RF Gallium Nitride Market Size, Share, Statistics and Industry Growth Analysis Report by Device (Discrete RF Device, Integrated RF Device), wafer size, end user (Telecom Infrastructure, Satellite Communications, Military & Defense) and Region - Global Forecast to 2028

Updated on : Sep 12, 2024

RF Gallium Nitride Market Size, Share & Growth

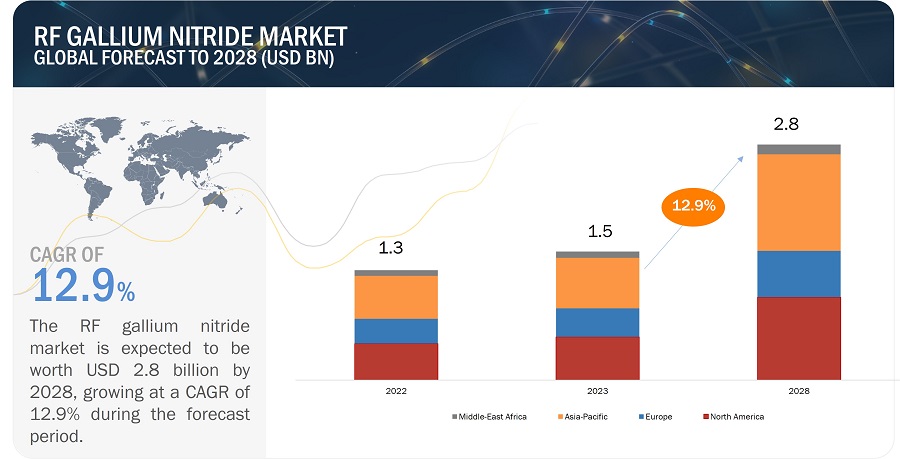

The RF Gallium Nitride Market Size was valued at USD 1.5 Billion in 2023 and is projected to reach USD 2.8 Billion by 2028; it is expected to register a CAGR of 12.9% during the forecast period.

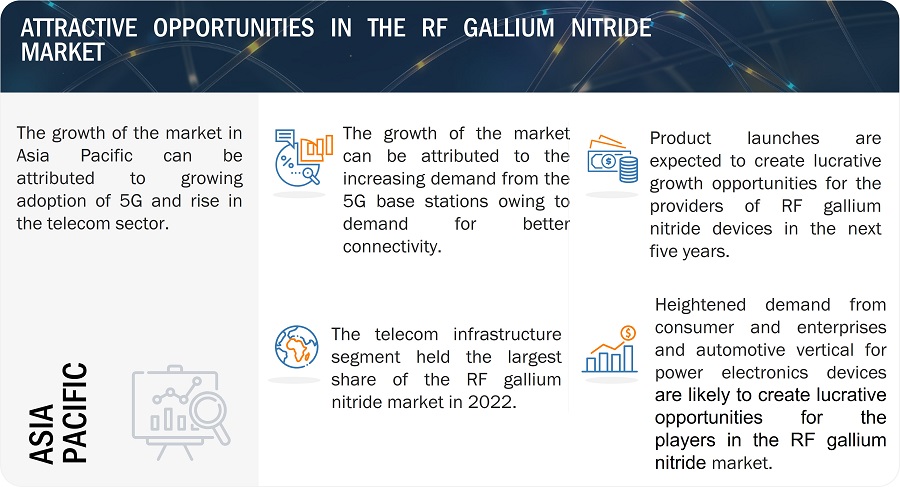

The advantages of GaN over traditional SI, heightened demand from consumers and enterprises and automotive vertical for power electronics devices, and the suitability of GaN in RF applications are among the factors driving the growth of the RF gallium nitride industry.

RF Gallium Nitride Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

RF Gallium Nitride Market Trends & Dynamics:

Driver: Advantage of GaN over traditional SI

Power applications are moving towards smaller and more efficient solutions. To achieve higher power density so that devices can be accommodated in smaller packages, GaN is ideal for replacing silicon where space is limited. Due to their superior performance, GaN-based power devices are increasingly being deployed in power electronics applications comprising power converters, inverters, and motor drives. GaN device development and manufacturing may further differ due to the distinctive features of GaN materials, which integrate improved heat dissipation techniques such as flip-chip bonding, wafer thinning, and the use of heat sinks or substrates with high thermal conductivity. These devices may operate at higher frequencies and manage larger power densities, which leads to increased energy efficiency and decreased system size.

The GaN devices provide benefits such as higher breakdown voltage, higher electron mobility and lower switching losses, thereby reducing operating costs and environmental damage. GaN devices are frequently designed with high-frequency operation, high power density, and effective heat dissipation in mind. To effectively maximize its advantages, GaN device designs must take into account the unique properties of GaN materials, such as their greater breakdown voltage and wider bandgap.

GaN-based power transistors are widely used in power electronics applications. Such devices are appropriate for power converters, inverters, motor drives, and various other applications which require effective power conversion and high-power handling capacities because they have high power density, high efficiency, and high-frequency operation. In general, wide bandgap semiconductors are suitable for high power density applications, high operating voltage applications with low power consumption, and high RF output applications in wireless communications.

Meanwhile, GaN technology is projected to enter more applications such as data augmentation, medical imaging, cybersecurity as a result of its special qualities and performance advantages. GaN's unique features make it particularly important in specific applications where the benefits overcome the limitations and justify the usage of this advanced semiconductor material.

Restraint: Higher efficacy of alternative such as Silicon Carbide (SiC) for high-voltage semiconductor applications

Silicon Carbide (SiC) and Gallium Nitride (GaN) are high-performance wide-bandgap semiconductor materials that perform better than standard silicon (Si) in a variety of applications. The decision between Silicon Carbide (SiC) and Gallium Nitride (GaN) in terms of efficiency depends on the particular needs of the application. Due to their higher breakdown voltage capabilities, SiC devices are often better suited for high-voltage applications. SiC power components are suitable for grid-level applications, high-power inverters, and the infrastructure of the electrical grid because they can withstand greater voltages. However, GaN devices are generally employed in low- to medium-voltage applications, including consumer electronics, server power supply, and automotive systems.

Furthermore, GaN devices are often more expensive than SiC devices. GaN devices are more expensive because of the complex production process and the requirement for specific tools and materials. However, SiC devices benefit from economies of scale and a more developed supply chain, which can lead to cheaper production costs. Both technologies are still evolving, and modern research and development activities attempt to solve these problems and increase the performance, cost-effectiveness, and scalability of GaN devices.

Opportunity: Evolving renewable energy applications of GaN

Solar power is one of the fastest-growing solutions for residential and commercial customers, also essential for developing a sustainable future. The growing awareness of the relevance of solar energy has resulted in an increase in study in the field of solar energy harvesting. GaN technology allows for better power densities in renewable energy systems as they can handle higher voltages and currents. For applications like energy storage systems and electric vehicle chargers, where power electronics must be small and offer high power levels, a higher power density is essential.

GaN-based devices are superior in comparison to traditional silicon-based devices in several ways, making them suitable for use in a variety of renewable energy applications. GaN-based converters and inverters may operate at greater switching frequencies, lowering the size and weight of the power electronics and enhancing overall system efficiency.

Challenge: High material and fabrication costs

The raw material which is required for GaN manufacturing, such as gallium and nitrogen precursors, can be costly when compared to those material used in Si-based devices. GaN epitaxial layers are typically manufactured on silicon carbide (SiC) or sapphire substrates, which can increase the cost of the raw materials. The price of materials is also increased by the particular equipment and processes needed to create GaN epitaxial layers.

Additionally, GaN device fabrication is a relatively challenging procedure that often asks for specialized equipment like molecular beam epitaxy (MBE) or metal-organic chemical vapor deposition (MOCVD) systems. It costs significantly much to buy, operate, and maintain these systems. The entire cost of manufacturing GaN devices is increased by the fabrication process' complexity and the requirement for strict process control.

As manufacturing techniques get more advanced and volume production rises, the costs related to GaN technology continue to gradually drop over time. It is projected that the cost of GaN devices will decrease as material growth methods and production procedures continue to progress.

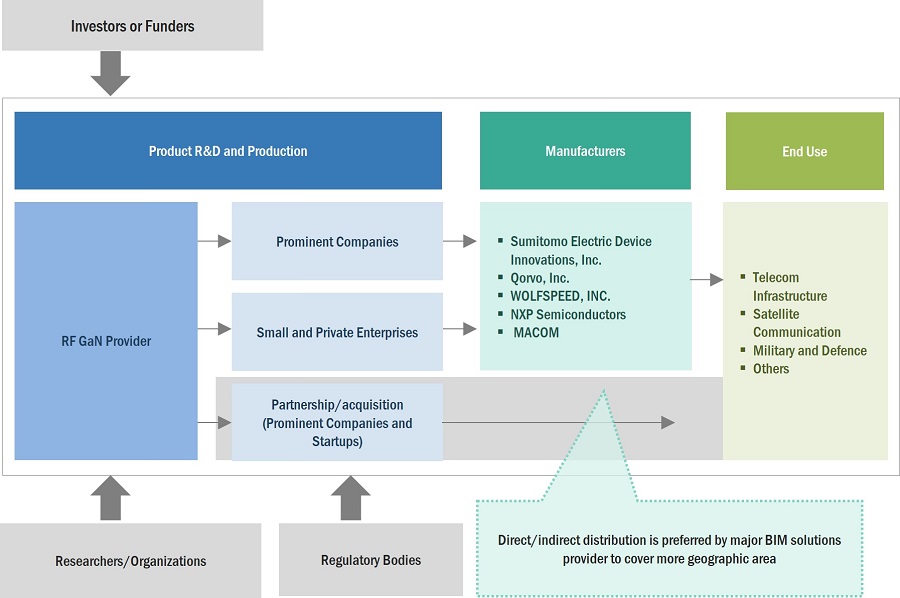

RF Gallium Nitride Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of RF GaN devices. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Sumitomo Electric Device Innovations, Inc. (Japan), Qorvo, Inc. (US), WOLFSPEED, INC. (US), NXP Semiconductors (Netherlands), MACOM (US), Infineon Technologies AG (Germany), ROHM Co., Ltd. (Japan), Texas Instruments Incorporated (Texas), Toshiba Corporation (Japan), and STMicroelectronics N.V. (Switzerland).

By end use, the satellite communication segment is expected to grow with the highest CAGR from 2023 to 2028

The RF gallium nitride market for satellite communication is expected to grow at the highest CAGR from 2023 to 2028. Satellite communication is a key enabler of high-speed data transmission, especially in remote and rural areas where there is no other infrastructure available. RF GaN devices are well-suited for satellite communication applications because they offer high power efficiency and bandwidth, which are essential for transmitting large amounts of data over long distances. Also, There are a number of new satellite constellations being developed, which will provide global coverage and high data rates. RF GaN devices are essential for these new constellations, as they offer the power efficiency and reliability necessary to operate in space. These factors are expected to drive the market for satellite communication end use in the RF gallium nitride market growth.

By wafer size, the 200 and more segment is expected to grow with a higher CAGR during the forecast period.

200 and more are expected to exhibit a higher CAGR in the RF gallium nitride market, by wafer size, from 2023 to 2028. The growth can be attributed to larger wafer sizes allowing for more dies to be produced per wafer, which can lead to significant cost savings. For instance, a 200mm wafer can produce up to 100 times more dies than a 6-inch wafer. This can lead to significant cost savings for RF GaN devices, as the cost of the wafer is a major factor in the overall cost of the device. Also, as the demand for RF GaN devices grows, the availability of materials for these devices is also increasing. This is leading to more 200mm and bigger wafer sizes becoming available, which is further driving the growth of this market segment.

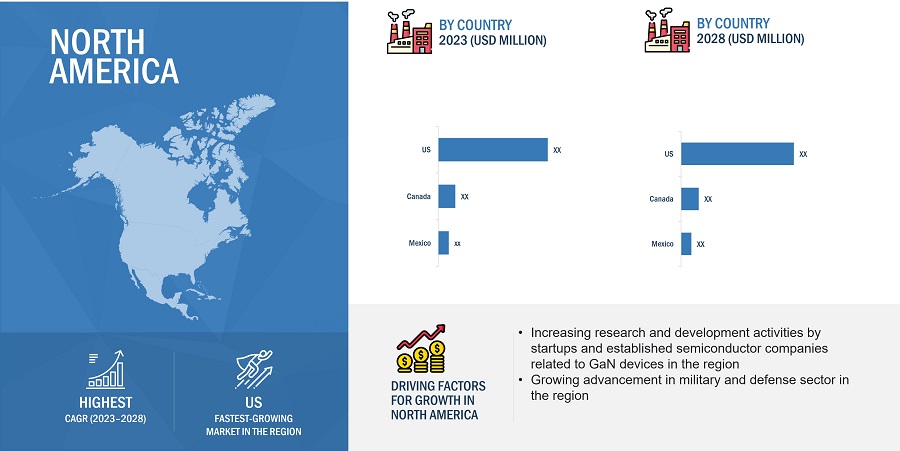

In 2028, North America is projected to hold the highest CAGR of the overall RF gallium nitride market.

In 2028, North America is expected to witness the highest CAGR. The growth in this region can be attributed to the growing electric and hybrid electric vehicle market is also supporting this growth in North America. In the electric and hybrid electric vehicle market, RF GaN devices have revolutionized the whole electronics system. The use of RF GaN devices in such vehicles leads to smaller systems, thereby reducing the weight of the overall vehicle and aiding in battery management. The growth of gallium nitride is dominated by the US due to the presence of large number of key players in the country. WOLFSPEED, INC., ON Semiconductor Corporation, Coherent Corp, Qorvo, Inc., MACOM are a few of the players catering to the RF GaN market.

RF Gallium Nitride Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies of RF Gallium Nitride Market

Sumitomo Electric Device Innovations, Inc. (Japan), Qorvo, Inc. (US), WOLFSPEED, INC. (US), NXP Semiconductors (Netherlands), MACOM (US), Infineon Technologies AG (Germany), ROHM Co., Ltd. (Japan), Texas Instruments Incorporated (Texas), Toshiba Corporation (Japan), STMicroelectronics N.V. (Switzerland) are some of the key players in the RF gallium nitride companies.

RF Gallium Nitride Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 1.5 Billion |

|

Projected Market Size in 2028 |

USD 2.8 Billion |

|

Growth Rate |

CAGR of 12.9% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By device type, wafer size, end use, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Sumitomo Electric Device Innovations, Inc. (Japan), Qorvo, Inc. (US), WOLFSPEED, INC. (US), NXP Semiconductors (Netherlands), MACOM (US), Infineon Technologies AG (Germany), ROHM Co., Ltd. (Japan), Texas Instruments Incorporated (Texas), Toshiba Corporation (Japan), STMicroelectronics N.V. (Switzerland) are some of the key players in the RF gallium nitride market. |

RF Gallium Nitride Market Highlights

This research report categorizes the RF gallium nitride market based on by device type, by wafer size, by end-use, and region.

|

Segment |

Subsegment |

|

By Device Type |

|

|

By Wafer Size |

|

|

By End Use |

|

|

By Geography |

|

Recent Developments

- In March 2023, Infineon Technologies AG acquired GaN Systems Inc (Canada)., a leader in Gallium Nitride (GaN) power transistors. This acquisition will accelerate the Infineon GaN roadmap and strengthen its leadership in power systems.

- In February 2023, MACOM acquired OMMIC SAS (France), a supplier of epitaxial wafers, foundry services and MMICs. With this acquisition MACOM is focused on entering the European markets, expand their wafer production capability and extend our product offerings to higher millimeter-wave frequencies, which are all in line with our long-term strategy.

- In March 2023, ON Semiconductor Corporation relocated the headquarter from Phoenix to Scottsdale, Arizona. With the relocation the company energy consumption will be reduced by 12.84 million kWh compared to its energy use in 2021, and thus positively impact the company's journey to its net-zero emissions by 2040 goal.

- In April 2022, ROHM Co., Ltd. partnered with Delta Electronics, Inc. to develop and mass produce next-generation GaN (gallium nitride) power devices. With Delta’s power supply device development technology and with ROHM’s power development and manufacturing expertise developed 600V breakdown voltage GaN power devices optimized for a wide range of power supply systems.

Frequently Asked Questions (FAQ):

Which are the major companies in the RF gallium nitride market? What are their major strategies to strengthen their market presence?

The major companies in the RF gallium nitride market are – Sumitomo Electric Device Innovations, Inc. (Japan), Qorvo, Inc. (US), WOLFSPEED, INC. (US), NXP Semiconductors (Netherlands), MACOM (US), Infineon Technologies AG (Germany), ROHM Co., Ltd. (Japan), Texas Instruments Incorporated (Texas), Toshiba Corporation (Japan), STMicroelectronics N.V. (Switzerland). The major strategies adopted by these players are product launches and developments.

What is the potential market for RF GaN in terms of the region?

Asia Pacific region is expected to dominate the RF gallium nitride market owing to the demand for 5G connectivity.

Who are the winners in the global RF gallium nitride market?

Companies such as Sumitomo Electric Device Innovations, Inc. (Japan), Qorvo, Inc. (US), WOLFSPEED, INC. (US), NXP Semiconductors (Netherlands), MACOM (US) fall under the winner’s category. These companies cater to the requirements of their customers by providing RF GaN devices. Moreover, these companies are highly adopting organic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the RF gallium nitride market?

Advantage of GaN over traditional SI and Advantage of GaN over traditional SI is the driver and opportunity in the RF gallium nitride market.

What are the restraints and challenges for the RF gallium nitride market?

Advantage of GaN over traditional SI and Advantage of GaN over traditional SI are restraints and challenges in the RF gallium nitride market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Various advantages of gallium nitride over traditional silicon- Increased demand from consumers, enterprises, and automotive vertical for power electronic devices- Effective development of technologies in gallium nitride ecosystem- Suitability of gallium nitride in RF applications- Increased adoption of gallium nitride RF semiconductor devices in military, defense, and aerospace applicationsRESTRAINTS- Higher efficacy of alternatives such as silicon carbide for high-voltage semiconductor applicationsOPPORTUNITIES- Evolving renewable energy applications of gallium nitride- Applications of gallium nitride in electric and hybrid electric vehicles- Potential use of gallium nitride in 6G infrastructure development- Consolidating trend of smart manufacturingCHALLENGES- High material and fabrication costs- Complexities associated with designing electrical layout of gallium nitride devices

-

5.3 VALUE CHAIN ANALYSISREVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

-

5.4 RF GALLIUM NITRIDE MARKET ECOSYSTEM

-

5.5 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE OF DEVICE TYPES, BY KEY PLAYER

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 CASE STUDIESDELTA ELECTRONICS POWERED DATA CENTERS WITH GALLIUM NITRIDE TECHNOLOGY FROM TEXAS INSTRUMENTS INCORPORATEDTRANSPHORM ENABLED CORSAIR TO OFFER HIGH-PERFORMANCE PSU AT LOW COST

-

5.9 TECHNOLOGY ANALYSISGALLIUM NITRIDE-ON-SILICON CARBIDE (GAN-ON-SIC)

-

5.10 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.11 PATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS- IEC 63373:2022

- 5.14 TARIFF ANALYSIS

- 6.1 INTRODUCTION

-

6.2 DISCRETE RF DEVICESDEPLOYMENT TO EXTEND BATTERY LIFE IN PORTABLE ELECTRONICS TO DRIVE MARKET

-

6.3 INTEGRATED RF DEVICESHIGHER LEVEL OF COMPACTNESS AND GREATER EFFICIENCY AND RELIABILITY THAN DISCRETE RF DEVICES TO BOOST SEGMENT

- 7.1 INTRODUCTION

-

7.2 LESS THAN 200 MMCOST-EFFECTIVENESS OF LESS THAN 200 MM WAFERS TO FUEL SEGMENT

-

7.3 GREATER THAN OR EQUAL TO 200 MMHIGHER PRODUCTION YIELD AND LOWER PRODUCTION COSTS TO DRIVE SEGMENT

- 8.1 INTRODUCTION

-

8.2 TELECOM INFRASTRUCTURERISING DEMAND FOR BETTER CONNECTIVITY TO FUEL MARKET GROWTH

-

8.3 SATELLITE COMMUNICATIONSNEED TO IMPROVE QUALITY OF SATELLITE COMMUNICATION SERVICES TO DRIVE MARKET

-

8.4 MILITARY & DEFENSEGROWING USE OF RF JAMMERS IN MILITARY INSTALLATIONS TO BOOST MARKET GROWTH

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- Prominent presence of various gallium nitride manufacturers to foster market growthCANADA- Government initiatives to promote use of EVs to drive marketMEXICO- Growing telecommunications sector to support market growthIMPACT OF RECESSION ON MARKET IN NORTH AMERICA

-

9.3 EUROPEUK- Rising demand for 5G connectivity to boost market growthGERMANY- Growing market for healthcare devices to drive marketFRANCE- Development of infrastructure to support 5G technology to fuel market growthREST OF EUROPEIMPACT OF RECESSION ON MARKET IN EUROPE

-

9.4 ASIA PACIFICCHINA- Growing population and need for better connectivity to boost market growthJAPAN- Increasing adoption of RF GaN devices to drive marketSOUTH KOREA- Increasing penetration of 5G technology to fuel market growthREST OF ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

-

9.5 ROWMIDDLE EAST & AFRICA (MEA)- Growing demand for broadband communications to drive marketSOUTH AMERICA- Rising smartphone adoption to lead to market growthIMPACT OF RECESSION ON MARKET IN ROW

- 10.1 OVERVIEW

-

10.2 MARKET EVALUATION FRAMEWORKPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC STRATEGIES

- 10.3 MARKET SHARE ANALYSIS, 2022

- 10.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

10.5 KEY COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewWOLFSPEED, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNXP SEMICONDUCTORS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMACOM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewQORVO, INC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSTMICROELECTRONICS- Business overview- Products/Services/Solutions offered- Recent developmentsON SEMICONDUCTOR CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsINFINEON TECHNOLOGIES AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROHM CO., LTD- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewANALOG DEVICES, INC.- Business overview- Products/Services/Solutions offeredRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSTEXAS INSTRUMENTS INCORPORATEDCOHERENT CORP. (II-VI INCORPORATED)TOSHIBA CORPORATIONMICROSEMI CORPORATIONMITSUBISHI ELECTRIC CORPORATIONAETHERCOMMGAN SYSTEMSINTEGRA TECHNOLOGIES INC.MERCURY SYSTEMS, INC.EFFICIENT POWER CONVERSION CORPORATION, INC.RFHIC CORPORATIONEPISTAR CORPORATIONTRANSPHORM INC.AMPLEON

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 AUTHOR DETAILS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 RF GALLIUM NITRIDE MARKET: KEY ASSUMPTIONS FOR MACRO- AND MICRO-ECONOMIC ENVIRONMENT

- TABLE 3 RF GALLIUM NITRIDE MARKET: RISK ASSESSMENT

- TABLE 4 GALLIUM NITRIDE VS. SILICON CARBIDE

- TABLE 5 RF GALLIUM NITRIDE MARKET: ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF DIFFERENT DEVICE TYPES, BY KEY PLAYER (USD)

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 9 RF GALLIUM NITRIDE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 12 LIST OF PATENTS PERTAINING TO MARKET, 2021–2023

- TABLE 13 RF GALLIUM NITRIDE MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 TARIFF FOR CARBIDES ON RF GALLIUM NITRIDE COVERED UNDER HS CODE 381800 EXPORTED BY CHINA, 2021

- TABLE 18 TARIFF FOR CARBIDES ON RF GALLIUM NITRIDE COVERED UNDER HS CODE 381800 EXPORTED BY GERMANY, 2021

- TABLE 19 RF GALLIUM NITRIDE MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 20 MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 21 DISCRETE RF DEVICES: RF GALLIUM NITRIDE MARKET, 2019–2022 (MILLION UNITS)

- TABLE 22 DISCRETE RF DEVICES: MARKET, 2023–2028 (MILLION UNITS)

- TABLE 23 RF GALLIUM NITRIDE MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 24 MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 25 MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 27 TELECOM INFRASTRUCTURE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 TELECOM INFRASTRUCTURE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 TELECOM INFRASTRUCTURE: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 30 TELECOM INFRASTRUCTURE: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 TELECOM INFRASTRUCTURE: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 TELECOM INFRASTRUCTURE: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 TELECOM INFRASTRUCTURE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 34 TELECOM INFRASTRUCTURE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 35 TELECOM INFRASTRUCTURE: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 TELECOM INFRASTRUCTURE: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 SATELLITE COMMUNICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 38 SATELLITE COMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 SATELLITE COMMUNICATIONS: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 40 SATELLITE COMMUNICATIONS: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 41 SATELLITE COMMUNICATIONS: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 42 SATELLITE COMMUNICATIONS: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 43 SATELLITE COMMUNICATIONS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 44 SATELLITE COMMUNICATIONS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 SATELLITE COMMUNICATIONS: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 SATELLITE COMMUNICATIONS: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MILITARY & DEFENSE: RF GALLIUM NITRIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 MILITARY & DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 50 MILITARY & DEFENSE: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 52 MILITARY & DEFENSE: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 54 MILITARY & DEFENSE: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 MILITARY & DEFENSE: MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 MILITARY & DEFENSE: MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 60 OTHERS: MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 61 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 62 OTHERS: MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 64 OTHERS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 OTHERS: MARKET IN ROW, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 66 OTHERS: MARKET IN ROW, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 67 RF GALLIUM NITRIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 75 US: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 76 US: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 80 MEXICO: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 87 UK: RF GALLIUM NITRIDE MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 88 UK: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 89 GERMANY: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 90 GERMANY: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 91 FRANCE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 92 FRANCE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 93 REST OF EUROPE: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 94 REST OF EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 101 CHINA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 103 JAPAN: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 SOUTH KOREA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 106 SOUTH KOREA: MARKET IN SOUTH KOREA, BY END USER, 2023–2028 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 ROW: RF GALLIUM NITRIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 ROW: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 112 ROW: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 ROW: MARKET, BY DEVICE, 2019–2022 (USD MILLION)

- TABLE 114 ROW: MARKET, BY DEVICE, 2023–2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 118 SOUTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 119 OVERVIEW OF STRATEGIES DEPLOYED BY KEY RF GAN DEVICE PROVIDERS

- TABLE 120 MARKET: MARKET SHARE ANALYSIS (2022)

- TABLE 121 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 122 STARTUPS/SMES IN MARKET: COMPANY PROFILES

- TABLE 123 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (END USER FOOTPRINT)

- TABLE 124 RF GALLIUM NITRIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- TABLE 125 COMPANY FOOTPRINT

- TABLE 126 COMPANY FOOTPRINT, BY END USER

- TABLE 127 COMPANY FOOTPRINT, BY REGION

- TABLE 128 PRODUCT LAUNCHES, MARCH 2020–MAY 2023

- TABLE 129 DEALS, MARCH 2020–MAY 2023

- TABLE 130 OTHERS, MARCH 2020–MAY 2023

- TABLE 131 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 132 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 133 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCT LAUNCH/DEVELOPMENT

- TABLE 134 WOLFSPEED, INC.: COMPANY OVERVIEW

- TABLE 135 WOLFSPEED, INC.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 136 WOLFSPEED, INC.: DEAL

- TABLE 137 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 138 NXP SEMICONDUCTORS: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 139 NXP SEMICONDUCTORS: PRODUCT LAUNCH/DEVELOPMENT

- TABLE 140 NXP SEMICONDUCTORS: OTHER

- TABLE 141 MACOM: COMPANY OVERVIEW

- TABLE 142 MACOM: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 143 MACOM: DEAL

- TABLE 144 MACOM: OTHER

- TABLE 145 QORVO, INC: COMPANY OVERVIEW

- TABLE 146 QORVO, INC: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 147 QORVO, INC: DEAL

- TABLE 148 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 149 STMICROELECTRONICS: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 150 STMICROELECTRONICS: PRODUCT LAUNCH/DEVELOPMENT

- TABLE 151 STMICROELECTRONICS: DEAL

- TABLE 152 ON SEMICONDUCTOR CORPORATION: COMPANY OVERVIEW

- TABLE 153 ON SEMICONDUCTOR CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 154 ON SEMICONDUCTOR CORPORATION: OTHER

- TABLE 155 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 156 INFINEON TECHNOLOGIES AG: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 157 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCH/DEVELOPMENT

- TABLE 158 INFINEON TECHNOLOGIES AG: DEAL

- TABLE 159 ROHM CO., LTD.: COMPANY OVERVIEW

- TABLE 160 ROHM CO., LTD.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 161 ROHM CO., LTD.: PRODUCT LAUNCH/DEVELOPMENT

- TABLE 162 ROHM CO., LTD.: DEAL

- TABLE 163 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- TABLE 164 ANALOG DEVICES, INC.: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 165 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 166 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERED

- TABLE 167 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCH/DEVELOPMENT

- FIGURE 1 RF GALLIUM NITRIDE MARKET: SEGMENTATION

- FIGURE 2 RF GALLIUM NITRIDE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) – REVENUE GENERATED BY COMPANIES FROM SALES OF PRODUCTS OFFERED IN MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (TOP-DOWN APPROACH, SUPPLY-SIDE ANALYSIS) – ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 RF GALLIUM NITRIDE MARKET: DATA TRIANGULATION

- FIGURE 10 SATELLITE COMMUNICATIONS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 GREATER THAN OR EQUAL TO 200 MM WAFERS TO RECORD HIGHER CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO DOMINATE MARKET, IN TERMS OF VALUE, IN 2028

- FIGURE 13 PRE- AND POST-RECESSION IMPACT ON MARKET, 2022–2028

- FIGURE 14 GROWING ADOPTION OF 5G TO DRIVE MARKET GROWTH

- FIGURE 15 INTEGRATED RF DEVICES SEGMENT TO RECORD HIGHER CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 16 MARKET IN ASIA PACIFIC FOR TELECOM INFRASTRUCTURE SEGMENT TO HOLD LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 17 SATELLITE COMMUNICATIONS TO REGISTER HIGHEST CAGR IN MARKET IN ASIA PACIFIC FROM 2023 TO 2028

- FIGURE 18 ASIA PACIFIC TO HOLD LARGEST SHARE OF MARKET, IN TERMS OF VALUE, IN 2028

- FIGURE 19 CHINA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 20 RF GALLIUM NITRIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 COMPARISON BETWEEN GALLIUM NITRIDE AND SILICON SEMICONDUCTORS

- FIGURE 22 DRIVERS AND THEIR IMPACT ON MARKET

- FIGURE 23 RESTRAINTS AND THEIR IMPACT ON MARKET

- FIGURE 24 OPPORTUNITIES AND THEIR IMPACT ON MARKET

- FIGURE 25 CHALLENGES AND THEIR IMPACT ON MARKET

- FIGURE 26 VALUE CHAIN OF MARKET

- FIGURE 27 REVENUE SHIFT IN MARKET

- FIGURE 28 GALLIUM NITRIDE ECOSYSTEM

- FIGURE 29 AVERAGE SELLING PRICE, BY DEVICE TYPE

- FIGURE 30 AVERAGE SELLING PRICE OF DEVICE TYPES OFFERED BY KEY PLAYERS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 34 NUMBER OF PATENTS GRANTED FOR GALLIUM NITRIDE, 2012–2022

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED FOR GALLIUM NITRIDE DEVICES, 2022

- FIGURE 36 INTEGRATED RF DEVICES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 GREATER THAN OR EQUAL TO 200 MM WAFERS TO LEAD MARKET IN 2028

- FIGURE 38 TELECOM INFRASTRUCTURE SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 39 ASIA PACIFIC TO OCCUPY LARGEST SHARE OF MARKET IN 2028

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 41 INTEGRATED RF DEVICES SEGMENT TO HOLD LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2028

- FIGURE 42 EUROPE: RF GALLIUM NITRIDE MARKET SNAPSHOT

- FIGURE 43 INTEGRATED RF DEVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN EUROPE IN 2028

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 INTEGRATED RF DEVICES SEGMENT TO OCCUPY LARGEST SHARE OF MARKET IN ASIA PACIFIC IN 2028

- FIGURE 46 INTEGRATED RF DEVICES SEGMENT TO HOLD LARGEST SHARE OF MARKET IN ROW IN 2028

- FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET, 2018–2022

- FIGURE 48 RF GALLIUM NITRIDE MARKET: KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 49 MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 50 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 51 WOLFSPEED, INC.: COMPANY SNAPSHOT

- FIGURE 52 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 53 MACOM: COMPANY SNAPSHOT

- FIGURE 54 QORVO, INC: COMPANY SNAPSHOT

- FIGURE 55 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 56 ON SEMICONDUCTOR CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 58 ROHM CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 60 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the size of the RF gallium nitride market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering RF GaN devices have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the RF gallium nitride market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of RF GaN devices to identify key players based on their products and prevailing industry trends in the RF gallium nitride market by device type, wafer size, end-use, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

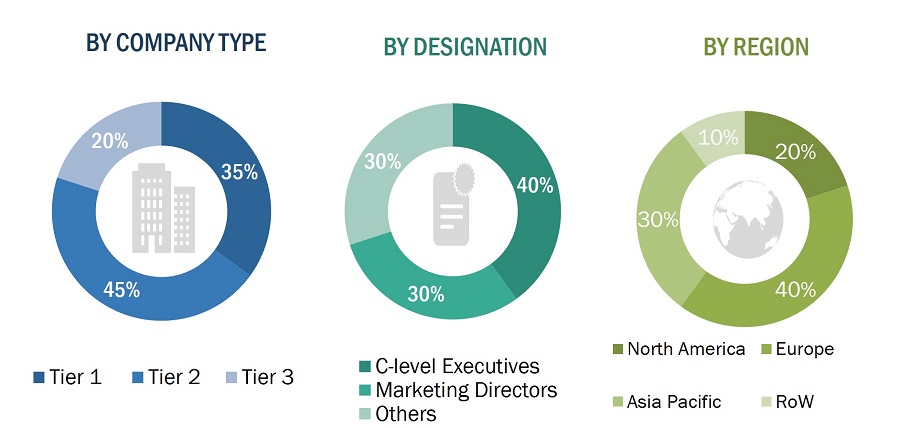

Extensive primary research has been conducted after understanding and analyzing the current scenario of the RF gallium nitride market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the RF gallium nitride market.

- Identifying approximate revenues of companies involved in the RF gallium nitride ecosystem

- Identifying different offerings of players in the RF gallium nitride market

- Analyzing the global penetration of each RF gallium nitride offering through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the RF GaN devices and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then, finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the RF gallium nitride market

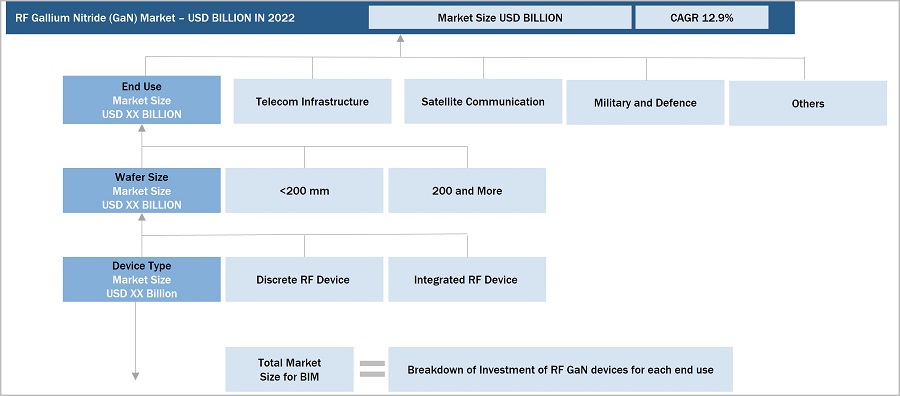

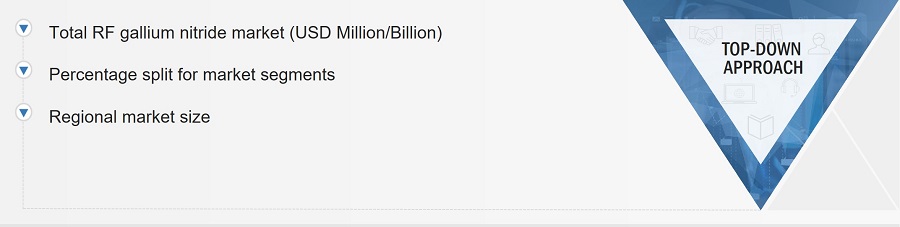

The top-down approach has been used to estimate and validate the total size of the RF gallium nitride market.

- Focusing initially on the top-line investments and expenditures made in the RF gallium nitride ecosystem; further splitting into offering and listing key developments in key market areas

- Identifying all major players offering a variety of RF GaN devices, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence for which all identified players offer RF GaN devices to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the RF gallium nitride market.

Market Definition

Radio Frequency (RF) refers to the frequency in the range of 3 kHz to 300 GHz. RF semiconductor devices are used to convert low-power radio frequency signals to high-power signals. Gallium Nitride (GaN) is a very hard, mechanically stable, wide-bandgap semiconductor used for high-efficiency power transistors and integrated circuits. GaN is a binary III/V direct wide-bandgap semiconductor with a bandgap of 3.4 electron volt (eV).

RF gallium nitride (RF GaN) is a semiconductor material used in various RF applications, including power amplifiers for wireless communications, radar systems, microwave ovens, and LED lighting. RF GaN offers several advantages over traditional silicon-based semiconductors, including higher power density, higher efficiency, wider bandwidth, and better thermal conductivity.

Key Stakeholders

- Raw material suppliers

- Original Equipment Manufacturers (OEMs

- Original Design Manufacturers (ODM)

- Research Institutes

- RF GaN Device provider

- Forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the size of the RF gallium nitride market, in terms of device type, application, and by end-user

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To describe and forecast the size of the RF gallium nitride market by wafer size in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the RF gallium nitride market

- To provide an overview of the value chain pertaining to the RF gallium nitride ecosystem, along with the average selling prices of RF GaN devices

- To strategically analyze the ecosystem, tariff and regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies, such product launches and development, acquisition, partnership, agreement, collaboration, agreement, and expansion are adopted by players in the RF gallium nitride market

- To profile key players in the RF gallium nitride market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies Updated market developments of profiled players: The current report includes the market developments from March 2020 and May 2023.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in RF Gallium Nitride Market