Rail Traffic Management Market - Global Forecast to 2029

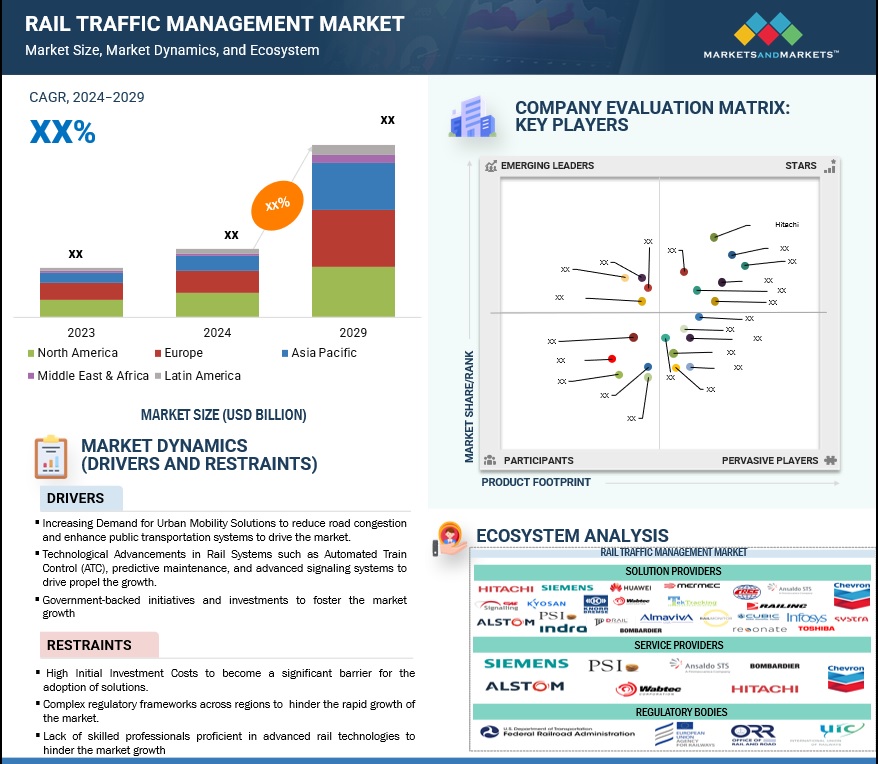

The Rail Traffic Management Market is projected to grow from USD XX billion in 2024 to USD XX billion by 2029 at a compound annual growth rate (CAGR) of XX % from 2024 to 2029. The rail traffic management market consists of advanced systems which are designed to optimize various rail network operations, enhancing safety and improving the safety. Governments across the globe are adopting these rail traffic management solutions in order to modernize their outdated rail infrastructure and address the mobility demands of the growing urban population. Major companies like Siemens, Alstom, and Hitachi are at the forefront of developing comprehensive solutions. Some of these solutions include real-time data analytics, automated signaling, and centralized control systems among other solutions. For example, Siemens’ Controlguide Iltis N - Traffic Management Systems provides seamless management of railway traffic. It optimizes traffic by precisely detecting and resolving conflicts ahead of time as well as implementing train timetables in a highly automated manner. Companies are now incorporating various technologies such as positive train control (PTC), communications-based train control (CBTC), and advanced analytics in order to enable efficient traffic management, ensuring seamless integration across diverse rail operations.

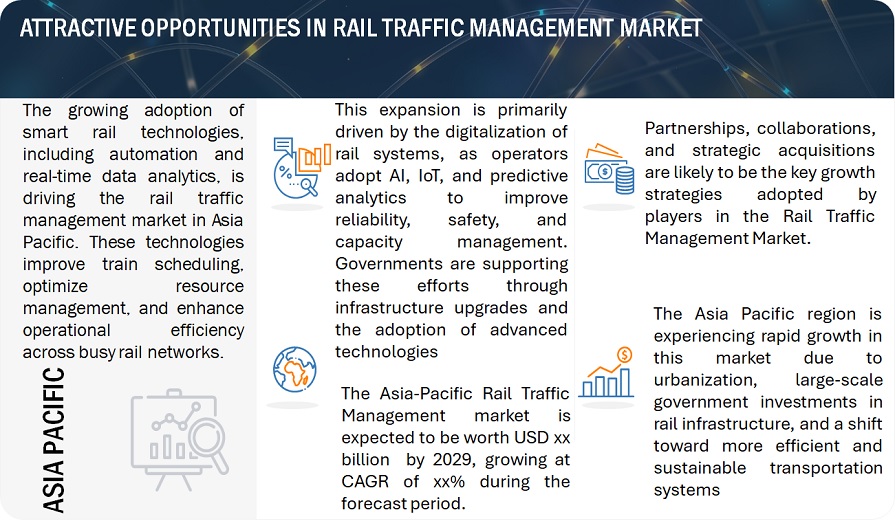

The rail traffic management market is expected to witness a significant growth owing to the high and fast adoption of advanced rail traffic management solutions, thereby creating a multitude of opportunities for innovation and expansion. Emerging economies like India are investing more in modern rail networks in order to achieve not only enhance operational efficiency but also support sustainability goals by reducing energy consumption and emissions. Moreover, rising adoption of AI, IoT, and cloud-based systems, will further create opportunities partnerships and technological innovations, ensuring long-term growth for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

ATTRACTIVE OPPORTUNITIES IN RAIL TRAFFIC MANAGEMENT MARKET

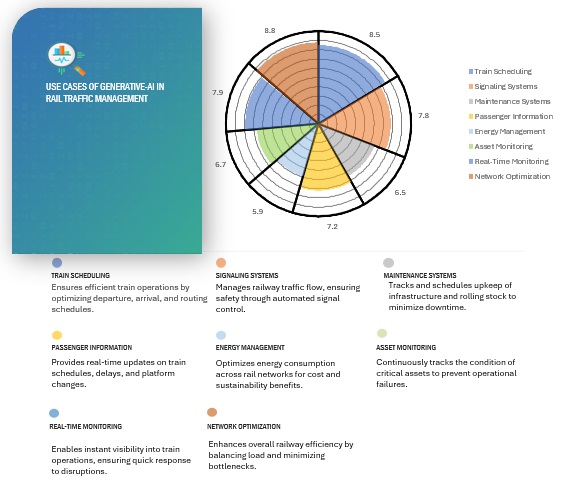

USE CASES OF AI/GEN AI IN RAIL TRAFFIC MANAGEMENT

Artificial Intelligence (AI) and Generative AI plays an important role in transforming the rail traffic management market through enabling different aspects such as predictive maintenance, autonomous decision-making, and optimized scheduling. The railway is at the forefront of the latest paradigm shift toward a digital transformation with AI. Moreover, analysis of vast amounts of data from sensors, signaling systems, and historical data to optimize efficiency in rail operations by using AI-powered algorithms has pivotal in this transformation. For instance, Alstom uses AI to provide operators and transport authorities with enhanced passenger flow management tools through its platform Mastria. The platform Mastria aggregates information on passenger demand from train weight sensors, ticketing machines, traffic signaling, management systems, surveillance cameras and mobile networks in order to offer a real-time picture of passenger flows. Another prominent company, Hitachi also offers intelligent mobility management through its Lumada platform. The platform is the company’s 360º vision for smarter mobility, which incorporates solutions across three key areas including smart ticketing, traffic management optimization, and electrified mobility solutions.<\p>

Some of the prominent use cases of AI and Gen AI include predictive maintenance, which forecasts potential equipment failures to avoid costly disruptions, and AI-enhanced route optimization, which improves train frequencies and reduces delays. Additionally, Gen AI also helps in creating dynamic simulation models, which allows operators to test various scenarios and implement the changes required proactively. AI and Gen AI are therefore driving market growth by reducing costs, enhancing network capacity, and improving energy efficiency. As more countries realize the potential of these technologies, they are bound to invest in AI-enabled rail systems like the countries India and the UK who have been investing heavily in modernizing their rail infrastructure. The adoption of these technologies will act as a catalyst for further innovation, partnerships, and expansion in the global rail traffic management market.

Rail Traffic Management Market Dynamics

Driver: Technological Advancements in Rail Systems such as Automated Train Control (ATC), predictive maintenance, and advanced signaling systems to drive propel the growth

Advances in automation, AI, and real-time data processing are revolutionizing the rail traffic management market. Automated Train Control (ATC), predictive maintenance, and advanced signaling systems are transforming how rail operators manage traffic, reduce accidents, and improve punctuality. These ATC solutions allow trains to operate without direct human intervention, thereby optimizing speed, braking, and scheduling. Moreover, these solutions also reduce energy consumption by optimizing acceleration and braking patterns, reduce wear and tear on tracks, and by ultimately enhancing overall safety. Companies such as Alstom, Bombardier, and Wabtec are heavily investing in R&D to offer innovative solutions that address these needs. They are incorporating various technologies such as predictive maintenance to improve the reliability of rail services and thereby extend the lifespan of infrastructure and rolling stock.

Companies are also venturing into building autonomous trains by integrating various technologies, however, fully autonomous trains are still in the experimental stages, and they will represent the pinnacle of automation in the rail industry. Countries like Germany, China, and Japan are at the forefront of developing and testing autonomous trains, which could be a common sight on rail networks in the coming decades. It can be touted that as technology evolves, future rail systems are expected to incorporate more autonomous capabilities, thereby minimizing human error and maximizing operational efficiency. This transformation will continue to drive market growth as operators seek to adopt smarter, safer, and more reliable rail systems.

Restraint: High Initial Investment Costs to become a significant barrier for the adoption of solutions

The cost of implementing advanced rail traffic management systems is a significant barrier, especially for smaller operators or countries with limited budgets. Upgrading signaling systems, implementing automated controls, and integrating real-time monitoring solutions require substantial financial resources. Even though leading companies such as Hitachi and Siemens are developing more cost-effective modular solutions, the high upfront costs can deter stakeholders from making immediate investments. This financial challenge is particularly prevalent in developing regions, potentially slowing market growth in these areas. However, as financing models evolve and public-private partnerships become more common, this restraint might ease in the long term.

Opportunity: Significant Opportunity for Expanding Rail Traffic Management Solutions into Emerging Markets

Emerging economies across Asia, Latin America, and Africa are increasingly prioritizing the development of modern rail infrastructure as a cornerstone of economic growth. Governments in these regions are recognizing the potential of rail networks to enhance trade connectivity, reduce logistics costs, and support urbanization efforts. This focus has led to substantial investments in rail infrastructure projects, including high-speed rail networks, metro systems, and freight corridors. Companies such as CRRC, Alstom, and Siemens are leveraging these opportunities by offering tailored solutions to meet the unique requirements of these markets. CRRC, for example, has been actively involved in supplying rolling stock and advanced rail technology to countries like South Africa and Argentina, while Alstom has been focused on urban rail systems that cater to densely populated cities in Latin America. These solutions range from signaling systems and centralized traffic control to predictive maintenance technologies, ensuring cost efficiency and long-term operational reliability. As infrastructure development gains momentum in these regions, the demand for sophisticated rail traffic management systems is expected to surge. Furthermore, technologies like positive train control (PTC), real-time scheduling, and integrated communication systems will become essential for managing increasingly complex networks. Therefore, these advancements are poised to drive long-term market expansion.

Challenge: Challenge: Rising Cybersecurity Threats To Hinder The Market Growth

The digital transformation of rail systems has heightened the risk of cyberattacks, posing a significant challenge for operators. As rail traffic management systems become more reliant on connected technologies, vulnerabilities increase. Cyberattacks could disrupt operations, compromise passenger safety, and result in financial losses. Companies like Siemens and Thales are investing in advanced cybersecurity measures to protect their systems, but the evolving nature of cyber threats requires continuous innovation. The need for robust cybersecurity solutions will remain a top priority, influencing the pace at which digital technologies are adopted in the rail sector.

Rail Traffic Management Market Ecosystem

The Rail Traffic Management market ecosystem comprises various solutions and service providers along with various regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Hitachi (Japan), Siemens (Germany), Huawei (China), Almaviva S.P.A. (Italy), CAF Signalling (Spain), Mermec (Italy), Alstom (France), Knorr-Bremse (Germany), PSI (Germany), Kyosan India Pvt. Ltd. (India), Wabtec Corporation (US), Indra (Spain), Infosys (India), Toshiba (Japan), Tracsis (UK), Tektracking (US), Drail (Sweden), Railmonitor (Denmark), CRCC (China), Ansaldo (Italy), Railinc (US), Resonate (US), Chevron (US), Cubic (US), Systra (France).

To know about the assumptions considered for the study, download the pdf brochure

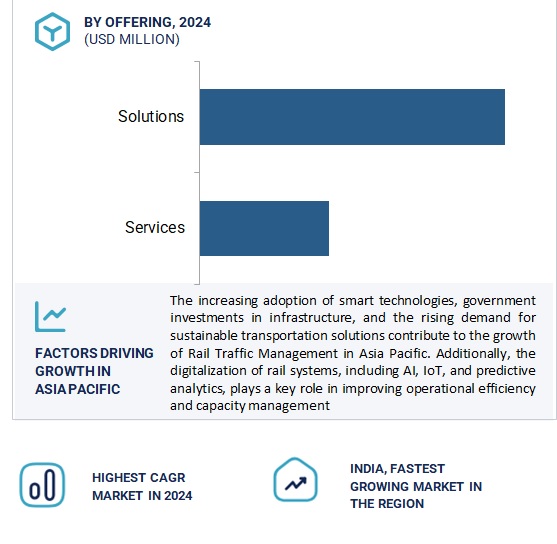

By Offering, Services segment is expected to hold a higher growth rate during the forecast period.

The services segment of the rail traffic management market is anticipated to experience the highest growth in the rail traffic management market from 2024 to 2029, driven by the increased demand for system integration, maintenance, and operation support. With the increasing complexity of modern rail networks, operators are prioritizing collaborations with specialized service providers to implement and manage the latest technology with the least disruption possible. The movement from installation to long-term service agreements encompasses the requirement for extended upgrades, predictive maintenance, and friction-free operations For instance, Asia-Pacific and Europe are experiencing significant investment from governments and rail operators in rail infrastructure projects, which is driving this trend. Moreover, the movement from installation to long-term service agreements encompasses the requirement for extended upgrades, predictive maintenance, and friction-free operations. For instance, Asia-Pacific and Europe are experiencing significant investment from governments and rail operators in rail infrastructure projects, which is driving this trend.

Siemens, Thales, Alstom and Hitachi Rail are among the front-runners in providing new service solutions to match changing rail systems and their requirements. They include all services such as system optimization, data-based maintenance, training, and technical support. Predictive maintenance services, for example, prevent possible failures from happening in the first place, improving safety and minimizing downtime. In the Asia-Pacific region, countries such as China and India are propelling demand with large-scale modernization and expansion projects for their railways, with the hope to provide a smoother experience for passengers whereas in Europe, Germany and France are leading the charge.

By Solutions, real-time train planning and route scheduling/optimizing segment is expected to hold a higher growth rate during the forecast period.

The process of train planning and route scheduling is a time-consuming and requires the evaluation of an overwhelming amount of data which is continuously on rise driven by increasing passenger and freight volumes. Therefore, the need of an efficient train operations has pushed rail operators to adopt advanced planning and scheduling solutions. Real-time train planning and route scheduling/optimizing is a critical solution in the rail traffic management market that ensures efficient and flexible operation of rail networks. This technology leverages advanced analytics, machine learning, and IoT to dynamically plan and adjust train routes and schedules in response to real-time conditions, such as delays, passenger demand, or network disruptions. Countries like the US, Germany, Japan, and China have been the early adopters of the solutions and are therefore leveraging these solutions to optimize the rail operations and planning.

Companies like Alstom, Siemens, and Wabtec are some of the leading companies in the development of real-time data analytics and AI-driven optimization tools that improve decision-making and enhance operational flexibility. For instance, Alstom’s HealthHub is a web-based platform solution that analyses and displays all the data captured from railway systems: from trains, signaling and infrastructure. Similarly, Siemen’s Railigent X uses AI-driven analytics for dynamic train scheduling and route optimization. These solutions are widely used in regions which have dense rail network such as Europe and North America. Currently, rail operators are integrating these solutions into broader digital transformation strategies, enabling better resource utilization and improved service delivery. In the future, it can be expected that as rail networks become more interconnected and complex, the adoption of real-time planning solutions will accelerate, particularly in regions with high-speed rail expansions and increasing urban rail demands, solidifying their role as a critical component of rail traffic management systems.

Asia Pacific’s highest growth rate during the forecast period.

The Asia Pacific region is expected to exhibit the highest growth rate in the Rail Traffic Management market during the forecast period driven by rapid urbanization, economic development, and government initiatives aimed at enhancing rail infrastructure. Countries such as China, India, and Japan are the prime economies that are responsible for driving this growth across the regions. For instance, China’s Belt and Road Initiative (BRI) and India’s “Make in India” campaign have spurred domestic rail modernization projects. Moreover, the Indian Railways collaborated with Hitachi Rail STS India and introduced India’s first operational Centralized Traffic Control (CTC) System in March 2024. Japan which is another growth driving country has been actively incorporating technologies in its rail traffic management systems in order to optimize its rail operations and enhance efficiency. In September 2024, the Central Japan Railway (JR) Company selected AWS for Yamanashi Maglev Line to drive efficient operations for its next-generation, high-speed train service. By building critical IT infrastructure workloads on AWS and using AWS's Internet of Things (IoT), machine learning (ML), and generative AI capabilities, Japan Railway Central plans to advance its data-driven operations, drive operational efficiencies, and reduce maintenance costs. Such initiatives by these countries indicate a high pace of growth of the rail traffic management market in the region. Additionally, the Asia-Pacific region also boasts large-scale rail projects with significant investments in automation, signaling, and digital rail technologies led by companies such as CRRC, Hitachi Rail, Alstom, and Siemens. These firms are playing a crucial role in driving technological advancements and system upgrades across the region. It can be touted that with the continuous technological advancements and modernization efforts across countries in the region, the rail traffic management market will witness a significant growth in the Asia-Pacific region.

Key Market Players

The major players in the Rail Traffic Management market are Hitachi (Japan), Siemens (Germany), Huawei (China), Almaviva S.P.A. (Italy), CAF Signalling (Spain), Mermec (Italy), Alstom (France), Knorr-Bremse (Germany), PSI (Germany), Kyosan India Pvt. Ltd. (India), Wabtec Corporation (US), Indra (Spain), Infosys (India), Toshiba (Japan), Tracsis (UK), Tektracking (US), Drail (Sweden), Railmonitor (Denmark), CRCC (China), Ansaldo (Italy), Railinc (US), Resonate (US), Chevron (US), Cubic (US), Systra (France) .These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their Rail Traffic Management market footprint.

Recent Developments:

- In September 2024, Hitachi Rail, the European rolling stock and rail infrastructure division of the Japanese multi-sector firm, has announced its new AI solution in partnership with NVIDIA. The “HMAX” (Hyper Mobility Asset Expert) is a suite of digital asset management solutions and covers the rail chain from rolling stock, signaling, and physical infrastructure. Through this the company’s customers will be able to remotely access HMAX’s insights into their entire rail network via a single online portal.

- In September 2024, Siemens Mobility launched its new suite Signaling X to lead rail signaling and control systems into the digital future. It introduced Siemens Xcelerator, Railigent X for AI-based maintenance, and its Mobility Software Suite X for seamless intermodal travel. The suite is designed to increase capacity and make operations, maintenance and service more efficient. While Signaling X opens interfaces and integrates signaling and control systems for mainline and mass transit into one cloud platform, the Railigent X features, fully automated visual inspection and mobile inspection to make service of trains more flexible and efficient.

- In May 2024, Hitachi Rail completed the acquisition process of Thales’ rail business. The acquisition of Thales GTS, a division of Thales specializing in signaling and train control systems, will significantly expand Hitachi Rail’s capabilities and presence in the global market. Hitachi Rail was also able to expand its geographic reach and advance its capabilities in in cybersecurity, artificial intelligence in transportation, and autonomous trains.

- In April 2024, Knorr-Bremse AG, one of the leading companies for braking systems and a provider of rail and commercial vehicle systems acquired the conventional rail signaling technology business of Alstom Signaling North America. With this acquisition, Knorr-Bremse was able to enter the control, command, and signaling (CCS) segment of the rail market.

Frequently Asked Questions (FAQ):

What is the definition of the Rail Traffic Management market?

What is the market size of the Rail Traffic Management market?

What are the major drivers in the Rail Traffic Management market?

Who are the key players operating in the Rail Traffic Management market?

What are the key technology trends prevailing in the Rail Traffic Management market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Rail Traffic Management Market