Reed Relay Market by Voltage (200 V, 200 V–500 V, 500 V–1 Kv, 1 kV–7.5 kV, & 7.5 kV–10 kV, & Above 10 kV), Application (Industrial, Household Appliances, Test & Measurement, Mining, Automotive, EV, Medical, Renewables), & Geography - Global Forecast to 2030

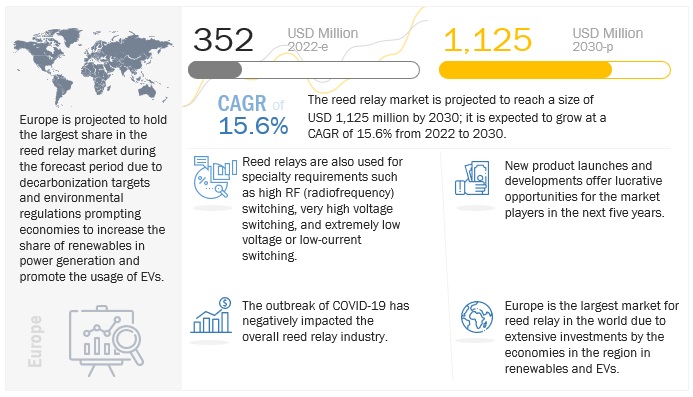

[210 Pages Report] The reed relay market is expected to grow from an estimated USD 352 million in 2022 to USD 1,125 million by 2030, at a CAGR of 15.6% during the forecast period. Due to the Increasing adoption of EVs and rising investment in renewables worldwide a considerable growth in reed relays is witnessed. Secondly, growing demand from medical and instrumentation industry is fuelling the demand of reed relays.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on reed relay market

COVID-19 had slowed the growth of the reed relay market, as countries were forced to implement lockdowns during the first half of 2020.

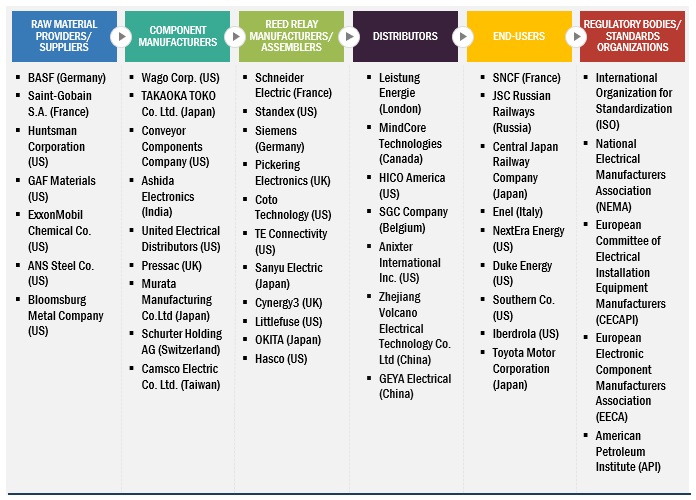

The reed relay market includes major Tier I and II suppliers such as ABB (Switzerland), Standex International Corporation (US), Siemens (Germany), Schneider Electric (France), and TE Connectivity, COTO Technology (US), Pickering Electronic Ltd (UK), General Electric (Switzerland), and Towards Relays (Taiwan). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific (excl. China), Europe, North America, China, and RoW. COVID-19 has impacted their businesses as well.

Schneider Electric witnessed a significant downturn in the software industry and has resulted in reduced demand for reed relay products and lower expenditure by clients. This was brought on by mobility constraints caused by extensive lockdowns during the COVID-19 pandemic and decreased customer investments in the telecommunication as well as automation industries. In 2021, the company’s energy management business segment organically declined by -6.8%, heavily impacted by a high base of comparison in software mainly in the UK and Switzerland. The company’s revenue from the Energy Management segment in China and India declined by 1.5%, and the Americas witnessed a drop of 6.4% in 2021 compared to 2020. Revenue in the US declined significantly by 7.6% in 2020 due to the downturn in the IT and telecommunication sectors and lower revenue in the reed relay market.

Solar inverters and power distribution units utilize reed relays. There are various types of renewable energy sources, such as solar, wind, hydroelectric, biomass, geothermal, tidal, and wave energy. Governments of multiple countries are incentivizing renewable energy generation in the form of tax credits, grants, and loan programs, which have encouraged investors and project developers to shift toward renewable power generation. Such favorable initiatives have also facilitated the maturity of these technologies on a commercial scale. Solar energy has experienced an average annual growth rate of 49% globally due to strong federal policy mechanisms to encourage the adoption of the energy, Investment Tax Credit (ITC) for solar power, and increasing demand for clean energy from both public and private sectors across all major economies in North America, Europe, and Asia Pacific. According to the Renewable Energy World, in China, power generation from renewable energy sources reached up to 1,870 TWh in 2018 (26.7% of the country’s total), which is an increase of 170 TWh. Hydro contributed 1,200 TWh (increased by 3.2%), wind contributed 366 TWh (up 20%), PV contributed 177.5 TWh (up 50%), and biomass contributed 90.6 TWh (up by 14%).

Restraint: Lower current rating compared to EMR and SSR

Reed relays are used in photomultiplier detectors and other extremely low-current handling circuits because of their incredibly low-leakage current (in the femtoamperes). Hence, they have a lower current rating compared to EMR and SSR which can sustain current surges better. This can restrain the market growth for reed relays. Reed relays are not as fast as solid-state relays, which may restrict their application in certain end-uses, which require faster switching. Solid-state relays can operate faster and more frequently than reed relays and have a much higher power rating. Reed relays are naturally isolated by the coil from the signal path; solid-state relays are not isolated, hence, a drive must be incorporated into the relay.

Opportunity: Rising number of EV charging stations applications

Reed relays find usage in charging stations for electric vehicles. China and Europe together accounted for 85% of global electric car sales in 2021. In view of the skyrocketing sales of electric vehicles, especially in these two geographies, the electric vehicle charging infrastructure is expanding significantly. According to IEA, publicly available EV charging points were up by nearly 40% in 2021, approaching 1.8 million charging points in 2021. The availability of both public slow and fast chargers is growing exponentially. Europe had over 300,000 slow chargers and around 50,000 fast chargers in 2021. Fast charging is being rolled out at a faster pace than slow charging in China, where fast charging installations (power rating >22 kW) increased by over 50% to 470 000 fast chargers in 2021, which is more than the 44% rise in 2020, but slower than the 93% high of 2019, according to IEA. Furthermore, the Alternative Fuels Data Centre states that there were around 50,000 EV charging stations operating around the US and this number is expected to grow in the coming years. The 2014 Alternative Fuel Infrastructure Directive (AFID) in the European Union regulates the deployment of public EV supply equipment and it recommends EU member Reed relays, as a result, may face an increased demand due to the rapid development of EV charging infrastructure around the world.

Challenge: Lack of investments by governments for grid stability

The financing of renewable energy continues to face multiple conundrums, largely entrenched with the nature of the current financial market in general, such as the short tenure of loans, high capital costs, and the lack of adequate financing from the governments. Governments of various countries are spending on increasing the existing grids and installing newer ones for better T&D of power. However, they are not investing enough toward ensuring grid stability. The installation of relays involves high capital expenditure, and these components are essential for line upgrades and modernization. Developing countries could be potential markets for relays, but they are still not investing in grid modernization, in comparison to their developed counterparts. This factor is acting as a challenge for the global reed relay market.

Reed relay Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

The automotive segment by application holds the largest segment in 2021

Reed switches have applications in the automotive industry for signal switching using reed relays, and in overheat protection using thermal reed sensors. Miniature reed relays, capable of switching high loads, are used in automobile climate control circuits to switch on or switch off the heater and air conditioning circuits. It is also used for controlling the turn signals, and in applications for overload protection and safety. Reed relay can consistently work at the required operating voltage range for hundreds of thousands of operations. In addition to reed relays, thermal reed sensors are also used in automobiles as safety cut-outs when the electronics on the control circuits cross a set temperature. Asia Pacific contributes more than 60% of global passenger car production. Thus, Asia Pacific is not only the largest but also the fastest-growing market for the automotive segment.

Below 200 V segment by voltage is estimated to be the largest segment for reed relay market

Low-voltage reed relays are used in commercial and industrial applications. The standard rating of low-voltage reed relays is 110–200 V. Reed relays of this voltage rating range are ideally suited to the needs of automated test equipment, instrumentation, and telecommunication requirements. Except for high-voltage dry reed switches (capsules that are pressurized or evacuated), the dielectric strength limitation of reed relays is determined by the ampere turn sensitivity of the switches used.

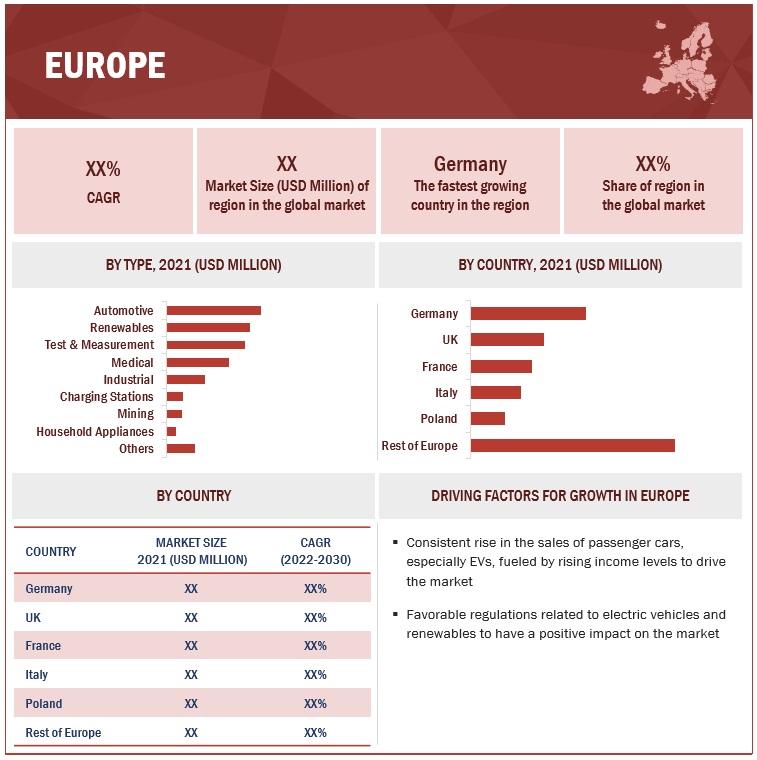

Europe is expected to account for the largest market size during the forecast period.

Europe accounted for a 25.8% share of the reed relay market in 2021. Europe region has been segmented, by country, into Germany, the UK, Italy, Poland, France, and the Rest of Europe. According to the BP Statistical Review of World Energy 2022, Europe accounted for 4.7% of global energy consumption in 2021. Due to stringent environmental policies set by the European Union, countries are shifting from conventional fuels such as coal to natural gas, shale gas, and renewables as the primary energy sources for power generation. Oil & gas still accounted for 48.02% of the total consumption of primary power generated in Europe in 2021, leading to increased imports. The increased investment in renewables, in addition to the deployment of new power generation facilities, refurbishment of existing power plants, high demand for automobiles and home appliances, and the installation of new transmission and distribution infrastructure in the region are expected to drive the market for reed relays during the forecast period.

Key Players

Key Players include ABB (Switzerland), Standex International Corporation (US), Siemens (Germany), Schneider Electric (France), and TE Connectivity, COTO Technology (US), Pickering Electronic Ltd (UK), General Electric (Switzerland), and Towards Relays (Taiwan).

Scope of the Report

|

Report Metrics |

Details |

| Market size available for years | 2020–2030 |

| Base year considered | 2021 |

| Forecast period | 2022–2030 |

| Forecast units | Value (USD Million) |

| Segments covered | By Voltage, By Application |

| Geographies covered | Asia Pacific (excl. China), North America, Europe, China, Rest of the World (RoW) |

| Companies covered | ABB (Switzerland), Standex Electronics Inc. (US), Siemens (Germany), Schneider Electric (France), and TE Connectivity, COTO Technology (US), Pickering Electronic Ltd (UK), General Electric (Switzerland), Towards Relays (Taiwan), Magnecraft (US), American Relays (US), Aleph (US), Cynergy3/Sensata Technology (UK), Sanyu Electric, Inc. (US), Comus (US), Yaskawa (US), Hasco (US), OKITA (Japan), Dolam (Poland), HVP High Voltage Products Ltd (Germany), and Cosmo Electronic (Taiwan). |

This research report categorizes the reed relay market based on type, phase, power rating, end user, and geography.

By Voltage

- Basic200 V

- 200 V–500 V

- 500 V–1 kV

- 1 kV–7.5 kV

- 7.5 kV–10 kV

- above 10 kV

By Application

- Industrial

- Household Appliances

- Test & Measurement

- Mining, Automotive

- EV

- Medical

- Renewables

- Others

By Geography

- North America

- Asia Pacific (excl. China)

- China

- Europe

- RoW

Recent Developments

- In January 2022, TE Connectivity acquired the German company Phoenix Contact Group, one of the leaders in relay technology. With this acquisition, TE's extensive relay portfolio for industrial automation, elevator, and rail applications now include a single-pole, force-guided solution. This acquisition aids TE Connectivity in the manufacture and supply of NSR element relays and the delivery of modern safety technology and miniaturized solutions to end-user applications such as robotic control, programmable logic control, elevator, and many more.

- In September 2022, ABB acquired PowerTech Converter (PTC) business, which is owned by German-based company RADIAL Capital Partners (RCP), PTC. ABB will expand its presence in the rail segment as a result of the acquisition and will be better positioned to capitalize on growth opportunities offered by rising industry demand for sustainable transportation solutions. Additionally, the acquisition expands market access for the ABB Traction division and completes its product portfolio.

- In April 2021, Schneider Electric collaborated with world-leading tech companies including RIB, ETAP, and AVEVA to drive digital transformation in the metro-rail market. Through EcoStruxure Rail, an end-to-end digital solution, which is launched by Schneider Electric, the company aims to build a collaborative digital environment for safe, efficient, reliable, and sustainable metro rail operations in India. The Indian metro-rail segment has significant problems, which can best be addressed by Schneider Electric's cutting-edge IoT-enabled EcoStruxure Rail platform. Utilizing intelligent energy management techniques, including renewable energy sources, and reducing energy recovery, aids in reducing energy consumption. It can be a provider of cutting-edge building management systems for non-traction infrastructure.

- In May 2021, Standex International Corporation acquired the reed switch-based relays company American Relays, Inc. This acquisition helps Standex International Corporation to strengthen its position in the reed relay market in North America. American Relays, Inc. is a manufacturer of standard reed relays, which include high-voltage, high-power, and mercury-wetted contact relays.

- In October 2021, Siemens Smart Infrastructure acquired a French start-up Wattsense, a hardware and software company that offers an innovative, plug-and-play IoT management system for small and mid-sized buildings, expanding Siemens’ building products portfolio.

Frequently Asked Questions (FAQ):

What is the current size of the reed relay market?

The current market size of global reed relay market is estimated to be USD 352 million in 2022.

What is the major drivers for reed relay market?

The reed relay market considers renewables as its major application segment. Solar inverters and power distribution units utilize reed relays. There are various types of renewable energy sources, such as solar, wind, hydroelectric, biomass, geothermal, tidal, and wave energy. Governments of multiple countries are incentivizing renewable energy generation in the form of tax credits, grants, and loan programs, which have encouraged investors and project developers to shift toward renewable power generation. Such favorable initiatives have also facilitated the maturity of these technologies on a commercial scale. Solar energy has experienced an average annual growth rate of 49% globally due to strong federal policy mechanisms to encourage the adoption of the energy, Investment Tax Credit (ITC) for solar power, and increasing demand for clean energy from both public and private sectors across all major economies in North America, Europe, and Asia Pacific. According to the Renewable Energy World, in China, power generation from renewable energy sources reached up to 1,870 TWh in 2018 (26.7% of the country’s total), which is an increase of 170 TWh. Hydro contributed 1,200 TWh (increased by 3.2%), wind contributed 366 TWh (up 20%), PV contributed 177.5 TWh (up 50%), and biomass contributed 90.6 TWh (up by 14%).

Which is the largest-growing geography during the forecasted period in reed relay market?

Europe is expected to account for the largest market size during the forecast period. Europe accounted for a 25.8% share of the reed relay market in 2021. Europe region has been segmented, by country, into Germany, the UK, Italy, Poland, France, and the Rest of Europe. According to the BP Statistical Review of World Energy 2022, Europe accounted for 4.7% of global energy consumption in 2021. Due to stringent environmental policies set by the European Union, countries are shifting from conventional fuels such as coal to natural gas, shale gas, and renewables as the primary energy sources for power generation. Oil & gas still accounted for 48.02% of the total consumption of primary power generated in Europe in 2021, leading to increased imports. The increased investment in renewables, in addition to the deployment of new power generation facilities, refurbishment of existing power plants, high demand for automobiles and home appliances, and the installation of new transmission and distribution infrastructure in the region are expected to drive the market for reed relays during the forecast period.

Which is the fastest-growing segment, by voltage during the forecasted period in reed relay market?

The 200 V–500 V segment, by voltage, is projected to hold the fastest market share during the forecast period. The reed relays within this range are designed to stand up and save space in cases where the PCB is limited. These reed relays are highly popular due to their customizability as they offer flexibility in the number of channels. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 REED RELAY MARKET, BY VOLTAGE TYPE

1.3.2 MARKET, BY APPLICATION

1.3.3 MARKET, BY GEOGRAPHY

1.4 MARKET SCOPE

1.4.1 REED RELAY MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 REED RELAY MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

2.2.2.2 Key data from primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND GEOGRAPHY

FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR REED RELAYS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Geographic analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 MARKET KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF RELAYS

FIGURE 8 GLOBAL RELAY MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 1 REED RELAY MARKET SNAPSHOT

FIGURE 9 RENEWABLES TO CONTINUE TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

FIGURE 10 200 V–500 V SEGMENT TO LEAD GLOBAL MARKET, BY VOLTAGE RANGE, DURING FORECAST PERIOD

FIGURE 11 EUROPE DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REED RELAY MARKET

FIGURE 12 INCREASING INVESTMENTS IN POWER GENERATION FROM RENEWABLES AND GROWTH OF EV SEGMENT TO DRIVE MARKET DURING 2022–2030

4.2 EUROPE: MARKET, BY APPLICATION AND COUNTRY, 2021

FIGURE 13 AUTOMOTIVE HELD THE LARGEST SHARE OF THE MARKET IN EUROPE IN 2021

4.3 MARKET, BY GEOGRAPHY

FIGURE 14 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 15 RENEWABLES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

4.5 MARKET, BY VOLTAGE RANGE

FIGURE 16 200 V–500 V SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS FOR REED RELAY MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of EVs

FIGURE 18 ELECTRIC VEHICLE MARKET, 2022 TO 2030 (THOUSAND UNITS)

5.2.1.2 Rising investments in renewables

FIGURE 19 GLOBAL ANNUAL SOLAR PV CAPACITY, IN GW, 2021

TABLE 2 GLOBAL SOLAR PV CAPACITY ADDITION PROJECTIONS

FIGURE 20 RENEWABLE CAPACITY ADDITION, 2019–2024 (GW)

5.2.1.3 Growing medical and instrumentation industry

5.2.2 RESTRAINTS

5.2.2.1 Lower current rating compared with EMR and SSR

5.2.2.2 Reed relays result in failures such as missing and sticking

5.2.3 OPPORTUNITIES

5.2.3.1 Rising number of EV charging stations

FIGURE 21 ELECTRIC VEHICLE CHARGING STATION MARKET, 2022–2027 (THOUSAND UNITS)

5.2.4 CHALLENGES

5.2.4.1 Lack of investments by governments for grid stability

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR GLOBAL MARKET

FIGURE 22 REVENUE SHIFT FOR RELAY PROVIDERS

5.4 MARKET MAP

FIGURE 23 MARKET MAP: GLOBAL MARKET

TABLE 3 GLOBAL MARKET: ROLE IN ECOSYSTEM

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: GLOBAL MARKET

5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.5.2 COMPONENT MANUFACTURERS

5.5.3 RELAY MANUFACTURERS/ASSEMBLERS

5.5.4 DISTRIBUTORS

5.5.5 END-USERS

5.5.6 POST-SALES SERVICES

5.6 TECHNOLOGY ANALYSIS

5.6.1 REED SWITCH TECHNOLOGY

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE OF REED RELAYS

TABLE 4 AVERAGE SELLING PRICE OF REED RELAYS, 2021

TABLE 5 AVERAGE SELLING PRICE OF REED RELAYS OFFERED BY KEY PLAYERS, 2021

5.8 KEY CONFERENCES AND EVENTS, 2022–2024

TABLE 6 GLOBAL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.9 TARIFF, CODES, AND REGULATIONS

5.9.1 TARIFF RELATED TO RELAYS

TABLE 7 IMPORT TARIFF FOR HS 853690 LOW-VOLTAGE PROTECTION EQUIPMENT, 2019

TABLE 8 IMPORT TARIFF FOR HS 8535 HIGH-VOLTAGE PROTECTION EQUIPMENT, 2019

5.10 TRADE ANALYSIS

5.10.1 TRADE ANALYSIS RELATED TO ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE EXCEEDING 1,000 V

5.10.2 IMPORT SCENARIO

TABLE 9 IMPORT SCENARIO FOR HS CODE: 8535, BY COUNTRY, 2019–2021 (USD)

5.10.3 EXPORT SCENARIO

TABLE 10 EXPORT SCENARIO FOR HS CODE: 8535, BY COUNTRY, 2019–2021 (USD)

5.10.4 TRADE ANALYSIS RELATED TO ELECTRICAL APPARATUS FOR SWITCHING OR PROTECTING ELECTRICAL CIRCUITS WITH VOLTAGE NOT EXCEEDING 1,000 V

5.10.5 IMPORT SCENARIO

TABLE 11 IMPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.10.6 EXPORT SCENARIO

TABLE 12 EXPORT SCENARIO FOR HS CODE: 853690, BY COUNTRY, 2019–2021 (USD)

5.10.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.8 CODES AND REGULATIONS RELATED TO REED RELAYS

TABLE 17 REED RELAYS: CODES AND REGULATIONS

5.11 PATENT ANALYSIS

TABLE 18 REED RELAY: INNOVATIONS AND PATENT REGISTRATIONS, JANUARY 2021–MAY 2022

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

TABLE 19 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 20 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.14 BUYING CRITERIA

FIGURE 27 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.15 CASE STUDY ANALYSIS

5.15.1 RELIANCE UPGRADES TO MORE ROBUST RELAYS FOR CRITICAL APPLICATIONS

5.15.1.1 Problem statement

5.15.1.2 Solution

5.15.2 LITTELFUSE ARC-FLASH RELAY SAVES PLANT FROM CATASTROPHIC DAMAGE

5.15.2.1 Problem statement

5.15.2.2 Solution

6 REED RELAY MARKET, BY APPLICATION (Page No. - 84)

6.1 INTRODUCTION

FIGURE 28 GLOBAL MARKET, BY APPLICATION, 2021

TABLE 22 GLOBAL MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

6.2 INDUSTRIAL

6.2.1 AUTOMATION IN INDUSTRIES LIKELY TO BOOST DEMAND

TABLE 23 INDUSTRIAL: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.3 HOUSEHOLD APPLIANCES

6.3.1 HIGH CONSUMER SPENDING TO DRIVE DEMAND FOR HOUSEHOLD APPLIANCES

TABLE 24 HOUSEHOLD APPLIANCES: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.4 TEST AND MEASUREMENT

6.4.1 FAST ACTUATION TIME TO PROPEL ADOPTION IN TEST AND MEASUREMENT APPLICATIONS

TABLE 25 TEST AND MEASUREMENT: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.5 MINING

6.5.1 RELIABILITY AND SAFETY PROVISION TO ACCELERATE DEMAND

TABLE 26 MINING: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.6 AUTOMOTIVE

6.6.1 CAPABILITY TO SWITCH HIGH LOADS TO DRIVE MARKET GROWTH

6.6.2 EV

6.6.2.1 Battery management systems

6.6.2.2 Charging stations

6.6.3 CONVENTIONAL

TABLE 27 AUTOMOTIVE: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.7 MEDICAL

6.7.1 DEMAND FOR EFFICIENT OPERATIONS LIKELY TO BOOST DEMAND FOR REED RELAYS IN MEDICAL APPLICATIONS

TABLE 28 MEDICAL: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.8 RENEWABLES

6.8.1 HIGH ADOPTION OF RENEWABLE POWER TO DRIVE DEMAND

6.8.2 SOLAR

6.8.3 WIND

TABLE 29 RENEWABLES: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.9 CHARGING STATIONS

6.9.1 NEED FOR CHARGING STATIONS TO CATER TO GROWING EV MARKET TO BOOST DEMAND

TABLE 30 CHARGING STATIONS: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

6.10 OTHERS

TABLE 31 OTHERS: GLOBAL MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

7 GLOBAL REED RELAY MARKET, BY VOLTAGE RANGE (Page No. - 93)

7.1 INTRODUCTION

FIGURE 29 GLOBAL MARKET (VALUE), BY VOLTAGE RANGE, 2021

TABLE 32 GLOBAL MARKET, BY VOLTAGE RANGE, 2020–2030 (USD MILLION)

7.2 BELOW 200 V

7.2.1 INSTRUMENTATION AND TELECOMMUNICATION REQUIREMENTS TO DRIVE MARKET

7.3 200 V–500 V

7.3.1 HIGH-VOLTAGE SWITCHING ELEMENTS TO BOOST MARKET GROWTH

7.4 500 V–1 KV

7.4.1 EXCELLENT STABILITY OFFRED BY RELAYS IN THIS VOLTAGE RANGE TO ACCELERATE MARKET GROWTH

7.5 1 KV–7.5 KV

7.5.1 HIGH FREQUENCY AND EFFICIENT PERFORMANCE TO PROPEL MARKET GROWTH

7.6 7.5 KV–10 KV

7.6.1 SMALL FOOTPRINT FEATURE TO ENHANCE MARKET GROWTH

7.7 ABOVE 10 KV

7.7.1 HIGH-RELIABILITY APPLICATIONS TO DRIVE MARKET

8 REED RELAY MARKET, BY GEOGRAPHY (Page No. - 97)

8.1 INTRODUCTION

FIGURE 30 GEOGRAPHICAL SNAPSHOT: CHINA TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 31 MARKET SHARE (VALUE), BY GEOGRAPHY, 2021

TABLE 33 MARKET, BY GEOGRAPHY, 2020–2030 (USD MILLION)

8.2 ASIA PACIFIC (EXCL. CHINA)

FIGURE 32 ASIA PACIFIC (EXCL. CHINA): MARKET SNAPSHOT

8.2.1 BY APPLICATION

TABLE 34 ASIA PACIFIC (EXCL. CHINA): MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 35 ASIA PACIFIC (EXCL. CHINA): MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 36 ASIA PACIFIC (EXCL. CHINA): MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.2.2 BY COUNTRY

TABLE 37 ASIA PACIFIC (EXCL. CHINA): MARKET, BY COUNTRY 2020–2030 (USD MILLION)

8.2.2.1 India

8.2.2.1.1 Huge amount of electricity generation from renewables to drive market

TABLE 38 INDIA: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 39 INDIA: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 40 INDIA: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.2.2.2 Japan

8.2.2.2.1 Shift from nuclear power to thermal power, renewables, and hydropower to boost market

TABLE 41 JAPAN: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 42 JAPAN: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 43 JAPAN: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.2.2.3 Rest of Asia Pacific

TABLE 44 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 45 REST OF ASIA PACIFIC: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 46 REST OF ASIA PACIFIC: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.3 CHINA

8.3.1 BY APPLICATION

TABLE 47 CHINA: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 48 CHINA: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 49 CHINA: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4 EUROPE

FIGURE 33 EUROPE: MARKET SNAPSHOT

8.4.1 BY APPLICATION

TABLE 50 EUROPE: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2 BY COUNTRY

TABLE 53 EUROPE: MARKET, BY COUNTRY, 2020–2030 (USD MILLION)

8.4.2.1 UK

8.4.2.1.1 Increasing investments in electrical infrastructure to offer growth opportunities for reed relay market players

8.4.2.1.2 By application

TABLE 54 UK: MARKET, BY APPLICATION, 2020–2030 (USD MILLION

TABLE 55 UK: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 56 UK: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2.2 Germany

8.4.2.2.1 Growing renewable energy capacity development to drive market

8.4.2.2.2 By application

TABLE 57 GERMANY: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 58 GERMANY: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 59 GERMANY: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2.3 Poland

8.4.2.3.1 Rising investments in automotive sector to boost market growth

8.4.2.3.2 By application

TABLE 60 POLAND: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 61 POLAND: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 62 POLAND: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2.4 France

8.4.2.4.1 Increasing investments in renewable energy to accelerate market growth

8.4.2.4.2 By application

TABLE 63 FRANCE: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 64 FRANCE: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 65 FRANCE: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2.5 Italy

8.4.2.5.1 Surging investments in industrial and manufacturing sectors to drive market

8.4.2.5.2 By application

TABLE 66 ITALY: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 67 ITALY: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 68 ITALY: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.4.2.6 Rest of Europe

8.4.2.6.1 By application

TABLE 69 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 70 REST OF EUROPE: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 71 REST OF EUROPE: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.5 NORTH AMERICA

8.5.1 BY APPLICATION

TABLE 72 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.5.2 BY COUNTRY

TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2030 (USD MILLION)

8.5.2.1 US

8.5.2.1.1 Increasing demand for primary energy production to propel market growth

8.5.2.1.2 By application

TABLE 76 US: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 77 US: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 78 US: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.5.2.2 Canada

8.5.2.2.1 Growing investments in electricity utility upgrades to drive market

8.5.2.2.2 By application

TABLE 79 CANADA: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 80 CANADA: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 81 CANADA: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.5.2.3 Mexico

8.5.2.3.1 Rising demand for transmission and distribution networks to contribute to market growth

8.5.2.3.2 By application

TABLE 82 MEXICO: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 83 MEXICO: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 84 MEXICO: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

8.6 ROW

8.6.1 BY APPLICATION

TABLE 85 ROW: MARKET, BY APPLICATION, 2020–2030 (USD MILLION)

TABLE 86 ROW: MARKET, BY AUTOMOTIVE APPLICATION, 2020–2030 (USD MILLION)

TABLE 87 ROW: MARKET, BY RENEWABLES APPLICATION, 2020–2030 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 130)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES

TABLE 88 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, APRIL 2019–APRIL 2022

9.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 89 MARKET: DEGREE OF COMPETITION

FIGURE 34 MARKET SHARE ANALYSIS,

9.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 35 TOP PLAYERS IN MARKET, 2017–2021

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STARS

9.5.2 PERVASIVE PLAYERS

9.5.3 EMERGING LEADERS

9.5.4 PARTICIPANTS

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2021

9.6 STARTUP/SME EVALUATION QUADRANT, 2021

9.6.1 PROGRESSIVE COMPANIES

9.6.2 RESPONSIVE COMPANIES

9.6.3 DYNAMIC COMPANIES

9.6.4 STARTING BLOCKS

FIGURE 37 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

9.6.5 COMPETITIVE BENCHMARKING

TABLE 90 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 91 MARKET: DETAILED LIST OF KEY START-UPS/SMES

9.7 MARKET: COMPANY FOOTPRINT

TABLE 92 COMPANY FOOTPRINT: BY APPLICATION

TABLE 93 COMPANY FOOTPRINT: BY VOLTAGE RANGE

TABLE 94 BY REGION: COMPANY FOOTPRINT

TABLE 95 OVERALL COMPANY FOOTPRINT

9.8 COMPETITIVE SCENARIO

TABLE 96 MARKET: PRODUCT LAUNCHES, MAY 2019–FEBRUARY 2021

TABLE 97 MARKET: DEALS, SEPTEMBER 2022–JANUARY 2020

TABLE 98 MARKET: OTHER DEVELOPMENTS, AUGUST 2020–APRIL 2019

10 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1 KEY PLAYERS

10.1.1 ABB

TABLE 99 ABB: BUSINESS OVERVIEW

FIGURE 38 ABB: COMPANY SNAPSHOT (2021)

TABLE 100 ABB: PRODUCTS OFFERED

TABLE 101 ABB.: DEALS

TABLE 102 ABB: OTHERS

10.1.2 SCHNEIDER ELECTRIC

TABLE 103 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 39 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT (2021)

TABLE 104 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 105 SCHNEIDER ELECTRIC: OTHERS

10.1.3 SIEMENS

TABLE 106 SIEMENS: BUSINESS OVERVIEW

FIGURE 40 SIEMENS: COMPANY SNAPSHOT (2021)

TABLE 107 SIEMENS: PRODUCTS OFFERED

TABLE 108 SIEMENS: DEALS

10.1.4 STANDEX ELECTRONICS, INC.

TABLE 109 STANDEX INTERNATIONAL CORPORATION.: BUSINESS OVERVIEW

FIGURE 41 STANDEX ELECTRONICS, INC.: COMPANY SNAPSHOT (2021)

TABLE 110 STANDEX ELECTRONICS, INC.: PRODUCTS OFFERED

TABLE 111 STANDEX ELECTRONICS, INC..: DEALS

10.1.5 TE CONNECTIVITY

TABLE 112 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 42 TE CONNECTIVITY: COMPANY SNAPSHOT (2021)

TABLE 113 TE CONNECTIVITY: PRODUCTS OFFERED

TABLE 114 TE CONNECTIVITY: DEALS

TABLE 115 TE CONNECTIVITY: OTHERS

10.1.6 BRIGHT TOWARD INDUSTRIAL CO., LTD. (TOWARD RELAYS)

TABLE 116 TOWARD RELAYS: BUSINESS OVERVIEW

TABLE 117 TOWARD RELAYS: PRODUCTS OFFERED

10.1.7 PICKERING ELECTRONICS LTD

TABLE 118 PICKERING ELECTRONICS LTD: BUSINESS OVERVIEW

TABLE 119 PICKERING ELECTRONICS LTD: PRODUCTS OFFERED

TABLE 120 PICKERING ELECTRONICS LTD: PRODUCT LAUNCHES

TABLE 121 PICKERING ELECTRONICS LTD: DEALS

10.1.8 COTO TECHNOLOGY, INC.

TABLE 122 COTO TECHNOLOGY, INC.: BUSINESS OVERVIEW

TABLE 123 COTO TECHNOLOGY, INC.: PRODUCTS OFFERED

10.1.9 LITTELFUSE, INC.

TABLE 124 LITTELFUSE, INC.: BUSINESS OVERVIEW

FIGURE 43 LITTELFUSE, INC.: COMPANY SNAPSHOT (2021)

TABLE 125 LITTELFUSE, INC.: PRODUCTS OFFERED

TABLE 126 LITTELFUSE, INC.: PRODUCT LAUNCHES

TABLE 127 LITTELFUSE, INC.: DEALS

TABLE 128 LITTELFUSE, INC.: OTHERS

10.1.10 HVP HIGH VOLTAGE PRODUCTS GMBH

TABLE 129 HVP HIGH VOLTAGE PRODUCTS GMBH: BUSINESS OVERVIEW

TABLE 130 HVP HIGH VOLTAGE PRODUCTS GMBH: PRODUCTS OFFERED

10.1.11 CELDUC

TABLE 131 CELDUC: BUSINESS OVERVIEW

TABLE 132 CELDUC: PRODUCTS OFFERED

TABLE 133 CELDUC: OTHERS

10.1.12 SANYU ELECTRIC, INC.

TABLE 134 TABLE 4 SANYU ELECTRIC, INC.: BUSINESS OVERVIEW

TABLE 135 SANYU ELECTRIC, INC.: PRODUCTS OFFERED

10.1.13 COMUS

TABLE 136 COMUS: BUSINESS OVERVIEW

TABLE 137 COMUS: PRODUCTS OFFERED

10.1.14 AMERICAN RELAYS INC.

TABLE 138 AMERICAN RELAYS INC.: BUSINESS OVERVIEW

10.1.15 ALEPH

TABLE 139 ALEPH: BUSINESS OVERVIEW

TABLE 140 ALEPH: PRODUCTS OFFERED

10.1.16 COSMO ELECTRONICS

TABLE 141 COSMO ELECTRONICS: COMPANY OVERVIEW

TABLE 142 COSMO ELECTRONICS: OTHERS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 202)

11.1 INSIGHTS OF INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 CUSTOMIZATION OPTIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved major activities in estimating the current size of the reed relay market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global reed relay market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The reed relay market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of automotive and renewables sector. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

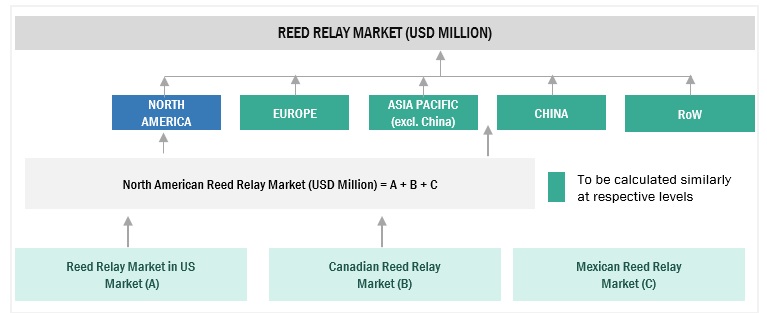

The bottom-up approach has been used to estimate and validate the size of the reed relay market.

- In this approach, the reed relay production statistics for each product type have been considered at a geographical level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of reed relays.

- Several primary interviews have been conducted with key opinion leaders related to reed relay system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Power Distribution Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the reed relay market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the reed relay market by voltage, by application, and geography, in terms of value

- To estimate and forecast the global market for various segments with respect to 5 main geograpies, namely, North America, Europe, Asia Pacific (excl. China), China, Rest of the World (RoW), in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the reed relay value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the reed relay market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Reed Relay Market