RF Mems Switch & Electromechanical RF Relays Market - Global Forecast to 2030

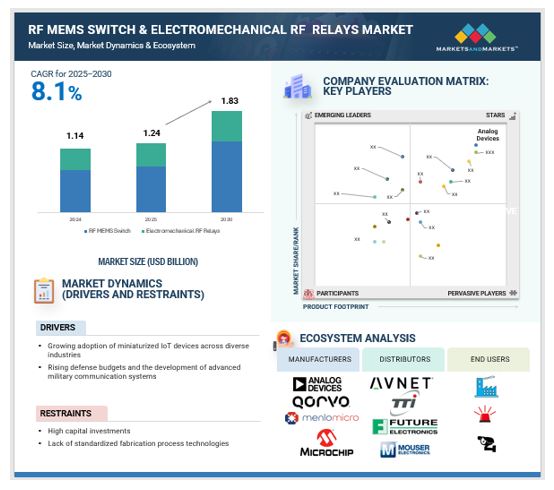

The global RF MEMS switch & Electromechanical RF relays market is estimated to reach USD 1.83 billion in 2030 from USD 1.24 billion in 2025, at a CAGR of 8.1% during the forecast period. The MEMS technology drives advancements in the IoT, automotive, and smart home industries, offering significant opportunities for sensor manufacturers in a rapidly growing market. Rising military expenditure boosts demand for RF MEMS switches and EM relays in advanced defense communication systems, favored for their durability and performance in extreme conditions.

Attractive Opportunities in the RF MEMS switch & Electromechanical RF relays Market

Market Dynamics

Driver: Growing adoption of miniaturized IoT devices across diverse industries

MEMS technology enhances RFID, Bluetooth, and smart devices in smart homes, factories, and the automotive industry. It is integral to smart thermostats, security systems, and industrial automation applications. According to CompTIA, Inc., the projected increase in connected IoT devices, expected to reach USD 15.9 billion by 2030, presents substantial opportunities for MEMS sensor manufacturers and suppliers to capitalize on this expanding market. MEMS technology powers ADAS and V2X in automotive and supports remote monitoring in healthcare devices. Its role is crucial for miniaturized IoT devices in automotive, healthcare, and smart homes.

Restraint: High capital investments

Establishing manufacturing facilities for RF MEMS switches and EM relays requires significant capital investment. The initial setup costs for cleanrooms, foundries, and high-precision fabrication equipment are substantial, creating a barrier for new entrants and smaller companies. The production of RF MEMS switches and EM relays involves intricate microfabrication processes such as lithography, etching, and bonding. These processes demand specialized expertise and resources, contributing to high production expenses and complexity. Manufacturing RF MEMS switches and EM relays is time-consuming, with complex stages including wafer fabrication, assembly, and testing. Fluctuations in material supply, obsolescence, and changing customer preferences can lead to production delays and supply shortages, increasing lead times.

Opportunity: Expansion of 5G networks and the increasing demand for high-speed data transmission

As 5G technology expands, the demand for components supporting these advanced networks surges. RF MEMS switches and EM relays are critical in developing 5G infrastructure because they can handle high-frequency signals with precision and reliability. According to 5G Americas, in April 2023, the global 5G network reported remarkable growth, with a 76% increase in connections from the end of 2021 to 1.05 billion by the end of 2022 and a projected reach of a staggering 5.9 billion by 2027. North America showed strong adoption, with a 5G penetration of 32%. It added 52 million 5G connections annually, totaling 215 million by 2023. The continuous expansion of 5G networks signifies a significant opportunity for the RF MEMS Switch and EM Relays Market. RF MEMS switches are key in 5G networks, improving signal routing and processing in high-frequency millimeter-wave environments to address signal integrity challenges. The GSMA's 2023 report forecasts 5G to overtake 4G by the decade's end, fueled by network expansions and affordable devices. This will create significant growth opportunities for the RF MEMS switch and EM relay market. In April 2022, Menlo Micro (California) introduced a DC-to-6 GHz RF MEMS switch featuring an integrated charge pump driver circuit designed specifically for 5G networks and high-power RF applications.

Challenge: Lack of standardized fabrication process technologies

The lack of standardized fabrication processes for RF MEMS switches and EM relays complicates large-scale production, raising costs and extending development cycles. High customization costs and research efforts deter smaller companies from entering the market, limiting competition and innovation. Inconsistent quality control and testing due to the absence of standardization can undermine customer confidence, particularly in safety-critical applications, slowing market adoption.

RF MEMS switch to account for the largest market share during the forecast period

RF MEMS switches' rapid switching speed enhances their performance in high-frequency applications, driving their adoption over traditional EM RF relays. RF MEMS switches consume significantly less power than EM RF relays, enhancing energy efficiency in portable and battery-powered devices. The CAGR of RF MEMS Switches is higher than that of Electromechanical RF Relays because RF MEMS switches offer superior miniaturization and integration capabilities, making them ideal for compact and multifunctional RF devices.

3 GHz – 20 GHz segment of RF MEMS switch to register highest CAGR during the forecast period

3 GHz – 20 GHz is poised to have high CAGR due to advancements in satellite communication to drive the need for high-frequency RF MEMS switches and relays. Rising demand for compact and high-performance devices fuels the adoption of RF MEMS switches in high-frequency applications. The growing demand for 5G infrastructure also boosts RF MEMS switch usage in high-frequency applications.

Wireless communication application of RF MEMS switches to register the highest CAGR during the forecast period

Wireless Communication has the highest CAGR due to the Increasing demand for high-speed data transmission, which drives the need for advanced RF MEMS switches in 5G networks and next-gen wireless systems. The growing adoption of IoT devices necessitates enhanced wireless communication components, boosting RF MEMS switch requirements for efficient connectivity and data handling. RF MEMS switches enable precise testing at 8-18 GHz, ensuring accurate high-frequency power measurements. The growing demand for high-frequency devices in 5G drives the need for advanced testing equipment. Testing hot-switching behavior in MEMS switches ensures performance under high-power RF conditions without failure. Expanding usage of high-power RF systems, such as radar and satellite, requires robust hot-switch testing.

Key Market Players

The RF MEMS switch & Electromechanical RF relays market is dominated by globally established players, which are listed below:

- Analog Devices

- Qorvo

- Menlo Micro

- Bright Toward Industrial Co., LTD.

- Guilin GLsun Science and Tech Group Co.,LTD.

- Microchip Technology Inc.

- Panasonic Corporation of North America

- Omron Corporation

- Teledyne Technologies Incorporated

- JFW Industries, Inc.

- Infinite Electronics International, Inc.

- Core Components, Inc.

- Mini-Circuits

- TE Connectivity

Future Outlook

- Increased Adoption in Telecommunications: The demand for RF MEMS switches and electromechanical RF relays is expected to grow significantly in the telecommunications industry, driven by the expansion of 5G networks and the impending development of 6G technology. RF MEMS switches offer low insertion loss and high isolation, making them ideal for use in 5G infrastructure, such as antenna tuning and reconfigurable RF front ends. Electromechanical RF relays, known for their reliability and ability to handle high power, will continue to be integral in legacy systems and in scenarios where power handling is crucial. The growth of 6G technology will further amplify the demand for advanced switching solutions, enhancing the performance and reliability of future communication networks.

- Advancements in Miniaturization and Integration: Ongoing advancements in miniaturization and integration of RF MEMS switches will open new opportunities in compact and multifunctional electronic devices, particularly in consumer electronics and IoT applications. RF MEMS switches, with their ability to be integrated into semiconductor chips, are well-suited for this purpose. These advancements will enable the development of highly integrated systems for consumer electronics, such as smartphones and wearable devices, and for IoT applications, where space and power efficiency are critical

TABLE OF CONTENTS

1.Introduction

1.1.Study Objectives

1.2.Market Definition and Scope

1.2.1.Inclusions and Exclusions

1.3.Study Scope

1.3.1.Markets Covered

1.3.2.Geographic Segmentation

1.3.3.Years Considered for the study

1.4.Currency

1.5.Limitations

1.6.Stakeholders

2.Research Methodology

2.1.Research Data

2.1.1.Secondary Data

2.1.1.1.Major Secondary Sources

2.1.1.2.Key Data from Secondary Sources

2.1.2.Primary Data

2.1.2.1.Primary Interviews with Experts

2.1.2.2.Key Data from Primary Sources

2.1.2.3.Key Industry Insights

2.1.2.4.Breakdown of Primaries

2.2.Market Size Estimation

2.2.1.Bottom-Up Approach

2.2.1.1.Approach for Capturing Market Share by Bottom-Up Analysis (Demand Side)

2.2.2.Top-Down Approach

2.2.2.1.Approach for Capturing Market Share by Top-Down Analysis (Supply Side)

2.3.Market Breakdown and Data Triangulation

2.4.Research Assumptions

2.5.Risk Assessment

2.6.Limitations of Research

3.Executive Summary

4.Premium Insights

5.Market Overview

5.1.Introduction

5.2.Market Dynamics

5.3.Trends/Disruptions Impacting Customer’s Business

5.4.Pricing Analysis

5.4.1.Average Selling Price Trend of Key Players

5.4.2.Average Selling Price Trend, By Region

5.5.Value Chain Analysis

5.6.Ecosystem Analysis

5.7.Investment and Funding Scenario

5.8.Technology Analysis

5.8.1.Key Technology

5.8.2.Complementary Technology

5.8.3.Adjacent Technology

5.9.Patent Analysis

5.10.Trade Analysis

5.11.Key Conferences and Events (2025-2026)

5.12.Case Study Analysis

5.13.Tariff and Regulatory Landscape

5.13.1.Regulatory Bodies, Government Agencies, and Other Organizations

5.13.2.Key Regulations

5.14.Porters Five Force Analysis

5.14.1.Threat from New Entrants

5.14.2.Threat of Substitutes

5.14.3.Bargaining Power of Suppliers

5.14.4.Bargaining Power of Buyers

5.14.5.Intensity of Competitive Rivalry

5.15.Key Stakeholders and Buying Criteria

5.15.1.Key Stakeholders in Buying Process

5.15.2.Buying Criteria

5.16.Impact of AI on the RF MEMS Switch & Electromechanical RF Relays Market

6.RF MEMS Switch & Electromechanical RF Relays Market, by Product Type

6.1.Introduction

6.2.RF MEMS Switch

6.3.Electromechanical RF Relays

7.RF MEMS Switch Market, by Frequency Range

7.1.Introduction

7.2.Upto 3 GHz

7.3.3 GHz – 20 GHz

7.4.Above 20 GHz

8.RF MEMS Switch & Electromechanical RF Relays Market, by Application

8.1.Introduction

8.2.Test and Measurement

8.3.Wireless Communication

8.4.Radar Systems

8.5.Satellite Systems

8.6.Broadcasting

9.RF MEMS Switch & Electromechanical RF Relays Market, By End-use Industry

9.1.Introduction

9.2.Consumer Electronics

9.3.Telecommunication

9.4.Automotive

9.5.Industrial

9.6.Military & Defense

9.7.Others

10.RF MEMS Switch & Electromechanical RF Relays Market, By Region

10.1.Introduction

10.2.North America

10.2.1.Macroeconomic Factors

10.2.2.US

10.2.3.Canada

10.2.4.Mexico

10.3.Europe

10.3.1.Macroeconomic Factors

10.3.2.UK

10.3.3.Germany

10.3.4.France

10.3.5.Italy

10.3.6.Rest of Europe

10.4.Asia Pacific

10.4.1.Macroeconomic Factors

10.4.2.China

10.4.3.Japan

10.4.4.South Korea

10.4.5.India

10.4.6.Rest of Asia Pacific

10.5.RoW

10.5.1.Macroeconomic Factors

10.5.2.Middle East

10.5.2.1.GCC Countries

10.5.2.2.Rest of Middle East

10.5.3.Africa

10.5.4.South America

11.RF MEMS Switch & Electromechanical RF Relays Market, Competitive Landscape

11.1.Introduction

11.2.Key Player Strategies/Right-to-Win

11.3.Revenue Analysis of Top 5 Players

11.4.Market Share Analysis

11.5.Company Valuation and Financial Metrics

11.6.Brand/Product Comparison

11.7.Company Evaluation Matrix: Key Players, 2024

11.7.1.Stars

11.7.2.Emerging Leaders

11.7.3.Pervasive Players

11.7.4.Participants

11.7.5.Company Footprint: Key Players, 2024

11.7.5.1.Company Footprint

11.7.5.2.Region Footprint

11.7.5.3.Application Footprint

11.8.Company Evaluation Matrix: Startups/SMEs, 2024

11.8.1.Progressive Companies

11.8.2.Responsive Companies

11.8.3.Dynamic Companies

11.8.4.Starting Blocks

11.8.5.Competitive Benchmarking: Startups/SMEs, 2024

11.8.5.1.Detailed List of Key Startups/SMEs

11.8.5.2.Competitive Benchmarking of Key Startups/SMEs

11.9.Competitive Situation and Trends

12.RF MEMS Switch & Electromechanical RF Relays Market, Company Profiles

12.1.Key Players

12.1.1.Analog Devices

12.1.2.Qorvo

12.1.3.Menlo Micro

12.1.4.Bright Toward Industrial Co., LTD.

12.1.5.Guilin GLsun Science and Tech Group Co.,LTD.

12.1.6.Microchip Technology Inc.

12.1.7.Panasonic Corporation of North America

12.1.8.Omron Corporation

12.1.9.Teledyne Technologies Incorporated

12.1.10.JFW Industries, Inc.

12.1.11.Infinite Electronics International, Inc.

12.1.12.Core Components, Inc.

12.1.13.Mini-Circuits

12.1.14.TE Connectivity

12.2.Other Players

13.Appendix

13.1.Discussion Guide

13.2.Knowledge Store: MarketsandMarkets’ Subscription Portal

13.3.Available Customizations

13.4.Related Reports

13.5.Author Details

Note 1: The above list of companies is tentative and might change during the due course of research.

Note 2: The current table of contents is tentative and is subject to change as we progress with our research.

Growth opportunities and latent adjacency in RF Mems Switch & Electromechanical RF Relays Market