robotics as a Service Market Trends

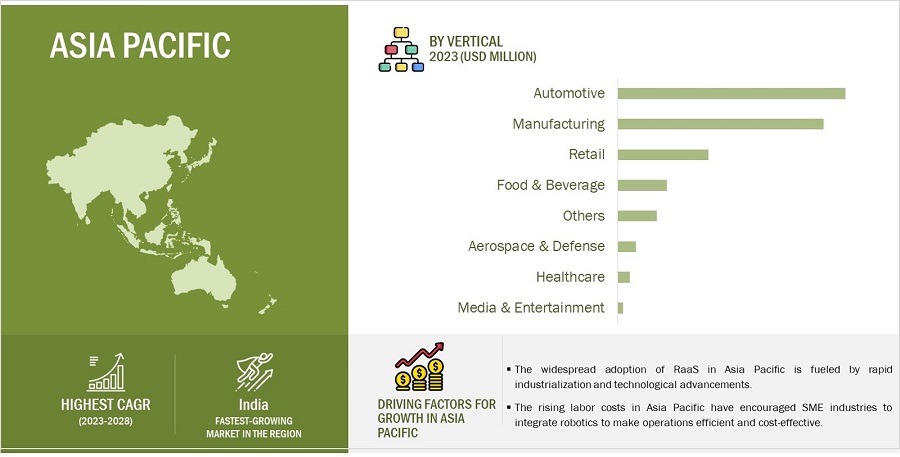

Driver: Anticipated skilled labor shortage in manufacturing industries

As a result of increasing labor costs and limited availability of labor, robotics as a service has been deemed to be the future of automation as robotics as a service has the ability to scale as needs change, operators can now take control of their business and deliver high levels of productivity and throughput today, as well as in the future, with the ability to gain control over their business as needs change, thus driving the market growth. Manufacturing industries in the developed nations like US, Germany, have experienced tremendous growth over the past decade; however, they are expected to face a workforce shortage within the next few years. To compensate for the shortage, stakeholders find solutions in RaaS; thus improving productivity and substituting human labor.

Restraint: Lack of interaction between robots and the human workforce

Hiring professionals; expert engineers and programmers from overseas for robotic installations is a time taking task. The limited interaction between unskilled labor and robots acts a restraint in market hindering market growth. The complexity of challenging regular tasks requires robotics systems with the temporal, spatial, physical, and social understanding that a broad range of methodologies and tools can best address.

Opportunity: Emergence of Industry 5.0

Industry 5.0 provides a vision of a sector that aims beyond efficiency and productivity as the sole goals and reinforces the role and contribution of industry to society. It places the worker's well-being at the center of the production process. It uses new technologies to provide prosperity beyond jobs and growth while respecting the production limits of the planet. Industry 5.0 complements the Industry 4.0 approach by specifically putting research and innovation at the service of the transition to a sustainable, human-centric, and resilient European sector.

Challenge: Safety concerns related to industrial robotics systems

Numerous safety issues are associated with industrial robots. Some robots, notably those in a traditional industrial environment, are fast and powerful. This increases the potential for injury as one swing from a robotic arm, for instance, could cause serious bodily harm. There are additional risks when a robot malfunctions or requires maintenance. A malfunctioning robot is typically unpredictable and can cause injury to workers, acting as a challenge for RaaS market growth.

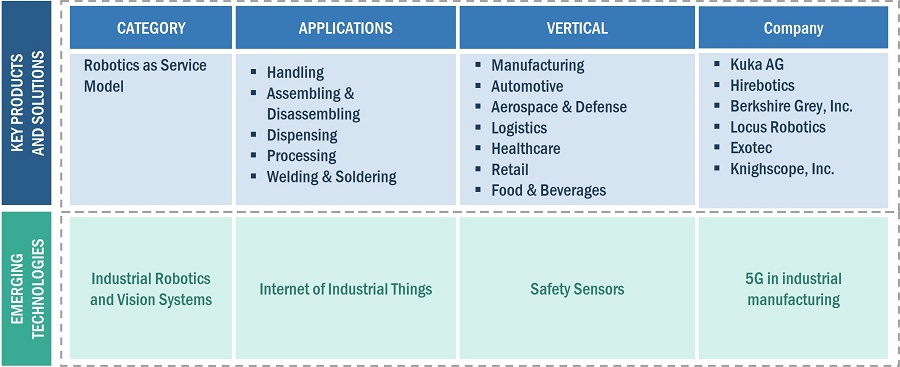

Robotics As A Service Market Ecosystem

This section describes robot as a service market ecosystem, describes the applications of robotics in different industries and sectors, and discusses the impact of emerging technologies on the market.

Assembling & disassembling by application to hold second-highest market share during the forecast period

Robots for assembling & disassembling applications are deployed to ensure quality and consistency in manufacturing. The robotic assembly process requires speed and precision without compromising on accuracy. Use cases can include assembling automotive components such as engines gearboxes, and complex operations such as clutch plate assembly. These robots can also assemble small and intricate consumer electronics and medical device parts.

Logistics by vertical to dominate market growth during forecast period

Robotics as a service has seen growth in the logistics industry. The logistics vertical holds the largest market share of RaaS in 2022 owing to the increased adoption rate of RaaS in logistics for tasks such as handling and dispensing. Warehouses have become smarter, with implementation of autonomous forklifts, mobile robots, and picking robots, to achieve efficiency in operations. Renting and leasing options by many robot suppliers support warehouse transformation by offering flexible pricing options through robotics as a service.

Europe to hold second-highest market share and CAGR during forecast period

In 2022, the European market accounted for the second-largest market share. RaaS in Europe is incorporated mostly in SMEs. Germany being the largest market for industrial robotics in the region. The automotive industry witnesses the introduction of RaaS with the introduction of hybrid and electric vehicles. European SMEs are increasingly considering deploying robotics to perform messy and dangerous jobs. Polishing tasks, for example, are done by collaborative robots, with workers performing the final inspection. SMEs grow at a rapid pace compared to large-scale enterprises. Thus, considerable growth is expected in the European market for robotics as a service during the forecast period.

Robotics as a Service Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the RaaS companies include KUKA AG (Germany), Berkshire Grey, Inc. (US), Locus Robotics (US), Exotec (France), Knightscope, Inc. (US), CYBERDYNE, Inc. (Japan), CAJA (Israel), Hirebotics (US), Cobalt Robotics (US), Relay Robotics (US), and inVia Robotics (US). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions to grow in the market.

Robotics as a Service Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 1.8 billion in 2023 |

| Projected Market Size | USD 4.0 billion by 2028 |

| Robot as a Service Market Growth Rate | CAGR of 17.4% |

|

Robotics as a Service Market size available for years |

2019–2023 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, By Application, By Vertical and By Region |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of World |

|

Companies covered |

The key players operating in the market KUKA AG (Germany), Berkshire Grey, Inc. (US), Locus Robotics (US), Exotec (France), Knightscope, Inc. (US), CYBERDYNE, Inc. (Japan), CAJA (Israel), Hirebotics (US), Cobalt Robotics (US), Relay Robotics (US), and inVia Robotics (US). |

Robot as a Service Market Highlights

The study categorizes the robotics as a service based on By Type, By Application, By Vertical and By Region

|

Segment |

Subsegment |

|

By Type: |

|

|

By Application: |

|

|

By Vertical: |

|

|

By Region: |

|

Recent Developments in Robotics as a Service Industry

- In November 2022, KUKA announced the launch of its new industrial robot, KR 3 D1200, designed for bearing loads of up to 6 kg. The robot can be used in the pharmaceuticals and food & beverage end-user industry as it contains food-safe H1 lubricants as standard, qualifying it for handling foodstuffs in secondary applications.

- In September 2022, Knightscope, Inc. launched its automatic criminal detection capability (ACDC) feature, a real-time and comprehensive criminal data intelligence solution, to help public safety officials better prepare for today's threats by delivering real-time, hyper-local information for improved situational awareness.

- In May 2022, Berkshire Grey, Inc. launched BG Flex, a next-generation mobile robotic platform, including dynamically controlled fleets of Berkshire Grey's industrial-grade mobile robots that work together to induct, transport, sort, sequence, and fulfill items, cases, and containers of merchandise.

Frequently Asked Questions (FAQ):

What is the current size of the robotics as a service market?

The global robotics as a service market is estimated to be valued at USD 1.8 billion in 2023 and reach USD 4.0 billion by 2028, at a CAGR of 17.4% between 2023 and 2028.

What is robotics as a service?

RaaS is a subscription-style business model where robotics companies offer clients and customers the opportunity to rent robots across industries. Robotics as a service operates in two business models time-based leases and task-based leases.

What are the challenges in the robot as a service market ?

Integration and interoperatibility issues and safety concerns related to robotic systems are some of the challenges robotics faces as a service market.

What are the technological trends going in the robotics as a service market?

The integration of industrial robots and vision systems and the penetration of the IoT and AI in manufacturing are some of the technological trends in RaaS market

Which are the major companies in the robot as a service market?

A few of major players in the RaaS market include Berkshire Grey, Inc. (US), KUKA AG (Germany), Locus Robotics (US), Exotec (France), and Knightscope, Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for collaborative robots across industries- Growing adoption of Industry 4.0- Anticipated shortage of skilled labor in manufacturing industries- Reduces cost in long runRESTRAINTS- Lack of interaction between human workforce and robotsOPPORTUNITIES- Emergence of Industry 5.0- Data-driven process improvementCHALLENGES- Interoperability and integration issues- Safety concerns related to industrial robotics systems

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT & NEW REVENUE POCKETS FOR ROBOTICS AS A SERVICE PROVIDERS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICES OF ROBOTICS AS A SERVICE MARKET OFFERED BY KEY PLAYERS, BY OFFERING

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGY TRENDS- Integration of industrial robots and vision systemsCOMPLEMENTARY TECHNOLOGIES- Penetration of industrial IoT and AI in industrial manufacturing- Adoption of safety sensors in industrial roboticsADJACENT TECHNOLOGIES- Introduction of 5G into industrial manufacturing

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDIES

- 5.11 TRADE AND TARIFF ANALYSIS

-

5.12 PATENT ANALYSISMAJOR PATENTS

- 5.13 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO ROBOTICS AS A SERVICE MARKETSTANDARDS AND REGULATIONS RELATED TO ROBOTICS AS A SERVICE

- 6.1 INTRODUCTION

-

6.2 PERSONAL ROBOTSAGING WORLD POPULATION TO DRIVE MARKET

-

6.3 PROFESSIONAL ROBOTSGROWING DEMAND FOR AUTOMATION TO FUEL MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 HANDLINGINCREASING DEMAND FOR PALLETIZING ROBOTS TO DRIVE MARKET

-

7.3 ASSEMBLING & DISASSEMBLINGAI AND INTELLIGENT ROBOT CONTROL TO DRIVE MARKET GROWTH

-

7.4 DISPENSINGHIGH PRECISION ACCURACY OF ROBOTS TO PROPEL MARKET GROWTH

-

7.5 WELDING & SOLDERINGRISING DEMAND FOR ROBOTS WITH HOLLOW WRISTS TO FUEL SEGMENT GROWTH

-

7.6 PROCESSINGNEED FOR AUTOMATED GRINDING AND POLISHING FOR CONSISTENT FINISH TO SUPPORT MARKET

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 MANUFACTURINGRISING DEMAND FOR CONSISTENT AND REPEATABLE RESULTS TO FUEL MARKET

-

8.3 AUTOMOTIVEEXTENSIVE USE OF ROBOTICS BY AUTOMOTIVE VERTICAL TO DRIVE MARKET

-

8.4 AEROSPACE & DEFENSEINCREASING DEMAND FOR CONSTANT MONITORING WORLDWIDE TO FUEL MARKET GROWTH

-

8.5 LOGISTICSGROWING ADOPTION OF AUTONOMOUS MOBILE ROBOTS TO DRIVE MARKET

-

8.6 HEALTHCAREUSE OF ROBOTS IN HOSPITALS TO HANDLE LONG QUEUES

-

8.7 RETAILRISING USE OF ROBOTS FOR STOCK MONITORING AND INSPECTION TO BOOST DEMAND

-

8.8 FOOD & BEVERAGESGROWING REQUIREMENT FOR FOOD-GRADE AND WATER-RESISTANT ROBOTS TO FUEL SEGMENT GROWTH

-

8.9 MEDIA & ENTERTAINMENTINCREASED FASCINATION AMONG END-USERS TO DRIVE DEMAND FOR HOME ENTERTAINMENT AND LEISURE ROBOTS

- 8.10 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Rising awareness of benefits of collaborative robots to drive marketCANADA- Increased foreign investments in robotics to drive marketMEXICO- Relaxed regulations for manufacturing and licensing operations to drive market

-

9.3 EUROPEUK- Strong manufacturing industry to push demand for robotsGERMANY- Growth of automobile industry to drive demand for industrial robotsFRANCE- Rising adoption of electric and hybrid vehicles to drive demand for robotsITALY- Increasing automation in small or medium-sized enterprises to propel marketSPAIN- Pharmaceuticals and automotive industries to create huge demand for robotsREST OF EUROPE

-

9.4 ASIA PACIFICCHINA- Growth of automotive and manufacturing industries to drive marketJAPAN- Rise in aging population to boost demand for industrial robotsSOUTH KOREA- Electrical & electronics industry to propel marketINDIA- Market for robotics as a service expected to record highest CAGR during forecast periodREST OF ASIA PACIFIC- Increasing adoption of automation and robotics in manufacturing

-

9.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Automation across industries expected to drive marketSOUTH AMERICA- Increasing use of robotics in various industries to fuel market growth

- 10.1 OVERVIEW

- 10.2 KEY PLAYERS’ STRATEGIES

- 10.3 REVENUE ANALYSIS OF TOP PLAYERS

- 10.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ROBOTICS AS A SERVICE MARKET IN 2022

-

10.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKINGCOMPANY FOOTPRINT, BY VERTICALCOMPANY FOOTPRINT, BY REGION (21 COMPANIES)OVERALL COMPANY FOOTPRINT

-

10.7 STARTUP/SME EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSKUKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBERKSHIRE GREY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCUS ROBOTICS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEXOTEC- Business overview- Products/Solutions/Services offered- MnM viewCYBERDYNE, INC.- Business overview- Products/Solutions/Services offered- MnM viewKNIGHTSCOPE, INC.- Business overview- Products/Solutions/Services offered- Recent developments- Recent developmentsCAJA- Business overview- Products/Solutions/Services offeredHIREBOTICS- Business overview- Products/Solutions/Services offered- Recent developmentsCOBALT ROBOTICS- Business overview- Products/Solutions/Services offered- Recent developments- Recent developmentsRELAY ROBOTICS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsINVIA ROBOTICS- Business overview- Products/Solutions/Services offered- Recent developments

-

11.3 OTHER PLAYERSTEMI USA INC.- Business overviewPROVEN ROBOTICS- Business overviewDOSSAN ROBOTICS INC.- Business overview6 RIVER SYSTEMS, LLC.- Business overviewAVIDBOTS CORP.- Business overviewDILIGENT ROBOTICS INC.- Business overviewGEEKPLUS TECHNOLOGY CO., LTD.- Business overviewHAIROBOTICS- Business overviewMAGAZINO- Business overviewRONAVI ROBOTICS LLC- Business overview

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 COMPANIES AND THEIR ROLE IN ROBOTICS AS A SERVICE ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT (USD)

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON ROBOTICS AS A SERVICE MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 6 VORTEX HIRED HIREBOTICS COBOT WELDER TO OVERCOME LABOR SHORTAGE

- TABLE 7 ATHENA MANUFACTURING PRODUCES SOPHISTICATED COMPONENTS 70% FASTER USING COBOT WELDER

- TABLE 9 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY JAPAN, 2021

- TABLE 10 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY GERMANY, 2021

- TABLE 11 MFN TARIFF FOR INDUSTRIAL ROBOTS, N.E.S., BY ITALY, 2021

- TABLE 12 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 13 MAJOR PATENTS IN ROBOTICS AS A SERVICE MARKET

- TABLE 14 ROBOTICS AS A SERVICE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 NORTH AMERICA: SAFETY STANDARDS FOR ROBOTICS AS A SERVICE MARKET

- TABLE 20 EUROPE: SAFETY STANDARDS FOR ROBOTICS AS A SERVICE MARKET

- TABLE 21 ASIA PACIFIC: SAFETY STANDARDS FOR ROBOTICS AS A SERVICE MARKET

- TABLE 22 ROW: SAFETY STANDARDS FOR ROBOTICS AS A SERVICE MARKET

- TABLE 23 ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 HANDLING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 HANDLING APPLICATION: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 ASSEMBLING & DISASSEMBLING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 28 ASSEMBLING & DISASSEMBLING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 29 DISPENSING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 DISPENSING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 WELDING & SOLDERING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 WELDING & SOLDERING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 PROCESSING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 34 PROCESSING: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 35 OTHERS: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 36 OTHERS: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 38 ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 39 MANUFACTURING: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 MANUFACTURING: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 41 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 46 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 48 MANUFACTURING: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 49 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 51 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 54 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 56 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 57 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 58 AUTOMOTIVE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 59 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 61 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 66 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 AEROSPACE & DEFENSE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 LOGISTICS: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 70 LOGISTICS: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 71 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 72 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 76 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 78 LOGISTICS: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 79 HEALTHCARE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 HEALTHCARE: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 81 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 84 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 86 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 87 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 88 HEALTHCARE: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 89 RETAIL: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 RETAIL: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 91 RETAIL: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 92 RETAIL: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 93 RETAIL: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 RETAIL: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 RETAIL: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 RETAIL: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 RETAIL: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 RETAIL: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 101 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 102 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 103 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 104 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 106 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 107 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 FOOD & BEVERAGES: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 111 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 114 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 118 MEDIA & ENTERTAINMENT: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 OTHERS: ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 120 OTHERS: ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028

- TABLE 121 OTHERS: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 OTHERS: ROBOTICS AS A SERVICE MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 OTHERS: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 124 OTHERS: ROBOTICS AS A SERVICE MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 125 OTHERS: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 126 OTHERS: ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 OTHERS: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 128 OTHERS: ROBOTICS AS A SERVICE MARKET IN ROW, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 ROBOTICS AS A SERVICE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 130 ROBOTICS AS A SERVICE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 134 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 136 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 137 US: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 138 US: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 139 CANADA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 140 CANADA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 141 MEXICO: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 142 MEXICO: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 UK: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 150 UK: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 151 GERMANY: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 152 GERMANY: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 153 FRANCE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 154 FRANCE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 155 ITALY: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 156 ITALY: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 SPAIN: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 158 SPAIN: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 160 REST OF EUROPE: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 164 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 166 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 CHINA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 168 CHINA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 169 JAPAN: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 170 JAPAN: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 171 SOUTH KOREA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 172 SOUTH KOREA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 173 INDIA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 174 INDIA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 ROW: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 178 ROW: ROBOTICS AS A SERVICE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 ROW: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 180 ROW: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 ROW: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 182 ROW: ROBOTICS AS A SERVICE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: ROBOTICS AS A SERVICE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 187 STRATEGIES ADOPTED BY KEY PLAYERS IN ROBOTICS AS A SERVICE MARKET

- TABLE 188 ROBOTICS AS A SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 189 ROBOTICS AS A SERVICE MARKET RANKING ANALYSIS

- TABLE 190 ROBOTICS AS A SERVICE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 191 ROBOTICS AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 192 ROBOTICS AS A SERVICE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2022

- TABLE 193 ROBOTICS AS A SERVICE MARKET: DEALS, 2020–2022

- TABLE 194 KUKA AG: COMPANY OVERVIEW

- TABLE 195 KUKA AG: PRODUCT LAUNCHES

- TABLE 196 KUKA AG: DEALS

- TABLE 197 BERKSHIRE GREY, INC.: COMPANY OVERVIEW

- TABLE 198 BERKSHIRE GREY, INC.: PRODUCT LAUNCHES

- TABLE 199 BERKSHIRE GREY, INC.: DEALS

- TABLE 200 LOCUS ROBOTICS: COMPANY OVERVIEW

- TABLE 201 LOCUS ROBOTICS: PRODUCT LAUNCHES

- TABLE 202 LOCUS ROBOTICS: DEALS

- TABLE 203 EXOTEC: COMPANY OVERVIEW

- TABLE 204 EXOTEC: DEALS

- TABLE 205 CYBERDYNE, INC.: COMPANY OVERVIEW

- TABLE 206 KNIGHTSCOPE, INC.: COMPANY OVERVIEW

- TABLE 207 KNIGHTSCOPE, INC.: PRODUCT LAUNCHES

- TABLE 208 KNIGHTSCOPE, INC.: DEALS

- TABLE 209 CAJA: COMPANY OVERVIEW

- TABLE 210 CAJA: DEALS

- TABLE 211 HIREBOTICS: COMPANY OVERVIEW

- TABLE 212 HIREBOTICS: PRODUCT LAUNCHES

- TABLE 213 HIREBOTICS: DEALS

- TABLE 214 COBALT ROBOTICS: COMPANY OVERVIEW

- TABLE 215 COBALT ROBOTICS: PRODUCT LAUNCHES

- TABLE 216 COBALT ROBOTICS: DEALS

- TABLE 217 RELAY ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 218 RELAY ROBOTICS, INC.: PRODUCT LAUNCHES

- TABLE 219 INVIA ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 220 INVIA ROBOTICS, INC.: DEALS

- FIGURE 1 ROBOTICS AS A SERVICE MARKET: SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 ROBOTICS AS A SERVICE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 RECESSION IMPACT: GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 9 RECESSION IMPACT ON ROBOTICS AS A SERVICE MARKET, 2018–2028 (USD MILLION)

- FIGURE 10 HANDLING APPLICATION SEGMENT TO ACCOUNT FOR HIGHEST MARKET SHARE IN ROBOTICS AS A SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 11 LOGISTICS VERTICAL TO HOLD LARGEST SHARE IN ROBOTICS AS A SERVICE MARKET IN 2023

- FIGURE 12 ROBOTICS AS A SERVICE MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWING NEED FOR AUTOMATION AND ROBOTICS IN LOGISTICS

- FIGURE 14 HANDLING APPLICATION SEGMENT TO DOMINATE ROBOTICS AS A SERVICE MARKET BETWEEN 2023 AND 2028

- FIGURE 15 LOGISTICS SEGMENT TO DOMINATE ROBOTICS AS A SERVICE MARKET BETWEEN 2023 AND 2028

- FIGURE 16 LOGISTICS SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC ROBOTICS AS A SERVICE MARKET IN 2028

- FIGURE 17 INDIA TO REGISTER HIGHEST CAGR IN ROBOTICS AS A SERVICE MARKET BETWEEN 2023 AND 2028

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ROBOTICS AS A SERVICE MARKET

- FIGURE 19 ANALYSIS OF IMPACT OF DRIVERS ON ROBOTICS AS A SERVICE MARKET

- FIGURE 20 ANALYSIS OF IMPACT OF RESTRAINTS ON ROBOTICS AS A SERVICE MARKET

- FIGURE 21 ANALYSIS OF IMPACT OF OPPORTUNITIES ON ROBOTICS AS A SERVICE MARKET

- FIGURE 22 ANALYSIS OF IMPACT OF CHALLENGES ON ROBOTICS AS A SERVICE MARKET

- FIGURE 23 VALUE CHAIN ANALYSIS: ROBOTICS AS A SERVICE MARKET

- FIGURE 24 ECOSYSTEM: ROBOTICS AS A SERVICE MARKET

- FIGURE 25 YC-YCC SHIFT: REVENUE SHIFT FOR ROBOTICS AS A SERVICE MARKET

- FIGURE 26 AVERAGE SELLING PRICES OF ROBOTICS AS A SERVICE OFFERED BY KEY PLAYERS FOR TOP PRODUCTS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2017−2021 (USD THOUSAND)

- FIGURE 31 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR, 2012−2022

- FIGURE 33 HANDLING APPLICATION TO DOMINATE ROBOTICS AS A SERVICE MARKET IN 2028

- FIGURE 34 ASIA PACIFIC TO HOLD LARGEST SHARE OF WELDING & SOLDERING IN ROBOTICS AS A SERVICE MARKET IN 2028

- FIGURE 35 LOGISTICS TO ACCOUNT FOR LARGEST SIZE OF ROBOTICS AS A SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 36 CHINA TO DOMINATE AUTOMOTIVE SEGMENT IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN LOGISTICS VERTICAL DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO HOLD LARGEST SIZE OF FOOD & BEVERAGE VERTICAL DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ROBOTICS AS A SERVICE MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA: ROBOTICS AS A SERVICE MARKET SNAPSHOT

- FIGURE 41 EUROPE: ROBOTICS AS A SERVICE MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: ROBOTICS AS A SERVICE MARKET SNAPSHOT

- FIGURE 43 FIVE-YEAR ANNUAL REVENUE OF TOP PLAYERS IN ROBOTICS AS A SERVICE MARKET, 2017–2021

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ROBOTICS AS A SERVICE MARKET IN 2022

- FIGURE 45 ROBOTICS AS A SERVICE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 46 ROBOTICS AS A SERVICE MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 47 KUKA AG: COMPANY SNAPSHOT

- FIGURE 48 BERKSHIRE GREY, INC.: COMPANY SNAPSHOT

- FIGURE 49 CYBERDYNE, INC.: COMPANY SNAPSHOT

- FIGURE 50 KNIGHTSCOPE, INC.: COMPANY SNAPSHOT

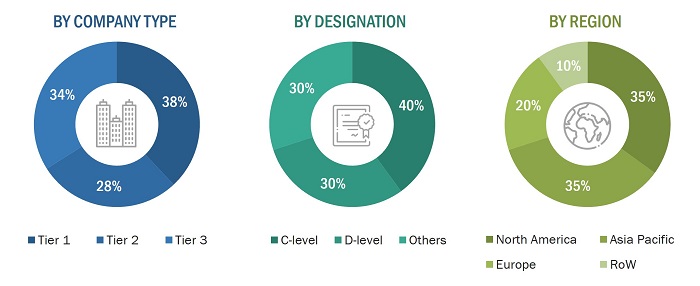

The study involved four major activities in estimating the size of the robotics as a service market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the robotics as a service market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East & Africa and South America).

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the overall robotics as a service market size and the various dependent submarkets. The key players involved in robotics as a service in the market have been identified through secondary research, and their market shares in the respective geographies have been determined through primary and secondary research. The research methodology includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

All the percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to derive the final quantitative and qualitative data. This data is consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation Methodology-Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of robotics as a service market from the subscriptions. Key players have been identified based on several parameters, such as product portfolio analysis, revenue, R&D expenditure, geographic presence, and recent activities.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The main objectives of this study are as follows:

- To define, describe, segment, and forecast the robotics as a service market in terms of value and based on application, vertical, and type (qualitative information)

-

To forecast the market size of the various segments with respect to four main regions:

North America, Europe, Asia Pacific, and the Rest of the World (RoW) - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and their core competencies2 and provide the details of the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, product launches, and research and development (R&D) activities in the robotics as a service market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Robotics as a Service Market