Radar Security Market by Surveillance Type (Ground, Air, Marine), Range (Long, Medium, Short), Application (Border Security, Seaport and Harbor, Critical Infrastructure), and Geography - Global Forecast to 2022

The radar security market is expected to grow from USD 17.85 billion in 2016 to USD 25.17 billion by 2022, at a CAGR of 5.90% during the forecast period. The objectives of the report includes forecast of the radar security market size in terms of value for ground surveillance radar (GSR) systems, air surveillance radar (ASR) systems, and marine surveillance radar (MSR) systems. Further it includes the detailed information regarding the drivers of the radar security market such as increasing demand for radar systems worldwide since militaries seek to replace legacy systems, rising territorial conflicts and geopolitical instabilities in the Middle East and APAC, and defense budget cuts in developed economies shifted the focus toward miniaturization & automation of defense & surveillance systems. It also includes detailed information about the restraints, opportunities, and challenges in the radar security market. The study of the value chain and analysis of the impact of Porter’s five forces on the market is also one of the objectives of the report which includes the study of the impact of the porters five forces, namely, threat of substitutes, degree of competition, threat of new entrants, bargaining power of buyers, and bargaining power of suppliers on the radar security market.

Years considered for this report:

- 2015 – Base Year

- 2016 – Estimated Year

- 2022 – Projected Year

Market Dynamics

Drivers

- Increasing demand for radar systems worldwide since militaries seek to replace legacy systems

- Rising territorial conflicts and geopolitical instabilities in the Middle East and Asia-Pacific regions

- Defense budget cuts in developed economies shifted the focus toward miniaturization & automation of defense & surveillance systems

Restraints

- High development cost

- Hindrance in the functionality of radar security systems due to growing cyber warfare

Opportunities

- Increase in investment and development of ballistic missile and air missile defense systems by the defense sector

- Increasing use of radar security systems for civilian applications such as highway safety systems and anti-collision systems for trains

Challenges

- To overcome electromagnetic jamming

The radar security market is in the growth phase. The said market is expected to grow from USD 17.85 billion in 2016 to USD 25.17 billion by 2022, at a CAGR of 5.90% between 2016 and 2022. The rising demand for radar systems worldwide since militaries seek to replace legacy systems. Rising territorial conflicts and geopolitical instabilities in the Middle East and Asia-Pacific regions is also a key factor responsible for the growth of the market. Furthermore, defense budget cuts in developed economies shifted the focus toward miniaturization & automation of defense and security systems is expected to propel the radar security market.

Among all the major applications of the radar security systems, the border security application has been driving the market. Controlling terrorist activities across the borders, monitoring human trafficking and illegal entry of immigrants, securing imports and exports at the borders are the major drivers for the adoption of radar security systems in border security applications. The market for others applications such as highway safety systems and anti-collision systems for trains is expected to grow at the highest rate.

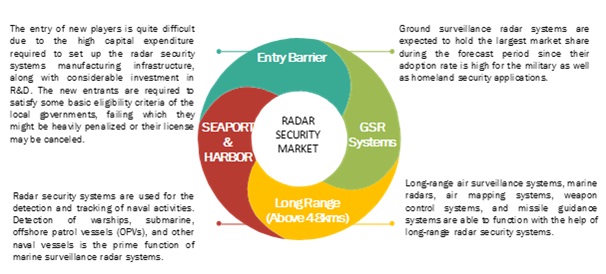

As of 2015, the ground surveillance radar (GSR) system held a major market share. The adoption rate of GSR systems is high for the military as well as homeland security applications. In addition, these systems are also used in detecting and tracking aircraft at low altitude. These are the key factors contributing for the large market share of GSR systems among other types. However, the market for marine surveillance radar (MSR) systems is expected to grow at the highest CAGR between 2016 and 2022.

The long-range radar security system is expected to hold the major share of the market in 2016.High demand for long-range radar security systems for air surveillance systems, marine radars, air mapping systems, weapon control systems, and missile guidance systems is the key driving factor for the growth of the long-range radar security systems market. However, the market for the short-range radar security systems is expected to grow at the highest growth rate between 2016 and 2022.

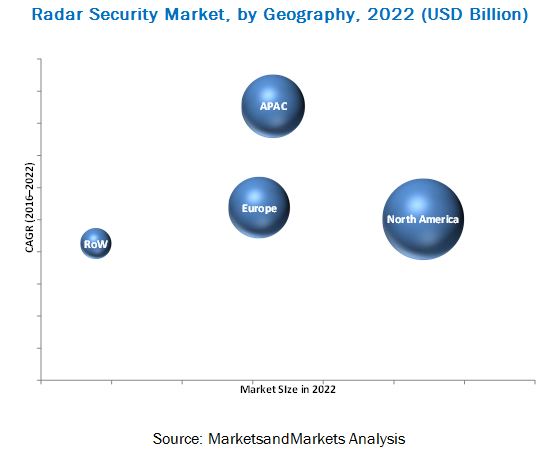

In terms of the different geographic regions, North America is expected to hold the largest market share in 2016. The APAC market is expected to grow at the highest rate between 2016 and 2022. Many of the countries considered under the APAC region are developing countries, wherein the number of manufacturing companies is increasing. The demographic factors (population), shifting consumer landscape (consumer adoption levels), and economic factors are the key drivers for the APAC market

The costs incurred for R&D and developing radar systems is on the higher side. Significant investments are required at different stages of the value chain of these systems, especially at the research and development, manufacturing, system integration, and assembly stages. Along with this, the radar security system is not a foolproof identification system for cyber attacks. Cyber hacking of fully automated radar security systems may result in unrecoverable damage to the critical infrastructure and country security. Hence, high development cost and hindrance in the functionality of radar security systems due to growing cyber warfare are the factors that are restraining the growth of the radar security market.

Border Security Application To Hold Largest Share Of The Radar Security Market In The Forecast Period

Border Security

Radar security application may cover small to large areas. The frequency band used in radar security applications may vary based on the range. For moderate range and moderate accuracy requirements, S band radars are preferred. For large area requirements, L band radars are preferred. Weapon guidance systems require precision and accuracy in acquiring the target. Bands such as Ku and X are preferred in the weapon guidance system applications of radars.

Seaport & Harbor

Radar security systems are used for the detection and tracking of naval activities. Detection of warships, submarine, offshore patrol vessels (OPVs), and other naval vessels is the prime function of marine surveillance radar systems. The detection of anti-ship missiles and other ammunitions is done by marine surveillance radar systems. Coast guards and other paramilitary forces use marine surveillance radars for monitoring illegal activities such as smuggling, piracy, illicit fishing, and terrorism.

Critical Infrastructure

The unmanned air vehicles, manned aircraft, and unauthorized vehicles travelling on land can be a threat to critical infrastructures such as commercial complex, R&D centers, and manufacturing facilities among others. High-profile airport perimeter security breaches around the world highlight the important need for accurate, dependable radar security systems to protect aviation assets. While security checkpoints and passenger screening systems are available inside the terminal, security problems are faced at the perimeters.

Others

Along with the national security, radar security systems have been adopted for homeland security applications in various countries around the globe. The systems have been used for highway safety systems to avoid accidents and anti-collision systems for trains in the UK. Many such civilian applications provide a great opportunity for the commercialization of radar security systems.

The prime strategy implemented by Thales SA (France) is to concentrate on a business mix which ensures equilibrium between the defence and commercial segments and earn healthy returns. Another strategy that Thales follows is to focus on research and development. It is strengthening its business and increasing its global presence by making ideal acquisitions and launching the best-in-class products, which meet varying requirements of customers. For example, in 2014, Thales delivered 15 radars from the Ground Master family to air forces and Thales Raytheon Systems signed contracts for 16 GM400 and GM200 radars to insure low- and medium-altitude surveillance of French territory. Also, in the field of lasers, Thales confirmed its market position on intense laser intended for scientific research with the notification of contracts in Romania, Germany, and Japan.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Market Segmentation, By Geography

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

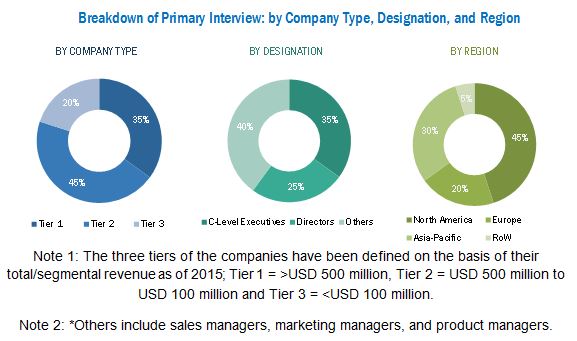

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Radar Security Market

4.2 U.S. Expected to Hold the Largest Share of the Radar Security Market in 2016

4.3 Market Share of Radar Security Systems Based on Type and Application

4.4 Radar Security Market, By Type

4.5 Radar Security Market, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Radar Security Market, By Type

5.2.2 Radar Security Market, By Application

5.2.3 Radar Security Market, By Range

5.2.4 Radar Security Market, By Band

5.2.5 Radar Security Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand for Radar Systems Worldwide Since Militaries Seek to Replace Legacy Systems

5.3.1.2 Rising Territorial Conflicts and Geopolitical Instabilities in the Middle East and APAC Regions

5.3.1.3 Defense Budget Cuts in Developed Economies Shifted the Focus Toward Miniaturization and Automation of Defense and Surveillance Systems

5.3.2 Restraints

5.3.2.1 High Development Cost

5.3.2.2 Hindrances in the Functionality of Radar Security Systems Due to Growing Cyber Warfare

5.3.3 Opportunities

5.3.3.1 Increase in Investment & Development of Ballistic Missiles and Air and Missile Defense Systems By the Defense Sector

5.3.3.2 Increasing Use of Radar Security Systems for Civilian Applications Such as Highway Safety Systems and Anti-Collision Systems for Train

5.3.4 Challenges

5.3.4.1 to Overcome Electromagnetic Jamming

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Radar Security Market, By Type (Page No. - 48)

7.1 Introduction

7.2 Ground Surveillance Radar (GSR) Systems

7.2.1 Perimeter Surveillance Radar Systems

7.3 Air Surveillance Radar (ASR) Systems

7.4 Marine Surveillance Radar (MSR) Systems

8 Radar Security Market, By Application (Page No. - 63)

8.1 Introduction

8.2 Border Security

8.3 Seaport & Harbor

8.4 Critical Infrastructure

8.5 Others

9 Radar Security Market, By Range (Page No. - 72)

9.1 Introduction

9.1.1 Long Range

9.1.2 Medium Range

9.1.3 Short Range

10 Radar Security Market, By Geography (Page No. - 77)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Russia

10.3.7 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.2 Middle East & Africa

11 Frequency Bands for Radar Security Systems (Page No. - 106)

11.1 Introduction

11.2 HF, VHF, and UHF Bands

11.2.1 HF and VHF Bands

11.2.2 UHF Bands

11.3 L, S, C, and X Bands

11.3.1 L Band

11.3.2 S Band

11.3.3 C Band

11.3.4 X Band

11.4 KU, K, KA, V, and W Bands

11.4.1 KU Band

11.4.2 K Band

11.4.3 KA Band

11.4.4 V Band

11.4.5 W Band

12 Competitive Landscape (Page No. - 111)

12.1 Overview

12.2 Market Ranking Analysis: Radar Security Market (2015)

12.3 Competitive Situations and Trends

12.3.1 Contracts & Agreements

12.3.2 New Product Launches

12.3.3 Expansions

12.3.4 Partnerships & Joint Ventures

12.3.5 Acquisitions

13 Company Profiles (Page No. - 123)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Thales SA

13.3 Lockheed Martin Corporation

13.4 Raytheon Company

13.5 Saab AB

13.6 Elbit Systems Ltd.

13.7 Flir Systems, Inc.

13.8 Israel Aerospace Industries Ltd.

13.9 Blighter Surveillance Systems

13.10 Kongsberg Gruppen

13.11 Detect, Inc.

13.12 SRC Inc.

13.13 Thalesraytheonsystems

13.14 Kelvin Hughes Limited

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 159)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (71 Tables)

Table 1 Radar Security Market, By Type

Table 2 Radar Security Market, By Application

Table 3 Radar Security Market, By Range

Table 4 Radar Security Market, By Band

Table 5 Radar Security Market, By Type, 2013–2022 (USD Million)

Table 6 Radar Security Market Size, By Type, 2013-2022 (Units)

Table 7 Radar Security Market for Ground Surveillance Radar (GSR) Systems, By Application, 2013–2022 (USD Million)

Table 8 Radar Security Market for Ground Surveillance Radar Systems, By Region, 2013–2022 (USD Million)

Table 9 Radar Security Market for Ground Surveillance Radar Systems in North America, By Country, 2013–2022 (USD Million)

Table 10 Radar Security Market for Ground Surveillance Radar Systems in Europe, By Country, 2013–2022 (USD Million)

Table 11 Radar Security Market for Ground Surveillance Radar Systems in APAC, By Country, 2013–2022 (USD Million)

Table 12 Radar Security Market for Ground Surveillance Radar Systems in RoW, By Region, 2013–2022 (USD Million)

Table 13 Radar Security Market for Air Surveillance Radar Systems, By Application, 2013–2022 (USD Million)

Table 14 Radar Security Market for Air Surveillance Radar Systems, By Region, 2013–2022 (USD Million)

Table 15 Radar Security Market for Air Surveillance Radar Systems in North America, By Country, 2013–2022 (USD Million)

Table 16 Radar Security Market for Air Surveillance Radar Systems in Europe, By Country, 2013–2022 (USD Million)

Table 17 Radar Security Market for Air Surveillance Radar Systems in APAC, By Country, 2013–2022 (USD Million)

Table 18 Radar Security Market for Air Surveillance Radar Systems in RoW, By Region, 2013–2022 (USD Million)

Table 19 Radar Security Market for Marine Surveillance Radar Systems, By Application, 2013–2022 (USD Million)

Table 20 Radar Security Market for Marine Surveillance Radar Systems, By Region, 2013–2022 (USD Million)

Table 21 Radar Security Market for Marine Surveillance Radar Systems in North America, By Country, 2013–2022 (USD Million)

Table 22 Radar Security Market for Marine Surveillance Radar Systems in Europe, By Country, 2013–2022 (USD Million)

Table 23 Radar Security Market for Marine Surveillance Radar Systems in APAC, By Country, 2013–2022 (USD Million)

Table 24 Radar Security Market for Marine Surveillance Radar Systems in RoW, By Region, 2013–2022 (USD Million)

Table 25 Radar Security Market, By Application, 2013–2022 (USD Million)

Table 26 Radar Security Market for Border Security Application, By Type, 2013–2022 (USD Million)

Table 27 Radar Security Market for Border Security Application, By Range, 2013–2022 (USD Million)

Table 28 Radar Security Market for Seaport and Harbour Application, By Type, 2013–2022 (USD Million)

Table 29 Radar Security Market for Seaport and Harbor Application, By Range, 2013–2022 (USD Million)

Table 30 Radar Security Market for Critical Infrastructure Application, By Range, 2013–2022 (USD Million)

Table 31 Radar Security Market for Critical Infrastructure Application, By Type, 2013–2022 (USD Million)

Table 32 Radar Security Market for Other Applications , By Type, 2013–2022 (USD Million)

Table 33 Radar Security Market for Other Applications, By Range, 2013–2022 (USD Million)

Table 34 Radar Security Market Size, By Range, 2013-2022 (Units)

Table 35 Radar Security Market, By Range, 2013–2022 (USD Million)

Table 36 Radar Security Market for Long-Range Systems, By Application, 2013–2022 (USD Million)

Table 37 Radar Security Market for Medium-Range Radar Systems, By Application, 2013–2022 (USD Million)

Table 38 Radar Security Market for Short-Range Systems, By Application, 2013-2022 (USD Million)

Table 39 Radar Security Market, By Region, 2013–2022 (USD Million)

Table 40 Radar Security Market in North America, By Country, 2013–2022 (USD Million)

Table 41 Radar Security Market Innorth America, By Type, 2013–2022 (USD Million)

Table 42 Radar Security Market in U.S., By Type, 2013–2022 (USD Million)

Table 43 Radar Security Market in Canada, By Type, 2013–2022 (USD Million)

Table 44 Radar Security Market in Mexico, By Type, 2013–2022 (USD Million)

Table 45 Radar Security Market in Europe, By Country, 2013–2022 (USD Million)

Table 46 Radar Security Market in Europe, By Type, 2013–2022 (USD Million)

Table 47 Radar Security Market in U.K., By Type, 2013–2022 (USD Million)

Table 48 Radar Security Market in Germany, By Type, 2013–2022 (USD Million)

Table 49 Radar Security Market in France, By Type, 2013–2022 (USD Million)

Table 50 Radar Security Market in Italy, By Type, 2013–2022 (USD Million)

Table 51 Radar Security Market in Spain, By Type, 2013–2022 (USD Million)

Table 52 Radar Security Market in Russia, By Type, 2013–2022 (USD Million)

Table 53 Radar Security Market in Rest of Europe, By Type, 2013–2022 (USD Million)

Table 54 Radar Security Market in APAC, By Country, 2013–2022 (USD Million)

Table 55 Radar Security Market in APAC, By Type, 2013–2022 (USD Million)

Table 56 Radar Security Market in China, By Type, 2013–2022 (USD Million)

Table 57 Radar Security Market in India, By Type, 2013–2022 (USD Million)

Table 58 Radar Security Market in Japan, By Type, 2013–2022 (USD Million)

Table 59 Radar Security Market in South Korea, By Type, 2013–2022 (USD Million)

Table 60 Radar Security Market in Rest of APAC, By Type, 2013–2022 (USD Million)

Table 61 Radar Security Market in RoW, By Country, 2013–2022 (USD Million)

Table 62 Radar Security Market in RoW, By Type, 2013–2022 (USD Million)

Table 63 Radar Security Market in South America, By Type, 2013–2022 (USD Million)

Table 64 Radar Security Market in Middle East and Africa, By Type, 2013–2022 (USD Million)

Table 65 List of Radar Frequency Bands

Table 66 Market Ranking of the Top 5 Players in the Radar Security Market, 2015

Table 67 Contracts & Agreements, 2013–2015

Table 68 New Product Launches, 2013–2015

Table 69 Expansions, 2013–2015

Table 70 Partnerships & Joint Ventures, 2013–2015

Table 71 Acquisitions, 2013–2015

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Radar Security Market: Research Design

Figure 3 Radar Security Market: Bottom-Up Approach

Figure 4 Radar Security Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market for Marine Surveillance Radar Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 7 Border Security Application Likely to Hold the Largest Market Size During the Forecast Period

Figure 8 North America Expected to Hold the Largest Share of the Radar Security Market in 2016

Figure 9 Lucrative Opportunities in the Radar Security Market

Figure 10 APAC Market Expected to Grow at A Significant Rate During the Forecast Period

Figure 11 Border Security Applications Likely to Hold A Major Share of the Radar Security Market During the Forecast Period

Figure 12 Market for Marine Surveillance Radar (MSR) Systems Estimated to Grow at the Highest Rate During the Forecast Period

Figure 13 North America to Dominate the Radar Security Market During the Forecast Period

Figure 14 Radar Security Market, By Geography

Figure 15 Rising Territorial Conflicts and Geopolitical Instabilities in the Middle East and APAC Expected to Propel the Radar Security Market During the Forecast Period

Figure 16 Major Value is Added During the Research & Development and Manufacturing Phases

Figure 17 Porter’s Five Forces Analysis

Figure 18 Porter’s Five Forces: Impact Analysis

Figure 19 Radar Security Market: Threat of New Entrants

Figure 20 Radar Security Market: Threat of Substitutes

Figure 21 Radar Security Market: Bargaining Power of Buyers

Figure 22 Radar Security Market: Bargaining Power of Suppliers

Figure 23 Radar Security Market: Intensity of Competitive Rivalry

Figure 24 2D Surveillance Radar Systems

Figure 25 3D Surveillance Radar Systems

Figure 26 Market for Marine Surveillance Radar Systems to Grow at the Highest Rate During the Forecast Period

Figure 27 Seaport and Harbor Application to Grow at the Highest Rate in the Market for Marine Surveillance Radar Systems During the Forecast Period

Figure 28 Border Security Application to Hold Highest Share for Radar Security Market in the Forecast Period

Figure 29 Radar Security Market for Short-Range Systems Expected to Grow at the Highest Rate During the Forecast Period

Figure 30 APAC Radar Security Market Expected to Grow at the Highest Rate During the Forecast Period

Figure 31 Radar Security Market in APAC Expected to Grow at the Highest Rate During the Forecast Period

Figure 32 U.S. to Hold the Largest Share of the North American Radar Security Market During the Forecast Period

Figure 33 North America: Radar Security Market Snapshot

Figure 34 Europe: Radar Security Market Snapshot

Figure 35 China to Hold the Largest Market Size During the Forecast Period

Figure 36 APAC: Surveillance Radar Systems Market Snapshot

Figure 37 Radar Security Market Players Adopted Contracts & Agreements as Key Strategies for Business Expansion

Figure 38 Radar Security Market Witnessed A Significant Growth Between 2013 and 2015

Figure 39 Contracts & Agreements Were the Key Growth Strategies Adopted Between 2013 and 2015

Figure 40 Geographic Revenue Mix of Major Players

Figure 41 Thales SA: Company Snapshot

Figure 42 Thales SA: SWOT Analysis

Figure 43 Lockheed Martin Corporation: Company Snapshot

Figure 44 Lockheed Martin Corporation: SWOT Analysis

Figure 45 Raytheon Company: Company Snapshot

Figure 46 Raytheon Company: SWOT Analysis

Figure 47 Saab AB: Company Snapshot

Figure 48 Saab AB: SWOT Analysis

Figure 49 Elbit Systems: Company Snapshot

Figure 50 Elbit Systems Ltd.: SWOT Analysis

Figure 51 Flir Systems, Inc.: Company Snapshot

Figure 52 Israel Aerospace Industries Ltd.: Company Snapshot

Figure 53 Kongsberg Gruppen: Company Snapshot

Major players of radar security ecosystem were identified across region, and their offerings, distribution channels, regional presence are understood through in-depth discussions. Also, Average revenue generated by these companies segmented by region is used to arrive at the overall security and surveillance market size. This overall market size is used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary sources directories, databases such as Hoovers, Bloomberg BusinessWeek, Factiva, OneSource, and primary research. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interview of key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

To know about the assumptions considered for the study, download the pdf brochure

The radar security market ecosystem includes radar system manufacturers such as Thales SA (France), Lockheed Martin Corporation (U.S.), Raytheon Company (U.S.), Saab AB (Sweden), Elbit Systems Ltd. (Israel), FLIR Systems, Inc. (U.S.), Israel Aerospace Industries Ltd. (Israel), Blighter Surveillance Systems (U.K.), Kongsberg Gruppen (Norway), DeTect Inc. (U.S.), SRC Inc. (U.S.), ThalesRaytheonSystems (France), and Kelvin Hughes Limited (U.K.) among others who offer the radar security systems to end users.

Key Target Audience:

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users who want to know more about the technology and the latest technological developments in the industry

Study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years (depends on the range of forecast period) for prioritizing the efforts and investments.

Major Market Developments

- In October 2018, The US Army awarded Lockheed Martin a contract modification to insert Gallium Nitride (GaN) into the AN/TPQ-53 (Q-53) radar as part of the full rate production configuration.

- In October 2018, Raytheon Company's AN/SPY-6(V) radar continues to demonstrate its integrated air and missile defense capability through exceptional performance against multiple targets. The radar detected, acquired and tracked multiple targets from the U.S. Navy's Pacific Missile Range Facility, Kauai, Hawaii.

- In September 2018, Defence Technology Institute (DTI), Datagate, and Thales signed an agreement to collaborate for enhancing their capabilities to develop digital communication system.

Critical questions the report answers:

- What are the opportunities for the various players present now and planning to enter at various stages of the value chain?

- Thales SA (France), Lockheed Martin (US), and Raytheon (Ireland) have been aggressive partnering with Governments of various countries worldwide, how will this impact the growth rate of the radar security market and who will have the un-due advantage?

Report Scope:

In this report, the radar security market has been segmented into the following categories in addition to the industry trends which have also been detailed below:

Market, by Type:

-

Ground Surveillance Radar (GSR) Systems:

- Perimeter Surveillance Radars

- Air Surveillance Radar (ASR) Systems

- Marine Surveillance Radar (MSR) Systems

Market, by Range:

- Long Range (Above 48kms)

- Medium Range (Up to 48kms)

- Short Range (Up to 500m)

Market, by Application:

- Border Security

- Seaport and Harbor

- Critical Infrastructure

- Others

Market, by Geography:

-

North America:

- U.S.

- Canada

- Mexico

-

Europe:

- U.K.

- Russia

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific:

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World:

- South America

- Middle East and Africa

- Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the radar security market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Growth opportunities and latent adjacency in Radar Security Market