Remote Firing Systems Market by Initiating Devices (Initiation Systems, Detonators), Application (Mining & Quarrying, Construction, Road Construction, & Military) & Region (North America, Europe, Asia-Pacific, South America, Africa) - Global Forecast to 2022

The remote firing systems market is estimated to be USD 469.0 Million in 2017 and is projected to reach USD 531.0 Million by 2022, at a CAGR of 2.51% from 2017 to 2022. Factors such as an increase in spending on new infrastructure development, redevelopment of existing infrastructure, increasing mining & quarrying activities, growing underwater drilling & blasting operations for the expansion of waterways and ports are expected to drive the remote firing systems market. This report forecasts the market and its dynamics over the next five years, while also recognizing market application gaps, recent developments in the market, and high potential countries. The objectives of the report are to study the factors influencing the market, map major industry players, and provide vendor analysis and competitor landscapes. The base year considered for the report is 2016 and the forecast period is from 2017 to 2022.

The remote firing systems market has been segmented on the basis of initiating device, application, and region. Based on initiating device, the market has been further segmented into initiation system and detonator. The detonator segment is projected to grow at a higher CAGR than the initiation system segment during the forecast period. The same detonator segment is also projected to lead the market during the forecast period. Factors such as increasing underground & surface mining activities and growing infrastructure spending in emerging economies have contributed to the growth of the detonator segment’s market.

Initiation systems and detonators are classified into electric, non-electronic, and electronic. Based on initiation system, the non-electronic segment is projected to lead the market during the forecast period owing to the increasing use of non-electronic initiation systems in mining, dredging, and infrastructure development activities. Based on detonator, the electronic detonator segment is projected to grow at the highest CAGR during the forecast period. The growth of this segment can be attributed to an increase in demand for cheap and simple microchip-based detonators across the globe.

Based on application, the remote firing systems market has been segmented into mining & quarrying, construction, road construction, and military. The mining & quarrying application segment is estimated to account for the largest market share in 2017. Increasing mining & quarrying activities specifically in emerging economies like India & China and rising mineral explorations in African countries are factors influencing the growth of the remote firing systems market in mining & quarrying application.

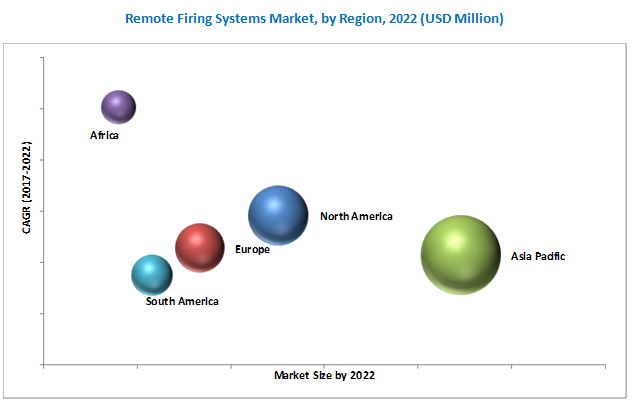

Asia Pacific accounted for the largest share of the remote firing systems market in 2016, followed by North America and Europe. Australia is estimated to account for the largest share of the Asia Pacific remote firing systems market in 2017 due to increased underground & surface mining activities in the country. Other emerging economies like India and China are increasing their mining and dredging activities so as to cater to the increasing demand for minerals and infrastructure on account of the surge in economic development.

The major challenges for the remote firing systems manufacturers are the lack of expected precision in blasting operations and inaccuracy in time delays for delay devices. At present, the accuracy of remote firing systems is enhanced by modern microchip-aided electronic initiation devices and detonators. However, the desired accuracy is still not achieved.

The major players in the remote firing systems market include Orica Mining Services (Australia), Dyno Nobel (Australia), and Solar Industries Limited (India). These manufacturers have mostly adopted new product launch and expansion into emerging markets as their key growth strategies. Orica Mining Services is the leading company in the remote firing systems market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Overview of the Market

4.2 Asia Pacific Market

4.3 Market, By Region

4.4 Market, By Initiating Device

4.5 Market, By Application

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Dredging Operations in Seaports and Routes

5.2.1.2 Increasing Urban Infrastructure Development

5.2.2 Restraints

5.2.2.1 Mining Ban

5.2.3 Opportunities

5.2.3.1 Expansion of the Mining Industry in Emerging Markets

5.2.4 Challenges

5.2.4.1 Safety & Reliability During Blasting Operations

5.3 Industry Trends

5.3.1 Technology Trends

5.3.1.1 Advancement in Electronic Initiation Systems

5.3.1.2 Advancement in Electronic Detonators

6 Remote Firing Systems Market, By Initiating Device (Page No. - 34)

6.1 Introduction

6.2 Initiation System

6.3 Detonator

7 Market, By Application (Page No. - 38)

7.1 Introduction

7.2 Mining & Quarrying

7.3 Construction

7.4 Road Construction

7.5 Military

8 Market, By Region (Page No. - 42)

8.1 Introduction

8.2 North America

8.2.1 By Country

8.2.1.1 US

8.2.1.2 Canada

8.3 Europe

8.3.1 By Country

8.3.1.1 Russia

8.3.1.2 Italy

8.3.1.3 France

8.3.1.4 Portugal

8.3.1.5 UK

8.3.1.6 Germany

8.3.1.7 Rest of Europe

8.4 Asia Pacific

8.4.1 By Country

8.4.1.1 China

8.4.1.2 India

8.4.1.3 Japan

8.4.1.4 Australia

8.4.1.5 South Korea

8.4.1.6 Rest of Asia Pacific (APAC)

8.5 South America

8.5.1 By Country

8.5.1.1 Brazil

8.5.1.2 Argentina

8.5.1.3 Chile

8.5.1.4 Peru

8.5.1.5 Rest of South America

8.6 Africa

8.6.1 By Country

8.6.1.1 South Africa

8.6.1.2 Ethiopia

8.6.1.3 Kenya

8.6.1.4 Rest of Africa

9 Competitive Landscape (Page No. - 81)

9.1 Introduction

9.2 Market Ranking of Players, 2016

9.3 Competitive Leadership Mapping

9.3.1 Dynamic Differentiators

9.3.2 Innovators

9.3.3 Visionary Leaders

9.3.4 Emerging Companies

9.4 Competitive Benchmarking

9.4.1 Strength of Product Portfolio (For 23 Companies)

9.4.2 Business Strategy Excellence (For 23 Companies)

10 Company Profiles (Page No. - 86)

(Business Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments.)*

10.1 Orica Mining Services

10.2 Solar Industries Limited

10.3 Austin Powder

10.4 Dynitec

10.5 Iskra

10.6 Ideal Industrial Explosives

10.7 Tamar Explosives

10.8 Mas Zengrange

10.9 Blasterone

10.10 Detnet

*Details on Business Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, Key Relationships Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 106)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (73 Tables)

Table 1 Container Traffic By Sea and Planned Capacity By 2030

Table 2 Remote Firing Systems Market, By Initiating Device, 2015–2022 (USD Million)

Table 3 Market, By Initiation System, 2015–2022 (USD Million)

Table 4 Market, By Detonator, 2015–2022 (USD Million)

Table 5 Market, By Application, 2015–2022 (USD Million)

Table 6 Market in Mining & Quarrying, By Region, 2015–2022 (USD Million)

Table 7 Market in Construction, By Region, 2015–2022 (USD Million)

Table 8 Market in Road Construction, By Region, 2015–2022 (USD Million)

Table 9 Market in Military, By Region, 2015–2022 (USD Million)

Table 10 Market, By Region, 2015-2022 (USD Million)

Table 11 North America Market, By Initiating Device, 2015-2022 (USD Million)

Table 12 North America Market, By Application, 2015-2022 (USD Million)

Table 13 North America Market, By Country, 2015-2022 (USD Million)

Table 14 US Market, By Initiating Device, 2015-2022 (USD Million)

Table 15 US Market, By Application, 2015-2022 (USD Million)

Table 16 Canada Market, By Initiating Device, 2015-2022 (USD Million)

Table 17 Canada Market, By Application, 2015-2022 (USD Million)

Table 18 Europe Market, By Initiating Device, 2015-2022 (USD Million)

Table 19 Europe Market, By Application, 2015-2022 (USD Million)

Table 20 Europe Market, By Country, 2015-2022 (USD Million)

Table 21 Russia Market, By Initiating Device, 2015-2022 (USD Million)

Table 22 Russia Market, By Application, 2015-2022 (USD Million)

Table 23 Italy Market, By Initiating Device, 2015-2022 (USD Million)

Table 24 Italy Market, By Application, 2015-2022 (USD Million)

Table 25 France Market, By Initiating Device, 2015-2022 (USD Million)

Table 26 France Market, By Application, 2015-2022 (USD Million)

Table 27 Portugal Market, By Initiating Device, 2015-2022 (USD Million)

Table 28 Portugal Market, By Application, 2015-2022 (USD Million)

Table 29 UK Market, By Initiating Device, 2015-2022 (USD Million)

Table 30 UK Market, By Application, 2015-2022 (USD Million)

Table 31 Germany Market, By Initiating Device, 2015-2022 (USD Million)

Table 32 Germany Market, By Application, 2015-2022 (USD Million)

Table 33 Rest of Europe Market, By Initiating Device, 2015-2022 (USD Million)

Table 34 Rest of Europe Market, By Application, 2015-2022 (USD Million)

Table 35 Asia Pacific Market, By Initiating Device, 2015-2022 (USD Million)

Table 36 Asia Pacific Market, By Application, 2015-2022 (USD Million)

Table 37 Asia Pacific Market, By Country, 2015-2022 (USD Million)

Table 38 China Market, By Initiating Device, 2015-2022 (USD Million)

Table 39 China Market, By Application, 2015-2022 (USD Million)

Table 40 India Market, By Initiating Device, 2015-2022 (USD Million)

Table 41 India Market, By Application, 2015-2022 (USD Million)

Table 42 Japan Market, By Initiating Device, 2015-2022 (USD Million)

Table 43 Japan Market, By Application, 2015-2022 (USD Million)

Table 44 Australia Market, By Initiating Device, 2015-2022 (USD Million)

Table 45 Australia Market, By Application, 2015-2022 (USD Million)

Table 46 South Korea Market, By Initiating Device, 2015-2022 (USD Million)

Table 47 South Korea Market, By Application, 2015-2022 (USD Million)

Table 48 Rest of APAC Market, By Initiating Device, 2015-2022 (USD Million)

Table 49 Rest of APAC Market, By Application, 2015-2022 (USD Million)

Table 50 South America Market, By Initiating Device, 2015-2022 (USD Million)

Table 51 South America Market, By Application, 2015-2022 (USD Million)

Table 52 South America Market, By Country, 2015-2022 (USD Million)

Table 53 Brazil Market, By Initiating Device, 2015-2022 (USD Million)

Table 54 Brazil Market, By Application, 2015-2022 (USD Million)

Table 55 Argentina Market, By Initiating Device, 2015-2022 (USD Million)

Table 56 Argentina Market, By Application, 2015-2022 (USD Million)

Table 57 Chile Market, By Initiating Device, 2015-2022 (USD Million)

Table 58 Chile Market, By Application, 2015-2022 (USD Million)

Table 59 Peru Market, By Initiating Device, 2015-2022 (USD Million)

Table 60 Peru Market, By Application, 2015-2022 (USD Million)

Table 61 Rest of South America Market, By Initiating Device, 2015-2022 (USD Million)

Table 62 Rest of South America Market, By Application, 2015-2022 (USD Million)

Table 63 Africa Market, By Initiating Device, 2015-2022 (USD Million)

Table 64 Africa Market, By Application, 2015-2022 (USD Million)

Table 65 Africa Market, By Country, 2015-2022 (USD Million)

Table 66 South Africa Remote Firing Systems Market, By Initiating Device, 2015-2022 (USD Million)

Table 67 South Africa Aircraft Arresting Market, By Application, 2015-2022 (USD Million)

Table 68 Ethiopia Remote Firing Systems Market, By Initiating Device, 2015-2022 (USD Million)

Table 69 Ethiopia Remote Firing Systems Market, By Application, 2015-2022 (USD Million)

Table 70 Kenya Remote Firing Systems Market, By Initiating Device, 2015-2022 (USD Million)

Table 71 Kenya Remote Firing Systems Market, By Application, 2015-2022 (USD Million)

Table 72 Rest of Africa Remote Firing Systems Market, By Initiating Device, 2015-2022 (USD Million)

Table 73 Rest of Africa Remote Firing Systems Market, By Application, 2015-2022 (USD Million)

List of Figures (23 Figures)

Figure 1 Research Process Flow

Figure 2 Remote Firing Systems Market: Research Design

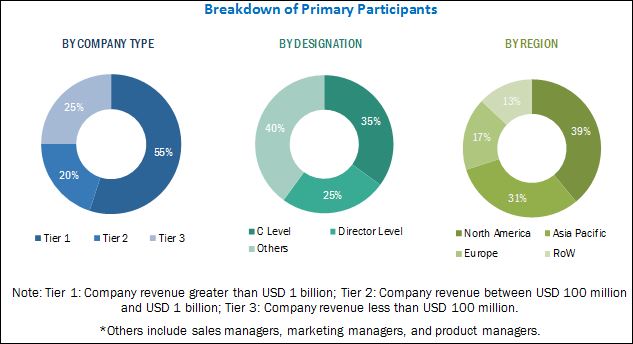

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 By Initiating Device, Detonator Segment to Dominate the Market During the Forecast Period

Figure 8 Mining & Quarrying Application Segment to Dominate the Remote Firing Systems Market During the Forecast Period

Figure 9 Non-Electric Detonator Segment to Lead the Remote Firing Systems Market During the Forecast Period

Figure 10 Non-Electronic Initiation System Segment to Lead the Remote Firing Systems Market From 2017 to 2022

Figure 11 Technological Advancements and Increasing Demand for Mining in Emerging Economies is Expected to Drive the Remote Firing Systems Market

Figure 12 Australia Estimated to Dominate the Asia Pacific Remote Firing Systems Market in 2017

Figure 13 Africa Remote Firing Systems Market Projected to Grow at the Highest CAGR During the Forecast Period

Figure 14 By Initiating Device, Detonator Segment Estimated to Capture the Largest Market Share in 2017

Figure 15 Mining & Quarrying Application Segment Estimated to Capture the Largest Market Share in 2017

Figure 16 Market Dynamics: Remote Firing Systems

Figure 17 Asia Pacific Estimated to Account for the Largest Share of the Remote Firing Systems Market in 2017

Figure 18 North America Remote Firing Systems Market Snapshot

Figure 19 Europe Remote Firing Systems Market Snapshot

Figure 20 Asia Pacific Remote Firing Systems Market Snapshot

Figure 21 Remote Firing Systems Market (Global), Competitive Leadership Mapping, 2017

Figure 22 Orica Mining Services: Company Snapshot

Figure 23 Solar Industries Limited: Company Snapshot

The remote firing systems market is projected to reach USD 531.0 Million by 2022, at a CAGR of 2.51% from 2017 to 2022. The growth of the market can be attributed to the increasing mining & quarrying activities and the various infrastructure development projects across the globe.

Market size estimations for various segments and subsegments of the remote firing systems market were arrived at through extensive secondary research, including company websites; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations, among others. Corroboration with primaries and further market triangulation with the help of statistical techniques using econometric tools were carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data is consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the remote firing systems market comprises manufacturers, raw material suppliers, distributors, and end users. The key end users of remote firing systems include global mining & dredging companies and militaries of countries. Some of the key manufacturers of remote firing systems are Orica Mining Services (Australia), Dyno Nobel (Australia), Solar Industries Limited (India), and Dynitec (Germany)

“This study answers several questions for stakeholders, primarily, which segments they need to focus upon over the next five years to prioritize their efforts and investments.”

Target Audience

- Manufacturers of Initiating Devices

- Explosives Manufacturers

- Technology Providers

- Mining Industries

- Military Forces

- Construction Industries

- Oil & Gas Exploration Industries

- Underwater Drilling & Mining Industries

Scope of the report

This research report categorizes the remote firing systems market into the following segments and subsegments:

-

Remote Firing Systems Market, by Initiating Device

- Initiation System

- Detonator

-

Remote Firing Systems Market, by Application

- Mining & Quarrying

- Construction

- Road Construction

- Military

-

Remote Firing Systems Market, By Region

- North America

- Europe

- South America

- Asia Pacific

- Africa

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

-

Country-level Analysis

- Comprehensive market projections for countries categorized under the Rest of Europe and the Rest of Asia Pacific

-

Company Information

- Detailed analysis and profiles of additional market players (Up to 5)

Growth opportunities and latent adjacency in Remote Firing Systems Market