Robot Operating System Market Size, Share & Industry Trends Analysis Report by Robot Type (Articulated, SCARA, Cartesian, Collaborative, Autonomous Mobile, Parallel), Application (Pick & Place, Testing & Quality Inspection, Inventory Management), End User and Region - Global Forecast to 2028

Updated on : Sep 18, 2024

Robot Operating System Market Size & Share

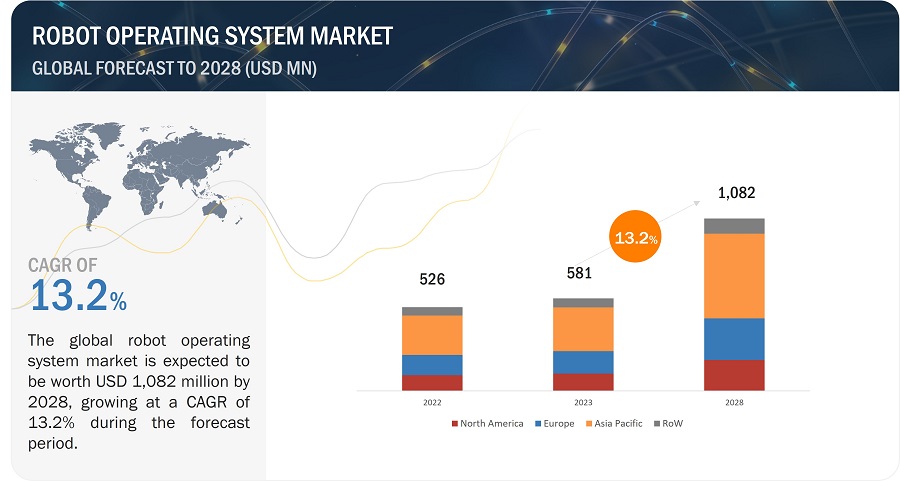

The global robot operating System market size is valued at USD 581 million in 2023 and is projected to reach USD 1,082 million by 2028, growing at a CAGR of 13.2% during the forecast period 2023-2028. The increasing adoption of robot operating system in the automotive industry, are among factors that contribute to the growth of the market.

Robot Operating System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Robot Operating System Market Trends

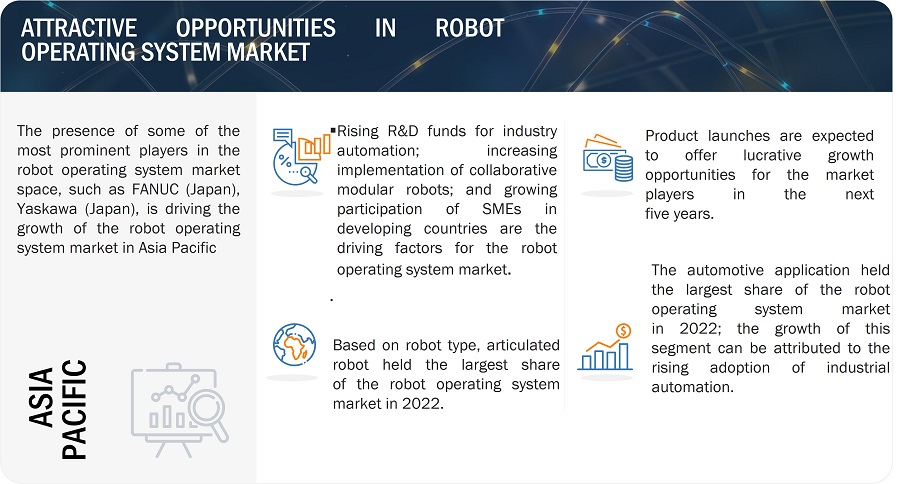

Drivers: Rising R&D fund for industrial automation

The market’s top robot operating system providers, such as ABB (Switzerland), Clearpath Robotics (Canada), Omron Corporation (Japan),Kuka AG (Germany) among others, are continuously investing in R&D activities to balance out the supply-demand chain. To improve the quality of robots as well as develop better robot operating system, companies such as ABB and FANUC (Japan) are looking forward to investing in research and innovation. The strategies such as collaborations and acquisitions are assisting organizations offering robot operating system in expanding their geographic footprints. These business expansions of the major players are creating demand for robot operating system.

Restraints: High installation cost of low-volume production applications

Despite the high rate of adoption of robot operating system among SMEs, most of the SMEs follow the low-volume production scenario due to the presence of more than one production line. The robot operating system is an inevitable process that modifies or reconfigures industrial robots, as it is designed as per the requirements of applications. The cost of reconfiguration and reinstallation of robotic systems is high for low- volume production.

Opportunity: Increasing demand for Robotics-as-a-Service (RaaS) Model

The Robotics-as-a-Service (RaaS) model can meet the growing demand for automation across several startups and multiple cost-sensitive industries, leading to the increasing adoption rate of the RaaS model across the ROS market. It enables robot operating system providers to lease their solutions to their customers in 2 ways: robotics-as-a-cloud service or on rental. The data captured by robots across different locations can be stacked in a centrally stored cloud-based system and accessed by humans.

The RaaS model would ensure seamless data and process flow, without disrupting the existing businesses. Moreover, it would add value to organizations operating many robots, with each robot performing different tasks. On the contrary, businesses that find it difficult to invest in robots leverage the power of robotics by renting robots and subscribing to the shared software model. Manufacturing is one of the leading industries wherein new technologies, such as Internet of Things (IoT), are adopted during predictive maintenance. The RaaS model would be used to manage manual, mundane, repetitive, and hazardous tasks across multiple locations in various industries.

Challenges: Need to safely handle industrial grade operation

Robot operating system is being used in several industrial and service applications. The robot operating system industry is growing at a rapid pace, owing to technological advancements and the integration of automation tools. The applications of robotics have been increasing, from automotive, packaging, distribution, and metalworking to inspection, mobile platforms, and human-machine interaction. However, making industrial robots safe for routine interaction with humans has been a major technological challenge, which the robotics industry has been facing for a long time.

Robot Operating System Market Map:

Autonomous Mobile robots to record a highest CAGR during the forecast period.

Autonomous mobile robots (AMRs) are robotic systems that have the capacity of navigating and operating in changing environments without constant human intervention. These robots are equipped with sensors, perception capabilities, and decision-making algorithms that enable them to perceive and interpret their surroundings, plan their actions, and navigate autonomously to perform tasks.

Robot operating system is widely used in the development of autonomous mobile robots due to its flexibility, modularity, and extensive set of tools and libraries. Few of the applications of robot operating system in autonomous mobile robots are sensing and perception, location and mapping, communication and coordination, simulation and testing among others.

Healthcare segment to showcase significant market growth during the forecast period.

Robot operating system in healthcare provides a common and open system with which hospitals can interconnect, monitor, command, and simulate thousands of robots and other devices, which are already being used in modern hospitals. Robotics improve operational efficiencies by taking over administrative or repetitive clinical tasks, such as monitoring patient vital statistics and logging patient data into the Electronic Health Record (EHR) and surgical precision.As the demand for new drugs and medicines is growing, pharmaceutical companies are continuously looking for new ways to increase productivity, leading to an increased reliance on automated equipment and robotics.

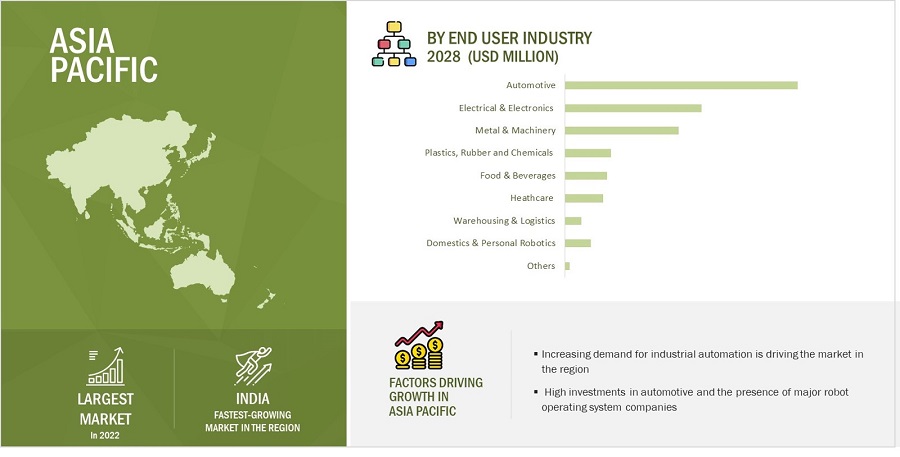

Robot operating system market in Asia Pacific estimated to grow at the fastest rate during the forecast period.

Asia Pacific is expected to have highest CAGR during the forecast period. The rising costs of labor in the Asia Pacific region caused SME industries to start integrating robots in their manufacturing processes to make operations more efficient and cost-effective, hence increase in growth rate during the forecast period.

Robot Operating System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Robot Operating System Companies - Key Market Players

In the robot operating system companies, key and emerging market players include

- ABB Ltd. (Switzerland),

- FANUC (Japan),

- KUKA AG (Germany),

- Yaskawa Electric Corporation (Japan),

- Denso (Japan),

- Microsoft (US),

- Omron Corporation (Japan),

- Universal Robotics (Denmark),

- Clearpath Robots (Canada),

- iRobot Corporation (US).

Robot Operating System Industry Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 581 million in 2023 |

| Projected Market Size | USD 1,082 million by 2028 |

| Robot Operating System Market Growth Rate | CAGR of 13.2% |

|

Robot Operating System Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Unit |

Thousand/Million/Billion |

|

Segments covered |

Robot type, integration with other operating systems, application, end user industry and region |

|

Geographic regions covered |

North America , Europe, Asia Pacific, and RoW |

|

Companies covered |

ABB Ltd. (Switzerland), FANUC (Japan), KUKA AG (Germany), Yaskawa Electric Corporation (Japan), Denso (Japan), Microsoft (US), Omron Corporation (Japan), Universal Robotics (Denmark), Clearpath Robots (Canada), iRobot Corporation (US), Apart from these, Pal Robotics (Spain), Robotnik (Spain), Rethink Robotics (Germany), Stanley Innovation (US), Husarion (Poland), Neobotix (Germany), Shadow Robot (UK), Yamaha Motor (Japan), Estun Automation (China), Shibaura Machine (Japan), Hirata Corporation (Japan), Techman Robot (Taiwan), Franka Emika (Germany), Bosch Rexroth AG (Germany), and Kawasaki Heavy Industries (Japan) |

Robot Operating System Market Highlights

This research report categorizes the market based on robot type, integration with other operating systems, application, end-user industry, and region.

|

Segment |

Subsegment |

|

Integration With Other Operating Systems |

|

|

Based On Robot Type: |

|

|

Based On Application |

|

|

Based On the End-User Industry: |

|

|

Based On Region: |

|

Recent Developments in Robot Operating System Industry

- In March 2023, Clearpath Robotics has launched Husky Observer™, a fully integrated system designed to accelerate inspection solutions. This new configuration of the Husky will enable robotics developers and technology groups to build their inspection solutions and fast track their system development. It is fully supported in robot operating systems, and the robot can be used to program complex autonomous systems.

- In March 2022, FANUC introduced the new CRX-5iA, CRX-20iA/L and CRX-25iA collaborative robots. The latest CRX cobots complement FANUC’s existing line of CR and CRX cobots that now comprises 11 cobot model variations to handle products from 4 to 35 kg.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the robot operating system market?

Product launches, acquisitions, and collaborations have been and continue to be some of the major strategies adopted by the key players to grow in the market.

What region dominates the robot operating system market?

The Asia Pacific region will dominate the market.

What end-user industry dominates the robot operating system market?

Automotive are expected to dominate the market.

Which robot type dominates the robot operating system market?

Articulated robots are expected to have the largest market size during the forecast period.

Who are the major companies in the robot operating system market?

ABB Ltd. (Switzerland), FANUC (Japan), KUKA AG (Germany), Yaskawa Electric Corporation (Japan), Denso (Japan),

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of automated systems to increase industrial production- Increasing deployment of flexible and cost-effective cobots- Focus of robot manufacturers on developing affordable robotic systems for SMEsRESTRAINTS- Complexities in developing optimal designs of modular robots- High installation costs of industrial robotic systemsOPPORTUNITIES- Growing popularity of RaaS model- Rapid technological advancements in roboticsCHALLENGES- Interoperability issues associated with IIoT-powered robots- Requirement for complex robot programming methods

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF INDUSTRIAL ROBOTSAVERAGE SELLING PRICE TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN ROBOT OPERATING SYSTEM MARKET

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGY TRENDS- Integration of industrial robots with vision systemsCOMPLEMENTARY TECHNOLOGIES- Deployment of IIoT and AI technologies in industrial robots

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISRETHINK ROBOTICS OFFERS BAXTER ROBOTS TO MINIMIZE MANUAL LABORCLEARPATH ROBOTICS PROVIDES AUTOMATED VEHICLES TO IMPROVE MINING OPERATIONSWIND RIVER SYSTEMS DEPLOYS VXWORKS ROS IN ROBOTS TO ENSURE CONSOLIDATED CONTROLOMRON CORPORATION DEVELOPS AUTONOMOUS INTELLIGENT VEHICLES TO INCREASE WORKPLACE SAFETY

-

5.11 TRADE ANALYSISTRADE DATA FOR HS CODE 847950

- 5.12 TARIFF ANALYSIS

-

5.13 PATENT ANALYSISLIST OF MAJOR PATENTS

- 5.14 KEY CONFERENCES AND EVENTS, 2022–2024

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO ROBOTICSSTANDARDS AND REGULATIONS RELATED TO ROBOTICS

-

6.1 INTRODUCTIONGAZEBOOPENCVPCLMOVEITROS-INDUSTRIAL

- 7.1 INTRODUCTION

-

7.2 ARTICULATED ROBOTSRELIANCE ON ARTICULATED ROBOTS TO AUTOMATE INDUSTRIAL OPERATIONS TO DRIVE SEGMENTAL GROWTH

-

7.3 SCARA ROBOTSADOPTION OF SCARA ROBOTS IN HIGH-SPEED APPLICATIONS TO CONTRIBUTE TO MARKET GROWTH

-

7.4 PARALLEL ROBOTSDEPLOYMENT OF PARALLEL ROBOTS IN MATERIAL HANDLING AND PACKAGING TO ACCELERATE SEGMENTAL GROWTH

-

7.5 CARTESIAN ROBOTSUSE OF CARTESIAN ROBOTS TO ENSURE INDUSTRIAL WORKSPACE AUTOMATION TO DRIVE MARKET

-

7.6 COLLABORATIVE ROBOTSIMPLEMENTATION OF COLLABORATIVE ROBOTS TO INCREASE EFFICIENCY OF LIGHT-DUTY TASKS TO PROPEL MARKET

-

7.7 AUTONOMOUS MOBILE ROBOTSUTILIZATION OF AUTONOMOUS MOBILE ROBOTS TO MINIMIZE HUMAN INTERVENTION TO FUEL MARKET

- 8.1 INTRODUCTION

-

8.2 PICK & PLACEINCREASING FOCUS OF INDUSTRIAL PLAYERS ON ENHANCING PRODUCTIVITY TO DRIVE SEGMENTAL GROWTH

-

8.3 PLASTIC INJECTION & BLOW MOLDINGPRESSING NEED TO AUTOMATE INJECTION MOLDING MACHINERY OPERATIONS TO BOOST DEMAND FOR ROBOTIC SYSTEMS

-

8.4 PCB HANDLING & ICTSURGING DEMAND FOR ROBOTS TO PERFORM COMPLEX PCB HANDLING & ICT TASKS TO FUEL MARKET GROWTH

-

8.5 TESTING & QUALITY INSPECTIONGROWING USE OF AUTONOMOUS SYSTEMS FOR WORKFLOW EFFICIENCY INSPECTION TO CONTRIBUTE TO MARKET GROWTH

-

8.6 METAL STAMPING & PRESS TRENDINGRISING INSTALLATION OF AUTOMATED METALWORKING TOOLS IN MANUFACTURING PLANTS TO DRIVE MARKET

-

8.7 CNC MACHINE TENDINGINCREASING DEPLOYMENT OF ROBOTS TO PERFORM REPETITIVE MACHINE TENDING TASKS TO SUPPORT MARKET GROWTH

-

8.8 CO-PACKING & END-OF-LINE PACKAGINGSURGING ADOPTION OF ROBOTS TO AUTOMATE PACKAGING TASKS TO BOOST SEGMENTAL GROWTH

-

8.9 MAPPING & NAVIGATIONRISING INTEGRATION OF MAPPING & NAVIGATION FUNCTIONALITIES INTO ROBOTS TO ACCELERATE MARKET GROWTH

-

8.10 INVENTORY MANAGEMENTINCREASING APPLICATIONS OF AUTONOMOUS SYSTEMS IN WAREHOUSE INVENTORY MANAGEMENT TO DRIVE MARKET

-

8.11 HOME AUTOMATION & SECURITYGROWING USE OF ROBOTS IN HOME SURVEILLANCE APPLICATIONS TO FUEL SEGMENTAL GROWTH

-

8.12 PERSONAL ASSISTANCEINCREASING ADOPTION OF ROBOTS TO PERFORM DAILY TASKS TO CONTRIBUTE TO MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVEINCREASING USE OF ROBOTS FOR AUTOMOTIVE SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

-

9.3 ELECTRICAL & ELECTRONICSSURGING DEMAND FOR MINIATURIZED ELECTRICAL & ELECTRONIC EQUIPMENT TO BOOST SEGMENTAL GROWTH

-

9.4 METALS & MACHINERYRISING ADOPTION OF AUTONOMOUS SYSTEMS IN MACHINE-TENDING APPLICATIONS TO FUEL MARKET GROWTH

-

9.5 CHEMICALS, PLASTICS & RUBBERPRESSING NEED TO INSTALL INDUSTRIAL ROBOTICS SYSTEMS IN CHEMICAL, PLASTICS & RUBBER PLANTS TO DRIVE MARKET

-

9.6 FOOD & BEVERAGESHIFT TOWARD AUTONOMOUS TOOLS FOR FOOD & BEVERAGE PACKAGING TO CONTRIBUTE TO SEGMENTAL GROWTH

-

9.7 HEALTHCARERISING DEPLOYMENT OF ROBOTIC SYSTEMS TO ASSEMBLE MEDICAL DEVICES TO ACCELERATE DEMAND

-

9.8 WAREHOUSING & LOGISTICSINCREASING RELIANCE ON ROBOTICS TO AUTOMATE WAREHOUSING & LOGISTICS TASKS TO SUPPORT MARKET GROWTH

-

9.9 DOMESTIC ROBOTICSRISING ADOPTION OF ROS-INTEGRATED PERSONAL ROBOTS TO DRIVE SEGMENTAL GROWTH

- 9.10 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Reliance of SMEs on ROS-powered robots to increase productivity to boost marketCANADA- Requirement for flexible automation systems to contribute to market growthMEXICO- Implementation of automation systems in manufacturing plants to support market growth

-

10.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Rising adoption of robots in manufacturing facilities to drive marketGERMANY- Surging deployment of robotics in EV production plants to boost demandITALY- Increasing use of industrial robots in automobile manufacturing to accelerate market growthFRANCE- Growing adoption for EVs to augment demand for ROS-powered robotsSPAIN- Rising implementation of robots in pharmaceutical and automobile factories to fuel market growthREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Installation of autonomous systems in electrical & electronic facilities to drive ROS demandJAPAN- Deployment of industrial robots to replace manual work to accelerate market growthSOUTH KOREA- Reliance on industrial robotic systems over human workforce to drive marketINDIA- Use of cobots by SMEs in manufacturing sector to contribute to market growthREST OF ASIA PACIFIC

-

10.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- Rising adoption of industrial robotic systems to fuel market growthSOUTH AMERICA- Surging demand for robots to automate manufacturing facilities to boost market

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 11.3 3-YEAR REVENUE ANALYSIS FOR TOP 5 COMPANIES

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFANUC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYASKAWA ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offeredOMRON CORPORATION- Business overview- Products/Solutions/Services offeredUNIVERSAL ROBOTS A/S- Business overview- Products/Solutions/Services offered- Recent developmentsCLEARPATH ROBOTICS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsIROBOT CORPORATION- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSPAL ROBOTICSROBOTNIKRETHINK ROBOTICSSTANLEY INNOVATION, INC.HUSARIONNEOBOTIXSHADOW ROBOT COMPANYYAMAHA MOTOR CO., LTD.ESTUN AUTOMATION CO., LTD.SHIBAURA MACHINE CO., LTD.HIRATA CORPORATIONTECHMAN ROBOT INC.FRANKA EMIKABOSCH REXROTH AGKAWASAKI HEAVY INDUSTRIES, LTD.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ROLE OF COMPANIES IN ROBOT OPERATING SYSTEM ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS BASED ON PAYLOAD CAPACITY

- TABLE 3 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS OFFERED BY TOP 3 COMPANIES (USD)

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 7 USE OF HRC SAFETY SOLUTIONS TO IMPROVE MANUFACTURING PRODUCTIVITY

- TABLE 8 IMPLEMENTATION OF ROBOTIC INTEGRATION PROJECTS TO SUPPORT AGRICULTURAL MANUFACTURING

- TABLE 9 INSTALLATION OF COMPACT ROBOTS TO BOOST PRODUCTION OF RESPIRATORY PROTECTION MASKS

- TABLE 10 DEPLOYMENT OF AUTOMATIC PACKAGING MACHINES TO FACILITATE BULK PALLETIZING

- TABLE 11 ADOPTION OF SCARA ROBOTS TO MINIMIZE HUMAN ERRORS AT MANUFACTURING PLANTS

- TABLE 12 MFN TARIFF FOR INDUSTRIAL ROBOTS EXPORTED BY US, 2022

- TABLE 13 MFN TARIFF FOR INDUSTRIAL ROBOTS EXPORTED BY CHINA, 2022

- TABLE 14 MFN TARIFF FOR INDUSTRIAL ROBOTS EXPORTED BY GERMANY, 2022

- TABLE 15 TOP 20 PATENT OWNERS, 2012–2022

- TABLE 16 MAJOR PATENTS RELATED TO ROBOT OPERATING SYSTEMS

- TABLE 17 ROBOT OPERATING SYSTEM MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 NORTH AMERICA: SAFETY STANDARDS FOR ROBOTICS

- TABLE 23 EUROPE: SAFETY STANDARDS FOR ROBOTICS

- TABLE 24 ASIA PACIFIC: SAFETY STANDARDS FOR ROBOTICS

- TABLE 25 ROW: SAFETY STANDARDS FOR ROBOTICS

- TABLE 26 ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 27 ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 28 ARTICULATED ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 ARTICULATED ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SCARA ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 SCARA ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PARALLEL ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 PARALLEL ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CARTESIAN ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 CARTESIAN ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 COLLABORATIVE ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 COLLABORATIVE ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 AUTONOMOUS MOBILE ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 AUTONOMOUS MOBILE ROBOTS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 AUTOMOTIVE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 AUTOMOTIVE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 ROW: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 ROW: ROBOT OPERATING SYSTEM MARKET FOR AUTOMOTIVE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 ELECTRICAL & ELECTRONICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 ELECTRICAL & ELECTRONICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 55 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 56 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 57 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 58 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 59 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 60 ROW: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 61 ROW: ROBOT OPERATING SYSTEM MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 62 METALS & MACHINERY: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 METALS & MACHINERY: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 65 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 66 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 67 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 68 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 69 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 70 ROW: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 71 ROW: ROBOT OPERATING SYSTEM MARKET FOR METALS & MACHINERY, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 72 CHEMICALS, PLASTICS & RUBBER: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 73 CHEMICALS, PLASTICS & RUBBER: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 74 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 75 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 76 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 77 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 78 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 79 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 80 ROW: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 81 ROW: ROBOT OPERATING SYSTEM MARKET FOR CHEMICALS, PLASTICS & RUBBER, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 82 FOOD & BEVERAGE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 83 FOOD & BEVERAGE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 84 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 85 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 86 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 87 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 88 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 89 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 90 ROW: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 91 ROW: ROBOT OPERATING SYSTEM MARKET FOR FOOD & BEVERAGE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 92 HEALTHCARE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 93 HEALTHCARE: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 95 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 96 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 97 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 98 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 99 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 100 ROW: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 101 ROW: ROBOT OPERATING SYSTEM MARKET FOR HEALTHCARE, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 102 WAREHOUSING & LOGISTICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 103 WAREHOUSING & LOGISTICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 104 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 105 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 106 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 107 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 108 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 109 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 110 ROW: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 111 ROW: ROBOT OPERATING SYSTEM MARKET FOR WAREHOUSING & LOGISTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 112 DOMESTIC ROBOTICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 DOMESTIC ROBOTICS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 115 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 116 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 117 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 118 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 119 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 120 ROW: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 121 ROW: ROBOT OPERATING SYSTEM MARKET FOR DOMESTIC ROBOTICS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 122 OTHERS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 123 OTHERS: ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 124 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 125 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 126 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, 2019–2022 (USD THOUSAND)

- TABLE 127 EUROPE: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, 2023–2028 (USD THOUSAND)

- TABLE 128 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 129 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 130 ROW: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 131 ROW: ROBOT OPERATING SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 132 ROBOT OPERATING SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 133 ROBOT OPERATING SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 137 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 138 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 141 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 143 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 144 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 EUROPE: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 149 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 150 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 ROW: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 153 ROW: ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 154 ROW: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2019–2022 (USD THOUSAND)

- TABLE 155 ROW: ROBOT OPERATING SYSTEM MARKET, BY END-USER INDUSTRY, 2023–2028 (USD THOUSAND)

- TABLE 156 ROW: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 157 ROW: ROBOT OPERATING SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 158 KEY STRATEGIES ADOPTED BY MAJOR COMPANIES, 2019–2023

- TABLE 159 ROBOT OPERATING SYSTEM MARKET: DEGREE OF COMPETITION

- TABLE 160 ROBOT OPERATING SYSTEM MARKET: RANKING ANALYSIS

- TABLE 161 LIST OF KEY STARTUPS/SMES

- TABLE 162 OVERALL COMPANY FOOTPRINT

- TABLE 163 ROBOT TYPE: COMPANY FOOTPRINT

- TABLE 164 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 165 REGION: COMPANY FOOTPRINT

- TABLE 166 PRODUCT LAUNCHES, 2020–2022

- TABLE 167 DEALS, 2020–2022

- TABLE 168 OTHERS, 2019–2022

- TABLE 169 ABB: COMPANY OVERVIEW

- TABLE 170 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 ABB: PRODUCT LAUNCHES

- TABLE 172 ABB: DEALS

- TABLE 173 ABB: OTHERS

- TABLE 174 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 175 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 177 FANUC CORPORATION: DEALS

- TABLE 178 FANUC CORPORATION: OTHERS

- TABLE 179 KUKA AG: COMPANY OVERVIEW

- TABLE 180 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 KUKA AG: PRODUCT LAUNCHES

- TABLE 182 KUKA AG: DEALS

- TABLE 183 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 184 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 YASAKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 186 YASAKAWA ELECTRIC CORPORATION: DEALS

- TABLE 187 YASAKAWA ELECTRIC CORPORATION: OTHERS

- TABLE 188 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 189 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 DENSO CORPORATION: PRODUCT LAUNCHES

- TABLE 191 MICROSOFT: COMPANY OVERVIEW

- TABLE 192 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 194 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 UNIVERSAL ROBOTS A/S: COMPANY OVERVIEW

- TABLE 196 UNIVERSAL ROBOTS A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 UNIVERSAL ROBOTS A/S: PRODUCT LAUNCHES

- TABLE 198 UNIVERSAL ROBOTS A/S: DEALS

- TABLE 199 CLEARPATH ROBOTICS INC.: COMPANY OVERVIEW

- TABLE 200 CLEARPATH ROBOTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 CLEARPATH ROBOTICS INC.: PRODUCT LAUNCHES

- TABLE 202 CLEARPATH ROBOTICS INC.: DEALS

- TABLE 203 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 204 IROBOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RECESSION IMPACT ON ROBOT OPERATING SYSTEM MARKET, 2019–2028 (USD MILLION)

- FIGURE 8 ARTICULATED ROBOTS SEGMENT TO HOLD LARGEST SHARE OF ROBOT OPERATING SYSTEM MARKET IN 2028

- FIGURE 9 AUTOMOTIVE SEGMENT TO DOMINATE ROBOT OPERATING SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN ROBOT OPERATING SYSTEM MARKET BETWEEN 2023 AND 2028

- FIGURE 11 STRONG FOCUS ON INDUSTRIAL AUTOMATION TO ACCELERATE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 12 ARTICULATED ROBOTS SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 13 METALS & MACHINERY SEGMENT TO DEPICT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ROBOT OPERATING SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 ROBOT OPERATING SYSTEM MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 17 ROBOT OPERATING SYSTEM MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 18 ROBOT OPERATING SYSTEM MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 19 ROBOT OPERATING SYSTEM MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 20 ROBOT OPERATING SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS OFFERED BY TOP 3 COMPANIES (USD)

- FIGURE 22 AVERAGE SELLING PRICE OF INDUSTRIAL ROBOTS BASED ON PAYLOAD CAPACITY

- FIGURE 23 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR ROBOT OPERATING SYSTEM PROVIDERS

- FIGURE 24 ROBOT OPERATING SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 27 IMPORT DATA, BY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 28 EXPORT DATA, BY COUNTRY, 2018−2022 (USD MILLION)

- FIGURE 29 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2022

- FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR, 2012−2022

- FIGURE 31 TYPES OF ROBOTICS SIMULATORS AND SOFTWARE

- FIGURE 32 ROBOT OPERATING SYSTEM MARKET, BY ROBOT TYPE

- FIGURE 33 AUTONOMOUS MOBILE ROBOTS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 34 KEY APPLICATIONS OF ROS-BASED ROBOTS

- FIGURE 35 METALS & MACHINERY SEGMENT TO DEPICT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 ROBOT OPERATING SYSTEM MARKET, BY REGION

- FIGURE 37 REGIONAL SNAPSHOT OF ROBOT OPERATING SYSTEM MARKET, 2023–2028

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF ROBOT OPERATING SYSTEM MARKET IN 2023

- FIGURE 39 NORTH AMERICA: ROBOT OPERATING SYSTEM MARKET SNAPSHOT

- FIGURE 40 EUROPE: ROBOT OPERATING SYSTEM MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ROBOT OPERATING SYSTEM MARKET SNAPSHOT

- FIGURE 42 REVENUE ANALYSIS OF TOP 5 PLAYERS IN ROBOT OPERATING SYSTEM MARKET, 2020–2022

- FIGURE 43 ROBOT OPERATING SYSTEM MARKET SHARE ANALYSIS, 2022

- FIGURE 44 COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 46 ABB: COMPANY SNAPSHOT

- FIGURE 47 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 KUKA AG: COMPANY SNAPSHOT

- FIGURE 49 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 52 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 IROBOT CORPORATION: COMPANY SNAPSHOT

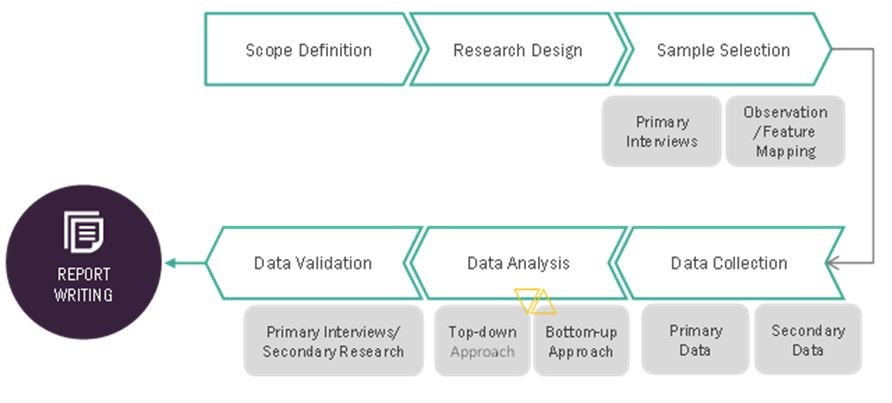

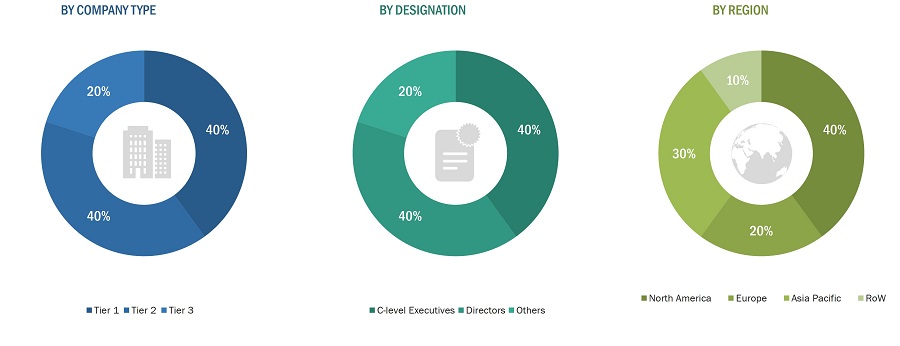

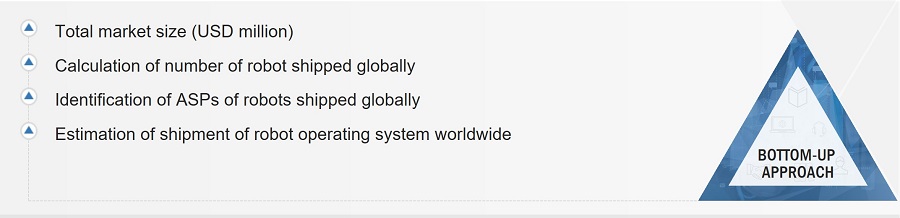

The study involved four major activities in estimating the size of the robot operating system market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players in the robot operating system market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the robot operating system market scenario through secondary research. Several primary interviews have been conducted with experts from the demand (end users) and supply side (robot operating system providers) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the robot operating system market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Robot Operating System Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

The robot operating system is a flexible and collaborative open-source software development framework. It is a special framework that was initially developed by the Stanford AI Laboratory in 2007 for developing robots. ROS provides tools, libraries, and conventions to simplify the creation of complex and robust robot functionalities across various robotic platforms.

The robot operating system acts as a robotic middleware that runs on different operating systems, such as Linux and Windows, which is a typical software platform for developers to build a robot. ROS is not an operating system but an open-source framework that provides hardware abstraction, low-level device control, implementation of commonly used functionalities, message-passing between processes, and package management.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users who want to know more about the technology and the latest technological developments in the industry.

Report Objectives

- To describe, segment, and forecast the robot operating system market based on robot type, application, industry, and region in terms of value.

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the robot operating system market

- To provide a detailed overview of the supply chain and ecosystem pertaining to the robot operating system, along with the average selling prices of the robot operating system

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies about the market under study

- To strategically analyze micromarkets1 about individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market.

- To analyze competitive developments such as product launches and developments, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the robot operating system market

- To strategically profile the key players in the robot operating system market and comprehensively analyze their market ranking and core competencies2.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Robot Operating System Market