Respiratory Protection Equipment Market by Product Type (Air-purifying Respirators, Supplied Air Respirators), End-use Industry (Healthcare & pharmaceuticals, Defense & Public Safety Services, Oil & Gas, Manufacturing, Mining) - Global Forecast to 2022

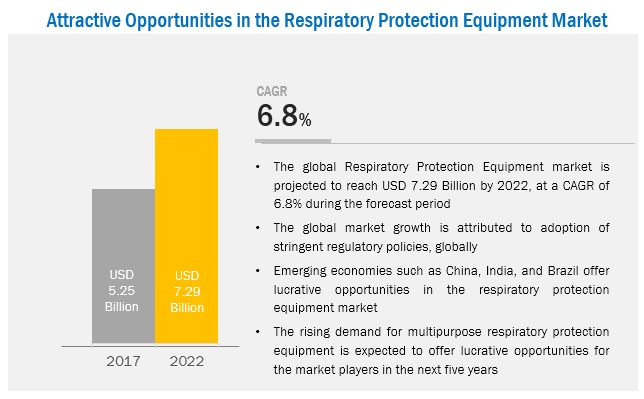

The respiratory protection equipment market is projected to reach USD 7.28 billion by 2022, at a CAGR of 6.8%. Respiratory protection equipment is a type of personal protective equipment used to protect an individual against inhalation of hazardous chemicals, dust particles, and gas. Respirators and breathing apparatus are collectively known as respiratory protection equipment. In this report, 2016 is considered as the base year for the study of the respiratory protection equipments market, while the forecast period is from 2017 to 2022.

Respiratory Protection Equipment Market Dynamics

Drivers

- Massive industrial growth in Asia-Pacific and Middle East & Africa

- Adoption of Stringent Regulatory Policies

- Increasing awareness about importance of workplace safety

Restraints

- Incresased automation in various end-use industries

- High price of Supplied-Air respirators

Opportunities

- Demand for multipurpose respiratory protection equipment

Increaisng awareness about importance of workplace safety

Respiratory protective equipment protects workers from toxic gases, chemicals, radiological, and nuclear hazards. Respiratory cancers, including lung cancer and mesothelioma, are caused due to exposure to asbestos, silica, diesel engine exhaust emissions, and mineral oils. In addition to this chronic obstructive pulmonary disease (COPD), occupational asthma, pneumoconiosis, and other non-cancerous disease are caused due exposure to a wide range of toxic vapors, dust, gases, and fumes. According to the National Statistics Health & Safety Executives (HSE), there are approximately 12,000 work related deaths each year in the U.K., two-thirds of which are due to exposure to asbestos.

The objectives of this study on the respiratory protection equipment market are:

- To define, describe, and analyze the respiratory protection equipment market on the basis of product type, end-use industry, and region

- To forecast and analyze the size of the respiratory protection equipments market (in terms of value) and its submarkets for five regions, namely, Asia Pacific, Europe, North America, the Middle East & Africa, and South America

- To forecast and analyze the respiratory protection equipment market at the country-level for each region

- To strategically analyze each submarket with respect to individual growth trends and its contribution to the respiratory protection equipments market

- To analyze opportunities in the respiratory protection equipment market for stakeholders by identifying high-growth segments of the market

- To identify significant market trends and factors driving or inhibiting the growth of the respiratory protection equipments market and its submarkets

- To strategically profile the key players operating in the respiratory protection equipment market and comprehensively analyze their growth strategies

- To analyze competitive developments, such as expansions, mergers & acquisitions, contracts & agreements, and new products launches adopted by the leading players to strengthen their position in the respiratory protection equipments market

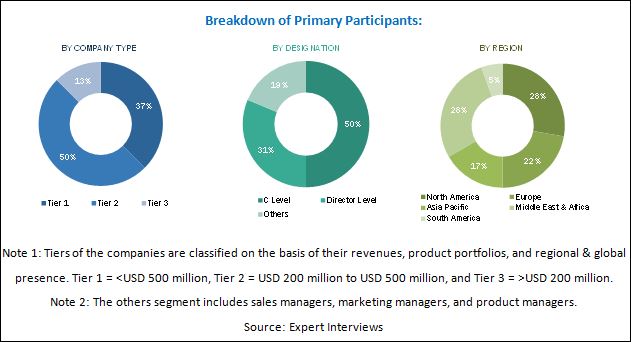

This technical, market-oriented, and commercial research study involves the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, among others, to identify and collect information on the respiratory protection equipment market. The primary sources mainly include several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industry’s supply chain. After arriving at the overall market size, the total market has been split into several segments. The figure below illustrates the breakdown of the primary interviews based on company type, designation, and region conducted during the research study on the respiratory protection equipments market:

To know about the assumptions considered for the study, download the pdf brochure

Supplied-air respirators are very expensive type of respirators. They are mainly used in mining, oil & gas, and firefighting. The cost of supplied-air respirators can go up to ten times the cost of air purifying respirators. Moreover, the maintenance cost associated with supplied-air respirators is higher than the cost of maintaining air-purifying respirators. The key market players profiled in this report include Honeywell International (US), 3M (US), Kimberly-Clark (US), Avon Protection Systems (US), MSA Safety (US), Alpha Pro Tech (Canada), Bullard (US), Dragerwerk (Germany), Gentex (US), and Jayco Safety Products (India), among others.

Major Respiratory Protection Equipment Market Developments

- In March 2017, 3M acquired Scott Safety (Canada), a subsidiary of Johnson Controls International PLC (Ireland). This acquisition helped the company to enhance its product portfolio

- In June 2015, MSA Safety introduced an innovative technology, G1 Supplied Air Respirators (SCBA). The product is advanced, comfortable, streamlined, balanced, configurable, and customizable. The major application of the product is firefighting respiratory protection

- In June 2015, Dragerwerk launched powered air purifying respirator (PAPR), especially for the chemical industry. The new product, that is, X-plore 8000 provides optimum protection against toxic gases

The target audiences for the respiratory protection equipment market report are as follows:

- Manufacturers of Respiratory Protection Equipment

- Raw Material Suppliers

- Investment Banks

- Distributors of Respiratory Protection Equipment

- Government Bodies

Respiratory Protection Equipment Market Report Scope

This report categorizes the respiratory protection equipment market on the basis of product type, end-use industry, and region.

Respiratory Protection Equipments Market, By Product Type:

-

Air-purifying Respirators

- Powered air-purifying respirators

- Non-powered air-purifying respirators

-

Supplied Air Respirators

- Self-contained Breathing Apparatus

- Airline Respirators

- Loose Fitting Hoods

Respiratory Protection Equipment Market, By End-Use Industry:

- Healthcare & Pharmaceuticals

-

Defense & Public Safety Services

- Defense

- Firefighting & Law Enforcement

- Oil & Gas

-

Manufacturing

- Automotive

- Chemical

- Metal Fabrication

- Food & Beverage

- Wood Working

- Paper & Pulp

- Mining

- Construction

-

Others

- Agriculture & Forestry

- Cement Production

- Power Generation

- Shipbuilding

- Textile

Respiratory Protection Equipment Market, By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Critical questions which the report answers

- What are new equipment which these companies are exploring?

- Which are the key players in the market and how intense is the competition?

Respiratory Protection Equipment Market Report Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Respiratory Protection Equipment Market Regional Analysis

- Further breakdown of a region with respect to a particular country and additional end-use industry

Respiratory Protection Equipment Market Country Information

- Additional country information (up to 3)

Respiratory Protection Equipment Market Company Information

- Detailed analysis and profiles of additional market players (up to 5)

The respiratory protection equipment market is estimated at USD 5.25 billion in 2017 and is projected to reach USD 7.28 billion by 2022, at a CAGR of 6.8% from 2017 to 2022. Adoption of stringent regulatory frameworks and increasing awareness about the importance of workplace safety are key factors expected to drive the growth of the respiratory protection equipments market during the forecast period.

Respiratory protection equipment is a type of personal protective equipment used to protect an individual against inhalation of hazardous chemicals, dust particles, and gas. Respirators and breathing apparatus are collectively known as respiratory protection equipment.

On the basis of product type, the respiratory protection equipment market has been segmented into air-purifying respirators (powered air-purifying respirators and non-powered air-purifying respirators) and supplied air respirators (self-contained breathing apparatus, air-line respirators, and loose fitting hoods). The air-purifying respirators segment is projected to lead the market during the forecast period due to the high demand from the healthcare & pharmaceuticals industry.

Based on end-use industry, the respiratory protection equipments market has been segmented into healthcare & pharmaceuticals, defense & public safety services (defense and firefighting & law enforcement), oil & gas, manufacturing (automotive, chemical, metal fabrication, food & beverage, woodworking, and paper & pulp), mining, construction, and others (agriculture & forestry, textile, cement production, power generation, and shipbuilding). The demand for respiratory protection equipment is high in the healthcare & pharmaceuticals segment due increasing workforce and rising consumption of disposable respirators in the healthcare industry.

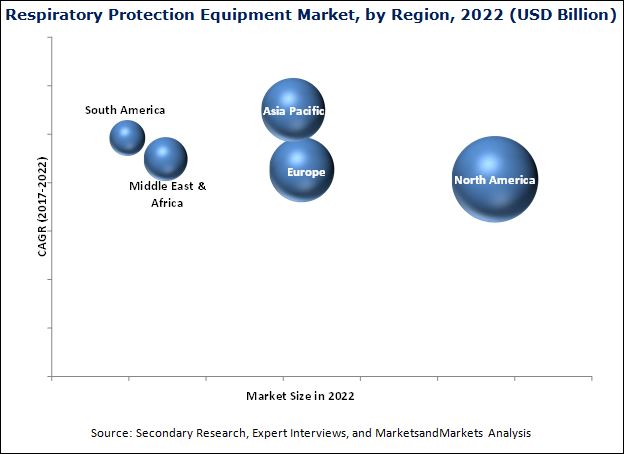

The respiratory protection equipment market has been studied for Asia Pacific, Europe, North America, the Middle East & Africa, and South America. North America is the largest market for respiratory protection equipment across the globe majorly due to strong consumer awareness, huge healthcare spending, and widespread consumption in the military and law enforcement. Additionally, stringent regulations regarding the use of protective equipment in industries also drive the respiratory protection equipment market in North America.

The Asia Pacific respiratory protection equipment market is projected to grow at the highest CAGR during the forecast period. Increased focus on the use of safety products and growing awareness about workplace safety are primarily responsible for the growing consumption of respiratory protection equipment in the Asia Pacific region.

Healthcare & Pharmaceuticals, Defense & Public Safety Services, and Oil & Gas Industries to drive the growth of Respiratory Protection Equipment market

Healthcare & Pharmaceuticals

Healthcare professionals and workers are exposed to several types of blood or body fluid contamination and chemicals. Some of the major hazards include biological hazards, drug exposures, blood-borne pathogen, respiratory hazards, laser hazards, and waste anesthetic gas exposures, among others. Respiratory protection equipment are used in the healthcare sector to protect doctors and patients from spreading contaminants and diseases.

Defense & Public Safety Services

Respiratory protective equipment is used in the defense sector to protect soldiers from contaminants, chemicals, and harmful gases. Respiratory protection equipment is used by air, land, and sea-based personnel in the defense sector. Personnel in the defense sector are exposed to hazards such as chemical warfare agents, toxic chemicals, and biological & radiological hazards.

Oil & Gas

Operations in the oil & gas industry involve exposure to serious life-threatening hazards such as harmful chemicals, gases, vapors, and fumes. The danger arises right from building well foundations and establishing tanks to hydraulically fracturing wells. Moreover, in offshore drilling, there is increased risk of release of hydrogen sulfide and formaldehyde that pose a threat to people working in such locations. Thus, in refineries, hazard assessment is carried out to procure respiratory protection equipment.

Critical Questions the Respiratory Protection Equipment Market Report Answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming equipment for respiratory equipment?

The adoption of stringent regulatory frameworks is expected to drive the respiratory protection equipment market during the forecast period. Government authorities are increasingly focused on the health and safety of workers. To reduce accidents and uncertainties in industries, governments of various countries have issued several safety regulations. These regulations and standards compel end-use industries to adopt respiratory protection equipment for their workers in certain types of a work environment. It is mandatory for workers in industries like oil & gas, firefighting, construction, and healthcare, among others, to wear respiratory protective equipment. In the US, the respiratory protection equipment is designed to meet specifications set by the National Institute for Occupational Safety and Health (NIOSH). However, respirators for fire and emergency services are tested and certified by the National Fire Protection Association (NFPA).

Key Respiratory Protection Equipment Market Industry Players

Some of the key players in the respiratory protection equipment market include Honeywell International (US), 3M (US), Kimberly-Clark (US), Avon Protection Systems (US), MSA Safety (US), Alpha Pro Tech (Canada), Bullard (US), Dragerwerk (Germany), Gentex (US), and Jayco Safety Products (India).

Frequently Asked Questions (FAQ):

What is the Respiratory Protection Equipment Market growth?

Growth of Respiratory Protection Equipment Market - At a CAGR of 6.8% between 2017 and 2022.

Who leading market players in Respiratory Protection Equipment Industry?

Some of the key players in the respiratory protection equipment market include Honeywell International (US), 3M (US), Kimberly-Clark (US), Avon Protection Systems (US), MSA Safety (US), Alpha Pro Tech (Canada), Bullard (US), Dragerwerk (Germany), Gentex (US), and Jayco Safety Products (India).

How big is the Respiratory Protection Equipment Market?

The respiratory protection equipment market is projected to reach USD 7.28 Billion by 2022.

Which segments are covered in Respiratory Protective Equipment Market report?

By Product Type (Air-purifying Respirators, Supplied Air Respirators) & End-use Industry (Healthcare & pharmaceuticals, Defense & Public Safety Services, Oil & Gas, Manufacturing, Mining).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Significant Opportunities in Respiratory Protection Equipment Market

4.2 Respiratory Protection Equipment Market, By Region

4.3 Respiratory Protection Equipments Market in North America, By End-Use Industry and Country

4.4 Respiratory Protection Equipment Market Share, By Product Type

4.5 Respiratory Protection Equipments Market Size, By End-Use Industry

4.6 Respiratory Protection Equipment Market Attractiveness

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Massive Industrial Growth in Asia-Pacific and Middle East & Africa

5.2.1.2 Adoption of Stringent Regulatory Policies

5.2.1.3 Increasing Awareness About Importance of Workplace Safety

5.2.2 Restraints

5.2.2.1 Increased Automation in Various End-Use Industries

5.2.2.2 High Price of Supplied-Air Respirators

5.2.3 Opportunities

5.2.3.1 Demand for Multipurpose Respiratory Protection Equipment

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Industry Outlook

5.4.1 Contribution of Healthcare Industry to GDP

5.4.2 Oil & Gas

6 Respiratory Protection Equipment Market, By Product Type (Page No. - 46)

6.1 Introduction

6.2 Air-Purifying Respirators

6.2.1 Powered Air-Purifying Respirators

6.2.2 Non-Powered Air-Purifying Respirators

6.3 Supplied-Air Respirators

6.3.1 Self-Contained Breathing Apparatus (SCBA)

6.3.2 Air-Line Respirators

6.3.3 Loose Fitting Hoods

7 Respiratory Protection Equipment Market, By End-Use Industry (Page No. - 52)

7.1 Introduction

7.2 Healthcare & Pharmaceuticals

7.3 Defense & Public Safety Services

7.3.1 Defense

7.3.2 Public Safety Services

7.4 Oil & Gas

7.5 Manufacturing

7.5.1 Automotive

7.5.2 Chemical

7.5.3 Metal Fabrication

7.5.4 Food & Beverage

7.5.5 Wood Working

7.5.6 Paper & Pulp

7.6 Mining

7.7 Construction

7.8 Others

7.8.1 Agriculture & Forestry

7.8.2 Cement Production

7.8.3 Power Generation

7.8.4 Shipbuilding

7.8.5 Textile

8 Respiratory Protection Equipment Market, By Region (Page No. - 65)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 Russia

8.3.3 U.K.

8.3.4 France

8.3.5 Italy

8.3.6 Spain

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 Australia

8.4.5 South Korea

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Venezuela

8.5.4 Chile

8.5.5 Peru

8.6 Middle East & Africa

8.6.1 Saudi Arabia

8.6.2 UAE

8.6.3 Iran

8.6.4 Egypt

8.6.5 South Africa

9 Competitive Landscape (Page No. - 104)

9.1 Introduction

9.2 Ranking of Key Market Players

9.2.1 3M

9.2.2 MSA Safety

9.2.3 Honeywell International

10 Company Profiles (Page No. - 106)

Business Overview, Strength Of Product Portfolio, Business Strategy Excellence, Recent Developments

10.1 3M

10.2 MSA Safety

10.3 Honeywell International

10.4 Dragerwerk

10.5 Kimberly-Clark

10.6 Avon Protection Systems

10.7 Alpha Pro Tech

10.8 Bullard

10.9 Gentex

10.10 Jayco Safety Products

10.11 Other Key Market Players

10.11.1 Protective Industrial Products

10.11.2 Delta Plus Group

10.11.3 Moldex-Metric

10.11.4 Cordova Safety Products

10.11.5 RBP Safety

10.11.6 RSG Safety

10.11.7 Ocenco

10.11.8 Dynamic Safety International

10.11.9 Shanghai Baoya Safety Equipment

10.11.10 Alpha Solway

10.11.11 Polison

10.11.12 Pan Taiwan Enterprise

10.11.13 Venus Safety & Health

10.11.14 Intech Safety

10.11.15 Siyabenza Manufacturing

11 Appendix (Page No. - 132)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (87 Tables)

Table 1 Annual GDP and Industrial Production Growth Rate of Countries in Asia-Pacific

Table 2 Annual GDP and Industrial Production Growth Rate of Countries in Middle East & Africa

Table 3 Healthcare Expenditure of Countries in Asia-Pacific

Table 4 Healthcare Expenditure of Countries in North America

Table 5 Healthcare Expenditure of Countries in Europe

Table 6 Healthcare Expenditure of Countries in South America

Table 7 Healthcare Expenditure of Countries in Middle East & Africa

Table 8 Oil Production in Asia-Pacific, 2016 (Barrel/Day)

Table 9 Oil Production in North America, 2016 (Barrel/Day)

Table 10 Oil Production in Europe, 2016 (Barrel/Day)

Table 11 Oil Production in South America, 2016 (Barrel/Day)

Table 12 Oil Production in Middle East & Africa, 2016 (Barrel/Day)

Table 13 Respiratory Protection Equipment Market Size, By Product Type, 2015–2022 (USD Million)

Table 14 Air-Purifying Respirators Market Size, By Region, 2015–2022 (USD Million)

Table 15 Supplied-Air Respirators Market Size, By Region, 2015–2022 (USD Million)

Table 16 Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 17 Market Size in Healthcare & Pharmaceuticals, By Region, 2015–2022 (USD Million)

Table 18 Market Size in Defense & Public Safety Services, By Region, 2015–2022 (USD Million)

Table 19 Market Size in Oil & Gas, By Region, 2015–2022 (USD Million)

Table 20 Market Size in Manufacturing, By Region, 2015–2022 (USD Million)

Table 21 Market Size in Mining, By Region, 2015–2022 (USD Million)

Table 22 Market Size in Construction,By Region, 2015–2022 (USD Million)

Table 23 Market Size in Other Industries, By Region, 2015–2022 (USD Million)

Table 24 Respiratory Protection Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 25 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 26 North America: Market Size, By Product Type, 2015–2022 (USD Million)

Table 27 North America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 28 U.S.: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 29 U.S.: Market Size, By Product Type, 2015–2022 (USD Million)

Table 30 Canada: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 31 Canada: Market Size, By Product Type, 2015–2022 (USD Million)

Table 32 Mexico: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 33 Mexico: Market Size, By Product Type, 2015–2022 (USD Million)

Table 34 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 35 Europe: Market Size, By Product Type, 2015–2022 (USD Million)

Table 36 Europe: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 37 Germany: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 38 Germany: Market Size, By Product Type, 2015–2022 (USD Million)

Table 39 Russia: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 40 Russia: Market Size, By Product Type, 2015–2022 (USD Million)

Table 41 U.K.: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 42 U.K.: Market Size, By Product Type, 2015–2022 (USD Million)

Table 43 France: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 44 France: Market Size, By Product Type, 2015–2022 (USD Million)

Table 45 Italy: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 46 Italy: Market Size, By Product Type, 2015–2022 (USD Million)

Table 47 Spain: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 48 Spain: Market Size, By Product Type, 2015–2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Product Type, 2015–2022 (USD Million)

Table 51 Asia-Pacific: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 52 China: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 53 China: Market Size, By Product Type, 2015–2022 (USD Million)

Table 54 Japan: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 55 Japan: Market Size, By Product Type, 2015–2022 (USD Million)

Table 56 India: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 57 India: Market Size, By Product Type, 2015–2022 (USD Million)

Table 58 Australia: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 59 Australia: Market Size, By Product Type, 2015–2022 (USD Million)

Table 60 South Korea: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 61 South Korea: Market Size, By Product Type, 2015–2022 (USD Million)

Table 62 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 63 South America: Market Size, By Product Type, 2015–2022 (USD Million)

Table 64 South America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 65 Brazil: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 66 Brazil: Market Size, By Product Type, 2015–2022 (USD Million)

Table 67 Argentina: By Equipment Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 68 Argentina: Market Size, By Product Type, 2015–2022 (USD Million)

Table 69 Venezuela: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 70 Venezuela: Market Size, By Product Type, 2015–2022 (USD Million)

Table 71 Chile: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 72 Chile: Market Size, By Product Type, 2015–2022 (USD Million)

Table 73 Peru: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 74 Peru: Market Size, By Product Type, 2015–2022 (USD Million)

Table 75 Middle East & Africa: Market Size, By Country, 2015–2022 (USD Million)

Table 76 Middle East & Africa: Market Size, By Product Type, 2015–2022 (USD Million)

Table 77 Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 78 Saudi Arabia: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 79 Saudi Arabia: Market Size, By Product Type, 2015–2022 (USD Million)

Table 80 UAE: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 81 UAE: Market Size, By Product Type, 2015–2022 (USD Million)

Table 82 Iran: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 83 Iran: Market Size, By Product Type, 2015–2022 (USD Million)

Table 84 Egypt: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 85 Egypt: Market Size, By Product Type, 2015–2022 (USD Million)

Table 86 South Africa: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 87 South Africa: Market Size, By Product Type, 2015–2022 (USD Million)

List of Figures (37 Figures)

Figure 1 Respiratory Protection Equipment Market Segmentation

Figure 2 Respiratory Protection Equipments Market: Research Design

Figure 3 Respiratory Protection Equipment Data Triangulation

Figure 4 Air-Purifying Respirators to Be Most-Widely Used Type of Respiratory Protection Equipment Between 2017 and 2022

Figure 5 Healthcare & Pharmaceuticals to Be Fastest-Growing End-Use Industry During Forecast Period

Figure 6 North America to Be Largest Market of Respiratory Protection Equipment Between 2017 and 2022

Figure 7 Asia-Pacific to Be Fastest-Growing Respiratory Protection Equipments Market Between 2017 and 2022

Figure 8 Market of Respiratory Protection Equipment to Register Moderate Cagr Between 2017 and 2022

Figure 9 North America to Be Largest Market for Respiratory Protection Equipment During Forecast Period

Figure 10 U.S. Accounted for Largest Share of North American Respiratory Protection Equipments Market in 2016

Figure 11 Air-Purifying Respirators to Account for Largest Market Share Between 2017 and 2022

Figure 12 Healthcare & Pharmaceuticals to Account for Largest Market “Share Between 2017 and 2022

Figure 13 Rising Awareness of Workplace Safety to Drive Market of Respiratory Protection Equipment in Asia-Pacific During Forecast Period

Figure 14 Drivers, Restraints, and Opportunities of Respiratory Protection Equipments Market

Figure 15 Porter’s Five Forces Analysis

Figure 16 Air-Purifying Respirators to Dominate Market of Respiratory Protection Equipment Between 2017 and 2022

Figure 17 North America to Be Largest Market of Air-Purifying Respirators Between 2017 and 2022

Figure 18 North America to Be Largest Market for Supplied-Air Respirators Between 2017 and 2022

Figure 19 Healthcare & Pharmaceuticals to Be Largest End-Use Industry Between 2017 and 2022

Figure 20 North America to Be Largest Respiratory Protection Equipments Market in Healthcare & Pharmaceuticals Between 2017 and 2022

Figure 21 North America to Be Largest Market for Respiratory Protection Equipment in Defense & Public Safety Services Between 2017 and 2022

Figure 22 Middle East & Africa to Be Largest Market for Respiratory Protection Equipment in Oil & Gas Between 2017 and 2022

Figure 23 North America to Be Largest Market for Respiratory Protection Equipments in Manufacturing Between 2017 and 2022

Figure 24 Asia-Pacific to Be Largest Market for Respiratory Protection Equipment in Mining Between 2017 and 2022

Figure 25 Europe to Be Largest Market for Respiratory Protection Equipments in Construction Between 2017 and 2022

Figure 26 North America to Be Largest Market for Respiratory Protection Equipment in Other Industries Between 2017 and 2022

Figure 27 Regional Snapshot: India is the Fastest-Growing Respiratory Protection Equipments Market

Figure 28 North America Market Snapshot: U.S. Dominates the Market of Respiratory Protection Equipment

Figure 29 Europe Market Snapshot: Germany Was the Largest Respiratory Protection Equipments Market in 2016

Figure 30 Asia-Pacific Market Snapshot: China Dominates the Market of Respiratory Protection Equipment

Figure 31 Ranking of Key Market Players, 2016

Figure 32 3M: Company Snapshot

Figure 33 MSA Safety: Company Snapshot

Figure 34 Honeywell International: Company Snapshot

Figure 35 Dragerwerk: Company Snapshot

Figure 36 Kimberly-Clark: Company Snapshot

Figure 37 Alpha Pro Tech: Company Snapshot

Growth opportunities and latent adjacency in Respiratory Protection Equipment Market