Rainscreen Cladding Market by Material (Composite Materials, Metal, Fiber Cement, HPL), Construction (New Construction and Renovation), End-Use Sector (Non-residential and Residential), and Region - Global Forecast to 2024

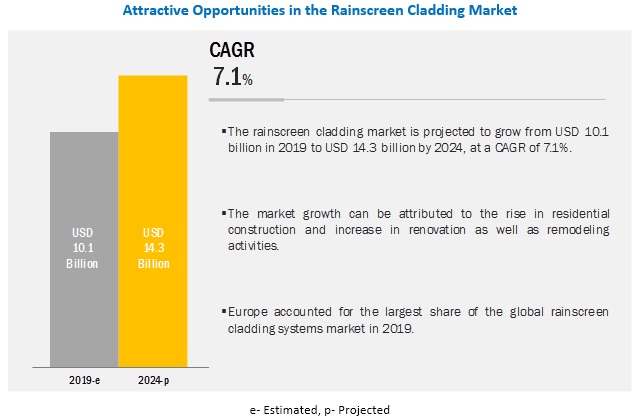

The rainscreen cladding market is projected to reach USD 14.3 billion by 2024, at a CAGR of 7.1%. Demand for rainscreen cladding market can be credited to the high growth of the construction industry across the globe. Factors such as increasing residential and non-residential construction, and remodeling & maintenance activities, its high durability, and ability to enhance the aesthetic appearance drives the demand for rainscreen cladding .

In terms of both value and volume, the new construction segment is projected to grow at the highest CAGR during the forecast period.

The new construction segment of the rainscreen cladding market is projected to grow at the highest CAGR during the forecast period, in terms of value as well as volume. It is a durable, flexible and waterproof cladding material in the market. It includes an extruded polymer-based core layer which provides a better rigid property to the floor. Its properties such as easy installation and smooth finished appearance after the installation further drive the market for rainscreen cladding market.

In terms of both value and volume, the composite material segment is projected to lead the rainscreen cladding market from 2019 to 2024.

Growth of composite material segment in the rainscreen cladding market is primarily attributed to the high strength, increased durability, and design flexibility. It accounted for the highest market share among all the materials used for rainscreen cladding due to its low cost and easy installation techniques. Composite materials are the most preferred rainscreen cladding material for residential as well as non-residential buildings, owing to their high durability, longer shelf-life of around 30–40 years, and no maintenance. Their easy maintenance & installation features save the additional labor cost involved in it.

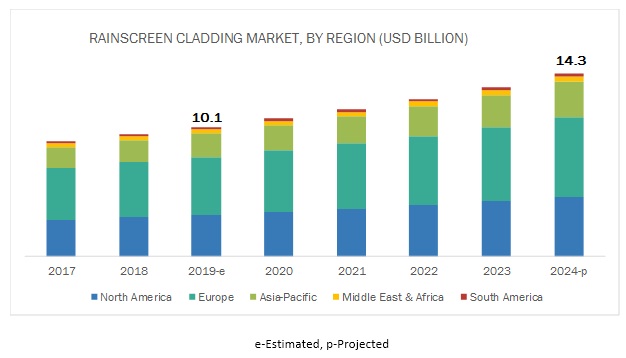

In terms of both value and volume, the Europe rainscreen cladding market is projected to contribute the maximum market share during the forecast period.

In terms of value, the Europe region is projected to lead the rainscreen cladding market from 2019 to 2024 due to the strong demand from countries such as UK, Germany, France, Russia, and Italy. This demand in these mentioned countries is due to the tremendous growth of the construction opportunities in these countries. The market is also driven by the increasing number of new housing units and huge investments in the infrastructural sector.

Key Rainscreen Cladding Market Players

Key players such as Kingspan Insulation (UK), SIKA (Switzerland), Rockwool International A/S (Denmark), Everest Industries Limited (Denmark), SFS Group AG (US), Sotech Architectural Façade (UK), Promat UK Ltd (UK) and Interface (US) adopted these strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the rainscreen cladding market.

Kingspan Insulation (UK) has an extensive product portfolio and strategic mix of investments and acquisitions have helped the company to establish a leading position in the flooring market. In the rainscreen cladding industry, Kingspan Insulation’s brands are among the most recognized. The company’s vertically integrated manufacturing, as well as distribution processes, offer competitive advantages in terms of production of cladding . Through its network of manufacturing facilities and sales distribution across the globe and leadership in every cladding product category, the company has been recognized as one of the world’s key cladding manufacturers.

Rainscreen Cladding Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD Billion) and Volume (Million Square Feet) |

|

Segments covered |

Construction, Material, End-Use Sector, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa |

|

Companies covered |

Kingspan Insulation (UK), SIKA (Switzerland), Rockwool International A/S (Denmark), Everest Industries Limited (Denmark), SFS Group AG (US), Sotech Architectural Façade (UK), Promat UK Ltd (UK). |

This research report categorizes the rainscreen cladding market based on construction, material end-use sector, and region.

On the basis of construction, the rainscreen cladding market has been categorized as follows:

- New construction

- Renovation

On the basis of material, the rainscreen cladding market has been categorized as follows:

- Composite Materials

- Metal

- Fiber Cement

- HPL

- Others

On the basis of end-use sector the rainscreen cladding market has been categorized as follows:

- Residential

- Non-residential

On the basis of region the rainscreen cladding market has been categorized as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments in Rainscreen Cladding Market

- In September 2018, Kingspan introduced Kingspan Facade, a facade business in the group. This new facade business would offer an advanced and diversified portfolio of building envelope to their customers.

- In March 2018, Kingspan invested in the Nordic market to boost its premium product range of Kooltherm insulation. The company would start a new manufacturing site near Jonkoping, Sweden, with an aim to promote the growth of Kooltherm products in the Nordic as well as Baltic countries.

- In December 2017, Kingspan agreed to acquire the Balex Metal sp.z.o.o. (Poland). The acquired company is a manufacturer of insulation board and insulated panels.

Key Questions Addressed by the Rainscreen Cladding Market Report

- What are the global trends in the rainscreen cladding market? Would the market witnessed an increase or decline in demand in the coming years?

- What is the estimated demand for different materials of rainscreen cladding products?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for rainscreen cladding ?

- Who are the major players in the rainscreen cladding market globally?

Frequently Asked Questions (FAQ):

How big is the rainscreen cladding market industry?

The rainscreen cladding market is projected to grow from USD 10.1 billion in 2019 to USD 14.3 billion by 2024, at a CAGR of 7.1% from 2019 to 2024.

Who leading market players in rainscreen cladding industry?

Kingspan Insulation (UK), Sika (Switzerland), Rockwool International A/S (Denmark), Everest Industries Limited (Denmark), and Sotech Architectural Facade (UK) are key players operating in the rainscreen cladding market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization Considered for the Study

1.4 Currency Considered for the Study

1.5 Volume Unit Considered for the Study

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Market Size Estimation

2.2.1 Approach 1 (Based on Material, By Region)

2.2.2 Approach 2 (Based on Global Cladding Market)

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Rainscreen Cladding Market

4.2 Europe: Rainscreen Cladding Systems Market, By Material and Country

4.3 Rainscreen Cladding Market, By Material

4.4 Rainscreen Cladding Systems Market, By Construction Type

4.5 Rainscreen Cladding Market, By End-Use Sector

4.6 Rainscreen Cladding Systems Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Population and Rapid Urbanization Translating to A Large Number of New Construction Projects

5.2.1.2 Increase in Non-Residential Construction Activities

5.2.1.3 High Durability of Rainscreen Cladding Systems

5.2.2 Restraints

5.2.2.1 High Raw Material and Installation Costs

5.2.3 Opportunities

5.2.3.1 Rise in Demand for Protective Systems, Enhancing the Aesthetic Appeal of A Building

5.2.3.2 Rise in Population and Urbanization in Emerging Economies

5.2.3.3 Increase in Demand for Fiber Cement in the Rainscreen Cladding Systems

5.2.3.4 Increase in Demand for Sustainable Cladding Materials

5.2.4 Challenges

5.2.4.1 High Repairing Costs

5.3 Yc, Ycc Drivers

6 Rainscreen Cladding Systems Market, By Material (Page No. - 39)

6.1 Introduction

6.1.1 Rainscreen Cladding Systems Market, By Material

6.2 Composite Materials

6.2.1 Composite Materials to Gain High Preference From the Construction Sector in the Rainscreen Cladding Systems Market

6.3 Fiber Cement

6.3.1 High Strength and Durability to Drive the Growth of the Fiber Cement Rainscreen Cladding Systems Market

6.4 Metal

6.4.1 The Increasing Demand for High Thermal Efficiency and Durability of the Material Drives the Demand for Metal Cladding

6.5 High-Pressure Laminate

6.5.1 The Hpl Segment is Projected to Record A Stagnant Growth Rate During the Forecast Period

6.6 Others

7 Rainscreen Cladding Systems Market, By Construction Type (Page No. - 45)

7.1 Introduction

7.2 Renovation

7.3 New Construction

8 Rainscreen Cladding Systems Market, By End-Use Sector (Page No. - 48)

8.1 Introduction

8.2 Residential

8.2.1 The Residential Sector is Projected to Grow at A Moderate Rate in the Rainscreen Cladding Systems Market

8.3 Non-Residential

8.3.1 The Non-Residential Application is Projected to Account for A Larger Share in the Rainscreen Cladding Systems Market

9 Rainscreen Cladding Systems Market, By Region (Page No. - 51)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 The Chinese Rainscreen Cladding Systems Market to Grow at the Highest Rate Through 2024

9.2.2 Japan

9.2.2.1 The New Construction Segment is Projected to Grow at A Higher Rate By 2024

9.2.3 India

9.2.3.1 India is Projected to Witness Second-Highest Growth in the Asia Pacific Rainscreen Cladding Systems Market

9.2.4 Australia

9.2.4.1 The New Construction Segment Accounted for the Larger Share in the Australian Rainscreen Cladding Systems Market

9.2.5 South Korea

9.2.5.1 The New Construction Segment is Projected to Lead the South Korea Rainscreen Cladding Systems Market

9.2.6 Rest of Asia Pacific

9.3 Europe

9.3.1 Germany

9.3.1.1 The Non-Residential Sector Segment is Projected to Witness High Growth in Germany

9.3.2 France

9.3.2.1 The Non-Residential Cement Segment is Projected to Grow at the Highest Rate in France

9.3.3 UK

9.3.3.1 The New Construction Segment is Projected to Witness High Consumption in the UK Through 2024

9.3.4 Italy

9.3.4.1 The New Construction Segment is Projected to Witness High Growth During the Forecast Period

9.3.5 Russia

9.3.5.1 The New Construction Segment Accounted for the Larger Share in 2017 in Russia

9.3.6 Rest of Europe

9.3.6.1 The Non-Residential Segment is Projected to Grow at the Highest Rate in the Rest of Europe Market By 2024

9.4 North America

9.4.1 US

9.4.1.1 The Non-Residential Sector to Witness the Highest Consumption in the US By 2024

9.4.2 Canada

9.4.2.1 The New Construction Segment to Grow at A Higher CAGR, in Terms of Value, in Canada

9.4.3 Mexico

9.4.3.1 New Construction to Witness High Growth, in Terms of Volume, in Mexico Through 2024

9.5 Middle East & Africa

9.5.1 Turkey

9.5.1.1 Turkey to Lead the Rainscreen Cladding Systems Market in the Middle East & Africa, in Terms of Value

9.5.2 Saudi Arabia

9.5.2.1 Saudi Arabia to Be the Second-Fastest-Growing Market in the Middle East & Africa, in Terms of Value

9.5.3 UAE

9.5.3.1 New Construction is Expected to Be the Faster-Growing Cladding Material in the UAE, in Terms of Volume

9.5.4 South Africa

9.5.4.1 The Non-Residential Segment to Lead the South African Rainscreen Cladding Market

9.5.5 Rest of the Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Brazil to Account for the Largest Share in the South American Rainscreen Cladding Systems Market

9.6.2 Argentina

9.6.2.1 Increase in Investment in Constructions is Projected to Drive the Rainscreen Cladding Market in Argentina

9.6.3 Rest of South America

9.6.3.1 New Construction is Projected to Remain the Larger Segment in the Rainscreen Cladding Systems Market in Rest of South America

10 Competitive Landscape (Page No. - 100)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Acquisitions

10.2.2 Investments

10.2.3 Expansions

11 Company Profiles (Page No. - 102)

11.1 Kingspan Insulation

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, and Right to Win)*

11.2 SIKA

11.3 Rockwool International A/S

11.4 Everest Industries Limited

11.5 SFS Group AG

11.6 Sotech Architectural Façade Systems

11.7 Promat UK Ltd.

11.8 Additional Company Profiles

11.8.1 CGL Façades Ltd

11.8.2 Celotex Ltd.

11.8.3 Terraclad

11.8.4 ECO Earth Solutions Pvt Ltd

11.8.5 Omnimax International Inc.

11.8.6 Trespa International B.V.

11.8.7 Middle East Insulation Llc

11.8.8 Euro Panels Overseas N.V.

11.8.9 Centria International

11.8.10 Dow Building Solutions

11.8.11 Fundermax

11.8.12 Alucobond (3A Composites)

11.8.13 Arconic Inc

11.8.14 Euroclad Group

11.8.15 Dams Incorporated

11.8.16 Northclad

11.8.17 Armetco Systems

11.8.18 Vulcan Cladding Systems

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, and Right to Win Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (147 Tables)

Table 1 USD Exchange Rates, 2014–2018

Table 2 Deciding Factors While Selecting A Rainscreen Cladding Material

Table 3 Rainscreen Cladding Systems Market Size, By Material, 2017–2024 (USD Million)

Table 4 Rainscreen Cladding Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 5 Pros and Cons of Fiber Cement Cladding Systems

Table 6 Pros and Cons of Metal Cladding Systems

Table 7 Rainscreen Cladding Systems Market Size, By Construction, 2017–2024 (USD Million)

Table 8 Rainscreen Cladding Market Size, By Construction, 2017–2024 (Million Square Feet)

Table 9 Rainscreen Cladding Systems Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 10 Rainscreen Cladding Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 11 Rainscreen Cladding Systems Market Size, By Region, 2017–2024 (USD Million)

Table 12 Rainscreen Cladding Market Size, By Region, 2017–2024 (Million Sq. Ft.)

Table 13 Asia Pacific: Rainscreen Cladding Market Size, By Country, 2017–2024 (USD Million)

Table 14 Asia Pacific: Rainscreen Cladding Systems Market Size, By Country, 2017–2024 (Million Sq. Ft.)

Table 15 Asia Pacific: Market Size, By Material, 2017–2024 (USD Million)

Table 16 Asia Pacific: Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 17 Asia Pacific: Market Size, By Construction Type, 2017–2024 (USD Million)

Table 18 Asia Pacific: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 19 Asia Pacific: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 20 Asia Pacific: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 21 China: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 22 China: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 23 China: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 24 China: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 25 Japan: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 26 Japan: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 27 Japan: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 28 Japan: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 29 India: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 30 India: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 31 India: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 32 India: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 33 Australia: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 34 Australia: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 35 Australia: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 36 Australia: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 37 South Korea: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 38 South Korea: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 39 South Korea: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 40 South Korea: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 41 Rest of Asia Pacific: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 42 Rest of Asia Pacific: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 43 Rest of Asia Pacific: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 44 Rest of Asia Pacific: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 45 Europe: Rainscreen Cladding Market Size, By Country, 2017–2024 (USD Million)

Table 46 Europe: Rainscreen Cladding Systems Market Size, By Country, 2017–2024 (Million Sq. Ft.)

Table 47 Europe: Market Size, By Material, 2017–2024 (USD Million)

Table 48 Europe: Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 49 Europe: Market Size, By Construction Type, 2017–2024 (USD Million)

Table 50 Europe: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 51 Europe: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 52 Europe: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 53 Germany: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 54 Germany: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 55 Germany: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 56 Germany: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 57 France: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 58 France: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 59 France: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 60 France: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 61 UK: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 62 UK: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 63 UK: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 64 UK: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 65 Italy: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 66 Italy: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 67 Italy: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 68 Italy: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 69 Russia: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 70 Russia: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 71 Russia: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 72 Russia: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 73 Rest of Europe: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 74 Rest of Europe: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 75 Rest of Europe: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 76 Rest of Europe: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 77 North America: Rainscreen Cladding Market Size, By Country, 2017–2024 (USD Million)

Table 78 North America: Rainscreen Cladding Systems Market Size, By Country, 2017–2024 (Million Sq. Ft.)

Table 79 North America: Market Size, By Material, 2017–2024 (USD Million)

Table 80 North America: Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 81 North America: Market Size, By Construction Type, 2017–2024 (USD Million)

Table 82 North America: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 83 North America: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 84 North America: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 85 US: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 86 US: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 87 US: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 88 US: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 89 Canada: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 90 Canada: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 91 Canada: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 92 Canada: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 93 Mexico: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 94 Mexico: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 95 Mexico: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 96 Mexico: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 97 Middle East & Africa: Rainscreen Cladding Market Size, By Country, 2017–2024 (USD Million)

Table 98 Middle East & Africa: Rainscreen Cladding Systems Market Size, By Country, 2017–2024 (Million Sq. Ft.)

Table 99 Middle East & Africa: Market Size, By Material, 2017–2024 (USD Million)

Table 100 Middle East & Africa: Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 101 Middle East & Africa: Market Size, By Construction Type, 2017–2024 (USD Million)

Table 102 Middle East & Africa: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 103 Middle East & Africa: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 104 Middle East & Africa: Market Size, By Application, 2017–2024 (Million Sq. Ft.)

Table 105 Turkey: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 106 Turkey: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 107 Turkey: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 108 Turkey: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 109 Saudi Arabia: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 110 Saudi Arabia: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 111 Saudi Arabia: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 112 Saudi Arabia: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 113 UAE: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 114 UAE: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 115 UAE: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 116 UAE: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 117 South Africa: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 118 South Africa: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 119 South Africa: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 120 South Africa: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 121 Rest of the Middle East & Africa: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 122 Rest of the Middle East & Africa: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 123 Rest of the Middle East & Africa: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 124 Rest of the Middle East & Africa: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 125 South America: Rainscreen Cladding Market Size, By Country, 2017–2024 (USD Million)

Table 126 South America: Rainscreen Cladding Systems Market Size, By Country, 2017–2024 (Million Sq. Ft.)

Table 127 South America: Market Size, By Material, 2017–2024 (USD Million)

Table 128 South America: Market Size, By Material, 2017–2024 (Million Sq. Ft.)

Table 129 South America: Market Size, By Construction Type, 2017–2024 (USD Million)

Table 130 South America: Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 131 South America: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 132 South America: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 133 Brazil: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 134 Brazil: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 135 Brazil: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 136 Brazil: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 137 Argentina: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 138 Argentina: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 139 Argentina: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 140 Argentina: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 141 Rest of South America: Rainscreen Cladding Market Size, By Construction Type, 2017–2024 (USD Million)

Table 142 Rest of South America: Rainscreen Cladding Systems Market Size, By Construction Type, 2017–2024 (Million Sq. Ft.)

Table 143 Rest of South America: Market Size, By End-Use Sector, 2017–2024 (USD Million)

Table 144 Rest of South America: Market Size, By End-Use Sector, 2017–2024 (Million Sq. Ft.)

Table 145 Key Acquisitions of the Leading Players in the Rainscreen Cladding Market, 2017–2018

Table 146 Key Investments of the Leading Players in the Rainscreen Cladding Market, 2018

Table 147 Key Business Expansions of the Leading Players in the Rainscreen Cladding Market, 2018

List of Figures (32 Figures)

Figure 1 Rainscreen Cladding Market Segmentation

Figure 2 Rainscreen Cladding Systems Market: Data Triangulation

Figure 3 Key Market Insights

Figure 4 List of Stakeholders Involved and Breakdown of Primary Interviews

Figure 5 Composite Materials to Lead the Rainscreen Cladding Systems Market During the Forecast Period

Figure 6 The New Construction Segment to Lead the Rainscreen Cladding Market During the Forecast Period

Figure 7 The Residential Segment to Lead the Rainscreen Cladding Systems Market During the Forecast Period

Figure 8 Europe Led the Rainscreen Cladding Systems Market in 2018

Figure 9 Rise in Non-Residential Construction is Projected to Drive the Rainscreen Cladding Market

Figure 10 The UK Was the Largest Market for Rainscreen Cladding Systems in Europe in 2018

Figure 11 Composite Materials to Lead the Rainscreen Cladding Market During the Forecast Period

Figure 12 New Construction to Lead the Rainscreen Cladding Systems Market

Figure 13 Non-Residential is Projected to Be the Faster-Growing End-Use Sector in the Rainscreen Cladding Systems Market

Figure 14 China is Projected to Grow at the Highest CAGR From 2019 to 2024

Figure 15 Rainscreen Cladding Systems Market Dynamics

Figure 16 Population Growth has Increased By Three Billion in the Last Three Decades

Figure 17 Rainscreen Cladding Market Size, By Material, 2019 vs. 2024 (USD Million)

Figure 18 The New Construction Segment is Projected to Grow at A Higher Rate By 2024

Figure 19 Rainscreen Cladding Systems Market Size, By End-Use Sector, 2018 vs. 2023 (USD Million)

Figure 20 Geographical Snapshot: Rainscreen Cladding Systems Market Growth Rate, By Country

Figure 21 Kingspan Insulation: Company Snapshot

Figure 22 Kingspan Insulation: SWOT Analysis

Figure 23 Kingspan Insulation: Winning Imperatives and Right to Win Factors

Figure 24 SIKA: Company Snapshot

Figure 25 SIKA: SWOT Analysis

Figure 26 SIKA: Winning Imperatives and Right to Win Factors

Figure 27 Rockwool International A/S: Company Snapshot

Figure 28 Rockwool International: Winning Imperatives and Right to Win Factors

Figure 29 Everest Industries Limited: Company Snapshot

Figure 30 Everest Industries Limited: Winning Imperatives and Right to Win Factors

Figure 31 SFS Group AG: Company Snapshot

Figure 32 SFS Group AG: SWOT Analysis

The study involved four major activities for estimating the current global size of the rainscreen cladding market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of rainscreen cladding through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the rainscreen cladding market. After that, market breakdown and data triangulation procedures were used to determine the extent of different segments and sub-segments of the market.

Rainscreen Cladding Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the rainscreen cladding market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Rainscreen Cladding Market Primary Research

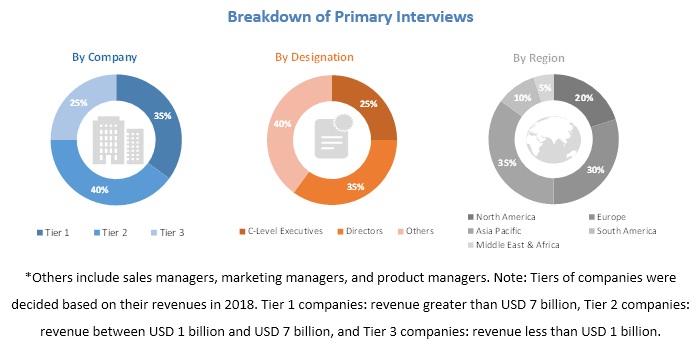

Various primary sources from both the supply and demand side of the rainscreen cladding market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the rainscreen cladding market. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Rainscreen Cladding Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the global size of the rainscreen cladding market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Rainscreen Cladding Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the rainscreen cladding market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Rainscreen Cladding Market Research Objectives

- To define, analyze, and project the size of the rainscreen cladding market in terms of value and volume based on type, end-use industry, and region

- To project the size of the market and its segments in terms of value and volume, concerning the five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micro-markets for individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments such as new product launches, expansions, investments, contracts, acquisitions, partnerships, agreements, and joint ventures in the luxury vinyl tiles (LVT) flooring market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Rainscreen Cladding Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the rainscreen cladding market report:

Rainscreen Cladding Market Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Rainscreen Cladding Market Regional Analysis

- Further analysis of the rainscreen cladding market for additional countries

Rainscreen Cladding Market Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Rainscreen Cladding Market