Rapid Food Testing Market

Rapid Food Testing Market by Target Tested (Pathogens, GMOs, Pesticides, Mycotoxins, Allergens, Heavy Metals), Food Tested (Meat, Poultry & Seafood, Dairy Products, Processed Foods, Fruits & Vegetables), Technology (Convenience-based Testing, PCR-based Testing, Immunoassay-based Testing, Chromatography & Spectrometry), End User (Food Manufacturers, Sood Service & Catering Companies, Retails & Supermarkets, Other End Users), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The rapid food testing market is estimated at USD 19.66 billion in 2025 and is projected to reach USD 31.22 billion by 2030, at a CAGR of 9.7%. This growth is primarily driven by stringent regulations, rising foodborne illness outbreaks, and globalized supply chains requiring faster quality checks. Increasing consumer demand for safe, high-quality products, along with technological advancements in PCR, biosensors, and immunoassays, is enhancing accuracy, speed, and efficiency, fueling widespread adoption across food industries.

KEY TAKEAWAYS

- Europe is expected to account for a share of 34.9% of the rapid food testing market in 2025.

- By target tested, the GMOs segment is expected to register the highest CAGR of 10.5%.

- By food tested, the processed foods segment is projected to grow at the fastest rate from 2025 to 2030.

- By technology, the PCR-based testing segment is expected to dominate the market.

- Eurofins Scientific, SGS Société Générale de Surveillance SA, and ALS were identified as star players in the rapid food testing market due to their strong market share and comprehensive service offerings.

- Certified Group, Symbio Labs, and AGROLAB, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Rapid food testing involves modern analytical techniques and technologies that can quickly identify contaminants, pathogens, allergens, chemical residues, and toxins in food. Unlike traditional methods that are often slow, rapid testing provides reliable results within minutes to hours, enabling faster decisions and lowering risks in the food supply chain.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The rapid food testing market is being shaped by multiple disruptive trends that are directly impacting customers’ businesses. Stricter regulations from global agencies such as the FDA and EFSA are driving the need for faster, validated, and more precise testing. Technology acceleration through AI, automation, robotics, and predictive analytics is critical in ensuring authenticity, safety, and compliance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Growing emphasis on food quality and protecting brand reputation

-

•Introduction of stringent food safety regulations and standards

Level

-

Maintenance and calibration costs of food testing labs

-

Inadequate cleaning and disinfection between tests increase cross-contamination risks

Level

-

•Integration of AI and ML for predictive food safety analytics

-

•Government-funded programs to modernize food safety infrastructure

Level

-

•High costs associated with procurement of food safety testing equipment

-

•Rapid tests frequently experience delays in availability for newly identified pathogens

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on food quality and protecting brand reputation

The growing emphasis on food quality and brand reputation is a key driver for the rapid food testing market. In today’s competitive food industry, consumers demand safe, high-quality products and quickly lose trust in brands linked to contamination or recalls. Even a single incident of adulteration, pathogen outbreak, or allergen mislabeling can cause reputational damage, financial loss, and long-term brand erosion. Companies adopt rapid testing solutions that deliver accurate results within hours to safeguard consumer trust, enabling swift corrective action and preventive measures. By ensuring consistent quality and safety, businesses comply with stringent regulations and build stronger brand loyalty, positioning rapid food safety testing as a vital tool in protecting reputation and market competitiveness.

Restraint: Maintenance and calibration costs of food testing labs

Maintenance and calibration costs remain a major restraint for the rapid food testing market. Attaining and sustaining accreditations such as ISO 17025 requires ongoing investment in equipment calibration and quality management, often reaching six-figure sums annually when third-party services, proficiency testing, internal audits, and certifications are factored in. These expenses are recurring, as instruments must be consistently maintained to comply with strict regulatory standards. Advanced pathogen detection systems like Hygiena’s BAX SalQuant also demand precise calibration and continual upkeep to ensure reliable results, adding to operational costs. Moreover, biohazard waste management, safety system maintenance, and parts replacement further increase financial burdens. Such continuous expenditures discourage many businesses from adopting or scaling rapid food safety testing, limiting broader market penetration despite its advantages in safeguarding food quality and consumer health.

Opportunity: Integration of AI and machine learning for predictive food safety analytics

The integration of artificial intelligence (AI) is creating significant opportunities for the rapid food testing market. With global food demand expected to rise by 59–98% by 2050 (Chicago Council on Global Affairs), the industry requires faster and more efficient safety solutions. AI technologies such as machine learning, deep learning, computer vision, and natural language processing enable real-time, non-destructive inspection, grading, and contamination detection, offering a faster alternative to traditional manual and chemical testing. A key example is the March 2022 partnership between ASI, LLC (US) and FoodReady, which leverages AI to streamline HACCP planning, compliance tracking, traceability, and temperature monitoring. By integrating AI with rapid testing, companies can reduce turnaround times, minimize human error, and enhance regulatory compliance. As adoption expands and costs fall, AI-driven tools combined with rapid testing will strengthen supply chain management and drive new growth opportunities in food safety.

Challenge: Rapid tests frequently experience delays in availability for newly identified pathogens

Addressing emerging and complex hazards remains a significant challenge for the global rapid food testing market, as hazard evolution often progresses faster than the development of validated testing methods. Newly emerging or re-emerging pathogens, such as novel Salmonella and E. coli serotypes, along with under-recognized foodborne viruses, require continuous advancements in assay design. Likewise, shifting dietary patterns and expanding global food trade are driving the rise of novel allergens that lack rapid-testing solutions. Chemical threats, including persistent contaminants like PFAS, climate-driven mycotoxin variations, and antimicrobial resistance (AMR) genes, add further complexity. Beyond creating sensitive and specific assays, global validation and approval from organizations such as AOAC, ISO, and local regulators is essential to ensure acceptance. However, delays in aligning test development with evolving hazards expose producers and regulators to risk, weaken consumer confidence, and hinder compliance, limiting broader adoption in high-risk, high-volume supply chains.

Rapid Food Safety Testing: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

In-process rapid pathogen testing in infant formula and dairy production | Ensures product safety for vulnerable consumers while minimizing recall risk |

|

Rapid microbial screening for Salmonella and Listeria in meat processing lines | Speeds up batch release and reduces costly production downtime |

|

Rapid pathogen and pesticide residue testing in fresh fruits and vegetables before shipment | Ensures export compliance and access to premium international markets |

|

On-site allergen testing across restaurants and supply chain | Protects brand reputation and guarantees consumer safety in high-volume outlets |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the rapid food testing market is shaped by a network of stakeholders working together to ensure food products meet regulatory and consumer safety standards. This ecosystem spans across technology developers, laboratories, regulatory agencies, food manufacturers, distributors, and end users, creating a highly interconnected value chain. With increasing globalization of food trade, growing consumer awareness, and stricter compliance requirements, the ecosystem has become more complex, where innovation, collaboration, and data-driven decision-making are central to ensuring food safety and preventing recalls. Regulatory bodies and certification organizations, such as the FDA, EFSA, and FSSAI, ensure that products meet stringent safety and quality benchmarks, while consumer groups emphasize transparency, sustainability, and ethical sourcing. Collectively, these stakeholders shape a market that is increasingly influenced by health-conscious, quality-driven, and regulation-aware consumers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rapid Food Testing Market, By Target Tested

Pathogens are harmful microorganisms, such as bacteria, viruses, parasites, or fungi, that can cause diseases in humans when ingested through contaminated food or water. The most common foodborne pathogens include Salmonella, Escherichia coli (E. coli), Listeria monocytogenes, Campylobacter, and Norovirus. These organisms contaminate food through improper handling, inadequate cooking, cross-contamination, or unsanitary processing environments. Pathogens are indeed a leading cause of foodborne illnesses, resulting in symptoms like diarrhea, vomiting, fever, and, in severe cases, hospitalization. To safeguard against such risks, rapid food safety testing technologies are employed. Polymerase Chain Reaction (PCR) and quantitative PCR enable fast detection of pathogen DNA. Immunoassays such as ELISA identify pathogen-specific antigens, while biosensors and microarrays provide real-time monitoring. Next-Generation Sequencing (NGS) allows precise pathogen identification and tracking. These technologies do not eliminate pathogens directly but ensure early detection, enabling food producers to take corrective actions that prevent contaminated products from reaching consumers.

Rapid Food Testing Market, By Technology

Polymerase Chain Reaction (PCR) is a molecular technique used to amplify specific DNA or RNA segments, making it possible to detect microorganisms even when present in very small amounts. In food safety testing, PCR is a key rapid detection tool for pathogens such as Salmonella, Listeria monocytogenes, E. coli (STEC), Campylobacter, and viruses like norovirus. Unlike traditional culture methods that may take several days, PCR can provide results within hours. Real-Time PCR (qPCR) enhances this by detecting and quantifying pathogens through fluorescent markers, offering faster and more precise outcomes. PCR in accredited laboratories uses advanced thermocyclers and automated systems to deliver highly accurate and high-throughput testing. Amplifying specific DNA sequences ensures the precise detection of pathogens and contaminants in food samples. Laboratory workflows combine preparation, amplification, and detection in controlled environments, reducing contamination risks. Automated platforms handle multiple samples efficiently, making them ideal for large-scale monitoring. Skilled molecular biologists and certified labs ensure confirmatory testing for regulatory compliance and product safety. This rigorous and reliable approach establishes laboratory-based PCR as a cornerstone of food safety testing, providing both speed and accuracy in protecting public health.

REGION

Asia Pacific is the fastest-growing rapid food testing market globally

The Asia Pacific rapid food testing market is expanding rapidly, driven by the enforcement of stringent food-related regulations across the region. Countries such as China, India, and Australia & New Zealand are leading this growth, while Japan has also made notable advancements in food safety development.

Rapid Food Safety Testing: COMPANY EVALUATION MATRIX

Eurofins Scientific (Star) leads the rapid food testing market with a strong market share and extensive product footprint. FoodChain ID (Emerging Leader) is gaining visibility with its solutions for food testing applications, strengthening its position through innovation and niche product offerings. While Eurofins Scientific dominates through scale and a diverse portfolio, FoodChain ID shows significant potential to move toward the leaders’ quadrant as demand for rapid food testing continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 18.01 BN |

| Market Forecast in 2030 (Value) | USD 31.22 BN |

| Growth Rate | CAGR of 9.7% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN/MN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, South America, Row |

WHAT IS IN IT FOR YOU: Rapid Food Safety Testing REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Demand analysis of rapid food safety testing across different technologies | Technology-specific mapping for each region Conveniently used technologies | Detailed rapid food safety testing demand forecast by country |

| Market trend analysis of target tested and regional analysis | Different targets with respect to the different regions and the penetration of targets across different food categories globally Further breakdown of the different regions of rapid food testing market into key countries | Fine segmentation of targets, i.e., split tests by pathogen (Salmonella, Listeria, E. coli) Market pain-points & buyer decision factors |

| Market share of food tested categories and players | Regional breakdown of food tested segments Analysis of different companies, which gives a detailed comparison of the food tested portfolio of each company | Map top suppliers’ category, including market share estimates, native/regional players |

RECENT DEVELOPMENTS

- April 2025 : SGS signed a Memorandum of Understanding with the Ministry of Economy of the United Arab Emirates to advance food safety and quality compliance cooperation. This partnership combines the Ministry’s progressive regulatory vision with SGS’s global expertise in testing to set new standards for food safety, strengthen consumer protection, and ensure products in the UAE meet the highest international quality and safety requirements.

- February 2025 : Intertek’s new regional headquarters in Riyadh strengthened its presence in the Middle East, offering advanced ATIC services that can support the growing food sector. This expansion enhances its capacity for localized testing, faster service delivery, and compliance with regional regulations, positioning Intertek to better serve food producers amid Saudi Arabia’s push for diversified, sustainable industry growth.

- October 2024 : SGS expanded its presence in the North American rapid food testing market with a new food and nutraceutical testing facility in Fairfield, New Jersey. Strategically located near a major manufacturing hub, the facility is equipped with advanced technology and scientific expertise to deliver high-quality analytical services.

- August 2024 : ALS launched InviRapid. The InviRapid Lateral Flow Assays provide rapid, on-site detection of food allergens within minutes in diverse samples. With all necessary reagents included, they integrate seamlessly into HACCP programs. Using colloidal gold-labeled antibodies for visual results, they enhance rapid food safety testing by enabling quick allergen identification, supporting compliance, and protecting consumers from potential allergen-related risks.

- June 2024 : ALS acquired Wessling Group, enhancing its food, environmental, and pharmaceutical testing capabilities across Europe. With expanded expertise and local presence in Germany and France, this strategic move strengthens ALS’ capacity to deliver advanced food testing solutions aligned with regional quality standards.

Table of Contents

Methodology

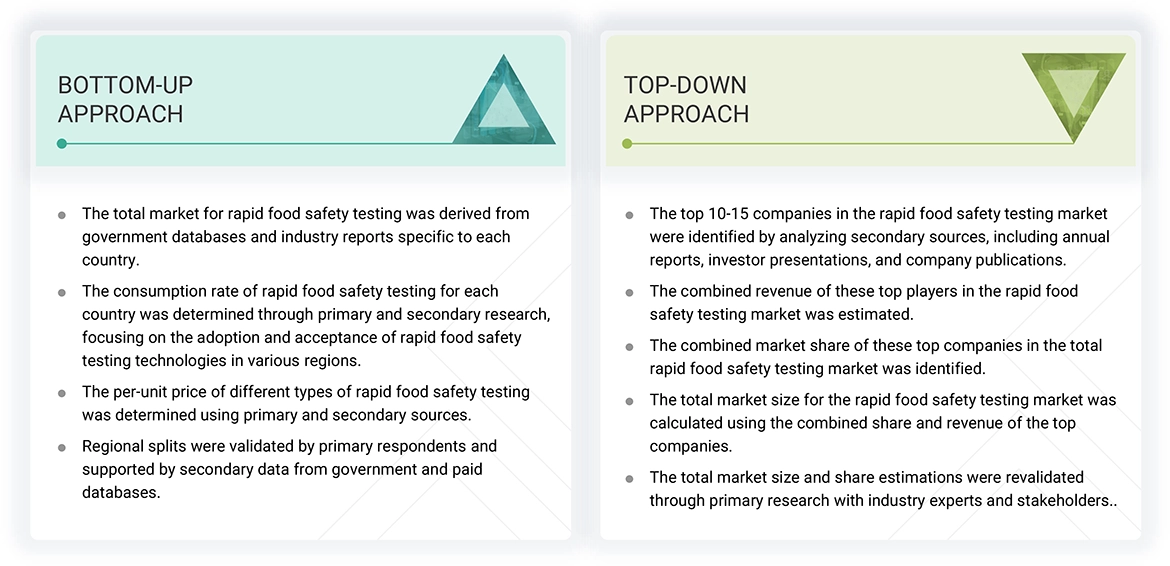

The study involved two major approaches in estimating the current size of the rapid food safety testing market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources, such as company annual reports, press releases, investor presentations, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were used to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the rapid food safety testing market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, research, and development teams, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to rapid food safety testing, target tested, food tested, technology, and region. Stakeholders from the demand side, such as research institutions and universities, third-party vendors, were interviewed to understand the buyer’s perspective on the service, their current usage of rapid testing services, and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2023 or 2024,

as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100

million = Revenue = USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Eurofins Scientific (Luxembourg) |

R&D Expert |

|

SGS Société Générale de Surveillance SA (Switzerland) |

Sales Manager |

|

ALS (Australia) |

Manager |

|

Intertek Group plc (UK) |

Sales Manager |

|

Mérieux NutriSciences (US) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the rapid food safety testing market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Rapid Food Safety Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall rapid food safety testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Rapid food safety testing refers to advanced analytical methods and technologies designed to quickly detect contaminants, pathogens, allergens, chemical residues, and toxins in food products. Unlike traditional testing, which can be time-consuming, rapid testing delivers accurate results within minutes to hours, enabling timely decision-making and reducing risks in the food supply chain. These tests are crucial for ensuring compliance with stringent food safety regulations, safeguarding public health, and maintaining consumer trust. Rapid food safety testing technologies include convenience-based testing, PCR-based testing, immunoassay-based testing, chromatography & spectrometry, and other technologies, all of which enhance efficiency, minimize recalls, and support the demand for safe, traceable food.

Stakeholders

- Manufacturers, importers & exporters, traders, distributors, and suppliers of food safety testing equipment, reagents, chemicals, and other related consumables

- Food safety testing laboratories

- Food raw material suppliers

- Food ingredient, intermediate, and end-product manufacturers and processors

-

Government, research organizations, and institutions

- World Health Organization (WHO)

- University of Florida, IFAS

- Food traders, trade associations, and industry bodies

-

Regulatory bodies

- Food and Agriculture Organization (FAO)

- Food Safety Council (FSC)

- European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- Canadian Food Inspection Agency (CFIA)

- Mexico’s National Service of Health, Food Safety, and Agro-Alimentary Quality (SENASICA)

- Food Safety Commission (FSC)

- Ministry of Health, Labour and Welfare (Japan)

- Food Safety and Standards Authority of India (FSSAI)

- Commercial research & development (R&D) institutions and financial institutions

- Regulatory bodies, including government agencies and NGOs

Report Objectives

- To determine and project the size of the rapid food safety testing market with respect to the target tested, food tested, technology, and region in terms of value and volume over five years, ranging from 2025 to 2030

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

- To identify and profile the key players in the rapid food safety testing market

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Service Matrix, which gives a detailed comparison of the service portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European rapid food safety testing market into key countries.

- Further breakdown of the Rest of Asia Pacific rapid food safety testing market into key countries.

- Further breakdown of the Rest of South American rapid food safety testing market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the rapid food safety testing market?

The rapid food safety testing market is estimated to be worth USD 19.66 billion in 2025 and is projected to reach USD 31.22 billion by 2030, registering a CAGR of 9.7% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Eurofins Scientific (Luxembourg), SGS Société Générale de Surveillance SA (Switzerland), ALS (Australia), Intertek Group plc (UK), and Mérieux NutriSciences (US) are some of the key market players. The market for rapid food safety testing is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also investing heavily.

Which region is projected to account for the largest share of the rapid food safety testing market?

In Europe, the rapid food safety testing market growth can be attributed to stringent regulatory standards, rising foodborne illness cases, and increasing demand for fast, reliable testing in processed and convenience foods.

What kind of information is provided in the company profiles section?

The company profiles provided deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the rapid food safety testing market?

The global rapid food safety testing market is driven by rising foodborne illness cases, stringent safety regulations, growing consumer demand for transparency, expansion of international food trade, and advancements in testing technologies.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Rapid Food Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Rapid Food Testing Market