Renewable Energy Management Systems Market - Global Forecast to 2029

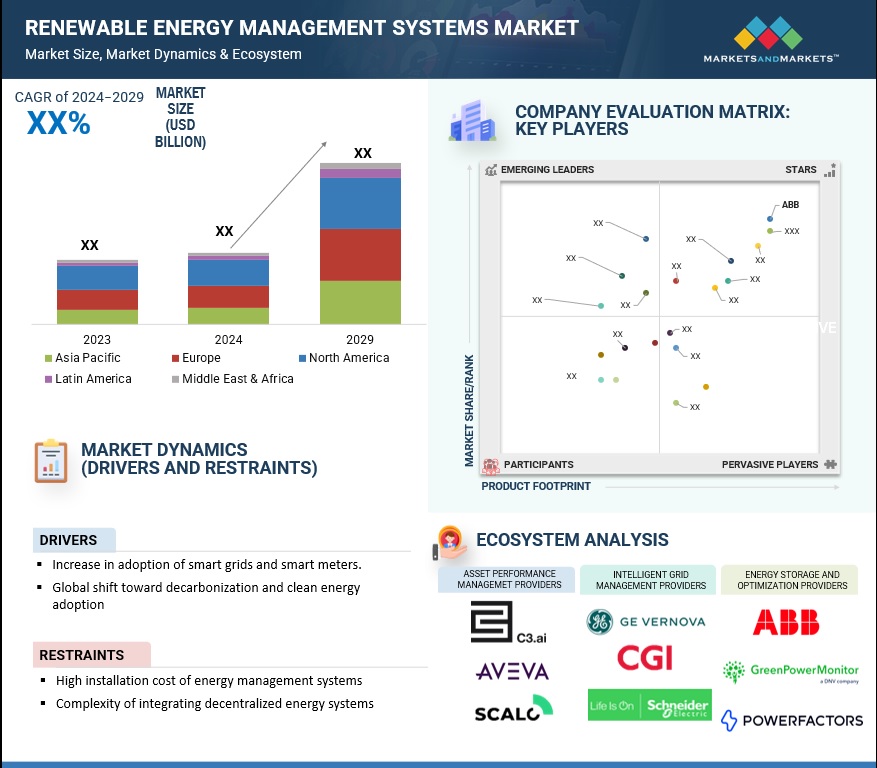

The Renewable energy management systems market size is expected to increase from USD XX billion in 2024 to USD XX billion by 2029, at a CAGR of XX% during the forecast period. The renewable energy management systems (REMS) leverage AI and ML to enable efficient, proactive management of all renewable assets and data sources to provide real-time insights into energy operations and facilitate strategic decisions in the market. With the rise in energy prices, organizations are willing to utilize renewable energy management systems for greater value forecasts. The advent of smart grid technologies into renewable energy management systems, as well as the implementation of smart meters, are improving the ability to connect renewable energy sources to existing power systems.

In the last few years, some significant changes have been witnessed in the REMS market. The first trend that has emerged is increased investment in energy digital solutions that increase operational efficiency and carbon emissions. The second trend is the deployment of renewable energy resources in smart city programs, which contributes to a wider agenda of building sustainable cities.

To know about the assumptions considered for the study, Request for Free Sample Report

ATTRACTIVE OPPORTUNITIES IN RAIL TRAFFIC MANAGEMENT MARKET

Impact of Generative AI on Renewable Energy Management Systems Market

The renewable energy management systems market is expected to be transformed with the implementation of generative Al. Generative Al's use of sophisticated forecasting methods results in appropriate levels of energy output which corresponds with current energy demand. Generative AI also revolutionizes asset management by enabling predictive maintenance, reducing maintenance costs and downtime. This optimizes operational expenses and extends the lifespan of renewable energy infrastructure. Also, GenAI enables more intelligent grid operations, and consequently, outages are minimized while load balancing is enhanced, and such improvements contribute to an efficient energy network that is more environmentally friendly. GenAI is expected to drive smarter, more adaptive grid operations, contributing to a more sustainable and environmentally friendly energy ecosystem.

Renewable Energy Management Systems Market Dynamics

Driver: Global shift toward decarbonization and clean energy adoption

There is a notable trend all over the world in decreasing the carbon footprint and moving toward cleaner sources of energy. This transition has necessitated the development and increased deployment of renewable energy management systems. Increasing concerns for climate change has pushed governments and the private sector to start engaging in sustainable practices which in turn has created a larger demand for renewable energy management systems. Governments engagement with their long-term climate goals and the Paris Agreement highlights the trend and a steady increase in market demand for REMS. As of 2023, the share of renewables in total generation increased to over 30 percent, further validating the pace of inversion. Since the electric power industry is undergoing a crucial transition, increasing demand for renewable energy management systems is expected. As global renewable energy capacity is projected to reach 12,380 GW by 2050, REMS will play a critical role in enabling efficient deployment and grid stability, driving their adoption across markets.

Restraint: High installation cost of energy management systems

The presence of a high up-front investment is one of the greatest restraints to the development of the market for renewable energy management systems, especially so for small and medium-sized enterprises (SMEs). For instance, the cost associated with installing solar panels and wind turbines, among other infrastructural components, may amount to millions of dollars. There are also additional constant operational and maintenance costs, making it extremely difficult for SMEs to undertake large-scale renewable projects. Organizations spending limitations prevent access to more sophisticated energy management systems capable of improving energy efficiency and sustainability. As a result, many organizations might postpone or abandon plans to invest in the procurement of renewable energy management systems, leading to stagnation in the growth and innovation of the market.

Opportunity: Integration of IoT and AI in existing energy management systems

Incorporating AI and IoT in the energy management sector represents a big opportunity for harnessing the management systems of renewable energy through real-time management, predictive maintenance, and optimized energy use. The use of IoT reveals the possibility of tracking energy consumption, production, and distribution of renewable energy from solar, wind, and hydro sources whereas Al technology works towards the storage of this energy, grid stability, and load balancing. It increases energy efficiency and reduces wastage, making it easier and cheaper to realize the full potential of renewables. In addition, it is also expected that system costs can be reduced by 10-15% on an annual basis by utilizing these energy management solutions, further promoting the use of renewables in the commercial and residential sectors.

Challenge: Regulatory and grid compatibility issues

Regulatory and grid compatibility problems are significant barriers to implementing renewable energy management systems. In addition, there are many regions where the legal frameworks lag the technical development of renewables, which causes approval processes to be slow and integration issues to be high. The International Energy Agency (IEA) has also pointed out that only 10% of the global grid structures and systems in place would allow for high renewable energy integration. Furthermore, there are too many different rules and regulations spread out across different countries, which hinder the ability of firms to implement a standard renewable energy management system on a global scale, delaying the movement towards greener energy sources.

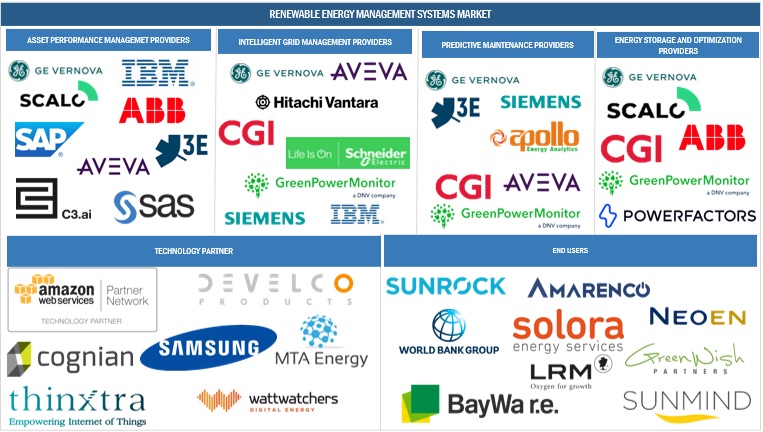

Renewable Energy Management Systems Market Ecosystem

The Renewable energy management systems market ecosystem comprises a diverse range of stakeholders. Key players include asset performance management providers, intelligent grid management providers, predictive maintenance providers, energy storage and optimization providers, and technology partners. These entities manage and optimize renewable energy production, operations, and maintenance across assets, sites, and portfolios.

To know about the assumptions considered for the study, download the pdf brochure

By software type, the asset performance management segment is to grow at the highest CAGR during the forecast period.

The asset performance management (APM) segment has been noted to grow at the highest CAGR within renewable energy management systems because of its criticality in optimizing the performance and reliability of energy assets. APM software allows organizations to assess asset health, anticipate malfunctions/failures, and improve operations via actionable insights obtained from data. APM systems take advantage of sophisticated analytics and active monitoring to cut costs tied to downtime and maintenance and increase the useful life of the assets. According to AVEVA and ABB, the efficient use of APM helps in enhancing decision-making and proper resource utilization, leading to increased production and lesser environmental footprints in the renewable energy industry. This emphasis on asset optimization further shows that APM has growth factors for the industry and it's a good growth strategy.

By deployment mode, cloud deployment mode will register the highest CAGR during the forecast period.

The cloud deployment segment within the renewable energy management systems market is expected to grow faster due to several factors. Cloud-based systems are more scalable and flexible, they also allow energy firms to operate and manage distributed energy resources without building a significant amount of infrastructure on-site. Cloud-based systems enable the management of assets in a manner that allows real-time analytics and control, which enhances operational efficiencies and minimizes expenditures. Energy integration is also improved by utilizing cloud computing since it allows for integrating data from various sources. Also, more data will be available to use remotely, which helps in decision-making, making cloud solutions increasingly attractive in the evolving energy landscape.

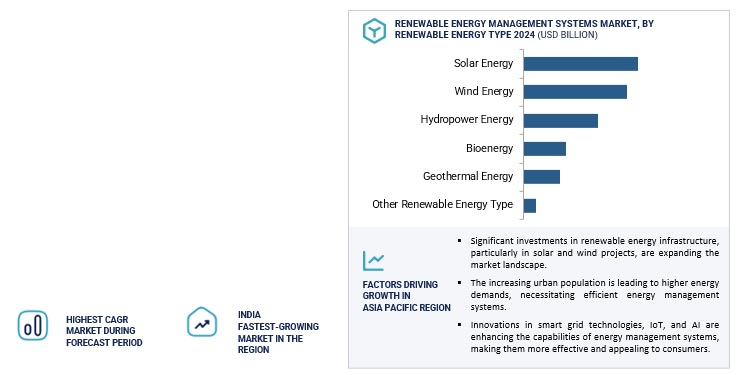

By renewable technology type, hydropower energy will register the highest CAGR during the forecast period

Hydropower energy type is expected to grow at the highest CAGR in the renewable energy management systems market. For maintaining stability of the grid, hydropower plants require sophisticated management that ensures consistency in power supply and deals with fluctuations in electricity demand, and storage of energy. The availability of renewable energy management systems reduces maintenance costs, providing the capacity for constant monitoring, predictive maintenance scheduling, and maximum production efficiency of the hydropower plants. The rise in analytics-driven process effectiveness and the application of IoT-based technologies are continuously boosting the productivity of hydropower by upgrading its efficiency, reducing idle time, and prolonging the service life of the entire hydropower facility. Due to the increasing complexity of grid interconnections, these systems additionally enable easy integration of hydropower plants with the generation and distribution systems, contributing to energy delivery reliability and efficiency.

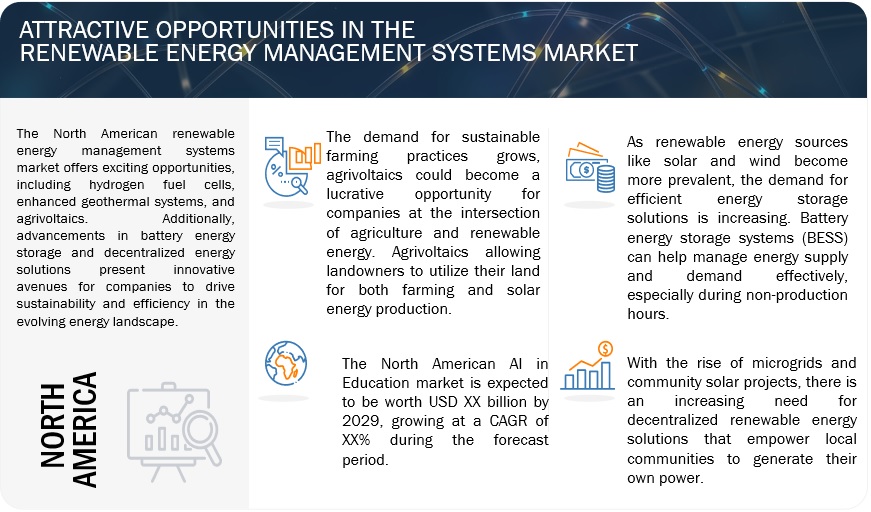

By region, the Asia Pacific region registered highest CAGR in the Renewable energy management systems market during the forecast period.

The Asia Pacific region is set to have the highest CAGR growth in the renewable energy management systems market. The energy demand has grown in countries such as China and India because of industrialization and urbanization which results in increased investment in renewable technologies. China, for instance, has been leading the world in solar panel manufacturing and renewable capacity installations. India’s push toward achieving 500 GW of renewable energy capacity by 2030 further underscores the demand for advanced REMS to ensure efficient energy generation and grid integration. The increasing demand for effective energy management solutions in developing countries throughout Southeast Asia is enhancing the uptake of REMS. These systems are crucial for enhancing renewable energy functions, boosting grid reliability, and tackling infrastructure issues in densely populated urban areas.

Key Market Players

- Siemens

- GE Vernova

- ABB

- EMERSON

- UL Solutions

- Baker Hughes

- C3.AI

- CGI

- AVEVA

- SCALO

- Simble Solutions

- Bazefield

- GreenPowerMonitor

- 3E

Recent Developments:

- In October 2024, AVEVA established a partnership with Schneider Electric which is intended to help increase sustainability in the renewable sector. The core of this partnership focuses on integrating some of AVEVA software within the industry and energy management solutions of Schneider Electric. Their goal is to improve the efficiency and sustainability of renewable energy projects through technologies that enhance energy effective use, emission reduction, and overall performance improvement of assets in the renewable energy management systems market.

- In July 2024, GreenPowerMonitor, a DNV company, developed an innovative Energy Management System designed for renewable power plants. GPM estimates that energy consumption will be almost doubled by 2050 and thus developed such a tool. The tool brings about automated control of power plants through active power dispatch schedules which are based on forecasted weather for maximized output and participation in multiple energy markets. It also makes automatic adjustments to changes occurring in factors that may affect the operation of the plants, therefore offering smooth interfacing with existing Greenpower Monitor for photovoltaic, wind, and hybrid plants.

- In May 2024, C3 AI and Bloom Energy formed a partnership to improve the performance of the fuel cell so that it is possible to integrate the operational C3 AI Reliability Suite. This partnership seeks to improve operational excellence for Bloom’s fuel cell servers through AI-based intelligence- real-time real time monitoring of the systems and switching them to the desired modes that improve power supply. With a gigawatt of installed capacity, Bloom Energy reaches a billion data points daily, and this allows for the utilization of remote engineering teams for AI recommendations in fuel cell operation.

- In February 2024, BayWa r.e. and 3E have signed a strategic partnership to increase profiling and analytics of BayWa r.e. photovoltaic (PV) portfolio worldwide. In terms of this agreement, BayWa r.e. will employ the SynaptiQ platform, one of the 3E’s developed web-based apps for optimal functioning of PV and battery energy storage systems (BESS). Such Partnership intends to help in enhancing asset management to achieve dependable energy production in their renewable energy projects and thus consolidate the two companies in their quest for sustainable energy solutions across the globe.

- li> In September 2023, ABB signed a partnership with WindESCO and purchased a minor stake in the analytics software provider to diversify its wind energy portfolio. This partnership seeks to enhance the effectiveness as well as the dependability of wind turbines using advanced analytics. With the use of WindESCO’s OEM-independent asset performance monitoring and wake optimization solutions, ABB can now meet the demand of wind customers with total integrated solutions. The investment complements ABB’s ambition to further the energy transition and increase the digital services offered in the renewable power generation industry, thus improving efficiency and helping mitigate the effects of climate change.

Frequently Asked Questions (FAQ):

What are the opportunities for the renewable energy management systems market?

Define the renewable energy management systems market.

Which are the major market players covered in the report?

How big is the global Renewable energy management systems market today?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Renewable Energy Management Systems Market