Road Marking Materials Market by Type (Performance-based Markings & Paint-based Markings), Application (Road & Highway Marking, Parking Lot Marking, Factory Marking, Airport Marking, and Anti-skid Marking), and Region - Global Forecast to 2025

Updated on : June 18, 2024

Road Marking Materials Market

Road Marking Materials Market was valued at USD 6.1 billion in 2020 and is projected to reach USD 7.5 billion by 2025, growing at 4.4% cagr from 2020 to 2025. The major reasons for the growth of the market include increased spending on safer roads, and new infrastructure and roadway projects in emerging economies, which in-turn act as driving factors for growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Road Marking Materials Market

The pandemic is estimated to have a significant impact on various factors of the value chain of road marking materials, which is expected to reflect during the time period of especially in the year 2020-2021. The various impact of COVID-19 are as follows:

Impact on construction of new facilities: The imposition of COVID-19 lockdowns across the world, has led to many delays in various construction projects globally. For instance the construction of the Silk Route, a high investment project of China, has been witnessing many delays due to the travel restrictions and lockdowns in the South-east Asia region. Also, factors like, delays, loss of efficiency, and cost impacts because of the pandemic are estimated to deter construction activities in many parts of the world. However, relief measures are provided for the middle market and large businesses in the construction industry.

Impact on non-residential construction: Due to the impact of COVID-19, reverse migration and disruption of supply chains, among others are some of the multiple consequences which the construction sector is expected to face. Despite all these factors, the heavy & civil engineering construction sector resumed its activities. For instance, as per the he Ministry of Road Transport and Highways (India) highway construction in the country dropped to 18 km per day as laborers were optimally employed to complete the highways with minimal hindrance. This is estimated to positively impact the road marking materials market in India. Similar is the case in Turkey as well, wherein many roadways and construction projects have been awarded in the year 2020, in-order to revive the economy from the negative impacts of COVID-19

Impact on raw material of road marking materials market: The South-east Asian nations like Singapore, Thailand, and China are some of the major exporters of resins like polyurethane, epoxy and others which are used to manufacture road marking materials. Hence, the lockdowns imposed by various European and Asian countries have severely impacted the raw material supply chain of the road marking materials market, on a global level.

Road Marking Materials Market Dynamics

Driver: Increased spending on safer roads

According to Association of Safe International Road Travel, approximately 1.25 million people die in road crashes each year, on average 3,287 deaths a day across the world. These accidents take place primarily due to the improper road conditions. Safer roads are required to avoid accidents that are caused due to climatic conditions of the region and decreased the visibility of the road markings during the day as well as the night. Governments of various countries such as the US, the UK China, and Switzerland have taken initiatives to improve road conditions and provide proper markings on the roads to decrease the death rate of the people caused due to unsafe roads. This is expected to enhance the use of road marking materials during the forecast period.

Restraint: Conservative approach of road contractors

The conservative approach of road contractors is the main restraints of the road marking materials market. Several road contractors prefer basic and low-cost products, while other contractors demand high-performance solutions at low and competitive prices. This strategy of contractors shrinks coating manufacturer’s margins, hence contracting the road marking materials market.

Opportunity: Smart and autonomous mobility

Autonomous mobility offers an opportunity for road marking materials in the future. Properly installed and well-maintained road markings provide guidance to commuters driving vehicles. Road markings help in the safe and reliable navigation of autonomous vehicles on roadways. According to EuroNAP, the technology in autonomous vehicles works effectively with the help of road markings and traffic signals. Vehicles which fall under the LEVEL 1 to LEVEL 4 are particularly dependent on the road markings to perform efficiently on roads.

Challenge: Certifications for road markings in Nordic countries

Road markings are considered to play a key role in ensuring and enhancing road safety globally. However, their performance is determined by two major factors, the properties of material used in road markings and the weather conditions. The significance of these factors become more prominent in the Nordic regions or during the night. During colder winters, the use of studded tires and winter maintenance demand varied requirements for road marking materials in the Nordic countries in comparison to the rest of the European Union. In order to improve road safety, transport administrations in Sweden, Norway, Denmark, and Iceland established a certification system for road marking material to test their performance in the cold and harsh Nordic climate. These factors pose a challenge to the road marking materials manufacturers.

Performance-based type of road marking material to grow at a high CAGR during the forecast period.

Performance-based type of road marking material is projected to grow with the highest CAGR during the forecast period of 2020-2025. Thermoplastics and cold plastics are the subtypes of performance-based markings. These subtypes of performance-based type of road markings offer advantages like increased durability, lack of VOC components, and excellent reflection properties, as well as an extended life of road markings is required. These factors are expected to drive the performance-based markings growth in the type segment of road marking materials market. These factors are expected to enhance the road marking materials market during the forecast period.

Road & highway markings application are projected to lead the road marking materials market, during the forecast period.

Road & highway markings are estimated to be the largest segment in road marking materials market in 2020. These markings are projected to lead the road marking materials market as they are applied on the largest segment of road markings market, which are the roads and highways. Due to this factor the road & highway markings are supposed to lead the road marking materials market during the forecast period.

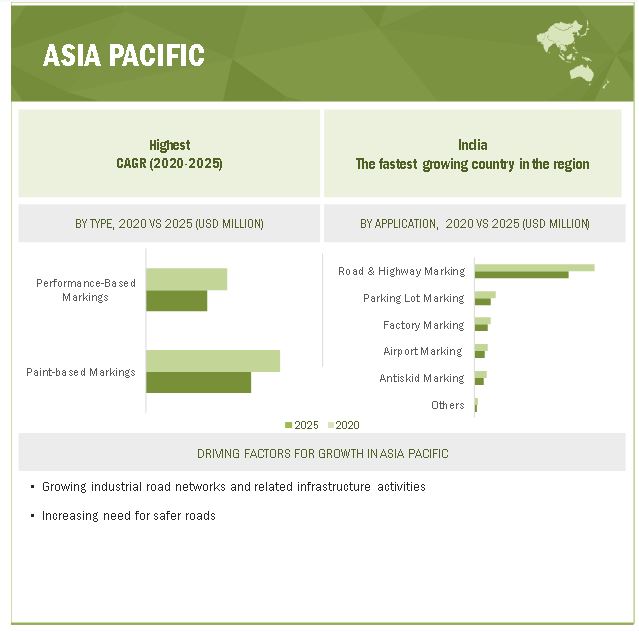

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing market for road marking materials during the forecast period. Factors like growing demand for safer roads as well as the increasing investments in the civil construction sector support the use of road marking materials in the Asia Pacific region, during the forecast period. These factors are expected to boost the demand for road marking materials in Asia Pacific region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Road Marking Materials Market Players

The Sherwin-Williams Company (US), Ennis-Flint, Inc. (US), Geveko Markings (Denmark), SWARCO AG (Austria), and SealMaster (US) are some of the leading players operating in the road marking materials market.

Road Marking Materials Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2025 |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Volume (Million Gallons) and Value (USD Million and USD Billion) |

|

Segments Covered |

Type, Application, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include The Sherwin-Williams Company (US), Ennis-Flint, Inc. (US), SWARCO AG (Austria), Geveko Markings (Denmark), SealMaster (US), 3M (US. (Total of 11 companies) |

This research report categorizes the Road Marking Materials market based on type, application, and region.

Road Marking Materials Market based on Type

The road marking materials market has been segmented as follows:

- Paint-based Marking

- Solvent-based paints

- Water-based paints

- Performance-based Marking

- Thermoplastics

- Cold Plastics

Road Marking Materials Market based on Application

The road marking materials market has been segmented as follows:

- Road & Highway Marking

- Antiskid Marking

- Parking Lot Marking

- Factory Marking

- Airport Marking

- Others (Playground, Sports Court, and Other Facility Markings)

Road Marking Materials Market based on Region

The road marking materials market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In December 2020, Geveko Markings introduced a ViaTherm LongDot road marking which provides better visibility, noise reduction, and increased road safety.

- In July 2019, Basler Lacke acquired HENELIT's HENESPORT ski and snowboard paint business. With its comprehensive experience, its extraordinary commitment and its high level of technical expertise, this acquisition suits very well with the company’s ambition to venture into niche markets.

Frequently Asked Questions (FAQ):

What is the current size of the global road marking materials market?

The global road marking materials market is estimated to be USD 6.1 billion in 2020 and projected to reach to USD 7.5 billion by 2025, at a CAGR of 4.4%.

Who are the winners in the global road marking materials market?

The Sherwin-Williams Company (US), Ennis-Flint, Inc. (US), Geveko Markings (Denmark), SWARCO AG (Austria), and SealMaster (US)., fall under the winners' category. These are leading players in the market, and the products offered by them are mostly used by all end-use industries, such as road & highways, factories, airports, parking lots, and antiskid. One of the most important differentiating factors providing a competitive edge to winners in the market is the extensive adoption of growth strategies, which gives them an enhanced geographical presence in the global road marking materials market.

What is the COVID-19 impact on road marking materials value chain?

COVID-19 outbreak is expected to have a major impact on the supply chain of global demand for road marking materials market. The outbreak and the spread of the COVID-19 led to major supply chain disruptions across the world, thereby resulting in non-delivery of raw materials used for manufacturing road markings. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 ROAD MARKING MATERIALS MARKET: INCLUSIONS & EXCLUSIONS

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

FIGURE 1 ROAD MARKING MATERIALS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 MARKET DEFINITION AND SCOPE

2.2 BASE NUMBER CALCULATION

FIGURE 2 BASE NUMBER CALCULATION APPROACH 1

FIGURE 3 BASE NUMBER CALCULATION APPROACH 2

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 RESEARCH DATA

FIGURE 6 ROAD MARKING MATERIALS MARKET : RESEARCH DESIGN

2.5.1 SECONDARY DATA

2.5.1.1 Key data from secondary sources

2.5.2 PRIMARY DATA

2.5.2.1 Key data from primary sources

2.5.2.2 Key industry insights

2.5.2.3 Breakdown of primary interviews

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.7 ASSUMPTIONS & LIMITATIONS

2.7.1 RESEARCH ASSUMPTIONS

2.7.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 8 PAINT-BASED MARKINGS SEGMENT TO LEAD THE ROAD MARKING MATERIALS MARKET

TABLE 2 ROAD MARKING MATERIALS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 9 PERFORMANCE-BASED MARKINGS TO GROW AT HIGHER CAGR IN THE ROAD MARKING MATERIALS MARKET DURING THE FORECAST PERIOD

FIGURE 10 ROAD & HIGHWAY MARKING PROJECTED TO BE THE LARGEST APPLICATION OF ROAD MARKING MATERIALS DURING THE FORECAST PERIOD

FIGURE 11 APAC TO LEAD THE ROAD MARKING MATERIALS MARKET

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ROAD MARKING MATERIALS MARKET

FIGURE 12 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ROAD MARKING MATERIALS MARKET, BY TYPE

FIGURE 13 PERFORMANCE-BASED MARKINGS TO GROW AT THE HIGHER CAGR DURING THE FORECAST PERIOD

4.3 ROAD MARKING MATERIALS MARKET, BY APPLICATION AND KEY COUNTRIES

FIGURE 14 ROAD & HIGHWAY MARKING SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE

4.4 ROAD MARKING MATERIALS MARKET, BY MAJOR COUNTRIES

FIGURE 15 MARKET IN THE UAE TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ROAD MARKING MATERIALS MARKET

5.2.1 DRIVERS

5.2.1.1 Increased spending on safer roads

5.2.1.2 New infrastructure and roadway projects in emerging economies

5.2.1.3 Safer roads positively impact GDP

5.2.2 RESTRAINTS

5.2.2.1 Conservative approach of road contractors

5.2.3 OPPORTUNITIES

5.2.3.1 Increased prominence of road markings in lane departure warning systems (LDWS)

5.2.3.2 Smart and autonomous mobility

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory policies over solvent-based road markings

5.2.4.2 Certifications for road markings in Nordic countries

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: ROAD MARKING MATERIALS MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECASTS OF GDP

TABLE 3 TRENDS AND FORECAST OF PER CAPITA GDP, BY COUNTRY, 2016–2022 (USD)

5.5 PATENT ANALYSIS

TABLE 4 LIST OF PUBLISHED PATENTS RELATED TO ROAD MARKING MATERIALS

6 IMPACT OF COVID-19 ON THE ROAD MARKING MATERIALS MARKET (Page No. - 49)

FIGURE 18 IMPACT OF COVID-19 IN 2020 (Q1) ON DIFFERENT COUNTRIES

FIGURE 19 THREE SCENARIO-BASED ANALYSES OF IMPACT OF COVID-19 ON THE OVERALL BUSINESS

6.1 DISRUPTION IN THE INDUSTRIAL/COMMERCIAL SECTORS

6.1.1 IMPACT ON THE CONSTRUCTION OF NEW FACILITIES

6.1.2 NON-RESIDENTIAL CONSTRUCTION

6.1.3 HEAVY & CIVIL ENGINEERING CONSTRUCTION

6.2 IMPACT ON VALUE CHAIN & MEASURES TAKEN

6.2.1 CONSTRUCTION MATERIAL SUPPLIERS

6.2.2 LOGISTICS/EQUIPMENT SUPPLIERS

6.2.3 CONSTRUCTION CONTRACTORS/CONSULTANTS

FIGURE 20 IMPACT ON THE VALUE CHAIN OF THE CONSTRUCTION INDUSTRY

6.3 LARGEST GAINERS, BY TOP SECTORS

6.3.1 HEAVY & CIVIL ENGINEERING

6.4 LARGEST LOSERS, BY SECTOR

6.4.1 NON-RESIDENTIAL

6.5 IMPACT ON RAW MATERIALS/SUPPLIERS

7 ROAD MARKING MATERIALS MARKET, BY TYPE (Page No. - 56)

7.1 INTRODUCTION

7.1.1 IMPACT OF COVID-19 ON THE ROAD MARKING MATERIALS MARKET, BY TYPE

FIGURE 21 PERFORMANCE-BASED MARKINGS SEGMENT TO GROW AT A HIGHER CAGR IN THE ROAD MARKING MATERIALS MARKET

TABLE 5 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 6 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 7 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 8 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

7.2 PAINT-BASED MARKINGS

7.2.1 PAINT-BASED MARKINGS ARE COST-EFFECTIVE AND EFFICIENT ROAD MARKINGS

7.2.1.1 Impact of COVID-19

FIGURE 22 ASIA PACIFIC PROJECTED TO BE THE LARGEST PAINT-BASED ROAD MARKING MATERIALS MARKET

TABLE 9 PAINT-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 PAINT-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 11 PAINT-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (MILLION GALLONS)

TABLE 12 PAINT-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (MILLION GALLONS)

7.3 PERFORMANCE-BASED MARKINGS

7.3.1 PERFORMANCE-BASED MARKINGS SEGMENT IS GROWING FASTER OWING TO EFFICIENCY IN VARIED WORKING CONDITIONS

7.3.1.1 Impact of COVID-19

TABLE 13 PERFORMANCE-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 PERFORMANCE-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 15 PERFORMANCE-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (MILLION GALLONS)

TABLE 16 PERFORMANCE-BASED ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (MILLION GALLONS)

8 ROAD MARKING MATERIALS MARKET, BY APPLICATION (Page No. - 64)

8.1 INTRODUCTION

8.1.1 IMPACT OF COVID-19 ON ROAD MARKING MATERIALS MARKET, BY APPLICATION SEGMENTATION

FIGURE 23 AIRPORT MARKING TO BE THE FASTEST-GROWING APPLICATION OF ROAD MARKING MATERIALS

TABLE 17 ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 18 ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

8.2 ROAD & HIGHWAY MARKING

8.2.1 ROAD & HIGHWAY MARKING IS THE LARGEST APPLICATION DUE TO ITS COST-EFFECTIVE TRAFFIC SAFETY SOLUTION

8.2.1.1 Impact of COVID-19

FIGURE 24 ASIA PACIFIC TO BE LARGEST MARKET IN ROAD & HIGHWAY MARKING APPLICATION

TABLE 19 ROAD MARKING MATERIALS MARKET SIZE IN ROAD & HIGHWAY MARKING, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 ROAD MARKING MATERIALS MARKET SIZE IN ROAD & HIGHWAY MARKING, BY REGION, 2020–2025 (USD MILLION)

8.3 PARKING LOT MARKING

8.3.1 PARKING LOT MARKING ENABLES SMOOTH TRAFFIC FLOW AND PARKING SPACES

8.3.1.1 Impact of COVID-19

TABLE 21 ROAD MARKING MATERIALS MARKET SIZE IN PARKING LOT MARKING, BY REGION, 2016–2023 (USD MILLION)

TABLE 22 ROAD MARKING MATERIALS MARKET SIZE IN PARKING LOT MARKING, BY REGION, 2020–2025 (USD MILLION)

8.4 FACTORY MARKING

8.4.1 FACTORY MARKING ENSURES SAFE INDUSTRIAL OR WORK ENVIRONMENT

8.4.1.1 Impact of COVID-19

TABLE 23 ROAD MARKING MATERIALS MARKET SIZE IN FACTORY MARKING, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 ROAD MARKING MATERIALS MARKET SIZE IN FACTORY MARKING, BY REGION, 2020–2025 (USD MILLION)

8.5 AIRPORT MARKING

8.5.1 AIRPORT MARKING PROVIDES AN ESSENTIAL VISUAL AID TO THE AIR TRAFFIC

8.5.1.1 Impact of COVID-19

TABLE 25 ROAD MARKING MATERIALS MARKET SIZE IN AIRPORT MARKING, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 ROAD MARKING MATERIALS MARKET SIZE IN AIRPORT MARKING, BY REGION, 2020–2025 (USD MILLION)

8.6 ANTISKID MARKING

8.6.1 ANTISKID SURFACES ACT AS A WARNING TO ROAD USERS

8.6.1.1 Impact of COVID-19

TABLE 27 ROAD MARKING MATERIALS MARKET SIZE IN ANTISKID MARKING, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 ROAD MARKING MATERIALS MARKET SIZE IN ANTISKID MARKING, BY REGION, 2020–2025 (USD MILLION)

8.7 OTHERS

TABLE 29 ROAD MARKING MATERIALS MARKET SIZE IN OTHER MARKINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 ROAD MARKING MATERIALS MARKET SIZE IN OTHER MARKINGS, BY REGION, 2020–2025 (USD MILLION)

9 ROAD MARKING MATERIALS MARKET, BY REGION (Page No. - 75)

9.1 INTRODUCTION

FIGURE 25 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE ROAD MARKING MATERIALS MARKET

TABLE 31 ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 33 ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2016–2019 (MILLION GALLONS)

TABLE 34 ROAD MARKING MATERIALS MARKET SIZE, BY REGION, 2020–2025 (MILLION GALLONS)

TABLE 35 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 36 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 37 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 38 ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 39 ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 40 ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SNAPSHOT

TABLE 41 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 42 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 43 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION GALLONS)

TABLE 44 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION GALLONS)

TABLE 45 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 46 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 47 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 48 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 49 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 50 ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.1 CHINA

9.2.1.1 The increasing importance of good road safety practices in line with the country’s National Road Safety Strategy to augment market growth

9.2.1.2 Impact of COVID-19 on China

TABLE 51 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 52 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 53 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 54 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 55 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 56 CHINA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.2 INDIA

9.2.2.1 Upcoming infrastructure projects and growing urbanization is fueling the demand for road marking materials

9.2.2.2 Impact of COVID-19 on India

TABLE 57 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 58 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 59 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 60 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 61 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 62 INDIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.3 JAPAN

9.2.3.1 Traffic safety programs and similar initiatives will supplement the growth of the market

9.2.3.2 Impact of COVID-19 on Japan

TABLE 63 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 64 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 65 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 66 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 67 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 68 JAPAN: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 Infrastructure improvements, safety campaigns, and awareness programs to provide opportunities for market growth

9.2.4.2 Impact of COVID-19 on South Korea

TABLE 69 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 70 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 71 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 72 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 73 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 74 SOUTH KOREA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.2.5 REST OF ASIA PACIFIC

TABLE 75 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 76 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 77 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 78 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 79 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 80 REST OF ASIA PACIFIC: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 27 EUROPE: ROAD MARKING MATERIALS MARKET SNAPSHOT

TABLE 81 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 82 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 83 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION GALLONS)

TABLE 84 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION GALLONS)

TABLE 85 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 87 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 88 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 89 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increased spending on expansion of road networks is boosting the demand for road marking materials

9.3.1.2 Impact of COVID-19 on Germany

TABLE 91 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 92 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 93 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 94 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 95 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 GERMANY: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Stringent road safety measures to increase the demand for road marking materials

9.3.2.2 Impact of COVID-19 on the UK

TABLE 97 UK: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 98 UK: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 99 UK: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 100 UK: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 101 UK: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 102 UK: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.3 RUSSIA

9.3.3.1 Increasing infrastructure development and expanding road network to drive the market

9.3.3.2 Impact of COVID-19 on Russia`

TABLE 103 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 104 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 105 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 106 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 107 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 RUSSIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.4 FRANCE

9.3.4.1 Introduction of efficient road safety products and solution to augment the market growth

9.3.4.2 Impact of COVID-19 on France

TABLE 109 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 110 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 111 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 112 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 113 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 FRANCE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.5 TURKEY

9.3.5.1 Growing number of road accidents are increasing the need for proper road safety measures

9.3.5.2 Impact of COVID-19 Impact on Turkey

TABLE 115 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 117 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 118 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 119 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 120 TURKEY: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 121 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 122 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 123 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 124 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 125 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 126 REST OF EUROPE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4 NORTH AMERICA

FIGURE 28 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SNAPSHOT

TABLE 127 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 128 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 129 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION GALLONS)

TABLE 130 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION GALLONS)

TABLE 131 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 132 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 133 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 134 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 135 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 136 NORTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.1 US

9.4.1.1 Strong safety initiatives by the government to drive the road marking materials market

9.4.1.2 Impact of COVID-19 on the US

TABLE 137 US: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 138 US: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 139 US: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 140 US: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 141 US: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 142 US: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.2 CANADA

9.4.2.1 Heavy investments in road safety to benefit the road marking materials market

9.4.2.2 Impact of COVID-19 on Canada

TABLE 143 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 144 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 145 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 146 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 147 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 148 CANADA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.4.3 MEXICO

9.4.3.1 Road network expansion and increasing infrastructure development is contributing to market growth

9.4.3.2 Impact of COVID-19 on Mexico

TABLE 149 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 150 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 151 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 152 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 153 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 154 MEXICO: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

FIGURE 29 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SNAPSHOT

TABLE 155 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION GALLONS)

TABLE 158 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION GALLONS)

TABLE 159 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 162 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 163 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Increased usage of high-quality materials and services for overall road safety to drive the road marking materials market

9.5.1.2 Impact of COVID-19 on Saudi Arabia

TABLE 165 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 166 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 167 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 168 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 169 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 170 SAUDI ARABIA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.2 UAE

9.5.2.1 Need for increased road safety owing to rising road accidents to drive the demand for road marking materials

9.5.2.2 Impact of COVID-19 on the UAE

TABLE 171 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 172 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 173 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 174 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 175 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 176 UAE: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 177 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 180 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 181 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST & AFRICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6 SOUTH AMERICA

FIGURE 30 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SNAPSHOT

TABLE 183 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 184 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 185 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2016–2019 (MILLION GALLONS)

TABLE 186 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY COUNTRY, 2020–2025 (MILLION GALLONS)

TABLE 187 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 188 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 189 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 190 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 191 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 192 SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Increasing government participation to promote road safety to drive the road marking materials market

9.6.1.2 Impact of COVID-19 on Brazil

TABLE 193 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 194 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 195 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 196 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 197 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 198 BRAZIL: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Need for road safety to reduce road accident related fatalities to drive the demand for road marking materials

9.6.2.2 Impact of COVID-19 on Argentina

TABLE 199 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 200 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 201 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 202 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 203 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 204 ARGENTINA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

9.6.3.1 Impact of COVID-19 on Chile

TABLE 205 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 206 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 207 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2016–2019 (MILLION GALLONS)

TABLE 208 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY TYPE, 2020–2025 (MILLION GALLONS)

TABLE 209 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 210 REST OF SOUTH AMERICA: ROAD MARKING MATERIALS MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 159)

10.1 OVERVIEW

FIGURE 31 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND SEPTEMBER 2020

10.2 MARKET RANKING

10.2.1 RANKING OF KEY MANUFACTURERS OF ROAD MARKING MATERIALS IN 2019

FIGURE 32 RANKING OF KEY MANUFACTURERS OF ROAD MARKING MATERIALS, 2019

10.3 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 PARTICIPANTS

FIGURE 33 ROAD MARKING MATERIALS MARKET: COMPETITIVE LANDSCAPE MAPPING, 2019

10.4 STRENGTH OF PRODUCT PORTFOLIOS

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ROAD MARKING MATERIALS MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ROAD MARKING MATERIALS MARKET

10.6 SME MATRIX, 2019

10.6.1 STAR

10.6.2 EMERGING COMPANIES

10.6.3 PERVASIVE

10.6.4 EMERGING LEADERS

FIGURE 36 ROAD MARKING MATERIALS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

10.7 KEY MARKET DEVELOPMENTS

TABLE 211 DEALS, 2017–2020

TABLE 212 PRODUCT LAUNCHES, 2018–2020

TABLE 213 OTHERS, 2017–2020

11 COMPANY PROFILES (Page No. - 171)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

11.1.1 THE SHERWIN-WILLIAMS COMPANY

FIGURE 37 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 38 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

11.1.2 AXIMUM

FIGURE 39 AXIMUM: COMPANY SNAPSHOT

11.1.3 3M

FIGURE 40 3M: COMPANY SNAPSHOT

11.1.4 ENNIS-FLINT, INC.

FIGURE 41 ENNIS-FLINT, INC.: SWOT ANALYSIS

11.1.5 SWARCO AG

FIGURE 42 SWARCO AG: SWOT ANALYSIS

11.1.6 GEVEKO MARKINGS

FIGURE 43 GEVEKO MARKINGS: SWOT ANALYSIS

11.1.7 SEALMASTER

FIGURE 44 SEALMASTER: SWOT ANALYSIS

11.1.8 REMBRANDTIN LACK GMBH NFG. KG

11.1.9 CROWN TECHNOLOGY, LLC

11.1.10 OZARK MATERIALS LLC

11.1.11 BASLER LACKE SWITZERLAND

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 ASIAN PAINTS PPG PVT. LIMITED

11.2.2 AUTOMARK TECHNOLOGIES (INDIA) PVT. LTD.

11.2.3 KELLY BROS

11.2.4 REDA NATIONAL CO.

11.2.5 REDA NATIONAL CO.

11.2.6 KESTREL

11.2.7 AMPERE SYSTEM

11.2.8 HITEX INTERNATIONAL GROUP

11.2.9 KATALINE GROUP

12 APPENDIX (Page No. - 196)

12.1 DISCUSSION GUIDE

12.2 NOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

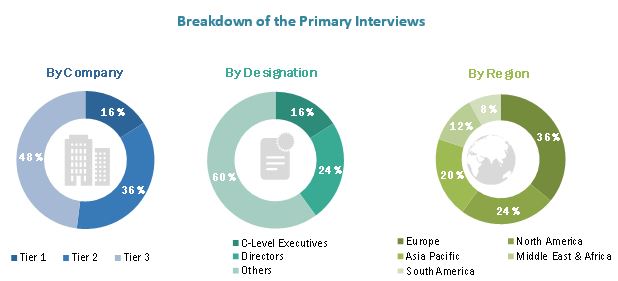

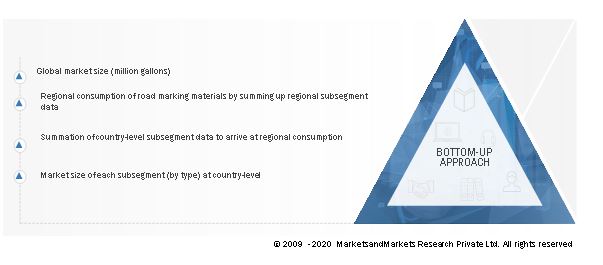

The study involved four major activities in estimating the current size of the road marking materials market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the road marking materials value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The road marking materials market comprises several stakeholders, such as raw material suppliers of road marking materials, manufacturers, distributors, end-use industry participants of different segments of the road marking materials market, associations and industrial bodies, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the road marking materials market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the road marking materials market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various application sectors.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the road marking materials market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the road marking materials market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size of road marking materials, in terms of value and volume

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define and segment the market size by type and application

- To forecast the size of the market on the basis of regions as North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, with their key countries

- To provide a competitive landscape of the stakeholders and market leaders

- To strategically identify and profile the key market players and analyze their core competencies1 in the market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of a region with respect to a particular country

- Details and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Road Marking Materials Market

CR reflecting centre line highway marking paint and TP paints market

intereseted in market information on Road Marking Materials Market by Type, Application and Region

Key challenges and restraints of road marking market