Robot Arm Market - Global Forecast to 2030

The robot arm consists of different joints, which allow linear and circular motion. Like most articulated robots, collaborative robots also have around 6 or 7 axes but are safe for human contact as defined by the ISO/TS 15066 standard. The arms are designed in such a way that they do not create any pinch points for the operator. For instance, the LBR iiwa and LBR iisy cobots from KUKA have an inherently curved design to remove any pinch points. The joints of collaborative robots are also rounded to minimize the force during impact.

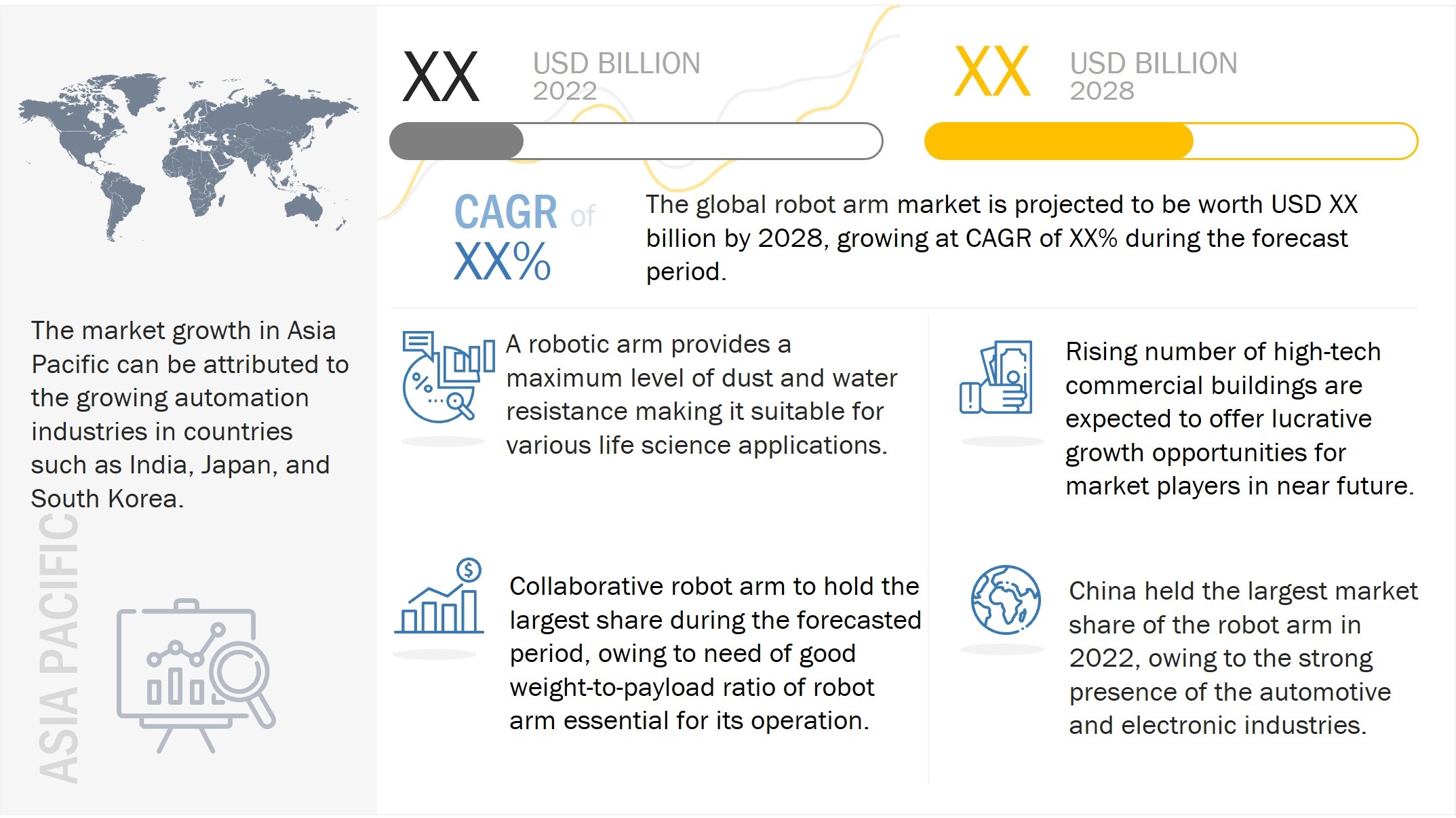

The global robot arm market size is expected to grow from USD XX billion in 2024 to USD XX billion by 2030, at a CAGR of XX% during the forecasted period.

To know about the assumptions considered for the study, Request for Free Sample Report

Robot Arm Market Dynamics

DRIVERS: Emerging applications of collaborative robot arms

Collaborative robots deliver precision and accuracy while packaging to decrease contact with other surfaces, thereby reducing the risk of contamination. Additionally, to comply with the quality demands of the medical device market, cobots are certified to meet strict ISO requirements. Unlike traditional industrial robots, software-driven cobots such as Sawyer from Rethink Robotics are designed to be operated with minimal training and do not require any formal programming knowledge or a roboticist to deploy. This allows manufacturers to expedite successful deployments with minimal technical expertise in programming. Advancements in technology have made it possible to employ collaborative robots to perform surgical processes. Collaborative robot arm can accurately position microscopes, thus giving the surgeon a clear view of surgical angles. This contributes substantially to improving precision in surgical processes. During surgery, collaborative robot arms can be moved manually or using a remote-control device. Hospitals are leveraging cobots in laser bone ablations procedures. The robot makes it easy to cut through bone to remove tumors. A collaborative robot arm can cut through bone without coming into physical contact with the patient using laser technology. Laboratory testing is a strenuous task that involves multiple repetitive processes, making it ideal to adopt the use of robots.

Increased ease of programming of collaborative robots

The major reason for the growth of robot arm is the advancing capabilities of edge computing, due to which cobots are becoming quicker and easier to program, reducing implementation time and investment. Some robots do not require any programming knowledge at all. For instance, Productive Robotics (US) has developed the General Equipment Interface (GEI), a ‘no programming’ software that features drag-and-drop functionality for programming its robots. The company also uses an absolute encoder system in its robots that cost about one-tenth that of a commercial solution, thus lowering the overall cost of the robot. Such intuitive programming software increases flexibility as operators do not need prior programming knowledge to operate cobots; they also have the option of programming collaborative robots using hand guidance.

CHALLENGES: Rising cybersecurity challenges in connected robot arms

Interconnectivity is expected to become increasingly common in a few years, raising concerns over safety and cybersecurity, which will be a critical component in the operation of robot arms. As a robot arm can be connected to cloud servers via a web interface in unprotected computers or handheld devices, the communication with the robot arms may be compromised. Although cybersecurity standards, such as the ISA/IEC 62443, have been developed recently by the International Electrotechnical Commission (IEC) and the International Society of Automation (ISA), implementation is still limited currently. Robot integrators are also expected to share responsibility when programming and deploying a collaborative robot with third-party peripherals such as controllers and vision systems.

Key Market Players:

The automotive oxygen sensor market is dominated by a few globally established players such as ABB, KUKA, FANUC Robotics, Universal Robots, Yaskawa Electric, Omron, and Denso among others.

Recent Developments

- In October 2022, Epson Robots launched VT6L-DC all-in-one 6-Axis Robot to its VT6L-Series product portfolio. VT6L-DC comprise of 6-axis robot arm deployed onto a mobile robotic base provides endless options for positioning the robotic arm and hence suitable for use in life science applications.

- May 2022, Stryker is medical technology company, launched Mako robotic-arm assisted technology for knee and hip replacement and installed at Parkash Hospital in Amritsar (India).

- In November 2021, Geek+ is an autonomous mobile robot manufacturer, launched 8 m high RobotShuttle RS8-DA robot arm. The robot arm is compatible with 8 m high racks, and can handle totes, cartons and boxes of various shapes and used to improve warehouse space by approximately five times to meet an increased demand in E-commerce industry.

- In July 2021, ERA launched in to International Space Station after being launched on a Proton rocket from the Baikonur Cosmodrome, in Kazakhstan. The European Robotic Arm (ERA) is the first robot capable of ‘walking’ around the Russian parts of the orbital complex.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Key Stakeholders

1.6. Summary of Changes

2 Research Methodology

2.1. Research Data

2.2. Secondary Data

2.2.1. Major Secondary Sources

2.2.2. Key Data from Secondary Sources

2.3. Primary Data

2.3.1. Key Data from Primary Sources

2.3.2. Key Participants in Primary Processes across Market Value Chain

2.3.3. Breakdown of Primary Interviews

2.3.4. Key Industry Insights

2.4. Market Size Estimation

2.5. Market Breakdown and Data Triangulation

2.6. Risk Analysis

2.7. Research Assumptions and Limitations

3 Executive Summary

4 Premium Insights

5 Industry Trends and Market Overview

5.1. Introduction

5.2. Value Chain Analysis

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.3.4. Challenges

5.4. Value Chain Analysis

5.5. Market Ecosystem

5.6. Pricing Analysis

5.6.1. Average Selling Price (ASP) of Key Players

5.6.2. Average Selling Price (ASP) Trends

5.7. Trends/Disruptions Impacting Customers

5.8. Technology Analysis

5.9. Key Stakeholders and Buying Criteria

5.9.1. Key Stakeholders and Buying Process

5.9.2. Buying Criteria

5.10. Porter’s Five Forces Analysis

5.11. Case Study Analysis

5.12. Patent Analysis

5.13. Trade Analysis

5.14. Tariffs and Regulatory Landscape

5.14.1. Regulatory Bodies, Government Agencies, and Other Organization

5.14.2. Regulations & Standards

6 Robot Arm Market, By Type

6.1. Introduction

6.2. Traditional Robot Arm

6.3. Collaborative Robot Arm

6.3.1. Articulated

6.3.2. SCARA

6.3.3. Cartesian

6.3.4. Others

7 Robot Arm Market, By Payload Capacity

7.1. Introduction

7.2. 500 Kg

7.3. 500-3000 Kg

7.4. 3000 Kg & above

8 Robot Arm Market, By Axis Type

8.1. Introduction

8.2. Single Axis

8.3. Multi Axis

9 Robot Arm Market, By Industry

9.1. Introduction

9.2. Aerospace & Defense

9.3. Automotive

9.4. Electrical & Electronics

9.5. Oil & Gas

9.6. Metal & Machinery

9.7. Chemicals

9.8. Food & Beverages

9.9. Others

10 Robot Arm Market, By Region

10.1. Introduction

10.2. North America

10.2.1. US

10.2.2. Canada

10.2.3. Mexico

10.3. Europe

10.3.1. UK

10.3.2. Germany

10.3.3. France

10.3.4. Italy

10.3.5. Rest of Europe

10.4. APAC

10.4.1. China

10.4.2. Japan

10.4.3. India

10.4.4. Rest of APAC

10.5. RoW

10.5.1. South America

10.5.2. Middle East

10.5.3. Africa

11 Competitive Landscape

11.1. Overview

11.2. 5-Year Revenue Analysis- Top 5 Companies

11.3. Market Share Analysis: Seamless Biometric Market (Top 5)

11.4. Company Evaluation Quadrant, 2021

11.4.1. Star

11.4.2. Pervasive

11.4.3. Participant

11.4.4. Emerging Leader

11.5. Startup/SME Evaluation Quadrant, 2021

11.5.1. Progressive Companies

11.5.2. Responsive Companies

11.5.3. Dynamic Companies

11.5.4. Starting Blocks

11.5.5. Startup/ SME Data Table

11.6. Company Footprint

11.7. Competitive Benchmarking

11.8. Competitive Situations and Trends

12 Company Profiles

12.1. Introduction

12.2. Key Players

12.2.1. ABB

12.2.2. FANUC Robotics

12.2.3. Universal Robots

12.2.4. Yaskawa Electric

12.2.5. Omron

12.2.6. Kuka Robotics

12.2.7. Mitsubishi Electric

12.2.8. UC Berkley

12.2.9. Denso

12.2.10. Centryco

12.3. Other Key Player

13 Adjacent & Related Market

14 Appendix

Growth opportunities and latent adjacency in Robot Arm Market