Robot Controller, Integrator and Software Market by Type (Controller, Integrator, & Software), Industrial (Articulated, COBOT, SCARA, Cartesian), Service (AGV, AMR, Medical), Software (Predictive Maintenance) Industry and Region - Global Forecast to 2028

Updated on : July 11, 2025

Robot Controller, Integrator and Software Market Summary

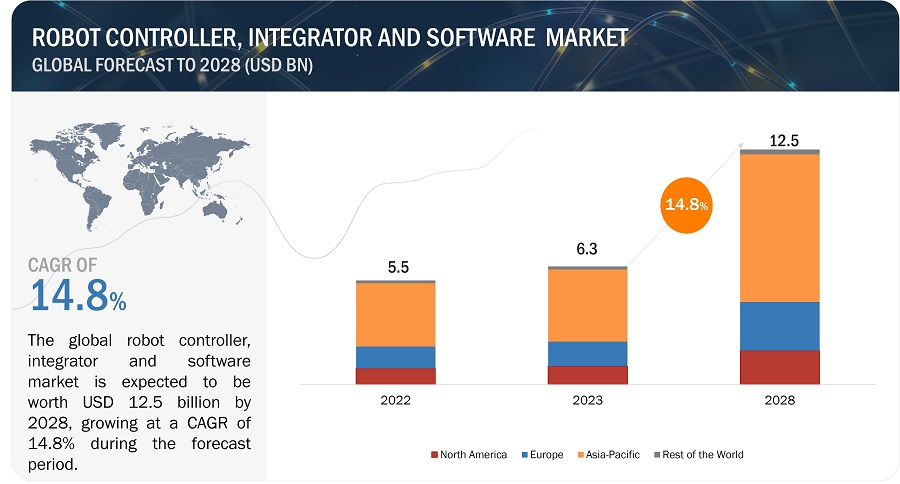

The Robot Controller, Integrator and Software Market size was estimated at USD 5.5 Billion in 2022 and is predicted to increase from USD 6.3 billion in 2023 to approximately USD 12.5 billion by 2028, expanding at a CAGR of 14.8% from 2023 to 2028

Robot Controller, Integrator and Software Market Key Takeaways

-

By witnessing rapid industrial automation, The global Robot Controller, Integrator and Software Market was valued at USD 1.6 Billion, and is projected to reach USD 4.2 Billion by 2028, growing at a CAGR of 21.1% from 2023 to 2028.

-

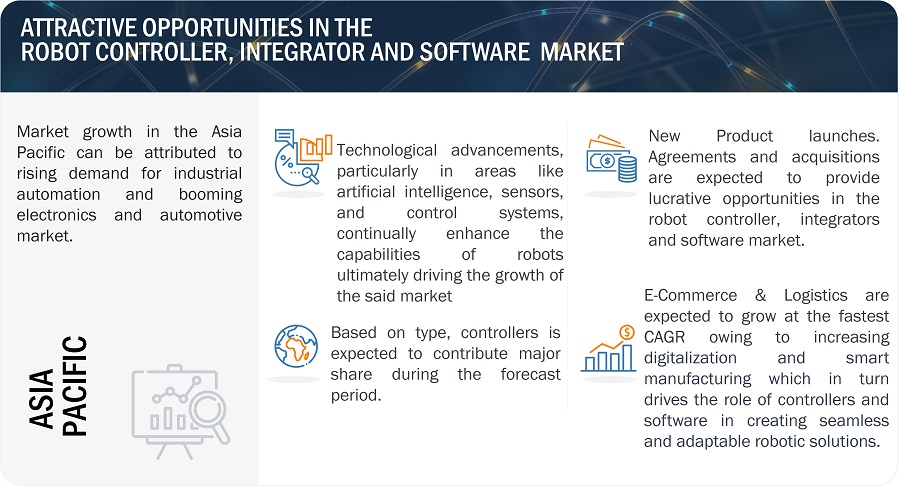

By focusing on cost-effective manufacturing, small and medium enterprises are increasingly adopting robot integration services, especially in regions like Asia Pacific and Europe, to enhance operational efficiency and reduce human error.

-

By experiencing a shift toward collaborative working, the use of robot controllers is expanding, particularly in industries like electronics and automotive, where precision and real-time responsiveness are crucial.

-

By integrating smarter programming interfaces, the demand for intuitive and customizable robot software is gaining momentum, allowing manufacturers to streamline complex processes with greater control and flexibility.

-

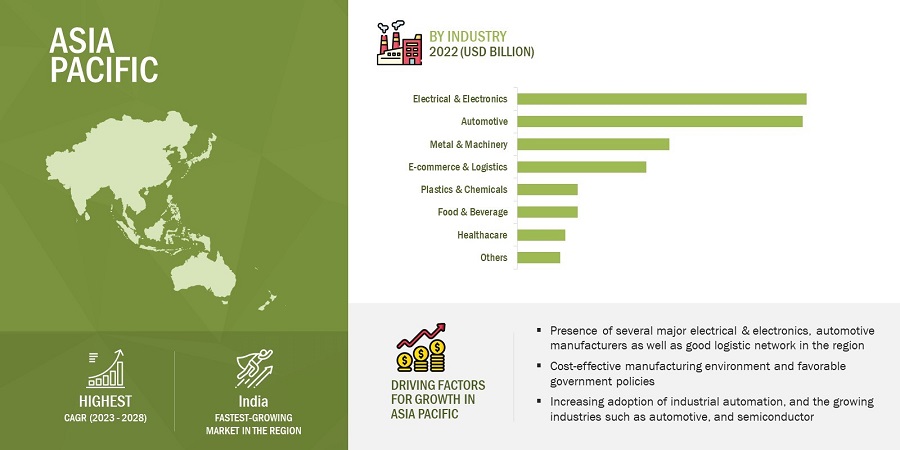

By accelerating factory modernization, Asia Pacific emerges as the fastest-growing region, led by countries like China, Japan, and South Korea, driven by government initiatives and growing investments in smart manufacturing.

-

By bridging the automation talent gap, robot integrators are becoming indispensable partners, enabling industries to deploy robotics without needing in-house expertise—especially vital for companies in North America and Europe.

-

By enhancing cross-platform compatibility, software solutions are being designed to support multiple robot brands and hardware, creating a more open and versatile ecosystem for end-users.

-

By prioritizing safety and scalability, industries such as pharmaceuticals, logistics, and food & beverage are increasingly adopting robotic systems, with tailored integration and control technologies meeting stringent operational requirements.

Market Size & Forecast Report

-

2023 Market Size: USD 1.6 Billion

-

2028 Projected Market Size: USD 4.2 Billion

-

CAGR (2023-2028): 21.1%

-

Asia Pacific market : Highest growth rate

The increasing demand for industrial automation as well as technological advancements in electrical and electronics, automotive and e-commerce, and logistics industries is driving the growth of the robot controller, integrator, and software market. The rising collaboration between robot manufacturers and integrators owing to the need to integrate artificial intelligence, machine learning, and IoT capabilities into robotic systems to amplify their capabilities require advanced robot controller, integrator, and software.

Robot Controller, Integrator and Software Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Robot Controller, Integrator and Software Market Trends:

Driver: Escalated demand for industrial automation in several industris such as automotive, healthcare and electronics

The growing automation in pharmaceuticals, food, automotive, electronics, metal, and packaging is creating a surge in demand for robot controllers, integrators, and software. Automation in the healthcare industry has been advancing to improve efficiency, accuracy, and safety in drug development and manufacturing processes. Advanced robot controllers enable surgeons to execute intricate maneuvers with enhanced skill and precision. Integrators collaborate with medical professionals to develop tailored solutions that align with patient care requirements, facilitating the integration of these robots into surgical workflows. For instance, precision manufacturing and consistent quality are paramount in the automotive sector. Robotic solutions offer the ability to perform intricate tasks with high accuracy, leading to improved assembly line efficiency and reduced errors. Robot controllers and software are crucial in orchestrating these operations, while integrators tailor systems to specific automotive manufacturing needs. The electronics industry relies on high-speed and precision manufacturing processes, miniaturization, and compact devices trends. All these factors are driving the demand for robot controller, integrator, and software industry during the forecast period.

Restraint: Interoperability and workforce skills

As robotics and automation technologies become more prevalent in various industries, there is a growing demand for a skilled workforce that can effectively operate, maintain, and program these robotic systems. Many existing workers does not have the necessary skills to adapt to the changing job landscape brought about by increased automation. Training the current workforce or providing relevant education to future workers can be a time-consuming and costly process. Moreover, The field of robotics is rapidly evolving, and new technologies and techniques emerge regularly. Therefore, ensuring that the workforce remains up to date with the latest advancements can be challenging for employers and employees alike. These factors negatively impact the adoption of robotics and its components.

Opportunity: Expansion of e-commerce and logistics industry

In the past few years mainly post March 2020, the e-commerce industry has witnessed an unprecedented surge in consumer demand, prompting online retailers to actively seek ways to strike a balance between speedy delivery and reduced shipping costs. The e-commerce and logistics sector is experiencing substantial growth, with advanced technologies like AI and Robotics revolutionizing the automation of complex operations in warehouses, logistics hubs, and fulfillment centers. AI-driven warehouse automation has proven highly advantageous in optimizing conveyor operations, maximizing storage utilization, streamlining inventory management, and facilitating comprehensive data collection and analytics, enabling seamless end-to-end logistics management.

Challenge: High Costs associated with integration of robots

The high costs associated with integrating robots represent a significant challenge for the robotics market. Purchasing and installing robotic systems can require a substantial upfront investment. The robots' cost, along with any necessary peripherals, sensors, and end-of-arm tools, can be significant. Additionally, some industries might require specialized robotic solutions, which can further drive up the initial costs. Also, ensuring that robots seamlessly integrate with other machinery and systems within a facility can be challenging and expensive, especially if the existing systems were not designed with automation in mind. These costs may hamper the robot controller, integrator, and software market.

Robot Controller, Integrator and Software Market Ecosystem

The Robot controller, integrator and software market is competitive, with major companies such as ABB Ltd (Switzerland), FANUC (Japan),Yaskawa Electrics (Japan), KUKA (Germany), Mitsubishi Electric (Japan), and numerous small- and medium-sized enterprises. Many players offer both controllers as well as software whilw many players along with components offer integration services. These controllers and software as well as integration services are widely required in automotive, electrical and electronics as well as e-commerce and logistics industries, among others.

Robot Controller, Integrator and Software Market Share

Based on type, the controller segment is expected to account largest market share during the forecast period.

The controller segment is projected to account for a significant market share during the forecast period. The burgeoning market for robot controllers is propelled by a confluence of factors, including escalating demand for automation across industries seeking enhanced operational efficiency and productivity. Rapid technological advancements, featuring faster processing speeds and expanded connectivity options, are driving the adoption of sophisticated robot controllers capable of intricate I/O sequencing, precise motion planning, and seamless communication with diverse devices via field-bus networks. Furthermore, the evolving landscape of manufacturing and logistics, coupled with the need for cost optimization, is fostering the demand for controllers that offer versatile integration, simplified system management, and reduced wiring complexities, fueling the growth of the robot controller segment.

Based on robot type, service robot segment is projected to grow with highest CAGR during the forecast period

The service robot market is propelled by factors including the need to address labor shortages and reduce costs through automation, technological advancements in AI and sensors, and the demand for efficient solutions in e-commerce and logistics. The aging population drives adoption in healthcare and eldercare, while safety concerns in hazardous environments favor robot deployment. Enhanced customer experiences, regulatory support, collaborative technological efforts, and environmental considerations further contribute to the expanding role of service robots across industries, from personalized retail interactions to space exploration and research.

Robot Controller, Integrator and Software Market Regional Analysis

Based on region, Asia Pacific is projected to grow fastest for the robot controller, integrator and software market

The scope of the robot controller, integrator, and software market in the Asia Pacific includes China, Japan, South Korea, India, and the Rest of Asia Pacific. The region is experiencing the fastest growth due to the increasing adoption of industrial automation and the growing automotive and semiconductor industries. As Asia Pacific is a significant automobile manufacturing hub, the adoption of robots are high in the region. The companies such as Toyota, Hyundai, Suzuki, Yamaha, and Nissan have a presence in the countries such as Japan, China, and South Korea.

Robot Controller, Integrator and Software Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Robot Controller, Integrator and Software Companies - Key Market Players:

The robot controller, integrator and software companies is dominated by a few globally established players such as

- ABB (Switzerland),

- FANUC(Japan),

- Yaskawa Electrics (Japan),

- KUKA(Germany),

- Mitsubishi Electric (Japan),

- Denso (Japan),

- ACEITA (US),

- Brain (US),

- Dynamic Robotics (India),

- KEBA (Austria) and so on)

Robot Controller, Integrator and Software Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 6.3 billion in 2023 |

| Projected Market Size | USD 12.5 billion by 2028 |

| Growth Rate | CAGR of 14.8% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

ABB Ltd(Switzerland), FANUC(Japan), Yaskawa Electrics (Japan), KUKA(Germany), Mitsubishi Electric (Japan), Denso (Japan), ACEITA (US), Brain (US), Dynamic Robotics (India), KEBA (Austria) and so on. |

Robot Controller, Integrator and Software Market Highlights

This research report categorizes the robot controller, integrator, and software market based on type, pitch, industry, and region

|

Segment |

Subsegment |

|

Based on type: |

|

|

Based on Robot Type: |

|

|

Based on Industry: |

|

|

Based on the Region: |

|

Recent Developments in Robot Controller, Integrator and Software Industry

- In May 2023, Yaskawa Electric Corporation (Japan) has recently announced a capital and business alliance with Oishii Farm Corporation (US). The objective of this collaboration is to establish global leadership in automation within the agricultural and food sectors.

- In March 2022, Fanuc Corporation (Japan) has launched DR-3iB/6 designed specifically for rigorous washdown environments, the DR-3iB/6 STAINLESS incorporates a completely sealed stainless steel body that provides excellent resistance to chemicals, high pressures, and elevated temperatures

- In December 2021, ABB Ltd launched E10 and V250XT controllers. It delivers top-of-the-line motion control capabilities as well as provide notable energy savings of up to 20 percent. Additionally, these controllers are equipped with built-in digital connectivity, ensuring future compatibility, and offer over 1000 additional functions to address evolving industry demands and changing requirements.

Frequently Asked Questions (FAQ):

Which are the major companies in the robot controller, integrator and software market? What are their major strategies to strengthen their market presence?

The major companies in the robot controller, integrator and software market are – ABB Ltd(Switzerland), FANUC(Japan),Yaskawa Electrics (Japan), KUKA(Germany), Mitsubishi Electric (Japan). The major strategies adopted bsy these players are product launches and developments, collaborations, acquisitions, and expansions.

Which is the potential market for the robot controller, integrator and software in terms of the region?

The Asia Pacific region is expected to dominate the robot controller, integrator and software market due to the presence of leading players from the robot controller, integrator and software market such as FANUC(Japan),Yaskawa Electrics (Japan) and Mitsubishi Electric (Japan),

What are the opportunities for new market entrants?

Opportunities in the robot controller, integrator and software market arise from Industry 4.0 integration, collaborative robotics, AI implementation, and tailored solutions for healthcare, logistics, and service industries. Customization, cybersecurity, energy efficiency, and skill development also offer avenues for innovation and growth in this dynamic market, reflecting the evolving landscape of automation and technological advancement.

What are the drivers and opportunities for the robot controller, integrator and software market?

Factors such as Growing automation in industries is fueling the demand for robot controllers, integrators and software, Rising deployment of robots in critical industries for precision and accuracy as well as rise of Industrial and collaborative robots is fueling the demand for the growth of the robot controller, integrator and software market.

Who are the major end users of the robot controller, integrator and software that are expected to drive the growth of the market in the next 5 years?

The major consumers for the robot controller, integrator and software are electrical and electronics, e-commerce and logistics, and automotive industries. They are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of automation in various industries- Rising deployment of robots by electronic companies to ensure precision and accuracy- Ongoing advancements in robotics technology- Widespread labor shortages and rising labor costs- Emergence of collaborative and industrial robotsRESTRAINTS- Interoperability issues requirement for highly trained and skilled workforceOPPORTUNITIES- Increasing investments by governments in AI and robotics- Rising use of robots to ensure environmental sustainability- Thriving e-commerce and logistics sectorCHALLENGES- High costs associated with integration of robots- Compatibility issues witnessed by end users due to diversity in robotic standards

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISPRICING ANALYSIS OF ROBOT CONTROLLERS, INTEGRATORS, AND SOFTWARE PRODUCTS OFFERED BY KEY PLAYERS, BY TYPEAVERAGE SELLING PRICE OF ROBOT CONTROLLERS PROVIDED BY KEY PLAYERSAVERAGE SELLING PRICE TREND

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISLOCALIZATION AND MAPPINGARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGMOTION PLANNING AND CONTROL ALGORITHMSSENSOR TECHNOLOGIES

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS:THREAT OF SUBSTITUTES:THREAT OF NEW ENTRANTS:

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISACIETA ASSISTS AA PRECISION TOOLING COMPANY TO DEPLOY FANUC ROBOTS TO ENHANCE PRODUCTIVITYKAWASAKI INSTALLS COLLABORATIVE ROBOT AT TOYO ELECTRIC FACILITYWORLD WIDE FITTINGS DEPLOYS SCADAWARE BY MITSUBISHI TO ENHANCE PRODUCTIVITYGRUPO FORTEC IMPLEMENTS ROBOT PALLETING SOLUTION TO HANDLE BULK CERAMIC ADHESIVE PACKAGESJR AUTOMATION INTEGRATES ROBOT TO AUTOMATE SORTING AND PALLETIZING ACTIVITIES

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2025

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS

- 6.1 INTRODUCTION

-

6.2 CONTROLLERSTECHNOLOGICAL ADVANCEMENTS IN ROBOT CONTROLLERS TO OFFER LUCRATIVE OPPORTUNITIES

-

6.3 INTEGRATORSABILITY TO OFFER COMPREHENSIVE AND CUSTOMIZED ROBOTIC SOLUTIONS TO DRIVE MARKET

-

6.4 SOFTWAREINTEGRATION OF SOFTWARE SOLUTIONS TO ENABLE TASK EXECUTION AND AUTOMATE PROCESSES TO BOOST DEMANDSIMULATION- Emphasis on resource and time saving to benefit marketPREDICTIVE MAINTENANCE- Enhanced operational efficiency and minimized downtime to drive marketCOMMUNICATION MANAGEMENT- Increasing use of communication management software for seamless data exchange to drive marketDATA MANAGEMENT AND ANALYSIS- Multi-language support and real-time analytics to offer lucrative opportunitiesRECOGNITION- Integration of AI technology with recognition software to tackle language-related issues to drive market

- 7.1 INTRODUCTION

-

7.2 INDUSTRIAL ROBOTSCOLLABORATIVE ROBOTS- Advancements in AI and ML technologies to drive marketARTICULATED ROBOTS- Ability to perform complex movements to drive marketCARTESIAN ROBOTS- Widespread use across manufacturing, logistics, and e-commerce verticals to boost demandSCARA ROBOTS- High-speed capabilities and precision to drive marketOTHERS

-

7.3 SERVICE ROBOTSAUTONOMOUS GUIDED VEHICLES- Steady production flow due to seamless supply of materials and minimal interruptions to drive marketAUTONOMOUS MOBILE ROBOTS- Increased operational safety to drive marketMEDICAL ROBOTS- Rising use of medical robots in surgeries to improve patient care and increase operational efficiency to drive marketOTHERS

- 8.1 INTRODUCTION

-

8.2 HANDLINGGROWING USE OF ROBOTIC CONTROLLERS IN PICK AND PLACE, PALLETIZING, AND PACKAGING APPLICATIONS

-

8.3 ASSEMBLING & DISASSEMBLINGINCREASING UTILIZATION OF ROBOTS OWING TO THEIR ADVANCE SENSING AND COLLABORATIVE FEATURES

-

8.4 WELDING & SOLDERINGGROWING ADOPTION OF ROBOTICS IN WELDING AND SOLDERING APPLICATIONS OWING TO THEIR ABILITY TO FACILITATE PRECISION CONTROL

-

8.5 DISPENSINGAUTOMOBILE AND PHARMA COMPANIES TO BE KEY USERS OF AUTOMATED DISPENSING SYSTEMS

-

8.6 PROCESSINGINCREASING ADOPTION OF AUTOMATED SYSTEMS OWING TO THEIR POTENTIAL TO HANDLE CUTTING, GRINDING, POLISHING, TASKS WITH GREATER PRECISION

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 AUTOMOTIVEINCREASING COMPETITIVENESS IN AUTOMOTIVE SECTOR TO OFFER LUCRATIVE OPPORTUNITIES

-

9.3 E-COMMERCE & LOGISTICSGROWING WAREHOUSE AUTOMATION TO BOOST MARKET GROWTH

-

9.4 METALS & MACHINERYADOPTION OF INDUSTRY 4.0 PRINCIPLES TO BOOST MARKET

-

9.5 HEALTHCARETECHNOLOGICAL ADVANCEMENTS IN MEDICAL ROBOTS TO DRIVE MARKET

-

9.6 ELECTRICAL & ELECTRONICSIMPLEMENTATION OF ROBOTS IN ELECTRONIC COMPONENT PLACING AND INSPECTION AND TESTING APPLICATIONS TO DRIVE MARKET

-

9.7 FOOD & BEVERAGESPRESSING NEED TO ENHANCE FOOD SAFETY AND QUALITY STANDARDS TO DRIVE MARKET

-

9.8 PLASTICS & CHEMICALSGREATER EMPHASIS OF CHEMICAL COMPANIES ON SAFE AND PRECISE OPERATIONS TO DRIVE MARKET

- 9.9 OTHERS

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

-

10.3 NORTH AMERICA: RECESSION IMPACTUS- Higher investments in automating manufacturing sector to fuel market growthCANADA- Booming automotive industry to create lucrative opportunities for playersMEXICO- Trade agreements between US and Canada to drive market

- 10.4 EUROPE

-

10.5 EUROPE: RECESSION IMPACTGERMANY- Rising focus of automobile and logistics companies on efficient, reliable, and safe operations to foster market growthUK- Strong manufacturing industry to favor market growthFRANCE- Increasing investments in automation and robotics to drive marketITALY- Increasing collaborations between government and industry players to support industrial robotics growth to drive marketREST OF EUROPE

- 10.6 ASIA PACIFIC

-

10.7 ASIA PACIFIC: RECESSION IMPACTCHINA- Government’s initiatives to boost manufacturing sector to drive adoption of automationJAPAN- Rising integration of automation technologies in e-commerce domains to drive marketSOUTH KOREA- Rising level of automation in automotive and consumer electronics verticals to fuel growthINDIA- Increasing adoption of automated tools in food industry to create lucrative opportunitiesREST OF ASIA PACIFIC

- 10.8 ROW

- 10.9 ROW: RECESSION IMPACT

-

10.10 MIDDLE EAST & AFRICAGROWING DEMAND FOR INDUSTRIAL ROBOTS IN MATERIAL HANDLING TO DRIVE MARKET

-

10.11 SOUTH AMERICAFLOURISHING LOGISTICS SECTOR AND GROWING MANUFACTURING CAPACITY TO DRIVE MARKET

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP COMPANIES

- 11.4 MARKET SHARE ANALYSIS, 2022

-

11.5 COMPETITIVE EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: COMPANY FOOTPRINT

- 11.8 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

-

12.1 KEY COMPANIESMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFANUC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYASKAWA ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUKA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDENSO CORPORATION- Business overview- Products/Solutions/Services offeredACEITA- Business overview- Products/Solutions/Services offeredBRAIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsDYNAMIC ROBOTICS- Business overview- Products/Solutions/Services offeredKEBA- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER PLAYERSKAWASAKI HEAVY INDUSTRIES, LTD.OMRON CORPORATIONNACHI-FUJIKOSHI CORP.CLOUDMINDSBASTIAN SOLUTIONS, LLCARTIMINDS ROBOTICS GMBHFH AUTOMATIONAIBRAIN INC.BHS ROBOTICSCOMAUDYNAMIC AUTOMATIONOPEN-SOURCE ROBOTICS FOUNDATION, INC.SHENZHEN INVT ELECTRIC CO., LTDAMTEC SOLUTIONS GROUPEPSON AMERICA, INC.

- 13.1 INTRODUCTION

- 13.2 SMART FACTORY MARKET, BY SOLUTION

-

13.3 MANUFACTURING EXECUTION SYSTEM (MES)RISING FOCUS OF MANUFACTURING FIRMS ON COST SAVINGS AND IMPROVING OPERATIONAL EFFICIENCY TO DRIVE MARKET

-

13.4 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)INCREASING INVESTMENTS IN AUTOMATING AND MANAGING INDUSTRIAL PROCESSES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

-

13.5 PLANT ASSET MANAGEMENT (PAM)ABILITY TO GATHER TIMELY INFORMATION TO BOOST DEMAND

-

13.6 INDUSTRIAL SAFETYGROWING DEMAND FOR SAFETY-CRITICAL CONTROL AND PROTECTIVE SYSTEMS TO DRIVE MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATIONS OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF ROBOT CONTROLLERS PROVIDED BY KEY PLAYER (USD)

- TABLE 3 AVERAGE SELLING PRICE OF ROBOT CONTROLLERS, BY REGION

- TABLE 4 ROBOT, CONTROLLER, INTEGRATORS, AND SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- TABLE 6 KEY BUYING CRITERIA, BY VERTICAL

- TABLE 7 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS, 2013–2023

- TABLE 8 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021–2023

- TABLE 9 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROBOT CONTROLLERS, INTEGRATORS, AND SOFTWARE: STANDARDS AND REGULATIONS

- TABLE 15 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 16 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 17 CONTROLLERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 18 CONTROLLERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 19 INTEGRATORS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 20 INTEGRATORS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 21 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY SOFTWARE TYPE, 2019–2022 (USD MILLION)

- TABLE 22 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY SOFTWARE TYPE, 2023–2028 (USD MILLION)

- TABLE 23 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 24 SOFTWARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 25 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 26 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 27 INDUSTRIAL ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 INDUSTRIAL ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 INDUSTRIAL ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 30 INDUSTRIAL ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 31 SERVICE ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 32 SERVICE ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 SERVICE ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 34 SERVICE ROBOTS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 35 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 36 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 37 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 40 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 41 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 AUTOMOTIVE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 44 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 45 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 46 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 47 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 E-COMMERCE & LOGISTICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 50 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 52 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 53 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 METALS & MACHINERY: ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 56 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 58 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 59 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 HEALTHCARE: ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 62 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 63 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 64 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 65 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 ELECTRICAL & ELECTRONICS: ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 68 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 69 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 70 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 71 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 FOOD & BEVERAGES: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 74 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 76 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 77 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 PLASTICS & CHEMICALS: ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 80 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 81 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2019–2022 (USD MILLION)

- TABLE 82 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE, 2023–2028 (USD MILLION)

- TABLE 83 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 OTHERS: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 92 EUROPE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 ROW: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 100 ROW: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 101 ROW: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 ROW: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 OVERVIEW OF STRATEGIES ADOPTED BY ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE PROVIDERS

- TABLE 104 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SHARE ANALYSIS, 2022

- TABLE 105 OVERALL COMPANY FOOTPRINT

- TABLE 106 TYPE: COMPANY FOOTPRINT

- TABLE 107 APPLICATION: COMPANY FOOTPRINT

- TABLE 108 REGION: COMPANY FOOTPRINT

- TABLE 109 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 110 TYPE: STARTUPS/SMES FOOTPRINT

- TABLE 111 REGION: STARTUPS/SMES FOOTPRINT

- TABLE 112 ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET: PRODUCT LAUNCHES, 2020−2023

- TABLE 113 ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET: DEALS, 2020–2023

- TABLE 114 ROBOT CONTROLLER, INTEGRATOR AND SOFTWARE MARKET: OTHERS, 2020–2023

- TABLE 115 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 116 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 118 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 119 ABB: COMPANY OVERVIEW

- TABLE 120 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 ABB: PRODUCT LAUNCHES

- TABLE 122 ABB: DEALS

- TABLE 123 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 124 FANUC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 FANUC CORPORATION: PRODUCT LAUNCHES

- TABLE 126 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 127 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 129 YASKAWA ELECTRIC CORPORATION: DEALS

- TABLE 130 YASKAWA ELECTRIC CORPORATION: OTHERS

- TABLE 131 KUKA AG: COMPANY OVERVIEW

- TABLE 132 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 KUKA AG: PRODUCT LAUNCHES

- TABLE 134 KUKA AG: DEALS

- TABLE 135 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 136 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 ACEITA: COMPANY OVERVIEW

- TABLE 138 ACEITA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 BRAIN CORPORATION: COMPANY OVERVIEW

- TABLE 140 BRAIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 BRAIN CORPORATION: PRODUCT LAUNCHES

- TABLE 142 BRAIN CORPORATION: DEALS

- TABLE 143 DYNAMIC ROBOTICS: COMPANY OVERVIEW

- TABLE 144 DYNAMIC ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 KEBA: COMPANY OVERVIEW

- TABLE 146 KEBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 KEBA: DEALS

- TABLE 148 SMART FACTORY MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 149 SMART FACTORY MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- FIGURE 1 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SEGMENTATION

- FIGURE 2 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)—REVENUE FROM SALES OF ROBOT CONTROLLERS, INTEGRATORS, AND SOFTWARE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 SOFTWARE SEGMENT TO DISPLAY HIGHEST CAGR, BY TYPE, FROM 2023 TO 2028

- FIGURE 8 INDUSTRIAL ROBOTS TO DOMINATE MARKET, BY ROBOT TYPE, FROM 2023 TO 2028

- FIGURE 9 E-COMMERCE & LOGISTICS TO EXHIBIT HIGHEST CAGR, BY VERTICAL, FROM 2023 TO 2028

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 INCREASING AUTOMATION IN MANUFACTURING INDUSTRIES TO FUEL DEMAND FOR ROBOT CONTROLLERS, INTEGRATORS, AND SOFTWARE IN COMING YEARS

- FIGURE 12 CONTROLLERS CAPTURED LARGEST MARKET SIZE IN 2022

- FIGURE 13 SERVICE ROBOTS TO EXHIBIT HIGHEST CAGR IN 2028

- FIGURE 14 ELECTRICAL & ELECTRONICS VERTICAL AND ASIA PACIFIC TO BE LARGEST STAKEHOLDERS IN MARKET IN 2023

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING 2023–2028

- FIGURE 16 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 18 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 19 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 20 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 21 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SUPPLY CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE ECOSYSTEM

- FIGURE 23 AVERAGE SELLING PRICE OF ROBOT CONTROLLERS PROVIDED BY KEY PLAYERS

- FIGURE 24 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN ROBOT, CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET

- FIGURE 25 ROBOT, CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 28 IMPORT DATA FOR KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 30 TOP 10 COMPANIES ACCOUNTING FOR LARGEST SHARE OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2023

- FIGURE 32 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY TYPE

- FIGURE 33 CONTROLLERS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 34 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY SOFTWARE TYPE

- FIGURE 35 RECOGNITION SOFTWARE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 36 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY ROBOT TYPE

- FIGURE 37 INDUSTRIAL ROBOTS HELD LARGEST MARKET SHARE IN 2022

- FIGURE 38 ARTICULATED INDUSTRIAL ROBOTS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 39 AUTONOMOUS GUIDED VEHICLES CAPTURED LARGEST MARKET SHARE IN 2022

- FIGURE 40 FUNCTIONS OF ROBOT CONTROLLERS AND SOFTWARE

- FIGURE 41 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET, BY VERTICAL

- FIGURE 42 ELECTRICAL & ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 43 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE OF E-COMMERCE & LOGISTICS VERTICAL IN 2028

- FIGURE 44 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE OF ELECTRICAL & ELECTRONICS IN 2028

- FIGURE 45 ASIA PACIFIC TO CAPTURE MAJORITY OF GLOBAL MARKET SHARE DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SNAPSHOT

- FIGURE 47 EUROPE: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET SNAPSHOT

- FIGURE 49 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS, 2018–2022

- FIGURE 50 MARKET SHARE ANALYSIS, 2022

- FIGURE 51 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 52 ROBOT CONTROLLER, INTEGRATOR, AND SOFTWARE MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 53 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 ABB: COMPANY SNAPSHOT

- FIGURE 55 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 KUKA AG: COMPANY SNAPSHOT

- FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT

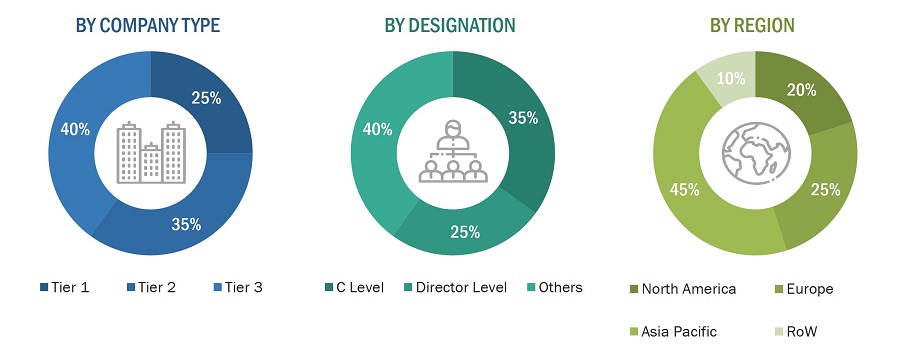

To estimate the size of the robot controller, integrator and software market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the robot controller, integrator, and software market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE NAME |

WEBLINK |

|

International Federation of Robotics |

|

|

International Trade Centre (ITC) |

|

|

World Economic Forum |

|

|

World Trade Organization |

|

|

Semiconductor Equipment and Material (SEMI) |

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using robot controllers, integrators, and software, were also conducted to understand their perspectives on suppliers, products, component providers, and their current and future use of robot controller, integrator and software, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the robot controller, integrator, and software market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Robot controller, integrator, and software Market Size: Botton Up Approach

- Identifying various robot controllers, integrators, and software

- Analyzing the penetration of each component through secondary and primary research

- Analyzing integration of robot controller and software in different applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of the robot controller, integrator, and software and their implementation in multiple industries; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Global Robot controller, integrator, and software Market Size: Top-Down Approach

The top-down approach has been used to estimate and validate the total size of the robot controller, integrator, and software market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the robot controller, integrator, and software market, further splitting the market on the basis of type, robot type, industry, and region and listing the key developments.

- Identifying leading players in the robot controller, integrator, and software market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the robot controller, integrator, and software market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Robot controller integrator and software are essential components of any robotic system. Robot controllers are hardware components that govern the movements and actions of robots, ensuring precise execution of tasks. Integrators are companies or professionals specializing in designing, configuring, and implementing robotic systems tailored to specific industry needs. Software in this context refers to the applications and programs that enable the operation, coordination, and optimization of robotic actions, often incorporating features like artificial intelligence, motion planning, and human-robot interaction. This market plays a crucial role in enabling automation across industries, offering solutions that range from industrial manufacturing and logistics to healthcare and service robotics.

Key Stakeholders

- Logistics and shipment companies

- Robot controllers and software providers

- Robotic Integrators

- Robotic product distributors

- Technology investors

- Governments and financial institutions

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and start-ups

Report Objectives

- To define, describe, and forecast the robot controller, integrator, and software market based on type, robot type, industry, and region.

- To forecast the shipment data of robot controller, integrator, and software market based on offerings.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the robot controller, integrator, and software market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the robot controller, integrator, and software market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the robot controller, integrator, and software market.

Growth opportunities and latent adjacency in Robot Controller, Integrator and Software Market