Queue Management System Market by Component, Solution Type, Application (Reporting & Analytics, Real-time Monitoring), Queue Type (Structured, Unstructured, Mobile Queue), Organization Size, Deployment Mode, Vertical, and Region - Global Forecast to 2026

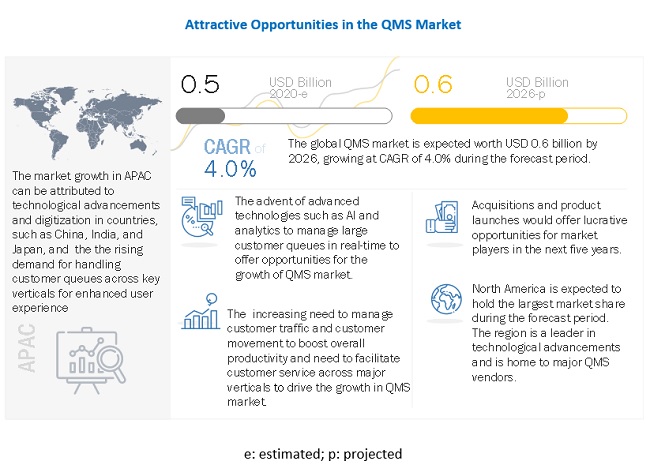

The global Queue Management System Market size was valued at $0.5 billion in 2020 and it is projected to reach $0.6 billion by the end of 2026 at a CAGR of 4.0% during the forecast period. Factors such as the increasing need to manage customer traffic and customer movement to boost productivity and the rising need to improve staff efficiency and enhance customer engagement during COVID-19 are driving the adoption of the QMS market across the globe. QMS can be used at any location undergoing a significant footfall. Most of the organizations prefer QMS solutions and services to shorten on-site customer wait times and reduce walkaways.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The queue management system market is expected to witness an insignificant slowdown in 2020 due to the global lockdown. The COVID-19 pandemic has increased the churn rate and shuddered almost every industry. The lockdown is impacting global manufacturing, and supply chains and logistics as the continuity of operations for various sectors is badly impacted. The sectors facing the greatest drawbacks are manufacturing, transportation and logistics, and retail and consumer goods. The availability of the essential items has been impacted due to the lack of manpower to work on production lines, supply chains, and transportation although the essential items are exempted from the lockdown. The condition is expected to come under control by early 2021 while the demand for QMS solutions and services is expected increase, which is due to the increased demand for enhanced customer experience and build a personalized relationship with the prospects. Several verticals are already planning to deploy a diverse array of QMS solutions and services to enable digital transformation initiatives, which address mission-critical processes, improve operations, and authenticate user’s identification. The reduction in operational costs, better customer experiences, fraud detection and prevention, enhanced authentication processes and operations, and improved real-time decision-making are the key business and operational priorities that are expected to drive the adoption of the queue management system market.

Queue Management System Market Dynamics

Driver: Increasing need to manage customer traffic and customer movement to boost productivity

QMS is an automated system designed to manage walk-in services or customer flow. It is majorly used to manage interactions with the customers, whether it be in person or through information displayed over the screen. This system benefits organizations to manage and control queues of persons. It offers a range of modules that users can utilizes to efficiently handle customer requests. QMS allows a business to accurately understand where the inefficiencies are in their queues and to address these issues on a continual basis to ensure a consistently positive experience. The benefits of QMS can extend throughout the business from improving customer satisfaction to improving business productivity. According to a survey by VersionX, 78% of customers agree that they like to be in control of when they want to be serviced.

Restraint: High setup costs for queue management system

QMS are widely used in the public transportation network. The deployment of these across the network requires joint efforts from entities, such as infrastructure providers, component manufacturers, service providers, the public sector, and user groups. The involvement of various entities for the successful implementation of ticketing systems entails a sophisticated framework, which results in a huge amount of investments. Hence, the successful implementation of QMS requires a large amount of funding from authorities, and this may slow down the growth of this market. There will be high initial setup cost and ongoing premiums associated with QMS which may cause hindrance the growth of this market

Opportunity: Advent of advanced technologies such as artificial intelligence and analytics

The booming technological world is witnessing a rapid multiplication in the use of connected devices due to the proliferation of Artificial Intelligence (AI) and analytics trends. In the hospitality industry, these technologies have presented an opportunity to improve the security of visitors and guests and reduce the human workforce required to maintain protective measures. The growing adherence to regulatory compliances further leads to a rise in the demand for automated visitor management systems. AI and analytics technologies are playing a major role in driving the adoption of the global queue management system market. Analytics is a combination of storing and processing sensor data and computing using data analytics to achieve and assist in managing the customer queues effectively. With the advent to AI and analytics, large enterprises can now provide secure QMS solutions with various key features, such as online booking, smart callback system, self-service sign-in, performance tracking, and real-time alerts and notifications.

Challenge: Data safety and security issues

Data safety and security issues associated with the use of QMS are estimated to be one of the major challenges affecting the growth of the market. User data stored in smart cards or mobile devices can be misused. However, large enterprises are more concerned related to the safety and security of these automated QMS due to several safety issues and vulnerability. As per a survey conducted by IBM, several QMS have flaws and can be easily hacked or accessed by attackers. These attackers can further access kiosks easily and can break into underlying Operating Systems (OS), leading to the loss or theft of the organization’s sensitive information

Among verticals, the healthcare and life sciences segment to grow at the highest CAGR during the forecast period

The global queue management system market is segmented into the various verticals, particularly verticals, such as government and public sector, BFSI, retail and consumer goods, healthcare and life sciences, IT and telecom, travel and hospitality, utilities, and other verticals (education, manufacturing, and media and entertainment). The healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. Ease of handling patient query and enhance productivity to drive the demand for QMS solutions across the healthcare and life sciences vertical across the world.

APAC to grow at a higher CAGR during the forecast period

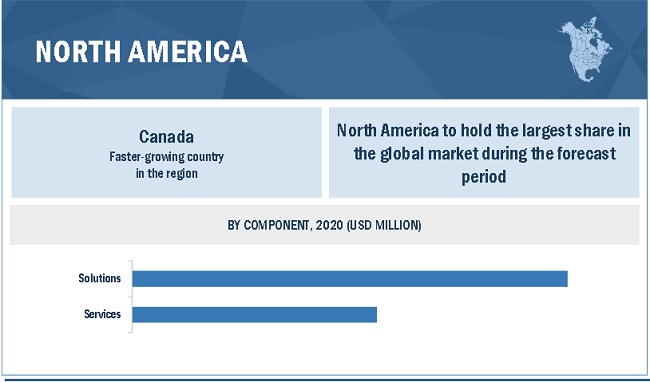

The global queue management system market has been segmented into five regions: North America, Europe, APAC, MEA, and Latin America. In terms of market size, North America is estimated to hold the largest size in the overall QMS market. APAC is expected to have the highest growth rate during the forecast period due to the growing need for QMS solutions to manage large customer queues and reduce waiting time for better customer experience.

To know about the assumptions considered for the study, download the pdf brochure

Queue Management System Market Key Players

The QMS vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the key players operating in the QMS market include Advantech (Taiwan), Wavetec (Dubai), Aurionpro (India), Lavi Industries (US), QLess (US), Qmatic (Europe), SEDCO (UAE), Q-nomy (US), Core Mobile (US), MaliaTec (Lebanon), JRNI (England), Qudini (England), Qminder (UK), ATT Systems (India), XIPHIAS (India), AKIS Technologies (Europe), AwebStar (Singapore), Xtreme Media (India), Skiplino (Bahrain), Business Automation (Bangladesh), Udentify (Turkey), 2Meters (Germany), OnlineToken (US), Hate2wait (India), VersionX (India). The study includes an in-depth competitive analysis of these key players in the queue management system market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 0.5 billion |

|

Market size value for 2026 |

USD 0.6 billion |

|

Growth Rate |

4.0% CAGR |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Solution Type, Queue Type, Organization Size, Deployment Mode, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Advantech (Taiwan), Wavetec (Dubai), Aurionpro (India), Lavi Industries (US), QLess (US), Qmatic (Europe), SEDCO (UAE), Q-nomy (US), Core Mobile (US), MaliaTec (Lebanon), JRNI (England), Qudini (England), Qminder (UK), ATT Systems (India), XIPHIAS (India), AKIS Technologies (Europe), AwebStar (Singapore), Xtreme Media (India), Skiplino (Bahrain), Business Automation (Bangladesh), Udentify (Turkey), 2Meters (Germany), OnlineToken (US), Hate2wait (India), VersionX (India) |

This research report categorizes the queue management system market based on component, type, application, deployment mode, organization size, vertical, and region.

By component:

-

Solutions

- Software

- Platform

-

Services

-

Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

By queue type:

- Linear Queuing

- Virtual Queuing

By queue type:

- Structured Queue

- Unstructured Queue

- Kiosk-Based

- Mobile Queues

By deployment mode:

- On-premises

- Cloud

By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By application:

- Reporting and Analytics

- Appointment Management

- Customer Service

- Query Handling

- In-Store Management

- Workforce Optimization

- Real-Time Monitoring

- Others (Digital Signage, and Customer Engagement)

By vertical:

- Government and Public Sector

- BFSI

- Retail and Consumer Goods

- Healthcare and Life Sciences

- IT and Telecom

- Travel and Hospitality

- Utilities

- Other Verticals (Education, Manufacturing, and Media And Entertainment)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- India

- Japan

- Rest of APAC

-

MEA

- South Africa

- UAE

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2021, SEDCO introduces a new series of self-service kiosks, enabling better customer experience and more efficient performance with less opex. The multi-functional kiosk comes in two series, FASTSERV and CONSULTA, enabling organizations to choose machines based on services requested, branch size, and budget. The self-service machines can be integrated with the advanced QMS to enable smart routing, where customers are guided to the right service channel based on the service type, service time, customers’ demography, and the availability of staff or machines.

- In December 2020, Advantech added two new models to its UTC-500 line — the UTC-515H 15.6 inch and UTC-520H 21.5-inch all-in-one touch computers. UTC-515H and the UTC-520H are ideal for HMI and facility management systems found in factories, kitchen display systems, and self-service kiosks. They empower integrated retail, hospitality, and public service applications.

- In December 2020, Qmatic and Karolinska University Laboratory have signed an agreement to implement Qmatic Mobile Ticket at 47 of its Laboratory units across Sweden. The implementation of Qmatic’s mobile queue management solution will digitally transform the patient experience and provide protective measures to prevent the spread of COVID-19 at its laboratory units.

- In September 2020, Qmatic announced new package offering for healthcare with the release of Qmatic’s latest and improved Health Level Seven (HL7) middleware module. The new healthcare offering from Qmatic supports the three most common patient flows within healthcare, pre-arrival, arrival, and serving, which allows healthcare providers to manage appointments, walk-ins, and emergency patients from arrival to discharge.

- In April 2019, Aurionpro signed a deal with one of the leading public sectors bank in India to set up self-servicing KIOSKS. The company won an order from one of the leading public sector banks in India for setting up of self-servicing KIOSKS at various locations across India. Aurionpro was supposed to supply, install, and maintain self-servicing KIOSKS at more than 500 branches of the bank across India.

Frequently Asked Questions (FAQ):

How big is the queue management system market?

What is growth rate of the queue management system market?

What are the key applications end-users looking for QMS solutions?

Who are the key players in queue management system market?

Who will be the leading hub for queue management system market?

What is the queue management system market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 49)

2.1 RESEARCH DATA

FIGURE 6 QUEUE MANAGEMENT SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 QMS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE QUEUE MANAGEMENT SYSTEM MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF THE QUEUE MANAGEMENT SYSTEM THROUGH OVERALL QUEUE MANAGEMENT SYSTEM SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON QMS MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 64)

TABLE 4 GLOBAL QUEUE MANAGEMENT SYSTEM MARKET SIZE AND GROWTH RATE, 2015–2019 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y %)

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2020

FIGURE 17 VIRTUAL QUEUING SEGMENT TO HOLD A HIGHER MARKET SHARE IN THE MARKET IN 2020

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2020

FIGURE 19 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN THE QMS MARKET IN 2020

FIGURE 20 STRUCTURED QUEUE SEGMENT TO HOLD THE LARGEST MARKET SIZE IN THE MARKET IN 2020

FIGURE 21 REPORTING AND ANALYTICS SEGMENT TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 22 CLOUD SEGMENT TO HOLD A HIGHER MARKET SHARE IN 2020

FIGURE 23 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 24 GOVERNMENT AND PUBLIC SECTOR VERTICAL TO HOLD THE HIGHEST MARKET SHARE IN 2020

FIGURE 25 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE AND ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE QUEUE MANAGEMENT SYSTEM MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 71)

4.1 ATTRACTIVE OPPORTUNITIES IN THE QUEUE MANAGEMENT SYSTEM MARKET

FIGURE 26 INCREASING NEED TO MANAGE CUSTOMER TRAFFIC AND CUSTOMER MOVEMENT TO BOOST OVERALL PRODUCTIVITY TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 27 WORKFORCE OPTIMIZATION APPLICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY COMPONENT AND TOP THREE VERTICALS

FIGURE 28 SOLUTIONS SEGMENT AND BFSI VERTICAL TO HOLD THE HIGHEST MARKET SHARES IN 2020

4.4 QUEUE MANAGEMENT SYSTEM MARKET: BY REGION

FIGURE 29 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 74)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: QUEUE MANAGEMENT SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing need to manage customer traffic and customer movement to boost productivity

5.2.1.2 Need to improve and facilitate customer service across major industry verticals

5.2.1.3 Rising need to improve staff efficiency and enhance customer engagement during COVID-19

5.2.2 RESTRAINTS

5.2.2.1 High setup costs for queue management system

5.2.3 OPPORTUNITIES

5.2.3.1 Advent of advanced technologies such as artificial intelligence and analytics

5.2.4 CHALLENGES

5.2.4.1 Data safety and security issues

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS

5.4 REGULATORY LANDSCAPE

5.4.1 GENERAL DATA PROTECTION REGULATION

5.4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.4.3 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.4.4 SERVICE ORGANIZATIONAL CONTROL 2

5.4.5 MARKETS IN FINANCIAL INSTRUMENTS DIRECTIVE II

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 IMPACT OF EACH FORCE ON THE QUEUE MANAGEMENT SYSTEM

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 QUEUE MANAGEMENT SYSTEM: ECOSYSTEM

FIGURE 33 ECOSYSTEM OF QUEUE MANAGEMENT SYSTEM MARKET

5.7 PATENT ANALYSIS

5.7.1 METHODOLOGY

5.7.2 DOCUMENT TYPE

TABLE 7 PATENTS FILED

5.7.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 34 TOTAL NUMBER OF PATENTS GRANTED IN THE LAST TEN YEARS

5.7.3.1 Top applicants

FIGURE 35 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010–2020

TABLE 8 TOP FIFTEEN PATENT OWNERS (US) IN THE QUEUE MANAGEMENT SYSTEM MARKET, 2010–2020

5.8 PRICING MODEL ANALYSIS

5.9 CASE STUDY ANALYSIS

5.9.1 JOHNSTONE SUPPLY DEPLOYED QLESS SOLUTION FOR VIRTUAL QUEUING SOLUTIONS

5.9.2 LYON AIRPORT ESTIMATION OF AVERAGE WAITING TIME

5.9.3 WITH QMINDER ISHOP GUATEMALA CUT THEIR WAIT TIMES IN HALF AND INCREASED CUSTOMER SATISFACTION

5.9.4 NINOVE USES QMATIC TO DISTRIBUTE COVID-19 VACCINES IN A SAFE WAY

5.9.5 UNIVERSITY WEST INCREASES STAFF AND STUDENT SATISFACTION WITH QMATIC

5.9.6 ALYN HOSPITAL REDUCED WAITING TIMES OF PATIENTS USING Q-NOMY SOFTWARE

5.9.7 QUDINI RETAIL CHOREOGRAPHY SOFTWARE ENABLED SAMSUNG’S STORES TO DELIVER A CONSISTENTLY HIGH LEVEL OF CUSTOMER EXPERIENCE

5.9.8 ORIENTAL BANK REDUCED WAIT TIMES BY OVER 50%

5.9.9 THE LEADING ENTERTAINMENT LIFESTYLE RETAILER DECREASED THE CHECKOUT QUEUES BY 55%

5.9.10 O2 CREATED MORE POWERFUL CUSTOMER EXPERIENCE WITH QUDINI

5.10 TECHNOLOGICAL ANALYSIS

5.10.1 ARTIFICIAL INTELLIGENCE

5.10.2 BLOCKCHAIN

5.10.3 BIG DATA AND ANALYTICS

5.11 QUEUE MANAGEMENT SYSTEM MARKET: COVID-19 IMPACT

FIGURE 36 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

6 QUEUE MANAGEMENT SYSTEM MARKET, BY COMPONENT (Page No. - 94)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

6.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 37 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

TABLE 11 SOLUTIONS: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 12 SOLUTIONS: QMS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 14 MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 39 CONSULTING SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 15 QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 16 MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 17 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 18 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.1 Consulting

TABLE 19 CONSULTING: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 20 CONSULTING: QMS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.2 System integration and implementation

TABLE 21 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 22 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.3 Support and maintenance

TABLE 23 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 24 SUPPORT AND MAINTENANCE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 25 MANAGED SERVICE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 26 MANAGED SERVICE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 QUEUE MANAGEMENT SYSTEM MARKET, BY SOLUTION TYPE (Page No. - 105)

7.1 INTRODUCTION

7.1.1 SOLUTION TYPES: COVID-19 IMPACT

7.1.2 SOLUTION TYPES: MARKET DRIVERS

FIGURE 40 VIRTUAL QUEUING SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 28 MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

7.2 LINEAR QUEUING

TABLE 29 LINEAR QUEUING: QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 30 LINEAR QUEUING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 VIRTUAL QUEUING

TABLE 31 VIRTUAL QUEUING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 32 VIRTUAL QUEUING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 QUEUE MANAGEMENT SYSTEM MARKET, BY QUEUE TYPE (Page No. - 110)

8.1 INTRODUCTION

8.1.1 QUEUE TYPES: COVID-19 IMPACT

8.1.2 QUEUE TYPES: MARKET DRIVERS

FIGURE 41 MOBILE QUEUE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 33 MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

8.2 STRUCTURED QUEUE

TABLE 35 STRUCTURED QUEUE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 36 STRUCTURED QUEUE: QMS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 UNSTRUCTURED QUEUE

TABLE 37 UNSTRUCTURED QUEUE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 38 UNSTRUCTURED QUEUE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.4 KIOSK-BASED

TABLE 39 KIOSK-BASED: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 40 KIOSK-BASED: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.5 MOBILE QUEUE

TABLE 41 MOBILE QUEUE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 42 MOBILE QUEUE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 QUEUE MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE (Page No. - 117)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

9.1.2 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 42 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 43 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 44 QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 45 SMALL AND MEDIUM-SIZED ENTERPRISES: QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 46 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 LARGE ENTERPRISES

TABLE 47 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 48 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 QUEUE MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE (Page No. - 122)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

10.1.2 DEPLOYMENT MODES: MARKET DRIVERS

FIGURE 43 CLOUD DEPLOYMENT MODE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

10.2 CLOUD

TABLE 51 CLOUD: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 52 CLOUD: QMS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.3 ON-PREMISES

TABLE 53 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 54 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11 QUEUE MANAGEMENT SYSTEM MARKET, BY APPLICATION (Page No. - 127)

11.1 INTRODUCTION

11.1.1 APPLICATIONS: COVID-19 IMPACT

11.1.2 APPLICATIONS: MARKET DRIVERS

FIGURE 44 REAL-TIME MONITORING APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 55 MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 56 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

11.2 REPORTING AND ANALYTICS

TABLE 57 REPORTING AND ANALYTICS: QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 58 REPORTING AND ANALYTICS: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.3 APPOINTMENT MANAGEMENT

TABLE 59 APPOINTMENT MANAGEMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 60 APPOINTMENT MANAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.4 CUSTOMER SERVICE

TABLE 61 CUSTOMER SERVICE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 62 CUSTOMER SERVICE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.5 QUERY HANDLING

TABLE 63 QUERY HANDLING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 64 QUERY HANDLING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.6 IN-STORE MANAGEMENT

TABLE 65 IN-STORE MANAGEMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 66 IN-STORE MANAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.7 WORKFORCE OPTIMIZATION

TABLE 67 WORKFORCE OPTIMIZATION: QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 68 WORKFORCE OPTIMIZATION: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.8 REAL-TIME MONITORING

TABLE 69 REAL-TIME MONITORING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 70 REAL-TIME MONITORING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.9 OTHER APPLICATIONS

TABLE 71 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 72 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12 QUEUE MANAGEMENT SYSTEM MARKET, BY VERTICAL (Page No. - 139)

12.1 INTRODUCTION

12.1.1 VERTICALS: COVID-19 IMPACT

12.1.2 VERTICALS: MARKET DRIVERS

FIGURE 45 HEALTHCARE AND LIFE SCIENCES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 73 MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 74 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 75 BANKING, FINANCIAL SERVICES, AND INSURANCE : QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 76 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.3 RETAIL AND CONSUMER GOODS

TABLE 77 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 78 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.4 IT AND TELECOM

TABLE 79 IT AND TELECOM: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 80 IT AND TELECOM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.5 GOVERNMENT AND PUBLIC SECTOR

TABLE 81 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 82 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.6 HEALTHCARE AND LIFE SCIENCES

TABLE 83 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 84 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.7 EDUCATION

TABLE 85 EDUCATION: QMS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 86 EDUCATION: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.8 TRANSPORTATION AND LOGISTICS

TABLE 87 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 88 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.9 OTHER VERTICALS

TABLE 89 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 90 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13 QUEUE MANAGEMENT SYSTEM MARKET, BY REGION (Page No. - 151)

13.1 INTRODUCTION

FIGURE 46 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE AND ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: COVID-19 IMPACT

13.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

13.2.3.1 Health Insurance Portability and Accountability Act of 1996

13.2.3.2 California Consumer Privacy Act

13.2.3.3 Gramm–Leach–Bliley Act

13.2.3.4 Health Information Technology for Economic and Clinical Health Act

13.2.3.5 Sarbanes Oxley Act

13.2.3.6 United States Securities and Exchange Commission

13.2.3.7 California Consumer Privacy Act

13.2.3.8 Federal Information Security Management Act

13.2.3.9 Federal Information Processing Standards

FIGURE 47 NORTH AMERICA MARKET SNAPSHOT

TABLE 91 NORTH AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 98 NORTH AMERICA: QMS MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

TABLE 101 NORTH AMERICA MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 106 NORTH AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.2.4 UNITED STATES

13.2.5 CANADA

13.3 EUROPE

13.3.1 EUROPE: MARKET DRIVERS

13.3.2 EUROPE: COVID-19 IMPACT

13.3.3 EUROPE: REGULATORY IMPLICATIONS

13.3.3.1 General Data Protection Regulation

13.3.3.2 European Committee for Standardization

13.3.3.3 European Technical Standards Institute

TABLE 111 EUROPE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 119 EUROPE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

TABLE 121 EUROPE QMS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 126 EUROPE: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.3.4 UNITED KINGDOM

13.3.5 GERMANY

13.3.6 FRANCE

13.3.7 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: MARKET DRIVERS

13.4.2 ASIA PACIFIC: COVID-19 IMPACT

13.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

13.4.3.1 Privacy Commissioner for Personal Data

13.4.3.2 Act on the Protection of Personal Information

13.4.3.3 Critical Information Infrastructure

13.4.3.4 International Organization for Standardization 27001

13.4.3.5 Personal Data Protection Act

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 131 ASIA PACIFIC: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 138 ASIA PACIFIC: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: QMS MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.4.4 CHINA

13.4.5 INDIA

13.4.6 JAPAN

13.4.7 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

13.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

13.5.3 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

13.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

13.5.3.2 Cloud Computing Framework

13.5.3.3 GDPR Applicability in the Kingdom of Saudi Arabia

13.5.3.4 Protection of Personal Information Act

TABLE 151 MIDDLE EAST AND AFRICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: QMS MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13.5.4 SOUTH AFRICA

13.5.5 UNITED ARAB EMIRATES

13.5.6 KINGDOM OF SAUDI ARABIA

13.5.7 REST OF MIDDLE EAST AND AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: COVID-19 IMPACT

13.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

13.6.3.1 Brazil Data Protection Law

13.6.3.2 Argentina Personal Data Protection Law No. 25.326

13.6.3.3 Federal Law on Protection of Personal Data Held by Individuals

TABLE 171 LATIN AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY SOLUTION TYPE, 2015–2019 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY SOLUTION TYPE, 2020–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 178 LATIN AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY QUEUE TYPE, 2015–2019 (USD MILLION)

TABLE 180 LATIN AMERICA: QMS MARKET SIZE, BY QUEUE TYPE, 2020–2026 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 185 LATIN AMERICA: QUEUE MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13.6.4 BRAZIL

13.6.5 MEXICO

13.6.6 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 205)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS AND EXPANSIONS FROM 2018 TO 2020

14.3 MARKET SHARE, 2020

FIGURE 50 ADVANTECH LED QUEUE MANAGEMENT SYSTEM MARKET IN 2020

14.4 HISTORIC REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 51 REVENUE ANALYSIS OF KEY MARKET PLAYERS

14.5 KEY MARKET DEVELOPMENTS

14.5.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 191 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2020–2021

14.5.2 DEALS

TABLE 192 DEALS, 2019–2021

14.5.3 OTHERS

TABLE 193 OTHERS, 2018

14.6 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

FIGURE 52 RANKING OF KEY PLAYERS, 2020

14.7 COMPANY EVALUATION MATRIX, 2020

14.7.1 STAR

14.7.2 EMERGING LEADERS

14.7.3 PERVASIVE

14.7.4 PARTICIPANTS

FIGURE 53 QMS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14.7.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 54 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

14.7.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 55 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

14.8 STARTUP/SME EVALUATION MATRIX, 2020

14.8.1 PROGRESSIVE COMPANIES

14.8.2 RESPONSIVE COMPANIES

14.8.3 DYNAMIC COMPANIES

14.8.4 STARTING BLOCKS

FIGURE 56 QUEUE MANAGEMENT SYSTEM MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

14.8.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 57 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN THE MARKET

14.8.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 58 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN THE MARKET

15 COMPANY PROFILES (Page No. - 222)

15.1 INTRODUCTION

15.2 MAJOR PLAYERS

(Business overview, Recent developments, COVID-19 Developments, MNM VIEW, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

15.2.1 ADVANTECH

TABLE 194 ADVANTECH: BUSINESS OVERVIEW

FIGURE 59 ADVANTECH: FINANCIAL OVERVIEW

TABLE 195 ADVANTECH: PRODUCTS OFFERED

TABLE 196 ADVANTECH: QMS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

15.2.2 WAVETEC

TABLE 197 WAVETEC: BUSINESS OVERVIEW

TABLE 198 WAVETEC: PRODUCTS OFFERED

TABLE 199 WAVETEC: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 200 WAVETEC: MARKET: DEALS

15.2.3 AURIONPRO

TABLE 201 AURIONPRO: BUSINESS OVERVIEW

FIGURE 60 AURIONPRO: FINANCIAL OVERVIEW

TABLE 202 AURIONPRO: PRODUCTS OFFERED

TABLE 203 AURIONPRO: QUEUE MANAGEMENT SYSTEM MARKET: DEALS

TABLE 204 AURIONPRO: MARKET: BUSINESS EXPANSION

15.2.4 LAVI INDUSTRIES

TABLE 205 LAVI INDUSTRIES: BUSINESS OVERVIEW

TABLE 206 LAVI INDUSTRIES: PRODUCTS OFFERED

TABLE 207 LAVI INDUSTRIES: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 208 LAVI INDUSTRIES: MARKET: DEALS

15.2.5 QLESS

TABLE 209 QLESS: BUSINESS OVERVIEW

TABLE 210 QLESS: PRODUCTS OFFERED

TABLE 211 QLESS: QMS MARKET: DEALS

15.2.6 QMATIC

TABLE 212 QMATIC: BUSINESS OVERVIEW

TABLE 213 QMATIC: PRODUCTS OFFERED

TABLE 214 QMATIC: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 215 QMATIC: MARKET: DEALS

15.2.7 SEDCO

TABLE 216 SEDCO: BUSINESS OVERVIEW

TABLE 217 SEDCO: PRODUCTS OFFERED

TABLE 218 SEDCO: QUEUE MANAGEMENT SYSTEM MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 219 SEDCO: MARKET: DEALS

15.2.8 Q-NOMY

TABLE 220 Q-NOMY: BUSINESS OVERVIEW

TABLE 221 Q-NOMY: PRODUCTS OFFERED

TABLE 222 Q-NOMY: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 223 Q-NOMY: MARKET: DEALS

15.2.9 CORE MOBILE

TABLE 224 CORE MOBILE: BUSINESS OVERVIEW

TABLE 225 CORE MOBILE: PRODUCTS OFFERED

TABLE 226 CORE MOBILE: QMS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

15.2.10 MALIATEC

TABLE 227 MALIATEC: BUSINESS OVERVIEW

TABLE 228 MALIATEC: PRODUCTS OFFERED

TABLE 229 MALIATEC: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

15.2.11 JRNI

15.2.12 QUDINI

15.2.13 QMINDER

15.2.14 ATT SYSTEMS

15.2.15 XIPHIAS

15.2.16 AKIS TECHNOLOGIES

15.2.17 AWEBSTAR

15.2.18 XTREME MEDIA

15.2.19 SKIPLINO

15.2.20 BUSINESS AUTOMATION

15.2.21 UDENTIFY

15.2.22 2METERS

15.2.23 ONLINETOKEN

15.2.24 HATE2WAIT

15.2.25 VERSIONX

*Details on Business overview, Recent developments, COVID-19 Developments, MNM VIEW, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 258)

16.1 INTRODUCTION

16.2 VISITOR MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2025

16.2.1 MARKET DEFINITION

16.2.2 MARKET OVERVIEW

TABLE 230 GLOBAL VISITOR MANAGEMENT MARKET SIZE AND GROWTH RATE, 2018–2025 (USD MILLION, Y-O-Y %)

16.2.2.1 Visitor management system market, by component

TABLE 231 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

16.2.2.2 Visitor management system market, by application

TABLE 232 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

16.2.2.3 Visitor management system market, by deployment mode

TABLE 233 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

16.2.2.4 Visitor management system market, by organization size

TABLE 234 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

16.2.2.5 Visitor management system market, by industry vertical

TABLE 235 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY INDUSTRY VERTICAL, 2018–2025 (USD MILLION)

16.2.2.6 Visitor management system market, by region

TABLE 236 VISITOR MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

16.3 SMART TICKETING MARKET - GLOBAL FORECAST TO 2024

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

16.3.2.1 Smart ticketing market, by component

TABLE 237 SMART TICKETING MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 238 SMART TICKETING MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

16.3.2.2 Smart ticketing market, by organization size

TABLE 239 SMART TICKETING MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 240 SMART TICKETING MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

16.3.2.3 Smart ticketing market, by application

TABLE 241 SMART TICKETING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 242 SMART TICKETING MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

16.3.2.4 Smart ticketing market, by region

TABLE 243 NORTH AMERICA: SMART TICKETING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 244 NORTH AMERICA: SMART TICKETING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 EUROPE: SMART TICKETING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 246 EUROPE: SMART TICKETING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 247 ASIA PACIFIC: SMART TICKETING MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 248 ASIA PACIFIC: SMART TICKETING MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 249 REST OF THE WORLD: SMART TICKETING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 250 REST OF THE WORLD: SMART TICKETING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

17 APPENDIX (Page No. - 267)

17.1 INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of QMS market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the queue management system market.

Secondary Research

In the secondary research process, various secondary sources, such as Information Discovery and Delivery, Journal of Data Mining and Knowledge Discovery, and Data Science Journal, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

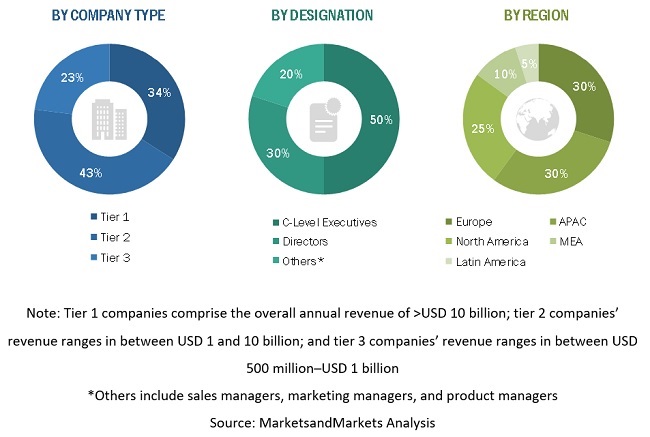

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from QMS solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the QMS market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the QMS market. The bottom-up approach was used to arrive at the overall market size of the global queue management system market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Queue Management System (QMS) market by component (solutions and services), solution type, queue type, organization size, deployment mode application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the QMS market

- To analyze the impact of the COVID-19 pandemic on the queue management system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American QMS market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA queue management system market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Queue Management System Market