Remote Work Security Market by Offering (Solutions and Services), Security Type (Endpoint & IoT, Network, Cloud), Remote Work Model (Fully, Hybrid, Temporary), Vertical (BFSI, Retail & eCommerce, IT & ITeS) and Region - Global Forecast to 2028

Updated on : Nov 17, 2025

Remote Work Security Market Overview

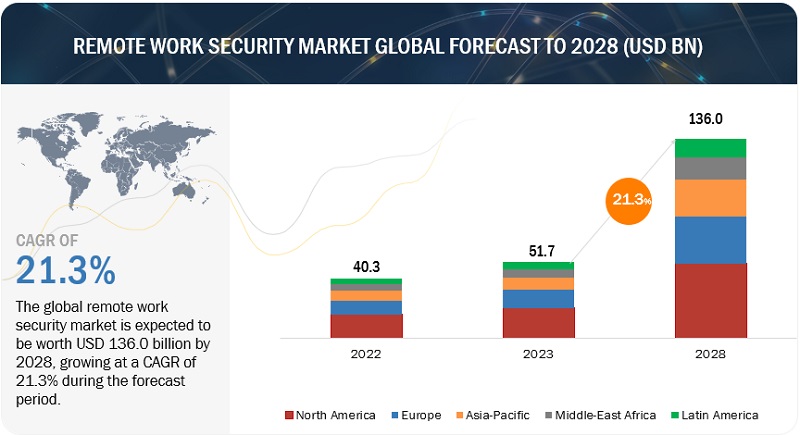

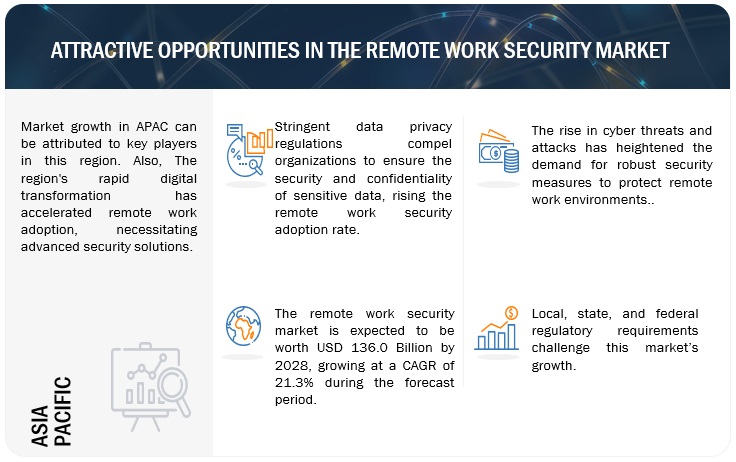

The global remote work security market size was estimated at USD 51.7 billion in 2023 and is projected to reach USD 136.0 billion by 2028, growing at a CAGR of 21.3% from 2023 to 2028.

Adopting the Zero Trust Network Access (ZTNA) framework is a significant driver in the market. ZTNA operates on the principle of “never trust, always verify,” continuously verifying users and devices to enhance security in remote work scenarios. It offers adaptive access controls, micro-segmentation, and enhanced data protection, aligning well with the dynamic nature of remote work. This framework ensures that access is based on real-time risk assessments and can restrict access in unusual situations, reducing the risk of data breaches and unauthorized sharing. Overall, ZTNA is recognized for its effectiveness in mitigating security risks associated with remote work, making it a key factor in the remote work security market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Remote Work Security Market Dynamics

Driver: Growing demand for cloud-based security solutions

Cloud-based security solutions are becoming increasingly popular as they offer several advantages over traditional on-premises setups. Cloud-based solutions are often more scalable and easier to manage, and they can be accessed from anywhere. The growing demand for these solutions is fueled by the ever-changing needs of businesses, which require adaptable and flexible security measures to keep pace with the dynamic threat landscape. Additionally, the cost-effectiveness of cloud security is an attractive proposition for organizations, as it allows them to avoid significant upfront investments in hardware and infrastructure. However, the importance of robust cloud security measures is highlighted by the findings of the Cost of data breach research conducted by IBM, which revealed that 45% of breaches occurred in cloud environments. Interestingly, breaches in the public cloud were found to cost considerably more than breaches in organizations with a hybrid cloud model. This emphasizes the need for comprehensive security solutions specifically designed for the cloud environment. With the rise of remote work and a mobile workforce, cloud-based security's ability to protect data and applications regardless of the user's location further solidifies its position as a preferred choice.

Restraint: Lack of awareness of remote work security risks

Lack of awareness regarding remote work security risks presents a significant challenge for remote work security as many individuals and organizations fail to grasp the potential threats and vulnerabilities associated with remote work, leading to complacency and inadequate protection measures. Consequently, sensitive data becomes exposed, and susceptibility to cyberattacks increases, resulting in potential financial losses. The Lookout State of Remote Work Security Report highlighted that 95% of cybersecurity breaches are caused by human error, often due to unintentional mistakes made by remote workers. Therefore, raising awareness about these risks is crucial to ensure remote workers and organizations remain vigilant, adopt robust security protocols, and effectively safeguard their digital assets.

Opportunity: Increasing demand for mobile security solutions

The reliance on mobile devices for business has increased as the global workforce embraces flexible work arrangements. However, this transition has also led to an increase in cyber threats and data breaches. According to the 2022 workforce security report by Checkpoint, 97% of organizations faced mobile threats, and 46% reported incidents where employees downloaded malicious mobile applications. Consequently, organizations seek comprehensive mobile security solutions to protect their remote workforce and sensitive information. These solutions encompass a range of advanced authentication methods, encryption protocols, secure mobile device management, and real-time threat monitoring. By implementing these robust measures, companies can fortify remote work environments, ensuring enhanced data protection and mitigating potential cyber-attacks. The deployment of mobile security solutions shields business assets and fosters confidence and peace of mind among remote employees, empowering them to work efficiently and productively from any location without compromising data integrity and confidentiality.

Challenge: Securing remote access to corporate resources

Securing remote access to corporate resources presents a significant challenge for organizations due to the diverse range of devices and networks used by remote workers. Personal devices and networks can expose vulnerabilities, making them potential cyberattack targets. According to the Lookout report on the state of remote work security, it has been found that 46% of remote employees opt to store the work files on personal devices rather than using the employer’s network drive, further heightening the security risks. The growing sophistication of cyberattacks poses an ongoing threat, requiring constant vigilance to counter emerging risks. Implementing VPNs and 2FA can be complex, demanding seamless integration with existing systems while ensuring user-friendliness. Maintaining security measures across various platforms and educating employees about security risks are crucial to preventing potential breaches and safeguarding sensitive corporate data.

Ecosystem of Remote Work Security Market

The application security type registers the highest CAGR in the remote work security market during the forecast period.

Application security refers to identifying, mitigating, and preventing security vulnerabilities and threats within software applications. Application security is critical as remote employees rely heavily on various software applications to perform their tasks. These applications may include communication tools, collaboration platforms, and business-critical applications. Ensuring the security of these applications is essential to prevent unauthorized access, data leaks, and cyber threats that could compromise remote work environments. Adequate application security in remote work settings includes regular vulnerability assessments, patch management, secure coding practices, and continuous monitoring of applications for suspicious activities. By prioritizing application security, organizations can enable remote employees to work confidently with software tools, minimizing the risks associated with application vulnerabilities and enhancing the overall security posture in remote work scenarios.

The professional services are expected to register a higher CAGR during the forecast period.

Professional services offer expert guidance, implementation, and ongoing support to organizations in remote work security. These services encompass various activities, including risk assessments, security policy development, infrastructure design, and security audits. Professionals in this field assist organizations in identifying vulnerabilities, designing and implementing robust security measures, and ensuring compliance with industry standards and regulations. They provide training and awareness programs for remote employees, equipping them with the knowledge and skills to recognize and respond to security threats. Moreover, professional services offer incident response planning and management, helping organizations swiftly mitigate and recover from security incidents. Professional services are instrumental in creating a secure remote work environment, adapting security strategies to evolving threats, and ensuring that organizations can harness the benefits of remote work without compromising on cybersecurity.

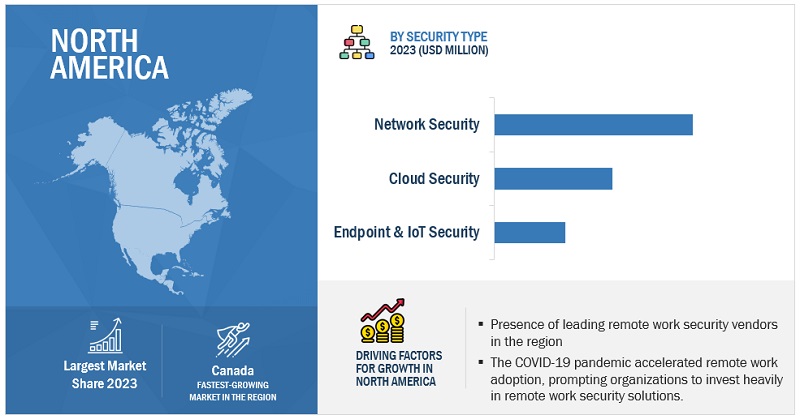

Based on region, North America is expected to hold the largest market size during the forecast.

The global remote work security market is set to witness North America as its most significant contributor in market size, with a considerable impact from the United States and Canada. Within the region, organizations heavily invest in cutting-edge technologies like AI, 5G, machine learning, blockchain, big data, and cloud computing. This tech-driven approach is fueling the demand for cloud-based security solutions, including Software-Defined Wide Area Networking (SD-WAN), Zero Trust Network Access (ZTNA), Secure Web Gateways (SWG), and Cloud Access Security Brokers (CASB). Projections from the Mobile Economy North America 2022 report suggest that 5G connections (excluding IoT) will reach a staggering 280 million by 2025, constituting 64% of all mobile connections in North America. Additionally, the sudden shift to remote work in 2020 amplified security concerns, prompting organizations to establish a distributed security perimeter. As a result, the market for remote work security solutions in North America is expected to experience substantial growth in the coming years.

Market Players:

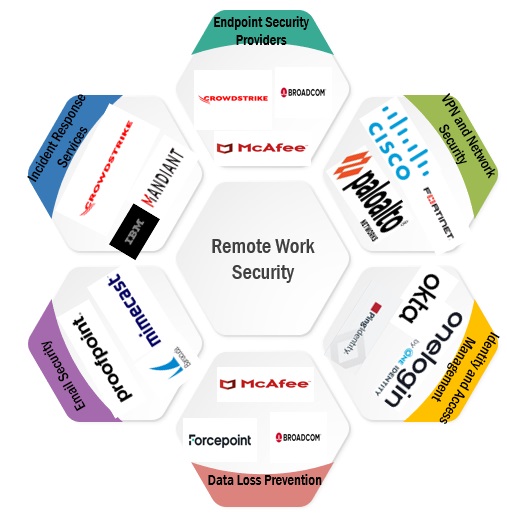

The major vendors in this market include Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their footprint in the remote work security market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By Offering security type, remote work model, vertical, and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

The major players in the market are Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US) |

Remote Work Security Market Highlights

This research report categorizes the Remote Work Security Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

Based on Offering: |

|

|

Based on Security Type: |

|

|

Based on the Remote Work Model: |

|

|

Based on Vertical: |

|

|

By Region: |

|

Recent Developments:

- In April 2023, VMware and Lookout partnered to offer a secure access service edge (SASE) solution, integrating the Lookout Cloud Security Platform with VMware SD-WAN. The partnership ensures optimized network connectivity, data protection, and enhanced visibility for cloud-first enterprises, providing reliable and secure remote access to applications from any device and location.

- In April 2023, Palo Alto Networks and Accenture joined forces to offer AI-powered Prisma SASE solutions, enhancing cyber resilience and enabling secure access control for organizations amidst the complexities of remote work and multi-cloud environments.

- In July 2022, Cisco and Ricoh formed a strategic partnership, offering Secure Remote Access Solutions, combining network security and Auto VPN elements, to enhance hybrid working and IoT support services in Hong Kong. The collaboration provides comprehensive smart office solutions for businesses.

Frequently Asked Questions (FAQ):

What is remote work security?

Remote work security refers to the practices, technologies, policies, and measures implemented to protect an organization’s data, systems, and network when employees work outside the traditional office environment, typically from remote locations such as their homes or other remote offices. Remote work security aims to ensure that sensitive and confidential information remains safe and secure, even when accessed and transmitted from various remote devices and networks.

What is the market size of the remote work security market?

The major drivers in the remote work security market include the increasing adoption of remote work, rising cybercrime rates, and growing demand for cloud-based security solutions. These factors have led to a rising demand for network emulators.

What are the major drivers in the remote work security market?

North America is expected to hold the highest market share during the forecast period.

Who are the key players operating in the remote work security market?

The key vendors operating in the remote work security market include Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US).

What are the opportunities for new market entrants in remote work security?

New entrants eyeing the remote work security market have various opportunities to establish themselves in this growing sector. Innovating with cutting-edge security solutions, specializing in niche areas, offering cost-effective options, ensuring user-friendly interfaces, forming strategic partnerships, and expanding into emerging markets are all viable strategies. Additionally, expertise in compliance, providing education and training services, scalability, and a robust customer-centric approach can set new entrants apart in this dynamic and competitive landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of remote work- Increasing cases of cybercrime- Growing demand for cloud-based security solutionsRESTRAINTS- Low readiness to adopt advanced solutions- Lack of awareness regarding remote work security risks- Challenges in managing remote devices and networksOPPORTUNITIES- Growth of cloud computing market- Increasing demand for mobile security solutions- Rise of Internet of Things (IoT)CHALLENGES- Diverse range of devices and networks used by remote workers- Development of new methods to breach data- Increasing phishing and other social engineering attacks

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISCOMPETITIVE RIVALRY WITHIN INDUSTRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSREMOTE WORK SECURITY MARKET: BUSINESS MODELS

-

5.6 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBLOCKCHAINZERO TRUST SECURITYSECURE ACCESS SERVICE EDGE (SASE)ENDPOINT SECURITYCYBERSECURITY MESH

-

5.7 HISTORY OF REMOTE WORK SECURITY MARKET1990S2000S2010S2020S–PRESENT

- 5.8 REMOTE WORK SECURITY TOOLS, FRAMEWORKS, AND TECHNIQUES

-

5.9 IMPACT OF REMOTE WORK SECURITY MARKET GROWTH ON ADJACENT NICHE TECHNOLOGIESSECURED COLLABORATION TOOLSENDPOINT SECURITY AND DEVICE MANAGEMENTCLOUD SECURITY AND IDENTITY MANAGEMENTVIRTUAL PRIVATE NETWORKS (VPNS)SECURE ACCESS SERVICE EDGE (SASE)ARTIFICIAL INTELLIGENCE (AI) AND AUTOMATIONSECURE VIDEO CONFERENCING AND WEBINAR SOLUTIONSSECURE PRINTING SOLUTIONS

- 5.10 FUTURE OF REMOTE WORK SECURITY MARKET LANDSCAPE

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.12 BEST PRACTICES IN MARKETSECURE REMOTE ACCESSINTERNET ACCESS SECURITYDATA PROTECTIONENDPOINT PROTECTION

-

5.13 CASE STUDY ANALYSISCASE STUDY 1: MOBILEZONE ADOPTED JEVOTRUST’S VMWARE WORKSPACE ONE UEM TO MODERNIZE ITS DEVICE MANAGEMENT STRATEGYCASE STUDY 2: AUTODESK EMBRACED CLOUD COMPUTING AND CITRIX SOLUTIONS TO FUEL ITS DIGITAL BUSINESS TRANSFORMATIONCASE STUDY 3: HENNY PENNY ADOPTED CHECK POINT’S NEXT-GENERATION SECURITY GATEWAYS TO SECURE ITS GLOBAL MANUFACTURING ORGANIZATIONCASE STUDY 4: GILLMAN ADOPTED ESET’S ENDPOINT ANTIVIRUS, UTILIZING RIP AND REPLACE FEATURE FOR QUICK, REMOTE DEPLOYMENTCASE STUDY 5: SHILPA MEDICARE LIMITED ADOPTED SECLORE’S RIGHTS MANAGEMENT SECURITY24 TO SAFEGUARD ITS HIGH-QUALITY FORMULATIONS’ INTELLECTUAL PROPERTY

-

5.14 PRICING ANALYSISPRICING MODELS OF OPENVPNPRICING MODELS OF MICROSOFTPRICING MODELS OF VMWAREPRICING MODELS OF CITRIXPRICING MODELS OF CLOUDFLARE

-

5.15 PATENT ANALYSIS

-

5.16 TARIFF AND REGULATORY LANDSCAPEGENERAL DATA PROTECTION REGULATION (GDPR)PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteria

- 5.17 KEY CONFERENCES & EVENTS

-

6.1 INTRODUCTIONOFFERINGS:MARKET DRIVERS

-

6.2 SOLUTIONSDEMAND FOR REMOTE WORK SECURITY SOLUTIONS TO SAFEGUARD MODERN ORGANIZATIONS TO DRIVE MARKET

-

6.3 SERVICESGROWING NEED TO SECURE INTEGRITY AND AVAILABILITY OF DATA TO BOOST GROWTHPROFESSIONAL SERVICES- Training & consulting- Integration & implementation- Support & maintenanceMANAGED SERVICES

-

7.1 INTRODUCTIONSECURITY TYPES: MARKET DRIVERS

-

7.2 ENDPOINT & IOT SECURITYFOCUS ON ENCOMPASSING ANTIVIRUS SOFTWARE, ANTI-MALWARE TOOLS, FIREWALLS, AND INTRUSION DETECTION SYSTEMS TO PROPEL MARKET

-

7.3 NETWORK SECURITYGROWING EMPHASIS ON SAFEGUARDING COMMUNICATION CHANNELS, DATA TRANSFERS, AND ACCESS TO COMPANY RESOURCES TO SPUR GROWTH

-

7.4 CLOUD SECURITYNEED FOR SECURED REMOTE ACCESS WHILE MITIGATING DATA EXPOSURE RISKS WITH CLOUD SECURITY TO ENCOURAGE MARKET EXPANSION

-

7.5 APPLICATION SECURITYAPPLICATION SECURITY SERVICES TO ENABLE REMOTE EMPLOYEES TO WORK CONFIDENTLY WITH SOFTWARE TOOLS

-

8.1 INTRODUCTIONREMOTE WORK MODELS: MARKET DRIVERS

-

8.2 FULLY REMOTENEED FOR FLEXIBILITY AND ACCESS TO GLOBAL TALENT POOL TO BOOST USE OF FULLY REMOTE MODEL

-

8.3 HYBRIDDEMAND FROM EMPLOYEES FOR SPACE TO ALIGN THEIR PERSONAL PREFERENCES WITH JOB REQUIREMENTS TO ENCOURAGE GROWTH

-

8.4 TEMPORARY REMOTERISING NEED FOR MORE FLEXIBILITY TO DRIVE POPULARITY OF TEMPORARY REMOTE MODEL

-

9.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

9.2 BFSIUSE OF SENSITIVE FINANCIAL DATA IN BFSI SECTOR TO DRIVE NEED FOR RIGOROUS SECURITY MEASURES

-

9.3 TELECOMMUNICATIONSNEED FOR STRICT REGULATIONS AND COMPLIANCE STANDARDS TO MAINTAIN SECURE REMOTE WORK ENVIRONMENT TO SPUR MARKET GROWTH

-

9.4 IT & ITESGROWING CYBER THREATS IN IT & ITES SECTOR TO COMPEL ADOPTION OF REMOTE WORK SECURITY SOLUTIONS

-

9.5 EDUCATIONNEED FOR SEAMLESS AND SECURE ONLINE LEARNING EXPERIENCES TO BOOST MARKET EXPANSION

-

9.6 RETAIL & ECOMMERCERISING DEMAND TO UPHOLD BRAND REPUTATION IN DIGITAL RETAIL LANDSCAPE TO SPUR GROWTH

-

9.7 GOVERNMENTUSE OF LARGE VOLUMES OF CONFIDENTIAL INFORMATION IN GOVERNMENT ENTITIES TO DRIVE ADOPTION OF REMOTE SECURITY MEASURES

-

9.8 MEDIA & ENTERTAINMENTRISING EMPHASIS ON PROTECTING VALUABLE INTELLECTUAL PROPERTY AND DIGITAL ASSETS TO SPUR POPULARITY OF REMOTE WORK SECURITY SOLUTIONS

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Need for prioritizing cybersecurity measures to safeguard remote work environments and protect sensitive dataCANADA- Rising number of government employees embracing hybrid or remote work arrangements to propel market

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Popularity of remote working model and digital technology advancements to drive demand for remote work security servicesGERMANY- Advancements in digital technology and changing work norms to drive marketFRANCE- Proactive adoption of remote workplace solutions by various government entities to spur growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Ascending rates of cybercrime to boost market expansionJAPAN- Growing acceptance of flexible work models to propel demand for remote work security solutionsINDIA- Increase in cyber threats and attacks to encourage need for robust security measuresREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST- Increase in freelancing jobs to drive popularity of remote work security servicesAFRICA- Increasing adoption of remote working models to encourage market expansion

-

10.6 LATIN AMERICALATIN AMERICA: REMOTE WORK SECURITY MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Rapid change in regulatory requirements and adoption of remote working models to boost use of remote work security solutionsMEXICO- Thriving digital boom and remarkable surge in remote working culture to encourage adoption of remote work security servicesREST OF LATIN AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY REMOTE WORK SECURITY TECHNOLOGY VENDORS

- 11.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 RANKING OF KEY PLAYERS

- 11.9 COMPETITIVE BENCHMARKING

-

11.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.11 REMOTE WORK SECURITY PRODUCT BENCHMARKINGPROMINENT REMOTE WORK SECURITY SOLUTIONS- VMware SASE- Citrix Secure Private Access- Zscaler Private Access- Venn Software- Check Point Harmony Connect

- 11.12 VALUATION AND FINANCIAL METRICS OF KEY REMOTE WORK SECURITY VENDORS

-

12.1 KEY PLAYERSVMWARE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORTINET- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsTREND MICRO- Business overview- Products/Solutions/Services offered- Recent developmentsBROADCOM- Business overview- Products/Solutions/Services offered- Recent developmentsCLOUDFLARE- Business overview- Products/Solutions/Services offered- Recent developmentsSOPHOSZSCALERCITRIXCYBERARKCROWDSTRIKEFORCEPOINTPROOFPOINTESETSECLORE

-

12.2 OTHER PLAYERSOPENVPNSECURITY ONIONWALLARMVENNCYNET SECURITYSENTINELONEISSQUAREDREVBITSSECURDENAXIS SECURITY

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 EDGE SECURITY MARKETEDGE SECURITY MARKET, BY ORGANIZATION SIZEEDGE SECURITY MARKET, BY DEPLOYMENT MODE

-

13.4 REMOTE WORKPLACE SERVICES MARKETREMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZEREMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT MODE

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 5 PRICING MODELS OF OPENVPN

- TABLE 6 PRICING MODELS OF MICROSOFT

- TABLE 7 PRICING MODELS OF VMWARE

- TABLE 8 PRICING MODELS OF CITRIX

- TABLE 9 PRICING MODELS OF CLOUDFLARE

- TABLE 10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 14 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 15 REMOTE WORK SECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 16 SOLUTIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 19 REMOTE WORK SECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 20 SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 25 REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 26 TRAINING & CONSULTING: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 TRAINING & CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 INTEGRATION & IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 MANAGED SERVICES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 35 REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 ENDPOINT & IOT SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 ENDPOINT & IOT SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 NETWORK SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 NETWORK SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 CLOUD SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 CLOUD SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 APPLICATION SECURITY: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 APPLICATION SECURITY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 45 REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 46 BFSI: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 TELECOMMUNICATIONS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 TELECOMMUNICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 IT & ITES: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 IT & ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 EDUCATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 EDUCATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 RETAIL & ECOMMERCE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 GOVERNMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 GOVERNMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 OTHER VERTICALS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 REMOTE WORK SECURITY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 77 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 US: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 79 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 80 US: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 81 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 82 US: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 83 US: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 84 US: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 85 US: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 99 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 100 UK: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 101 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 102 UK: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 103 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 104 UK: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 105 UK: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 UK: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 107 UK: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 109 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 GERMANY: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 111 GERMANY: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 113 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 114 GERMANY: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 115 GERMANY: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 116 GERMANY: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 117 GERMANY: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 131 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 132 CHINA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 133 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 134 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 135 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 137 CHINA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 139 CHINA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 162 AFRICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 163 AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 164 AFRICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 165 AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 166 AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 167 AFRICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 168 AFRICA: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 169 AFRICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 171 AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 184 BRAZIL: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 185 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 186 BRAZIL: MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 187 BRAZIL: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 188 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2018–2022 (USD MILLION)

- TABLE 189 BRAZIL: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 190 BRAZIL: MARKET, BY SECURITY TYPE, 2018–2022 (USD MILLION)

- TABLE 191 BRAZIL: MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 192 BRAZIL: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 193 BRAZIL: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 194 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 195 OVERALL COMPANY FOOTPRINT

- TABLE 196 COMPANY FOOTPRINT, BY OFFERING

- TABLE 197 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 198 COMPANY FOOTPRINT, BY REGION

- TABLE 199 DETAILED LIST OF STARTUPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 201 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 202 PRODUCT LAUNCHES, 2021–2023

- TABLE 203 DEALS, 2021–2023

- TABLE 204 COMPARATIVE ANALYSIS OF PROMINENT REMOTE WORK SECURITY SOLUTIONS

- TABLE 205 VMWARE: BUSINESS OVERVIEW

- TABLE 206 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 VMWARE: PRODUCT LAUNCHES

- TABLE 208 VMWARE: DEALS

- TABLE 209 CISCO: BUSINESS OVERVIEW

- TABLE 210 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 CISCO: DEALS

- TABLE 212 FORTINET: BUSINESS OVERVIEW

- TABLE 213 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FORTINET: PRODUCT LAUNCHES

- TABLE 215 FORTINET: DEALS

- TABLE 216 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 217 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 219 PALO ALTO NETWORKS: DEALS

- TABLE 220 CHECK POINT: BUSINESS OVERVIEW

- TABLE 221 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 CHECK POINT: PRODUCT LAUNCHES

- TABLE 223 CHECK POINT: DEALS

- TABLE 224 MICROSOFT: BUSINESS OVERVIEW

- TABLE 225 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MICROSOFT: PRODUCT LAUNCHES

- TABLE 227 MICROSOFT: DEALS

- TABLE 228 IBM: BUSINESS OVERVIEW

- TABLE 229 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 IBM: PRODUCT LAUNCHES

- TABLE 231 IBM: DEALS

- TABLE 232 TREND MICRO: BUSINESS OVERVIEW

- TABLE 233 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TREND MICRO: PRODUCT LAUNCHES

- TABLE 235 TREND MICRO: DEALS

- TABLE 236 BROADCOM: BUSINESS OVERVIEW

- TABLE 237 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BROADCOM: DEALS

- TABLE 239 CLOUDFLARE: BUSINESS OVERVIEW

- TABLE 240 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 CLOUDFLARE: PRODUCT LAUNCHES

- TABLE 242 CLOUDFLARE: DEALS

- TABLE 243 ADJACENT MARKETS AND FORECASTS

- TABLE 244 EDGE SECURITY MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 245 EDGE SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 246 SMALL & MEDIUM-SIZED ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 247 SMALL & MEDIUM-SIZED ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 248 LARGE ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 249 LARGE ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 250 EDGE SECURITY MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 251 EDGE SECURITY MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 252 ON-PREMISES: EDGE SECURITY MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 253 ON-PREMISES: EDGE SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 254 CLOUD: EDGE SECURITY MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 255 CLOUD: EDGE SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 256 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 257 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 258 SMALL & MEDIUM-SIZED ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 259 SMALL & MEDIUM-SIZED ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 260 LARGE ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 261 LARGE ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 262 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT MODE, 2017–2021 (USD MILLION)

- TABLE 263 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 264 ON-PREMISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 265 ON-PREMISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 266 CLOUD: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 267 CLOUD: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE FROM REMOTE WORK SECURITY OFFERINGS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE)

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 REMOTE WORK SECURITY MARKET, 2021–2028

- FIGURE 8 REMOTE WORK SECURITY MARKET, REGIONAL SHARE, 2023

- FIGURE 9 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 10 INCREASING ADOPTION OF REMOTE WORK AND RISING RATES OF CYBERCRIME TO DRIVE MARKET

- FIGURE 11 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 12 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 13 REMOTE WORK SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 VALUE CHAIN ANALYSIS

- FIGURE 15 ECOSYSTEM MAP

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 EVOLUTION OF REMOTE WORK SECURITY MARKET

- FIGURE 18 REVENUE SHIFT IN REMOTE WORK SECURITY MARKET

- FIGURE 19 TOP TEN PATENT OWNERS, 2015–2023

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 23 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 ENDPOINT & IOT SECURITY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 RETAIL & ECOMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 29 REVENUE ANALYSIS FOR LEADING REMOTE WORK SECURITY PROVIDERS, 2020–2022 (USD MILLION)

- FIGURE 30 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 31 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 32 RANKING OF KEY PLAYERS, 2022

- FIGURE 33 EBITDA OF KEY PLAYERS, 2023

- FIGURE 34 VMWARE: COMPANY SNAPSHOT

- FIGURE 35 CISCO: COMPANY SNAPSHOT

- FIGURE 36 FORTINET: COMPANY SNAPSHOT

- FIGURE 37 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 38 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 40 IBM: COMPANY SNAPSHOT

- FIGURE 41 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 42 BROADCOM: COMPANY SNAPSHOT

- FIGURE 43 CLOUDFLARE: COMPANY SNAPSHOT

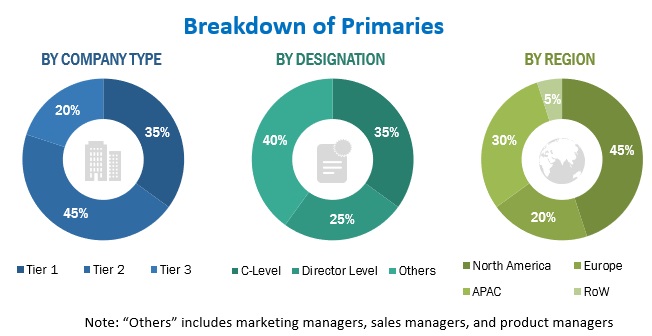

The research study involved four major activities in estimating the Remote Work Security market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research was mainly done to obtain essential information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, and regional outlook and developments from both market and technology perspectives.

Primary Research

In the primary research, various supply and demand sources were interviewed to obtain the qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, equipment manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the Remote Work Security market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

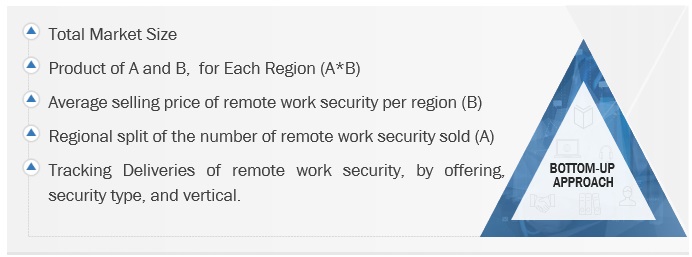

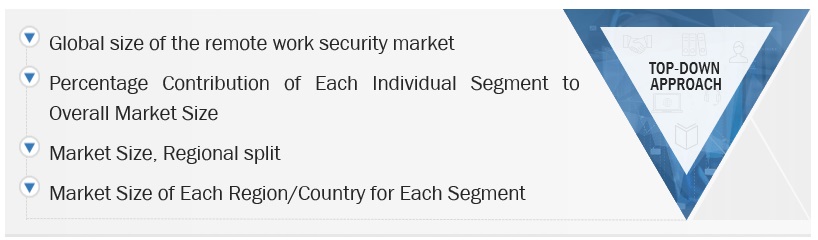

In the market engineering process, top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the Remote Work Security market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Initially, MarketsandMarkets focuses on top-line investments and spending in the ecosystems. Further, significant developments in the key market area have been considered.

- Analyzing major original equipment manufacturers (OEMs), studying their product portfolios, and understanding different applications of their solutions.

- Analyzing the trends related to adopting different types of authentications and brand protection equipment.

- Tracking the recent and upcoming developments in the Remote Work Security market that include investments, R&D activities, product launches, collaborations, mergers and acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters.

- Conduct multiple discussions with key opinion leaders to know about different types of authentications and brand protection offerings used and the applications for which they are used to analyze the break-up of the scope of work carried out by major companies.

- Segmenting the market based on technology types concerning applications wherein the types are to be used and deriving the size of the global application market.

- Segmenting the overall market into various market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The Remote Work Security market has been split into several segments and sub-segments after arriving at the overall market size from the estimation process explained above. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

The Remote work security market size has been validated using top-down and bottom-up approaches.

Market Definition

Remote work security involves safeguarding access to various applications, including those managed by the corporation, personal, recreational, and web-based applications. As businesses increasingly embrace hybrid and remote work models, ensuring the security of these critical applications, regardless of the device being used, has become a paramount concern. Organizations must carefully assess the necessary infrastructure to maintain application performance and security standards to meet the IT requirements associated with hybrid work effectively.

Stakeholders

- Remote Work Security vendors

- Project Managers

- System Integrators (SIs)

- Developers

- Business Analysts

- Cybersecurity Specialists

- Third-party vendors

- Technology Providers

- Consulting Firms

- Quality Assurance (QA)/ test engineers

Report Objectives

- To determine and forecast the global Remote work security market by offering (solution and service), security type, remote work model, vertical, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors affecting market growth.

- To forecast the size of the market segments concerning five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Remote work security market.

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the MEA market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Remote Work Security Market