Remote Workplace Services Market by Component (Solutions and Services), Deployment Mode (On-Premises and Cloud), Organization Size, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Global Forecast to 2027

Updated on : April 03, 2023

Remote Workplace Services Market Size

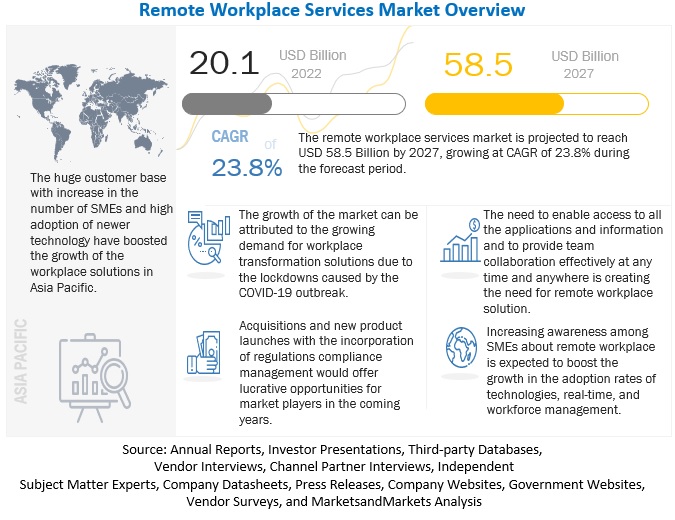

The remote workplace services market size is expected to increase from USD 20.1 billion in 2022 to USD 58.5 billion by 2027 At a CAGR of 23.8% during the forecast period. The remote workplace experience provides personalized, role-based services as well as the data, applications, and collaboration tools required for employees to work from anywhere, on any device, at any time. To achieve this, digital workplaces utilize mobility services and digital technology to adapt to user activities to help increase employee engagement.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Remote Workplace Services Market

The COVID-19 led to work from home scenario, due to worldwide lockdown, this has fuelled the growth of the market. The trend toward remote workplace services has grown because of the organizations adopting remote working, and the economic uncertainty brought on by COVID-19 supports the market’s expansion. Since employees from diverse departments need remote solutions to interact, communicate, and share data within the firm, remote working is predicted to boost the remote workplace services market. The digitalization of work and social connections has accelerated under COVID-19.

Remote Workplace Services Market Dynamics

Driver: Better employee engagement and initiatives

A remote workplace offers a central platform to access all the applications, business data, and projects in one place, which saves time and improves employee experience. For remote employees, well-being is very important, particularly emotional wellness. The critical problem of mental health can severely impact engagement levels. Employers can identify the benefits among the difficulties by highlighting the qualities of their workforce while adhering to fundamental values of honesty and trust. A remote workplace can increase productivity by ensuring that business divisions work in harmony and removing obstacles that hinder them from completely sharing resources. A remote workplace service gives workers more work-life balance while boosting the productivity and agility of the company since it makes it simpler to participate in virtual meetings and removes restrictions related to time, place, devices, and network connections.

Restraint: Security repercussions of remote work

SMEs prefer remote workplace platform solutions, as they are SaaS-based services that are cost-effective, scalable, agile, and can be opted based on the pay-as-you-use model. However, there are security concerns associated with cloud deployment modules, which can lead to data leakage of critical business information. Furthermore, other security issues can arise, such as hijacking accounts, insider threats, malware injections, insecure Application Programming Interfaces (APIs), shared vulnerabilities, and data loss in remote workplace service platforms.

Opportunity: Cost reduction and improved productivity in remote services

Remote workers lower the amount of real estate required, implying that companies spend much less on leasing or purchasing office space. Moreover, a remote worker saves money on expenses related to running an office, such as computers, phones, power, heating, and air conditioning. Since the majority of a company’s workers work from home, there is no need for them to rent a larger space, saving them money on rent and utilities. The digitalization of workplaces is about using technology for greater efficiency. Digitization enables organizations to create proactive tools to scan data streams for potential issues and implement workflows that automate corrective actions before problems occur. Remote workplaces allow access to innovative market research apps that post the results on a shared intranet or platform so employees can actively work toward implementing them.

Challenge: Low readiness to adopt advanced solutions

Most businesses prefer the traditional workplace system due to its simplicity. The major challenges for adopting remote workplace solutions are services, resistance to change in the workplace environment, and due to lack of IT spending, a skilled IT workforce, and complications associated with IT architecture. Moreover, office settings frequently have some form of protection to guard against various security hazards, such as cyberattacks, but remote workers frequently do not. When working remotely, employees run a higher risk of connecting to an unsecured network, being targets of cyberattacks, or having their tools stolen or misplaced. Such factors are impacting the growth and adoption of remote workplace services. Due to siloed activity, business units are impeded or unable to collaborate because their processes, systems, documentation, and communications apply to only a part of the organization. This is specifically relevant for today’s distributed hybrid workforce and fragmented teams.

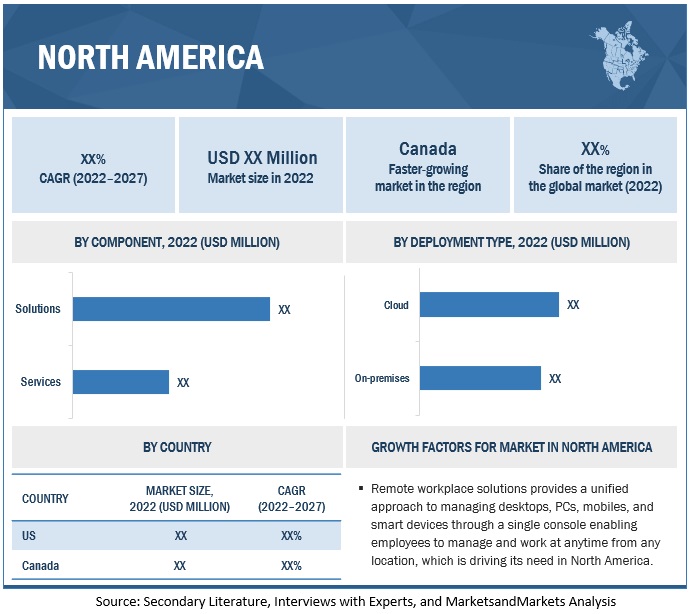

North America to account for largest market size during the forecast period

The geographic analysis of the Remote Workplace Services Market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured most of the share, as the US and Canada are rapidly adopting Cloud Native Storage. North America has the presence of top vendors, including Microsoft, IBM, Unisys, VMware, Hewlett Packard Enterprise, and Google. The region is experiencing significant innovations in technologies.

To know about the assumptions considered for the study, download the pdf brochure

As per organization size, large enterprises segment to hold largest market size during the forecast period

The remote workplace services market organization size segment is sub segmented into SMEs and large enterprises. As per organization size, large enterprises segment to held largest market share in 2022 and the trend is expected to continue during the forecast period. Large enterprises are utilizing cutting-edge digital transformation technology to enhance corporate operations and gain an advantage over rivals. The majority of large enterprises have embraced the remote workplace to give their staff a better working environment. A growing need for remote workplace services is being caused by large enterprises' ongoing adoption of new technologies including big data, social media, and mobile devices. Large enterprises can profit from the advantages of remote workplace services and related services by committing to digital transformation solutions and significant economies of scale.

Key Market Players

Some of the major Remote Workplace Services Market vendors are Wipro (India), HCL Technologies (India), TCS (India), Atos (France), Accenture (Ireland), IBM (US), NTT Data (Japan), Hewlett Packard Enterprise (US), VMware (US), Unisys (US)

Scope of the Report

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 58.5 Billion |

|

Market value in 2022 |

USD 20.1 Billion |

|

Market Growth Rate |

15.9% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Segments covered |

Component, Organization Size, Deployment Type, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Middle East & Africa, and Latin America |

|

Companies covered |

Wipro (India), HCL Technologies (India), TCS (India), Atos (France), Accenture (Ireland), IBM (US), NTT Data (Japan), Hewlett Packard Enterprise (US), VMware (US), Unisys (US), Zensar (India), DXC Technology (US), Microsoft (US), Google (US), Cognizant (US), Infosys (India), Capgemini (France), Citrix (US), and others |

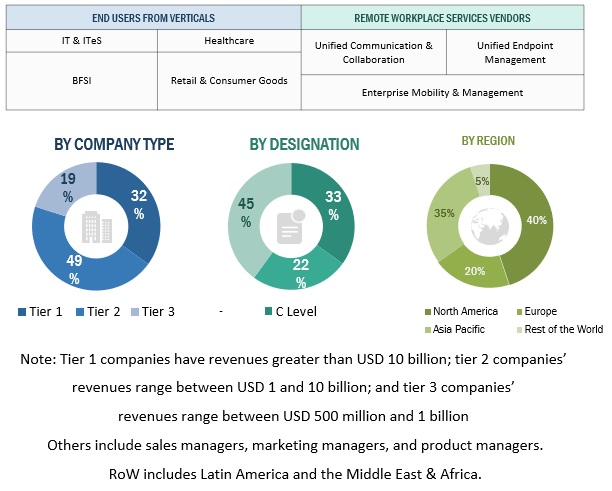

This research report categorizes the remote workplace services market based on Component, Organization Size, Deployment Type, Verticals and Regions.

By Component:

-

Solutions

- Unified Communication & Collaboration

- Unified Endpoint Management

- Enterprise Mobility Management

-

Services

- Managed Services

- Professional Services

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Type:

- On-Premises

- Cloud

By Verticals:

- Telecommunication

- Banking, Financial Services, & Insurance

- IT & ITeS

- Manufacturing

- Retail & Consumer Goods

- Media & Entertainment

- Healthcare & Life Sciences

- Government & Public Sectors

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In August 2022, to enhance employee experience and workplace safety, Wipro introduced a digital tool. Clients would gain access to the solution under both perpetual and subscription-based license models, and there will be no extra charge for mobility.

- In July 2022, Atos announced the addition of five new startups to the program to concentrate particularly on quantum technology and digital security. As startups contribute novel solutions to Atos’ portfolio, Scaler added value for the company’s clients. In return, Atos promoted the startups’ business and international expansion by facilitating faster access to its clientele and partner network.

- In July 2022, Accenture assist Colonial Pipeline, the largest refined product pipeline in the US, to lower regulated and deregulated electric utility rates for its interstate pipeline system by leveraging a proprietary database powered by artificial intelligence (AI).

- In November 2021, The IBM CIC (Client Innovation Center) would be essential in the city’s IT ecosystem’s digital transformation and open new job possibilities to support the next generation of technological innovation.

- In May 2021, The Unisys Corporation stated InteliServ, the platform for digital workplace services to engage users with service desks, incorporated voice recognition technology from PerVoice. When using business services such as HR or the Service Desk, using this automated technology directly would improve the end user experience. Additionally, it boosted productivity by allowing support employees to focus on fixing problems.

Frequently Asked Questions (FAQ):

What is remote workplace services?

According to Cognizant, Modern technology and top-notch support services are combined to provide remote workplace services, which give employees of a company the freedom to work from any location, at any time, in a secure setting.

According to LumApps, A remote workplace is an ecosystem of office technologies that enables businesses to communicate and cooperate successfully, working remotely, or using hybrid technologies.

Which regions are early adopter of remote workplace services?

North America and Europe are at the initial stage towards adoption of Remote Workplace Services.

Which are key verticals adopting remote workplace services?

Key verticals adopting remote workplace services include: -

- Telecommunication

- Banking, Financial Services, & Insurance

- IT & ITeS

- Manufacturing

- Retail & Consumer Goods

- Media & Entertainment

- Healthcare & Life Sciences

- Government & Public Sectors

- Other Verticals

Which are the key vendors exploring remote workplace services?

The key vendors exploring remote workplace services includes Wipro (India), HCL Technologies (India), TCS (India), Atos (France), Accenture (Ireland), IBM (US), NTT Data (Japan), Hewlett Packard Enterprise (US), VMware (US), Unisys (US), Zensar (India), DXC Technology (US), Microsoft (US), Google (US), Cognizant (US), Infosys (India), Capgemini (France), Citrix (US), and others .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 REMOTE WORKPLACE SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

TABLE 2 PRIMARY CONTACTED: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 REMOTE WORKPLACE SERVICES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING REMOTE WORKPLACE SOLUTIONS AND SERVICES

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM VERTICALS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF REMOTE WORKPLACE VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE): CAGR PROJECTIONS FROM THE SUPPLY-SIDE

2.4 RESEARCH ASSUMPTIONS

TABLE 3 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 7 REMOTE WORKPLACE SERVICES MARKET SNAPSHOT, 2020–2027

FIGURE 8 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE, 2022

FIGURE 9 REMOTE WORKPLACE SOLUTIONS TO BE LARGER THAN SERVICES DURING FORECAST PERIOD

FIGURE 10 LARGE ENTERPRISES TO BE LARGER MARKET DURING FORECAST PERIOD

FIGURE 11 ON-PREMISE DEPLOYMENT TO BE LARGER THAN CLOUD DURING FORECAST PERIOD

FIGURE 12 TOP VERTICALS IN MARKET, 2022–2027 (USD MILLION)

FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN REMOTE WORKPLACE SERVICES MARKET

FIGURE 14 GEOGRAPHIC CHANGES AND TECHNOLOGICAL EVOLUTION TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 15 MARKET, BY COMPONENT, 2022 VS. 2027

4.3 MARKET, BY DEPLOYMENT TYPE

FIGURE 16 MARKET, BY DEPLOYMENT TYPE, 2022 VS. 2027

4.4 MARKET, BY ORGANIZATION SIZE

FIGURE 17 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

4.5 MARKET, BY VERTICAL

FIGURE 18 MARKET, BY VERTICAL, 2022 VS. 2027

4.6 MARKET INVESTMENT SCENARIO

FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: REMOTE WORKPLACE SERVICES MARKET

5.2.1 DRIVERS

5.2.1.1 Central platform to access all applications

5.2.1.2 Better employee engagement and initiatives

5.2.1.3 High productivity and diverse geo-collaboration

5.2.2 RESTRAINTS

5.2.2.1 Security repercussions of remote work

FIGURE 21 TOP ENTERPRISE SECURITY ISSUES, 2021

5.2.3 OPPORTUNITIES

5.2.3.1 Digitalization across organizations through digital and remote workplace solutions

5.2.3.2 Cost reduction and improved productivity in remote services

5.2.4 CHALLENGES

5.2.4.1 Internet connectivity issues and security risks involved

5.2.4.2 Low readiness to adopt advanced solutions

5.3 COVID-19 IMPACT ANALYSIS ON REMOTE WORKPLACE SERVICES MARKET

TABLE 4 PERCENTAGE OF TEAMS WORKING REMOTELY BEFORE AND AFTER COVID-19

TABLE 5 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN COVID-19 ERA

TABLE 6 CUMULATIVE GROWTH ANALYSIS

5.4 CASE STUDY ANALYSIS

5.4.1 THOUGHTWORKS CREATED AN IMPACT BY CONNECTING ITS GLOBAL WORKFORCE

5.4.2 SUPERDRUG USED MANGOAPPS TO STREAMLINE COLLABORATION AND CENTRALIZE INFORMATION

5.4.3 DEPAUL UK ADOPTED ACCENTURE’S SOLUTION TO ELIMINATE INEFFICIENCIES ACROSS THE WORKPLACE

5.5 ECOSYSTEM

FIGURE 22 ECOSYSTEM: MARKET

TABLE 7 REMOTE WORKPLACE ECOSYSTEM

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN: MARKET

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS

TABLE 8 REMOTE WORKPLACE SERVICES MARKET: PRICING LEVELS

5.7.2 AVERAGE SELLING PRICE TRENDS

TABLE 9 MARKET: AVERAGE PRICING LEVELS (USD)

5.8 PATENT ANALYSIS

FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2011–2021

FIGURE 25 TOP TEN GLOBAL PATENT APPLICANTS, 2021

TABLE 10 TOP PATENT OWNERS

5.9 TECHNOLOGY ANALYSIS

5.9.1 ARTIFICIAL INTELLIGENCE

5.9.2 CYBERSECURITY

5.9.3 INTERNET OF THINGS

5.9.4 DATA ANALYTICS

5.9.5 CLOUD STORAGE

5.9.6 BLOCKCHAIN

5.10 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 SEC RULE 17A-4

5.10.5 ISO/IEC 27001

5.10.6 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCE

5.10.7 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.10.8 FREEDOM OF INFORMATION ACT

5.10.9 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11 KEY CONFERENCES AND EVENTS

TABLE 15 REMOTE WORKPLACE SERVICES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: MARKET

TABLE 16 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 THREAT FROM SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 DEGREE OF COMPETITION

5.13 KEY STAKEHOLDERS & BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 27 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP VERTICALS

5.13.2 BUYING CRITERIA

FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 18 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 29 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

6 REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT (Page No. - 93)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 30 REMOTE WORKPLACE SERVICES TO GROW AT HIGHER CAGR THAN SOLUTIONS

TABLE 19 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 31 ENTERPRISE MOBILITY & MANAGEMENT TO BE FASTEST-GROWING SOLUTION DURING FORECAST PERIOD

TABLE 21 MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 22 REMOTE WORKPLACE SERVICES MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.1 UNIFIED COMMUNICATION & COLLABORATION

TABLE 23 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 24 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 UNIFIED ENDPOINT MANAGEMENT

TABLE 25 UNIFIED ENDPOINT MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 UNIFIED ENDPOINT MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 ENTERPRISE MOBILITY & MANAGEMENT

TABLE 27 ENTERPRISE MOBILITY & MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 ENTERPRISE MOBILITY & MANAGEMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 32 MANAGED SERVICES TO GROW AT HIGHER CAGR THAN PROFESSIONAL SERVICES DURING FORECAST PERIOD

TABLE 29 REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 30 REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2022–2027 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 31 MANAGED SERVICES SUBMARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 MANAGED SERVICES SUBMARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 PROFESSIONAL SERVICES

TABLE 33 PROFESSIONAL SERVICES SUBMARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 34 PROFESSIONAL SERVICES SUBMARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2.1 Training, support, and maintenance

6.3.2.2 Consulting services

6.3.2.3 Integration & implementation services

7 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT TYPE (Page No. - 104)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 33 CLOUD DEPLOYMENT TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 35 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 36 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

7.2 ON-PREMISES

TABLE 37 ON-PREMISE MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 ON-PREMISE MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CLOUD

TABLE 39 CLOUD MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 CLOUD MARKET, BY REGION, 2022–2027 (USD MILLION)

8 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE (Page No. - 109)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 34 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

TABLE 41 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 42 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL- & MEDIUM-SIZED ENTERPRISES

TABLE 43 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 SMALL- & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 45 LARGE ENTERPRISES MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 LARGE ENTERPRISES MARKET, BY REGION, 2022–2027 (USD MILLION)

9 REMOTE WORKPLACE SERVICES MARKET, BY VERTICAL (Page No. - 114)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 35 IT & IT-ENABLED SERVICES VERTICAL TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 47 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 48 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 49 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 TELECOMMUNICATIONS

TABLE 51 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 TELECOMMUNICATIONS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 RETAIL & CONSUMER GOODS

TABLE 53 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 RETAIL & CONSUMER GOODS VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 IT & ITES

TABLE 55 IT & ITES VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 56 IT & ITES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 HEALTHCARE & LIFE SCIENCES

TABLE 57 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 58 HEALTHCARE & LIFE SCIENCES VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 MANUFACTURING

TABLE 59 MANUFACTURING VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 60 MANUFACTURING VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MEDIA & ENTERTAINMENT

TABLE 61 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 62 MEDIA & ENTERTAINMENT VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 GOVERNMENT & PUBLIC SECTOR

TABLE 63 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 64 GOVERNMENT & PUBLIC SECTOR VERTICAL MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 OTHER VERTICALS

TABLE 65 OTHER VERTICALS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 66 OTHER VERTICALS MARKET, BY REGION, 2022–2027 (USD MILLION)

10 REMOTE WORKPLACE SERVICES MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 36 NORTH AMERICA TO BE THE LARGEST MARKET BY 2027

TABLE 67 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

TABLE 69 NORTH AMERICA: REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

TABLE 83 US: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 84 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 85 US: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 86 US: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.2.2 CANADA

TABLE 87 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 88 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 89 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 90 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.3 EUROPE

TABLE 91 EUROPE: REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 96 EUROPE: REMOTE WORKPLACE SERVICES SUBMARKET MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 UK

TABLE 105 UK: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 106 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 107 UK: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 108 UK: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.3.2 GERMANY

TABLE 109 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 111 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 112 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.3.3 FRANCE

TABLE 113 FRANCE: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 117 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

TABLE 135 CHINA: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 136 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 137 CHINA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 138 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.4.2 JAPAN

TABLE 139 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 141 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.4.3 AUSTRALIA & NEW ZEALAND

TABLE 143 AUSTRALIA & NEW ZEALAND: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 144 AUSTRALIA & NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 145 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 146 AUSTRALIA & NEW ZEALAND: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.4.4 INDIA

TABLE 147 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 148 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 149 INDIA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 150 INDIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 151 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 152 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 153 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 154 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 155 MIDDLE EAST & AFRICA: REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.1 KINGDOM OF SAUDI ARABIA

TABLE 169 KINGDOM OF SAUDI ARABIA: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 170 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 171 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 172 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.5.2 SOUTH AFRICA

TABLE 173 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 174 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 175 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 176 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.5.3 UAE

TABLE 177 UAE: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 178 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 179 UAE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 180 UAE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.5.4 REST OF THE MIDDLE EAST & AFRICA

TABLE 181 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 182 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 183 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 184 REST OF THE MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

TABLE 185 LATIN AMERICA: REMOTE WORKPLACE SERVICES MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 189 LATIN AMERICA: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 190 LATIN AMERICA: REMOTE WORKPLACE SERVICES SUBMARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.1 BRAZIL

TABLE 199 BRAZIL: REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 200 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 201 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 202 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.6.2 MEXICO

TABLE 203 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 204 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 205 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 206 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

10.6.3 REST OF LATIN AMERICA

TABLE 207 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 208 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 209 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 210 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 177)

11.1 INTRODUCTION

FIGURE 39 REMOTE WORKPLACE SERVICES MARKET EVALUATION FRAMEWORK

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 211 OVERVIEW OF STRATEGIES ADOPTED BY KEY REMOTE WORKPLACE VENDORS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 40 MARKET HISTORICAL REVENUE ANALYSIS, 2017–2021 (USD MILLION)

11.4 KEY COMPANY EVALUATION QUADRANT

FIGURE 41 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 42 REMOTE WORKPLACE SERVICES MARKET: KEY COMPANY EVALUATION QUADRANT

11.4.5 KEY PLAYER COMPETITIVE BENCHMARKING

TABLE 212 KEY COMPANY COMPONENT FOOTPRINT

TABLE 213 KEY COMPANY REGIONAL FOOTPRINT

TABLE 214 KEY COMPANY PRODUCT FOOTPRINT

11.5 STARTUP/SME EVALUATION QUADRANT

FIGURE 43 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.5.1 RESPONSIVE VENDORS

11.5.2 PROGRESSIVE VENDORS

11.5.3 DYNAMIC VENDORS

11.5.4 STARTING BLOCKS

FIGURE 44 REMOTE WORKPLACE SERVICES MARKET: STARTUP/SME EVALUATION QUADRANT

TABLE 215 STARTUP/SME COMPONENT FOOTPRINT

TABLE 216 STARTUP/SME REGIONAL FOOTPRINT

TABLE 217 STARTUP/SME PRODUCT FOOTPRINT

11.5.5 STARTUP/SME COMPETITIVE BENCHMARKING

TABLE 218 MARKET: DETAILED LIST OF KEY STARTUP/SMES

11.6 COMPETITIVE SCENARIO

TABLE 219 MARKET: NEW LAUNCHES, 2019–2022

TABLE 220 MARKET: DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 194)

12.1 INTRODUCTION

12.2 MAJOR PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

12.2.1 WIPRO

TABLE 221 WIPRO: BUSINESS OVERVIEW

FIGURE 45 WIPRO: COMPANY SNAPSHOT

TABLE 222 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 223 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 224 WIPRO: DEALS

12.2.2 HCL TECHNOLOGIES

TABLE 225 HCL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 46 HCL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 226 HCL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 227 HCL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 228 HCL TECHNOLOGIES: DEALS

12.2.3 TCS

TABLE 229 TCS: BUSINESS OVERVIEW

FIGURE 47 TCS: COMPANY SNAPSHOT

TABLE 230 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 TCS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 232 TCS: DEALS

12.2.4 ATOS

TABLE 233 ATOS: BUSINESS OVERVIEW

FIGURE 48 ATOS: COMPANY SNAPSHOT

TABLE 234 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 ATOS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 236 ATOS: DEALS

12.2.5 ACCENTURE

TABLE 237 ACCENTURE: BUSINESS OVERVIEW

FIGURE 49 ACCENTURE: COMPANY SNAPSHOT

TABLE 238 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 239 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 240 ACCENTURE: DEALS

12.2.6 IBM

TABLE 241 IBM: BUSINESS OVERVIEW

FIGURE 50 IBM: COMPANY SNAPSHOT

TABLE 242 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 243 IBM: PRODUCT LAUNCHES & ENHANCEMENT

TABLE 244 IBM: DEALS

12.2.7 NTT DATA

TABLE 245 NTT DATA: BUSINESS OVERVIEW

FIGURE 51 NTT DATA: COMPANY SNAPSHOT

TABLE 246 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 247 NTT DATA: SERVICE LAUNCHES & BUSINESS EXPANSIONS

TABLE 248 NTT DATA: DEALS

12.2.8 HEWLETT PACKARD ENTERPRISE

TABLE 249 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 52 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

TABLE 250 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 251 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 252 HPE: DEALS

12.2.9 VMWARE

TABLE 253 VMWARE: BUSINESS OVERVIEW

FIGURE 53 VMWARE: COMPANY SNAPSHOT

TABLE 254 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 255 VMWARE: DEALS

12.2.10 UNISYS

TABLE 256 UNISYS: BUSINESS OVERVIEW

FIGURE 54 UNISYS: COMPANY SNAPSHOT

TABLE 257 UNISYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 258 UNISYS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 259 UNISYS: DEALS

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 ZENSAR

12.3.2 DXC TECHNOLOGY

12.3.3 FUJITSU

12.3.4 MICROSOFT

12.3.5 GOOGLE

12.3.6 COGNIZANT

12.3.7 INFOSYS

12.3.8 CAPGEMINI

12.3.9 CITRIX

12.4 STARTUP/SME PLAYERS

12.4.1 KISSFLOW

12.4.2 MANGOAPPS

12.4.3 AXERO SOLUTIONS

12.4.4 LUMAPPS

12.4.5 JOSTLE

12.4.6 WORKVIVO

12.4.7 CLOUDHESIVE

12.4.8 YOOBIC

12.4.9 POWELL SOFTWARE

12.4.10 DINCLOUD

13 ADJACENT/RELATED MARKETS (Page No. - 244)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 UNIFIED COMMUNICATION AND COLLABORATION MARKET

TABLE 260 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 261 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 262 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 263 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 264 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 265 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 266 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 267 UNIFIED COMMUNICATION & COLLABORATION MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

13.3 DIGITAL WORKPLACE MARKET

TABLE 268 DIGITAL WORKPLACE MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 269 DIGITAL WORKPLACE MARKET, BY DEPLOYMENT, 2020–2026 (USD MILLION)

TABLE 270 DIGITAL WORKPLACE MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 271 DIGITAL WORKPLACE MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 249)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size for remote workplace services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the remote workplace services market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing remote workplace services offerings; associated service providers; and SIs operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the cloud native storage market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, government & public sector, healthcare & life sciences, telecommunications, IT & ITeS, manufacturing, retail & consumer goods, media & entertainment, and other verticals. Others include education, and travel & hospitality.

Report Objectives

- To describe and forecast the remote workplace services market based on components (solutions and services), deployment types, organization size, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To comprehensively analyze the core competencies of the key players in the market

- To assess the impact of COVID-19 on the remote workplace services market

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, partnerships, contracts, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

- Further breakup of the European digital map market

- Further breakup of the Asia Pacific digital map market

- Further breakup of the Latin American digital map market

- Further breakup of the Middle East & Africa digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Workplace Services Market