Quantum Networking Market by Offering (Quantum Key Distribution (QKD), Quantum Random Number Generator (QRNG), Quantum Repeater, Quantum Memory, Photon Detectors, Software), End User Industry (BFSI, Government & Defense, IT & Telecom) - Global Forecast to 2029

Quantum Networking Market Size & Growth

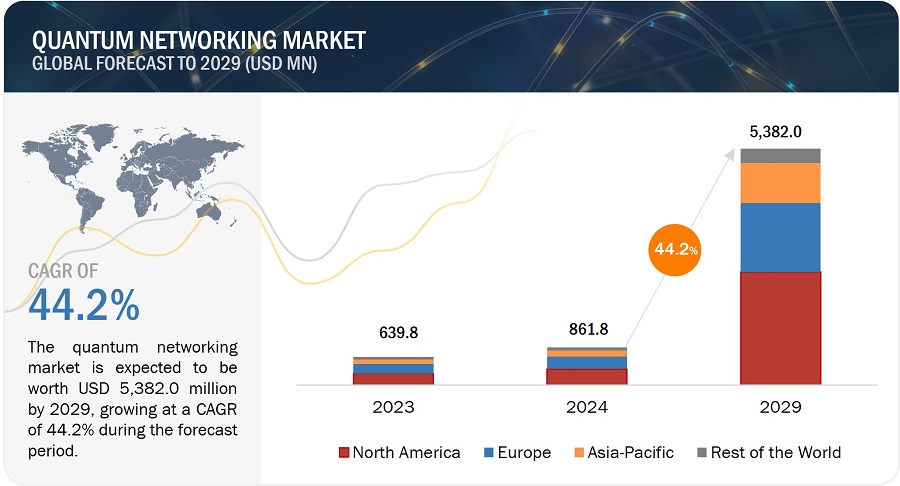

The global quantum networking market is projected to grow from USD 861.8 million in 2024 to USD 5,382.0 million by 2029, at a CAGR of 44.2% from 2024 to 2029.Key growth drivers include the increasing complexity of cyber-attacks and the mounting demand for secure communication channels, propelled by rapid advancements in quantum cryptography and computing. The integration of quantum technologies in sectors like banking, government, and healthcare further bolsters market expansion.

Key Takeaways:

• The global quantum networking market is projected to grow from USD 861.8 million in 2024 to USD 5,382.0 million by 2029, at a CAGR of 44.2% from 2024 to 2029.

• By Technology: Quantum Random Number Generators (QRNG) held the largest market share in 2023, driven by the demand for cryptographic security in quantum networks.

• By Application: Secure communication remains a pivotal application, with significant investments aimed at safeguarding data against evolving cyber threats.

• By End User: The banking & finance industry is a significant adopter of quantum networking solutions due to the increasing frequency of cyber-attacks.

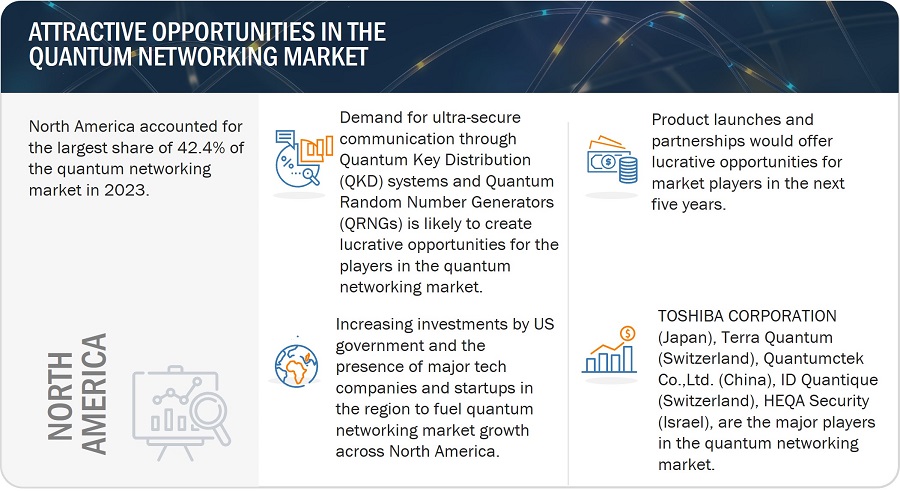

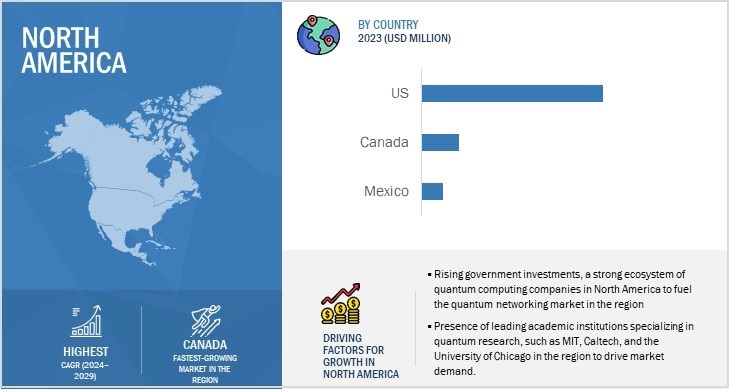

• By Region: NORTH AMERICA is expected to grow fastest at 47.3% CAGR, attributed to substantial government investment in quantum technologies and robust R&D activities.

• Market Dynamics: The emergence of smart cities and industrial automation presents lucrative opportunities, although high costs and standardization issues pose challenges.

• Ecosystem Collaboration: Key partnerships, such as those between Hitachi Energy and ID Quantique, highlight the importance of collaborative efforts to secure critical infrastructure.

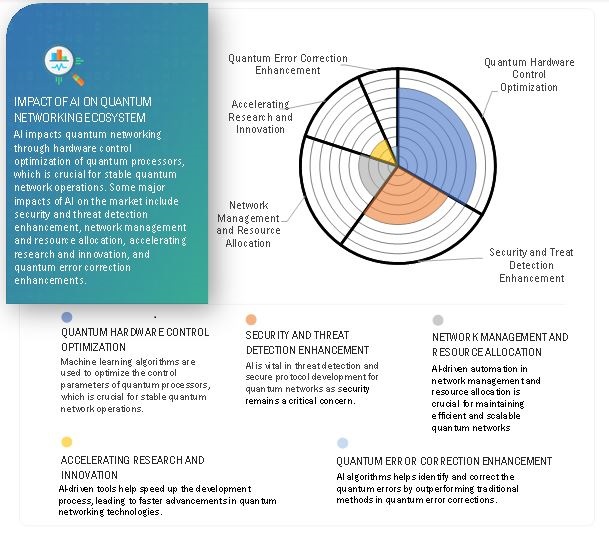

• AI Integration: AI-driven optimization of quantum hardware control and security protocols enhances the robustness and efficiency of quantum networks.

In conclusion, the Quantum Networking Market is set for transformative growth driven by technological advancements and increasing investments in securing digital communications. As industries worldwide continue to prioritize data security and privacy, the demand for quantum networking solutions is poised to accelerate, presenting significant opportunities for innovation and collaboration in the coming years.

Quantum Networking Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

AI Impact on Quantum Networking Market The adoption of AI in the quantum networking ecosystem drives major advancements and optimization across various aspects of the market. One of the impacts is the quantum hardware control optimization. Here, machine learning algorithms are used to optimize the control parameters of the quantum processors, which are crucial for stable quantum network operations. Additionally, AI is crucial in developing threat detection and security protocols for quantum networks due to the growing security concern in quantum networks. AI-based tools and solutions also help speed up the development processes, further boosting the advancement in quantum networking technologies.

Quantum Networking Market Trends & Dynamics

Driver: Growing demand for quantum-secure communication solutions to mitigate cyber-attacks

The increasing rate of cyberattacks drives the quantum networking market. Traditional security methodologies struggle to keep up with complex cyber-attack threats. The May 2023 MOVEit hack, which was a cyberattack that targeted a flaw in the MOVEit managed files, for example, demonstrated how vulnerability in a file-sharing application could be exploited across multiple organizations. It also demonstrated how an attack on various organizations can facilitate data identification. Several emerging cyber threats are sophisticated, advanced attacks. They use zero-day vulnerabilities, ransomware, and the cyber operations of state-sponsored attacks, resulting in damage beyond the ability of traditional defenses and leading to a rise in costs. Additionally, old encryption schemes (e.g., RSA, ECC) assert less impact due to the rapid advances in quantum computing.

Traditional computing devices solve complex math, while quantum devices can conduct computation solving. Quantum computers have the potential to break widely used encryption algorithms by solving complex mathematical problems exponentially faster than classical computers. As such, the National Institute of Standards and Technology (NIST) has recognized this risk through its analysis and reports on the threat level and risk transitioning of quantum computers versus traditional cryptographic methods. It is working toward standardization of post-quantum cryptography.

Quantum Key Distribution (QKD) serves as a solution to potential risks associated with traditional encryption methodologies. This is aided by advancements in quantum networking that leverage the principles of quantum mechanics. QKD designs intelligent and more advanced encryption keys that are extremely challenging to intercept or decrypt without detection. Adopting post-quantum cryptography (PQC) solutions significantly enhances cybersecurity by addressing the limitations of current encryption methods. These advanced cryptographic techniques are designed to withstand attacks from both classical and quantum computers, effectively mitigating the risks posed by emerging quantum computing solutions such as universal quantum computers, quantum annealers, and photonic quantum computers, which are capable of running quantum algorithms, that could break widely-used public-key cryptography.

Restraint: High costs of quantum networking hardware

A major restraint in the quantum networking market is the high costs of quantum networking hardware and research & development. Single-photon detectors and sources required for quantum communication are expensive and resource-intensive. Therefore, the reduced budgets of organizations limit the adoption and integration capabilities of the quantum networking solution. These factors prove further advancements and cost reductions are required for broad market acceptance. In addition, government funding for quantum research is used to build up the required infrastructure, and research and technology development costs are high. The high cost of quantum networking limits large-scale adoption since it requires long-term financial commitment and huge resources following investments from the public and private sectors. This is expected to restrain the quantum networking market growth.

Opportunity: Increasing need for quantum networking technologies for secure financial transactions

The increasing deployment of quantum networking technologies in financial transactions creates lucrative opportunities for players in the global quantum networking market. Quantum Key Distribution (QKD) provides unparalleled security by exchanging encryption keys with absolute confidentiality, enabling secure communication and making it a crucial tool for safeguarding sensitive data in corporate, healthcare, and government environments. Security is critical for the banking industry due to the availability of sensitive client and proprietary information. Banks need to secure information while also ensuring the availability of data for transactions on a real-time basis. Quantum networks can provide near-impenetrable security in banking and other critical sectors, driving the market. These factors encourage companies to develop and implement advanced quantum networking technologies that address the specific needs of end-use industries.

Challenge: Vulnerabilities to interference, decoherence, and signal loss

In any quantum network, qubits the building blocks of quantum information-are easily corrupted by electromagnetic radiation and other forms of usual environmental noise, leading to errors in sending information and quantum state processing. Besides, decoherence explains a situation in which a quantum system loses its quantum effect due to interaction with the environment. This could potentially lead to qubits losing their quantum state and switching over to classical behavior, causing the failure of quantum information transmission and processing. As a signal travels within the communication channel, absorption can weaken or attenuate quantum information. At times, this can reduce or even destroy communication fidelity. This will further break the effective operation in practically problematic parts in connections that use optimal fiber states, where losses in the photon break the effective operation of the quantum network.

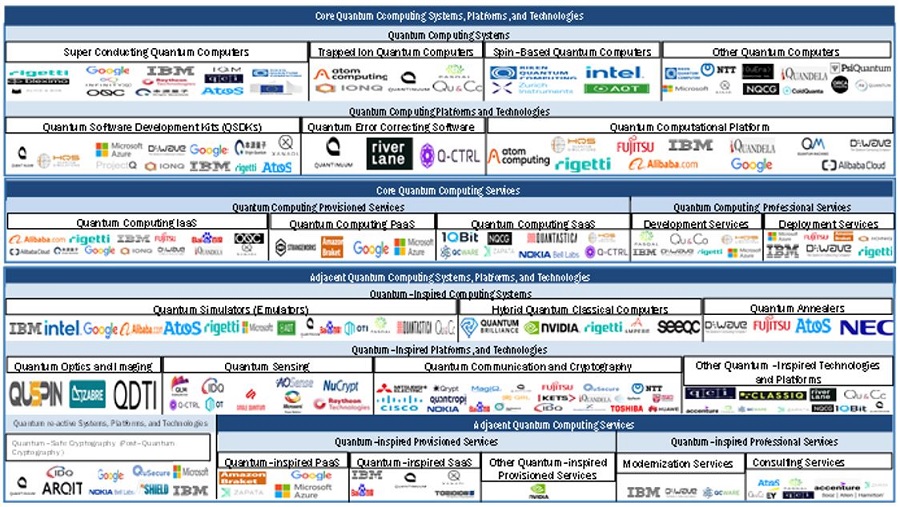

Quantum Networking Ecosystem

Quantum Random Number Generator (QRNG) segment held largest market share in 2023

The QRNG segment accounted for the largest market share in 2023. QRNG devices, which are essential for generating random numbers for cryptographic applications, gain momentum due to rapid integration into consumer and enterprise devices. Companies are developing next-generation quantum random number generators inside mobile handsets, IoT, and edge devices. In April 2022, ID Quantique (Switzerland) launched the Quantis QRNG chip, the first Quantum Random Number Generator designed and manufactured for mobile handsets, loT, and edge devices. It generates provably unbiased and unpredictable randomness with high entropy from the first bit. Therefore, advanced quantum random number generators have been adopted at an accelerated rate by businesses and consumers who seek security in all their digital interactions. Corresponding quantum networking solutions will drive investment as part of the broader trend of securing the quantum communication infrastructure.

Government & defense segment captured largest share of quantum networking market in 2023

Government & defense is likely to dominate the quantum networking market during the forecast period. This end-use industry applies quantum networking to secure classified information and enhance cryptography against sophisticated cyber threats. With the increasing sophistication and frequency of cyber threats, the demand for advanced solutions to protect sensitive information and maintain secure communication is growing in the defense sector. The latest in quantum networking for defense is the Defense Advanced Research Projects Agency (DARPA) Quantum-Augmented Network program. Through QuANET, DARPA will explore how integrating quantum and classical approaches to networking could provide quantum physics-based security capabilities to critical network infrastructures. The program will be the first to genuinely realize the security and covert advantages that quantum networks bring while taking advantage of the pervasive reach of classical networks. Companies, such as QuANET, provide a bridge between the communities of optical communications and quantum networking. Such innovations will drive the transition to a new networking paradigm, offering increased security to key defense infrastructures that can be scaled up to metropolitan area networks.

North America to register highest CAGR in quantum networking market during forecast period

North America is projected to exhibit the highest CAGR during the forecast period due to significant government investments, a strong ecosystem of research institutions and technology companies, and a rapidly growing commercial interest in quantum technologies across various industries such as finance, healthcare, and defense sectors which are exploring quantum networking applications. Considering that most major tech companies and startups operating in the region require heavy investment in the region, there is a significant flow of capital into quantum networking research & development. This investment is crucial for advancing the technology, building infrastructure, and bringing quantum networking solutions to the market. Companies, such as MagiQ Technologies, Qubitekk, Inc., Quantum Xchange, Qunnect Inc., Aliro Technologies, Inc., and QuSecure, Inc., are leading the charge with significant investments in quantum computing and networking in the region.

Quantum Networking Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Quantum Networking - Key Market Players

The quantum networking market is dominated by players, such as TOSHIBA CORPORATION (Japan), Quantumctek Co.,Ltd. (China), ID Quantique (Switzerland), HEQA Security (Israel), QuintessenceLabs (Australia), MagiQ Technologies (US), Terra Quantum (Switzerland), Crypta Labs Limited (UK), Quantum Xchange (US), and Qunnect Inc. (US). Apart from these, some of the emerging companies in the quantum networking market are Qubitekk, Inc. (US), Aliro Technologies, Inc. (US), QuNu Labs Private Limited. (India), Arqit Quantum Inc. (UK), Miraex (Switzerland), SpeQtral Pte Ltd (Singapore), KETS QUANTUM SECURITY LTD (UK), Aegiq Ltd. (Sheffield), QuBalt GmbH (Germany), SSH (Finland), QuSecure, Inc. (US), VeriQloud (France), Qrypt (New York), Quside Technologies. (Spain), and LuxQuanta Technologies S.L. (Spain).

Scope of the Quantum Networking Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 861.8 million in 2024 |

| Projected Market Size | USD 5,382.0 million by 2029 |

| Growth Rate | at a CAGR of 44.2% |

|

Market size available for years |

2020–2029 |

|

Base year |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast Units |

Value (USD Million) |

|

Segments covered |

Offering, End-user Industry, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

A total of 25 players have been covered. Major players include TOSHIBA CORPORATION (Japan), Quantumctek Co.,Ltd. (China), ID Quantique (Switzerland), HEQA Security (Israel), QuintessenceLabs (Australia), MagiQ Technologies (US), Terra Quantum (Switzerland), Crypta Labs Limited (UK), Quantum Xchange (US), and Qunnect Inc. (US), among others. |

Quantum Networking Market Highlights

This research report categorizes the quantum networking market Offering, Vertical, Application, and Region

|

Segment |

Subsegment |

|

By Offering: |

|

|

By End User Industry: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In May 2024, Cisco became a corporate partner in the Chicago Quantum Exchange to enhance quantum communications and quantum-safe networking. Cisco Quantum Lab will collaborate on tapping the Chicago Quantum Network—a 124-mile quantum network—to develop secure quantum internet technologies. At the same time, it would work toward better national security and financial systems through quantum-resistant protocols and techniques.

- In March 2024, ID Quantique (IDQ) introduced Clarion KX, a quantum-enhanced key exchange platform to future-proof the security of the network for enterprises and telecom operators. This platform combines Quantum Key Distribution with advanced algorithm-based encryption to provide an out-of-band, secure key distribution process. It integrates NIST-approved QRNG for extreme security, wherein vulnerability mitigation against emerging quantum threats and “Harvest Now, Decrypt Later” cyber-attacks are handled.

- In December 2023, Aliro Quantum launched the Aliro Simulator, a modular quantum network design and testing tool. It models everything from small optical components to large networks, allowing examination into configurations and use cases before their actual deployment in the real world.

- In November 2023, TOSHIBA CORPORATION and SpeQtral Pte Ltd expanded their collaboration on Singapore’s National Quantum-Safe Networks+ Project. This would include scaling up deployments with Toshiba’s battle-tested fiber-based QKD and the Quantum Key Management System product in quantum-safe testbeds globally.

- In April 2023, Qunnect launched GothamQ, a quantum network distributing entangled photons across NYC’s telecom fibers, marking a significant step toward practical quantum networking and the Quantum Internet.

Frequently Asked Questions:

At what CAGR is the quantum networking market expected to grow from 2024 to 2029?

The global quantum networking market is expected to exhibit a CAGR of 44.2% from 2024 to 2029.

Which region is expected to account for the largest market share?

North America is expected to dominate the quantum networking market during the forecast period, owing to the robust tech ecosystem and the increased investments in quantum technologies by major tech companies, such as IBM, Google, and Microsoft.

Who are the leading players in the global quantum networking market?

Key companies operating in the global quantum networking market include TOSHIBA CORPORATION (Japan), Quantumctek Co.,Ltd. (China), QuintessenceLabs (Australia), ID Quantique (Switzerland), and HEQA Security (Israel).

What are some of the major applications in the quantum networking market?

Secure communication, distributed quantum computing, quantum sensing and metrology, quantum clock synchronization, and secure financial transactions are some of the major applications in the quantum networking market.

What factors will create opportunities for players in the quantum networking market?

Expanding use cases in secure communications and financial transactions and the significant funding and initiatives to implement quantum technologies will create lucrative opportunities for players in the quantum networking market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing complexity of cyber-attacks in digital era- Rising data generation from IoT and cloud computing devices- Mounting demand for secure communication channelsRESTRAINTS- High costs of quantum networking hardware- Standardization and interoperability issuesOPPORTUNITIES- Rising emphasis on data protection and privacy- Increasing allocation of funds for developing quantum technologies- Emergence of smart cities and industrial automationCHALLENGES- Sensitivity of quantum systems to electromagnetic radiation- Technical compatibility issues

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERINGAVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Quantum sensing- Quantum computingCOMPLEMENTARY TECHNOLOGIES- Post-quantum cryptography- Integrated quantum circuitsADJACENT TECHNOLOGIES- Photonics and optoelectronics

-

5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIO (HS CODE 847180)EXPORT SCENARIO (HS CODE 847180)

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISGLOBAL TECH SOLUTIONS ADOPTS QRNG-INTEGRATED EZQUANT SECURITY KEY TO ENABLE SECURE PASSWORDLESS AUTHENTICATIONHITACHI ENERGY AND ID QUANTIQUE PARTNER TO SECURE MISSION-CRITICAL NETWORKS WITH QUANTUM ENCRYPTIONEPB, QUBITEKK, AND ALIRO UNITE TO ENABLE SECURE AND SCALABLE COMMUNICATION WITH EPB QUANTUM NETWORKQUANTUM COMMUNICATIONS HUB DEPLOYS QKD ACROSS UKQN AND UKQNTEL NETWORKS TO ESTABLISH SECURE QUANTUM COMMUNICATIONTHALES TRUSTED CYBER TECHNOLOGIES ADOPTS LUNA T-SERIES HSMS WITH ID QUANTIQUE’S QRNG CHIP TO ADDRESS CYBER THREATS

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.14 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 IMPACT OF AI ON QUANTUM NETWORKING MARKETINTRODUCTIONCASE STUDY: APPLICATION OF AI IN MARL-BASED APPROACH FOR DECENTRALIZED RESOURCE ALLOCATION IN QUANTUM COMPUTING NETWORKS

- 6.1 INTRODUCTION

- 6.2 SECURE COMMUNICATION

- 6.3 DISTRIBUTED QUANTUM COMPUTING

- 6.4 QUANTUM SENSING & METROLOGY

- 6.5 QUANTUM CLOCK SYNCHRONIZATION

- 6.6 SECURE VOTING

- 6.7 SECURE FINANCIAL TRANSACTION

- 7.1 INTRODUCTION

-

7.2 HARDWAREQUANTUM KEY DISTRIBUTION SYSTEMS- Increasing need for promising technology for long-term data security to expedite segmental growthQUANTUM RANDOM NUMBER GENERATORS- Rising emphasis on secure financial transactions and communications to drive marketQUANTUM MEMORY DEVICES- Growing focus on efficient storage and management of quantum information for computation tasks to boost segmental growthQUANTUM REPEATERS- Increasing integration with telecom infrastructure to transform communications to fuel segmental growthOTHER HARDWARE TYPES

-

7.3 SOFTWAREGROWING CONCERN ABOUT CYBER THREATS AND DATA BREACHES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 BANKING & FINANCEINCREASING FREQUENCY OF CYBER-ATTACKS TO BOOST SEGMENTAL GROWTH

-

8.3 GOVERNMENT & DEFENSEGROWING DEMAND FOR ROBUST ENCRYPTION SOLUTIONS TO SAFEGUARD CRITICAL INFRASTRUCTURE TO FOSTER SEGMENTAL GROWTH

-

8.4 HEALTHCARE & LIFE SCIENCESRISING EMPHASIS ON SAFEGUARDING SENSITIVE PATIENT INFORMATION TO AUGMENT SEGMENTAL GROWTH

-

8.5 IT & TELECOMINCREASING FOCUS ON PREVENTING SIGNAL LOSS AND INTERFERENCE TO BOLSTER SEGMENTAL GROWTH

-

8.6 ENERGY & UTILITIESRISING FOCUS ON ACCURATE WEATHER FORECASTING AND SAFE DATA EXCHANGE TO BOOST SEGMENTAL GROWTH

-

8.7 MANUFACTURINGINCREASING DATA GENERATION AND NEED FOR ADVANCED SECURITY AND COMMUNICATION SOLUTIONS TO FUEL SEGMENTAL GROWTH

- 8.8 OTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Mounting investment in advanced communication technologies to foster market growthCANADA- Increasing development of algorithms to enhance telecom networks to expedite market growthMEXICO- Rising allocation of funds to develop advanced information technologies to drive market

-

9.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Rising emphasis on addressing cybersecurity threats to accelerate market growthGERMANY- Growing focus on enabling secure and efficient data exchange to augment market growthFRANCE- Surging demand for advanced technologies for secure communication to contribute to market growthREST OF EUROPE

-

9.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Rising investment in emerging technologies to accelerate market growthJAPAN- Increasing focus on advancing high-tech sector to spur demandSOUTH KOREA- Growing focus on technological innovation to contribute to market growthREST OF ASIA PACIFIC

-

9.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- Increasing need for robust and secure communication systems to boost market growth- GCC countries- Rest of Middle EastAFRICA- Growing interest in enhancing technological capabilities and securing communication infrastructure to augment market growthSOUTH AMERICA- Rising emphasis on technology-driven economic growth to drive market

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 10.3 REVENUE ANALYSIS, 2021–2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

-

10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Offering footprint- End-use industry footprint- Region footprint

-

10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

10.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSTOSHIBA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewID QUANTIQUE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEQA SECURITY- Products/Solutions/Services offered- Recent developments- MnM viewQUANTUMCTEK CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewQUINTESSENCELABS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTERRA QUANTUM- Business overview- Products/Solutions/Services offered- Recent developmentsMAGIQ TECHNOLOGIES- Business overview- Products/Solutions/Services offeredCRYPTA LABS LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsQUANTUM XCHANGE- Business overview- Products/Solutions/Services offered- Recent developmentsQUNNECT INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSQUBITEKK, INC.ALIRO TECHNOLOGIES, INC.QUNU LABS PRIVATE LIMITEDARQITMIRAEXSPEQTRAL PTE LTDKETS QUANTUM SECURITY LTD.AEGIQ LTD.QUBALT GMBHSSHQUSECURE, INC.VERIQLOUDQRYPTQUSIDE TECHNOLOGIESLUXQUANTA TECHNOLOGIES S.L.

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 QUANTUM NETWORKING MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING TREND OF QUANTUM NETWORKING TECHNOLOGIES OFFERED BY KEY PLAYERS, BY OFFERING (USD)

- TABLE 3 INDICATIVE PRICING TREND OF QUANTUM NETWORKING TECHNOLOGIES, BY OFFERING, 2020–2023 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF QUANTUM KEY DISTRIBUTION SYSTEMS, BY REGION, 2020–2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF QUANTUM RANDOM NUMBER GENERATORS, BY REGION, 2020–2023 (USD)

- TABLE 6 ROLE OF COMPANIES IN QUANTUM NETWORKING ECOSYSTEM

- TABLE 7 LIST OF PATENTS, 2022–2024

- TABLE 8 IMPORT SCENARIO FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 9 EXPORT SCENARIO FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 17 QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 18 QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 19 HARDWARE: QUANTUM NETWORKING MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 20 HARDWARE: QUANTUM NETWORKING MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 21 HARDWARE: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 22 HARDWARE: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 23 HARDWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 24 HARDWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 25 HARDWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 26 HARDWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 27 HARDWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 28 HARDWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 29 HARDWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 30 HARDWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 31 QUANTUM KEY DISTRIBUTION SYSTEMS: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 32 QUANTUM KEY DISTRIBUTION SYSTEMS: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 33 QUANTUM RANDOM NUMBER GENERATORS: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 34 QUANTUM RANDOM NUMBER GENERATORS: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 QUANTUM MEMORY DEVICES: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 QUANTUM MEMORY DEVICES: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 QUANTUM REPEATERS: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 38 QUANTUM REPEATERS: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 OTHER HARDWARE TYPES: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 40 OTHER HARDWARE TYPES: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 41 SOFTWARE: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 42 SOFTWARE: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 SOFTWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 44 SOFTWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 45 SOFTWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 46 SOFTWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 47 SOFTWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 48 SOFTWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 49 SOFTWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 SOFTWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 52 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 53 BANKING & FINANCE: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 54 BANKING & FINANCE: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 56 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 57 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 58 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 59 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 60 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 61 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 62 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 63 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 64 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 66 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 67 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 68 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 69 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 70 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 71 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 72 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 73 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 79 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 80 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 83 IT & TELECOM: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 84 IT & TELECOM: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 85 IT & TELECOM: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 86 IT & TELECOM: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 87 IT & TELECOM: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 88 IT & TELECOM: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 89 IT & TELECOM: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 90 IT & TELECOM: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 91 IT & TELECOM: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 92 IT & TELECOM: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 93 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 94 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 95 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 96 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 97 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 98 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 100 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 101 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 102 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 103 MANUFACTURING: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 104 MANUFACTURING: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 105 MANUFACTURING: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 106 MANUFACTURING: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 107 MANUFACTURING: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 108 MANUFACTURING: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 109 MANUFACTURING: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 110 MANUFACTURING: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 111 MANUFACTURING: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD THOUSAND)

- TABLE 112 MANUFACTURING: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD THOUSAND)

- TABLE 113 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 114 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 115 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 116 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 117 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 118 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 119 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD THOUSAND)

- TABLE 120 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD THOUSAND)

- TABLE 121 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020–2023 (USD THOUSAND)

- TABLE 122 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024–2029 (USD THOUSAND)

- TABLE 123 QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 124 QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 125 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 128 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 129 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 130 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 131 US: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 132 US: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 133 US: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 134 US: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 135 CANADA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 136 CANADA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 137 CANADA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 138 CANADA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 139 MEXICO: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 140 MEXICO: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 141 MEXICO: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 142 MEXICO: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 143 EUROPE: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 144 EUROPE: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 145 EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 146 EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 147 EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 148 EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 149 UK: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 150 UK: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 151 UK: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 152 UK: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 153 GERMANY: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 154 GERMANY: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 155 GERMANY: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 156 GERMANY: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 157 FRANCE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 158 FRANCE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 159 FRANCE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 160 FRANCE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 161 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 162 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 163 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 164 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 171 CHINA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 172 CHINA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 173 CHINA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 174 CHINA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 175 JAPAN: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 176 JAPAN: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 177 JAPAN: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 178 JAPAN: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 179 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 180 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 181 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 182 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 183 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, BY OFFERING, 2020–2023 (USD THOUSAND)

- TABLE 186 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, BY OFFERING, 2024–2029 (USD THOUSAND)

- TABLE 187 ROW: QUANTUM NETWORKING MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 188 ROW: QUANTUM NETWORKING MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 189 ROW: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 190 ROW: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 191 ROW: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 192 ROW: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 193 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 194 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 195 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 196 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 197 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 198 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 199 AFRICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 200 AFRICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 201 AFRICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 202 AFRICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 203 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 204 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 205 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020–2023 (USD THOUSAND)

- TABLE 206 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024–2029 (USD THOUSAND)

- TABLE 207 QUANTUM NETWORKING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2024

- TABLE 208 QUANTUM NETWORKING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 209 QUANTUM NETWORKING MARKET: OFFERING FOOTPRINT

- TABLE 210 QUANTUM NETWORKING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 QUANTUM NETWORKING MARKET: REGION FOOTPRINT

- TABLE 212 QUANTUM NETWORKING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 QUANTUM NETWORKING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 214 QUANTUM NETWORKING MARKET: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2024

- TABLE 215 QUANTUM NETWORKING MARKET: DEALS, JANUARY 2020–JUNE 2024

- TABLE 216 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 217 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 219 TOSHIBA CORPORATION: DEALS

- TABLE 220 TOSHIBA CORPORATION: EXPANSIONS

- TABLE 221 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 222 ID QUANTIQUE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ID QUANTIQUE: PRODUCT LAUNCHES

- TABLE 224 ID QUANTIQUE: DEALS

- TABLE 225 HEQA SECURITY: COMPANY OVERVIEW

- TABLE 226 HEQA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 HEQA SECURITY: DEALS

- TABLE 228 QUANTUMCTEK CO., LTD.: COMPANY OVERVIEW

- TABLE 229 QUANTUMCTEK CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 QUINTESSENCELABS: COMPANY OVERVIEW

- TABLE 231 QUINTESSENCELABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 QUINTESSENCELABS: PRODUCT LAUNCHES

- TABLE 233 QUINTESSENCELABS: DEALS

- TABLE 234 TERRA QUANTUM: COMPANY OVERVIEW

- TABLE 235 TERRA QUANTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 TERRA QUANTUM: PRODUCT LAUNCHES

- TABLE 237 TERRA QUANTUM: DEALS

- TABLE 238 MAGIQ TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 239 MAGIQ TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 CRYPTA LABS LIMITED: COMPANY OVERVIEW

- TABLE 241 CRYPTA LABS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 CRYPTA LABS LIMITED: DEALS

- TABLE 243 QUANTUM XCHANGE: COMPANY OVERVIEW

- TABLE 244 QUANTUM XCHANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 QUANTUM XCHANGE: PRODUCT LAUNCHES

- TABLE 246 QUANTUM XCHANGE: DEALS

- TABLE 247 QUNNECT INC.: COMPANY OVERVIEW

- TABLE 248 QUNNECT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 QUNNECT INC.: EXPANSIONS

- FIGURE 1 QUANTUM NETWORKING MARKET SEGMENTATION

- FIGURE 2 QUANTUM NETWORKING MARKET: RESEARCH DESIGN

- FIGURE 3 QUANTUM NETWORKING MARKET: RESEARCH FLOW

- FIGURE 4 QUANTUM NETWORKING MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 QUANTUM NETWORKING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 QUANTUM NETWORKING MARKET: TOP-DOWN APPROACH

- FIGURE 7 QUANTUM NETWORKING MARKET: DATA TRIANGULATION

- FIGURE 8 QUANTUM NETWORKING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 10 GOVERNMENT & DEFENSE SEGMENT TO DOMINATE QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 11 NORTH AMERICA HELD LARGEST SHARE OF QUANTUM NETWORKING MARKET IN 2023

- FIGURE 12 RISING EMPHASIS ON SECURE COMMUNICATION TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN QUANTUM NETWORKING MARKET

- FIGURE 13 HARDWARE SEGMENT TO EXHIBIT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 14 IT & TELECOM SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CANADA TO EXHIBIT HIGHEST CAGR IN GLOBAL QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO RECORD HIGHEST CAGR IN QUANTUM NETWORKING MARKET BETWEEN 2024 AND 2029

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VOLUME OF DATA GENERATED WORLDWIDE, 2020–2025 (ZETTABYTES)

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF QUANTUM NETWORKING TECHNOLOGIES OFFERED BY KEY PLAYERS, BY OFFERING

- FIGURE 25 AVERAGE SELLING PRICE TREND OF QUANTUM KEY DISTRIBUTION SYSTEMS, BY REGION, 2020–2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF QUANTUM RANDOM NUMBER GENERATORS, BY REGION, 2020–2023

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 QUANTUM NETWORKING ECOSYSTEM

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2020–2023

- FIGURE 30 INVESTMENTS IN QUANTUM TECHNOLOGY, 2015–2023

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014–2024

- FIGURE 32 IMPORT DATA FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- FIGURE 33 EXPORT DATA FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023

- FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 37 IMPACT OF AI ON QUANTUM NETWORKING INDUSTRY

- FIGURE 38 HARDWARE SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 39 GOVERNMENT & DEFENSE SEGMENT TO DOMINATE QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO RECORD HIGHEST CAGR IN QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 41 NORTH AMERICA: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 42 CANADA TO EXHIBIT HIGHEST CAGR IN NORTH AMERICAN QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 43 EUROPE: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 44 GERMANY TO RECORD HIGHEST CAGR IN EUROPEAN QUANTUM NETWORKING MARKET BETWEEN 2024 AND 2029

- FIGURE 45 ASIA PACIFIC: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 46 CHINA TO DOMINATE ASIA PACIFIC QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 47 ROW: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST TO RECORD HIGHEST CAGR IN ROW QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 49 QUANTUM NETWORKING MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2021–2023

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING QUANTUM NETWORKING TECHNOLOGIES, 2023

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 QUANTUM NETWORKING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 QUANTUM NETWORKING MARKET: COMPANY FOOTPRINT

- FIGURE 56 QUANTUM NETWORKING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 QUANTUMCTEK CO., LTD.: COMPANY SNAPSHOT

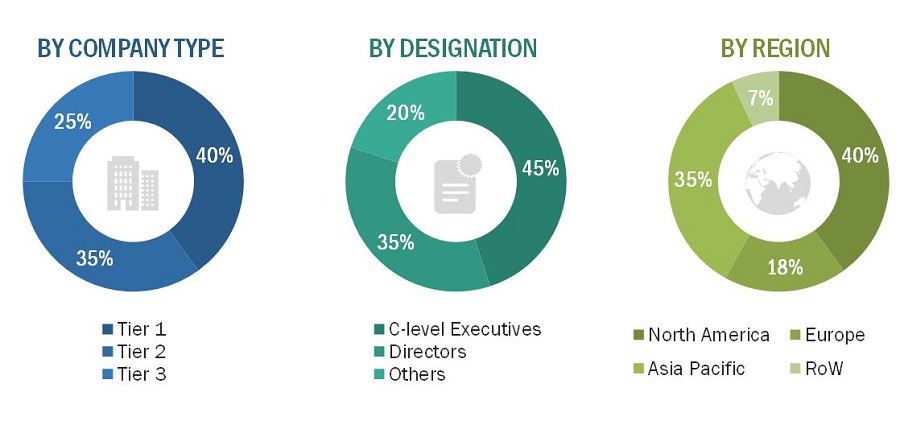

The research process for this technical, market-oriented, and commercial study of the quantum networking market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the quantum networking market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC) (Switzerland), and the International Monetary Fund (IMF).

Primary Research

Extensive primary research was accomplished after understanding and analyzing the quantum networking market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 30% of the primary interviews were conducted with the demand side, and 70% with the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to quantum networking market.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Quantum Networking Market: Bottom-Up Approach

The bottom-up procedure was employed to arrive at the overall size of the quantum networking market from revenues of the key players and their share in the market. The overall market size was calculated on the basis of the revenues of the key companies identified in the market.

Quantum Networking Market: Top-Down Approach

In the top-down approach, the overall size of the quantum networking market was used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. To calculate the size of the specific market segments, the size of the most appropriate parent market was used to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from the secondary research to validate the size of various segments of the quantum networking market. The share of each company in the market was estimated to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and the validation of data through primaries, sizes of the parent market and each individual market were determined and confirmed. The data triangulation procedure used for this study has been explained in the next section.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Quantum networking is an emerging technology that uses quantum mechanics to enable secure, high-speed communication over existing networks. Quantum networks make use of certain quantum phenomena that classical networks are unable to employ, such as superposition, and quantum entanglement. The photon exists in a superposition of all possible quantum states, each with a corresponding probability, prior to measurement. These are used across various industries like banking & finance, government & defense, healthcare & life sciences, IT & telecom, energy & utilities, manufacturing, and others.

Key Stakeholders

- Quantum networking device manufacturers

- Research organizations and universities

- Original equipment manufacturers (OEMs)

- Technology standard organizations, forums, alliances, and associations

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- Existing and prospective end users

- Venture capitalists, private equity firms, and startup companies

- Distributors and traders

Report Objectives

- To define, describe, segment, and forecast the quantum networking market size, in terms of value, based on offering, vertical, and region

- To forecast the market size, in terms of value, across North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To present detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s Five Forces analysis, investment and funding scenario, and regulations pertaining to the market.

- To offer a comprehensive overview of the value chain of the quantum networking market ecosystem

- To critically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To assess the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments in the market, such as collaborations, agreements, partnerships, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Quantum Networking Market