Robotic Manipulator Market by Type (Cartesian, Cylindrical, Polar, Articulated, SCARA, and Delta), by Application (Material Handling, Cutting & Processing, and Soldering & Welding), by Payload, by Axis, by Industry, and Region – Global Forecast to 2030

The International Organization for Standardization (ISO) defines a robotic manipulator as a machine in which the grasping or moving mechanism in several degrees of freedom is achieved by a series of jointed or sliding segments. These are devices that are used in various industries to manipulate articles or materials that are located generally in inaccessible locations.

There are various types of robotic manipulators namely, cartesian, cylindrical, polar, articulated, SCARA, and delta. They are used in various applications such as materials handling, cutting and processing, soldering and welding, and assembling and disassembling applications among others.

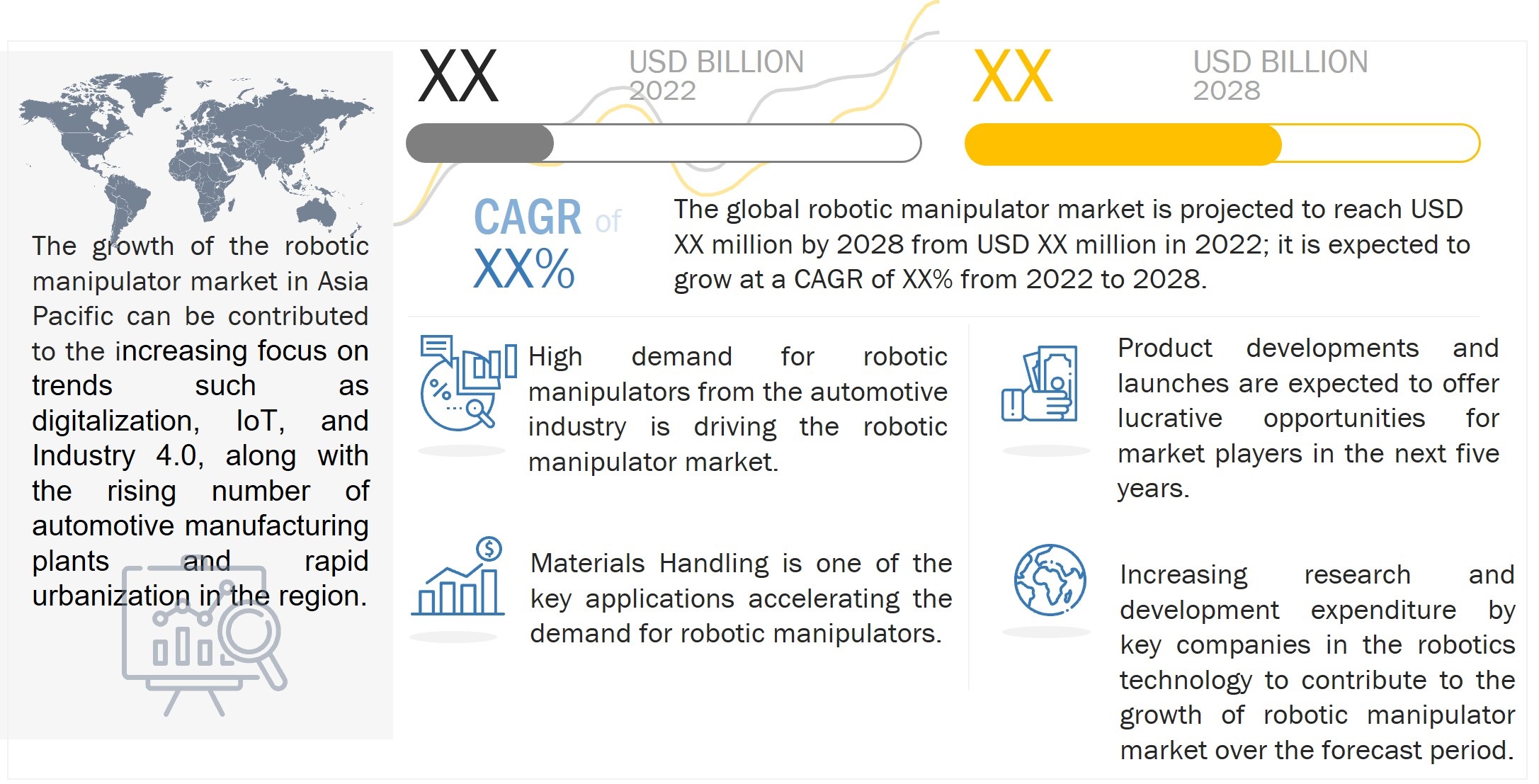

The global robotic manipulator market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. The high adoption of robotic manipulators from the automotive industry is one of the major factors fueling the growth of robotic manipulator market.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Growing adoption of Industry 4.0

Industry 4.0 refers to the current industrial revolution that is led by the evolution of robotics, automation, and the Internet of Things (IoT). Industry 4.0 and the Internet of Things are increasing the automation of previously manual tasks with a collection of real-time data, AI and device interconnectivity. Industry 4.0 has fostered the development of new technologies such as collaborative robots, and AI-enabled robots, allowing industries to use robots to streamline various processes, boost productivity, and minimize errors. The increasing adoption of industry 4.0 in manufacturing across the globe is among the major drivers leading to the growth of robotics as well as robotic manipulators in various industries.

Anticipated shortage of skilled labor in manufacturing industries

The anticipated shortage of laborers in developed countries has fueled the need for automation. Manufacturing industries in the US, Germany, and China have experienced tremendous growth over the past decade; however, they are expected to face a workforce shortage within the next few years. The shortage of labor is especially prevalent in jobs with many repetitive and ergonomically unfavorable tasks, such as packaging and monitoring in the food industry. In the US, the growth of the manufacturing sector, coupled with retiring workers and the reluctance of millennials and Generation Z to enter the manufacturing industries, is expected to create a skill gap in the coming years. To compensate for the shortage, stakeholders must find solutions to improve productivity and substitute human labor. Increasing automation to counter the skill gap is one of the solutions companies are adopting, especially in developed countries.

In China, increasing labor costs and a low robot density (robots installed per thousand workers) have threatened productivity, making it difficult for manufacturers to retain their advantage of low manufacturing costs. In response, the Chinese government has introduced the Made in China 2025 initiative, which provides subsidies for the deployment of industrial robots at workplaces. As a result, China topped the shipment of industrial robots purchased in 2021. This factor is also fueling the growth of robotic manipulators as robotic manipulators are used in industrial robots.

Challenges: Interoperability and integration issues

Interoperability is an important function in any factory or manufacturing unit. A modular framework must exist for both hardware and software to connect and coordinate various automation systems. The focus here is on the software used for programming, diagnosing, and monitoring. It is common for industries to use robot arms from different manufacturers. Companies may also need to reprogram robots due to changes in production and demand or accommodate different parts, such as vision systems and end effectors. It is the responsibility of the integrator, rather than the manufacturer or end user, to decide on the implementation and setup or programming of the robot. Interoperability issues present a big challenge, especially to SMEs, due to their unique requirements and lack of personnel to set up complex automation systems.

Key Market Players:

ABB (Switzerland), Yaskawa (Japan), FANUC (Japan), Kuka (Germany), Mitsubishi Electric (Japan), Kawasaki Heavy Industries (Japan), and DENSO (Japan) are few key players in the robotic manipulator market globally.

- In 2022, GITAI USA Inc. (US), one of the well-known space robotics company, developed "S10," a 10-meter autonomous robotic arm for commercial space stations, which are being developed by several companies in the US.

- In 2021, Blueprint Laboratories (Australia) developed the world’s smallest ROV manipulator that operate in the harsh environment of the ocean floor. The unique selling point of the company’s robotic manipulators and grippers is size. The Reach Alpha 5 is the world’s smallest ROV manipulator, according to Paul. When curled up, it’s only 23x15x4cm and is approximately 58cm at full extension with a dynamic reach of 40cm. The arm is able to lift 2kg of weight at full reach and an axial load rating of 100kg. End-effector closing force is about 600N. The units are designed to operate at depths of up to 300 meters.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1. Objective of the Study

1.2. Market Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered for the Study

1.4. Currency

1.5. Limitations

1.6. Stakeholders

2 RESEARCH METHODOLOGY

2.1. Research Data

2.1.1. Secondary Data

2.1.2. Primary Data

2.2. Market Size Estimation

2.2.1. Bottom-Up Approach

2.2.2. Top-Down Approach

2.3. Market Breakdown and Data Triangulation

2.4. Assumptions

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.2.4. Challenges

5.3. Trends Impacting Customer’s Business

5.4. Pricing Analysis

5.4.1. Average selling Price of Key Players, By Application

5.4.2. Average selling Price Trend

5.5. Value Chain Analysis

5.6. Ecosystem/Market Map

5.7. Technology Analysis

5.8. Patent Analysis

5.8.1. List of Major Patents

5.9. Case Study Analysis

5.10. Trade Analysis

5.11. Tariffs and Regulatory Landscape

5.11.1. Regulations

5.11.2. Regulatory Bodies, Government Agencies and Other Organizations

5.12. Porter’s Five Forces Analysis

5.13. Key Conferences and Events in 2022-2023

5.14. Key Stakeholders and Buying Criteria

5.14.1. Key Stakeholders and Buying Process

5.14.2. Buying Criteria

6 ROBOTIC MANIPULATOR MARKET, BY TYPE

6.1. Introduction

6.2. Cartesian

6.3. Cylindrical

6.4. Polar

6.5. Articulated

6.6. SCARA

6.7. Delta

7 ROBOTIC MANIPULATOR MARKET, BY PAY LOAD

7.1. Introduction

7.2. Up to 16.00 kg

7.3. 16.01–60.00 kg

7.4. 60.01–225.00 kg

7.5. More than 225.00 kg

8 ROBOTIC MANIPULATOR MARKET, BY AXIS

8.1. Introduction

8.2. 1-Axis

8.3. 2-Axis

8.4. 3-Axis

8.5. 4-Axis

8.6. 5-Axis

8.7. 6-Axis

8.8. 7-Axis

9 ROBOTIC MANIPULATOR MARKET, BY APPLICATION

9.1. Introduction

9.2. Materials Handling

9.3. Cutting and Processing

9.4. Soldering and Welding

9.5. Assembling and Disassembling

9.6. Others

10 ROBOTIC MANIPULATOR MARKET, BY INDUSTRY

10.1. Introduction

10.2. Automotive

10.3. Electronics

10.4. Metals & Machining

10.5. Plastics & Polymers

10.6. Food & Beverages

10.7. Healthcare

10.8. Others

11 ROBOTIC MANIPULATOR MARKET, BY GEOGRAPHY

11.1. Introduction

11.2. North America

11.2.1. US

11.2.2. Canada

11.2.3. Mexico

11.3. Europe

11.3.1. UK

11.3.2. Germany

11.3.3. France

11.3.4. Rest of Europe

11.4. APAC

11.4.1. Japan

11.4.2. China

11.4.3. South Korea

11.4.4. Rest of APAC

11.5. Rest of the World (RoW)

11.5.1. Middle East & Africa

11.5.2. South America

12 COMPETITIVE LANDSCAPE

12.1. Introduction

12.2. Top 5 Company Revenue Analysis

12.3. Market Share/Rank Analysis

12.4. Company Evaluation Quadrant

12.5. Competitive Situation and Trends

12.5.1. Product Launches and Developments

12.5.2. Deals

13 COMPANY PROFILE

13.1. Introduction

13.2. Key Companies

13.2.1. FANUC

13.2.2. ABB

13.2.3. KUKA

13.2.4. Yaskawa Electric Corporation

13.2.5. Kawasaki Heavy Industries

13.2.6. Mitsubishi Electric

13.2.7. Adept Technologies

13.2.8. DENSO WAVE

13.2.9. Rockwell Automation

13.2.10. Universal Robots

Note: This ToC is tentative and minor changes are possible as the study progresses.

Growth opportunities and latent adjacency in Robotic Manipulator Market