Rapid Liquid Printing Market by Offering (Printers, Services, Materials, Software), Application (Prototyping, Functional Part/End-Use Manufacturing, Tooling), Vertical (Consumer Products, Fashion), and Region - Global Forecast to 2027

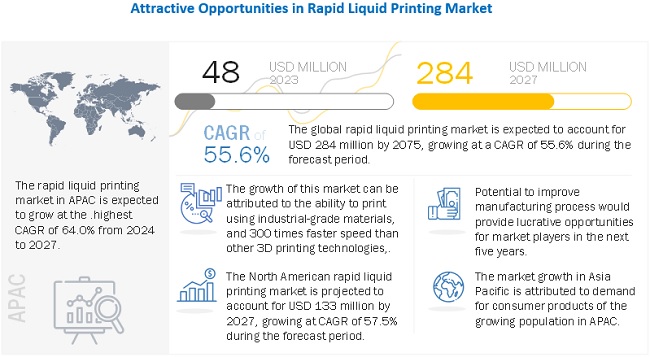

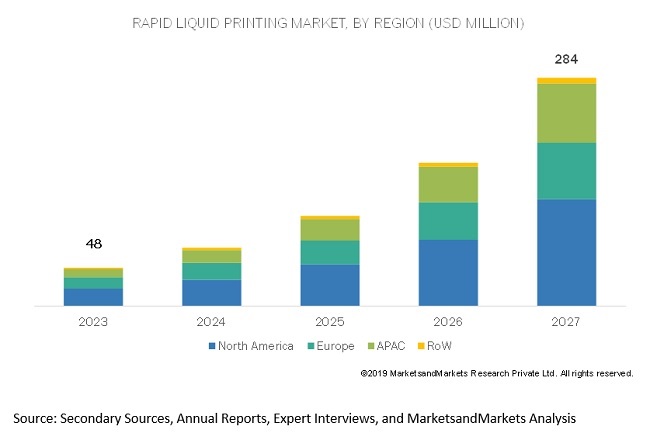

[138 Pages Report] The rapid liquid printing market size is expected to grow from USD 48 million in 2023 to USD 284 million by 2027 at a CAGR of 55.6% from 2023 to 2027.

Fastest printing among all 3D printing technologies, ability to print using industrial-grade materials, and ease of development of customized products are some of the major factors driving the growth of the rapid liquid printing market.

To know about the assumptions considered for the study, Request for Free Sample Report

Rapid liquid printing market for services to grow at a higher CAGR during forecast period

The rapid liquid printing market for services is expected to grow at a higher CAGR during the forecast period. The high growth is expected due to the projected increase in the demand for custom design and manufacturing. With the increasing number of companies offering 3D printing services, it is expected that several companies will adopt rapid liquid printers for manufacturing purposes. As the rapid liquid printing technology facilitates the manufacturing of products with complex geometries and offers competitive pricing compared to traditional manufacturing methods, several companies across industries are expected to outsource everythingfrom the design to the production of customized products to sustain in the highly competitive markets. As a result, the market for rapid liquid printing services is expected to witness the highest growth rate.

Rapid liquid printing market for automotive vertical is expected to grow at highest CAGR during forecast period

The rapid liquid printing market for automotive vertical is expected to capture the highest CAGR during the forecast period. This growth is mainly driven by the increasing demand for hybrid vehicles and battery-operated vehicles, along with the development of autonomous vehicles, is driving the growth of the global automotive industry. Moreover, the rise in demand for electric and autonomous vehicles is expected to fuel the demand for new automobile components and improved engine design. The adoption of 3D printing technologies to decrease the overall manufacturing cost of vehicles and improve interior designs is expected to fuel the market for 3D printing technologies in the automotive vertical.

To know about the assumptions considered for the study, download the pdf brochure

Rapid liquid printing market in APAC to be fastest-growing market during forecast period

Rapid liquid printing market in APAC is expected to be the fastest-growing market. The growing demand for 3D printing technologies from automotive, aerospace & defense, utility, and healthcare verticals in APAC is expected to support the growth of rapid liquid printing in the region. The requirement to meet the demand for consumer products of the growing population in APAC, along with the ongoing industrialization in emerging economies, is expected to fuel the growth of consumer products and automotive verticals in this region. This, in turn, is expected to contribute to the growing demand for 3D printing technologies, which again translates to the growing demand for rapid liquid printing in APAC. China and Japan are expected to be major markets for rapid liquid printing in APAC. Japan is home to major automobile manufacturers and suppliers who are facing challenges of high labor costs and increased lead time taken by conventional production processes. As such, companies are adopting automated and advanced production technologies to overcome these challenges. The use of additive manufacturing technologies in these countries is expected to fuel the growth of the market for rapid liquid printing in APAC.

Key Market Players

Steelcase (US), Stratasys (US), 3D Systems (US), Materilise (Belgium), ExOne (US), EOS (Germany), Dassault Systemes (France), Autodesk (US), Native Canada Footwear (Canada), and BMW (Germany) are among a few major players operating in the rapid liquid printing market.

Stratasys (US) is one of the leading providers of additive manufacturing solutions for rapid prototyping and direct digital manufacturing (DDM). It also develops, manufactures, and markets materials for 3D plastic printing marketplace, along with related services. Stratasys is one of the major multidisciplinary 3D technological leadership companies and has the advantage of its proprietary 3D printing technologies, including FDM- and inkjet-based PolyJet printing processes. The company also focuses on the expansion of its Stratasys Direct Manufacturing (SDM) services, which was formed in February 2015 by combining Solid Concepts, Harvest Technologies, and RedEye Services. The company intends to explore these advantages to further explore applications in various industries for its products. It is also planning to expand its SDM platform, where it can serve customers and create awareness about Rapid Prototyping and DDM. The strategy of the company to lead by innovation and increase its geographical presence is expected to support its growth.

3D Systems (US) is among the leading players in the 3D printing industry. It has its patented SLA technology alongside various other technologies, such as SLS, DMP, MJP, film transfer imaging, and color jet printing technology, which provide it with a strong technological advantage. The presence of 3D Systems in multiple industries, such as aerospace, automotive, defense, healthcare, and manufacturing, shows broad applications and capabilities of its products and its image as a diversified company. With frequent technological upgrades in its offerings and the addition of more supply chain partners, 3D Systems further explores new application areas and extends its reach toward unexplored regions.

Report Scope

|

Report Metric |

Details |

|

Years considered to provide market size |

20232027 |

|

Forecast Period |

20232027 |

|

Segments Covered |

Offering, Application, Vertical, and Geography |

|

Geographies Covered |

America, Europe, APAC, and RoW |

|

Companies Covered |

Steelcase (US), Stratasys (US), 3D Systems (US), Materilise (Belgium), ExOne (US), EOS (Germany), Dassault Systemes (France), Autodesk (US), Native Canada Footwear (Canada), and BMW (Germany) |

This research report segments the rapid liquid printing market based on offering, application, vertical, and geography.

Rapid Liquid Printing Market By Offering:

- Printers

- Desktop Printers

- Industrial Printers

- Services

- Materials

- Plastic

- Rubber

- Foam

- Others

- Software

- Design

- Inspection

- Printing

- Scannning

Rapid Liquid Printing Market By Application

- Prototyping

- Functional/End-Use Part Manufacturing

- Tooling

Rapid Liquid Printing Market By Vertical

- Consumer Products

- Fashion

- Automotive

- Healthcare

- Aerospace & Defense

- Utility

- Construction

- Others

Rapid Liquid Printing Market By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC

- Rest of the World (RoW)

- Middle East and Africa

- South America

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for rapid liquid printing market during 2023-2027?

The rapid liquid printing market is expected to record the CAGR of 55.6% during 2023-2027.

Which are the drivers and opportunities influencing the growth of the rapid liquid printing market?

Fastest among all 3D printing technologies, ability to print using industrial-grade materials, and ease of development of customized products are the drivers influencing the growth of rapid liquid printing market.

Which region would lead the global rapid liquid printing market during the forecast period?

North America is expected to lead the global rapid liquid printing market during the forecast period.

Who are the significant players operating in the rapid liquid printing market?

Stratasys, Steelcase, 3D systems, Materialise, and ExOne are the some of the major companies operating in the rapid liquid printing market.

How is the rapid liquid printing market segmented?

The rapid liquid printing market is segment on the basis of offering, application, vertical, and region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 1 RAPID LIQUID PRINTING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Arriving at the market size through the bottom-up approach (demand side)

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Arriving at the market size through the top-down approach (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 4 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 5 ASSUMPTIONS FOR THE RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 6 SERVICES OFFERING TO GROW AT THE HIGHEST CAGR FROM 2023 TO 2027

FIGURE 7 PROTOTYPING APPLICATION TO HOLD THE LARGEST SHARE OF THE MARKET IN 2023

FIGURE 8 MARKET FOR THE AUTOMOTIVE VERTICAL TO GROW AT THE HIGHEST CAGR FROM 2023 TO 2027

FIGURE 9 NORTH AMERICA IS EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET IN 2023

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 OVERVIEW OF THE MARKET

FIGURE 10 ABILITY TO PRINT USING INDUSTRIAL-GRADE MATERIALS IS EXPECTED TO DRIVE THE DEMAND FOR RAPID LIQUID PRINTING

4.2 MARKET, BY OFFERING

FIGURE 11 SERVICES OFFERING OF THE MARKET IS EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2023 TO 2027

4.3 MARKET, BY APPLICATION

FIGURE 12 PROTOTYPING EXPECTED TO HOLD THE LARGEST SHARE OF THE MARKET BY 2023

4.4 RAPID LIQUID PRINTING, BY VERTICAL AND REGION

FIGURE 13 CONSUMER PRODUCTS AND NORTH AMERICA TO HOLD THE LARGEST SHARE OF THE MARKET BY 2027

4.5 RAPID LIQUID PRINTING, BY REGION

FIGURE 14 US TO HOLD THE LARGEST SHARE OF THE MARKET IN 2023

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 RAPID LIQUID PRINTING: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Fastest among all 3D printing technologies

5.2.1.2 Ability to print using industrial-grade materials

5.2.1.3 Ease of development of customized products

5.2.2 RESTRAINTS

5.2.2.1 High initial capital and maintenance costs

5.2.2.2 Lack of standardized processes, materials, and software

5.2.3 OPPORTUNITIES

5.2.3.1 Potential to improve manufacturing processes and enhance supply chain management

5.2.3.2 Increase in focus on lifecycle sustainability

5.2.3.3 Growth in the number of potential applications due to the COVID-19 pandemic

5.2.4 CHALLENGES

5.2.4.1 Threat of copyright infringement

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDITION DURING MANUFACTURING/ASSEMBLY STAGES

6 RAPID LIQUID PRINTING MARKET, BY OFFERING (Page No. - 45)

6.1 INTRODUCTION

FIGURE 17 PRINTERS TO HOLD THE LARGEST MARKET SIZE IN 2027

TABLE 1 RAPID LIQUID PRINTING, BY OFFERING, 20232027 (USD MILLION)

6.2 PRINTERS

TABLE 2 RAPID LIQUID PRINTING, BY PRINTER, 20232027 (USD MILLION)

6.2.1 DESKTOP PRINTERS

6.2.1.1 The increasing adoption of advanced technologies in schools and universities is likely to drive the rapid liquid printing market growth

6.2.2 INDUSTRIAL PRINTERS

6.2.2.1 Rapid liquid printers for industrial applications are expected to be used to generate concept models, precision and functional prototypes, master patterns and molds for tooling, and end-use parts

FIGURE 18 PRINTERS: PROTOTYPING TO HOLD THE LARGEST SHARE FROM 2023 TO 2027

TABLE 3 MARKET FOR PRINTERS, BY APPLICATION, 20232027 (USD MILLION)

TABLE 4 MARKET FOR PRINTERS, BY VERTICAL, 20232027 (USD MILLION)

TABLE 5 MARKET FOR PRINTERS, BY REGION, 20232027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES SEGMENT IS EXPECTED TO GARNER SIGNIFICANT TRACTION COMPARED TO SALES OF PRINTERS AND MATERIALS

TABLE 6 MARKET FOR SERVICES, BY APPLICATION, 20232027 (USD MILLION)

TABLE 7 MARKET FOR SERVICES, BY VERTICAL, 20232027 (USD MILLION)

TABLE 8 MARKET FOR SERVICES, BY REGION, 20232027 (USD MILLION)

6.4 MATERIALS

FIGURE 19 MATERIALS: MARKET FOR PLASTIC EXPECTED TO GROW AT THE HIGHEST RATE FROM 2023 TO 2027

TABLE 9 MARKET, BY MATERIAL, 20232027 (USD MILLION)

6.4.1 PLASTIC

6.4.2 RUBBER

6.4.3 FOAM

6.4.4 OTHERS

TABLE 10 MARKET FOR MATERIALS, BY APPLICATION, 20232027 (USD MILLION)

TABLE 11 MARKET FOR MATERIAL, BY VERTICAL, 20232027 (USD MILLION)

FIGURE 20 MATERIALS: MARKET IN APAC EXPECTED TO GROW AT THE HIGHEST RATE FROM 2023 TO 2027

TABLE 12 MARKET FOR MATERIALS, BY REGION, 20232027 (USD MILLION)

6.5 SOFTWARE

TABLE 13 MARKET, BY SOFTWARE, 20232027 (USD MILLION)

6.5.1 DESIGN

6.5.1.1 In rapid liquid printing, software is used to create drawings of end-use products and parts

6.5.2 INSPECTION

6.5.2.1 Inspection software is developed to inspect prototypes to ensure their compliance with the required specification

6.5.3 PRINTING

6.5.3.1 Printing software includes tools to ensure precision with the functioning of printers

6.5.4 SCANNING

6.5.4.1 Scanning software allows users to scan physical objects and create digital models and designs

FIGURE 21 SOFTWARE: PROTOTYPING EXPECTED TO ACCOUNT FOR THE LARGEST SHARE FROM 2023 TO 2027

TABLE 14 MARKET FOR SOFTWARE, BY APPLICATION, 20232027 (USD MILLION)

TABLE 15 MARKET FOR SOFTWARE, BY VERTICAL, 20232027 (USD MILLION)

TABLE 16 MARKET FOR SOFTWARE, BY REGION, 20232027 (USD MILLION)

7 RAPID LIQUID PRINTING MARKET, BY APPLICATION (Page No. - 58)

7.1 INTRODUCTION

FIGURE 22 PROTOTYPING EXPECTED TO HOLD THE LARGEST SHARE IN 2023

TABLE 17 RAPID LIQUID PRINTING, BY APPLICATION, 20172025 (USD MILLION)

7.2 PROTOTYPING

7.2.1 PROTOTYPING AIDS IN THE REDUCTION OF WASTAGE

TABLE 18 MARKET FOR PROTOTYPING, BY OFFERING, 20232027 (USD MILLION)

TABLE 19 MARKET FOR PROTOTYPING, BY VERTICAL, 20232027 (USD MILLION)

TABLE 20 FASHION: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD MILLION)

TABLE 21 CONSUMER GOODS: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD THOUSAND)

TABLE 22 AUTOMOTIVE: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD MILLION)

FIGURE 23 HEALTHCARE: NORTH AMERICAN MARKET FOR PROTOTYPING EXPECTED TO HOLD THE LARGEST SHARE FROM 2023 TO 2027

TABLE 23 HEALTHCARE: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD THOUSAND)

TABLE 24 MARKET OF PROTOTYPING FOR AEROSPACE & DEFENSE, BY REGION, 20232027 (USD THOUSAND)

TABLE 25 UTILITY: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD THOUSAND)

TABLE 26 CONSTRUCTION: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD THOUSAND)

TABLE 27 OTHERS: MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD THOUSAND)

TABLE 28 MARKET FOR PROTOTYPING, BY REGION, 20232027 (USD MILLION)

7.3 FUNCTIONAL/END-USE PART MANUFACTURING

7.3.1 RAPID LIQUID PRINTING FOR END-USE PART MANUFACTURING IS EXPECTED TO GROW AT THE HIGHEST RATE

FIGURE 24 PRINTERS EXPECTED TO HOLD THE LARGEST SHARE FROM 2023 TO 2027

TABLE 29 RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY OFFERING, 20232027 (USD MILLION)

TABLE 30 RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY VERTICAL, 20232027 (USD MILLION)

TABLE 31 CONSUMER GOODS: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD MILLION)

TABLE 32 FASHION: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD MILLION)

TABLE 33 AUTOMOTIVE: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

TABLE 34 HEALTHCARE: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

FIGURE 25 NORTH AMERICAN MARKET FOR FUNCTIONAL/END-USE PART MANUFACTURING APPLICATION IN THE AEROSPACE & DEFENSE VERTICAL EXPECTED TO HOLD THE LARGEST SHARE IN 2027

TABLE 35 AEROSPACE & DEFENSE: RAPID LIQUID PRINTING FOR FUNCTIONAL/ END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

TABLE 36 UTILITY: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

TABLE 37 CONSTRUCTION: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

TABLE 38 OTHERS: RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD THOUSAND)

TABLE 39 RAPID LIQUID PRINTING FOR FUNCTIONAL/END-USE PART MANUFACTURING, BY REGION, 20232027 (USD MILLION)

7.4 TOOLING

7.4.1 RAPID LIQUID PRINTING IS VITAL IN THE MANUFACTURING INDUSTRY, ESPECIALLY IN TERMS OF TOOLING FOR SHORT-RUN PRODUCTION OF END PARTS

FIGURE 26 PRINTERS EXPECTED TO HOLD THE LARGEST SHARE IN 2027

TABLE 40 RAPID LIQUID PRINTING FOR TOOLING, BY OFFERING, 20232027 (USD MILLION)

TABLE 41 RAPID LIQUID PRINTING FOR TOOLING, BY VERTICAL, 20232027 (USD MILLION)

TABLE 42 CONSUMER GOODS: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD MILLION)

TABLE 43 FASHION: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD MILLION)

TABLE 44 AUTOMOTIVE: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

TABLE 45 HEALTHCARE: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

TABLE 46 AEROSPACE & DEFENSE: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

TABLE 47 UTILITY: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

TABLE 48 CONSTRUCTION: RAPID LIQUID PRINTING FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

TABLE 49 OTHERS: MARKET FOR TOOLING, BY REGION, 20232027 (USD THOUSAND)

FIGURE 27 NORTH AMERICA EXPECTED TO HOLD THE LARGEST SHARE IN 2023

TABLE 50 MARKET FOR TOOLING, BY REGION, 20232027 (USD MILLION)

8 RAPID LIQUID PRINTING MARKET, BY VERTICAL (Page No. - 75)

8.1 INTRODUCTION

FIGURE 28 CONSUMER PRODUCTS PROJECTED TO LEAD THE RAPID LIQUID PRINTING IN 2027

TABLE 51 RAPID LIQUID PRINTING, BY VERTICAL, 20232027 (USD MILLION)

8.2 CONSUMER PRODUCTS

8.2.1 RISING ADOPTION OF DESKTOP OR PERSONAL PRINTERS IS EXPECTED TO DRIVE THE MARKET FOR CONSUMER PRODUCTS

TABLE 52 MARKET FOR CONSUMER PRODUCTS, BY OFFERING, 20232027 (USD MILLION)

TABLE 53 MARKET FOR CONSUMER PRODUCTS, BY PRINTER, 20232027 (USD MILLION)

FIGURE 29 CONSUMER PRODUCTS: FUNCTIONAL PART/END-USE MANUFACTURING EXPECTED TO GROW AT THE HIGHEST RATE FROM 2023 TO 2027

TABLE 54 MARKET FOR CONSUMER PRODUCTS, BY APPLICATION, 20232027 (USD MILLION)

TABLE 55 MARKET FOR CONSUMER PRODUCTS, BY REGION, 20232027 (USD MILLION)

8.3 FASHION

8.3.1 USE OF ENVIRONMENT-FRIENDLY MATERIALS EXPECTED TO FUEL THE MARKET GROWTH IN THE FASHION VERTICAL

TABLE 56 MARKET FOR FASHION, BY OFFERING, 20232027 (USD MILLION)

TABLE 57 MARKET FOR FASHION, BY PRINTER, 20232027 (USD MILLION)

TABLE 58 MARKET FOR FASHION, BY APPLICATION, 20232027 (USD MILLION)

FIGURE 30 FASHION: MARKET EXPECTED TO GROW AT THE HIGHEST RATE IN APAC FROM 2023 TO 2027

TABLE 59 MARKET FOR FASHION, BY REGION, 20232027 (USD MILLION)

8.4 AUTOMOTIVE

8.4.1 AUTOMOTIVE SEGMENT PROJECTED TO LEAD THE MARKET FROM 2023 TO 2025

TABLE 60 MARKET FOR AUTOMOTIVE, BY OFFERING, 20232027 (USD MILLION)

FIGURE 31 AUTOMOTIVE: INDUSTRIAL SEGMENT EXPECTED TO HOLD A LARGER SHARE OF THE RAPID LIQUID PRINTING

TABLE 61 RAPID LIQUID PRINTING FOR AUTOMOTIVE, BY PRINTER, 20232027 (USD MILLION)

TABLE 62 RAPID LIQUID PRINTING FOR AUTOMOTIVE, BY APPLICATION, 20232027 (USD MILLION)

TABLE 63 RAPID LIQUID PRINTING MRKET FOR AUTOMOTIVE, BY REGION, 20232027 (USD MILLION)

8.5 HEALTHCARE

8.5.1 THE GLOBAL PANDEMIC OF COVID-19 IS EXPECTED TO CREATE NEW OPPORTUNITIES FOR RLP IN HEALTHCARE

FIGURE 32 HEALTHCARE: SERVICES OFFERING OF RAPID LIQUID PRINTING EXPECTED TO GROW AT THE HIGHEST RATE

TABLE 64 RAPID LIQUID PRINTING FOR HEALTHCARE, BY OFFERING, 20232027 (USD MILLION)

TABLE 65 RAPID LIQUID PRINTING FOR HEALTHCARE, BY PRINTER, 20232027 (USD MILLION)

TABLE 66 RAPID LIQUID PRINTING FOR HEALTHCARE, BY APPLICATION, 20232027 (USD MILLION)

TABLE 67 RAPID LIQUID PRINTING FOR HEALTHCARE, BY REGION, 20232027 (USD MILLION)

8.6 AEROSPACE & DEFENSE

8.6.1 LATEST ADVANCEMENTS IN TECHNOLOGIES AND MATERIALS EXPECTED TO MAKE AEROSPACE & DEFENSE A MAJOR APPLICATION AREA FOR RAPID LIQUID PRINTING PLAYERS

TABLE 68 RAPID LIQUID PRINTING FOR AEROSPACE & DEFENSE, BY OFFERING, 20232027 (USD MILLION)

TABLE 69 RAPID LIQUID PRINTING FOR AEROSPACE & DEFENSE, BY PRINTER, 20232027 (USD MILLION)

FIGURE 33 AEROSPACE & DEFENSE: PROTOTYPING APPLICATION PROJECTED TO LEAD THE RAPID LIQUID PRINTING IN 2027

TABLE 70 RAPID LIQUID PRINTING FOR AEROSPACE & DEFENSE, BY APPLICATION, 20232027 (USD MILLION)

TABLE 71 RAPID LIQUID PRINTING FOR AEROSPACE & DEFENSE, BY REGION, 20232027 (USD MILLION)

8.7 UTILITY

8.7.1 THE GROWING ADOPTION OF 3D PRINTING IN THE UTILITY INDUSTRY IS EXPECTED TO CREATE NEW OPPORTUNITIES FOR RLP

TABLE 72 RAPID LIQUID PRINTING FOR UTILITY, BY OFFERING, 20232027 (USD MILLION)

TABLE 73 RAPID LIQUID PRINTING FOR UTILITY, BY PRINTER, 20232027 (USD MILLION)

TABLE 74 RAPID LIQUID PRINTING FOR UTILITY, BY APPLICATION, 20232027 (USD MILLION)

FIGURE 34 UTILITY: APAC RAPID LIQUID PRINTING EXPECTED TO GROW AT THE HIGHEST RATE FROM 2025 TO 2027

TABLE 75 RAPID LIQUID PRINTING FOR UTILITY, BY REGION, 20232027 (USD THOUSAND)

8.8 CONSTRUCTION

8.8.1 RAPID LIQUID PRINTING CAN BE USED BY ARCHITECTS AND CONTRACTORS TO BUILD 3D STRUCTURES, INCLUDING HOUSES AND APARTMENTS

FIGURE 35 CONSTRUCTION: PRINTERS PROJECTED TO LEAD THE RAPID LIQUID PRINTING IN 2027

TABLE 76 RAPID LIQUID PRINTING FOR CONSTRUCTION, BY OFFERING, 20232027 (USD MILLION)

TABLE 77 RAPID LIQUID PRINTING FOR CONSTRUCTION, BY PRINTER, 20232027 (USD MILLION)

TABLE 78 RAPID LIQUID PRINTING FOR CONSTRUCTION, BY APPLICATION, 20232027 (USD MILLION)

TABLE 79 RAPID LIQUID PRINTING FOR CONSTRUCTION, BY REGION, 20232027 (USD THOUSAND)

8.9 OTHERS

TABLE 80 RAPID LIQUID PRINTING FOR OTHERS, BY OFFERING, 20232027 (USD THOUSAND)

TABLE 81 RAPID LIQUID PRINTING FOR OTHERS, BY PRINTER, 20232027 (USD THOUSAND)

FIGURE 36 OTHERS: PROTOTYPING TO LEAD THE MARKET FROM 2025 TO 2027

TABLE 82 RAPID LIQUID PRINTING FOR OTHERS, BY APPLICATION, 20232027 (USD THOUSAND)

TABLE 83 RAPID LIQUID PRINTING FOR OTHERS, BY REGION, 20232027 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS (Page No. - 96)

9.1 INTRODUCTION

FIGURE 37 RAPID LIQUID PRINTING IN CHINA PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2023 TO 2027

TABLE 84 RAPID LIQUID PRINTING MARKET, BY REGION, 20232027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: RAPID LIQUID PRINTING MARKET SNAPSHOT

9.2.1 US

9.2.1.1 The US to hold the largest share of the rapid liquid printing in North America

9.2.2 CANADA

9.2.2.1 Rapid liquid printing is expected to open new avenues for various businesses in Canada

9.2.3 MEXICO

9.2.3.1 Mexican companies and associations are constantly striving to boost the market for 3D printing technologies in the country

TABLE 85 NORTH AMERICA: RAPID LIQUID PRINTING , BY COUNTRY, 20232027 (USD MILLION)

TABLE 86 NORTH AMERICA: RAPID LIQUID PRINTING , BY OFFERING, 20232027 (USD MILLION)

TABLE 87 NORTH AMERICA: RAPID LIQUID PRINTING , BY APPLICATION, 20232027 (USD MILLION)

TABLE 88 NORTH AMERICA: RAPID LIQUID PRINTING, BY VERTICAL, 20232027 (USD MILLION)

9.3 EUROPE

FIGURE 39 EUROPE: RAPID LIQUID PRINTING SNAPSHOT

9.3.1 GERMANY

9.3.1.1 Germany projected to account for the largest share of the market in Europe from 2023 to 2027

FIGURE 40 PASSENGER CAR PRODUCTION IN EUROPE IN 2018

9.3.2 UK

9.3.2.1 Government, 3D printing associations, and several firms in the UK promote the adoption of 3D printing technologies, such as rapid liquid printing

9.3.3 FRANCE

9.3.3.1 Flourishing end-user sectors of 3D printers projected to contribute to the growth of the rapid liquid printing in the country

9.3.4 REST OF EUROPE (ROE)

TABLE 89 EUROPE: MARKET, BY COUNTRY, 20232027 (USD MILLION)

TABLE 90 EUROPE: RAPID LIQUID PRINTING, BY OFFERING, 20232027 (USD MILLION)

TABLE 91 EUROPE: RAPID LIQUID PRINTING, BY APPLICATION, 20232027 (USD MILLION)

TABLE 92 EUROPE: RAPID LIQUID PRINTING, BY VERTICAL, 20232027 (USD MILLION)

9.4 APAC

FIGURE 41 APAC: RAPID LIQUID PRINTING SNAPSHOT

9.4.1 CHINA

9.4.1.1 China to hold the largest share of the rapid liquid printing in APAC from 2023 to 2027

9.4.2 JAPAN

9.4.2.1 Increasing government investments in 3D printing technologies are among the major factors driving the market growth in Japan

9.4.3 SOUTH KOREA

9.4.3.1 Strong initiatives by the government expected to lead to noticeable growth of the rapid liquid printing in South Korea

9.4.4 INDIA

9.4.4.1 3D printing technologies in India are still in the developing stage and would grow at a rapid rate during the forecast period

9.4.5 REST OF APAC (ROAPAC)

TABLE 93 APAC: RAPID LIQUID PRINTING, BY COUNTRY, 20232027 (USD MILLION)

TABLE 94 APAC: RAPID LIQUID PRINTING, BY OFFERING, 20232027 (USD MILLION)

TABLE 95 APAC: RAPID LIQUID PRINTING, BY APPLICATION, 20232027 (USD MILLION)

TABLE 96 APAC: RAPID LIQUID PRINTING, BY VERTICAL, 20232027 (USD MILLION)

9.5 ROW

FIGURE 42 ROW: RAPID LIQUID PRINTING SNAPSHOT

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Investments in the construction vertical expected to fuel growth

9.5.2 SOUTH AMERICA

9.5.2.1 South America expected to grow at a slower pace compared to other regions in RoW

TABLE 97 ROW: MARKET, BY REGION, 20232027 (USD MILLION)

TABLE 98 ROW: MARKET, BY OFFERING, 20232027 (USD THOUSAND)

TABLE 99 ROW: MARKET, BY APPLICATION, 20232027 (USD MILLION)

TABLE 100 ROW: RAPID LIQUID PRINTING, BY VERTICAL, 20232027 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE (Page No. - 114)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS FOR RAPID LIQUID PRINTING PLAYERS

FIGURE 43 MARKET SHARE: RAPID LIQUID PRINTING MARKET (2023)

11 COMPANY PROFILES (Page No. - 115)

11.1 KEY PLAYERS

(Business Overview, SWOT Analysis, MnM View)*

11.1.1 STEELCASE

FIGURE 44 STEELCASE: COMPANY SNAPSHOT

11.1.2 STRATASYS

FIGURE 45 STRATASYS: COMPANY SNAPSHOT

11.1.3 3D SYSTEMS

FIGURE 46 3D SYSTEMS: COMPANY SNAPSHOT

11.1.4 MATERIALISE

FIGURE 47 MATERIALISE: COMPANY SNAPSHOT

11.1.5 EXONE

FIGURE 48 EXONE: COMPANY SNAPSHOT

11.1.6 EOS

11.1.7 DASSAULT SYSTEMES

FIGURE 49 DASSAULT SYSTEMES: COMPANY SNAPSHOT

11.1.8 AUTODESK

FIGURE 50 AUTODESK: COMPANY SNAPSHOT

11.1.9 NATIVE CANADA FOOTWEAR

11.1.10 BMW

FIGURE 51 BMW: COMPANY SNAPSHOT

*Details on Business Overview, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 132)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

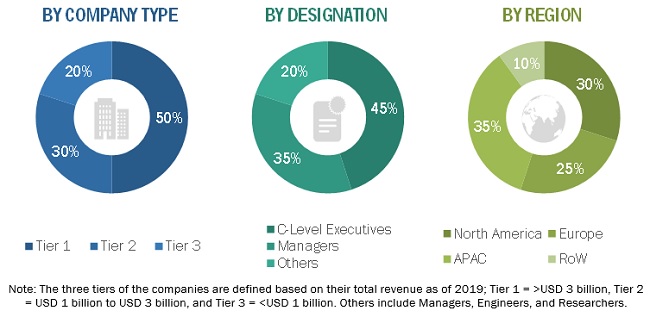

This study involved four major activities in estimating the size of the rapid liquid printing market. Exhaustive secondary research has been conducted to collect information on the rapid liquid printing market. In the next step, these findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. Following that, the market breakdown and data triangulation methods have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for the rapid liquid printing market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, manufacturing associations (such as Massachusetts Institute of Technology (MIT), 3D Printing Education & Research Association (3 Dpera), National Additive Manufacturing Association) International, and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the rapid liquid printing market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall rapid liquid printing market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Key players in the rapid liquid printing market have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall rapid liquid printing market sizeusing the estimation processes explained abovethe market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the rapid liquid printing market.

Report Objectives:

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the rapid liquid printing market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Rapid Liquid Printing Market