Riboflavin Market by Source (Plant and Animal), Form (Food & Beverages, Dietary Supplements, Pharmaceutical, Cosmetics & Personal Care, Animal Feed) and Region - Global Forecast to 2027

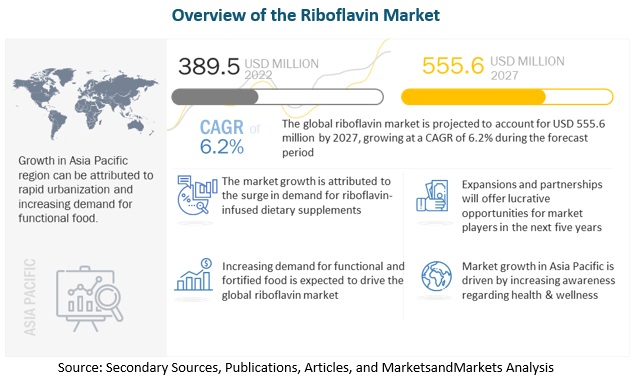

According to MarketsandMarkets, the global riboflavin market is estimated to be valued at USD 389.5 million in 2022 and is projected to reach USD 555.6 million by 2027. The market is expected to grow with a CAGR of 6.2%, in terms of value between 2022 and 2027. Riboflavin, or vitamin B2, assists many enzymes with multiple daily functions in the body. The market is majorly driven by increasing consumer awareness regarding health & wellness and rising demand for dietary supplements.

Riboflavin Market Dynamics

Drivers: Increasing awareness regarding health and wellness among consumers

In recent years, consumers have become more aware about their health. They are increasingly incorporating dietary supplements in their daily routine. This is expected to drive the consumption and demand for riboflavin-infused supplements.

Restraints: Certain characteristics of riboflavin hinders its growth

Riboflavin is very sensitive to humidity. It becomes less stable in humid environment. Hence, this property of riboflavin is expected to restrain the growth of the market.

Opportunities: Increasing use of riboflavin in cosmetics & personal care industry

Riboflavin is increasingly being used in cosmetic & personal care products and offering lucrative growth opportunities. Riboflavin helps in dealing with fine lines and wrinkles. It also assists in improving skin tone and balancing natural oils.

Challenges: High price of riboflavin

High prices associated with riboflavin and riboflavin products act as a major challenge for companies operating in the market. This factor hinders the growth of global riboflavin market.

By source, the animal segment is expected to dominate the global riboflavin market

Riboflavin is sourced from two sources namely animals and plants. Among these two, animal segment acquires the major market share in the global riboflavin market.

By application, the dietary supplements segment is projected to grow in the forecasted period

On the basis of application, the dietary supplements segment is expected to grow in the coming years. Riboflavin is increasingly being used in supplements owing to its multi-utility. Riboflavin-infused supplements are gaining popularity among the consumers.

Asia Pacific region is expected to dominate the global riboflavin market. The growth of the Asia Pacific riboflavin market is majorly driven by consumers being more aware of health & wellness and the rising per capita income of consumers in the region. Along with this, riboflavin is increasingly being used in various application areas.

Key Market Players:

Key players in this market include BASF SE (Germany), DSM (Netherlands), Hubei Guangji Pharmaceutical Co Ltd (China), NB Group Co., Ltd. (China), Shanghai Acebright Pharmaceuticals Group Co., Ltd. (China), Xinfa Pharmaceutical Co. Ltd (China), Hegno (China), Duchefa Biochemie (Netherlands), Supriya Lifescience Ltd. (India), Harman Finochem Ltd (India), and Ningxia Qiyuan Pharmaceutical Co. (China).

FAQs:

- Which are the major sources of riboflavin considered in this study and which segments are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for food & beverage segment and dietary supplement segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the riboflavin market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 RIBOFLAVIN MARKET, BY SOURCE

7.1 INTRODUCTION

7.2 PLANT

7.3 ANIMAL

8 RIBOFLAVIN MARKET, BY APPLICATION

8.1 INTRODUCTION

8.2 FOOD & BEVERAGES

8.3 DIETARY SUPPLEMENTS

8.4 PHARMACEUTICAL

8.5 COSMETICS & PERSONAL CARE

8.6 ANIMAL FEED

9 RIBOFLAVIN MARKET, BY FORM

9.1 INTRODUCTION

9.2 DRY

9.3 LIQUID

10 RIBOFLAVIN MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

12 COMPANY PROFILES

12.1 BASF SE

12.2 DSM

12.3 HUBEI GUANGJI PHARMACEUTICAL CO LTD

12.4 NB GROUP CO., LTD.

12.5 SHANGHAI ACEBRIGHT PHARMACEUTICALS GROUP CO., LTD.

12.6 XINFA PHARMACEUTICAL CO. LTD

12.7 HEGNO

12.8 DUCHEFA BIOCHEMIE

12.9 SUPRIYA LIFESCIENCE LTD.

12.10 HARMAN FINOCHEM LTD

Note: Currently, list of only 10 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Riboflavin Market