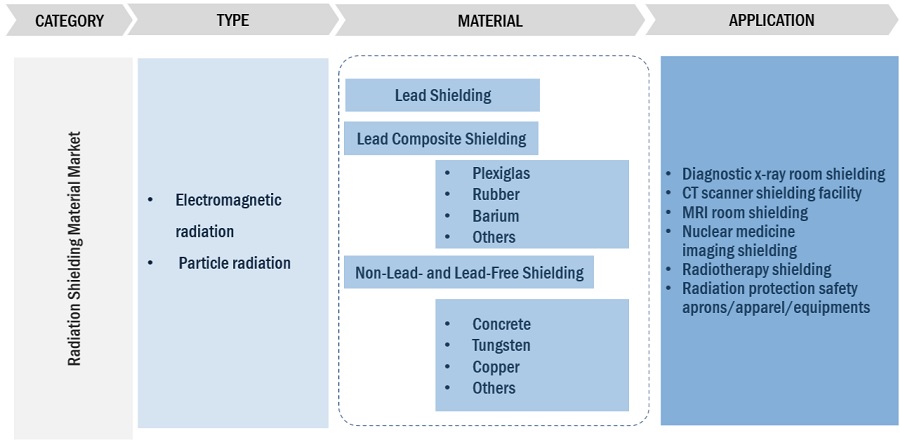

Radiation Shielding Material Market by Type (Electromagnetic Radiation, Particle Radiation), Material (Lead Shielding, Lead Composite Shielding, Copper, Tungsten), Application (X-ray room, CT Scan Facility, MRI Room), & Region - Global Forecast to 2028

Market Growth Outlook Summary

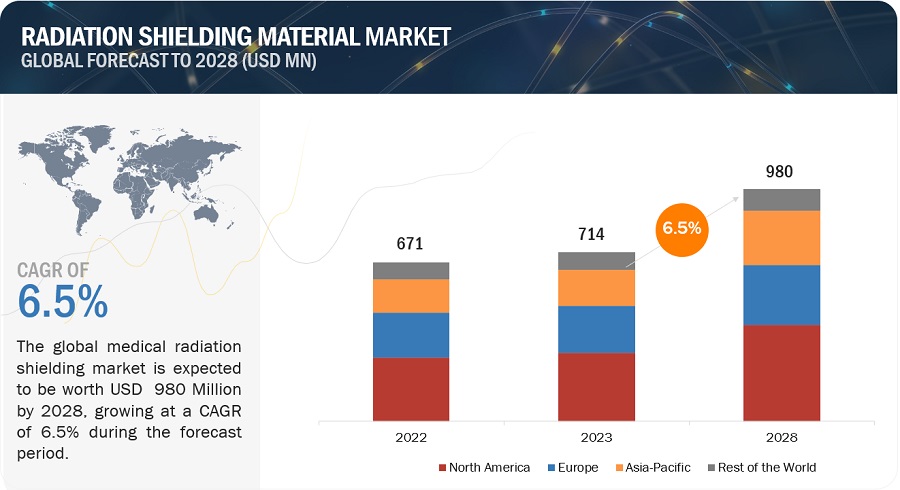

The global radiation shielding material market, valued at US$671 million in 2022, stood at US$714 million in 2023 and is projected to advance at a resilient CAGR of 6.5% from 2023 to 2028, culminating in a forecasted valuation of US$980 million by the end of the period. Factors such as Growing usage of nuclear medicine and radiation therapy for diagnosis and treatment, increasing use of particle therapy for cancer treatment, Growing incidences of cancer and Development of number of PET/CT scans technology have increased the demand of this market.

Attractive Opportunities in the Radiation Shielding Material Market

To know about the assumptions considered for the study, Request for Free Sample Report

Radiation Shielding Material Dynamics

DRIVER: Increasing use of particle therapy for cancer treatment

Particle therapy is an emerging technology for providing radiation therapy to cancer patients. Particle therapy, especially proton therapy have various advantages as compared to the conventional photon therapy which surely drive the demand for particle therapy in the regions where the adoption rate of advanced products which are technology based is more. Therefore the number of particle therapy centers is steadily increasing across the globe. Recently in May 2022, the total number of particle therapy facilities in clinical operations is 115 worldwide. Whereas, in January 2017, there were 66 particle therapy centers in operation (including proton, carbon ion, and combined proton/carbon) and 61 centers either planned or under construction (Source: HealthPACT). Moreover, the increased demand for proton therapy encourages several prominent cancer centers to offer this therapy. Thus, the increasing use of particle therapy for cancer treatment will increase the use of Radiation shielding material and, consequently, the radiation shielding materials used to manufacture radiation shielding material.

RESTRAINT: Dearth of skilled oncologist/radiologist

The Radiation shielding material market is witnessing continuous technological innovations and advancements aimed towards making the devices and techniques more accurate and specific. Due to the shortage of skilled and trained personnel a lot of cancer patients miss out on effective radiotherapy procedures. According to the American Society of Clinical Oncologists (ASCO), In US in 2021 there were 13,146 oncologists engaged in active patient care. However, 32 million Americans live in a county with no oncologists. ASCO projects a shortage for more than 2,200 oncologists by 2025. Similarly, In Inida according to the Indian Council for Medical Research (ICMR), the number of Indians suffering from cancer is expected to increase to 29.8 million in the year 2025 from 26.7 million in 2021. However, the country has a huge shortfall of number of oncologists available for cancer patients.

A shortage of radiation oncologists and radiographers may reduce the capacity of radiation therapy facilities to operate. Because of the scarcity of trained professionals, existing treatment facilities may be underutilized, resulting in a decrease in demand for Radiation shielding products. As a result, the market for radiation shielding materials will suffer.

The scarcity of skilled workers may impede the establishment of new radiation therapy centers or the expansion of existing ones. A lack of trained personnel can cause project delays, affecting the demand for radiation shielding materials required for the construction and outfitting of these centers. The scarcity of trained radiation oncologists and radiographers may have an impact on the adoption of Radiation shielding products and, as a result, the Radiation shielding materials market.

This shortage of oncologists and radiologists in several countries across the globe is expected to affect the adoption of oncology procedures. The significant gap between the demand and supply of trained radiation oncologists and the lack of trained radiographers is expected to hamper the adoption of Radiation shielding material across the globe in the coming years.

OPPORTUNITY: Raising demand for cancer treatment Increasing private investments in cancer research

Radiotherapy has been accepted as a standard procedure for cancer treatment. The growing incidence of cancer and approval of different technologies for various radiotherapy applications are increasing the demand for radiotherapy procedures globally. Currently, for every million people, there are almost 12 linear accelerators in the US, 5 to 8 radiotherapy machines in European countries, and less than one machine in developing countries across Asia, Latin America, and Africa. To bridge this gap, there is a global requirement for over 10,000 more treatment machines (Source: Cancer Control). Therefore, The rasing investments and funding for cancer research will surely bring advancements in the cancer related diagnostic and radiotherapy procedures that will help in the development of radiation shielding market. For instances,

In July 2021, Leo Cancer Care (UK) raised USD 25.3 million in funding from investors including Yu Galaxy, WARF, Alumni Ventures, Junson Capital, Serra Ventures, and industry players CHC, Cosylab, Toret Devices, and Radiation Business Solutions for development of new radiotherapy solutions.

In August 2020, the Australian Government for the development of regional radiation treatment centers has opened an application for funding of USD 45.5 million for cancer patients in rural areas of New South Wales, Queensland, Victoria, and South Australia.

- In 2019, AICR signed onto OVAC’s (One Voice Against Cancer) letter urging Congress to provide at least USD 42.1 billion for NIH, with a proportional USD 6.4 billion increase for NCI for FY 2020. NIH was eventually funded at USD 41.46 billion, with NCI receiving USD 6.44 billion, a success for cancer research.

- In April 2019, the Australian government announced an investment of USD 63.4 million to expand cancer treatment capacity through new radiation therapy services in 13 regional locations, in addition to the USD 6 billion funds that the Liberal National Government already provides for cancer treatments and services every year.

- Such investments from public and private sources are expected to offer potential growth opportunities for market players in the coming years.

CHALLENGE: High cost of lead in manufacturing radiation accessories

The cost of implementing radiation shielding measures can be a significant restraint. Radiation shielding materials, construction modifications, and specialized equipment can be expensive, especially for smaller healthcare facilities or those with budget constraints. The upfront costs associated with radiation shielding products may deter some facilities from investing in comprehensive shielding solutions.

Generally, The shielding thicknesses which is requires for the 1/4 in. of lead in the doors and 4-6 in. of concrete for certain walls. The cost of shielding one shielded wall and a shielded door per room is approximately USD 6000. From low-level gamma radiation applying recent estimates of the cancer risk the cost of shielding per cancer fatality averted would range around USD 1.8 million to USD 10.9 million Therefore, the increasing cost of radiation sheielding material will challenge the for the market.

Radiation Shielding Material Ecosystem

Prominent companies in this market include well-established manufacturers of Radiation Shielding Material Market and offer a wide range of products. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ESCO Technologies, Infab Corporation and Burlington Medical.

In 2022, Electromagnetic Radiation segment to observe highest growth rate of the Radiation Shielding Material Industry, by type.

Based on the type, The Radiation Shielding Material Market is categorized into Electromagnetic Radiation and Particle Radiation. Electromagnetic Radiation are expected to grow fastest due to the growing incidences of cancer and the use of diagnostic procedure and the radiation therapy for the treatment of cancer. One of the major factors driving the demand for diagnostic imaging procedures in the UK is the rising prevalence of target diseases. For instance, according to GLOBOCAN, in 2020, there were 457,960 cancer patients in the UK. Similarly, according to Alzheimer’s Research UK, an estimated 850,000 people had Alzheimer’s disease in the UK in 2018; this is estimated to reach 1 million by 2025 and 2 million by 2050.

In 2022, Diagnostic x-ray room shielding segment to dominate the Radiation Shielding Material Industry, by the application.

Based on end users, the Radiation Shielding Material Market is segmented into Diagnostic x-ray room shielding, CT Scanner shielding facility, MRI Room shielding, Nuclear medicine imaging shielding and Radiotherapy shielding and Radiation protection safety aprons/apparel/equipments. Diagnostic x-ray room shielding to dominate the market due to the Growing usage of nuclear medicine and radiation therapy for diagnosis and treatment which will increase the demand for the rising number of hospitals and diagnostic centers sheilding.

To know about the assumptions considered for the study, download the pdf brochure

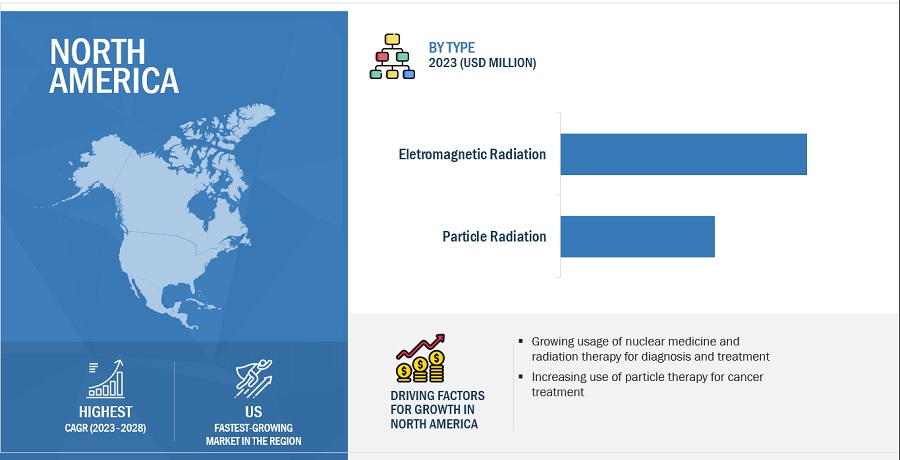

The global Radiation Shielding Material Market is segmented into North America, Europe, Asia Pacific, and Rest of the World. North America is expected to rise at the highest CAGR due to the rising incidence of cancer and the use of radiation therapy for diagnosis and treatment. For Instance, According to a study published in Cancer Epidemiology, Biomarkers & Prevention, a journal of the American Association for Cancer Research, the total national cost of cancer in the US is projected to increase by over 30% from 2015 to 2030, corresponding to a total cost of over USD 245 billion.

The American Cancer Society funds cancer research and training in medical schools, universities, research institutes, and hospitals across the US. As of March 2021, a total of 162 breast cancer grants are in effect in the US, with a total funding of USD 94 million (Source: American Cancer Society). Also, in October 2020, Susan G. Komen (a US-based breast cancer organization) announced research funding of USD 287,286 to support local programs that provide mammograms, diagnostics, breast cancer treatment, patient navigation, and education

The Radiation Shielding Material Market is dominated by players such ESCO Technologies Inc., Infab Corporation and Burlington Medical.

Scope of the Radiation Shielding Material Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$714 million |

|

Estimated Value by 2028 |

$980 million |

|

Revenue Rate |

Poised to grow at a CAGR of 6.5% |

|

Market Driver |

Increasing use of particle therapy for cancer treatment |

|

Market Opportunity |

Raising demand for cancer treatment Increasing private investments in cancer research |

This research report categorizes the radiation shielding material market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Type

- Electromagnetic Radiation

- Particle Radiation

By Material

- Lead Shielding

-

Lead Composite Shielding

- Rubber

- Barium

- PVC

- Others

-

Non-Lead and Lead Free Shielding

- Concrete

- Copper

- Tungsten

- Others

By Application

- Diagnostic x-ray room shielding

- CT Scanner shielding facility

- MRI Room shielding

- Nuclear medicine imagingshielding

- Radiotherapy shielding

- Radiation protection safety aprons/apparel/equipments

Recent Developments of Radiation Shielding Material Industry

- In August 2023, ETS-Lindgren announced its strategic alliance with TUV Rheinland North America for its new Technology and Innovation Center located in Massachusetts, including AMETEK-CTS, Fair-Rite, Innova, and Rohde & Schwarz, are key supporting partners in the creation of the Technology and Innovation Center. With the cooperation of ETS-Lindgren and these industry leaders, TUV Rheinland will facilitate the integration of essential equipment, enabling the delivery of holistic customer solutions..

- In July, 2022, Burlington Medical has launched the XENOLITE 800 NL (No-Lead) apron series. XENOLITE 800 NL is a lead-free, super-lightweight, flexible, and recyclable x-ray radiation protection apron. The XENOLITE 800 NL series uses antimony and tungsten, which are supported, encapsulated, and homogeneously distributed in a tough-but-flexible, high-tech plasticized Dow elastomer matrix.

- In January 2021, Infab Corporation (US) acquired MediDrapes, a provider of disposable protective drapes used in medical imaging equipment such as mini-C-arms, fluoroscopes, and ultrasound machines, added to the company’s portfolio..

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global radiation shielding material market between 2023 and 2028?

The global radiation shielding material market is projected to grow from USD 714 million in 2023 to USD 980 million by 2028, demonstrating a robust CAGR of 6.5%.

What are the key factors driving the radiation shielding material market?

Key factors driving the radiation shielding material market include the growing use of particle therapy for cancer treatment, increasing incidences of cancer, and the development of advanced technologies for diagnostic imaging like PET/CT scans.

What challenges does the radiation shielding material market face?

The radiation shielding material market faces challenges such as a shortage of skilled oncologists and radiologists, high costs of radiation shielding materials, and the need for substantial investments to establish and maintain radiation therapy facilities.

Which regions are expected to experience growth in the radiation shielding material market?

North America is expected to exhibit the highest growth rate in the radiation shielding material market, driven by the rising incidence of cancer and increasing use of radiation therapy for diagnosis and treatment.

What types of radiation shielding materials are commonly used?

Common types of radiation shielding materials include lead, concrete, and specialized composites used to protect against electromagnetic and particle radiation in healthcare settings.

How is the demand for cancer treatment impacting the radiation shielding material market?

The increasing demand for cancer treatment drives the need for radiation shielding materials in facilities offering radiotherapy and diagnostic imaging, thereby enhancing market growth.

What recent advancements have been made in radiation shielding materials?

Recent advancements in radiation shielding materials focus on developing lighter, more effective composites that enhance safety while reducing costs associated with traditional shielding materials.

How do private investments influence the radiation shielding material market?

Private investments in cancer research and technology development significantly contribute to the radiation shielding material market by fostering innovation and improving treatment capabilities.

What is the role of particle therapy in the radiation shielding material market?

Particle therapy, including proton therapy, is driving demand for radiation shielding materials due to its growing acceptance and increased number of particle therapy centers worldwide, necessitating effective shielding solutions.

What impact does the shortage of trained personnel have on the radiation shielding material market?

The shortage of trained oncologists and radiographers limits the capacity of radiation therapy facilities, impacting the demand for radiation shielding products needed for the construction and operation of these centers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing use of nuclear medicine and radiation therapy for diagnosis and treatment- Increasing use of particle therapy for cancer treatment- Growing incidence of cancerRESTRAINTS- Lack of adequate healthcare infrastructure- Dearth of skilled personnelOPPORTUNITIES- Growing healthcare expenditure across developing countries- Recommendations for cancer screening- Increasing public-private investments in cancer researchCHALLENGES- Discomfort and pain due to weight of lead aprons- High cost of lead in manufacturing radiation accessories

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFIC

- 5.7 TRADE ANALYSIS

-

5.8 ECOSYSTEM ANALYSIS

-

5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 PRICING ANALYSIS

-

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- 5.13 TECHNOLOGY ANALYSIS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 ELECTROMAGNETIC RADIATIONCOMMONLY USED IN MEDICAL IMAGING AND RADIATION THERAPY FOR DIAGNOSTIC AND TREATMENT PURPOSES

-

6.3 PARTICLE RADIATIONUSED IN CANCER TREATMENT AND DIAGNOSTIC IMAGING

- 7.1 INTRODUCTION

-

7.2 LEAD SHIELDINGEFFICIENT SHIELDING PROPERTIES AND RELATIVELY LOW PRICE TO DRIVE ADOPTION

-

7.3 LEAD COMPOSITE SHIELDINGRUBBER- Used as composite shielding material to provide effective radiation protectionBARIUM- Enhances visibility of certain anatomical structures in X-ray imagesPVC- Lighter than solid lead sheets of same thicknessOTHER LEAD COMPOSITE SHIELDING MATERIALS

-

7.4 NON-LEAD AND LEAD-FREE SHIELDINGCONCRETE- Suitable for neutron and proton shieldingCOPPER- Easily adaptable to various room configurationsTUNGSTEN- Viable option for applications where lead is not feasibleOTHER NON-LEAD AND LEAD-FREE SHIELDING MATERIALS

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTIC X-RAY FACILITIESLARGE NUMBER OF DIGITAL IMAGING PROCEDURES PERFORMED TO BOOST DEMAND

-

8.3 CT SCAN FACILITIESGROWING EMPHASIS ON MAINTAINING HEALTH AND WELL-BEING TO DRIVE MARKET

-

8.4 MRI FACILITIESWIDE USE OF MRI IN HOSPITALS FOR MEDICAL DIAGNOSIS AND STAGING OF DISEASES TO BOOST GROWTH

-

8.5 NUCLEAR MEDICINE IMAGING FACILITIESINCREASING NUMBER OF NUCLEAR MEDICINE PROCEDURES TO PROPEL MARKET

-

8.6 RADIOTHERAPY FACILITIESINCREASING ADOPTION OF RADIOTHERAPY TO DRIVE MARKET

-

8.7 RADIATION PROTECTION SAFETY APPAREL AND EQUIPMENTGROWING VOLUME OF MEDICAL IMAGING PROCURES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Widespread use of medical imaging technologies to drive adoptionCANADA- Increasing use of nuclear medicine and radiation therapy for diagnosis and treatment to drive market

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Increasing radiography procedures to propel marketUK- Increasing government initiatives to support market growthFRANCE- Large number of CT procedures to fuel marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising geriatric population to aid market growthJAPAN- Increasing public-private investments in cancer research to propel marketINDIA- Favorable government policies to support market growthREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDRISING HEALTHCARE SPENDING TO SUPPORT MARKET GROWTHREST OF THE WORLD: RECESSION IMPACT

- 10.1 OVERVIEW

- 10.2 MARKET RANKING

-

10.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

10.4 COMPANY EVALUATION MATRIX FOR SMES/STARTUPSPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.5 COMPETITIVE BENCHMARKING

- 10.6 COMPANY FOOTPRINT ANALYSIS

-

10.7 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSETS-LINDGREN (ESCO TECHNOLOGIES COMPANY)- Business overview- Products offered- Recent developments- MnM viewINFAB CORPORATION- Business overview- Products offered- Recent developments- MnM viewNELCO WORLDWIDE- Business overview- Products offered- MnM viewBURLINGTON MEDICAL- Business overview- Products offered- Recent developmentsMARSHIELD CUSTOM RADIATION SHIELDING PRODUCTS- Business overview- Products offeredRAY-BAR ENGINEERING CORP.- Business overview- Products offeredMARS METAL COMPANY- Business overview- Products offeredRADIATION PROTECTION PRODUCTS, INC.- Business overview- Products offeredNUCLEAR LEAD CO. INC.- Business overview- Products offeredULTRARAY- Business overview- Products offeredVERITAS MEDICAL SOLUTIONS- Business overview- Products offeredGLOBAL PARTNERS IN SHIELDING, INC.- Business overview- Products offeredNUCLEAR SHIELDS B.V.- Business overview- Products offeredA&L SHIELDING- Business overview- Products offeredAMRAY MEDICAL- Business overview- Products offeredPROTECH MEDICAL- Business overview- Products offeredLEMER PAX- Business overview- Products offeredPILOT INDUSTRIES LIMITED- Business overview- Products offeredMAYCO INDUSTRIES- Business overview- Products offered

-

11.2 OTHER PLAYERSNUCLEAR SHIELDING SUPPLIES & SERVICECANADA METAL NORTH AMERICA LTD.INTECH LEAD SHIELDINGWARDRAY PREMISE LIMITEDCALDER HEALTHCARE (PART OF CALDER INDUSTRIAL MATERIALS LTD.)GRAVITA INDIA LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: RADIATION SHIELDING MATERIALS MARKET

- TABLE 2 PROJECTION FOR INCREASE IN NUMBER OF NEW CASES OF CANCER BASED ON WHO-INTERNATIONAL AGENCY FOR RESEARCH ON CANCER (IARC) DATA

- TABLE 3 INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 4 IMPORT DATA FOR HS CODE 780411, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 5 EXPORT DATA FOR HS CODE 780411, BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 6 RADIATION SHIELDING MATERIALS MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 7 LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 8 PRICE RANGE OF KEY PRODUCTS IN RADIATION SHIELDING MATERIALS MARKET, 2022

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

- TABLE 10 KEY BUYING CRITERIA FOR HOSPITALS & CLINICS AND ASCS AND DIAGNOSTIC CENTERS

- TABLE 11 RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 12 ELECTROMAGNETIC RADIATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 13 PARTICLE RADIATION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 15 LEAD SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 RADIATION SHIELDING MARKET FOR RUBBER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 RADIATION SHIELDING MARKET FOR BARIUM, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 RADIATION SHIELDING MARKET FOR PVC, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 OTHER LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 RADIATION SHIELDING MARKET FOR CONCRETE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 RADIATION SHIELDING MARKET FOR COPPER, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 RADIATION SHIELDING MARKET FOR TUNGSTEN, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 OTHER NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 29 RADIATION SHIELDING MATERIALS MARKET FOR DIAGNOSTIC X-RAY FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 RADIATION SHIELDING MATERIALS MARKET FOR CT SCAN FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 RADIATION SHIELDING MATERIALS MARKET FOR MRI FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 RADIATION SHIELDING MATERIALS MARKET FOR NUCLEAR MEDICINE IMAGING FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 RADIATION SHIELDING MATERIALS MARKET FOR RADIOTHERAPY FACILITIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 RADIATION SHIELDING MATERIALS MARKET FOR RADIATION PROTECTION SAFETY APPAREL AND EQUIPMENT, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 RADIATION SHIELDING MATERIALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: RADIATION SHIELDING MATERIALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 42 US: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 43 US: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 US: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 US: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 US: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 CANADA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 48 CANADA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 GERMANY: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 59 GERMANY: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 GERMANY: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 GERMANY: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 GERMANY: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 UK: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 64 UK: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 UK: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 66 UK: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 UK: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 FRANCE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 FRANCE: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 FRANCE: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 FRANCE: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 REST OF EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 74 REST OF EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 CHINA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 85 CHINA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 CHINA: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 CHINA: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 CHINA: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 JAPAN: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 90 JAPAN: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 JAPAN: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 JAPAN: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 JAPAN: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 INDIA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 95 INDIA: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 INDIA: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 INDIA: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 INDIA: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

- TABLE 100 REST OF ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 REST OF THE WORLD: RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2021–2028 (USD MILLION)

- TABLE 106 REST OF THE WORLD: RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 REST OF THE WORLD: LEAD COMPOSITE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 REST OF THE WORLD: NON-LEAD AND LEAD-FREE SHIELDING MATERIALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF THE WORLD: RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN RADIATION SHIELDING MATERIALS MARKET

- TABLE 111 RADIATION SHIELDING MATERIALS: MARKET RANKING ANALYSIS

- TABLE 112 RADIATION SHIELDING MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 113 FOOTPRINT ANALYSIS OF COMPANIES IN RADIATION SHIELDING MATERIALS MARKET

- TABLE 114 REGIONAL FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 115 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 116 KEY DEALS, JANUARY 2020–AUGUST 2023

- TABLE 117 OTHER KEY DEVELOPMENTS, JANUARY 2020–AUGUST 2023

- TABLE 118 ETS-LINDGREN (ESCO TECHNOLOGIES COMPANY): BUSINESS OVERVIEW

- TABLE 119 INFAB CORPORATION: BUSINESS OVERVIEW

- TABLE 120 NELCO WORLDWIDE: BUSINESS OVERVIEW

- TABLE 121 BURLINGTON MEDICAL: BUSINESS OVERVIEW

- TABLE 122 MARSHIELD CUSTOM RADIATION SHIELDING PRODUCTS: BUSINESS OVERVIEW

- TABLE 123 RAY-BAR ENGINEERING CORP.: BUSINESS OVERVIEW

- TABLE 124 MARS METAL COMPANY: BUSINESS OVERVIEW

- TABLE 125 RADIATION PROTECTION PRODUCTS, INC.: BUSINESS OVERVIEW

- TABLE 126 NUCLEAR LEAD CO. INC.: BUSINESS OVERVIEW

- TABLE 127 ULTRARAY: BUSINESS OVERVIEW

- TABLE 128 VERITAS MEDICAL SOLUTIONS: BUSINESS OVERVIEW

- TABLE 129 GLOBAL PARTNERS IN SHIELDING, INC.: BUSINESS OVERVIEW

- TABLE 130 NUCLEAR SHIELDS B.V.: BUSINESS OVERVIEW

- TABLE 131 A&L SHIELDING: BUSINESS OVERVIEW

- TABLE 132 AMRAY MEDICAL: BUSINESS OVERVIEW

- TABLE 133 PROTECH MEDICAL: BUSINESS OVERVIEW

- TABLE 134 LEMER PAX: BUSINESS OVERVIEW

- TABLE 135 PILOT INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 136 MAYCO INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 1 RADIATION SHIELDING MATERIALS MARKET SEGMENTATION

- FIGURE 2 GEOGRAPHIC SCOPE

- FIGURE 3 RADIATION SHIELDING MATERIALS MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 4 PRIMARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 COST OF MATERIAL APPROACH

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 RADIATION SHIELDING MATERIALS MARKET: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 RADIATION SHIELDING MATERIALS MARKET, BY TYPE OF RADIATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 RADIATION SHIELDING MATERIALS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 RADIATION SHIELDING MATERIALS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF RADIATION SHIELDING MATERIALS MARKET

- FIGURE 14 INCREASING INCIDENCE OF CANCER TO DRIVE MARKET

- FIGURE 15 ELECTROMAGNETIC RADIATION SEGMENT HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- FIGURE 16 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 RADIATION SHIELDING MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 19 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

- FIGURE 20 KEY PLAYERS OPERATING IN RADIATION SHIELDING MATERIALS MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HOSPITALS & CLINICS AND ASCS AND DIAGNOSTIC CENTERS

- FIGURE 22 KEY BUYING CRITERIA FOR HOSPITALS & CLINICS AND ASCS AND DIAGNOSTIC CENTERS

- FIGURE 23 NORTH AMERICA: RADIATION SHIELDING MATERIALS MARKET SNAPSHOT

- FIGURE 24 ASIA PACIFIC: RADIATION SHIELDING MATERIALS MARKET SNAPSHOT

- FIGURE 25 RADIATION SHIELDING MATERIALS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 26 RADIATION SHIELDING MATERIALS MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS, 2022

- FIGURE 27 ETS-LINDGREN (ESCO TECHNOLOGIES COMPANY): COMPANY SNAPSHOT (2022)

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships of the leading players, the competitive landscape of the radiation shielding material market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the radiation shielding material market. A database of the key industry leaders was also prepared using secondary research.

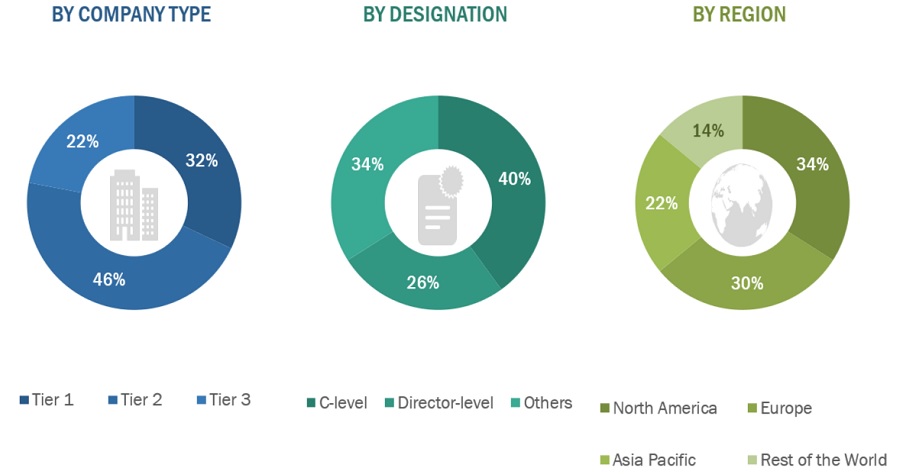

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the radiation shielding material market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such as Hospitals and Clinics & ASCs) and supply side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing, and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific and Rest of the world. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

ESCO Technologies Inc. (US) |

Senior Product Manager |

|

Infab Corporation (US) |

Regional Manager |

|

Burlington Medical (US) |

Product Manager |

Market Size Estimation

All major product manufacturers offering various Radiation Shielding Material Markets were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value Radiation Shielding Material market was also split into various segments and subsegments at the regional and country levels based on the following:

- Product mapping of various manufacturers for each solution of Radiation Shielding Material market at the regional and country-level

- Relative adoption pattern of each Radiation Shielding Material market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Radiation Shielding Material Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Radiation Shielding Material industry.

Market Definition

Radiation shielding materials are substances or barriers designed to reduce or block the transmission of various forms of radiation, such as alpha particles, beta particles, gamma rays, and X-rays. These materials are used in a variety of applications, ranging from nuclear power plants and medical facilities to space exploration and industrial settings where radiation exposure needs to be minimized to protect human health and equipment integrity. The primary goal of radiation shielding materials is to absorb, scatter, or attenuate the energy of radiation particles or photons before they can penetrate and damage living tissue or sensitive equipment.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the Radiation shielding material market by Type, Material, Application and Region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall Radiation shielding material market

- To forecast the size of the Radiation shielding material market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, and Rest of the world

- To profile key players in the Radiation shielding material market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the Radiation shielding material market.

- To benchmark players within the Radiation shielding material market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the radiation shielding material market

- Profiling of additional market players (up to 5) Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the radiation shielding material market

Growth opportunities and latent adjacency in Radiation Shielding Material Market