Recyclable Packaging Market by Material (plastics, paper, glass, metal, others), Packaging Type (Paper & Paperboard, Pouche & Envelopes, Void Fill Packaging, Buble Wrap), End-use Industry (Packaging, Building & Construction, Automotive, Electronics), and Region - Global Forecast to 2029

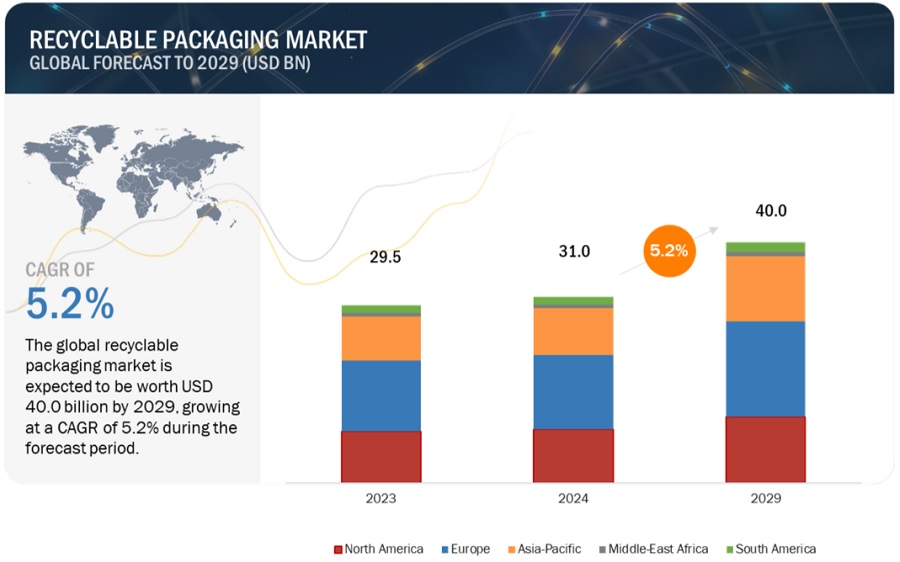

The recyclable packaging market size is projected to grow from USD 31.0 billion in 2024 and is projected to reach USD 40.0 billion by 2029 at a CAGR of 5.2%. Recyclable packaging consists of glass, metal, paper, and cardboard, which can be collected by the recycling centers and reprocessed to form new packaging products. This type of packaging is more sustainable than 85% of conventional plastic packaging since it helps to cut down on landfill waste. With awareness of environmental issues rising, the public demands sustainable products from the market. There is a vast range of environmentally friendly packaging solutions, and several companies in the wholesale sector offer robust products that meet several requirements and needs and are environmentally friendly. The recyclable packaging markets are focusing on circularity; mainly, the European markets will introduce mandates for both recyclability and recycled content. This regulation change and increasing concern from the consumer and stakeholders to shift towards sustainable practices is fuelling the market. Most industries have independently set their targets, including using 100% recyclable, reusable packaging, which shows companies’ high interest in sustainability goals. This will propel the market in the coming years.

Attractive Opportunities in the Recyclable Packaging Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recyclable Packaging Market Dynamics

Driver:Ban on single-use plastics

Plastic waste is a global problem, and to resolve this problem global solutions, governments worldwide are tightening their laws governing the use and disposal of plastics, especially non-recyclable and single-use packaging. One of the factors for this process is the legislation called Extended Producer Responsibility (EPR), according to which manufacturers must take full responsibility for the packaging, starting from collection, recycling, and final disposal.

For instance,

- In 2024, 10 states in the US passed EPR legislation on the package, and several bills regarding EPR on packaging are already in the pipeline.

- According to the Waste Framework Directive in the European Union, all packaging on the market must be reusable or recyclable by 2030.

Such policies will make companies move towards recyclable packaging materials.

Restraints: High cost of recyclable packaging

Recyclable packaging is more complex than non-recyclable packaging in terms of the manufacturing processes and the material used, thus leading to high production costs. While biodegradable plastics and papers are recyclable, they are relatively more costly than standard plastic or Styrofoam. Recyclable products of superior quality, such as recycled papers or glass, may incur additional production expenses because of the equipment and technique required. These increased production costs reduce the appeal of recyclable packaging to industries, especially food and beverages or consumable goods, owing to highly sensitive prices. The cost of recyclable packaging also has an additional expenditure on collecting, sorting, and recycling those materials. In places with few recycling facilities, the collection and segregation of recyclable material is generally very inefficient and expensive.

Opportunity: Innovation in recyclable packaging

New trends and developments in recyclable materials present significant potential for firms to adopt recyclable packaging solutions. Some of the latest developments are plant-based plastics derived from renewable sources like corn or sugarcane. Such plastics are better than conventional petroleum-based plastics as they are not just reusable but also re-usable and can also be biodegradable, enhancing environmental conservation while satisfying the packaging requirements.

For instance,

- The Coca-Cola firm has developed plant-based plastic bottles from sugarcane ethanol to reduce their carbon footprints.

The emergence of the advanced multilayer material that is easier to recycle also pushes the possibilities of recyclable packaging forward. Multi-layered materials that are in food packaging for instance are usually challenging to recycle due to their laminated structures. However, material science innovations are providing new multi-layer options that are easier to separate and produce.

For instance,

- Amcor, a global packaging company, has developed a recyclable flexible retort pouch, the first multi-layer flexible retort packaging solution.

These advancements in innovation will help in maintaining product safety and quality also reduce packaging waste.

Challenges: Consumer awareness

Consumer awareness and behavior play a key role in determining the performance of the recyclable packaging market. One of the common problems experienced while recycling includes contamination and wrong disposal of recyclable materials due to poor knowledge of actual recycling processes. For instance, containers such as glasses from recyclable material are discarded in regular trash cans while products that should be recycled like cups made from paper coated with plastic are also disposed of in recycling containers. This improper sorting pollutes the recycling stream and makes it costly for recycling centers to process the materials. Furthermore, on packaging, there are often corresponding labels that create confusion and possibly lead to more errors as people are not clear about which packaging material is recyclable. Besides, awareness, consumer awareness with more emphasis on convenient packaging rather than recyclable packaging is a barrier to the packaging. Some consumers are willing to sacrifice the environment and use single-use packaging. This preference prevents the push to use more recyclable packaging solutions, mainly when considered inconvenient or more costly than other packaging materials.

RECYCLABLE PACKAGING MARKET ECOSYSTEM ANALYSIS

The ecosystem of recyclable packaging involves raw material suppliers such as paper, glass, metals, and biodegradable plastics, recyclable packaging manufacturers, distributors, and end-users.

Paper is the fastest-growing material segment in the recyclable packaging market.

Paper is the fastest-growing material segment in recyclable packaging. Paper is among the most popular recyclable packaging materials among all materials due to its flexibility, affordability, and renewability. It is a substitute for many types of plastic packaging, including bubble wrap and plastic bags, making it very popular in the packaging market. Paper can conveniently be rolled or crumpled into any form as a wrapping or shredded paper. This makes it a very versatile material for various packaging companies dealing with food and beverages. Paper packaging will also help to reduce the growing problem of plastic pollution.

Paper & paperboard is the faster-growing packaging type segment in the recyclable packaging market.

Paper and paperboard is the fastest-growing segment of the recyclable packaging market. They are ideal for recyclable packaging because of their environmentally friendly features, flexibility, and ease of acceptance by consumers and industries. Made from renewable materials, they are suitable replacements for plastics and other non-recyclable materials. The recyclability of these materials is exceptionally high, which is strengthened by various recycling companies.

For instance,

- The European Paper Recycling Council (EPRC) expects the paper value chain to attain rates of 76% recycling by the year 2030.

Their biodegradable nature helps reduce the pressure on landfills and, most importantly, fulfills the rising consumer awareness of environmentally friendly packaging materials. The versatility of paper and paperboard strengthens their position as recyclable packaging materials. Their excellent printability means brands can create visually appealing aesthetic designs and marketing messages. These products can be formed into different structures like corrugated boxes, cartons, and paper bags and are suitable for various applications such as food and beverages, e-commerce, and personal care.

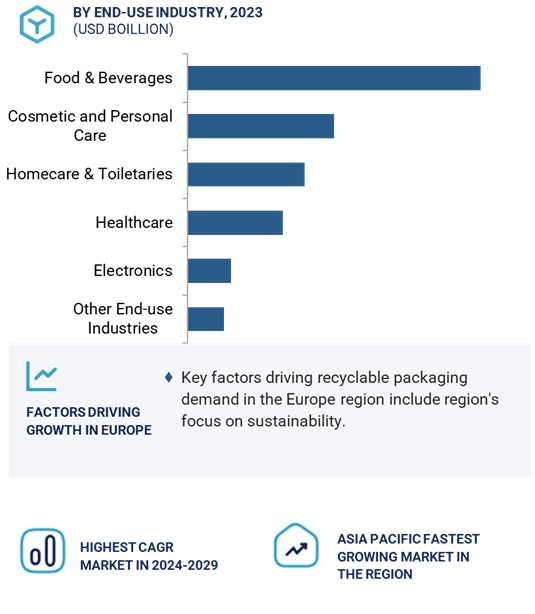

Food & beverage is the largest end-use industry segment in the recyclable packaging market.

The food & beverage industry continues to dominate the recyclable packaging market. This sector widely employs recycled packaging to contain the product as it increases its shelf stability and freshness. Convenience products such as paperboard cartons, glass bottles, and aluminum cans are ideal for meeting such requirements. These days, consumers have become very conscious about the environment, especially the packaging of food and beverage products, and this is driving firms to use recycled paper.

- Coca-Cola and Nestle, among other brands, have vowed to embrace fully recyclable packaging, which will fulfill customers' needs and comply with laws and regulations affecting the environment.

The food and beverages industry dominates because the use of recyclable packing materials is highly adaptable to different product types. The popular forms of packaging material used include glass jars, paperboard cartons, and biodegradable films suitable for products such as liquids and perishables goods, amongst others. The industry has developed other types of recyclable packaging that are as effective as non-recyclable ones, such as coated paper for products quickly damaged by moisture and aluminum cans for beverages that can be resealed. All these advances guarantee that recyclable packaging is durable enough to protect the product and meet conveniences and branding requirements.

Europe is estimated to be the largest market for recyclable packaging.

Europe dominated the recyclable packaging market in 2023. The region has the largest market for recyclable packaging since it has strict laws and its consumers care about environmental conservation. The European Union has come up with measures to deal with recyclability in packaging by putting up strategies, including the Circular Economy Action Plan and the Single-Use Plastics Directive that makes packaging must be reusable or recyclable by 2030. Other Countries like Germany and France have also applied extended producer responsibility systems where businesses are made liable for packaging waste collection and transition to the use of recycled materials.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Amcor Plc (Switzerland)

- Mondi Plc (UK)

- Berry Global Inc. (US)

- Smurfit Kappa Group (Smurfit Westrock) (Ireland)

- Ball Corporation (US)

- Mauser Packaging Solutions (US)

- International Paper (US)

- Huhtamaki Inc. (Finland)

- Ardagh Group SA (Luxembourg)

- ALLTUB GROUP (Netherlands)

- UFlex Limited (India)

- Albéa Group (France)

- AptarGroup, Inc. (US)

- Sealed Air Corporation (US)

- Silgan Holdings Inc. (US)

- Crown Holdings, Inc. (US)

- Graham Packaging Company (US)

- Elopak AS (Norway)

- DS Smith (UK)

- SIG Group (Switzerland)

- Tetra Pak International S.A. (Sweden)

- Schütz GmbH & Co. KGaA (Germany)

- Gerresheimer AG (Germany)

- Constantia Flexibles (Austria)

- ProAmpac (US)

Recent Developments in Recyclable Packaging Market

- In July 2024, Mondi plc launched FlexiBag Reinforced, the latest addition to its renowned range of sustainable pre-made plastic bags. This innovative mono-PE-based, recyclable packaging solution offers enhanced mechanical properties.

- In June 2024, Berry Global Group, Inc. launched a customizable, rectangular Domino bottle with up to 100% post-consumer recycled (PCR) plastic for the beauty, home, and personal care markets.

- In April 2024, Amcor introduced the first 1-liter carbonated soft drink stock bottle made entirely from 100% post-consumer recycled material.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What primary factor is propelling the growth of the recycling packaging market?

The key factor driving the growth of the recycling packaging market is the ban on single-use plastics.

What are the significant challenges in the recycling packaging market?

Consumer awareness is the major challenge in the recycling packaging market.

What are the significant opportunities in the recycling packaging market?

Innovation in recyclable packaging is a key opportunity area in the market.

Which region has the most significant demand?

The Europe region stands out as having the highest demand for recyclable packaging.

Who are the major manufacturers of recyclable packaging?

Major players in the recyclable packaging market are Amcor Plc (Switzerland), Mondi Plc (UK), Berry Global Inc. (US), Smurfit Kappa Group (Ireland), and Ball Corporation (US).

Recyclable Packaging Market

Growth opportunities and latent adjacency in Recyclable Packaging Market