Resin Capsules Market by Catalyst Type (Organic Peroxides, Oil-based, and Water-based), Resin Type (Polyester, Epoxy, and Acrylic), End-Use Industry (Mining, Construction, and Manufacturing), and Region - Global Forecast to 2022

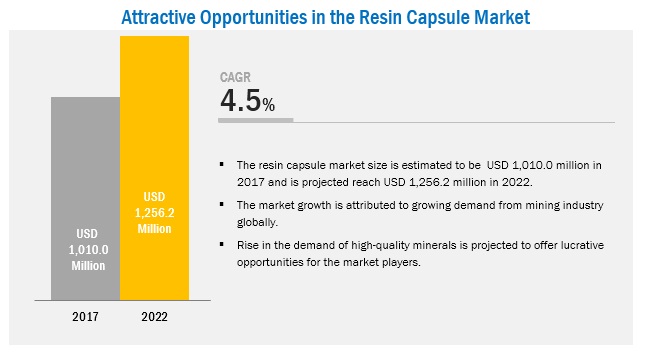

[141 Pages Report] The market for resin capsules is projected to grow from USD 972.8 million in 2016 to USD 1,256.2 million by 2022, with a CAGR of 4.46%, as studied from 2017. The resin capsule market across the globe is driven by their increasing mining capacity of various metals and minerals. By catalyst type, organic peroxide is expected to grow at a highest CAGR between 2017 and 2022. The increasing demand for resin capsule in this segment can be attributed to the high demand from the mining countries. The mining industry is projected to be largest end-use industry.

Market Dynamics

Drivers

- Increasing investments in the construction industry

- Rapid urbanization and industrialization stimulate the demand for resin capsules

- Increasing applications of resin capsules in the mining industry

Restraints

- Fluctuations in the prices of raw materials

- Cost-to-benefit ratio a concern for small manufacturers

Opportunities

- Mining sectors in Africa and Eastern Europe offer high-growth potential

- New product developments to offer high-growth potential

Challenges

- Shorter shelf-life of resin capsule

- Health implications of resin capsule

Increasing applications of resin capsules in the mining industry

Resin capsules play a vital role in supporting mining excavations. It is primarily used as an anchoring medium for rock bolts and cable bolts, and provides necessary roof and sidewall support to the underground excavations. It enhances the inherent strength of the rock mass stabilization and can be used with hydraulic and pneumatic type bolters. Owing to the operational ergonomics of the resin/bolt system, the installation time of rock bolting reduced significantly. Additionally, with the increasing use of resin capsules, accidents caused by the movement of strata in underground mines have significantly reduced.

The trend toward deeper mines has increased the need for automation and mechanization in the mining industry. AngloGold Ashanti Limited (South Africa), for instance, follows that mining below 13,200 feet (4km) needs to be fully mechanized, with few mineworkers involved, in order to ensure the safety at the workplace. With a large number of mines getting deeper, the stress level exerted on the surrounding rock increases. This, in turn, fuels the demand for reinforcement. With the emergence of resin capsules, challenges associated with providing sufficient load-transfer capability in primary and secondary roof-support systems reduced significantly. Resin capsules, owing to their dynamic loading and squeezing capabilities, are able to cope with increased stress loading, thus becoming increasingly important in the mining industry. This implies that the increasing number of applications of resin capsules in mining excavations will drive the market growth during the forecast period.

The following are the major objectives of the study.

- To describe and forecast the resin capsule market, in terms of value, by terminal type, and application

- To describe and forecast the resin capsule market, in terms of value, by regionAsia Pacific (APAC), Europe, North America, Middle East &Africa, and South America along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of reed sensor

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the resin capsule market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the resin capsule market

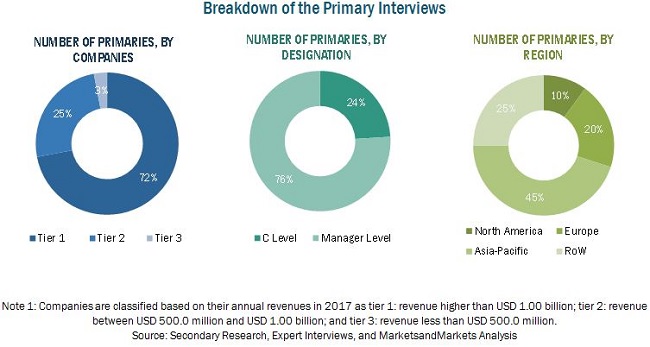

During this research study, major players operating in the resin capsule market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Some of the major players operating in the resin capsule market are Sika AG (Switzerland), Orica Limited (Australia), Barnes Group (US), DYWIDAG-Systems International (Germany), Rawlplug (Poland), Bohle AG (Germany), Sormat OY (Finland), Fischer Holding GmbH & CO. (Germany), Liebig. (France), and Hexion Inc. (US).

Major Market Developments

- In September 2014, RSC Ekusasa built its new resin capsule manufacturing facility which will help the company to expand its business in the South African market

- In February 2016, DSI acquired Jennmar Canada which strengthened DSIs mining capabilities in Canada

- In August 2013, Rawlplug developed a formula called R-KEM II, a multipurpose polyester styrene-free resin approved for 15 substrates. It can be used for various applications and for installation in hollow structures. It is suitable for medium and heavy load applications where standard fixings are not sufficient. It can be used for both, indoor and outdoor applications.

- In December 2012, Sormat Group acquired the business of LIEBIG mechanical heavy duty anchors from the Simpson Strong-Tie International Inc. (U.S.) as part of its consistent development of its ETA-approved anchoring product range.

Target Audience:

- Resin capsule manufacturers

- Resin capsule traders/distributors/suppliers

- Manufacturers of raw materials

- Regulatory bodies

- Research organizations

- Association and industry bodies

- End-use industries

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing their efforts and investments.

Scope of the Report:

This research report categorizes the resin capsule market based on terminal type, application, and region.

Resin Capsule Market, by Type:

- Polyester

- Epoxy

- Acrylic

- Others(vinyl ester, phenols, and amines)

Resin Capsule Market, by Catalyst Type:

- Organic peroxides

- Oil-based

- Water-based

Resin Capsule Market, by End-Use Industry:

- Construction

- Mining

- Manufacturing

- Others(marine and oil & gas)

Resin Capsule Market, by Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Critical questions which the report answers

- What are new application areas which the resin capsule companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Application Analysis

- A product matrix, which gives a detailed analysis of various types of resin capsule used in various applications.

Regional Analysis

- A further breakdown of the regional resin capsule market to the country level

Company information

- Detailed analysis and profiling of additional market players (up to 5)

The resin capsule market is projected to grow from USD 1010.0 million in 2017 to USD 1,256.2 million by 2022, at a CAGR of 4.46% from 2017 to 2022. Increase in government investments on infrastructural developments in developing countries and rise in construction & mining activities are expected to boost the demand for resin capsules. Increasing applications of resin capsules in the strata reinforcement function play a critical role in fostering its demand in emerging countries.

Resin capsule comprises various types of polymer or monomer resins and catalyst components packed in a cartridge/capsule form. Resin capsules, during installation, are inserted into the anchor hole and get ruptured with the rotation. With this, the catalyzed resin spreads around the anchor bolt and grouts the annular space. During mixing, a chemical reaction takes place between the two components which further improves the mechanical strength, high yield, and shelf life of the equipment. Resin capsules have also found wide application as an anchoring medium for rock bolts and cable bolts to provide roof and sidewall support to underground excavations.

On the basis of catalyst type, the market is segmented into organic peroxides, oil-based catalysts, and water-based catalysts. The organic peroxides segment accounted for the largest share of the global resin capsules market in 2016. This segment is witnessing tremendous growth due to the rapid industrialization and urbanization in key countries such as China and India, which have fueled the development of the manufacturing sector in the region.

Based on end-use industry, the resin capsule market has been segmented into mining, construction, manufacturing, and others. The mining segment accounted for the largest share in 2016; the rise in demand for high-quality minerals is expected to contribute significantly to the growth of the mining industry, which in turn is boosting the resin capsules market growth.

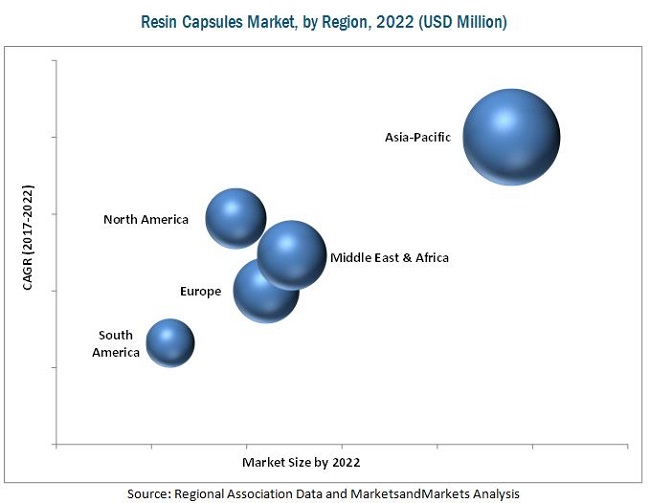

The resin capsule market has been studied for North America, Europe, APAC, Middle East & Africa and South America. In 2016, the Asia-Pacific market accounted for the largest share of the global resin capsules market, followed by the Middle East & Africa and North America. Countries such as China and Australia are expected to witness high growth in the resin capsules market due to rapid economic expansion, which is has increased the export of resin capsules. Advancements in terms of product innovations and technologies are expected to create strong investment opportunities for resin capsule. As a result, the mining capacity of various metals and minerals is increasing, thereby boosting the demand for resin capsules.

Mining Industry to Drive The Resin Capsule Market

Mining

Mining is a primary economic activity of obtaining minerals and rare earth metals from the ground. Continuous demand for minerals and rare earth metals has propelled the growth of resin capsules market. The mining industry utilizes resin capsules for rock bolting and cable bolting. It also uses resin capsules to support roof and sidewall underground excavations.

Construction

Increase in population, urbanization, and industrialization has boosted the growth of the building & construction industry. The demand for the strengthening of concrete structures has resulted in an increased use of chemical bonded anchors. Unsaturated polyester resin, which is a structural adhesive, is an essential element in a chemical bonded anchor; it also works as a threaded rod or a reinforcing bar that is inserted in a drilled hole.

Manufacturing

The general manufacturing segment includes metal furniture, plastic parts, transformer construction, insulation, adhesives, and the encapsulation of electronic modules. Resin capsules are widely used in the manufacturing industry owing to their ability to mix effectively, and their properties which help in improved film shredding, increased encapsulation, easier bolt installation, and extended shelf life.

The manufacture of resin capsules is a capital-intensive process; the initial capital involved in setting up a manufacturing plant for resin capsules is very high. The rapid technological innovations have led to the development of highly advanced equipment, which is expensive to buy. In general, players with high-investment capabilities are entering the market as the returns are high only in the long term. However, resin capsule manufacturing has become an issue for small manufacturers as they are reluctant to enter the business. The demands of clients with respect to shapes, sizes, materials, and resins used differ. This means that the production lines should be fully equipped to produce the different specifications. Small manufacturers fail to enjoy the cost benefit ratio in the long term as they do not have the capacity to invest initially. Therefore, cost of benefit ratio concern for small manufacturer can be one of the major restraints in the resin capsule market.

Sika AG (Switzerland), Orica Limited (Australia), Barnes Group (US), DYWIDAG-Systems International (Germany), Rawlplug (Poland), Bohle AG (Germany), Sormat OY (Finland), Fischer Holding GmbH & CO. (Germany), Liebig. (France), and Hexion Inc. (US) among others are the leading companies operating in the resin capsule market. These companies are expected to account for significant shares of the resin capsule market in the near future.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for resin capsule?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Developing Economies to Witness High Demand for Resin Capsules

4.2 Resin Capsules Market, By Resin Type

4.3 Resin Capsules Market, By Catalyst Type

4.4 Resin Capsules Market, By End-Use Industry

4.5 Resin Capsules Market: Regional Snapshot

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Evolution of Resin Capsules

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Investments in the Construction Industry

5.3.1.2 Rapid Urbanization and Industrialization Stimulates the Demand for Resin Capsule

5.3.1.3 Increasing Applications of Resin Capsules in Mining Industry.

5.3.2 Restraints

5.3.2.1 Cost to Benefit Ratio A Concern for Small Manufacturers

5.3.3 Opportunities

5.3.3.1 Mining Sector in Africa and Eastern Europe Offer High Growth Potential

5.3.3.2 New Product Developments to Offer High Growth Potential

5.3.4 Challenges

5.3.4.1 Shorter Shelf-Life of Resin Capsule

5.3.4.2 Health Implications of Resin Capsule

5.3.4.3 Fluctuations in the Prices of Raw Materials

5.4 Impact Analysis

6 Resin Capsules Market, By Catalyst Type (Page No. - 41)

6.1 Introduction

6.2 Organic Peroxides

6.3 Oil-Based

6.4 Water-Based

7 Resin Capsules Market, By Resin Type (Page No. - 44)

7.1 Introduction

7.2 Polyester

7.3 Epoxy

7.4 Acrylic

7.5 Others

8 Resin Capsules Market, By End-Use Industry (Page No. - 47)

8.1 Introduction

8.2 Mining

8.3 Construction

8.4 Manufacturing

8.5 Others

9 Resin Capsules Market, By Region (Page No. - 50)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Asia-Pacific

9.3.1 China

9.3.2 Australia

9.3.3 India

9.3.4 New Zealand

9.3.5 Japan

9.3.6 Rest of Asia-Pacific

9.4 Europe

9.4.1 Russia

9.4.2 Germany

9.4.3 U.K.

9.4.4 Spain

9.4.5 France

9.4.6 Rest of Europe

9.5 Middle East & Africa (MEA)

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 Turkey

9.5.4 UAE

9.5.5 Rest of MEA

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Chile

9.6.4 Peru

9.6.5 Rest of South America

10 Competitive Landscape (Page No. - 103)

10.1 Introduction

10.2 Competitive Leadership Mapping

10.2.1 Dynamic Differentiators

10.2.2 Innovators

10.2.3 Visionary Leaders

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio

10.3.2 Business Strategy Excellence

10.4 Market Ranking of Key Players

11 Company Profiles (Page No. - 108)

(Business Overview, Strength of Product Portfolio, Business Strategy Excellence & Recent Developments)*

11.1 Sika AG

11.2 Orica Limited

11.3 Barnes Group Inc.

11.4 Dywidag-Systems International

11.5 Rawlplug

11.6 Bohle AG

11.7 Sormat Oy

11.8 Fischer Holding GmbH & Co.

11.9 Arkema SA

11.10 Hexion Inc.

11.11 Mungo

11.12 W R Grace and Company

11.13 Liebig International Ltd.

11.14 Polygon Chemicals Pvt. Ltd.

11.15 Precision Drawell

11.16 Fosroc

11.17 Kee Systems

11.18 Kunal Conchem (P)

11.19 Multifix

11.20 Hightech Mining Products

11.21 Forgefix Ltd.

11.22 Laxmi Industries

11.23 Candorr International

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence & Recent Developments, Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 134)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (101 Tables)

Table 1 Asia-Pacific: Urbanization Prospects

Table 2 Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 3 By Market Size, By Resin Type, 20152022 (USD Million)

Table 4 Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 5 By Market Size, By Region, 20152022 (USD Million)

Table 6 North America: Resin Capsules Market Size, By Country, 20152022 (USD Million)

Table 7 North America: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 8 North America: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 9 North America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 10 U.S.: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 11 U.S.: By Market Size, By Resin Type, 20152022 (USD Million)

Table 12 U.S.: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 13 Canada: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 14 Canada: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 15 Canada: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 16 Mexico: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 17 Mexico: By Market Size, By Resin Type, 20152022 (USD Million)

Table 18 Mexico: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 19 Asia-Pacific: By Market Size, By Country, 20152022 (USD Million)

Table 20 Asia-Pacific: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 21 Asia-Pacific: By Market Size, By Resin Type, 20152022 (USD Million)

Table 22 Asia-Pacific: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 23 China: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 24 China: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 25 China: By Market Size, By End-Use Sector, 20152022 (USD Million)

Table 26 Australia: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 27 Australia: By Market Size, By Resin Type, 20152022 (USD Million)

Table 28 Australia: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 29 India: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 30 India: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 31 India: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 32 New Zealand: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 33 New Zealand: By Market Size, By Resin Type, 20152022 (USD Million)

Table 34 New Zealand: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 35 Japan: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 36 Japan: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 37 Japan: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 38 Rest of Asia-Pacific: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 39 Rest of Asia-Pacific: By Market Size, By Resin Type, 20152022 (USD Million)

Table 40 Rest of Asia-Pacific: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 41 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 42 Europe: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 43 Europe: By Market Size, By Resin Type, 20152022 (USD Million)

Table 44 Europe: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 45 Russia: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 46 Russia: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 47 Russia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 48 Germany: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 49 Germany: By Market Size, By Resin Type, 20152022 (USD Million)

Table 50 Germany: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 51 U.K.: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 52 U.K.: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 53 U.K.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 54 Spain: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 55 Spain: By Market Size, By Resin Type, 20152022 (USD Million)

Table 56 Spain: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 57 France: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 58 France: By Market Size, By Resin Type, 20152022 (USD Million)

Table 59 France: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 60 Rest of Europe: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 61 Rest of Europe: By Market Size, By Resin Type, 20152022 (USD Million)

Table 62 Rest of Europe: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 64 Middle East & Africa: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 65 Middle East & Africa: By Market Size, By Resin Type, 20152022 (USD Million)

Table 66 Middle East & Africa: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 67 South Africa: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 68 South Africa: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 69 South Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 70 Saudi Arabia: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 71 Saudi Arabia: By Market Size, By Resin Type, 20152022 (USD Million)

Table 72 Saudi Arabia: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 73 Turkey: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 74 Turkey: By Market Size, By Resin Type, 20152022 (USD Million)

Table 75 Turkey: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 76 UAE: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 77 UAE: By Market Size, By Resin Type, 20152022 (USD Million)

Table 78 UAE: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 79 Rest of MEA: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 80 Rest of MEA: By Market Size, By Resin Type, 20152022 (USD Million)

Table 81 Rest of MEA: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 82 South America: By Market Size, By Country, 20152022 (USD Million)

Table 83 South America: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 84 South America: By Market Size, By Resin Type, 20152022 (USD Million)

Table 85 South America: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 86 Brazil: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 87 Brazil: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 88 Brazil: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 89 Argentina: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 90 Argentina: By Market Size, By Resin Type, 20152022 (USD Million)

Table 91 Argentina: Resin Capsules Market Size, By End-Use Industry, 20152022 (USD Million)

Table 92 Chile: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 93 Chile: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 94 Chile: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 95 Peru: Resin Capsules Market Size, By Catalyst Type, 20152022 (USD Million)

Table 96 Peru: By Market Size, By Resin Type, 20152022 (USD Million)

Table 97 Peru: Resin Capsules Market Size, By Application, 20152022 (USD Million)

Table 98 Rest of South America: By Market Size, By Catalyst Type, 20152022 (USD Million)

Table 99 Rest of South America: Resin Capsules Market Size, By Resin Type, 20152022 (USD Million)

Table 100 Rest of South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 101 Market Ranking

List of Figures (31 Figures)

Figure 1 Market Segmentation

Figure 2 Resin Capsules Market, By Region

Figure 3 Resin Capsules Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Organic Peroxides Projected to Remain the Largest Catalyst Type Through 2022

Figure 8 Polyester is Expected to Account for the Largest Share in the Resin Capsules Market Through 2022

Figure 9 Mining Segment is Expected to Lead the Market for Resin Capsules Through 2022

Figure 10 Asia-Pacific Dominated the Resin Capsules Market in 2016

Figure 11 Emerging Economies Offer Attractive Opportunities in the Resin Capsules Market

Figure 12 Polyester Segment Expected to Lead the Market Through 2022

Figure 13 Organic Peroxides Segment to Lead the Market During the Forecast Period

Figure 14 Demand for Resin Capsules in the Construction Industry to Grow at the Highest Rate

Figure 15 Organic Peroxides Segment Captured the Largest Share of the Asia-Pacific Market, 2016

Figure 16 Market in China is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 17 Resin Bolting System has Evolved Significantly Since Its Inception

Figure 18 Increasing Investments in the Construction Industry to Drive the Growth of the Resin Capsules Market

Figure 19 Resin Capsules Market, By Catalyst Type, 2017 vs 2022 (USD Million)

Figure 20 Resin Capsules Market, By Resin Type, 2017 vs 2022 (USD Million)

Figure 21 Resin Capsules Market, By End-Use Industry, 2017 vs 2022

Figure 22 Geographic Snapshot: Asia-Pacific Resin Capsules Market Emerging as the New Hotspot

Figure 23 Asia-Pacific Resin Capsules Market Snapshot: China is Projected to Be the Fastest-Growing Market Between 2017 & 2022

Figure 24 Resin Capsule Market:Competitive Leadership Mapping, 2016

Figure 25 Sika AG: Company Snapshot

Figure 26 Orica Limited: Company Snapshot

Figure 27 Barnes Group Inc.: Company Snapshot

Figure 28 Rawlplug Company: Company Snapshot

Figure 29 Arkema SA: Company Snapshot

Figure 30 Hexion Inc.: Company Snapshot

Figure 31 Strength of Product Portfolio

Growth opportunities and latent adjacency in Resin Capsules Market